Netflix Set to Unveil Q1 2024 Earnings Amid Subscription Growth and Rumors of Price Increases

April 18 2024 - 8:27AM

IH Market News

Netflix (NASDAQ:NFLX) is poised to announce its financial

results for the first quarter of 2024 after the US stock markets

close on Thursday. Wall Street analysts are projecting a notable

increase in revenues and earnings, with expectations set for the

video-on-demand streaming giant to post earnings of $9.27 billion

for the quarter, up from $8.2 billion in the same period last year.

The earnings per share (EPS) are anticipated to rise significantly

to $4.52, compared from $2.88 per share in the previous year.

Analysts at MoffettNathanson are optimistic about subscriber

growth, predicting an addition of between 5 million and 7 million

new subscriptions. This boost is expected to elevate the total

number of Netflix subscribers to over 265 million globally. Such

growth continues to underline Netflix’s dominance in the streaming

sector.

Investors and analysts are also closely monitoring the potential

impact of rumored subscription price increases on new memberships.

Although Netflix’s Standard plan price has been stable since

January 2022, there are strong indications of an impending price

hike.

Adding to its revenue stream, Netflix’s advertising-driven tier

has shown significant growth. Amy Reinhard, Netflix’s president of

advertising, highlighted at the Variety Entertainment Summit in

January that the ad-tier plan had attracted over 23 million monthly

active users. This development hints at an expanding revenue base

for the company.

Further attention is on Netflix’s strategy to curtail password

sharing, a move that substantially boosted subscriber numbers in

the latter half of 2023. Although the surge from this initiative is

expected to stabilize, the platform continues to draw attention

with recent hits like “Avatar: The Last Airbender,” “The

Gentlemen,” and “Griselda,” along with movies such as “Damsel” and

“Spaceman.”

The impact of Verizon Communications Inc.’s latest bundle

offerings on Netflix’s performance is still under scrutiny.

Verizon’s web portal, which includes Netflix-STARZ and Netflix

Premium-AMC+ packages, could influence Netflix’s subscription

dynamics and financial outcomes.

Shares of Netflix were up 0.62% in premarket trading, priced at

$617.50 each. The company’s market capitalization currently stands

at $265.58 billion, reflecting investor confidence ahead of the

earnings release.

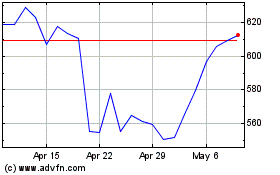

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2024 to May 2024

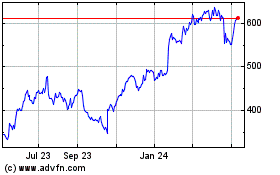

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From May 2023 to May 2024