0000936395false00009363952024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 7, 2024

Ciena Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-36250

Delaware

(State or other jurisdiction of incorporation)

7035 Ridge Road, Hanover, MD

(Address of principal executive offices)

23-2725311

(IRS Employer Identification No.)

21076

(Zip Code)

Registrant's telephone number, including area code: (410) 694-5700

Not Applicable

(Former name or former address, if changed since last report)

| | | | | | | | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock, $0.01 par value | CIEN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 – RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On March 7, 2024, Ciena Corporation ("Ciena") issued a press release announcing its financial results for its fiscal first quarter ended January 27, 2024. The text of the press release is furnished as Exhibit 99.1 to this Report. As discussed in this press release, Ciena will be hosting an investor call to discuss its results of operations for its fiscal first quarter ended January 27, 2024.

In conjunction with the issuance of this press release, Ciena posted to the quarterly results page of the Investors section of www.ciena.com an accompanying investor presentation. The investor presentation is furnished as Exhibit 99.2 to this Report.

The information in Exhibits 99.1 and 99.2, as well as Item 2.02 of this Report, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended. Investors are encouraged to review the “Investors” page of our website at www.ciena.com because, as with the other disclosure channels that we use, from time to time we may post material information exclusively on that site.

ITEM 9.01 – FINANCIAL STATEMENTS AND EXHIBITS

| | | | | | | | | | | |

Exhibit Number | Description of Document |

| |

Exhibit 99.1 |

|

Exhibit 99.2 |

|

Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

| | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. |

| | | | | | | | |

| Ciena Corporation |

| | |

| | |

Date: March 7, 2024 | By: | /s/ Sheela Kosaraju |

| | Sheela Kosaraju |

| | Senior Vice President, General Counsel and Assistant Secretary |

FOR IMMEDIATE RELEASE

Ciena Reports Fiscal First Quarter 2024 Financial Results

HANOVER, Md. - March 7, 2024 - Ciena® Corporation (NYSE: CIEN), a networking systems, services and software company, today announced unaudited financial results for its fiscal first quarter ended January 27, 2024.

•Q1 Revenue: $1.04 billion

•Q1 Net Income per Share: $0.34 GAAP; $0.66 adjusted (non-GAAP)

•Share Repurchases: Repurchased approximately 691 thousand shares of common stock for an aggregate price of $32.0 million during the quarter

"We delivered solid fiscal first quarter results, including strong profitability, as we continue to expand our relationships and gain share with cloud providers," said Gary Smith, president and CEO of Ciena. "While we remain very confident in the strength and durability of bandwidth demand as a long-term driver of our business, it is taking longer than expected for service providers to work through high levels of inventory."

For fiscal first quarter 2024, Ciena reported revenue of $1.04 billion as compared to $1.06 billion for the fiscal first quarter 2023.

Ciena's GAAP net income for the fiscal first quarter 2024 was $49.5 million, or $0.34 per diluted common share, which compares to a GAAP net income of $76.2 million, or $0.51 per diluted common share, for the fiscal first quarter 2023.

Ciena's adjusted (non-GAAP) net income for the fiscal first quarter 2024 was $96.8 million, or $0.66 per diluted common share, which compares to an adjusted (non-GAAP) net income of $95.6 million, or $0.64 per diluted common share, for the fiscal first quarter 2023.

Fiscal First Quarter 2024 Performance Summary

The tables below (in millions, except percentage data) provide comparisons of certain quarterly results to the prior year. Appendices A and B set forth reconciliations between the GAAP and adjusted (non-GAAP) measures contained in this release.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | GAAP Results (unaudited) |

| | Q1 | | Q1 | | Period Change | | | | |

| | FY 2024 | | FY 2023 | | Y-T-Y* | | | | | | |

| Revenue | | $ | 1,037.7 | | | $ | 1,056.5 | | | (1.8) | % | | | | | | |

| Gross margin | | 45.0 | % | | 43.2 | % | | 1.8 | % | | | | | | |

| Operating expense | | $ | 382.3 | | | $ | 370.7 | | | 3.1 | % | | | | | | |

| Operating margin | | 8.2 | % | | 8.1 | % | | 0.1 | % | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Non-GAAP Results (unaudited) |

| | Q1 | | Q1 | | Period Change | | | | |

| | FY 2024 | | FY 2023 | | Y-T-Y* | | | | | | |

| Revenue | | $ | 1,037.7 | | | $ | 1,056.5 | | | (1.8) | % | | | | | | |

| Adj. gross margin | | 45.7 | % | | 43.7 | % | | 2.0 | % | | | | | | |

| Adj. operating expense | | $ | 336.8 | | | $ | 329.3 | | | 2.3 | % | | | | | | |

| Adj. operating margin | | 13.2 | % | | 12.6 | % | | 0.6 | % | | | | | | |

| Adj. EBITDA | | $ | 160.0 | | | $ | 155.1 | | | 3.2 | % | | | | | | |

* Denotes % change, or in the case of margin, absolute change

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue by Segment (unaudited) |

| | Q1 FY 2024 | | Q1 FY 2023 |

| | Revenue | | %** | | Revenue | | %** |

| Networking Platforms | | | | | | | | |

| Optical Networking | | $ | 695.8 | | | 67.1 | | | $ | 735.6 | | | 69.6 | |

| Routing and Switching | | 111.4 | | | 10.7 | | | 119.5 | | | 11.3 | |

| Total Networking Platforms | | 807.2 | | | 77.8 | | | 855.1 | | | 80.9 | |

| | | | | | | | |

| Platform Software and Services | | 89.7 | | | 8.6 | | | 73.4 | | | 6.9 | |

| | | | | | | | |

| Blue Planet Automation Software and Services | | 14.0 | | | 1.4 | | | 15.4 | | | 1.5 | |

