Bilibili Inc. (“Bilibili” or the “Company”) (NASDAQ: BILI and HKEX:

9626), an iconic brand and a leading video community for young

generations in China, today announced its unaudited financial

results for the fourth quarter and fiscal year ended December 31,

2023.

Fourth Quarter and Fiscal Year 2023

Highlights:

- Total

net revenues were RMB6.3 billion (US$894.3 million) in the

fourth quarter of 2023 and RMB22.5 billion (US$3.2 billion) in

2023, each increased by 3% compared with the same prior year

period.

-

Advertising revenues were RMB1.9 billion (US$271.7

million) in the fourth quarter of 2023, and RMB6.4 billion

(US$903.1 million) in 2023, representing increases of 28% and 27%

year over year, respectively.

-

Value-added services (VAS) revenues were RMB2.9

billion (US$402.4 million) in the fourth quarter of 2023, and

RMB9.9 billion (US$1.4 billion) in 2023, representing increases of

22% and 14% year over year, respectively.

- Gross

profit was RMB1.7 billion (US$233.8 million) in the fourth

quarter of 2023 and RMB5.4 billion (US$766.5 million) in 2023,

representing increases of 33% and 41% year over year, respectively.

Gross profit margin reached 26.1% in the fourth quarter of 2023,

improving from 20.3% in the same period last year. Gross profit

margin reached 24.2% in 2023, improving from 17.6% in 2022.

- Net

loss was RMB1.3 billion (US$182.6 million) in the fourth

quarter of 2023 and RMB4.8 billion (US$677.7 million) in 2023,

narrowing by 13% and 36% year over year, respectively.

- Adjusted

net loss1 was RMB555.8 million (US$78.3 million) in the

fourth quarter of 2023 and RMB3.4 billion (US$480.9 million) in

2023, narrowing by 58% and 49% year over year, respectively.

-

Operating cash flow was RMB640.4 million (US$90.2

million) in the fourth quarter of 2023 and RMB266.6 million

(US$37.6 million) in 2023, compared with negative RMB707.3 million

for the same period last year and negative RMB3.9 billion in

2022.

- Average daily active users

(DAUs) were 100.1 million in the fourth quarter of 2023,

representing an increase of 8% from the same period of 2022.

“Presented with both challenges and

opportunities in 2023, we closed the year with healthy community

growth and a vastly improved financial profile,” said Mr. Rui Chen,

chairman and chief executive officer of Bilibili. “We continued to

build our large community with DAUs exceeding 100 million in the

fourth quarter, while users’ daily time spent remained robust at

over 95 minutes on average. Meanwhile, to better serve our content

creators and strengthen the overall community ecosystem, we further

advanced our commercialization strategy and improved various

monetization products. In 2023, over 3 million content creators

earned income on Bilibili, up 30% compared with 2022. The

commercial progress we made can also be seen in our mounting

advertising and value-added services revenues, which grew by 27%

and 14% for the full year of 2023, respectively. As we move through

2024, we plan to keep facilitating a virtuous cycle between

community and commercialization, and create value for our users,

creators and shareholders.”

Mr. Sam Fan, chief financial officer of

Bilibili, said, “Throughout 2023, we focused on business operation

efficiency, resulting in expanded gross margins and bottom-line

improvement. For the fourth quarter, our gross profit increased by

33% year over year and our gross profit margin reached 26.1%,

marking our sixth consecutive quarter of margin expansion. We also

reduced our operating expenses by 17% year over year during the

fourth quarter and 14% for the full year. As a result, our adjusted

net loss narrowed by 58% in the fourth quarter and 49% in 2023,

both year over year, putting us on track to achieve our

profitability goal. Moreover, we are delighted to share that we

have achieved positive operating cash flow for the full year of

2023, and we are committed to further improving our financials in

2024.”

Fourth Quarter 2023 Financial

Results

Total net revenues. Total net

revenues were RMB6.3 billion (US$894.3 million), representing an

increase of 3% from the same period of 2022.

