Futures Pointing To Roughly Flat Open On Wall Street

April 30 2024 - 9:07AM

IH Market News

The major U.S. index futures are currently pointing to roughly

flat open on Tuesday, with stocks likely to show a lack of

direction after ending yesterday’s lackluster session modestly

higher.

Traders may remain reluctant to make significant moves ahead of

the Federal Reserve’s monetary policy announcement on

Wednesday.

The Fed is widely expected to leave interest rates unchanged,

but the accompanying statement and Fed Chair Jerome Powell’s

post-meeting press conference may shed additional light on the

outlook for rates.

Recent economic data has tamped down expectations of a near-term

rate cut, with the central bank now seen as likely to leave rates

unchanged until at least September.

Among individual stocks, shares of Eli Lilly (NYSE:LLY) are

moving sharply higher in pre-market trading after the drugmaker

reported better than expected first quarter earnings and raised its

full-year guidance.

Industrial conglomerate 3M (NYSE:MMM) is also seeing significant

pre-market strength after reporting first quarter results that beat

expectations on both the top and bottom lines.

On the other hand, shares of McDonald’s (NYSE:MCD) may move to

the downside after the fast food giant reported first quarter

earnings that missed analyst estimates.

Beverage giant Coca-Cola (NYSE:KO) is also seeing modest

pre-market weakness despite reporting better than expected first

quarter results.

Following the strong upward move seen last week, stocks managed

to see further upside during trading on Monday. The major averages

fluctuated over the course of the session but ended the day in

positive territory.

The Dow rose 146.43 points or 0.4 percent to38389.09, the Nasdaq

climbed 55.18 points or 0.4 percent to 15983.08 and the S&P 500

advanced 16.21 points or 0.3 percent to 5,116.17.

The modestly higher close on Wall Street came as stocks continue

to benefit from the upward momentum seen last week, which came amid

a positive reaction to upbeat tech earnings.

Shares of Tesla (NASDAQ:TSLA) skyrocketed by 15.3 percent after

the electric vehicle maker said local Chinese authorities removed

restrictions on its cars,

Overall trading activity was somewhat subdued, however, as

traders look ahead to the Federal Reserve’s monetary policy

announcement on Wednesday.

Traders may also have been sticking to the sidelines ahead of

the release of an avalanche of earnings news this week along with

the Labor Department’s closely watched monthly jobs report.

Tobacco stocks showed a significant move to the upside on the

day, driving the NYSE Arca Tobacco Index up by 1.5 percent.

Considerable strength was also visible among utilities stocks,

as reflected by the 1.4 percent gain posted by the Dow Jones

Utilities average

Biotechnology, telecom and commercial real estate stocks also

saw notable strength, while most of the other major sectors showed

only modest moves.

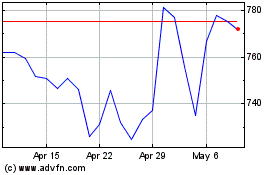

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2024 to May 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From May 2023 to May 2024