| | | | | | | | |

| Global Services | | | | | | | | |

| Maintenance Support and Training | | 74.1 | | | 7.1 | | | 67.9 | | | 6.4 | |

| Installation and Deployment | | 42.7 | | | 4.1 | | | 34.6 | | | 3.3 | |

| Consulting and Network Design | | 10.0 | | | 1.0 | | | 10.1 | | | 1.0 | |

| Total Global Services | | 126.8 | | | 12.2 | | | 112.6 | | | 10.7 | |

| | | | | | | | |

| Total | | $ | 1,037.7 | | | 100.0 | | | $ | 1,056.5 | | | 100.0 | |

| | | | | | | | |

** Denotes % of total revenue

Additional Performance Metrics for Fiscal First Quarter 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue by Geographic Region (unaudited) |

| | Q1 FY 2024 | | Q1 FY 2023 |

| | Revenue | | % ** | | Revenue | | % ** |

| Americas | | $ | 718.2 | | | 69.2 | | | $ | 765.1 | | | 72.4 | |

| Europe, Middle East and Africa | | 207.4 | | | 20.0 | | | 152.8 | | | 14.5 | |

| Asia Pacific | | 112.1 | | | 10.8 | | | 138.6 | | | 13.1 | |

| Total | | $ | 1,037.7 | | | 100.0 | | | $ | 1,056.5 | | | 100.0 | |

| | | | | | | | |

** Denotes % of total revenue

•Two customers represented 10%-plus of revenue combining for a total of 26.5% of revenue

•Cash and investments totaled $1.48 billion

•Cash flow from operations totaled $266.1 million

•Average days' sales outstanding (DSOs) were 88

•Accounts receivable, net balance was $865.2 million

•Unbilled contract asset, net balance was $151.6 million

•Inventories totaled $984.9 million, including:

◦Raw materials: $571.7 million

◦Work in process: $60.6 million

◦Finished goods: $369.8 million

◦Deferred cost of sales: $36.8 million

◦Reserve for excess and obsolescence: $(54.0) million

•Product inventory turns were 1.9

•Headcount totaled 8,647

Supplemental Materials and Live Web Broadcast of Unaudited Fiscal First Quarter 2024 Results

Today, Thursday, March 7, 2024, in conjunction with this announcement, Ciena has posted to the Quarterly Results page of the Investor Relations section of its website certain related supporting materials for its unaudited fiscal first quarter 2024 results.

Ciena's management will also host a discussion today with investors and financial analysts that will include the Company's outlook. The live audio web broadcast beginning at 8:30 a.m. Eastern will be accessible via www.ciena.com. An archived replay of the live broadcast will be available shortly following its conclusion on the Investor Relations page of Ciena's website.

Notes to Investors

Forward-Looking Statements. You are encouraged to review the Investors section of our website, where we routinely post press releases, Securities and Exchange Commission ("SEC") filings, recent news, financial results, supplemental financial information, and other announcements. From time to time we exclusively post material information to this website along with other disclosure channels that we use. This press release contains certain forward-looking statements that involve risks and uncertainties. These statements are based on current expectations, forecasts, assumptions and other information available to the Company as of the date hereof. Forward-looking statements include statements regarding Ciena's expectations, beliefs, intentions or strategies regarding the future and can be identified by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," "will," and "would" or similar words. Forward-looking statements in this release include:

"We delivered solid fiscal first quarter results, including strong profitability, as we continue to expand our relationships and gain share with cloud providers. While we remain very confident in the strength and durability of bandwidth demand as a long-term driver of our business, it is taking longer than expected for service providers to work through high levels of inventory."

Ciena's actual results, performance or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Ciena's business, including: the effect of broader economic and market conditions on our customers, their spending and their businesses and markets; our ability to execute our business and growth strategies; the impact of macroeconomic conditions and global supply chain constraints or disruptions including increased supply costs and lead times; the impact of the introduction of new technologies by us or our competitors; seasonality and the timing and size of customer orders, their delivery dates and our ability to recognize revenue relating to such sales; the level of competitive pressure we encounter; the product, customer and geographic mix of sales within the period; changes in foreign currency exchange rates; factors beyond our control such as natural disasters, climate change, acts of war or terrorism, geopolitical tensions or events, including but not limited to the ongoing conflicts between Ukraine and Russia, and Israel and Hamas, and public health emergencies or epidemics, including the COVID-19 pandemic; changes in tax or trade regulations, including the imposition of tariffs, duties or efforts to withdraw from or materially modify international trade agreements; cyberattacks, data breaches or other security incidents involving our enterprise network environment or our products; regulatory changes, litigation involving our intellectual property or government investigations; and the other risk factors disclosed in Ciena’s periodic reports filed with the Securities and Exchange Commission (SEC) including its Annual Report on Form 10-K filed with the SEC on December 15, 2023 and included in its Quarterly

Report on Form 10-Q for the first quarter of fiscal 2024 to be filed with the SEC. Ciena assumes no obligation to update any forward-looking information included in this press release.

