false

0001424657

0001424657

2024-03-13

2024-03-13

0001424657

CUEN:CommonStockParValue0.001PerShareMember

2024-03-13

2024-03-13

0001424657

CUEN:WarrantsEachExercisableForOneShareOfCommonStockMember

2024-03-13

2024-03-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March

14, 2024 (March 13, 2024)

Cuentas, Inc.

(Exact name of registrant as specified in its charter)

| Florida |

|

001-39973 |

|

20-3537265 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(I.R.S. Employer |

| of incorporation or

organization) |

|

|

|

Identification Number) |

235 Lincoln Rd., Suite 210

Miami Beach, FL

(Address of principal executive offices)

33139

(Zip Code)

(800) 611-3622

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered under Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| |

|

|

|

|

| Common Stock, par value $0.001 per share |

|

CUEN |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each exercisable for one share of Common Stock |

|

CUENW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive

Agreement.

On March 13, 2024, Cuentas,

Inc., (“Cuentas”) through its 63% participation in Brooksville Development Partners, LLC (“Company”) approved

the signing of a Letter of Intent to sell the “Brooksville Property” located at 19200 Cortez Boulevard, Brooksville, Florida

34601. The April 28, 2023 purchase of this property was previously disclosed on a May 4, 2023 SEC 8k submission.

The property was originally

purchased April 28, 2023 for $5.05 Million and is now is expected to be sold for $7.2 Million. Cuentas contributed $2 million to the original

purchase price and almost $65k towards engineering expenses. The $3.05 million mortgage with Republic Bank of Chicago was amended and

restated on January 27, 2024 for $3.055 million. Additionally, a $500,000 Loan Extension Agreement was executed between the Company and

ALF Trust u/a/d 09/28/2023 to ensure the Promissory Note necessary to fund the interest reserve and fees relating to the Loan Extension

Agreement and the working capital needs of the Company.

Brooksville Development Partners,

LLC (“Company”) consists of Brooksville Development DE, LLC (the “Class A Member” with 30% Membership Interest),

Cuentas Inc, (a “Class B Member” with 63% Membership Interest) and Brooksville FL Partners, LLC, (a “Class B Member”

with 7% Membership Interest), collectively the “Members”.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CUENTAS INC. |

| |

|

|

| Date: March 14, 2024 |

By: |

/s/ Shalom Arik Maimon |

| |

|

Shalom Arik Maimon |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

March 12, 2024

CONFIDENTIAL

Mr. Jim Engleman

Commercial Partners Realty, Inc.

Tampa, FL

RE: Letter of lntent to Purchase Arden’s

Interest in a 360 Unit Apartment Development Project Currently Named Arden of Brooksville in Brooksville Florida

Dear Mr. Engelman:

I am pleased

to confirm our interest in purchasing Arden’s interest in the project currently named Arden of Brooksville in the name of Terwilliger

Brothers Residential, LLC, or its affiliate. This Letter of Intent describes the terms, conditions, and timing of our acquisition of this

interest which would be fully documented in a Purchase Agreement to be executed by the owner of the Property, as seller (“Seller”)

and the undersigned, on behalf of an entity to be formed (“Purchaser”), incorporating the following terms and conditions:

| 1. | Purchase Price: The purchase price will be Seven Million Two Hundred Thousand

and no dollars ($7,200,000) including land and all efforts to date. |

| 2. | Ernest Money Deposit. $75,000 to be held in escrow by a title company issuing

the title policy, to be deposited upon acceptance of a Purchase Agreement. The balance of the Earnest Money shall be fully refundable

until the expiration of the Due Diligence Period. |

| 3. | Conditions Precedent. Closing of the transaction will be contingent upon

the following conditions precedent: |

| a. | Purchase Agreement. The Purchase Agreement will to be provided by Buyer to Seller within fifteen

(15) days of the execution of this Letter of Intent. |

| b. | Due Diligence Period. Sixty (60) days to inspect all aspects of the physical

and economic conditions of the Property to review all third-party reports, title, and survey of the Property (the “Due Diligence

Period”). |

Terwilliger Brothers Residential- Florida, 900

Pinellas Bayway., Unit 213, St. Petersburg, FL 33715

Tel 301-346-8104

| c. | Pro-Rations. Customary pro-rations of taxes, assessments, etc. The seller

will pay all transfer taxes associated with the transaction. |

| d. | Title Insurance, Survey, Property Condition Report and Environmental Reports.

Seller shall provide upon execution of the Purchase Agreement and pay for owner’s policy with standard exceptions deleted and creditor’s

rights exclusion deleted and provide any other reports on the property that are available (Environmental, Survey, Geotech, etc.) |

| 4. | Closing. Closing under the Purchase Agreement will take place fifteen (15)

days after the end of the Due Diligence Period. The purchaser shall have the right to extend the closing for an additional month with

an additional non-refundable deposit of $25,000. |

| 5. | Expiration of Letter of Intent. This Letter of Intent shall automatically

expire if not accepted by the Seller within ten (10) business days of the Purchaser’s execution of this Letter of Intent. |

Brokers.

It is acknowledged that Jim Englemann (Purchaser’s Broker) represents Purchaser. Seller shall compensate Purchaser’s Broker, at

Closing, 4.25% of the total sales price, and shall indemnify and hold Purchaser harmless from any commissions, brokerage fees or other

compensation due and payable to Seller’s Broker and to Purchaser’s Broker as a result of the sale and purchase of the Property as contemplated

herein. Seller and Purchaser each represent and warrant to the other that, other than Purchaser’s Broker, neither Party has had any dealings

with any person, firm, broker or finder in connection with the negotiations of this Agreement and/or the consummation of the purchase

and sale contemplated hereby and no other broker or other person, firm or entity is entitled to any commission or finder’s fee in connection

with this transaction. Seller and Purchaser do each hereby indemnify, defend, protect and hold the other harmless from and against any

costs, expenses or liability for compensation, commission or charges that may be claimed by any other broker, finder or other similar

party by reason of any actions of the indemnifying Party.

Nothing herein

shall be deemed, interpreted, or construed as to create an agreement of purchase and sale or other binding obligation on either party,

it being the sole purpose of this Letter oflntent to outline the acceptable transactional terms regarding the subject Property.

It is expressly

acknowledged and agreed that neither Seller nor Purchaser shall have any liability, obligation, or commitment as to the terms set forth

herein. Neither Seller nor Purchaser shall have any liability or obligation until both parties sign a written Purchase Agreement in form

and content acceptable to both parties.

