0001337013false00013370132024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 8, 2024

___________________________________

InfuSystem Holdings, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-35020 (Commission File Number) | 20-3341405 (I.R.S. Employer Identification Number) |

| | |

3851 West Hamlin Road Rochester Hills, Michigan 48309 |

(Address of principal executive offices) (Zip Code) |

| | |

(248) 291-1210 |

(Registrant's telephone number, including area code) |

| | |

| Not Applicable | |

| (Former Name or Former Address, if Changed Since Last Report) |

___________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Common Stock, par value $.0001 per share | INFU | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 - Entry into a Material Definitive Agreement

The information set forth in Item 5.02 below relating to the Cooperation Agreement (as defined below) is incorporated herein by reference.

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On March 8, 2024, the Board of Directors (the "Board") of InfuSystem Holdings, Inc. (the “Company”) accepted the resignation of Mr. R. Rimmy Malhotra as a member of the Board, effective March 8, 2024, pursuant to a cooperation agreement (the "Cooperation Agreement") by and among the Company, Mr. Malhotra and Nicoya Capital LLC ("Nicoya"). Mr. Malhotra's resignation is not the product of any disagreement with the Company.

In consideration for certain standstill, release, indemnity and voting provisions under the Cooperation Agreement as well as all potential costs incurred by Nicoya, Mr. Malhotra and their respective controlled affiliates in connection with Mr. Malhotra’s transition off the Board, the Company has agreed to pay Nicoya a one-time separation payment in an amount equal to $500,000. Additionally, the Company has agreed to pay Mr. Malhotra $125,000 as compensation for (i) the value of the director stock options that Mr. Malhotra agrees to surrender coincident to his resignation and (ii) the balance of compensation that would be payable to Mr. Malhotra for his service on the Board through the end of his current term (such amount, collectively with the one-time separation payment, the “Exit Consideration”).

The standstill provisions of the Cooperation Agreement provide that, for three years following the date of the Cooperation Agreement, the Company, Mr. Malhotra and Nicoya have mutually agreed to refrain from making or inducing any public oral or written statements that disparage or demean the other party. In addition, during the three years following the date of the Cooperation Agreement, neither Mr. Malhotra nor Nicoya will, without the written consent of the Board, directly or indirectly:

(a) acquire or attempt to acquire any shares of the Company’s stock, or any options to purchase or sell shares of the Company’s stock;

(b) make, effect or commence any tender or exchange offer, merger or other business combination involving the Company;

(c) make, or in any way participate in, any “solicitation” of “proxies” (as such terms are used in the proxy rules of the Securities and Exchange Commission) to vote, or seek to advise any person with respect to the voting of, any voting securities of the Company;

(d) disclose any intention, plan or arrangement inconsistent with the foregoing; or

(e) form, join or in any way participate in a “group” (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934) with respect to any voting securities of the Company, other than a group among Malhotra, Nicoya and their affiliates.

The release, indemnity and voting provisions agreed upon under the Cooperation Agreement are as follows:

(a) the Company releases Mr. Malhotra, Nicoya and each of their respective affiliates (“Malhotra’s Released Parties”), and Mr. Malhotra and Nicoya release the Company and each of its respective affiliates (the “Company’s Released Parties”), from all causes of action and obligations, whether known or unknown, one may have against the other as of the date of the Cooperation Agreement, other than any matter related to the enforceability or performance of the Cooperation Agreement;

(b) Mr. Malhotra and Nicoya will hold the Company’s Released Parties harmless from and against any civil suit filed in a court of competent jurisdiction (“Civil Suit”) filed, or actively participated in, by Mr. Malhotra, Nicoya, or any of their affiliates, against the Company’s Released Parties in connection with any claim arising on or before the date of the Cooperation Agreement. In the event of any such Civil Suit as described above, Mr. Malhotra and Nicoya, jointly and severally, will be liable for liquidated damages to the Company in an amount equal to the Exit Consideration;