Non-GAAP Presentation of Quarterly and Annual Results. This release includes non-GAAP measures of Ciena's gross profit, operating expense, income from operations, earnings before interest, tax, depreciation and amortization (EBITDA), Adjusted EBITDA, and measures of net income and net income per share. In evaluating the operating performance of Ciena's business, management excludes certain charges and credits that are required by GAAP. These items share one or more of the following characteristics: they are unusual and Ciena does not expect them to recur in the ordinary course of its business; they do not involve the expenditure of cash; they are unrelated to the ongoing operation of the business in the ordinary course; or their magnitude and timing is largely outside of Ciena's control. Management believes that the non-GAAP measures below provide management and investors useful information and meaningful insight to the operating performance of the business. The presentation of these non-GAAP financial measures should be considered in addition to Ciena's GAAP results and these measures are not intended to be a substitute for the financial information prepared and presented in accordance with GAAP. Ciena's non-GAAP measures and the related adjustments may differ from non-GAAP measures used by other companies and should only be used to evaluate Ciena's results of operations in conjunction with our corresponding GAAP results. To the extent not previously disclosed in a prior Ciena financial results press release, Appendices A and B to this press release set forth a complete GAAP to non-GAAP reconciliation of the non-GAAP measures contained in this release.

About Ciena. Ciena (NYSE: CIEN) is a global leader in networking systems, services, and software. We build the most adaptive networks in the industry, enabling customers to anticipate and meet ever-increasing digital demands. For three-plus decades, Ciena has brought our humanity to our relentless pursuit of innovation. Prioritizing collaborative relationships with our customers, partners, and communities, we create flexible, open, and sustainable networks that better serve all users—today and into the future. For updates on Ciena, follow us on LinkedIn, X, the Ciena Insights blog, or visit www.ciena.com.

CIENA CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | |

| Quarter Ended | | |

| | January 27, | | January 28, | | | | |

| | 2024 | | 2023 | | | | |

| Revenue: | | | | | | | |

| Products | $ | 835,777 | | | $ | 877,715 | | | | | |

| Services | 201,932 | | | 178,806 | | | | | |

| Total revenue | 1,037,709 | | | 1,056,521 | | | | | |

| Cost of goods sold: | | | | | | | |

| Products | 466,472 | | | 500,337 | | | | | |

| Services | 104,275 | | | 100,238 | | | | | |

| Total cost of goods sold | 570,747 | | | 600,575 | | | | | |

| Gross profit | 466,962 | | | 455,946 | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 187,269 | | | 181,730 | | | | | |

| Selling and marketing | 128,158 | | | 123,807 | | | | | |

| General and administrative | 54,683 | | | 50,896 | | | | | |

| Significant asset impairments and restructuring costs | 4,971 | | | 4,298 | | | | | |

| Amortization of intangible assets | 7,252 | | | 7,441 | | | | | |

| Acquisition and integration costs | — | | | 2,558 | | | | | |

| | | | | | | |

| Total operating expenses | 382,333 | | | 370,730 | | | | | |

| Income from operations | 84,629 | | | 85,216 | | | | | |

| Interest and other income, net | 10,650 | | | 31,973 | | | | | |

| Interest expense | (23,776) | | | (15,870) | | | | | |

| | | | | | | |

| | | | | | | |

| Income before income taxes | 71,503 | | | 101,319 | | | | | |

| Provision for income taxes | 21,956 | | | 25,078 | | | | | |

| Net income | $ | 49,547 | | | $ | 76,241 | | | | | |

| | | | | | | |

| Net Income per Common Share | | | | | | | |

| Basic net income per common share | $ | 0.34 | | | $ | 0.51 | | | | | |

| Diluted net income per potential common share | $ | 0.34 | | | $ | 0.51 | | | | | |

| | | | | | | |

| Weighted average basic common shares outstanding | 145,291 | | | 149,081 | | | | | |

Weighted average dilutive potential common shares outstanding 1 | 145,848 | | | 149,551 | | | | | |

1 Weighted average dilutive potential common shares outstanding used in calculating GAAP diluted net income per potential common share includes the following number of shares underlying certain stock option and stock unit awards: (i) 0.6 million for the first quarter of fiscal 2024, and (ii) 0.5 million for the first quarter of fiscal 2023.

CIENA CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(unaudited)

| | | | | | | | | | | |

| January 27,

2024 | | October 28,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,264,751 | | | $ | 1,010,618 | |

| Short-term investments | 106,678 | | | 104,753 | |

| Accounts receivable, net | 865,239 | | | 1,003,876 | |

| Inventories, net | 984,886 | | | 1,050,838 | |

| Prepaid expenses and other | 387,193 | | | 405,694 | |

| Total current assets | 3,608,747 | | | 3,575,779 | |

| Long-term investments | 103,862 | | | 134,278 | |

| Equipment, building, furniture and fixtures, net | 280,357 | | | 280,147 | |

| Operating lease right-of-use assets | 35,679 | | | 35,140 | |

| Goodwill | 445,084 | | | 444,765 | |

| Other intangible assets, net | 195,682 | | | 205,627 | |

| Deferred tax asset, net | 814,098 | | | 809,306 | |

| Other long-term assets | 109,701 | | | 116,453 | |

| Total assets | $ | 5,593,210 | | | $ | 5,601,495 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 316,094 | | | $ | 317,828 | |

| Accrued liabilities and other short-term obligations | 329,910 | | | 431,419 | |

| Deferred revenue | 166,714 | | | 154,419 | |

| Operating lease liabilities | 16,888 | | | 16,655 | |

| Current portion of long-term debt | 11,700 | | | 11,700 | |

| | | |

| Total current liabilities | 841,306 | | | 932,021 | |

| Long-term deferred revenue | 76,556 | | | 74,041 | |

| Other long-term obligations | 176,313 | | | 170,407 | |

| Long-term operating lease liabilities | 32,418 | | | 33,259 | |

| Long-term debt, net | 1,543,118 | | | 1,543,406 | |

| Total liabilities | 2,669,711 | | | 2,753,134 | |

| Stockholders’ equity: | | | |

Preferred stock – par value $0.01; 20,000,000 shares authorized; zero shares issued and outstanding | — | | | — | |