Terwilliger Brothers Residential- Florida, 900

Pinellas Bayway., Unit 213, St. Petersburg, FL 33715

Tel 301-346-8104

If the foregoing

terms of sale are agreeable, then please so indicate by executing the acknowledgement copy of this letter in the space indicated below.

If there is

any question regarding the capability of Terwilliger Brothers Residential to undertake the proposed transaction, we would be happy to

provide additional information as requested.

Seller will cooperate with Buyer to

assist in the due diligence review process.

| |

Sincerely, |

| |

|

| |

/s/ Bruce K. Terwilliger |

| |

Terwilliger Brothers Residential, LLC |

| |

|

| |

Bruce K. Terwilliger |

| |

Manager |

| ACKNOWLEDGED AND AGREED: |

|

| |

|

|

| SELLER: |

/s/ Boris

Tabak |

|

| |

Boris Tabak |

|

| |

|

| By: |

|

|

| Its: |

Trustee |

|

| |

|

|

| Dated: |

3/13/2024 |

|

Terwilliger Brothers Residential- Florida, 900

Pinellas Bayway., Unit 213, St. Petersburg, FL 33715

Tel 301-346-8104

3

Exhibit 10.2

This document prepared by and,

after recording, return to:

Meltzer, Purtill & Stelle LLC

125 South Wacker Drive, Suite 2900

Chicago, Illinois 60606

NOTICE TO RECORDER: THIS FIRST AMENDMENT

TO MORTGAGE AND ASSIGNMENT OF LEASES (“AGREEMENT”) AMENDS THAT CERTAIN MORTGAGE AND

SECURITY AGREEMENT DATED APRIL 27, 2023 RECORDED IN the public records of HERNANDO County, florida oN MAY 10, 2023, IN OFFICIAL RECORDS

BOOK 4296, PAGE 452 (“MOrtgage”) WHICH SECURES indebtedness in the principal

amount of $3,055,000.00 (“ORIGINAL INDEBTEDNESS”). Florida Documentary Stamp Tax in THE amount of $10,692.50 and Florida Non-Recurring

Intangible Tax in the amount of $6,110.00 HAVE BEEN PREVIOUSLY PAID ON THE ORIGINAL INDEBTEDNESS to the Clerk of THE CIRCUIT Court in

HERNANDO County, Florida AS SHOWN ON THE MORTGAGE. no additional indebtedness is being

extended. Accordingly, no additional Florida documentary stamp tax or Florida non-recurring intangible tax are due on this AGREEMENt.

FIRST AMENDMENT TO MORTGAGE AND ASSIGNMENT

OF LEASES

BROOKSVILLE

THIS FIRST AMENDMENT TO

MORTGAGE AND ASSIGNMENT OF LEASES (“Agreement”) is made effective as of January 27, 2024, by and between BROOKSVILLE

DEVELOPMENT PARTNERS, LLC, a Florida limited liability company (“Mortgagor” or “Borrower”) to

and for the benefit of REPUBLIC BANK OF CHICAGO, its successors and assigns (“Mortgagee” or “Lender”).

R E C I T A L S:

A. Pursuant

to the terms and conditions of that certain Loan Agreement dated April 27, 2023 among Borrower, Guarantor and Lender (as amended,

restated, or modified from time to time, “Loan Agreement”), Lender has heretofore made a loan (“Loan”)

to Borrower in the principal amount of Three Million Fifty-Five Thousand and No/100 Dollars ($3,055,000.00). The Loan is evidenced by

that certain Promissory Note dated April 27, 2023 in the principal amount of the Loan (as amended, restated, or modified from time to

time, “Original Note”) made payable by Borrower to the order of Lender.

B. The

Original Note is secured by, among other things, (i) that certain Mortgage and Security Agreement dated April 27, 2023 from Borrower to

Lender and recorded with the Hernando County, Florida Recorder (“Recorder’s Office”) on May 10, 2023, in Official

Records Book 4296, Page 452 (as amended, restated, or modified from time to time, “Mortgage”), which Mortgage encumbers

the real property and all improvements thereon legally described on Exhibit A attached hereto (“Property”), (ii)

that certain Assignment of Leases and Rents dated April 27, 2023 from Borrower to Lender and recorded with the Recorder’s Office

on May 10, 2023 in Official Records Book 4296, Page 474 (as amended, restated, or modified from time to time, “Assignment of

Leases”), (iii) that certain Environmental Indemnity Agreement dated April 27, 2023 executed by Borrower and Guarantor to and

for the benefit of Lender (as amended, restated, or modified from time to time, “Indemnity Agreement”), (iv) that certain

Guaranty dated April 27, 2023 executed by Guarantor to and the for the benefit of Lender (as amended, restated, or modified from time

to time, “Guaranty”), and (v) certain other loan documents (the Loan Agreement, the Original Note, the Mortgage, the

Assignment of Leases, the Indemnity Agreement, the Guaranty, and the other documents evidencing, securing and guarantying the Loan, in

their original form and as amended, are collectively referred to herein as the “Loan Documents”).

C. Pursuant

to the terms of that certain First Modification of Loan Documents of even date herewith by and among Borrower, Guarantor, and Lender (the

“First Modification,” which term shall be included in the definition of “Loan Agreement” and “Loan

Documents” set forth above), Borrower, Guarantor and Lender agreed to amend the Loan Documents to, among other things, extend the

Maturity Date of the Loan.

D. Mortgagor

and Lender desire to amend the Mortgage and the Assignment of Leases to reflect the terms and provisions of the First Modification, and

the parties have agreed to the requested amendments as set forth herein.

AGREEMENTS:

ACCORDINGLY, in consideration

of (i) the facts set forth hereinabove (which are hereby incorporated into and made a part of this Agreement), (ii) the agreements

by Lender to modify the Mortgage and the Assignment of Leases as provided herein, (iii) the covenants and agreements contained herein,

and (iv) other good and valuable consideration, the receipt, adequacy and sufficiency of which are hereby acknowledged, the parties

hereby agree as follows:

1. Recitals.

The recitals set forth above are hereby incorporated herein and made a part hereof.

2. Capitalized

Terms. The capitalized terms used herein without definition shall have the same meaning herein as such terms have in the Loan

Agreement.

3. References.

All references to the Loan Agreement and/or to any or all of the Loan Documents in the Mortgage and the Assignment of Leases shall be

deemed to mean and include the Loan Agreement and the Loan Documents as amended by the First Modification. All references to the Mortgage

and the Assignment of Leases in the Loan Documents shall be deemed to mean and include the Mortgage and the Assignment of Leases as amended

by this Agreement.

