U.S. Stocks Pull Back Well Off Best Levels But Closely Mostly Higher

March 21 2024 - 4:34PM

IH Market News

Stocks showed a strong move to the upside in early trading on

Thursday but gave back ground over the course of the session. While

the major averages pulled back well off their best levels of the

day, they still ended the session at new record closing highs.

The Dow (DOWI:DJI) finished the day firmly in positive

territory, while the S&P 500 (SPI:SP500) and the Nasdaq

(NASDAQI:COMP) posted more modest gains. The Dow climbed 269.24

points or 0.7 percent to 39,781.37, the S&P 500 rose 16.91

points or 0.3 percent at 5,241.53 and the Nasdaq edged up 32.43

points or 0.2 percent to 16,401.84.

The early strength on Wall Street came as stocks continued to

benefit from positive reaction to Wednesday’s monetary policy

announcement by the Federal Reserve.

While the Fed left interest rates unchanged, as widely expected,

the central bank also maintained its forecast for three interest

rate cuts this year.

The unrevised rate cut forecast is seen as bullish for stocks,

as some investors had been worried recent hotter-than-expected

inflation data could lead Fed officials to reconsider lowering

rates.

“We view today’s FOMC interest rate decision and press

conference as bullish for the equity markets and soft landing

scenario,” Larry Tentarelli, President and Founder, Blue Chip Daily

Trend Report, said on Wednesday.

“A concern that we had going into was the recent higher than

forecast CPI readings,” he added. “The FOMC dot plot (FOMC members

projections for future interest rate levels) remained unchanged at

3 cuts expected for 2024, which we view as a major positive.”

In U.S. economic news, the Labor Department released a report

unexpectedly showing a slight drop by first-time claims for U.S.

unemployment benefits in the week ended March 16th.

The Labor Department said initial jobless claims edged down to

210,000, a decrease of 2,000 from the previous week’s revised level

of 212,000.

The dip surprised economists, who had expected jobless claims to

rise to 215,000 from the 209,000 originally reported for the

previous week.

The National Association of Realtors also released on report

showing existing home sales unexpectedly continued to soar in the

month of February.

NAR said existing home sale index spiked by 9.5 percent to an

annual rate of 4.38 million in February after jumping by 3.1

percent to a rate of 4.00 million in January.

The continued surge came as a surprise to economists, who had

expected existing home sales to pull back by 1.5 percent to a rate

of 3.94 million.

With the unexpected increase, existing home sales reached their

highest level since hitting an annual rate of 4.530 million in

February 2023.

Sector News

Semiconductor stocks continued to see significant strength on

the day, resulting in a 2.3 percent surge by the Philadelphia

Semiconductor Index.

Chipmaker Micron (NASDAQ:MU) helped lead the sector higher,

soaring by 14.1 percent after reporting better than expected fiscal

second quarter results and providing upbeat fiscal third quarter

guidance.

Considerable strength also remained visible among financial

stocks, with the NYSE Arca Broker/Dealer Index and the KBW Bank

Index both jumping by 2.2 percent.

Housing stocks also turned in a strong performance following the

existing home sales data, driving the Philadelphia Housing Sector

Index up by 1.7 percent.

Computer hardware, networking and transportation stocks also

showed notable moves to the upside, while weakness emerged among

tobacco and telecom stocks.

Other Markets

In overseas trading, stock markets across the Asia-Pacific

region moved mostly higher during trading on Thursday. Japan’s

Nikkei 225 Index soared by 2.0 percent, while Hong Kong’s Hang Seng

Index shot up by 1.9 percent.

Most European stocks also moved to the upside on the day. While

the U.K.’s FTSE 100 Index surged by 1.9 percent, the German DAX

Index jumped by 0.9 percent, the French CAC 40 Index edged up by

0.2 percent.

In the bond, treasuries showed a lack of direction over the

course of the session after seeing early strength. Subsequently,

the yield on the benchmark ten-year note, which moves opposite of

its price, edged down by less than a basis point at 4.271

percent

Looking Ahead

Following the release of several key reports this morning, the

U.S. economic calendar is relatively quiet on Friday, although

traders are likely to keep an eye on remarks by Fed Chair Jerome

Powell.

Source: RTTNEWS

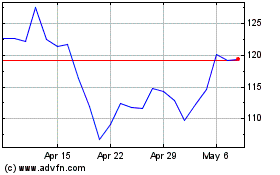

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024