Filed pursuant to Rule 497(e)

File No. 333-182274

Supplement dated July 14, 2023

to the Summary Prospectus, Prospectus and

Statement of Additional Information (“SAI”)

dated January 31, 2023 of the

ETFMG Prime Junior Silver Miners ETF (SILJ);

AI Powered Equity ETF (AIEQ);

Etho Climate Leadership U.S. ETF (ETHO);

ETFMG Prime Cyber Security ETF (HACK);

ETFMG Prime Mobile Payments ETF (IPAY);

ETFMG Treatments, Testing and Advancements ETF (GERM);

ETFMG Alternative Harvest ETF (MJ);

ETFMG U.S. Alternative Harvest ETF (MJUS);

Wedbush ETFMG Video Game Tech ETF (GAMR);

Wedbush ETFMG Global Cloud Technology ETF (IVES);

ETFMG Travel Tech ETF (AWAY);

BlueStar Israel Technology ETF (ITEQ);

(each, a “Target Fund” and collectively, the “Target Funds”)

and

ETFMG Prime 2x Daily Junior Silver Miners ETF (SILX);

ETFMG Breakwave Sea Decarbonization Tech ETF (BSEA); and

ETFMG Sit Ultra Short ETF (VALT)

(with the Target Funds, each, a “Fund” and, collectively, the “Funds”)

________

Reorganizations of the Target Funds

The Board of Trustees of ETF Managers Trust (the “Trust”) has approved an Agreement and Plan of Reorganization (the “Agreement”) providing for the reorganization of the Target Funds into corresponding new funds (the “Acquiring Funds”), which are newly created series of Amplify ETF Trust with similar investment objectives and the same fees and expenses as the corresponding Target Funds. The Reorganizations are subject to certain conditions including approval by shareholders of the Target Funds. The following table shows shares of the Acquiring Funds that will be issued to shareholders of the corresponding Target Funds.

| | | | | | | | |

| Target Fund | | Acquiring Fund |

| ETFMG Prime Junior Silver Miners ETF | | Amplify Junior Silver Miners ETF |

| | | |

| AI Powered Equity ETF | | Amplify AI Powered Equity ETF |

| | |

| Etho Climate Leadership U.S. ETF | | Amplify Etho Climate Leadership U.S. ETF |

| | |

| ETFMG Prime Cyber Security ETF | | Amplify Cybersecurity ETF |

| | |

| ETFMG Prime Mobile Payments ETF | | Amplify Mobile Payments ETF |

| | |

| ETFMG Treatments, Testing and Advancements ETF | | Amplify Treatments, Testing and Advancements ETF |

| | |

| ETFMG Alternative Harvest ETF | | Amplify Alternative Harvest ETF |

| | |

| ETFMG U.S. Alternative Harvest ETF | | Amplify U.S. Alternative Harvest ETF |

| | |

| Wedbush ETFMG Video Game Tech ETF | | Amplify Video Game Tech ETF |

| | |

| Wedbush ETFMG Global Cloud Technology ETF | | Amplify Global Cloud Technology ETF |

| | |

| BlueStar Israel Technology ETF | | Amplify BlueStar Israel Technology ETF |

| | |

| ETFMG Travel Tech ETF | | Amplify Travel Tech ETF |

The Reorganizations will shift management responsibility from ETF Managers Group LLC to Amplify Investments LLC, the investment adviser of the Acquiring Funds. Each Acquiring Fund will also have a sub-adviser who has responsibility for implementing the Acquiring Fund’s investment program by, among other things, trading portfolio securities and performing related services, rebalancing the Acquiring Fund’s portfolio, and providing cash management services. The sub-adviser for each Acquiring Fund is listed below.