4. Amendment

to Mortgage. The Recitals A., B., and C. of the Mortgage are hereby amended to read in their entirety as follows:

“A. Mortgagee

has extended to Mortgagor a loan in the principal amount of Three Million Fifty-Five Thousand and No/100 Dollars ($3,055,000.00) (“Loan”),

as evidenced by that certain Amended and Restated Promissory Note with an effective date of January 27, 2024, executed by Mortgagor in

favor of Mortgagee (as amended, restated or modified from time to time, the “Note”).

B. The

Note is governed and secured by this Mortgage and the other Loan Documents as set forth in that certain Loan Agreement dated April 27,

2023, as modified by that certain First Modification of Loan Documents made effective as of January 27, 2024 (as amended, restated or

modified from time to time, “Loan Agreement”) among Mortgagor, Guarantor and Mortgagee. All terms not otherwise defined

herein shall have the meanings set forth in the Loan Agreement.

C. The

unpaid principal amount and all accrued and unpaid interest due under the Loan, as evidenced by the Note, if not sooner paid, shall be

due on the day that is 364 days after the effective date of the Note, or January 25, 2025 (“Maturity Date”). All such

payments on account of the Indebtedness evidenced by the Note shall be applied as set forth in the Note and being made payable at such

place as the holder of the Note may from time to time in writing appoint, and in the absence of such appointment, then at the office of

Mortgagee, at the address indicated in the Loan Agreement, or at such other address as Mortgagee may from time to time designate in writing.”

5. Amendment

to Assignment of Leases. The Recitals A. and B. of the Assignment of Leases are hereby amended to read in their entirety as follows:

“A. Assignee

has extended to Assignor a loan in the principal amount of Three Million Fifty-Five Thousand and No/100 Dollars ($3,055,000.00) (“Loan”),

as evidenced by that certain Amended and Restated Promissory Note with an effective date of January 27, 2024, executed by Assignor in

favor of Assignee (as amended, restated or modified from time to time, the “Note”).

B. The

Note is governed and secured by this Assignment and the other Loan Documents as set forth in that certain Loan Agreement dated April 27,

2023, as modified by that certain First Modification of Loan Documents made effective as of January 27, 2024 (as amended, restated or

modified from time to time, “Loan Agreement”) among Assignor, Guarantor and Assignee. All terms not otherwise defined

herein shall have the meanings set forth in the Loan Agreement.”

6. Representations

and Warranties. Mortgagor represents and warrants that it has full power and authority to execute this Agreement, that there are

no other liens or claims against the Property or any of the collateral other than the first lien of the Mortgage and the Permitted Encumbrances,

that the Mortgage and the Assignment of Leases are binding upon Mortgagor, its successors and assigns, that Lender has heretofore fully

performed its obligations under the Loan Documents, and that Mortgagor has no claims or offsets against Lender or against the indebtedness

under the Note, the obligations under the Mortgage or the Assignment of Leases, or the obligations under any of the Loan Documents. Mortgagor

represents and warrants that (i) it has no defenses, setoffs, counterclaims, actions or equities in favor of Mortgagor to or against enforcement

of the Note, the Mortgage, the Assignment of Leases, or any other Loan Documents; and (ii) no oral agreement has been made by any of Lender’s

employees, agents, officers or directors to further modify the Note, the Mortgage, the Assignment of Leases, or any other of the Loan

Documents.

7. Release.

Mortgagor does hereby release and hold harmless Lender, its officers, employees and agents, from and against any claim, action, suit,

demand, cost, expense, liability of any kind whether known or unknown, relating in any way to the making of the Loan or the administration

thereof, or the communications and business dealings between Lender and Mortgagor through the date hereof.

8. No

Novation; Full Force. It is the intent of the parties hereto that this Agreement shall not constitute a novation and shall in

no way adversely affect or impair the lien priority of the Mortgage. As modified hereby, the Mortgage shall continue in full force and

effect as collateral security for the performance and payment of the Loan, as evidenced by the Note.

9. Governing

Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

IN WITNESS WHEREOF,

Mortgagor has caused this Agreement to be executed the day and year first above written.

|

|

MORTGAGOR: |

| Signed, Sealed and Delivered |

|

|

|

|

| In the Presence of: |

|

BROOKSVILLE DEVELOPMENT PARTNERS, LLC, a Florida limited liability company |

| |

|

|

|

|

|

| Print Name: |

|

|

By: |

Brooksville Development DE LLC, |

| |

|

|

|

a Delaware limited liability company |

| |

|

|

Its: |

Manager |

| |

|

|

|

|

|

| Print Name: |

|

|

|

By: |

SAF Trust Under Agreement Dated |

| |

|

|

|

|

July 5, 2022 |

| |

|

|

|

Its: |

Manager |

| |

|

|

|

|

|

| |

|

|

|

By: |

|

| |

|

|

|

|

Boris Tabak, Co-Trustee |

SIGNATURE PAGE

FIRST AMENDMENT TO MORTGAGE AND ASSIGNMENT OF LEASES

ACKNOWLEDGMENT

STATE OF FLORIDA

COUNTY OF ______________________

The foregoing instrument was

acknowledged before me by means of ☐ physical presence or ☐

online notarization, this ______ day of ________________, 2024, by Boris Tabak, Co-Trustee of the SAF Trust Under Agreement Dated July

5, 2022, being the manager of Brooksville Development DE LLC, a Delaware limited liability company, being the manager of BROOKSVILLE DEVELOPMENT

PARTNERS, LLC, a Florida limited liability company (“Mortgagor”), on behalf of Mortgagor, who is personally known to

me or has produced _______________________ as identification.

| (Notary Seal) |

|

|

| |

|

Notary Public |

| |

|

|

| |

|

|

| |

|

Name typed, printed or

stamped |

| |

|

My Commission Expires:

___________________________ |

ACKNOWLEDGMENT PAGE

FIRST AMENDMENT TO MORTGAGE AND ASSIGNMENT OF LEASES

EXHIBIT A

LEGAL DESCRIPTION

A PARCEL OF LAND LYING IN AND BEING A PART OF

SECTION 28, TOWNSHIP 22 SOUTH, RANGE 19 EAST, HERNANDO COUNTY, FLORIDA, AND BEING MORE PARTICULARLY DESCRIBED AS FOLLOWS:

COMMENCE AT THE NW CORNER OF THE SW 1/4 OF SAID

SECTION 28; THENCE RUN SOUTH 00°24'13" EAST ALONG THE WEST BOUNDARY OF SAID SW 1/4 A DISTANCE OF 61.82 FEET TO THE NW CORNER

OF LANDS DESCRIBED IN OFFICIAL RECORDS BOOK 1922, PAGE 1778, PUBLIC RECORDS OF HERNANDO COUNTY, FLORIDA; THENCE RUN SOUTH 72°31'51"

