0001892480false--12-3100018924802024-03-042024-03-04iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 4, 2024

Hempacco Co., Inc. |

(Exact name of registrant as specified in its charter) |

001-41487 | | 83-4231457 |

(Commission File Number) | | (IRS Employer Identification Number) |

9925 Airway Road, San Diego, CA | | 92154 |

(Address of Principal Executive Offices) | | (Zip Code) |

(619) 779-0715

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 | | HPCO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03. Material Modification to Rights of Security Holders.

Hempacco Co., Inc. (the “Company”), filed a Certificate of Change with the State of Nevada to effect a 1-for-10 reverse stock split of the Company’s (a) authorized shares of common stock; and (b) issued and outstanding shares of common stock (the “Reverse Stock Split”), which was accepted for filing by the State of Nevada on or about March 4, 2024.

Reason for the Reverse Stock Split

The Reverse Stock Split is being effected solely to enable the Company to expeditiously restore compliance with the continued listing standards of the Nasdaq Stock Market (the “Nasdaq”) and Nasdaq’s $1.00 minimum bid price requirements.

Effects of the Reverse Stock Split

Effective Date; Symbol; CUSIP Number. The Reverse Stock Split is expected to become effective and be reflected with the Nasdaq and in the marketplace at the open of business on March 13, 2024 (the “Effective Date”), whereupon the shares of common stock of the Company are expected to begin trading on a split-adjusted basis. In connection with the Reverse Stock Split, the Company’s shares of common stock will continue to trade on the Nasdaq under the symbol “HPCO” but will trade under a new CUSIP Number, 42371L205.

Split Adjustment; No Fractional Shares. The total number of shares of the Company’s common stock held by each shareholder will be converted automatically into the number of whole shares of common stock equal to (i) the number of issued and outstanding shares of common stock held by such shareholder immediately prior to the Reverse Stock Split, divided by (ii) 10.

No fractional shares will be issued, and no cash or other consideration will be paid. Instead, the Company will issue one whole share of the post-Reverse Stock Split common stock to any shareholder who otherwise would have received a fractional share as a result of the Reverse Stock Split.

Non-Certificated Shares; Certificated Shares. Stockholders who are holding their shares in electronic form at brokerage firms do not have to take any action as the effect of the Reverse Stock Split will automatically be reflected in their brokerage accounts.

Stockholders holding paper certificates may (but are not required to) send the certificates to the Company’s transfer agent at the address given below. The transfer agent will issue a new share certificate reflecting the terms of the Reverse Stock Split to each requesting shareholder.

Transfer Online, Inc.

512 SE Salmon Street

Portland, OR 97214

Please contact Transfer Online, Inc. for further information, related costs and procedures before sending any certificates.

State Filing. The Reverse Stock Split was effected by the Company filing a Certificate of Change (the “Certificate”) pursuant to Section 78.209 of the Nevada Revised Statutes (“NRS”), with the Secretary of State of the State of Nevada, which was processed by the State of Nevada on or about March 4, 2024. A copy of the Certificate is attached hereto as Exhibit 3.1 and incorporated herein by reference.

No Stockholder Approval Required. Under Nevada law, because the Reverse Stock Split was approved by the Board of Directors of the Company in accordance with NRS Section 78.207 of the NRS, no shareholder approval was required. Section 78.207 provides that the Reverse Stock Split may be implemented by a resolution adopted by the Board of Directors of the Company, without shareholder approval, if (i) both the number of authorized shares of common stock and the number of outstanding shares of common stock are proportionally reduced as a result of the Reverse Stock Split; (i) the Reverse Stock Split does not adversely affect any other class of stock of the Company; and (ii) the Company does not pay money or issue scrip to shareholders who would otherwise be entitled to receive a fractional share as a result of the Reverse Stock Split. As described herein, the Company has complied with these requirements.

Capitalization. Prior to the Effective Date of the Certificate, the Company was authorized to issue 200,000,000 shares of common stock. As a result of the Reverse Stock Split, the Company is authorized to issue 20,000,000 shares of common stock (the Company’s authorized shares of common stock were reduced in the same ratio (1-for-10) as its outstanding common stock was reduced). As of March 4, 2024 (immediately prior to the Effective Date), there were 31,433,413 shares of common stock outstanding. As a result of the Reverse Stock Split, there are expected to be approximately 3,143,342 shares of common stock outstanding (subject to adjustment due to the effect of rounding fractional shares into whole shares). The Reverse Stock Split will not have any effect on the stated par value of the common stock.

The Reverse Stock Split does not affect the Company’s authorized preferred stock. After the Reverse Stock Split, the Company’s authorized preferred Stock of 50,000,000 shares will remain unchanged. Additionally, the Reverse Stock Split will not affect the par value of the preferred stock.

Each shareholder’s percentage ownership interest in the Company and proportional voting power remains virtually unchanged as a result of the Reverse Stock Split, except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and privileges of the holders of shares of common stock will be substantially unaffected by the Reverse Stock Split.

All options, warrants and convertible securities of the Company outstanding immediately prior to the Reverse Stock Split (to the extent they do not provide otherwise) will be appropriately adjusted by dividing the number of shares of common stock into which the options, warrants and convertible securities are exercisable or convertible by 10 and multiplying the exercise or conversion price thereof by 10, as a result of the Reverse Stock Split.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information required by this Item 5.03 is set forth in Item 3.03 above, which information is incorporated herein by reference.

Item 8.01. Other Information.

On March 8, 2024, the Company issued a press release announcing an anticipated effective date of December 13, 2024 for the Reverse Stock Split. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunder duly authorized.

| HEMPACCO CO., INC. | |

| | | |

Dated: March 8, 2024 | By: | /s/ Sandro Piancone | |

| | Sandro Piancone | |

| | Chief Executive Officer | |

nullnull

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

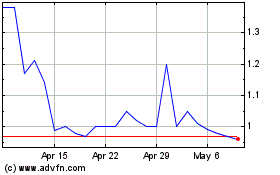

Hempacco (NASDAQ:HPCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hempacco (NASDAQ:HPCO)

Historical Stock Chart

From Apr 2023 to Apr 2024