Value-added services (VAS). Revenues from VAS

were RMB2.9 billion (US$402.4 million), representing an increase of

22% from the same period of 2022, led by an increase in revenues

from live broadcasting and other value-added services.

Advertising. Revenues from advertising were

RMB1.9 billion (US$271.7 million), representing an increase of 28%

from the same period of 2022, mainly attributable to the Company’s

improved advertising product offerings and enhanced advertising

efficiency.

Mobile games. Revenues from mobile games were

RMB1.0 billion (US$141.8 million), representing a 12%

year-over-year decrease, and a 2% quarter-over-quarter increase.

The year-over-year decrease was mainly attributable to the high

base from the release of Space Hunter 3 in the second half of 2022,

while revenues from top-performing legacy games, like Azur Lane and

FGO, remained relatively stable.

IP derivatives and others (formerly known as

E-commerce and others). Revenues from IP derivatives and others

were RMB556.0 million (US$78.3 million), representing a decrease of

51% from the same period of 2022, mainly attributable to a decrease

in revenues from e-sports copyright sublicensing.

Cost of revenues. Cost of

revenues was RMB4.7 billion (US$660.4 million), representing a

decrease of 4% from the same period of 2022. The decrease was

mainly due to lower content costs, server and bandwidth costs,

staff costs and other costs led by effective cost control measures.

Revenue-sharing costs, a key component of cost of revenues, were

RMB2.8 billion (US$398.9 million), representing an increase of 12%

from the same period of 2022.

Gross profit. Gross profit was

RMB1.7 billion (US$233.8 million), representing an increase of 33%

from the same period of 2022, primarily attributed to the Company’s

reduction of costs related to platform operations, as the Company

enhanced its monetization efficiency.

Total operating expenses. Total

operating expenses were RMB3.0 billion (US$417.6 million),

representing a decrease of 17% from the same period of 2022.

Sales and marketing expenses. Sales and

marketing expenses were RMB1.1 billion (US$158.5 million),

representing an 11% year-over-year decrease. The decrease was

primarily attributable to reduced promotional spending related to

user acquisition in the fourth quarter of 2023.

General and administrative expenses. General and

administrative expenses were RMB511.9 million (US$72.1 million),

representing a 37% year-over-year decrease. The decrease was

primarily attributable to a decrease in headcount of general and

administrative personnel in the fourth quarter of 2023.

Research and development expenses. Research and

development expenses were RMB1.3 billion (US$186.9 million),

representing an 11% year-over-year decrease. The decrease was

mainly attributable to a decline in headcount of research and

development personnel and fewer expenses associated with the

termination of certain game projects in the fourth quarter of

2023.

Loss from operations. Loss from

operations was RMB1.3 billion (US$183.8 million), narrowing by 44%

from the same period of 2022.

Adjusted loss from

operations1. Adjusted loss from

operations was RMB635.1 million (US$89.4 million), narrowing by 53%

from the same period of 2022.

Total other income/(expenses),

net. Total other income was RMB13.1 million (US$1.8

million), compared with total other income of RMB850.6 million in

the same period of 2022. The change was primarily attributable to

the gains of RMB842.8 million from the repurchase of convertible

senior notes in the fourth quarter of 2022.

Income tax expense. Income tax

expense was RMB5.1 million (US$0.7 million), compared with RMB20.5

million in the same period of 2022.

Net loss. Net loss was RMB1.3

billion (US$182.6 million), narrowing by 13% from the same period

of 2022.

Adjusted net

loss1. Adjusted net loss

was RMB555.8 million (US$78.3 million), narrowing by 58% from the

same period of 2022.

Basic and diluted EPS and adjusted basic

and diluted EPS1. Basic

and diluted net loss per share were RMB3.13 (US$0.44) each,

compared with RMB3.77 each in the same period of 2022. Adjusted

basic and diluted net loss per share were RMB1.34 (US$0.19) each,

compared with RMB3.31 each in the same period of 2022.

Net cash provided by operating

activities. Net cash provided by operating activities was

RMB640.4 million (US$90.2 million), compared with net cash used in

operating activities of RMB707.3 million in the same period of

2022.

