UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

AGEAGLE

AERIAL SYSTEMS INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

AGEAGLE

AERIAL SYSTEMS INC.

8201

E. 34th Street North

Wichita,

Kansas 67226

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

to

be held on December 20, 2024

TO

THE SHAREHOLDERS OF AGEAGLE AERIAL SYSTEMS INC.:

This

Special Meeting of the Shareholders (the “Special Meeting”) of AgEagle Aerial Systems Inc., a Nevada corporation (the

“Company”), will be held as a virtual meeting on December 20, 2024, at 11:00 a.m., Eastern Time, at

https://web.viewproxy.com/uavs/2024, for the following purposes:

(1)

To authorize the Board of Directors (the “Board”), at the discretion of the Board, to file an amendment to the Company’s

Articles of Incorporation, as amended to date, to increase the number of authorized shares of our common stock, par value $0.001 per

share (the “Common Stock”), from 5,000,000 to 200,000,000 (the “Amendment Proposal”);

(2)

To approve the issuance of shares of our Common Stock representing more than 20% of our Common Stock outstanding upon the conversion

of the Convertible Note issued to Alpha Capital Anstalt (“Alpha”) on February 8, 2024 and due on December 31,

2024, which is initially convertible into up to 2,608,128 shares of Common Stock (“Convertible Note”), which amount

would be in excess of 19.99% of the issued and outstanding shares of the Company’s Common Stock, in accordance with NYSE American

Rule 713(a)(ii) (the “Stock Issuance Proposal”); and

(3)

To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

Amendment Proposal and/or the Stock Issuance Proposal (the “Adjournment Proposal”).

We

will also consider any other business that properly comes before the Special Meeting.

Shareholders

of record of the Company’s Common Stock at the close of business on November 8, 2024 are entitled to notice of, and to vote at,

the Special Meeting or any adjournment or postponement thereof.

Your

attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of matters to be considered at the

Special Meeting.

We

are pleased to take advantage of the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials primarily

over the Internet. We believe that it will expedite shareholders’ receipt of proxy materials, lower costs and reduce the environmental

impact of distributing proxy materials for our Special Meeting. It is anticipated that on or about November 19, 2024, we will

commence mailing to our shareholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability

of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials, including this Proxy

Statement over the Internet. The Notice also includes instructions on how you can receive a paper copy of the proxy materials by mail.

If you receive meeting materials by mail, the Notice, this Proxy Statement and proxy card will be enclosed. If you receive your proxy

materials via e-mail, the e-mail will contain voting instructions and links to this Proxy Statement on the Internet, which is available

at https://web.viewproxy.com/uavs/2024.

All

shareholders are cordially invited to attend the meeting virtually. The Special Meeting will be held in virtual meeting format only,

and you will not be able to attend the Special Meeting physically. Whether or not you plan to participate in this Special Meeting, your

vote is very important and we encourage you to vote promptly. After reading this Proxy Statement, please promptly mark, sign and date

the enclosed proxy card and return it by following the instructions on the proxy card or voting instruction card or vote by telephone

or by Internet. If you virtually attend the Special Meeting, you will have the right to revoke the proxy and vote your shares. If you

hold your shares through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from your

brokerage firm, bank, or other nominee to vote your shares.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Grant Begley |

| |

Grant

Begley |

| |

Chairman

of the Board of Directors |

| |

|

| Dated:

November 19, 2024 |

|

AGEAGLE

AERIAL SYSTEMS INC.

8201

E. 34th Street North

Wichita,

Kansas 67226

PROXY

STATEMENT

for

Special

Meeting of Shareholders

to

be held December 20, 2024

PROXY

SOLICITATION

The

Company is soliciting proxies on behalf of the Board of Directors (the “Board”) in connection with the Special Meeting

of the shareholders (the “Special Meeting”) of AgEagle Aerial Systems Inc., a Nevada corporation (the “Company”),

which will be held as a virtual meeting on December 20, 2024, at 11:00 a.m., Eastern Time, at https://web.viewproxy.com/uavs/2024,

for the following purposes:

(1)

To authorize the Board, at the discretion of the Board, to file an amendment to the Company’s Articles of Incorporation, as amended

to date, to increase the number of authorized shares of our common stock, par value $0.001 per share (the “Common Stock”)

from 5,000,000 to 200,000,000 (the “Amendment Proposal”);

(2)

To approve the issuance of shares of our Common Stock representing more than 20% of our Common Stock outstanding upon the conversion

of the Convertible Note issued to Alpha Capital Anstalt (“Alpha”) on February 8, 2024 and due on December 31,

2024, which is initially convertible into up to 2,608,128 shares of Common Stock (“Convertible Note”), which amount

would be in excess of 19.99% of the issued and outstanding shares of the Company’s Common Stock, in accordance with NYSE American

Rule 713(a)(ii) (the “Stock Issuance Proposal”); and

(3)

To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

Amendment Proposal and/or the Stock Issuance Proposal (the “Adjournment Proposal”).