(c) until such time as Mr. Malhotra and Nicoya cease to hold any securities of the Company, and Mr. Malhotra has notified the Company of the same in writing, (i) Mr. Malhotra and Nicoya will hold the Company’s Released Parties harmless from and against any and all liabilities, losses, and expenses of any kind incurred by the Company’s Released Parties in connection with any Civil Suit made against a Company Released Party by Mr. Malhotra, Nicoya or any of their affiliates arising out of any matter occurring after the date of the Cooperation Agreement and (ii) the Company will hold Malhotra’s Released Parties harmless from and against any and all liabilities, losses, and expenses of any kind incurred by Malhotra’s Released Parties in connection with any Civil Suit made against a Malhotra Released Party by the Company or its controlled affiliates arising out of any matter occurring after the date of the Cooperation Agreement;

(d) nothing in the Cooperation Agreement restricts or alters the Company’s indemnification policies benefiting current or former independent directors, including Mr. Malhotra; and

(e) during the three years following the date of the Cooperation Agreement, Mr. Malhotra and Nicoya agree that they will, and each will cause their respective controlled affiliates, to vote all shares of the Company’s stock held by such persons or entities in conformity with the Board’s recommendations for any matter brought to a shareholder vote.

Pursuant to the Cooperation Agreement, Mr. Malhotra has participated in the process leading to the slate of director nominees that are intended to be put forward by the Company for election at the Company’s 2024 annual meeting of stockholders, and all such individuals have been approved by Mr. Malhotra and each member of the Board.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| INFUSYSTEM HOLDINGS, INC. |

| |

By: | /s/ Scott Shuda |

| Scott Shuda |

| Chairman of the Board |

Dated: March 8, 2024

Exhibit 99.1

COOPERATION AGREEMENT

This Cooperation Agreement (this “Agreement”) is made as of March 8, 2024, by and among InfuSystem Holdings, Inc. (the “Company”), R. Rimmy Malhotra (“Malhotra”), and Nicoya Capital LLC (“Nicoya”); each a “Party” and, collectively, the “Parties.”

WHEREAS, Malhotra has been serving as a member of the Company’s board of directors (the “Board”) since September 20, 2022, during which time he has assisted the Board with, among other things, corporate governance matters; and

WHEREAS, after approximately 18 months of active participation on the Board, Malhotra and the Company now desire to (i) provide for Malhotra’s amicable transition off the board and (ii) establish a basis for continued constructive dialog and cooperation among the Parties.

NOW THEREFORE, the Parties agree as follows:

I.Resignation from the Board. On the date of this Agreement, Malhotra shall deliver to the Company a resignation in the form attached as Exhibit A. Within two business days after the date of this Agreement, the Company will file a Form 8-K with the Securities and Exchange Commission in the form attached as Exhibit B. Except for such Form 8-K, unless otherwise required by applicable securities laws or the rules of the NYSE American, none of the Parties will issue any press release or public announcement regarding this Agreement or the matters contemplated hereby without the prior written consent of the other Parties.

II.Standstill.

A.Until the date that is three years following the date of this Agreement (the “Term”), neither Malhotra nor Nicoya shall, without the prior written approval of the Board, directly or indirectly: (i) make, effect or commence any tender or exchange offer, merger or other business combination involving the Company; (ii) make, or in any way participate in, any “solicitation” of “proxies” (as such terms are used in the proxy rules of the Securities and Exchange Commission) to vote, or seek to advise any person with respect to the voting of, any voting securities of the Company; (iii) disclose any intention, plan or arrangement inconsistent with the foregoing (iv) form, join or in any way participate in a “group” (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934) with respect to any voting securities of the Company, other than a group among Malhotra, Nicoya and their affiliates.

B.Further, during the Term, neither Malhotra nor Nicoya shall acquire or attempt to acquire, directly or indirectly, any shares of the Company’s stock, or any options to purchase or sell shares of the Company’s stock.

III.Release and indemnity.

A.Release by Malhotra and Nicoya. For the consideration and mutual promises specified herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each of Malhotra and Nicoya hereby releases and discharges the Company and all of its successor(s), predecessor(s)-in-interest, subsidiaries, related and affiliated companies and entities, and each of the foregoing companies’ and entities’ respective divisions, officers, directors, agents, employees, and past and present independent contractors (the “Company’s Released Parties”) from all obligations, debts, liabilities, torts, covenants, contracts or causes of action of any kind whatsoever, at law or in equity, whether known or unknown, that any of them may have against the Company’s Released Parties as of the date of this Agreement, except that any matter related to the enforceability or performance of this Agreement is not released.

