FB Financial Corporation Announces $100 Million Common Stock Repurchase Authorization

March 21 2024 - 9:00AM

Business Wire

FB Financial Corporation (“the Company”) (NYSE: FBK), the parent

company of FirstBank, announced today that its board of directors

authorized the repurchase of up to $100 million of the Company’s

outstanding common stock. The repurchase authorization will be in

place until January 31, 2026, and replaces the Company’s previous

authorization, which expired on January 31, 2024.

Christopher T. Holmes, President and Chief Executive Officer,

commented, “This repurchase authorization reflects the Company’s

financial strength and strong profitability. Our management team is

keenly focused on deploying capital to deliver superior returns and

to create long-term value. This program provides another arrow in

our quiver to achieve those objectives.”

The timing and amount of any repurchases will be based on

management’s consideration of various factors including market

conditions, securities laws restrictions, the price of the

Company’s stock, regulatory requirements, alternative uses of

capital and the Company’s financial performance. Repurchases may be

executed through the open market or in privately negotiated

transactions, including under Rule 10b5-1 plans.

ABOUT FB FINANCIAL CORPORATION

FB Financial Corporation (NYSE: FBK) is a financial holding

company headquartered in Nashville, Tennessee. FB Financial

Corporation operates through its wholly owned banking subsidiary,

FirstBank with 81 full-service bank branches across Tennessee,

Kentucky, Alabama and North Georgia, and mortgage offices across

the Southeast. FB Financial Corporation has approximately $12.6

billion in total assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240321747619/en/

MEDIA CONTACT: Jeanie M. Rittenberry 615-313-8328

jrittenberry@firstbankonline.com www.firstbankonline.com

FINANCIAL CONTACT: Michael Mettee 615-564-1212

mmettee@firstbankonline.com

investorrelations@firstbankonline.com

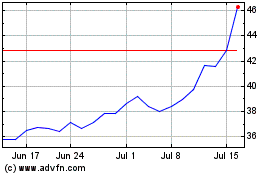

FB Financial (NYSE:FBK)

Historical Stock Chart

From Apr 2024 to May 2024

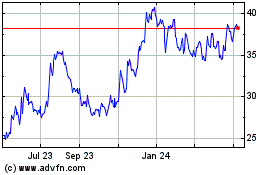

FB Financial (NYSE:FBK)

Historical Stock Chart

From May 2023 to May 2024