Common stock – par value $0.01; 290,000,000 shares authorized; 144,946,510 and 144,829,938 shares issued and outstanding | 1,449 | | | 1,448 | |

| Additional paid-in capital | 6,274,773 | | | 6,262,083 | |

| Accumulated other comprehensive loss | (24,867) | | | (37,767) | |

| Accumulated deficit | (3,327,856) | | | (3,377,403) | |

| Total stockholders’ equity | 2,923,499 | | | 2,848,361 | |

| Total liabilities and stockholders’ equity | $ | 5,593,210 | | | $ | 5,601,495 | |

| | | |

CIENA CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands) (unaudited) | | | | | | | | | | | |

| Quarter Ended |

| | January 27, | | January 28, |

| | 2024 | | 2023 |

| Cash flows provided by (used in) operating activities: | | | |

| Net income | $ | 49,547 | | | $ | 76,241 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| | | |

| Depreciation of equipment, building, furniture and fixtures, and amortization of leasehold improvements | 22,808 | | | 22,208 | |

| Share-based compensation expense | 37,827 | | | 30,512 | |

| Amortization of intangible assets | 10,016 | | | 10,325 | |

| Deferred taxes | (4,368) | | | (7,247) | |

| Provision for inventory excess and obsolescence | 10,350 | | | 5,503 | |

| Provision for warranty | 4,841 | | | 8,230 | |

| Gain on cost method equity investments, net | — | | | (26,455) | |

| Other | 5,051 | | | 7,325 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 135,160 | | | (133,067) | |

| Inventories | 56,157 | | | (235,059) | |

| Prepaid expenses and other | 17,116 | | | 4,667 | |

| Operating lease right-of-use assets | 3,084 | | | 3,891 | |

| Accounts payable, accruals and other obligations | (90,915) | | | (56,979) | |

| Deferred revenue | 14,022 | | | 29,459 | |

| Short and long-term operating lease liabilities | (4,620) | | | (5,193) | |

| Net cash provided by (used in) operating activities | 266,076 | | | (265,639) | |

| Cash flows provided by (used in) investing activities: | | | |

| Payments for equipment, furniture, fixtures and intellectual property | (16,599) | | | (30,030) | |

| | | |

| Purchases of investments | (21,213) | | | (35,411) | |

| Proceeds from sales and maturities of investments | 53,674 | | | 123,249 | |

| Settlement of foreign currency forward contracts, net | 2,271 | | | (4,001) | |

| | | |

| Acquisition of business, net of cash acquired | — | | | (230,048) | |

| | | |

| | | |

| Net cash provided by (used in) investing activities | 18,133 | | | (176,241) | |

| Cash flows provided by (used in) financing activities: | | | |

| | | |

| Proceeds from issuance of term loan, net | — | | | 497,500 | |

| Payment of long term debt | — | | | (1,732) | |

| | | |

| Payment of debt issuance costs | (2,402) | | | (3,996) | |

| Payment of finance lease obligations | (981) | | | (913) | |

| | | |

| Shares repurchased for tax withholdings on vesting of stock unit awards | (10,076) | | | (12,980) | |

| Repurchases of common stock - repurchase program | (38,195) | | | — | |

| Proceeds from issuance of common stock | 16,934 | | | 14,315 | |

| Net cash provided by (used in) financing activities | (34,720) | | | 492,194 | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 4,646 | | | 9,884 | |

| Net increase in cash, cash equivalents and restricted cash | 254,135 | | | 60,198 | |

| Cash, cash equivalents and restricted cash at beginning of period | 1,010,786 | | | 994,378 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 1,264,921 | | | $ | 1,054,576 | |

| Supplemental disclosure of cash flow information | | | |

| Cash paid during the period for interest, net | $ | 18,582 | | | $ | 10,536 | |

| Cash paid during the period for income taxes, net | $ | 8,260 | | | $ | 8,383 | |

| Operating lease payments | $ | 5,080 | | | $ | 5,638 | |

| Non-cash investing and financing activities | | | |

| Purchase of equipment in accounts payable | $ | 4,225 | | | $ | 7,354 | |

| | | |

| Repurchase of common stock in accrued liabilities from repurchase program | $ | 3,110 | | | $ | — | |

| Operating right-of-use assets subject to lease liability | $ | 3,498 | | | $ | 6,244 | |