EAST ALONG THE NORTHERLY BOUNDARY OF SAID LANDS A DISTANCE OF 459.37 FEET TO THE POINT OF BEGINNING; THENCE RUN NORTH 17°36'50"

EAST ALONG THE EASTERLY BOUNDARY, AND THE EXTENSION THEREOF, OF AND DESCRIBED IN OFFICIAL RECORDS BOOK 1059, PAGE 1669 OF SAID PUBLIC

RECORDS, A DISTANCE OF 765.00 FEET TO THE SOUTHERLY RIGHT OF WAY LINE OF STATE ROAD 50 (CORTEZ BOULEVARD); THENCE RUN ALONG SAID RIGHT

OF WAY THE FOLLOWING THREE (3) COURSES AND DISTANCES: (1) SOUTH 72°31'51" EAST 675.21 FEET; (2) NORTH 00°25'38" WEST,

24.17 FEET; (3) SOUTH 72°31'51" EAST, 473.70 FEET TO THE WESTERLY BOUNDARY OF LAND DESCRIBED IN OFFICIAL RECORDS BOOK 961, PAGE

601 AND OFFICIAL RECORDS BOOK 1038, PAGE 1280, OF SAID PUBLIC RECORDS; THENCE RUN ALONG SAID BOUNDARY THE FOLLOWING SEVEN (7) COURSES

AND DISTANCES: (1) SOUTH 17°28'09" WEST, 388.00 FEET; (2) SOUTH 72°31'51" EAST, 25.00 FEET; (3) SOUTH 17°28'09"

WEST, 17.50 FEET TO THE POINT OF CURVATURE OF A CURVE CONCAVE NORTHWESTERLY, HAVING A RADIUS OF 125.00 FEET, A DELTA OF 86°49'54'',

A CHORD BEARING OF SOUTH 60°53'06" WEST, AND A CHORD OF 171.82 FEET; THENCE RUN ALONG THE ARC OF SAID CURVE (4) 189.44 FEET;

(5) SOUTH 14°18'03" WEST, 36.00 FEET; (6) SOUTH 72°31'51" EAST, 362.65 FEET; (7) SOUTH 02°07'13" EAST, 231.92

FEET TO THE SOUTH BOUNDARY OF THE EAST 1/2 OF THE NW 1/4 OF THE NE 1/4 OF THE SW 1/4 OF SAID SECTION 28; THENCE RUN SOUTH 89°19'20"

WEST ALONG SAID SOUTH BOUNDARY A DISTANCE OF 10.44 FEET TO THE NORTHERLY BOUNDARY OF LAND DESCRIBED IN SAID OFFICIAL RECORDS BOOK 1922,

PAGE 1778; THENCE RUN NORTH 72°31'51" WEST ALONG SAID NORTHERLY BOUNDARY A DISTANCE OF 1482.80 FEET TO THE POINT OF BEGINNING.

EXHIBIT A

Exhibit 10.3

BROOKSVILLE DEVELOPMENT PARTNERS, LLC

CERTIFICATE OF COMPANY RESOLUTION FOR

REPUBLIC BANK OF CHICAGO LOAN EXTENSION

THE UNDERSIGNED, Brooksville

Development DE LLC, a Delaware limited liability company and the Class A Member (the “Class A Member”) holding 29% of

the membership interest in Brooksville Development Partners, LLC, a Florida limited liability company (the “Company”)

and the managing member of the Company, Brooksville FL Partners, LLC (“BFLP”), a Florida limited liability company

and a Class B Member holding 7.1% of the membership interest in the Company, and Cuentas, Inc., a Florida corporation holding 63.9% of

the membership interest in the Company (“Cuentas”) collectively with BFLP, the “Class B Members”)

in lieu of a meeting of the members of the Company, hereby consent to and adopt the following resolutions:

WHEREAS, the Company desires

to enter into that certain Loan Extension Agreement with Republic Bank of Chicago (the “Lender”) to extend to January

__, 2024, the current Maturity Date of the Loan Agreement, the Promissory Note in the original principal amount of $3,055,000 (the “Secured

Loan”), and the related loan documents (collectively, the “Loan Documents”);

WHEREAS, the Class A and

Class B Members desire to set forth their agreement regarding the terms and conditions of the Loan Extension Agreement and the grant of

an option to Cuentas regarding the repayment of the loan;

NOW, THEREFORE, be it:

RESOLVED, the Class A Member

and Class B Members hereby approve the (i) terms of the Loan Extension Agreement as set forth in Exhibit A by and between the Company

and Republic Bank of Chicago and (ii) the terms of the $500,000 loan evidenced by the Promissory Note between the Company and ALF Trust

u/a/d 09/28/2023 necessary to fund the interest reserve and fees relating to Loan Extension Agreement and the working capital needs of

the Company (the “Unsecured Loan”), subject to the following terms and conditions:

A.

Class A Member and BFLP hereby grant Cuentas an option to satisfy or cause to be satisfied in full or in part the indebtedness, including

the principal and interest and other charges outstanding, under either the Secured Loan or the Unsecured Loan (the “Satisfied

Indebtedness”), and to convert the Satisfied Indebtedness into membership interests to be transferred respectively from each

the Class A Member and BFLP pro rata to Cuentas or its designees to be calculated as follows: the percentage membership interests of the

Class A Member and BFLP to be transferred to Cuentas or its designees to equal the percentage membership interests owned by Class A Member

and BFLP multiplied by the fraction, the numerator of which is the sum of (i) the amount of the Satisfied Indebtedness and the denominator

of which is the sum of the aggregate Capital Contributions of the Members of the Company. The amount of the Satisfied Indebtedness shall

be added to the Capital Account Balance of Cuentas or allocated to establish the Capital Account Balance of the Cuentas designees. The

percentage membership interest and Capital Account balances shall be automatically adjusted accordingly without the need for further act

of the party.

B.

Class A Member and BFLP grant Cuentas the option at any time before the sale of the real estate project to sell a portion or all of its

membership interest in the Company to a qualified investor subject to the approval of Class A Member and BFLP such approval to be in good

faith and not to be unreasonably withheld.

FURTHER RESOLVED, subject

to the provisions above, that Boris Tabak is hereby authorized to sign, or caused to be signed, on behalf of the Managing Member of the

Company, the Loan Extension Agreement and the Unsecured Loan and any and all related loan documents, settlement statements, and other

documents necessary to consummate the aforementioned loan extension transaction;

FURTHER RESOLVED, that Boris

Tabak is hereby authorized and directed to certify to any interested party that this resolution has been duly adopted, is in full force

and effect, and is in accordance with the provisions of the operating agreement of the Company, the Class A Member and the Class B Members.

