Marathon Digital Holdings, Inc.

(NASDAQ:MARA) ("Marathon"

or "Company"), one of the world’s largest publicly traded

Bitcoin miners and a leader in supporting and securing the Bitcoin

ecosystem, has entered into a definitive purchase agreement to

acquire Applied Digital Corporation’s (“Applied Digital”) Bitcoin

mining data center in Garden City, Texas, with a name plate

capacity of 200 megawatts, for a purchase price of $87.3 million,

or approximately $437,000 per megawatt, prior to any purchase price

adjustments. Marathon will pay the purchase price in cash from its

balance sheet.

This transaction is Marathon’s second major

acquisition of data centers dedicated to Bitcoin mining in the last

four months and increases the amount of self-owned and operated

megawatts in Marathon’s Bitcoin mining portfolio to 54%. Prior to

the acquisition of its first two data centers, which closed in

January of this year, Marathon’s Bitcoin mining portfolio consisted

of 584 megawatts, 3% of which resided on sites directly owned and

operated by the Company. Following the close of this acquisition

and the anticipated expansion of the site in 2024, Marathon will

have increased the number of megawatts in its mining portfolio to

1.1 gigawatts, 54% of which will reside on sites directly owned and

operated by the Company.

The Bitcoin mining data center in Garden City,

Texas is located adjacent to a wind farm and uses predominantly

renewable energy. It was constructed and energized in 2023 and

supports a workforce of approximately 25 employees. At this site,

Marathon is currently converting approximately 100 megawatts (c.

4.5 exahash of miners) into economic value via Bitcoin mining.

By acquiring this data center, Marathon will

take direct ownership of its current on-site operations and will

also gain an additional 100 megawatts of capacity in which to

expand, 32 megawatts of which are expected to be available as of

the closing date and the remainder of which are subject to

regulatory approvals. Marathon expects to expand its presence at

the site in 2024 by an additional 100 megawatts to accommodate a

total of 200-megawatts of capacity dedicated exclusively to

Marathon’s Bitcoin mining operations.

In addition to providing Marathon with more

influential and secure ownership of its operations as well as

expansion opportunities, this transaction is also expected to

reduce the cost per coin of Marathon’s current operations at the

site by approximately 20%.

The transaction is subject to customary closing

conditions and is expected to close in the second quarter of

2024.

Management Commentary

“After taking over ownership and operational

control of the data centers we recently acquired in Granbury, Texas

and Kearney Nebraska, we are building on that momentum by now

acquiring the Bitcoin mining data center in Garden City, Texas from

Applied Digital,” said Fred Thiel, Marathon’s chairman and CEO.

“This transaction increases our influence over our current

operations, reduces our cost per coin by approximately 20% at the

site, and provides us with an additional 100 megawatts of capacity

in which to expand.

“Following the close of this transaction and the

anticipated expansion of the site this year, our Bitcoin mining

portfolio will consist of approximately 1.1 gigawatts of capacity,

54% of which will reside on sites we directly own and operate, and

all of which are diversified across eleven sites on three

continents. As a result, we will directly own and operate more

megawatts than we had in our entire Bitcoin mining portfolio in

December 2023.

“As a close collaborator of Applied Digital, we

are intimately familiar with the site’s operations. Therefore, we

expect a smooth transition as we work to integrate this renewably

powered data center into our diversified portfolio of Bitcoin

mining assets.”

Wes Cummins, CEO and chairman of the board at

Applied Digital, commented, “Marathon has been a valuable partner

of ours since 2022, and we welcome them as the new stewards of this

state-of-the-art bitcoin mining data center in Garden City, Texas.

We look forward to closing this mutually beneficial transaction,

which we believe allows both companies to pursue their long-term

strategies more effectively.”

Advisors

Paul, Weiss, Rifkind, Wharton & Garrison LLP

is serving as legal advisor to Marathon in connection with the

transaction and Lowenstein Sandler LLP is serving as legal advisor

to Applied Digital.

Investor Notice

Investing in our securities involves a high

degree of risk. Before making an investment decision, you should

carefully consider the risks, uncertainties and forward-looking

statements described under "Risk Factors" in Item 1A of our most

recent Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed with the SEC on February 28, 2024. If any

of these risks were to occur, our business, financial condition or

results of operations would likely suffer. In that event, the value

of our securities could decline, and you could lose part or all of

your investment. The risks and uncertainties we describe are not

the only ones facing us. Additional risks not presently known to us

or that we currently deem immaterial may also impair our business

operations. In addition, our past financial performance may not be

a reliable indicator of future performance, and historical trends

should not be used to anticipate results in the future. See

"Forward-Looking Statements" below.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the federal securities laws.

Forward-looking statements in this press release relate to the

expected timing and achievement of our growth targets, specifically

relating to our anticipated hash rate and exahash growth. You can

identify forward-looking statements by the use of words such as

“may,” “will,” “could,” “anticipate,” “expect,” “intend,”

“believe,” “continue,” or the negative of such terms, or other

comparable terminology. Forward-looking statements include the

assumptions underlying or relating to such statements. The Company

has based these forward-looking statements largely on its current

expectations and projections about future events and trends that we

believe may affect its business, results of operations and

financial condition. The outcomes of the events described in these

forward-looking statements are subject to risks, uncertainties and

other factors described under the heading “Risk Factors” in the

reports the Company files with the Securities and Exchange

Commission. The Company cannot assure you that the events and

circumstances reflected in the forward-looking statements will be

achieved or occur, and actual results could differ materially from

those expressed or implied in the forward-looking statements. The

forward-looking statements made in this press release relate only

to events as of the date of this press release. The Company

undertakes no obligation to update any forward-looking statement to

reflect events or circumstances after the date on which the

statement is made.

About Marathon Digital

Holdings

Marathon is a digital asset technology company

that focuses on supporting and securing the Bitcoin ecosystem. The

Company is currently in the process of becoming one of the largest

and most sustainably powered Bitcoin mining operations in North

America.

For more information, visit www.mara.com, or

follow us on:

Twitter: @MarathonDHLinkedIn:

www.linkedin.com/company/marathon-digital-holdings Facebook:

www.facebook.com/MarathonDigitalHoldings Instagram:

@marathondigitalholdings

Marathon Digital

Holdings Company Contact:

Telephone: 800-804-1690Email: ir@mara.com

Marathon Digital Holdings Media

Contact:Email: marathon@wachsman.com

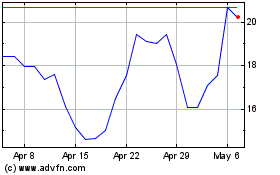

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024