B.Release by the Company. For the consideration and mutual promises specified herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company hereby releases and discharges Malhotra and Nicoya and all of their successor(s),

predecessor(s)-in-interest, subsidiaries, related and affiliated companies and entities, and each of the foregoing companies’ and entities’ respective divisions, officers, directors, agents, employees, and past and present independent contractors (“Malhotra’s Released Parties”) from all obligations, debts, liabilities, torts, covenants, contracts or causes of action of any kind whatsoever, at law or in equity, whether known or unknown, that the Company may have against the Malhotra’s Released Parties as of the date of this Agreement, except that any matter related to the enforceability or performance of this Agreement is not released.

IV.Other Indemnities.

A.Malhotra and Nicoya will hold the Company’s Released Parties harmless from and against any civil suit filed in a court of competent jurisdiction brought or actively participated in by Nicoya, Malhotra or any of their affiliates (which for this purpose includes all investors in Nicoya or Nicoya Fund LLC, and any of such persons’ or entities’ respective affiliates), against the Company’s Released Parties in connection with any claim arising out of any matter occurring on or before the date of this Agreement. In the event of any such claim as described above, Malhotra and Nicoya, jointly and severally, will be liable for liquidated damages to the Company in an amount equal to the Exit Consideration (defined below) and no more, which actual damages the Parties agree are inherently difficult to determine, and the which amount the Parties agree is not a penalty, but rather a reasonable measure of damages under the circumstances. Consistent with such indemnity, Malhotra and Nicoya represent and warrant having no knowledge of such potential actions. Further, the Company agrees that should it seek redress under this Section IV.A, it will limit its discovery to Malhotra and Nicoya, and should such discovery reveal no reasonable cause for the Company, the Company will reimburse Malhotra and Nicoya for their reasonable expenses.

B.Until such time as Malhotra and Nicoya cease to hold any securities of the Company, and Malhotra has notified the Company of the same in writing, Malhotra and Nicoya will hold the Company’s Released Parties harmless from and against any and all liabilities, losses, damages, expenses, fines and penalties of any kind, including reasonable attorneys’ fees and disbursements, incurred by the Company’s Released Parties in connection with any civil suit brought in a court of competent jurisdiction directly or indirectly by Nicoya, Malhotra or any of their affiliates (which for this purpose includes all investors in Nicoya or Nicoya Fund LLC, and any of such persons’ or entities’ respective affiliates), made against a Company Released Party by Malhotra, Nicoya or any of their affiliates (which for this purpose includes all investors in Nicoya or Nicoya Fund LLC, and any of such persons’ or entities’ respective affiliates) arising out of any matter occurring after the date of this Agreement related directly to Nicoya’s ownership of the Company’s stock or the stewardship of the Company (including related fiduciary duties with respect to the Company) by the Company’s Released Parties in an amount equal to the Exit Consideration (defined below) and no more, which actual damages the Parties agree are inherently difficult to determine, and which amount the Parties agree is not a penalty, but rather a reasonable measure of damages under the circumstances. To be clear Malhotra will have no obligation above and beyond payment of the Exit Consideration under this section.

C.Until such time as Malhotra and Nicoya cease to hold any securities of the Company, and Malhotra has notified the Company of the same in writing, the Company will hold Malhotra’s Released Parties harmless from and against any and all liabilities, losses, damages, expenses, fines and penalties of any kind, including reasonable attorneys’ fees and disbursements, incurred by Malhotra’s Released Parties in connection with any claim made against a Malhotra Released Party by the Company, its controlled affiliates, directors or officers arising out of any matter occurring before or after the date of this Agreement.

D.Nothing in this Agreement shall be read to restrict, discharge or in any way alter the Company’s past, present or future indemnification policies benefiting current or former independent directors, including Malhotra. During the Term, the Company will not amend any of its charter documents or reduce any of its D&O insurance coverages in any manner adverse to Malhotra.