FURTHER RESOLVED that by

signature below, each Class A Member and the Class B Member represents that it is duly organized and existing and has the power to take

the action called for by the foregoing resolution that there has been no event of dissolution.

[SIGNATURE PAGES TO FOLLOW]

IN WITNESS THEREOF, this Certificate of Company

Resolution is executed this __ day of January 2024.

| COMPANY: |

|

| |

|

| BROOKSVILLE DEVELOPMENT PARTNERS, LLC, |

|

| A Florida limited liability company |

|

| |

|

| By: BROOKSVILLE DEVELOPMENT DE, LLC, |

|

| A Delaware limited liability company |

|

| Its: Manager |

|

| By: SAF Trust u/a/d July 5, 2022 |

|

| Its: Manager |

|

| |

|

| By: |

|

|

| Name: Boris Tabak |

|

| Its: Co-Trustee |

|

| |

|

| CLASS A MEMBER: |

|

| |

|

| BROOKSVILLE DEVELOPMENT DE LLC, |

|

| |

|

| A Delaware limited liability company |

|

| By: SAF Trust u/a/d July 5, 2022 |

|

| Its: Manager |

|

| |

|

| By: |

|

|

| Name: Boris Tabak |

|

| Its: Co-Trustee |

|

| |

|

| CLASS B MEMBERS: |

|

| |

|

BROOKSVILLE FL PARTNERS, LLC,

|

|

| |

|

| By: SAF Trust u/a/d July 5, 2022 |

|

| Its: Manager |

|

| |

|

| By: |

|

|

| Name: Boris Tabak |

|

| Its: Co-Trustee |

|

| |

|

| CUENTAS INC. |

|

| |

|

| By: |

|

|

| Name: Arik Maimon |

|

| President |

|

3

Exhibit 10.4

AMENDED AND RESTATED PROMISSORY NOTE

BROOKSVILLE

| $3,055,000.00 |

Effective Date: January 27, 2024 |

| |

Chicago, Illinois |

1.

AGREEMENT TO PAY. FOR VALUE RECEIVED, BROOKSVILLE DEVELOPMENT PARTNERS, LLC, a Florida limited liability company

(“Borrower”), HEREBY PROMISES TO PAY to the order of REPUBLIC BANK OF CHICAGO, its successors and assigns (“Lender”),

the principal sum of Three Million Fifty-Five Thousand and No/100 Dollars ($3,055,000.00) (“Loan”) or so much of the

Loan as may be advanced under and pursuant to that certain Loan Agreement dated as of April 27, 2023, as modified by that certain First

Modification of Loan Documents (“First Modification”) made effective as of January 27, 2024 (as amended, restated or

replaced from time to time, “Loan Agreement”) among Borrower, Guarantor (as defined therein) and Lender, on the day

that is 364 days after the effective date of this Amended and Restated Promissory Note (“Note”), or January 25, 2025

(“Maturity Date”) at the place and in the manner hereinafter provided, together with interest thereon at the rate or

rates described below, and any and all other amounts which may be due and payable hereunder or under any of the Loan Documents from time

to time.

This Note amends, restates

and replaces in its entirety that certain Promissory Note dated April 27, 2023, in the principal amount of Three Million Fifty-Five Thousand

and No/100 Dollars ($3,055,000.00) made payable by Borrower to the order of Lender (the “Original Note”). The indebtedness

evidenced by the Original Note is continuing indebtedness, and nothing in this Note shall be deemed to constitute a payment, settlement

or novation of the Original Note, or the release of, or otherwise adversely affect, any lien, mortgage or security interest securing such

indebtedness or any rights of Lender against the undersigned, or any Guarantor of the Original Note or this Note. All of the obligations

of Borrower shall, from and after execution and delivery of this Note by Borrower, continue in full force and effect as set forth herein.

The Original Note is the Note referenced in and was made pursuant to the Loan Agreement. This Note is the Amended Note referred to in

the First Modification. From and after the date hereof, any reference to the Original Note in any of the Loan Documents shall mean and

refer to this Note. Any interest accrued on such Original Note as of the date hereof will be included in the next monthly installment

due hereunder, and any interest adjustment accrued on such Original Note as of the date hereof will be included in the calculation of

the next interest payment due hereunder.

2.

INTEREST.

2.1

Definitions. For the purposes of this Note, the following terms shall have the following meanings:

(a)

“Applicable Margin” means .50% per annum with respect to the Prime based rate.

(b)

“Business Day” means any day other than a Saturday, a Sunday or, as determined by Lender, any day that banks

in Chicago, Illinois are required or permitted to close, including federal holidays.

(c)

“Default Rate” means an interest rate equal to five percent (5.00%) plus the Loan Rate then in effect,

provided, however, in no event shall the Default Rate exceed the maximum rate permitted by law.

(d)

“Loan Rate” means the Prime Rate then in effect.

(e)

“Prime” means, for any day, the prime rate of interest in effect for such day as published in the Wall Street

Journal or other similar sources as designated by Lender (it being understood and agreed that such rate may not be Lender’s

best or lowest rate); provided, if any day falls on a date other than a Business Day or on a date when the Wall Street Journal

is not published, the rate shall be determined with reference to the applicable rate shown in the most recently published edition

of the Wall Street Journal. In no event shall Prime be less than 0.00.

(f)

“Prime Rate” means an interest rate per annum equal to Prime as in effect from time to time plus the Applicable

Margin.

(g)

All terms not otherwise defined herein shall have the meaning set forth in the Loan Agreement.

2.2

Interest Rate.

(a)

From the date hereof through the Maturity Date, interest shall accrue on the outstanding principal balance of this Note at the

Prime Rate.

(b)

The initial Prime Rate shall be equal to the Prime Rate in effect as of the date of this Note, and thereafter the Prime Rate shall

be reset on the day that Lender announces a change in Prime (herein, a “Change Date”) and remain in effect until the

next Change Date.

2.3

Interest After Default. From and after the Maturity Date or upon the occurrence of an Event of Default, interest shall accrue

on the unpaid principal balance of this Note during any such period at the Default Rate. The interest accruing under this section shall

be immediately due and payable by Borrower to the holder of this Note upon demand and shall be additional indebtedness evidenced by this

Note.

2.4

Interest Calculation. Interest on this Note shall be calculated on the basis of, and “per annum” shall mean

a 360 day year and the actual number of days elapsed in any portion of a month in which interest is due. If any payment to be made by

Borrower hereunder shall become due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day

and such extension of time shall be included in computing any interest in respect of such payment.

