false

0000008504

0000008504

2024-07-25

2024-07-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 25, 2024

AGEAGLE

AERIAL SYSTEMS INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-36492 |

|

88-0422242 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 8201

E. 34th Cir N, Suite 1307, Wichita, Kansas |

|

67226 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (620) 325-6363

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

UAVS |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

As

previously reported on a Current Report on Form 8-K filed on June 30, 2022, the Company entered into a Securities Purchase Agreement,

dated June 26, 2022 (the “Original SPA”), as subsequently amended by the Series F SPA Amendment Agreement dated February

8, 2024 (the “Series F Amendment Agreement”, and together with the Original SPA, the “SPA”), with Alpha Capital

Anstalt (“Alpha”), pursuant to which Alpha purchased 10,000 shares of the Company’s Series F 5% Convertible Preferred

Stock (the “Series F Convertible Preferred”) and a warrant to purchase 5,212,510 shares of the Company’s Common Stock.

Pursuant to the terms of the SPA, Alpha had the right to purchase up to an aggregate of $25,000,000 stated value of the Series F Convertible

Preferred and accompanying warrants (the “Additional Investment Right”), at a purchase price equal to the volume-weighted

average prices (“VWAPs”) of the Company’s common stock for three trading days prior to the date Alpha gives notice

to the Company that it will exercise its Additional Investment Right.

On

July 25, 2024, the Company and Alpha entered into that certain SPA Amendment Agreement (the “2024 Amendment”), pursuant to

which the SPA was amended to (i) increase the time period in which Alpha may exercise its Additional Investment Right to December 31,

2025, and (ii) lowered the minimum additional investment amount from $1,000,000 to $500,000.

The

foregoing description of the 2024 Amendment does not purport to be complete and is qualified in its entirety by reference to the 2024

Amendment, which is filed as Exhibit 10.1 to this Current Report and incorporated by reference herein.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

As

previously reported on a Current Report on Form 8-K filed on February 8, 2024, the Company issued to Alpha a Convertible Note due January

8, 2024 in the principal amount of $4,849,491 (the “Convertible Note”). The Convertible Note accrues interest at 12 % per

annum. Commencing April 1, 2024, and on the first business day of each calendar month thereafter, the Company shall pay $484,949, plus

any accrued but unpaid interest, with any remaining principal plus accrued interest payable in full upon the Maturity Date (each, an

“Amortization Payment”). Each Amortization Payment shall be paid in cash pursuant to instructions provided by Alpha, unless

Alpha, in its sole discretion decides to receive Conversion Shares in lieu of a cash payment.

On

July 25, 2024, the Company and Alpha entered into that certain Note Amendment Agreement (the “Note Amendment”), pursuant

to which the Convertible Note was amended to, (i) increase the principal balance of the Convertible Note by $586,286.90 to $4,850,828.90,

representing accrued interest of $159,832,70 and $426,454.20 as liquidated damages for the Company’s failure to make the June and

July Amortization Payments, (ii) defer the June 3, 2024, July 1, 2024 and August 1, 2024, Amortization Payments to the Maturity Date,

and (iii) waive the defaults related to the failure to make the June 3, 2024 and July 1, 2024 Amortization Payments.

The

foregoing description of the Note Amendment does not purport to be complete and is qualified in its entirety by reference to the Note

Amendment, which is filed as Exhibit 10.2 to this Current Report and incorporated by reference herein.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated: July 25, 2024 |

AGEAGLE AERIAL SYSTEMS INC. |

| |

|

|

| |

By: |

/s/

Mark DiSiena |

| |

Name: |

Mark DiSiena |

| |

Title: |

Chief Financial Officer |

Exhibit

10.1

SPA

AMENDMENT AGREEMENT

This

NOTE AMENDMENT AGREEMENT dated as of July 25, 2024 (this “Agreement”), by and between AgEagle Aerial Systems, Inc. (“Company”),

and Alpha Capital Anstalt (the “Purchaser” and together with the Company each a “Party” and collectively as the

“Parties”). Capitalized words not otherwise defined herein shall have the meanings attributed to them in the SPA (as defined

below)

W

I T N E SS E T H :

WHEREAS,

the Company and the Purchaser are parties to a Securities Purchase Agreement dated June 26, 2022, (the “SPA”).