| Gain on cost method equity investments, net | $ | — | | | $ | 26,455 | |

| | | | | | | | | | | | | | | | | | |

| APPENDIX A - Reconciliation of Adjusted (Non- GAAP) Measurements |

| (in thousands, except per share data) (unaudited) |

| | | | | | | | |

| | Quarter Ended | | |

| | January 27, | | January 28, | | | | |

| | 2024 | | 2023 | | | | |

| Gross Profit Reconciliation (GAAP/non-GAAP) | | | | | | | | |

| GAAP gross profit | | $ | 466,962 | | | $ | 455,946 | | | | | |

| Share-based compensation-products | | 1,318 | | | 1,051 | | | | | |

| Share-based compensation-services | | 3,020 | | | 2,297 | | | | | |

| Amortization of intangible assets | | 2,764 | | | 2,883 | | | | | |

| Total adjustments related to gross profit | | 7,102 | | | 6,231 | | | | | |

| Adjusted (non-GAAP) gross profit | | $ | 474,064 | | | $ | 462,177 | | | | | |

| Adjusted (non-GAAP) gross profit percentage | | 45.7 | % | | 43.7 | % | | | | |

| | | | | | | | |

| Operating Expense Reconciliation (GAAP/non-GAAP) | | | | | | | | |

| GAAP operating expense | | $ | 382,333 | | | $ | 370,730 | | | | | |

| Share-based compensation-research and development | | 12,880 | | | 9,234 | | | | | |

| Share-based compensation-sales and marketing | | 10,305 | | | 8,424 | | | | | |

| Share-based compensation-general and administrative | | 10,079 | | | 9,468 | | | | | |

| Significant asset impairments and restructuring costs | | 4,971 | | | 4,298 | | | | | |

| Amortization of intangible assets | | 7,252 | | | 7,441 | | | | | |

| Acquisition and integration costs | | — | | | 2,558 | | | | | |

| | | | | | | | |

| Total adjustments related to operating expense | | 45,487 | | | 41,423 | | | | | |

| Adjusted (non-GAAP) operating expense | | $ | 336,846 | | | $ | 329,307 | | | | | |

| | | | | | | | |

| Income from Operations Reconciliation (GAAP/non-GAAP) | | | | | | | | |

| GAAP income from operations | | $ | 84,629 | | | $ | 85,216 | | | | | |

| Total adjustments related to gross profit | | 7,102 | | | 6,231 | | | | | |

| Total adjustments related to operating expense | | 45,487 | | | 41,423 | | | | | |

| Total adjustments related to income from operations | | 52,589 | | | 47,654 | | | | | |

| Adjusted (non-GAAP) income from operations | | $ | 137,218 | | | $ | 132,870 | | | | | |

| Adjusted (non-GAAP) operating margin percentage | | 13.2 | % | | 12.6 | % | | | | |

| | | | | | | | |

| Net Income Reconciliation (GAAP/non-GAAP) | | | | | | | | |

| GAAP net income | | $ | 49,547 | | | $ | 76,241 | | | | | |

| Exclude GAAP provision for income taxes | | 21,956 | | | 25,078 | | | | | |

| Income before income taxes | | 71,503 | | | 101,319 | | | | | |

| Total adjustments related to income from operations | | 52,589 | | | 47,654 | | | | | |

| | | | | | | | |

| Gain on cost method equity investments, net | | — | | | (26,455) | | | | | |

| Adjusted income before income taxes | | 124,092 | | | 122,518 | | | | | |

| Non-GAAP tax provision on adjusted income before income taxes | | 27,300 | | | 26,954 | | | | | |

| Adjusted (non-GAAP) net income | | $ | 96,792 | | | $ | 95,564 | | | | | |

| | | | | | | | |

| Weighted average basic common shares outstanding | | 145,291 | | 149,081 | | | | |

Weighted average dilutive potential common shares outstanding 1 | | 145,848 | | 149,551 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| APPENDIX A - Reconciliation of Adjusted (Non- GAAP) Measurements |

| (in thousands, except per share data) (unaudited) |

| | | | | | | | |

| | Quarter Ended | | |

| | January 27, | | January 28, | | | | |

| | 2024 | | 2023 | | | | |

| Net Income per Common Share | | | | | | | | |

| GAAP diluted net income per potential common share | | $ | 0.34 | | | $ | 0.51 | | | | | |

| Adjusted (non-GAAP) diluted net income per potential common share | | $ | 0.66 | | | $ | 0.64 | | | | | |

1 Weighted average dilutive potential common shares outstanding used in calculating Adjusted (non-GAAP) diluted net income per potential common share includes the following number of shares underlying certain stock option and stock unit awards: (i) 0.6 million for the first quarter of fiscal 2024; and (ii) 0.5 million for the first quarter of fiscal 2023.

| | | | | | | | | | | | | | | | | | |

| APPENDIX B - Calculation of EBITDA and Adjusted EBITDA (unaudited) |

| (in thousands) (unaudited) |

| | | | | | | | |

| | Quarter Ended | | |

| | January 27, | | January 28, | | | | |

| | 2024 | | 2023 | | | | |

| Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) | | | | | | | | |

| Net income (GAAP) | | $ | 49,547 | | | $ | 76,241 | | | | | |

| Add: Interest expense | | 23,776 | | | 15,870 | | | | | |

| Less: Interest and other income, net | | 10,650 | | | 31,973 | | | | | |

| | | | | | | | |

| Add: Provision for income taxes | | 21,956 | | | 25,078 | | | | | |

| Add: Depreciation of equipment, building, furniture and fixtures, and amortization of leasehold improvements | | 22,808 | | | 22,208 | | | | | |

| Add: Amortization of intangible assets | | 10,016 | | | 10,325 | | | | | |

| EBITDA | | $ | 117,453 | | | $ | 117,749 | | | | | |

| Add: Share-based compensation cost | | 37,602 | | | 30,474 | | | | | |

| Add: Significant asset impairments and restructuring costs | | 4,971 | | | 4,298 | | | | | |

| Add: Acquisition and integration costs | | — | | | 2,558 | | | | | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 160,026 | | | $ | 155,079 | | | | | |

* * *

The adjusted (non-GAAP) measures above and their reconciliation to Ciena's GAAP results for the periods presented reflect adjustments relating to the following items:

•Share-based compensation - a non-cash expense incurred in accordance with share-based compensation accounting guidance.