We

will also consider any other business that properly comes before the Special Meeting.

The

Special Meeting will be held in virtual meeting format only, and you will not be able to attend the Special Meeting physically.

The

Board has set November 8, 2024 as the record date (the “Record Date”) to determine those holders of the Common Stock

who are entitled to notice of, and to vote at, the Special Meeting. A list of the shareholders entitled to vote at the meeting may be

examined at the Company’s office at 8201 E. 34th Street North, Wichita, Kansas 67226 during the 10-day period preceding the Special

Meeting.

It

is anticipated that on or about November 19, 2024, the Company shall commence mailing to all shareholders of record, as of the

Record Date, a Notice of Availability of Proxy Materials (the “Notice”). Please carefully review the Notice for information

on how to access the Notice of Special Meeting and access the Proxy Statement at https://web.viewproxy.com/uavs/2024 using your Virtual

Control Number that was included in the Notice you received in the mail, in addition to instructions on how you may request to receive

a paper or e-mail copy of these documents. There is no charge to you for requesting a paper copy of these documents. Please choose one

of the following methods to make your request:

●

By Internet: www.FCRvote.com/UAVS

●

By Telephone: 1-866-402-3905

●

By E-Mail*: tabulation@allianceadvisors.com

*

If requesting materials by e-mail, please send a blank e-mail with your Virtual Control Number that was included in the Notice.

IMPORTANT:

Please mark, date, and sign the enclosed proxy card and promptly return it in the accompanying postage-paid envelope or vote by telephone

or by Internet to assure that your shares are represented at the meeting.

IMPORTANT

NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 20, 2024:

Our Proxy Statement is enclosed. A complete set of proxy materials relating to our Special Meeting, consisting of the Notice of the Special

Meeting of Shareholders and the Proxy Statement is available on the Internet at https://web.viewproxy.com/uavs/2024 using your Virtual

Control Number that was included in the Notice you received in the mail.

GENERAL

INFORMATION ABOUT VOTING

Proxy

Materials

Why

am I receiving these materials?

The

Board of Directors (the “Board”) of AgEagle Aerial Systems Inc. (the “Company”) has made these

proxy materials available to you on the Internet, or, upon your request, has delivered printed versions of these materials to you by

mail, in connection with the solicitation of proxies for use at the Company’s Special Meeting of the shareholders (the “Special

Meeting”), which will take place on December 20, 2024, at 11:00 a.m., Eastern Time, at https://web.viewproxy.com/uavs/2024.

As

a shareholder, you are invited to participate in the Special Meeting and are requested to vote on the proposals described in this Proxy

Statement. This Proxy Statement includes information that we are required to provide to you under Securities and Exchange Commission

(“SEC”) rules and is designed to assist you in voting your shares.

What

is included in these materials?

The

proxy materials include:

| |

● |

this

Proxy Statement for the Special Meeting; and |

| |

|

|

| |

● |

the

proxy card or a voting instruction card for the Special Meeting. |

Why

did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

In

accordance with rules adopted by the SEC, we may furnish proxy materials, including this Proxy Statement, to our shareholders by providing

access to such documents over the Internet instead of mailing printed copies. Most shareholders will not receive printed copies of the

proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (“Notice”),

which was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the

Internet. If you would like to receive a paper copy of our proxy materials, you should follow the instructions for requesting such materials

in the Notice.

How

can I access the proxy materials over the Internet?

The

Notice, proxy card or voting instructions card will contain instructions on how to:

| |

● |

access

and view our proxy materials for the Special Meeting over the Internet; and |

| |

|

|

| |

● |

how

to vote your shares. |

If

you choose to receive our future proxy materials electronically, it will save us the cost of printing and mailing documents to you and

will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials electronically,

you will receive an e-mail with instructions containing a link to the website where those materials are available. Your election to receive

proxy materials electronically will remain in effect until you terminate it.

How

may I obtain a paper copy of the proxy materials?

Shareholders

receiving a Notice will find instructions in that notice about how to obtain a paper copy of the proxy materials. Shareholders receiving

a Notice by e-mail will find instructions in that e-mail about how to obtain a paper copy of the proxy materials. Shareholders who have

previously submitted a standing request to receive paper copies of our proxy materials will receive a paper copy of the proxy materials

by mail.

What

shares are included on the proxy card?

If

you are a shareholder of record, you will receive only one proxy card for all the shares you hold of record in certificate form and in

book-entry form.

If

you are a beneficial owner, you will receive voting instructions from your broker, bank or other holder of record.

What

is “householding” and how does it affect me?

We

have adopted a procedure approved by the SEC called “householding.” Under this procedure, shareholders of record who have

the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Notice

of the Special Meeting of Shareholders and this Proxy Statement, unless we are notified that one or more of these shareholders wishes

to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Shareholders

who participate in householding will continue to receive separate proxy cards.

