Futures Turn Positive Following Monthly Jobs Report

March 08 2024 - 9:03AM

IH Market News

The major U.S. index futures are currently pointing to a higher

open on Friday, with stocks likely to extend the strong upward move

seen over the two previous sessions.

The futures turned positive following the release of the Labor

Department’s closely watched report on employment in the month of

February.

While job growth in February came in much stronger than

expected, the report also showed notable downward revisions to job

growth in the two previous months.

The Labor Department said non-farm payroll employment surged by

275,000 jobs in February, while economists had expected employment

to jump by 200,000 jobs.

However, the report also said job growth in December and January

was downwardly revised to 290,000 and 229,000 jobs, respectively,

reflecting a net downward revision of 167,000 jobs.

The Labor Department also said the unemployment rate rose to 3.9

percent in February from 3.7 percent in January. Economists had

expected the unemployment rate to come in unchanged.

The downward revisions to job growth in the two previous months

combined with the increase in the unemployment rate may add to

recent optimism about the outlook for interest rates.

Treasury yields initially jumped following the release of the

report but have since moved lower, extending a recent downward

trend.

Extending the rebound seen during Wednesday’s session, stocks

moved sharply higher during trading on Thursday. The major averages

further offset the notable pullback seen to start the week, with

the Nasdaq and the S&P 500 bouncing back to record intraday

highs.

The tech-heavy Nasdaq surged 241.83 points or 1.5 percent to

16,273.38, ending the day just shy of last Friday’s record closing

high, while the S&P 500 managed to set a new record closing

high, jumping 52.60 points or 1.0 percent to 5,157.36. The narrower

Dow posted a more modest gain, rising 130.30 points or 0.3 percent

to 38,791.35.

The extended rebound on Wall Street came as optimism about the

outlook for interest rates continued to inspire traders to get back

into the markets following the pullback seen on Monday and

Tuesday.

After saying rate cuts were likely this year during

Congressional testimony on Wednesday, Federal Reserve Chair Jerome

Powell doubled-down during remarks today, saying cuts “can and

will” begin this year.

While Powell also reiterated officials needs “greater

confidence” inflation is slowing, traders remain optimistic the Fed

will begin cutting rates in June.

Adding to the optimism about interest rates, the European

Central Bank lowered its annual inflation forecast while announcing

its widely expected decision to leave rates unchanged.

Potentially adding to the buying interest on Wall Street,

treasury yields saw further downside on the day, with the ten-year

yield falling to its lowest closing level in a month.

Semiconductor stocks led the way higher, with the Philadelphia

Semiconductor Index soaring by 3.4 percent to a record closing

high.

Shares of Nvidia (NASDAQ:NVDA) shot up by 4.5 percent after

Mizuho Securities raised its price target on the AI darling to

$1,000 per share, while Micron (NASDAQ:MU) surged by 3.6 percent

after Stifel upgraded its rating on the chipmaker’s stock to Buy

from Hold.

Considerable strength was also visible among oil service stocks,

as reflected by the 1.9 percent jump by the Philadelphia Oil

Service Index. The strength in the sector came despite a modest

decrease by the price of crude oil.

Housing stocks also showed a strong move to the upside, driving

the Philadelphia Housing Sector Index up by 1.6 percent to a record

closing high.

Software, gold and retail stocks also saw notable strength on

the day, while networking stocks were among the few groups to buck

the uptrend.

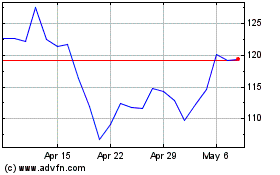

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024