•Significant asset impairments and restructuring costs - costs incurred as a result of restructuring activities taken to align resources with perceived market opportunities, the redesign of business processes and restructuring certain real estate facilities.

•Amortization of intangible assets - a non-cash expense arising from the acquisition of intangible assets, principally developed technologies and customer-related intangibles, that Ciena is required to amortize over an expected useful life.

•Acquisition and integration costs - primarily consist of financial, legal and accounting advisors' costs and employment-related costs related to Ciena's acquisitions in fiscal 2023.

•Gain on cost method equity investments, net - reflects changes in the carrying value of certain cost method equity investments due to triggering events.

•Non-GAAP tax provision - consists of current and deferred income tax expense commensurate with the level of adjusted income before income taxes and utilizes a current, blended U.S. and foreign statutory annual tax rate of 22.0% for both the fiscal first quarter 2024 and the fiscal first quarter 2023. This rate may be subject to change in the future, including as a result of changes in tax policy or tax strategy.

© Ciena Corporation 2023. All rights reserved. Proprietary Information. Ciena Corporation Fiscal Q1 2024 Earnings Presentation Period ended January 27, 2024 March 7, 2024

© Ciena Corporation 2023. All rights reserved. Proprietary Information.2 Forward-looking statements and non-GAAP measures You are encouraged to review the Investors section of our website, where we routinely post press releases, Securities and Exchange Commission ("SEC") filings, recent news, financial results, supplemental financial information, and other announcements. From time to time we exclusively post material information to this website along with other disclosure channels that we use. This press release contains certain forward-looking statements that involve risks and uncertainties. These statements are based on current expectations, forecasts, assumptions and other information available to the Company as of the date hereof. Forward-looking statements include statements regarding Ciena's expectations, beliefs, intentions or strategies regarding the future and can be identified by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," "will," and "would" or similar words. Ciena's actual results, performance or events may differ materially from these forward-looking statements made or implied due to a number of risks and uncertainties relating to Ciena's business, including: the effect of broader economic and market conditions on our customers, their spending and their businesses and markets; our ability to execute our business and growth strategies; the impact of macroeconomic conditions and global supply chain constraints or disruptions including increased supply costs and lead times; the impact of the introduction of new technologies by us or our competitors; seasonality and the timing and size of customer orders, their delivery dates and our ability to recognize revenue relating to such sales; the level of competitive pressure we encounter; the product, customer and geographic mix of sales within the period; changes in foreign currency exchange rates; factors beyond our control such as natural disasters, climate change, acts of war or terrorism, geopolitical tensions or events, including but not limited to the ongoing conflicts between Ukraine and Russia, and Israel and Hamas, and public health emergencies or epidemics, including the COVID-19 pandemic; changes in tax or trade regulations, including the imposition of tariffs, duties or efforts to withdraw from or materially modify international trade agreements; cyberattacks, data breaches or other security incidents involving our enterprise network environment or our products; regulatory changes, litigation involving our intellectual property or government investigations; and the other risk factors disclosed in Ciena’s periodic reports filed with the Securities and Exchange Commission (SEC) including its Annual Report on Form 10-K filed with the SEC on December 15, 2023 and included in its Quarterly Report on Form 10-Q for the first quarter of fiscal 2024 to be filed with the SEC. All information, statements, and projections in this presentation and the related earnings call speak only as of the date of this presentation and related earnings call. Ciena assumes no obligation to update any forward-looking or other information included in this presentation or related earnings calls, whether as a result of new information, future events or otherwise. In addition, this presentation includes historical, and may include prospective, non-GAAP measures of Ciena’s gross margin, operating expense, operating margin, EBITDA, and net income per share. These measures are not intended to be a substitute for financial information presented in accordance with GAAP. A reconciliation of non-GAAP measures used in this presentation to Ciena’s GAAP results for the relevant period can be found in the Appendix to this presentation. Additional information can also be found in our press release filed this morning and in our reports on Form 10-Q and Form 10K filed with the Securities and Exchange Commission..

© Ciena Corporation 2023. All rights reserved. Proprietary Information.3 Table of Contents 1. Overview & Ciena's portfolio 2. Market context 3. Fiscal Q1 2024 financial performance 4. Appendix

© Ciena Corporation 2023. All rights reserved. Proprietary Information. Overview

© Ciena Corporation 2023. All rights reserved. Proprietary Information.5 Ciena is an industry-leading global networking systems, services, and software company

© Ciena Corporation 2023. All rights reserved. Proprietary Information.6 The Adaptive Network enables open, programmable, and sustainable networks

© Ciena Corporation 2023. All rights reserved. Proprietary Information. Market context

© Ciena Corporation 2023. All rights reserved. Proprietary Information.8 Mega-trends driving persistent network traffic growth