If

you are eligible for householding, but you and other shareholders of record with whom you share an address currently receive multiple

copies of the Notice the Special Meeting of Shareholders and the Proxy Statement, or if you hold stock of the Company in more than one

account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact the

Corporate Secretary of the Company by sending a written request to AgEagle Aerial Systems Inc., Corporate Secretary, 8201 E. 34th Street

North, Wichita, Kansas 67226.

If

you participate in householding and wish to receive, free of charge, a separate copy of the Notice of Special Meeting of Shareholders

and this Proxy Statement, or if you do not wish to continue to participate in householding and prefer to receive separate copies

of these documents in the future, please contact the Corporate Secretary of the Company, as set forth above.

If

you are a beneficial owner, you can request information about householding from your broker, bank, or other holder of record.

Voting

Information

What

items of business will be voted on at the Special Meeting?

The

items of business scheduled to be voted on at the Special Meeting are:

(1)

To authorize the Board of Directors (the “Board”), at the discretion of the Board, to file an amendment to the Company’s

Articles of Incorporation, as amended to date, to increase the number of authorized shares of our common stock, par value $0.001 per

share (the “Common Stock”) from 5,000,000 to 200,000,000 (the “Amendment Proposal”);

(2)

To approve the issuance of shares of our Common Stock representing more than 20% of our Common Stock outstanding upon the conversion

of the Convertible Note issued to Alpha Capital Anstalt (“Alpha”) on February 8, 2024 and due on December 31,

2024, which is initially convertible into up to 2,608,128 shares of Common Stock (“Convertible Note”), which amount

would be in excess of 19.99% of the issued and outstanding shares of the Company’s Common Stock, in accordance with NYSE American

Rule 713(a)(ii) (the “Stock Issuance Proposal”); and

(3)

To consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the

Amendment Proposal and/or the Stock Issuance Proposal (the “Adjournment Proposal”).

How

does the Board recommend that I vote?

The

Board unanimously recommends that you vote your shares:

| |

● |

“FOR”

authorizing the Board, at its discretion, to file an amendment to the Company’s Articles of Incorporation, as amended to date,

to increase the number of authorized shares of our common stock, par value $0.001 per share (the “Common Stock”)

from 5,000,000 to 200,000,000 (the “Amendment Proposal”); |

| |

|

|

| |

● |

“FOR”

approving the issuance of shares of our Common Stock representing more than 20% of our Common Stock outstanding upon the conversion

of the Convertible Note in accordance with NYSE American Rule 713(a)(ii) (the “Stock Issuance Proposal”); and |

| |

|

|

| |

● |

“FOR”

adjourning the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based

upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Amendment Proposal and/or

the Stock Issuance Proposal (the “Adjournment Proposal”). |

Who

is entitled to vote at the Special Meeting?

Only

shareholders of record at the close of business on November 8, 2024 (the “Record Date”) will be entitled to vote at

the Special Meeting. As of the Record Date, 4,378,308 shares of the Common Stock were outstanding and entitled to vote. Each share

of Common Stock outstanding on the Record Date is entitled to one vote on each proposal.

Is

there a list of shareholders entitled to vote at the Special Meeting?

The

names of shareholders of record entitled to vote at the Special Meeting will be available for ten days prior to the Special Meeting at

our principal executive offices at 8201 E. 34th Street North, Wichita, Kansas 67226. If you would like to examine the list for any purpose

germane to the Special Meeting prior to the meeting date, please contact our Corporate Secretary.

How

can I vote if I own shares directly?

Most

shareholders do not own shares registered directly in their name, but rather are “beneficial holders” of shares held in a

stock brokerage account or by a bank or other nominee (that is, shares held in “street name”). Those shareholders should

refer to “How can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?” below for instructions

regarding how to vote their shares.

If,

however, your shares are registered directly in your name with our transfer agent, Equiniti Trust Company, you are considered, with respect

to those shares, the shareholder of record, and these proxy materials are being sent directly to you. You may vote in the following ways:

| |

● |

By

Mail: Votes may be cast by mail, as long as the proxy card or voting instruction card is delivered in accordance with its

instructions prior to 4:00 p.m., Eastern Time, on December 19, 2024. Shareholders who have received a paper copy of a proxy card

or voting instruction card by mail may submit proxies by completing, signing, and dating their proxy card or voting instruction card

and mailing it in the accompanying pre-addressed envelope. |

| |

|

|

| |

● |

By

Virtually Attending the Meeting: Please follow the instructions in the “How can I participate and vote at the Special

Meeting virtually” section of this Proxy Statement. |

| |

|

|

| |

● |

By

Phone or Internet: Shareholders may vote by phone or Internet by following the instructions included in the proxy card they

received. Your vote must be received by 11:59 p.m., Eastern Time, on December 19, 2024 to be counted. If you received a Notice by

mail, you may vote by proxy over the Internet by going to www,FCRvote.com/UAVS and logging in using your Virtual Control Number that

was included in the Notice. If you wish to vote by telephone, call 1-866-402-3905 using any touch-tone telephone to vote your

shares using your Virtual Control Number that was included in the Notice. Have your proxy card available when you access the website

or when you call. We provide Internet and telephone proxy voting to allow you to vote your shares on-line or by phone, with procedures

designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear

any costs or usage charges from Internet access providers and telephone companies. |

If

you vote by proxy, your vote must be received by 11:59 p.m., Eastern Time, on December 19, 2024, to be counted.

