U.S. Index Futures Indicate Moderate Recovery Ahead of March Employment Report Release, Oil Edges Up

April 05 2024 - 7:32AM

IH Market News

U.S. index futures indicate a moderate recovery in pre-market

trading on Friday, ahead of the release of the U.S. employment

report for March.

At 06:45 AM, Dow Jones futures (DOWI:DJI) rose 63 points, or

0.16%. S&P 500 futures advanced 0.27%, and Nasdaq-100 futures

gained 0.32%. The yield on 10-year Treasury bonds stood at

4.33%.

In the commodities market, West Texas Intermediate crude for May

rose 0.21%, to $86.77 per barrel. Brent crude for June rose 0.41%,

close to $91.02 per barrel.

On the economic agenda scheduled for Friday, the highlight is

the release of the numbers of jobs created or lost by the economy

(payroll) and the unemployment rate for March, which will be

published at 8:30 AM by the Department of Labor. Economists

currently expect employment to increase by 200,000 jobs in March,

after an increase of 275,000 jobs in February, while the

unemployment rate is expected to remain at 3.9%. In addition, at

3:00 PM, the Fed will publish data on consumer credit for

February.

Asian markets mostly closed in the red, with the Japanese Nikkei

leading losses by falling 1.96%, negatively influenced by

semiconductor sector and brokerage stocks. The South Korean Kospi

also recorded a decline of 1.01%, while the Hang Seng in Hong Kong

remained stable. Statements from the American Federal Reserve

generated concerns, affecting investor sentiment in the region. The

Shanghai SE market in China remained closed due to a holiday.

The main European stock exchanges are recording declines this

Friday, marking the end of a lackluster opening week of trading for

the new quarter. Investors digest recent information on

construction and retail sales in the euro zone, as well as updates

on housing prices in the United Kingdom. Retail sales in the

eurozone fell 0.5% in February, confirming economists’ forecasts

and extending the trend of stagnation for the third month.

Construction faced a decline in March, reflecting weaker demand. UK

house prices fell 1% in March, after five months of increases, with

a modest annual rise of 0.3%.

On Thursday, the United States stock market started strong but

faced strong pressure in the last hours, resulting in a sharply

lower close. The Dow Jones fell 1.35%, while the S&P 500 and

Nasdaq fell 1.23% and 1.40%, respectively. The decline was

influenced by the continuous increase in oil prices, raising

concerns about inflation and delay in the reduction of interest

rates by the Federal Reserve.

On the earnings front, Byrna Technologies

(NASDAQ:BYRN) and Greenbrier Companies (NYSE:GBX)

are scheduled to present financial reports.

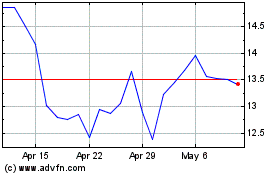

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

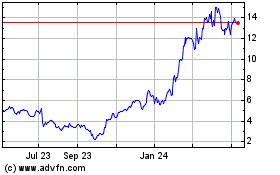

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Apr 2023 to Apr 2024