© Ciena Corporation 2023. All rights reserved. Proprietary Information.9 Our market leadership Optical Transport Report, 4Q23Optical Networking Report, 3Q23 Service Provider Switching & Routing Report, 3Q23 Transport Hardware Report, 4Q23 #1 Globally • Data center interconnect • Optical for internet content provider customers #1 N. America • Data center interconnect • Total optical networking • Optical packet #2 Globally • Total optical networking • Purpose-built/compact modular DCI • Optical for cable MSO customers #1 Globally • Purpose-built/compact modular DCI • SLTE WDM • Access switching #1 N. America • Total optical networking • Purpose-built/compact modular DCI • Access switching #2 Globally • Total optical networking #1 Globally • Purpose-built/compact modular DCI • Optical for cloud and colo • SLTE WDM • Routing/Access #1 N. America • Total optical networking • Purpose-built/compact modular DCI • Optical for cloud and colo • Routing/Access #2 Globally • Total optical networking • Optical for enterprise and government

© Ciena Corporation 2023. All rights reserved. Proprietary Information.10 Next-Gen Metro and Edge is a strategic growth segment Fiber Broadband Access is a key driver in this space

© Ciena Corporation 2023. All rights reserved. Proprietary Information. Q1 FY 2024 results

© Ciena Corporation 2023. All rights reserved. Proprietary Information.12 Q1 FY 2024 key highlights ▪ Non-telco represented a record high 54% of total revenue • Direct Cloud Provider revenue was up 38% YoY ▪ Subsea revenue grew nearly 49% YoY ▪ EMEA revenue increased 36% YoY ▪ Global Services revenue grew 13% YoY • Customer traction continues with WL5e 800G technology, reaching 270 customers • For our WL5n 400ZR/ZR+ pluggables, we have 86 customers, 19 new this quarter • Three new customer orders for WaveLogic 6 Extreme ▪ Surpassed 2,000 x 81xx platforms delivered to over 50 customers as we continue to scale our Metro & Coherent Routing capabilities around the globe ▪ Increased the breadth of our Broadband Access portfolio with the 3806 10GXGS PON extended temp ONU for outdoor locations • Total shareholder return five-year CAGR of 7%1 • Under our authorized $1 billion stock repurchase program, repurchased ~0.7 million shares for $32 million, and are targeting $250 million for FY 2024 to complete the $1 billion authorized plan 1 Based on closing share price between 2/13/2019 to 2/13/2024 Achieving balanced growth Prioritizing long term shareholder value Driving the pace of innovation

© Ciena Corporation 2023. All rights reserved. Proprietary Information.13 Q1 FY 2024 comparative financial highlights * Reconciliations of these non-GAAP measures to our GAAP results are included in the Appendix and in the press release for the relative period. Q1 FY 2024 Q1 FY 2023 Revenue $1,037.7M $1,056.5M Adjusted Gross Margin* 45.7% 43.7% Adjusted Operating Expense* $336.8M $329.3M Adjusted Operating Margin* 13.2% 12.6% Adjusted EBITDA* $160.0M $155.1M Adjusted EPS* $0.66 $0.64

© Ciena Corporation 2023. All rights reserved. Proprietary Information.14 Q1 FY 2024 comparative operating metrics Q1 FY 2024 Q1 FY 2023 Cash and investments $1.48B $1.16B Cash provided by (used in) operations $266M $(266)M DSO 88.0 103.0 Inventory Turns 1.9 1.7 Gross Leverage 2.42x 3.05x Net Debt $148M $471M

© Ciena Corporation 2023. All rights reserved. Proprietary Information.15 Revenue by segment (Amounts in millions) Q1 FY 2024 Q1 FY 2023 Revenue %** Revenue %** Networking Platforms Optical Networking $695.8 67.1 $735.6 69.6 Routing and Switching 111.4 10.7 119.5 11.3 Total Networking Platforms 807.2 77.8 855.1 80.9 Platform Software and Services 89.7 8.6 73.4 6.9 Blue Planet Automation Software and Services 14.0 1.4 15.4 1.5 Global Services Maintenance Support and Training 74.1 7.1 67.9 6.4 Installation and Deployment 42.7 4.1 34.6 3.3 Consulting and Network Design 10.0 1.0 10.1 1.0 Total Global Services 126.8 12.2 112.6 10.7 Total $1,037.7 100.0 $1,056.5 100.0 * A reconciliation of these non-GAAP measures to GAAP results is included in the appendix to this presentation. ** Denotes % of total revenue

© Ciena Corporation 2023. All rights reserved. Proprietary Information.16 Record revenue derived from non-telco customers

© Ciena Corporation 2023. All rights reserved. Proprietary Information.17 Revenue by geographic region 13% 15% 14% 15% 15% 15% 72% 70% 70% 71% 14% 16% 20% 11% 69%

© Ciena Corporation 2023. All rights reserved. Proprietary Information. Q1 FY 2024 appendix

© Ciena Corporation 2023. All rights reserved. Proprietary Information.19 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 Q2 FY 2023 Q1 FY 2023 GAAP gross profit $466,962 $486,281 $448,941 $487,683 $455,946 Share-based compensation-products 1,318 1,194 1,118 1,155 1,051 Share-based compensation-services 3,020 2,827 2,687 2,659 2,297 Amortization of intangible assets 2,764 2,763 3,187 3,431 2,883 Total adjustments related to gross profit 7,102 6,784 6,992 7,245 6,231 Adjusted (non-GAAP) gross profit $474,064 $493,065 $455,933 $494,928 $462,177 Adjusted (non-GAAP) gross profit percentage 45.7 % 43.7 % 42.7 % 43.7 % 43.7 % Gross Profit Reconciliation (Amounts in thousands)