3.

PAYMENT TERMS.

3.1

Principal and Interest. Payments of principal and interest due under this Note, if not sooner declared to be due in accordance

with the provisions hereof, shall be made as follows:

(a)

Commencing on February 1, 2024, and continuing on the first (1st) day of each month thereafter through and including the month

in which the Maturity Date occurs, payments of accrued and unpaid interest at the Prime Rate shall be due and payable; and

(b)

The unpaid principal balance of this Note, if not sooner paid or declared to be due in accordance with the terms hereof, together

with all accrued and unpaid interest thereon and any other amounts due and payable hereunder or under any of the Loan Documents shall

be due and payable in full on the Maturity Date.

3.2

Application of Payments. Prior to the occurrence of an Event of Default, all payments and prepayments on account of the

indebtedness evidenced by this Note shall be applied as follows: (a) first, to fees, expenses, costs and other similar amounts then due

and payable to Lender, including, without limitation, any prepayment premium, exit fee or late charges due hereunder, (b) second, to accrued

and unpaid interest on the principal balance of this Note, (c) third, to the payment of principal due in the month in which the payment

or prepayment is made, (d) fourth, to any escrows, impounds or other amounts which may then be due and payable under the Loan Documents,

(e) fifth, to any other amounts then due Lender hereunder or under any of the Loan Documents, and (f) last, to the unpaid principal balance

of this Note in the inverse order of maturity. Any prepayment on account of the indebtedness evidenced by this Note shall not extend or

postpone the due date or reduce the amount of any subsequent monthly payment of principal and interest due hereunder. After an Event of

Default has occurred, payments may be applied by Lender to amounts owed hereunder and under the Loan Documents in such order as Lender

shall determine, in its sole discretion.

3.3

Method of Payments. All payments of principal, interest, and other amounts due hereunder shall be paid by automatic debit

from Borrower’s accounts with Lender on the first (1st) day of each month during the term of the Loan or in such other manner as

Lender or the legal holder or holders of this Note may from time to time designate in the payment invoice. Notwithstanding the foregoing,

the final payment due under this Note must be made by wire transfer or other immediately available funds. Interest, principal payments

and any fees and expenses owed Lender from time to time will be deducted by Lender automatically on the due date from Borrower’s

account with Lender, as designated in writing by Borrower; provided, however, that if no Event of Default has occurred, then such interest

payments may be advanced from the Interest Reserve Allocation until such reserve is depleted and then from such other account designated

in writing by Borrower. Borrower shall maintain sufficient funds in the account on the Payment Date. If there are insufficient funds in

the account on the Payment Date, the debit will be reversed, and such event may result in Lender’s declaration of an Event of Default.

3.4

Late Charge. If any payment of interest or principal due hereunder is not made within ten (10) days after such payment is

due in accordance with the terms hereof, then, in addition to the payment of the amount so due, Borrower shall pay to Lender a “late

charge” of five cents for each whole dollar so overdue to defray part of the cost of collection and handling such late payment.

Borrower agrees that the damages to be sustained by the holder hereof for the detriment caused by any late payment are extremely difficult

and impractical to ascertain, and that the amount of five cents for each one dollar due is a reasonable estimate of such damages, does

not constitute interest, and is not a penalty.

3.5

Optional Principal Prepayments. Borrower may voluntarily prepay the entire balance of this Note, subject to the following

conditions:

(a)

Not less than fifteen (15) days prior to the date upon which Borrower desires to make such prepayment, Borrower shall deliver to

Lender written notice of Borrower’s intention to prepay the outstanding principal balance of this Note, which notice shall state

the proposed prepayment date (“Prepayment Date”); and

(b)

Borrower shall pay to Lender all accrued and unpaid interest through the Prepayment Date on the principal balance being prepaid

and any other obligations of Borrower to Lender then due which remain unpaid.

4.

SECURITY. This Note is secured by, among other things, the Mortgage and the Liens created by the other Loan Documents

granted in favor of Lender. Reference is hereby made to the Loan Documents (which are incorporated herein by reference as fully and with

the same effect as if set forth herein at length) for a statement of the covenants and agreements contained therein, a statement of the

rights, remedies, and security afforded thereby, and all matters therein contained.

5.

EVENTS OF DEFAULT. The occurrence of any one or more of the following events shall constitute an “Event

of Default” under this Note:

5.1

The failure by Borrower to pay (a) the entire Indebtedness due under the Loan Documents by the Maturity Date, (b) any installment

of principal or interest payable pursuant to this Note or any payment required to be made into a Reserve Account within ten (10) days

after the date when due, or (c) any other amount payable to Lender under this Note, the Mortgage or any of the other Loan Documents and

which failure continues for more than ten (10) days after written notice from Lender to Borrower; or

5.2

The occurrence of any “Event of Default” under the Loan Agreement, the Mortgage or any of the other Loan Documents.

6.

REMEDIES. At the election of the holder hereof, and without notice, the principal balance remaining unpaid under

this Note, and all unpaid interest accrued thereon and any other amounts due hereunder and under the other Loan Documents shall be and

become immediately due and payable in full upon the occurrence of any Event of Default. Failure to exercise this option shall not constitute

a waiver of the right to exercise same in the event of any subsequent Event of Default. No holder hereof shall, by any act of omission

or commission, be deemed to waive any of its rights, remedies or powers hereunder or otherwise unless such waiver is in writing and signed

by the holder hereof, and then only to the extent specifically set forth therein. The rights, remedies and powers of the holder hereof,

as provided in this Note, the Mortgage and in all of the other Loan Documents are cumulative and concurrent, and may be pursued singly,

successively or together against Borrower, any Guarantor hereof, the Property and any other security given at any time to secure the repayment

hereof, all at the sole discretion of the holder hereof. If any suit or action is instituted or attorneys are employed to collect this

Note or any part hereof, Borrower promises and agrees to pay all costs of collection, including reasonable attorneys’ fees and court

costs.

7.

