Nasdaq, S&P 500 Extend Losing Streaks To Five Days

April 18 2024 - 4:40PM

IH Market News

After once again failing to sustain an early upward move, stocks

came under pressure over the course of the trading session on

Thursday. The major averages pulled back well off their highs of

the session, with the Nasdaq and the S&P 500 ending the day in

negative territory.

Reflecting weakness in the tech sector, the Nasdaq slid 81.87

points or 0.5 percent to 15,601.50, while the S&P 500 dipped

11.09 points or 0.2 percent to 5,011.12. The narrower Dow bucked

the downtrend, inching up 22.07 points or 0.1 percent to

37,775.38

With the downturn on the day, the Nasdaq and the S&P 500

extended their losing streaks to five days, falling to their lowest

closing levels in almost two months.

The early strength on Wall Street partly reflected bargain

hunting, as traders looked to pick up stocks at relatively reduced

levels following recent weakness.

However, as with other recent rebound attempts, buying interest

waned over the course of the session amid ongoing concerns about

the outlook for interest rates.

Potentially adding to the interest rate worries, the

Philadelphia Federal Reserve released a report showing a

considerable acceleration in the pace of growth in regional

manufacturing activity in the month of April.

The Philly Fed said its diffusion index for current general

activity jumped to 15.5 in April from 3.2 in March, with a positive

reading indicating growth. Economists had expected the index to

edge down to 1.5.

Notably, the report also said the prices paid index surged to

23.0 in April from 3.7 in May, reaching its highest reading since

December 2023.

Quincy Krosby, Chief Global Strategist for LPL Financial, said

the spike by the prices paid index supports “the Fed’s concerns

regarding inflationary pressures stalling in its downward

trajectory.”

The Labor Department also released a report showing first-time

claims for U.S. unemployment benefits remained flat in the week

ended April 13th.

The report said initial jobless claims came in at 212,000,

unchanged from the previous week’s revised level. Economists had

expected jobless claims to rise to 215,000 from the 211,000

originally reported for the previous week.

“Jobless claims remain well below levels that would signal a

major slowdown in job growth,” said Nancy Vanden Houten, Lead U.S.

Economist at Oxford Economics.

She added, “A strong labor market gives the Federal Reserve the

room to put off rate cuts until inflation gets back on a

sustainable path to 2%.”

Meanwhile, the National Association of Realtors released a

report showing a sharp pullback by existing home sales in the U.S.

in the month March.

NAR said existing home sales plunged by 4.3 percent to an annual

rate of 4.19 million in March after surging by 9.5 percent to a

rate of 4.38 million in February. Economists had expected existing

home sales to slump to a rate of 4.20 million.

Sector News

Semiconductor stocks came under pressure over the course of the

session, dragging the Philadelphia Semiconductor Index down by 1.7

percent to its lowest closing level in almost two months.

U.S.-listed shares of Taiwan Semiconductor Manufacturing

(NYSE:TSM) have tumbled by 4.9 percent even though the chipmaker

reported better than expected first quarter results.

Considerable weakness also emerged among biotechnology stocks,

with the NYSE Arca Biotechnology Index falling by 1.6 percent to

its lowest closing level in well over four months.

Software, computer hardware and oil producer stocks also moved

to the downside on the day, while significant strength remained

visible among airline stocks.

Alaska Air (NYSE:ALK) soared by 4.0 percent after reporting a

narrower than expected first quarter loss on revenues that exceeded

analyst estimates.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly higher on Thursday. China’s Shanghai Composite

Index inched up by 0.1 percent and Japan’s Nikkei 225 Index rose by

0.3 percent, while South Korea’s Kospi surged by 2.0 percent.

The major European markets also moved to the upside on the day.

While the French CAC 40 Index climbed by 0.5 percent, the U.K.’s

FTSE 100 Index and the German DAX Index both rose by 0.4

percent.

In the bond market, treasuries once again came under pressure

following the rebound seen in the previous session. Subsequently,

the yield on the benchmark ten-year note, which moves opposite of

its price, jumped 6.2 basis points to 4.647 percent

Looking Ahead

Amid a lack of major U.S. economic news, the reaction to the

latest corporate earnings news may drive trading on Friday.

Streaming giant Netflix (NASDAQ:NFLX) is among the companies

releasing their quarterly results after the close of today’s

trading, while credit card giant America Express (NYSE:AXP) is

among the companies due to report their results before the start of

trading on Friday.

SOURCE: RTTNEWS

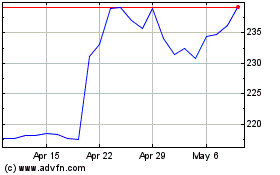

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2024 to May 2024

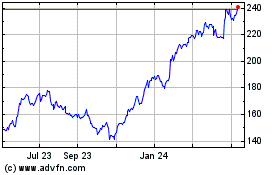

American Express (NYSE:AXP)

Historical Stock Chart

From May 2023 to May 2024