V.Voting Agreement. Malhotra and Nicoya agree that they will, and each shall cause its controlled affiliates, during the Term, to vote all shares of the Company’s stock held by such persons or entities in conformity with the recommendations of the Board for any matter brought to a shareholder vote.

VI.Consideration.

A.In consideration of the above standstill, release, indemnity and voting provisions, within two business days after the date of this Agreement, the Company will pay Nicoya, as directed, an amount equal to $500,000 (which amount reflects the total consideration for the above items as well as any and all legal and other costs whatsoever experienced by Nicoya, Malhotra and their respective controlled affiliates).

B.In addition, the Company agrees to compensate Malhotra $125,000 for (i) the value of the director stock options that Malhotra agrees to surrender coincident to his resignation and (ii) the balance of compensation that would be payable to Malhotra for his service on the Board through the end of his current term (such amount, collectively with all other amounts described in this Section VI is referred to herein as the “Exit Consideration”).

VII.Governance Items.

A.The Parties acknowledge that Malhotra has participated in the process leading to the slate of director nominees that are intended to be put forward by the Company for election at the Company’s 2024 annual meeting of stockholders, and all such individuals have been approved by Malhotra and each member of the Board.

B.The Company agrees that (i) the Board (based on input from Malhotra) has modified the terms of its stock ownership policy applicable to independent directors of the Board, changing the existing minimum ownership requirements and making them mandatory and not advisory and (ii) it will appropriately disclose such stock ownership policy and any future changes thereto in accordance with applicable law and the rules of any applicable stock exchange.

VIII.Confidential Information and Non-Disparagement.

A.Confidential Information.

i.“Confidential Information” means information regarding the Company and its affiliates, their respective business affairs, strategies, financial reports or condition, products, customers, and any other Company-related information which is not publicly known or available and could reasonably be considered confidential and/or proprietary.

ii.Confidential Information shall be subject to the restrictions and obligations specified in this Agreement whether such Confidential Information is in writing or other tangible form; whether it is clearly marked as proprietary or confidential; or whether it is disclosed orally, electronically, or visually. Under no circumstances will Malhotra or Nicoya disclose Confidential Information to any third party (other than attorneys and accountants in connection with seeking assistance relating to this Agreement). Malhotra and Nicoya will use the same degree of care, but not less than a reasonable standard of care, to prevent the unauthorized disclosure or dissemination of Confidential Information as they would use to protect their own similar confidential information. All Confidential Information will remain the property of the Company, and all such information will be immediately returned or destroyed (with certification of destruction by Malhotra and Nicoya) at the request of the Company, except as required by law, policy or regulation. In no event will Malhotra or Nicoya have any right or interest in any Confidential Information.

iii.If Malhotra or Nicoya is required by applicable law, regulation or legal process to disclose any of the Confidential Information, Malhotra and Nicoya agree, provided it is allowed by applicable law, (x) to notify the Company immediately of the existence such demand, (y) to consult with the Company on the advisability of taking legally available steps to resist or narrow such request, and (z) if disclosure of the Confidential Information is required to prevent Malhotra or Nicoya from being held in contempt or other penalty, to furnish only such portion of the Confidential Information as Malhotra or Nicoya is in good-faith advised by counsel that Malhotra or Nicoya is legally compelled to disclose and to exercise reasonable efforts to obtain an order or other reliable assurance that confidential treatment will be accorded to the disclosed Confidential Information. The company will bear any costs and expenses associated with this provision.

iv.Nothing in this Agreement is intended to supersede or amend any previously-entered agreement containing confidentiality protections.

B.Mutual Non-Disparagement. Subject to applicable law, each of the Parties covenants and agrees that during the Term neither it nor any of its respective current agents, subsidiaries, controlled affiliates, successors, assigns, officers, key employees or directors will make or induce others to make any public written or public oral statements that disparage or demean any other Party or any other Party’s affiliates, or any other Party’s or any other Party’s affiliates’ officers, directors, employees, stockholders, managers, members, representatives, agents, products, services, or business plans other than, in the case of individuals, to the individual’s immediate family members or financial or legal advisors, or if (a) testifying truthfully under oath pursuant to a lawful court order or subpoena or the equivalent, including arbitral orders, and interview requests from governmental agencies or (b) responding truthfully pursuant to a request from a governmental agency acting within the scope of their investigative authority. Nothing in this Section or in any other provision of this Agreement will be interpreted or applied to prohibit a Party from making any good faith report to any governmental agency or other governmental entity concerning any acts or omissions that a Party believes to constitute a possible violation of federal or state law or making other disclosures that are protected under the whistleblower provisions of applicable federal or state law or regulation.