COVENANTS AND WAIVERS. Borrower and all others who now or may at any time become liable for all or any part of the

obligations evidenced hereby, expressly agree hereby to be jointly and severally bound, and jointly and severally: (a) waive and renounce

any and all homestead, redemption and exemption rights and the benefit of all valuation and appraisement privileges against the indebtedness

evidenced by this Note or by any extension or renewal hereof; (b) waive presentment and demand for payment, notices of nonpayment and

of dishonor, protest of dishonor, and notice of protest; (c) except as expressly provided in the Loan Documents, waive any and all notices

in connection with the delivery and acceptance hereof and all other notices in connection with the performance, default, or enforcement

of the payment hereof or hereunder; (d) waive any and all lack of diligence and delays in the enforcement of the payment hereof; (e) agree

that the liability of Borrower and any guarantor, endorser or obligor shall be unconditional and without regard to the liability of any

other person or entity for the payment hereof, and shall not in any manner be affected by any indulgence or forbearance granted or consented

to by Lender to any of them with respect hereto; (f) consent to any and all extensions of time, renewals, waivers, or modifications that

may be granted by Lender with respect to the payment or other provisions hereof, and to the release of any security at any time given

for the payment hereof, or any part thereof, with or without substitution, and to the release of any person or entity liable for the payment

hereof; and (g) consent to the addition of any and all other makers, endorsers, guarantors, and other obligors for the payment hereof,

and to the acceptance of any and all other security for the payment hereof, and agree that the addition of any such makers, endorsers,

guarantors or other obligors, or security shall not affect the liability of Borrower, any guarantor and all others now liable for all

or any part of the obligations evidenced hereby. Borrower agrees that it will not assert any claim against Lender on any theory of lability

for special, indirect, consequential, incidental or punitive damages. This provision is a material inducement for Lender making the Loan

to Borrower.

8.

GENERAL AGREEMENTS.

8.1

Business Purpose Loan. The Loan is a business loan which comes within the purview of Section 205/4, paragraph (1)(c) of

Chapter 815 of the Illinois Compiled Statutes, as amended. Borrower agrees that the Loan evidenced by this Note is an exempted transaction

under the Truth In Lending Act, 15 U.S.C. § 1601 et seq.

8.2

Time. Time is of the essence hereof.

8.3

Disbursement. This Note has been made and delivered at Chicago, Illinois and all funds disbursed to or for the benefit of

Borrower will be disbursed in Chicago, Illinois.

8.4

Benefit. This Note shall inure to the benefit of and may be enforced by Lender and its successors and assigns.

8.5

Enforceability. In the event any one or more of the provisions contained in this Note shall for any reason be held to be

invalid, illegal or unenforceable in any respect by a court of competent jurisdiction, such invalidity, illegality or unenforceability

shall, at the option of Lender, not affect any other provision of this Note, and this Note shall be construed as if such invalid, illegal

or unenforceable provision had never been contained herein or therein.

8.6

Interest Limitation. If the interest provisions herein or in any of the Loan Documents shall result, at any time while this

Note remains outstanding, in an effective rate of interest which, for any month, exceeds the limit of usury or other laws applicable to

the Loan, all sums in excess of those lawfully collectible as interest for the period in question shall, without further agreement or

notice between or by any party hereto, be applied upon principal immediately upon receipt of such monies by Lender, with the same force

and effect as though the payer has specifically designated such extra sums to be so applied to principal and Lender had agreed to accept

such extra payment(s) as a premium-free prepayment. Notwithstanding the foregoing, however, Lender may at any time and from time to time

elect by notice in writing to Borrower to reduce or limit the collection to such sums which, when added to the said first-stated interest,

shall not result in any payments toward principal in accordance with the requirements of the preceding sentence. In no event shall any

agreed to or actual exaction as consideration for this Loan transcend the limits imposed or provided by the law applicable to this transaction

or the makers hereof in the jurisdiction in which the Property is located for the use or detention of money or for forbearance in seeking

its collection.

8.7

Assignability. Lender may at any time assign its rights in this Note and the Loan Documents, or any part thereof and transfer

its rights in any or all of the collateral, and Lender thereafter shall be relieved from all liability with respect to such collateral.

In addition, Lender may at any time sell one or more participations in this Note. Borrower may not assign its interest in this Note, or

any other agreement with Lender or any portion thereof, either voluntarily or by operation of law, without the prior written consent of

Lender.

9.

NOTICES. All notices required under this Note will be in writing and will be transmitted in the manner and to the

addresses required by the Loan Agreement.

10.

GOVERNING LAW. This Note shall be governed by and construed in accordance with the substantive laws of the State

of Illinois.

11.

CONSENT TO JURISDICTION. TO INDUCE LENDER TO ACCEPT THIS NOTE, BORROWER IRREVOCABLY AGREES THAT, SUBJECT TO LENDER’S

SOLE AND ABSOLUTE ELECTION, ALL ACTIONS OR PROCEEDINGS IN ANY WAY ARISING OUT OF OR RELATED TO THIS NOTE WILL BE LITIGATED IN COURTS HAVING

SITUS IN COOK COUNTY, ILLINOIS OR THE COUNTY WHERE THE PROPERTY IS LOCATED. BORROWER HEREBY CONSENTS AND SUBMITS TO THE JURISDICTION OF

ANY COURT LOCATED WITHIN COOK COUNTY, ILLINOIS OR THE COUNTY WHERE THE PROPERTY IS LOCATED, WAIVES PERSONAL SERVICE OF PROCESS UPON BORROWER,

AND AGREES THAT ALL SUCH SERVICE OF PROCESS MAY BE MADE BY NOTICE TO BORROWER IN ACCORDANCE WITH THE LOAN AGREEMENT AND SERVICE SO MADE

WILL BE DEEMED TO BE COMPLETED UPON ACTUAL RECEIPT.

12.

WAIVER OF JURY TRIAL. BORROWER AND LENDER (BY ACCEPTANCE OF THIS NOTE), HAVING BEEN REPRESENTED BY COUNSEL, EACH

KNOWINGLY AND VOLUNTARILY WAIVES ANY RIGHT TO A TRIAL BY JURY IN ANY ACTION OR PROCEEDING TO ENFORCE OR DEFEND ANY RIGHTS (A) UNDER THIS

NOTE OR ANY RELATED AGREEMENT OR UNDER ANY AMENDMENT, INSTRUMENT, DOCUMENT OR AGREEMENT DELIVERED OR WHICH MAY IN THE FUTURE BE DELIVERED

IN CONNECTION WITH THIS NOTE OR (B) ARISING FROM ANY BANKING RELATIONSHIP EXISTING IN CONNECTION WITH THIS NOTE, AND AGREES THAT ANY SUCH

ACTION OR PROCEEDING WILL BE TRIED BEFORE A COURT AND NOT BEFORE A JURY.

13.

WAIVER OF DEFENSES. OTHER THAN CLAIMS BASED UPON THE FAILURE OF LENDER TO ACT IN A COMMERCIALLY REASONABLE MANNER,

BORROWER WAIVES EVERY PRESENT AND FUTURE DEFENSE (OTHER THAN THE DEFENSE OF PAYMENT IN FULL), CAUSE OF ACTION, COUNTERCLAIM OR SETOFF

WHICH BORROWER MAY NOW HAVE OR HEREAFTER MAY HAVE TO ANY ACTION BY LENDER IN ENFORCING THIS NOTE OR ANY OF THE LOAN DOCUMENTS. THIS PROVISION

IS A MATERIAL INDUCEMENT FOR LENDER GRANTING ANY FINANCIAL ACCOMMODATION TO BORROWER.