Whichever

method you select to transmit your instructions, the proxy holders will vote your shares in accordance with those instructions. If no

specific instructions are given, the shares will be voted in accordance with the recommendation of our Board and as the proxy holders

may determine in their discretion with respect to any other matters that properly come before the meeting.

How

can I participate and vote at the Special Meeting virtually?

You

may virtually attend the Special Meeting and any adjournment or postponement thereof only if you were a shareholder of ours at the close

of business on the Record Date for the Special Meeting, or you hold a valid proxy to vote at the Special Meeting. The Special Meeting

will be held virtually and will begin promptly at 11:00 a.m., Eastern Time. In order to attend the Special Meeting live via the

Internet, you must register at https://web.viewproxy.com/uavs/2024 by 11:59 p.m., Eastern Time, on December 19, 2024, using your Virtual

Control Number that was included in the Notice or your proxy card (if you received a printed copy of the proxy materials). If you hold

your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you

will be assigned a Virtual Control Number in order to vote your shares during the Special Meeting. If you are unable to obtain a legal

proxy to vote your shares, you will still be able to attend the Special Meeting (but will not be able to vote your shares) so long as

you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate

proof of stock ownership, are posted at https://web.viewproxy.com/uavs/2024.

On

the day of the Special Meeting, if you have properly registered, you may enter the Special Meeting at https://web.viewproxy.com/uavs/2024

by logging in using the password you received via e-mail in your registration confirmation.

Will

I have the same participation rights in this virtual-only shareholder meeting as I would have at an in-person shareholder meeting?

Yes.

If you register to attend, and attend, the Special Meeting pursuant to the instructions above, you will be able to vote online during

the Special Meeting, change a vote you may have submitted previously, or ask questions online that will be reviewed and may be answered

by the speakers. We have created and implemented the virtual format to facilitate shareholder attendance and participation by enabling

shareholders to participate fully from any location, at no cost. You will, however, bear any costs associated with your Internet access,

such as usage charges from Internet access providers and telephone companies. A virtual Special Meeting makes it possible for more shareholders,

regardless of size, resources or physical location, to have direct access to information more quickly, while saving the Company and our

shareholders time and money. We also believe that the online tools we have selected will increase shareholder communication. Both shareholders

of record and street name shareholders will be able to attend the Special Meeting via live audio webcast, submit their questions during

the meeting and vote their shares electronically at the Special Meeting.

There

will be technicians ready to assist you with any technical difficulties accessing the Special Meeting live audio webcast. Please be sure

to check in by 11:00 a.m. on December 20, 2024 (15 minutes prior to the start of the meeting is recommended), so that any technical

difficulties may be addressed before the Special Meeting live audio webcast begins. If you encounter any difficulties accessing the webcast

during the check-in or meeting time, please e-mail virtualmeeting@viewproxy.com or call 1-866-612-8937.

How

can I vote if my shares are held in a stock brokerage account, or by a bank or other nominee?

If

your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner”

of shares held in “street name,” and your broker or nominee is considered the “shareholder of record” with respect

to those shares. Your broker or nominee should be forwarding these proxy materials to you. As the beneficial owner, you have the right

to direct your broker, bank, or other nominee how to vote, and you are also invited to participate in the Special Meeting. However, since

you are not the shareholder of record, you may not vote these shares at the Special Meeting unless you obtain a legal proxy from your

brokerage firm or bank. If a broker, bank, or other nominee holds your shares, you will receive instructions from them that you must

follow in order to have your shares voted.

What

is a quorum for the Special Meeting?

The

presence of the holders of 33-1/3% of the issued and outstanding shares of the Company’s Common Stock entitled to vote as of the

Record Date, represented at the Special Meeting or by proxy, is necessary to constitute a quorum for the transaction of business at the

Special Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf

by your broker) or if you participate in, and vote electronically at, the Special Meeting. Abstentions and broker non-votes will be counted

as present for purposes of determining a quorum.

What

is the voting requirement to approve each of the proposals?

| Proposal |

|

Vote

Required |

|

Broker

Discretionary Voting Allowed |

| No.

1 – Approval of an amendment to our Articles of Incorporation to increase the number of authorized shares of Common Stock. |

|

Affirmative

vote of the holders of a majority of our outstanding shares of Common Stock |

|

Yes |

| |

|

|

|

|

| No.