© Ciena Corporation 2023. All rights reserved. Proprietary Information.20 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 Q2 FY 2023 Q1 FY 2023 GAAP operating expense $382,333 $394,979 $370,727 $384,870 $370,730 Share-based compensation-research and development 12,880 11,412 10,954 10,731 9,234 Share-based compensation-sales and marketing 10,305 9,187 8,770 8,755 8,424 Share-based compensation-general and administrative 10,079 10,274 9,377 8,468 9,468 Significant asset impairments and restructuring costs 4,971 7,209 4,174 8,153 4,298 Amortization of intangible assets 7,252 10,578 9,487 9,845 7,441 Acquisition and integration costs — — 59 857 2,558 Legal Settlement — 8,750 — — — Total adjustments related to operating expense 45,487 57,410 42,821 46,809 41,423 Adjusted (non-GAAP) operating expense $336,846 $337,569 $327,906 $338,061 $329,307 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 Q2 FY 2023 Q1 FY 2023 GAAP income from operations $84,629 $91,302 $78,214 $102,813 $85,216 Total adjustments related to gross profit 7,102 6,784 6,992 7,245 6,231 Total adjustments related to operating expense 45,487 57,410 42,821 46,809 41,423 Total adjustments related to income from operations 52,589 64,194 49,813 54,054 47,654 Adjusted (non-GAAP) income from operations $137,218 $155,496 $128,027 $156,867 $132,870 Adjusted (non-GAAP) operating margin percentage 13.2 % 13.8 % 12.0 % 13.8 % 12.6 % Operating Expense Reconciliation (Amounts in thousands) Income from Operations Reconciliation (Amounts in thousands)

© Ciena Corporation 2023. All rights reserved. Proprietary Information.21 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 Q2 FY 2023 Q1 FY 2023 GAAP net income $49,547 $91,199 $29,733 $57,654 $76,241 Exclude GAAP provision (benefit) for income taxes 21,956 (20,681) 34,608 29,821 25,078 Income before income taxes 71,503 70,518 64,341 87,475 101,319 Total adjustments related to income from operations 52,589 64,194 49,813 54,054 47,654 Loss on extinguishment and modification of debt — 7,874 — — — (Gain) loss on cost method equity investment — — 87 — (26,455) Adjusted income before income taxes 124,092 142,586 114,241 141,529 122,518 Non-GAAP tax provision on adjusted income before income taxes 27,300 31,369 25,133 31,136 26,954 Adjusted (non-GAAP) net income $96,792 $111,217 $89,108 $110,393 $95,564 Weighted average basic common shares outstanding 145,291 147,437 149,690 149,616 149,081 Weighted average diluted potential common shares outstanding(1) 145,848 147,891 149,977 150,147 149,551 Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 Q2 FY 2023 Q1 FY 2023 GAAP diluted net income per potential common share $ 0.34 $ 0.62 $ 0.20 $ 0.38 $ 0.51 Adjusted (non-GAAP) diluted net income per potential common share $ 0.66 $ 0.75 $ 0.59 $ 0.74 $ 0.64 1. Weighted average dilutive potential common shares outstanding used in calculating Adjusted (non-GAAP) diluted net income per potential common share for the first quarter of fiscal 2024 includes 0.6 million shares underlying certain stock option and stock unit awards. Net Income Reconciliation (Amounts in thousands) Net Income per Common Share

© Ciena Corporation 2023. All rights reserved. Proprietary Information.22 Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) Q1 FY 2024 Q4 FY 2023 Q3 FY 2023 Q2 FY 2023 Q1 FY 2023 Net income (GAAP) $49,547 $91,199 $29,733 $57,654 $76,241 Add: Interest expense 23,776 24,207 24,060 23,889 15,870 Less: Interest and other income, net 10,650 11,297 10,187 8,551 31,973 Add: Loss on extinguishment and modification of debt — 7,874 — — — Add: Provision (benefit) for income taxes 21,956 (20,681) 34,608 29,821 25,078 Add: Depreciation of equipment, building, furniture and fixtures, and amortization of leasehold improvements 22,808 23,351 23,310 23,695 22,208 Add: Amortization of intangible assets 10,016 13,342 12,674 13,275 10,325 EBITDA $117,453 $127,995 $114,198 $139,783 $117,749 Add: Share-based compensation cost 37,602 34,894 32,906 31,768 30,474 Add: Significant asset impairments and restructuring costs 4,971 7,209 4,174 8,153 4,298 Add: Acquisition and integration costs — — 59 857 2,558 Add: Legal settlement — 8,750 — — — Adjusted EBITDA $160,026 $178,848 $151,337 $180,561 $155,079 Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) (Amounts in thousands)

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

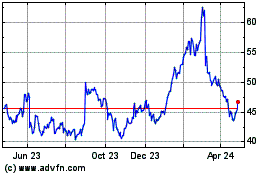

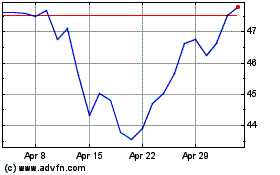

Ciena (NYSE:CIEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ciena (NYSE:CIEN)

Historical Stock Chart

From Apr 2023 to Apr 2024