Fiscal Year 2023 Financial

Results

Total net revenues. Total net

revenues were RMB22.5 billion (US$3.2 billion), representing an

increase of 3% from 2022.

Value-added services (VAS). Revenues from VAS

were RMB9.9 billion (US$1.4 billion), representing an increase of

14% from 2022, led by an increase in revenues from live

broadcasting and other value-added services.

Advertising. Revenues from advertising were

RMB6.4 billion (US$903.1 million), representing an increase of 27%

from 2022, mainly attributable to the Company’s improved

advertising product offerings and enhanced advertising

efficiency.

Mobile games. Revenues from mobile games were

RMB4.0 billion (US$566.4 million), representing a decrease of 20%

from 2022. The decrease was mainly attributable to fewer new game

launches as well as lower revenue contributions from certain games,

while revenues from top-performing legacy games, like Azur Lane and

FGO, remained relatively stable in 2023.

IP derivatives and others (formerly known as

E-commerce and others). Revenues from IP derivatives and others

were RMB2.2 billion (US$307.7 million), representing a decrease of

29% from 2022, mainly attributable to a decrease in revenues from

e-sports copyright sublicensing and IP derivatives sales.

Cost of revenues. Cost of

revenues was RMB17.1 billion (US$2.4 billion), representing a

decrease of 5% from 2022. The decrease was mainly due to lower

server and bandwidth costs, staff costs, content costs and other

costs led by effective cost control measures. Revenue-sharing

costs, a key component of cost of revenues, were RMB9.5 billion

(US$1.3 billion), representing an increase of 4% from 2022.

Gross profit. Gross profit was

RMB5.4 billion (US$766.5 million), representing an increase of 41%

from 2022, primarily as a result of the Company’s reduction of

costs related to platform operations, as the Company enhanced its

monetization efficiency.

Total operating expenses. Total

operating expenses were RMB10.5 billion (US$1.5 billion),

representing a decrease of 14% from 2022.

Sales and marketing expenses. Sales and

marketing expenses were RMB3.9 billion (US$551.6 million),

representing a 20% decrease from 2022. The decrease was primarily

attributable to reduced promotional spending related to user

acquisition in 2023.

General and administrative expenses. General and

administrative expenses were RMB2.1 billion (US$298.9 million),

representing a 16% decrease from 2022. The decrease was primarily

attributable to a decrease in headcount of general and

administrative personnel and allowance for expected credit loss in

2023.

Research and development expenses. Research and

development expenses were RMB4.5 billion (US$629.2 million),

representing a 6% year-over-year decrease. The decrease was mainly

attributable to a decrease in headcount of research and development

personnel and fewer expenses associated with the termination of

certain game projects in 2023.

Loss from operations. Loss from

operations was RMB5.1 billion (US$713.3 million), narrowing by 39%

from 2022.

Adjusted loss from

operations1. Adjusted

loss from operations was RMB3.4 billion (US$476.8 million),

narrowing by 46% from 2022.

Total other income/(expenses), net. Total other

income was RMB331.2 million (US$46.6 million), compared with

RMB954.4 million in the same period of 2022. The change was

primarily attributable to gains of RMB292.2 million from the

repurchase of convertible senior notes in 2023, compared with gains

of RMB1.3 billion in 2022.

Income tax expense. Income tax

expense was RMB78.7 million (US$11.1 million), compared with

RMB104.1 million in 2022.

Net loss. Net loss was RMB4.8

billion (US$677.7 million), narrowing by 36% from 2022.

Adjusted net

loss1. Adjusted net loss

was RMB3.4 billion (US$480.9 million), narrowing by 49% from

2022.

Basic and diluted EPS and adjusted basic

and diluted EPS1. Basic

and diluted net loss per share were RMB11.67 (US$1.64) each,

compared with RMB18.99 each in 2022. Adjusted basic and diluted net

loss per share were RMB8.29 (US$1.17) each, compared with RMB16.95

each in 2022.