2 – Approval of Issuance of More than 20% of our Common Stock Upon Conversion of the Convertible Note. |

|

Affirmative

vote of a majority of votes cast |

|

No |

| |

|

|

|

|

| No.

3 – Adjourn the Special Meeting to solicit more votes to approve the Amendment Proposal and/or the Stock Issuance Proposal. |

|

Affirmative

vote of a majority of shares present and entitled to vote |

|

Yes |

What

is the effect of abstentions and broker non-votes?

For

the Amendment Proposal, abstentions and broker non-votes will have the same effect as an “AGAINST” vote. For the Stock Issuance

Proposal, abstentions will have the same effect as an “AGAINST” vote while broker non-votes will not be counted as votes

cast and, accordingly, will not have an effect on such matters. For the Adjournment Proposal, abstentions will have the same effect as

an “AGAINST” vote while broker non-votes will not have any effect on the proposal.

If

you are a beneficial owner and hold your shares in “street name” in an account at a bank or brokerage firm, it is critical

that you cast your vote if you want it to count in the vote on the above proposals. Under the rules governing banks and brokers who submit

a proxy card with respect to shares held in “street name,” such banks and brokers have the discretion to vote on routine

matters, but not on non-routine matters. Banks and brokers may not vote on the Stock Issuance Proposal being presented at the Special

Meeting if you do not provide specific voting instructions. Accordingly, we encourage you to vote promptly, even if you plan to participate

in the Special Meeting.

Can

I change my vote or revoke my proxy?

Subject

to any rules and deadlines your broker, trustee or nominee may have, you may change your proxy instructions at any time before your proxy

is voted at the Special Meeting . If you are a shareholder of record, you may change your vote by (1) going to www.FCRvote.com/UAVS and

logging in using your Virtual Control Number that was included in the Notice, (2) delivering a valid, later-dated proxy in a timely manner,

(3) virtually attending the Special Meeting and voting electronically (although attendance at the Special Meeting will not, by itself,

revoke a proxy), or (4) voting again via phone or Internet at a later date.

If

you are a beneficial owner of shares held in “street name”, you may change your vote (1) by submitting new voting instructions

to your broker, trustee or other nominee, or (2) if you have obtained a legal proxy from the broker, trustee or other nominee that holds

your shares giving you the right to vote the shares and provided a copy to our transfer agent and registrar, Equiniti, together with

your e-mail address as described below, by virtually attending the Special Meeting and voting electronically.

Any

written notice of revocation or subsequent proxy card must be received by the Company’s Corporate Secretary prior to the taking

of the vote at the Special Meeting.

Who

will bear the cost of soliciting votes for the Special Meeting?

We

will bear the entire cost of soliciting proxies, including the cost of the preparation, assembly, printing and mailing of this Proxy

Statement, the proxy card and any additional information furnished to our shareholders in connection with the Special Meeting. In addition

to this solicitation by mail, our directors, officers and other employees may solicit proxies by use of mail, telephone, facsimile, electronic

means, in person or otherwise. These persons will not receive any additional compensation for assisting in the solicitation but may be

reimbursed for reasonable out-of-pocket expenses in connection with the solicitation. We have retained Alliance Advisors LLC (“Alliance”)

to aid in the distribution of proxy materials and to provide voting and tabulation services for the Special Meeting. For these services,

we will pay Alliance a fee of approximately $[13,000] and reimburse it for certain expenses. In addition, we will reimburse brokerage

firms, nominees, fiduciaries, custodians and other agents for their expenses in distributing proxy material to the beneficial owners

of our Common Stock.

Who

Can Answer Your Questions About Voting Your Shares?

If

you are a holder of AgEagle’s shares and have any questions about how to vote or direct a vote in respect of your securities, you

may call Alliance, the Company’s proxy solicitor, at 866-620-1197 (toll free) or e-mail at UAVS@AllianceAdvisors.com.

PROPOSAL

NO. 1

AMENDMENT

TO OUR ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

Purposes

of the Proposed Increase in Authorized Shares

On

October 23, 2024, the Company’s Board of Directors (the “Board”) approved an amendment to our Articles of Incorporation,

as amended to date, to increase the number of authorized shares of our common stock, par value $0.001 per share (the “Common

Stock”) from 5,000,000 to 200,000,000 (the “Amendment”). Under the terms of our Articles of Incorporation,

as amended, and Nevada law, the Amendment must be approved by the holders of a majority of the outstanding shares of Common Stock. A

copy of the Amendment, which is in the form of a Certificate of Amendment to Articles of Incorporation (the “Certificate of

Amendment”), is attached to this Proxy Statement as Appendix A. The Amendment makes no other changes to our Articles

of Incorporation.