NOW,

THEREFORE, in consideration of the agreements of the Parties set forth herein, and other good and valuable consideration the receipt

and legal adequacy of which are hereby acknowledged by the Company and the Purchaser, it is hereby agreed as follows:

1. Section

2.4(i) is deleted and replaced with the following:

“Purchasers’

Additional Investment. During the period beginning on the initial Closing Date and ending on December 31, 2025, the Purchasers (pro

rata by initial Subscription Amounts) shall each, severally and not jointly, have the right to purchase additional Preferred Stock and

Warrants from the Company, in minimum aggregate Subscription Amount tranches of $500,000 each, up to a total aggregate additional Stated

Value of Preferred Stock equal to $25,000,000 (in addition to the initial $10,000,000 Stated Value of Preferred Stock) (each, an “Additional

Closing” and the date, an “Additional Closing Date” and the amount subscribed for, the “Additional Subscription

Amount”). The Purchaser(s) shall give the Company not less than five Trading Days’ written notice of its/their intention

to purchase additional Preferred Stock and Warrants. The additional Preferred Stock and Warrants shall be identical to the initial Preferred

Stock and Warrants, except the Original Issue Date of the Preferred Stock and the Initial Exercise Date and Termination Date of the Warrants

shall be from the applicable subsequent Closing Date, and the purchase price per share of Preferred Stock shall be adjusted such that

the Conversion Price shall equate to the average of the VWAPs for the three Trading Days prior to the date on which the Purchaser gives

notice to the Company of an Additional Closing, and the Warrant Exercise Price shall also be the average of the VWAPs for the three Trading

Days prior to the date on which the Purchaser gives notice to the Company of an Additional Closing. As a condition to the Purchasers’

expectation to purchase each subsequent tranche of Preferred Stock and Warrants, (i) the Equity Conditions (as defined in the Certificate

of Designation) shall have been met (or waived, in whole or in part, by the subscribing Purchaser) and the Closing Price shall not be

less than the Conversion Price; (ii) any required Shareholder Approval shall have been obtained; and (iii) the Company shall not be or

become in default of any other Indebtedness. Each subsequent Closing shall otherwise be in accordance with Sections 2.2 and 2.3.”

2. The

Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement.

The execution, delivery and performance by the Company of this Agreement do not and will not (i) conflict with or violate any provision

of the Company’s certificate or articles of incorporation, bylaws or other organizational or charter documents, or (ii) conflict

with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation

of any lien upon any of the properties or assets of the Company, or give to others any rights of termination, amendment, anti-dilution

or similar adjustments, acceleration or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility,

debt or other instrument (evidencing a Company debt or otherwise) or other understanding to which the Company is a party or by which

any property or asset of the Company is bound or affected, other than securities issued to Purchaser by Company or (iii) conflict with

or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental

authority to which the Company is subject (including federal and state securities laws and regulations), or by which any property or

asset of the Company is bound or affected; except in the case of each of clauses (ii) and (iii), such as could not have or reasonably

be expected to result in a Material Adverse Effect.

3. The

Company confirms that neither it nor any other Person acting on its behalf has provided Purchaser or its agents or counsel with any information

that constitutes or could reasonably be expected to constitute material, non-public information concerning the Company, other than the

existence of the transactions contemplated by this Agreement and the other Transaction Documents. The Company understands and confirms

that Purchaser will rely on the foregoing representations in effecting transactions in securities of the Company.

4. The

Company shall not, and the Company shall cause each of its officers, directors, employees and agents not to provide Purchaser with any

material, non-public information regarding the Company or any of its subsidiaries from and after the date hereof without the express

prior written consent of Purchaser (which may be granted or withheld in Purchaser’s sole discretion). In the event of a breach

of the foregoing covenants, in addition to any other remedy provided herein, Purchaser shall have the right to make a public disclosure,

in the form of a press release, public advertisement or otherwise, of such breach or such material, non-public information, as applicable,

without the prior approval by the Company, or any of its officers, directors, employees or agents. Purchaser shall have no liability

to the Company, any of its subsidiaries, or any of its or their respective officers, directors, employees, affiliates, stockholders or

agents, for any such disclosure. To the extent that the Company delivers any material, non-public information to Purchaser without Purchaser’s

consent, the Company hereby covenants and agrees that Purchaser shall not have any duty of confidentiality with respect to, or a duty

not to trade on the basis of, such material, non-public information.

5. Within

one (1) Business Days after execution of this Agreement, the Company shall file a form 8-K with the Securities and Exchange Commission,

disclosing this Agreement and the Note Amendment Agreement entered into contemporaneously herewith, both of which shall be exhibits to

such filing. The form 8-K is annexed as Exhibit A.