| | | | | |

| Acquiring Fund | Sub-Advisor |

| Amplify Cybersecurity ETF | Penserra Capital Management |

| Amplify Mobile Payments ETF | Penserra Capital Management |

| Amplify Junior Silver Miners ETF | Toroso Investment, LLC |

| Amplify Alternative Harvest ETF | Toroso Investment, LLC |

| Amplify U.S. Alternative Harvest ETF | Toroso Investment, LLC |

| Amplify Video Game Tech ETF | Penserra Capital Management |

| Amplify BlueStar Israel Technology ETF | Toroso Investment, LLC |

| Amplify Treatments Testing & Advancements ETF | Toroso Investment, LLC |

| Amplify Global Cloud Technology ETF | Penserra Capital Management |

| Amplify AI Powered Equity ETF | Toroso Investment, LLC |

| Amplify Travel Tech ETF | Toroso Investment, LLC |

| Amplify Etho Climate Leadership U.S. ETF | Toroso Investment, LLC |

Amplify is an ETF provider sponsoring, advising, or sub-advising 15 ETFs with over $4.4 billion in assets under management as of June 30, 2023.

The Acquiring Funds will have substantially similar investment themes as the Target Funds. However, some of the Acquiring Funds may have differences from their corresponding Target Funds, such as using a different, but substantially similar, underlying index to the corresponding Target Fund or tracking an index that that implements the current strategy of the corresponding Target Fund which is actively managed, while other Acquiring Funds will track the same underlying index or implement the same active strategy. While any changes in the underlying index or change from active management to index tracking may affect the specific constituents and the weight of constituents in an Acquiring Fund’s portfolio, any new index will have the same investment themes as the index or active strategy implemented by the Target Fund.

Pursuant to the Agreement, each Target Fund will transfer all of its assets to the respective Acquiring Fund in return for shares of beneficial interest of the Acquiring Fund and each Acquiring Fund will assume all of the respective Target Fund’s liabilities. As a result of the Reorganizations, shareholders of each Target Fund will become shareholders of the respective Acquiring Fund. Shareholders of each Target Fund will receive shares of the respective Acquiring Fund with a value equal to the aggregate net asset value of their shares of the Target Fund held immediately prior to the Reorganizations. The proposed Reorganizations are expected to be a tax-free transaction for federal income tax purposes.

Shareholders of record of each Target Fund will receive proxy materials soliciting their vote with respect to the proposed Reorganizations. If approved by the Target Fund’s shareholders, each Reorganization is expected to occur in the fourth quarter of 2023.

Resignation of Samuel R. Masucci, III

Effective July 15, 2023, Samuel R. Masucci, III will have resigned from his positions as Trustee of ETF Managers Trust (the “Trust”), Chairman of the Board of Trustees (the “Board”), President of the Trust, and Secretary of the Trust. In addition, Mr. Masucci resigned as Chief Executive Office of ETF Managers Group LLC and as a portfolio manager of ETFMG Prime Junior Silver Miners ETF, ETFMG Prime 2x Daily Junior Silver Miners ETF, AI Powered Equity ETF, Etho Climate Leadership U.S. ETF, ETFMG Prime Cyber Security ETF, ETFMG Prime Mobile Payments ETF, ETFMG Treatments, Testing and Advancements ETF, ETFMG Alternative Harvest ETF, ETFMG U.S. Alternative Harvest ETF, Wedbush ETFMG Video Game Tech ETF, Wedbush ETFMG Global Cloud Technology ETF, BlueStar Israel Technology ETF, and ETFMG Breakwave Sea Decarbonization Tech ETF.

As such, all references to Mr. Masucci are removed throughout the Summary Prospectus, Prospectus and SAI of each Fund.

New Chair of Trust Board

Effective July 15, 2023, Mr. Terry Loebs is Chair of the Board.