The

Amendment is intended to give the Company flexibility to issue Common Stock or securities convertible into Common Stock for general corporate

purposes if an attractive opportunity to do so arises. The Company will be required to raise additional capital to execute its business

plan, which will require us to issue additional shares of Common Stock or securities convertible into Common Stock, in public or private

offerings, under convertible notes or other equity-linked securities and to provide the Company with enough authorized and unissued shares

for the exercises of the outstanding Series A Warrant and Series B Warrants (as described below). Without an increase in the number of

authorized shares of Common Stock, the Company may be constrained in its ability to raise capital in order to support its business objectives,

and may lose important business opportunities, including to competitors, which could adversely affect the Company’s financial performance

and growth.

Further,

on September 30, 2024, the Company entered into a placement agency agreement (the “Placement Agency Agreement”) with

Spartan Capital Securities, LLC (the “Placement Agent”) in connection with the issuance and sale by the Company in

a public offering (the “Offering”) of 26,899,996 units (the “Units”), consisting of common units

(“Common Units”), each consisting of one share of Common Stock of the Company, $0.001 par value per share,

one Series A warrant (“Series A Warrant”) to purchase one share of Common Stock and one Series B warrant (“Series

B Warrant”) to purchase one share of Common Stock and pre-funded Units (the “Pre-Funded Units”),

with each Pre-Funded Unit consisting of one pre-funded warrant (the “Pre-Funded Warrants”) to purchase one share of

Common Stock, one Series A Warrant to purchase one share of Common Stock and one Series B Warrant to purchase one share

of Common Stock.

On

October 14, 2023, the Company effectuated a 1-for-50 reverse stock split of the Company’s authorized and issued and outstanding

shares (the “Reverse Stock Split”). As a result of the Reverse Stock Split the number of Company’s authorized

shares of Common Stock was reduced from 250,000,000 to 5,000,000. The Series A Warrants and Series B Warrants contain a reset

of the exercise price that was triggered by the Reverse Stock Split. The reset of the exercise price and the proportionate adjustment

to the number of shares underlying the Series A Warrants and Series B Warrants has caused the Company to have insufficient authorized

shares for the exercise of all Series A Warrants and Series B Warrants. Pursuant to the Placement Agent Agreement and the Securities

Purchase Agreement, the Company must take reasonable actions to ensure that there are sufficient authorized but unissued shares

available for the exercise of the Series A Warrants and Series B Warrants.

If

the Company issues additional shares, the ownership interests of holders of our Common Stock will be diluted. Also, if the Company issues

shares of preferred stock, the shares may have rights, preferences and privileges senior to those of its Common Stock.

Description

of the Amendment

As

of November 8, 2024 (the “Record Date”), our current authorized capital stock of 30,000,000 consisted of

5,000,000 shares of Common Stock, of which 4,378,308 shares were outstanding, and 25,000,000 shares of preferred stock, par

value $0.001, of which 1,764 shares have been designated as our Series B Preferred Stock, 10,000 shares have been designated as our

Series C Preferred Stock, 2,000 shares have been designated as our Series D Preferred Stock, and 35,000 shares have been designated

as our Series F Preferred Stock. As of the Record Date, no shares of our Series B Preferred Stock, Series C Preferred Stock, or

Series D Preferred Stock were issued and outstanding, while 4,295 shares of our Series F Preferred Stock were issued and

outstanding. As of the Record Date, the following additional securities are outstanding: (i) 7,380 shares of our Common Stock

that are issuable upon exercise of outstanding options and restricted stock units, (ii) 222,589 additional shares of our

Common Stock that are reserved for issuance under the Company’s 2017 Omnibus Equity Incentive Plan, (iii) 3,966,683

shares of our Common Stock that are issuable upon exercise of Series A Warrants outstanding, (iv) 2,550,133 shares of our

Common Stock that are issuable upon exercise of Series B Warrants outstanding; (v) 174,807 shares of our Common Stock that

are issuable upon exercise of warrants outstanding; and (vi) 2,674,724 shares issuable upon the conversion of convertible Series

F Preferred Stock.

Under

the terms of the Amendment, the total number of authorized shares of capital stock will be increased to 195,000,000. The number of shares

of Common Stock authorized will be increased to 200,000,000. The number of shares of preferred stock will remain unchanged at 25,000,000.

The newly authorized shares of Common Stock will be identical to previously authorized shares of Common Stock and will entitle the holders

thereto to the same rights and privileges as holders of the previously authorized shares.

Terms

of the Common Stock

The

terms of the Common Stock are as follows:

Voting

Rights. Each holder of Common Stock is entitled to one vote for each share of Common Stock held on all matters submitted to a vote

of shareholders. Any action other than the election of directors shall be authorized by a majority of the votes cast, except where applicable

Nevada law prescribes a different percentage of votes and/or exercise of voting power.

Dividend

Rights. Subject to the rights of the holders of preferred stock, the holders of outstanding Common Stock are entitled to receive

dividends out of funds legally available at the times and in the amounts that the Board may determine.

No

Preemptive or Similar Rights. Holders of our Common Stock do not have preemptive rights and shares of our Common Stock are not convertible

or redeemable.