6. Except

as expressly amended hereby, each of the SPA and the Transaction Documents (as defined in the SPA), shall remain in full force and effect

in accordance with their respective terms and provisions. All references in the SPA shall include this Agreement. The Purchaser is not

waiving any of its rights under the SPA or Transaction Documents.

7. This

Agreement shall be deemed a portion of the SPA and shall be governed by the terms thereof.

8. This

Amendment shall be deemed to have been drafted jointly by the Parties and therefore any rule of law that stands for the proposition that

ambiguities contained within an agreement are to be construed against the drafter thereof is inapplicable.

[REST

OF THIS PAGE LEFT INTENTIONALLY BLANK]

IN

WITNESS WHEREOF, each of the undersigned Parties has duly executed this Amendment as of the date first written above.

| COMPANY |

|

PURCHASER |

| |

|

|

| AgEagle

Aerial Systems, Inc. |

|

Alpha

Capital Anstalt |

| |

|

|

| /s/

Bill Irby |

|

/s/

Nicola Feuerstein |

| By: |

Bill

Irby |

|

By: |

Nicola

Feuerstein |

| Its: |

CEO

& President |

|

Its:

|

Director |

Exhibit

10.2

NOTE

AMENDMENT AGREEMENT

This

NOTE AMENDMENT AGREEMENT dated as of July 25, 2024 (this “Agreement”), by and between AgEagle Aerial Systems, Inc. (“Borrower”),

and Alpha Capital Anstalt (the “Holder” and together with the Borrower each a “Party” and collectively as the

“Parties”). Capitalized words not otherwise defined herein shall have the meanings attributed to them in the Note (as defined

below)

W

I T N E SS E T H :

WHEREAS,

the Borrower issued to the Holder a note dated February 8, 2024, in the principal amount of $4,849,491.00 (the “Note”).

WHEREAS,

the Note is in default for Borrower’s failure to make the Amortization Payments due on June 3, 2024, and July 1, 2024 (the “Payment

Defaults”).

NOW,

THEREFORE, in consideration of the agreements of the Parties set forth herein, and other good and valuable consideration the receipt

and legal adequacy of which are hereby acknowledged by the Borrower and the Holder, it is hereby agreed as follows:

1. As

of July 24, 2024, interest in the amount of $159,832.70 has accrued on the Note (the “Accrued Interest”).

2. The

Principal Amount of the Note is hereby increased by $586,286.90 to $4,850,828.90 (the “Additional Principal), representing the

Accrued Interest and an additional amount added as liquidated damages for the default and consideration for Holder to enter into this

Agreement.

3. The

Additional Principal shall be payable on the Maturity Date of the Note and shall not be convertible into shares of the Borrower’s

common stock.

4. The

Amortization Payments due on June 3, 2024, July 1, 2024, and August 1, 2024, are hereby deferred to the Maturity Date.

5. The

Holder hereby waives the Payment Defaults.

6. Within

one (1) Business Days after execution of this Agreement, the Borrower shall file a form 8-K with the Securities and Exchange Commission,

disclosing this Agreement, which shall be an exhibit to such filing. The form 8-K shall be provided to Holder for review and comment

prior to filing.

7. This

Agreement shall be deemed a portion of the Note and shall be governed by the terms thereof.

8. This

Amendment shall be deemed to have been drafted jointly by the Parties and therefore any rule of law that stands for the proposition that

ambiguities contained within an agreement are to be construed against the drafter thereof is inapplicable.

[REST

OF THIS PAGE LEFT INTENTIONALLY BLANK]

IN

WITNESS WHEREOF, each of the undersigned Parties has duly executed this Amendment as of the date first written above.

| BORROWER |

|

HOLDER |

| |

|

|

| AgEagle Aerial Systems, Inc. |

|

Alpha Capital Anstalt |

| |

|

|

|

|

| /s/

Bill Irby |

|

/s/

Nicola Feuerstein |

| By: |

Bill Irby |

|

By: |

Nicola Feuerstein |

| Its: |

CEO & President |

|

Its: |

Director |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

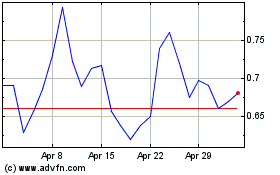

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Dec 2024 to Jan 2025

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Jan 2024 to Jan 2025