IX.General Provisions.

A.The Parties agree that a breach of any part of this Agreement by any Party may cause immediate and irreparable injury to another Party and that all Parties shall therefore be entitled to seek equitable relief, including injunction and specific performance, in the event of any such breach, in addition to all other remedies available at law or in equity.

B.The Parties represent that they have had the opportunity to be represented by counsel with respect to this Agreement and that their signatures to this Agreement are with full knowledge, understanding and the product of their free will, act, and deed under no compulsion or duress.

C.This Agreement shall be exclusively governed by and construed according to the laws of the State of Delaware. If a suit is filed by Malhotra or Nicoya, the suit must be filed exclusively in the Chancery Court of the State of Delaware. If a suit is filed by the Company, the suit must be filed exclusively in a federal court located in the State of California.

D.Each of the Parties represents and warrants to the other that this Agreement has been duly executed and constitutes a valid, binding, and enforceable obligation.

E.This Agreement may be signed in any number of counterparts, which when taken together, will constitute one agreement. A facsimile transmission or electronic document attachment (such as PDF) to an email communication of a signed counterpart of this Agreement will be sufficient to bind the Party whose signature appears thereon.

F.Each Party will pay its their own expenses with respect to this Agreement.

G.If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Agreement will remain in full force and effect and will not be affected, impaired or invalidated. In addition, the Parties agree to use commercially reasonable efforts to agree upon and substitute a valid and enforceable term, provision, covenant or restriction for any of such that is held invalid, void or enforceable by a court of competent jurisdiction.

H.Each Party will execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions of this Agreement and give effect to the transactions contemplated by this Agreement.

I.No Party will assign this Agreement or any rights, interests or obligations hereunder, or delegate performance of any of its obligations hereunder, without the prior written consent of the other Parties.

J.Except as provided in Section VI.A(iv), this Agreement constitutes the entire agreement and understanding of the Parties in respect of the subject matter contained herein. This Agreement

supersedes all prior agreements and understandings between the Parties with respect to the subject matter hereof.

K.This Agreement will be binding upon and inure to the benefit of the Parties and their successors and permitted assigns. Nothing expressed or implied herein is intended or will be construed to confer upon or to give to any third party any rights or remedies by virtue hereof.

| | | | | |

| InfuSystem Holdings, Inc. |

| |

By: | /s/ Scott Shuda |

| Name: | Scott Shuda |

| Title: | Chairman of the Board |

| |

| |

| /s/ R. Rimmy Malhotra |

| R. Rimmy Malhotra |

| |

| Nicoya Capital LLC |

| |

By: | /s/ R. Rimmy Malhotra |

| Name: | R. Rimmy Malhotra |

| Title: | Managing Member |

EXHIBIT A

Resignation

To the Board and Management of InfuSystem Holdings, Inc.:

I hereby resign from (1) all officer or other positions of the company and its affiliates, including the board of directors of the company and (2) all fiduciary positions (including as trustee) I hold with respect to any pension plans or trusts established by the company, effective as of March 8, 2024. This resignation is not the product of any disagreement between myself and the company.

Thank you and I look forward to our continued cooperation.

March 8, 2024.

| | | | | |

| |

| /s/ R. Rimmy Malhotra |

| R. Rimmy Malhotra |

| |

EXHIBIT B

Mutually Agreed Form 8-K

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

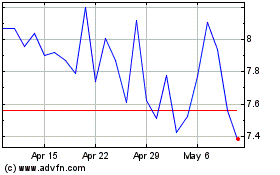

InfuSystems (AMEX:INFU)

Historical Stock Chart

From Mar 2024 to Apr 2024

InfuSystems (AMEX:INFU)

Historical Stock Chart

From Apr 2023 to Apr 2024