Right

to Receive Liquidation Distributions. Subject to the rights of the holders of preferred stock, as discussed below, upon our dissolution,

liquidation or winding-up, our assets legally available for distribution to our shareholders are distributable ratably among the holders

of Common Stock.

Anti-Takeover

Effects of the Amendment

An

increase in the number of authorized shares of Common Stock may also, under certain circumstances, be construed as having an anti-takeover

effect. Although not designed or intended for such purposes, the effect of the proposed increase might be to render more difficult or

to discourage a merger, tender offer, proxy contest or change in control of us and the removal of management, which shareholders might

otherwise deem favorable. For example, the authority of our Board to issue Common Stock might be used to create voting impediments or

to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance of additional

shares of Common Stock would dilute the voting power of the Common Stock then outstanding. Our Common Stock could also be issued to purchasers

who would support our Board in opposing a takeover bid which our Board determines not to be in our best interests and those of our shareholders.

The

Board is not presently aware of any attempt, or contemplated attempt, to acquire control of the Company and the proposed Certificate

of Amendment to increase the number of authorized shares of Common Stock is not part of any plan by our Board to recommend or implement

a series of anti-takeover measures.

Dissenters’

Rights of Appraisal

We

are a Nevada corporation and are governed by the Nevada Revised Statutes. Holders of the Company’s Common Stock will not have appraisal

or dissenter’s rights under Nevada law in connection with the Amendment.

Interest

of Certain Persons in Matters to be Acted Upon

No

director, executive officer, associate of any director or executive officer or any other person has any substantial interest, direct

or indirect, by security holdings or otherwise, in the Amendment that is not shared by all other shareholders of ours.

Procedure

for Implementing the Increase in Authorized Shares

The

Amendment will become effective upon the filing of the Certificate of Amendment with the Secretary of State of the State of Nevada.

Vote

Required for Approval

The

affirmative vote of the holders of a majority of our outstanding shares of Common Stock is required to amend our Articles of Incorporation

to effect the increase in authorized Common Stock. Abstentions will have the same effect as votes against the Amendment. Because the

Amendment is expected to be considered a “routine” matter for which brokers may vote in their discretion if beneficial owners

of our stock do not provide voting instructions, we do not expect to receive any broker non-votes; however, if any broker non-votes

are received they would have the same effect as votes against the Amendment.

THE

BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF AN AMENDMENT TO OUR ARTICLES OF INCORPORATION TO INCREASE THE

NUMBER OF AUTHORIZED SHARES OF COMMON STOCK.

PROPOSAL

NO. 2

APPROVAL

OF THE ISSUANCE OF SHARES OF OUR COMMON STOCK REPRESENTING MORE THAN 20% OF OUR COMMON STOCK OUTSTANDING UPON CONVERSION OF THE CONVERTIBLE

NOTE IN ACCORDANCE WITH NYSE AMERICAN RULE 713(a)(ii).

Our

Common Stock is currently listed on the NYSE American. We are subject to NYSE American Rule 713(a)(ii), which requires us to obtain shareholder

approval when shares will be issued in connection with a transaction involving the sale, issuance or potential issuance of Common Stock

(or securities convertible into or exercisable for Common Stock) equal to 20% or more of presently outstanding shares for less than the

greater of book or market value of the shares.

Securities

Purchase Agreement

On

December 6, 2022, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with an institutional

investor (the “Investor”) which is an existing shareholder of the Company. Pursuant to the terms of the Agreement,

the Company had agreed to issue to the Investor (i) an 8% original issue discount promissory note (the “Original Note”)

in the aggregate principal amount of $3,500,000, and (ii) a common stock purchase warrant (the “Warrant”) to purchase

up to 5,000,000 shares of the Company’s common stock (the “Shares”) at an exercise price of $0.44 per share,

subject to standard anti-dilution adjustments. The Note was an unsecured obligation of the Company. It has an original issue discount

of 4% and bears interest at 8% per annum. The Warrant is not exercisable for the first six months after issuance and has a five-year

term from the exercise date.

The

Company and the Investor amended the Original Note on August 14, 2023 (the “Note Amendment Agreement”) increasing

the principal amount of the Original Note to $4,095,000, and modifying the timing of, and cure periods for, an Event of Default (defined

in the Original Note) under the Original Note. The Company and the Investor amended the Original Note on October 5, 2023 (the “Second

Amendment”), which among other things, increased the principal amount of the Original Note by $595,000 and deferred payments

and amortization payments due pursuant to the Original Note. The Second Amendment also partially waives the Event of Default in Section

3 (a)(vii) of the Original Note as a result of the resignation of a majority of the officers listed therein.

On

February 8, 2024, the Company and the Investor entered into a Securities Exchange Agreement (the “Exchange Agreement”),

pursuant to which the parties agreed to exchange the Original Note for a Convertible Note due December 31, 2024 in the principal

amount of $4,849,491 (as amended, the “Convertible Note”), convertible into Common Stock at the initial conversion

price of $0.10 per share of Common Stock, subject to adjustment, as described therein.