[Signatures on the following page]

IN WITNESS WHEREOF,

Borrower has executed and delivered this Amended and Restated Promissory Note as of the day and year first above written.

| |

BORROWER: |

| |

|

|

|

| |

BROOKSVILLE DEVELOPMENT PARTNERS,

LLC, a Florida limited liability company |

| |

|

|

|

| |

By: |

Brooksville Development DE LLC, |

| |

|

a Delaware limited liability company |

| |

Its: |

Manager |

| |

|

|

|

| |

|

By: |

SAF Trust Under Agreement Dated |

| |

|

|

July 5, 2022 |

| |

|

Its: |

Manager |

| |

|

|

|

| |

|

By: |

|

| |

|

|

Boris Tabak, Co-Trustee |

Signature Page

Amended and Restated Promissory Note

Exhibit 10.5

CUEN – Unlocking

Value: Cuentas, Inc. Sells Brooksville Real Estate for $7.2 Million, Unleashing Double Digit Profits and Rewards Founders Strategic Vision

Cuentas, Inc.’s Strategic Move: From $5.05

Million Acquisition to $7.2 Million Sale - A Remarkable Leap in Record Time

MIAMI BEACH, FL, March 14, 2024 (GLOBE NEWSWIRE)

-- Cuentas, Inc. (OTC: CUEN & CUENW) (“CUEN” or “the Company”), a pioneer driving the seamless integration

of fintech, mobile telecommunications, and real estate for the unbanked and underbanked Hispanic demographic, Cuentas is pleased to announce

the unveiling of the terms for the sale of its esteemed Brooksville, Florida property. Acquired in 2023, the transaction sets the stage

for a transformative deal expected to close within 60 days, following due diligence by the purchaser. This transaction will furnish the

Company with organic cash, fortifying its resources for future ventures and affirming its successful strategic focus on Fintech and Mobile

Services.

The agreement solidifies Cuentas’ decision to

divest its real estate investments in Brooksville, Florida, a market renowned for its rapid growth. The sale of the property for $7.2

million unlocks liquidity and yields double-digit returns on the investment, based on its purchase price of $5.05 million. With the closing

slated for within 60 days and funds in escrow, the Company is poised for further enhancement of its financial position.

After extensive evaluation of various options,

including exploring development joint ventures and assessing multiple purchase offers, management opted for the most advantageous agreement.

This decision prioritizes expediency in closing and delivers double-digit percentage returns. Management views this transaction as a tactical

triumph, aligning with the Company’s objectives of profitability and cash flow. It empowers continued involvement in development projects

in the South Florida region, leveraging the company’s local headquarters in Miami Beach, Florida.

The proceeds from this sale will be channeled

towards self-funding the company, reinforcing its Cuentas Money (Fintech) and Cuentas Mobile (Mobile) services, and fostering additional

real estate developments akin to the successful Lakewood Villas development, where the company holds a 6% stake.

Cuentas has duly filed an 8K with the requisite

disclosures regarding this transaction. Interested parties may access the filing through the following link: [8K].

Cuentas, Inc. (OTC: CUEN & CUENW) is

creating an alternative financial ecosystem for the growing global population who do not have access to traditional financial alternatives.

The Company’s proprietary technologies help to integrate FinTech (Financial Technology), e-finance and e-commerce services into

solutions that deliver next generation digital financial services to the unbanked, under-banked and underserved populations nationally

in the USA. The Cuentas Platform integrates Cuentas Mobile, the Company’s Mobile Telecommunications solution, with its core financial

services offerings to help entire communities enter the modern financial marketplace. Cuentas has launched its General Purpose Reloadable

(GPR) Card, which includes a digital wallet, discounts for purchases at major physical and online retailers, rewards, and the ability

to purchase digital content. LINK: https://cuentas.com AND https://cuentasmobile.com.

For additional media and information, please follow us on:

Twitter Instagram YouTube

LinkedIn

Forward-Looking Statements

This news release contains “forward-looking

statements,” as that term is defined in section 27a of the United States Securities Act of 1933, as amended, and section 21e of the

United States Securities Exchange Act of 1934, as amended. These forward-looking statements involve substantial uncertainties and risks

and are based upon our current expectations, estimates and projections and reflect our beliefs and assumptions based upon information

available to us at the date of this release. We caution readers that forward-looking statements are predictions based on our current expectations

about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties

and assumptions that are difficult to predict. Our actual results, performance or achievements could differ materially from those expressed

or implied by the forward-looking statements as a result of a number of factors, including, but not limited to, OTC and shareholder approval

of the proposed transaction, our ability to manage our research and development programs that are based on novel technologies, our ability

to successfully integrate WHEN operations and product offerings, the sufficiency of working capital to realize our business plans and

our ability to raise additional capital, market acceptance, the going concern qualification in our financial statements, our ability to

retain key employees, our competitors developing better or cheaper alternatives to our products, risks relating to legal proceedings against

us and the risks and uncertainties discussed under the heading “RISK FACTORS” in Item 1A of our Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, and in our other filings with the Securities and Exchange Commission. We undertake no obligation

to revise or update any forward-looking statement for any reason.

Contact Information:

Arik Maimon

CEO at Cuentas Inc

Cuentas Inc. (OTC:CUEN)

Phone: 800-611-3622

Mobile: 786-774-2835

Web: www.cuentas.com

Email: arik@cuentas.com

v3.24.0.1

Cover

|

Mar. 13, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 13, 2024

|

| Entity File Number |

001-39973

|

| Entity Registrant Name |

Cuentas, Inc.

|

| Entity Central Index Key |

0001424657

|

| Entity Tax Identification Number |

20-3537265

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

235 Lincoln Rd.

|

| Entity Address, Address Line Two |

Suite 210

|

| Entity Address, City or Town |

Miami Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33139

|

| City Area Code |

800

|

| Local Phone Number |

611-3622

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CUEN

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Common Stock

|

| Trading Symbol |

CUENW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CUEN_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CUEN_WarrantsEachExercisableForOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

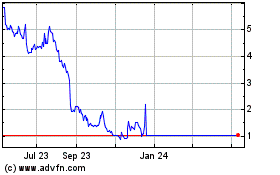

Cuentas (NASDAQ:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cuentas (NASDAQ:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024