New Trust Officers

Effective July 15, 2023, Michael Minella is appointed as President and Principal Executive Officer of the Trust and Matthew Bromberg was appointed Secretary of the Trust. Accordingly, the table in the section of the SAI titled “MANAGEMENT OF THE TRUST – Members of the Board,” with the officers of the Trust will be deleted in its entirety and replaced with the following:

| | | | | | | | | | | | | | |

Name and Year of Birth | Position(s) Held with the Trust, Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios in Fund Complex Overseen By Trustee | Other Directorships Held by Trustee During Past 5 Years |

Officers |

Michael Minella (1971) | President (since 2023) | Senior Principal Consultant, ACA Group (since 2022); Vice President and Director, Fidelity Investments (2009-2022). | n/a | n/a |

John A. Flanagan (1946) | Treasurer (since 2015) | President, John A. Flanagan CPA, LLC (accounting services) (since 2010); Treasurer, ETF Managers Trust (since 2015); Chief Financial Officer, ETF Managers Capital LLC (commodity pool operator) (since 2015). | n/a | Independent Trustee - Absolute Shares Trust (since 2014) (6 portfolios) |

Kevin Hourihan (1978) | Chief Compliance Officer (since 2022) | Senior Principal Consultant, Fund Chief Compliance Officer, ACA Global, LLC (since 2022); Chief Compliance Officer, Ashmore Funds (2017-2022); Chief Compliance Officer, Ashmore Investment Management (US) Corp (2014-2022); Chief Compliance Officer, Ashmore Equities Investment Management (2015-2019). | n/a | n/a |

Matthew J. Bromberg (1973) | Secretary (since 2023) | Chief Operating Officer and Chief Compliance Officer of ETF Managers Group, LLC (since 2022); General Counsel and Secretary of Exchange Traded Managers Group LLC (since 2020); ETF Managers Group LLC (since 2020); ETFMG Financial LLC (since 2020); ETF Managers Capital LLC (since 2020); Partner of Dorsey & Whitney LLP (law firm) (2019-2020); General Counsel of WBI Investments, Inc. (2016-2019); Millington Securities, Inc. (2016-2019). | n/a | n/a |

Benjamin F. Yuro (1990) | Assistant Treasurer (since 2022) | Product Controller, ETF Managers Group, LLC (since 2021); Senior Associate - Private Equity, SS&C Technologies (2020-2021); Senior Accountant - Financial Services, WithumSmith+Brown, PC (2016-2020). | n/a | n/a |

Ongoing Administrative Proceedings

The section of each Fund’s Prospectus titled “Litigation” is renamed “Legal Proceedings” and the following paragraph is added to the section:

The Adviser and Mr. Masucci (the “Recipients”) received Wells Notices from the staff of the U.S. Securities and Exchange Commission (“SEC”). The notices indicated the staff’s preliminary determination to recommend that the SEC commence a civil action against the Recipients stemming from findings made during its non-public investigation. The Recipients cooperated with the investigation and during the Wells process each Recipient demonstrated to the SEC staff why it believes its conduct was appropriate, in keeping with industry standards, and that no action should be taken.

The Recipients have been engaged in settlement discussions with the SEC staff to conclude the investigations. The Recipients, on a neither admit nor deny basis have, consented to the entry of findings under Sections 206(1) and 206(2) of the Investment Adviser’s Act, Section 17D of the Investment Company Act of 1940, and Rule 17d-1 thereunder. The settlement will have a financial component for each Recipient along with certain undertakings, including Mr. Masucci’s resignation as Trustee and CEO. The expected findings principally pertain to alleged non-disclosure of conflicts of interest arising in connection with the ETFMG Alternative Harvest ETF (MJ) participation in the securities lending program administered by its prior custodian.

The Recipients expect to submit Offers of Settlement incorporating these charges and applicable penalties for consideration by the Commission.

Other Items

The fifth paragraph of the section titled “Index/Trademark Licenses/Disclaimers” in the Prospectus for GAMR and IVES is hereby deleted in its entirety.

Please retain this Supplement with your Summary Prospectus, Prospectus

and SAI for future reference.

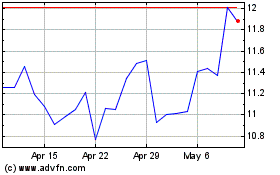

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From Apr 2024 to May 2024

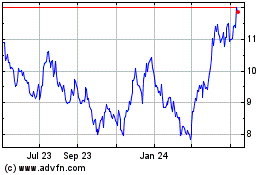

Amplify Junior Silver Mi... (AMEX:SILJ)

Historical Stock Chart

From May 2023 to May 2024