Assuming

the full conversion of the Convertible Note, including principal and interest through January 8, 2024, the total number of shares issuable

(at the initial Conversion Price of $0.10) would be up to 2,608,128 (pre-Reverse Stock Split) shares of Company Common Stock, which amount

would be in excess of 19.99% of the issued and outstanding shares of the Company’s Common Stock on the closing date.

As

of the date hereof, the outstanding principal balance, plus accrued interest, of the Convertible Note is $1,334,638. The total number

of shares issuable thereunder is 686,366 shares of

Company Common Stock, which would represent 15.7% of the issued and outstanding shares of the Company’s Common Stock as of

the Record Date.

The

Company is required to seek shareholder approval, at every meeting of the shareholders until the earlier of the date shareholder approval

is obtained or the Convertible Note is no longer outstanding, for the issuance of all of the Conversion Shares issuable under the Convertible

Note and all adjustments of the Conversion Price under the Convertible Note that would result in the issuance of more than 19.99% of

the issued and outstanding shares of Common Stock on the closing date.

Why

Approval is Needed

If

the Investor wishes to convert the full amount of the Convertible Note, the shares of Common Stock issued upon conversion would be more

than 20% of our Common Stock outstanding. NYSE American Rule 713(a)(ii) requires that we obtain shareholder approval of the issuances

of Common Stock and/or securities convertible into, or exercisable for, Common Stock in excess of 20% of our current issued and outstanding

shares of Common Stock. Accordingly, we seek your approval of the Stock Issuance Proposal to issue additional Series F Convertible Preferred

Stock and Warrants to the Investor, at its option, in order to satisfy the requirements of NYSE American Rule 713(a)(ii).

Approval

Required

The

approval of the Stock Issuance Proposal requires the affirmative vote of holders of a majority of the stock having voting power present

or represented by proxy at the Special Meeting. Abstentions have the effect of a vote “AGAINST” the Stock Issuance Proposal

and broker non-votes will have no effect with respect to the approval of the Stock Issuance Proposal.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE STOCK ISSUANCE PROPOSAL.

PLEASE

NOTE: The Stock Issuance Proposal is considered a “non-routine” matter. If your shares are held in “street name”,

your broker, bank, custodian or other nominee holder cannot vote your shares for the Stock Issuance Proposal, unless you direct the holder

how to vote, by marking your proxy card, or by following the instructions on the enclosed proxy card to vote on the Internet or by telephone.

PROPOSAL

NO. 3

THE

ADJOURNMENT PROPOSAL

Overview

The

Adjournment Proposal, if adopted, will allow the Board to adjourn the Special Meeting to a later date or dates to permit further solicitation

of proxies. The Adjournment Proposal will only be presented to the Company’s shareholders, in the event that, based upon the tabulated

vote at the time of the Special Meeting there are insufficient votes for, or otherwise in connection with, the approval of the Amendment

Proposal and/or the Share Issuance Proposal.

Consequences

if the Adjournment Proposal is Not Approved

If

the Adjournment Proposal is not approved by the shareholders, the Board may not be able to adjourn the Special Meeting to a later date

in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Amendment Proposal and the Share

Issuance Proposal.

Vote

Required for Approval

The

affirmative vote of a majority of shares present or represented by proxy at the Special Meeting and entitled to vote is required to approve

Adjournment Proposal. Abstentions will have the effect of a vote “AGAINST” the Adjournment Proposal and broker non-votes

will have no effect with respect to the approval of the Adjournment Proposal. The Adjournment Proposal is considered to be “routine”

and thus if you do not return voting instructions to your bank or broker, your shares may be voted by your bank or broker in its discretion

on the Adjournment Proposal.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADJOURNMENT PROPOSAL.

OTHER

INFORMATION

Important

Notice Regarding Delivery of Shareholder Documents

If

your shares are held in “street name”, your broker, bank, custodian, or other nominee holder may, upon request, deliver only

one copy of this Proxy Statement to shareholders to multiple shareholders sharing an address, absent contrary instructions from

one or more of the shareholders. The Company will, upon request, deliver a separate copy of the proxy materials to a shareholder at a

shared address to which a single copy was delivered, upon written or oral request, to William Irby, Chief Executive Officer, AgEagle

Aerial Systems Inc., 8201 E. 34th Street North, Wichita, Kansas 67226. Shareholders sharing an address and receiving multiple copies

of the proxy materials who wish to receive a single copy should contact their broker, bank, custodian, or other nominee holder.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Grant Begley |

| |

Grant

Begley |

| |

Chairman

of the Board of Directors |

| |

|

| November

19, 2024 |

|

Appendix

A

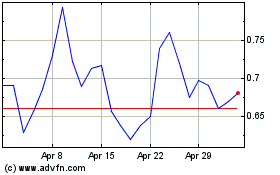

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Nov 2024 to Dec 2024

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Dec 2023 to Dec 2024