Net cash provided by operating

activities. Net cash provided by operating activities was

RMB266.6 million (US$37.6 million), compared with net cash used in

operating activities of RMB3.9 billion in 2022.

Cash and cash equivalents, time deposits

and short-term investments. As of December 31, 2023, the

Company had cash and cash equivalents, time deposits and short-term

investments of RMB15.0 billion (US$2.1 billion).

Convertible Senior

Notes. As of December 31, 2023, the

aggregate outstanding principal amount of April 2026 Notes, 2027

Notes and December 2026 Notes was US$861.8 million (RMB6.1

billion).

1 Adjusted loss from operations, adjusted net

loss and adjusted basic and diluted EPS are non-GAAP financial

measures. For more information on non-GAAP financial measures,

please see the section of “Use of Non-GAAP Financial Measures” and

the table captioned “Unaudited Reconciliations of GAAP and Non-GAAP

Results.”

Conference Call

The Company’s management will host an earnings

conference call at 7:00 AM U.S. Eastern Time on March 7, 2024 (8:00

PM Beijing/Hong Kong Time on March 7, 2024). Details for the

conference call are as follows:

| Event

Title: |

Bilibili 2023

Fourth Quarter and Fiscal Year Earnings Conference Call |

| Registration Link: |

https://register.vevent.com/register/BIbf5014f1c88f40899dfa24f4a0731484 |

All participants must use the link provided

above to complete the online registration process in advance of the

conference call. Upon registering, each participant will receive a

set of participant dial-in numbers and a personal PIN, which will

be used to join the conference call.

Additionally, a live webcast of the conference

call will be available on the Company’s investor relations website

at http://ir.bilibili.com, and a replay of the webcast will be

available following the session.

About Bilibili Inc.

Bilibili is an iconic brand and a leading video

community with a mission to enrich the everyday lives of young

generations in China. Bilibili offers a wide array of video-based

content with All the Videos You Like as its value proposition.

Bilibili builds its community around aspiring users, high-quality

content, talented content creators and the strong emotional bonds

among them. Bilibili pioneered the “bullet chatting” feature, a

live comment function that has transformed our users’ viewing

experience by displaying the thoughts and feelings of audience

members viewing the same video. The Company has now become the

welcoming home of diverse interests among young generations in

China and the frontier for promoting Chinese culture across the

world.

For more information, please visit:

http://ir.bilibili.com.

Use of Non-GAAP Financial

Measures

The Company uses non-GAAP measures, such as

adjusted loss from operations, adjusted net loss, adjusted net loss

per share and per ADS, basic and diluted and adjusted net loss

attributable to the Bilibili Inc.’s shareholders in evaluating its

operating results and for financial and operational decision-making

purposes. The Company believes that the non-GAAP financial measures

help identify underlying trends in its business by excluding the

impact of share-based compensation expenses, amortization expense

related to intangible assets acquired through business

acquisitions, income tax related to intangible assets acquired

through business acquisitions, gain/loss on fair value change in

investments in publicly traded companies, gain/loss on repurchase

of convertible senior notes, expenses related to organizational

optimization, and termination expenses of certain game projects.

The Company believes that the non-GAAP financial measures provide

useful information about the Company’s results of operations,

enhance the overall understanding of the Company’s past performance

and future prospects and allow for greater visibility with respect

to key metrics used by the Company’s management in its financial

and operational decision-making.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP.

The non-GAAP financial measures have limitations as analytical

tools, and when assessing the Company’s operating performance, cash

flows or liquidity, investors should not consider them in

isolation, or as a substitute for net loss, cash flows provided by

operating activities or other consolidated statements of operations

and cash flows data prepared in accordance with U.S. GAAP.

The Company mitigates these limitations by

reconciling the non-GAAP financial measures to the most comparable

U.S. GAAP performance measures, all of which should be considered

when evaluating the Company’s performance.

For more information on the non-GAAP financial

measures, please see the table captioned “Unaudited Reconciliations

of GAAP and Non-GAAP Results.”

Exchange Rate Information

This announcement contains translations of

certain RMB amounts into U.S. dollars (“US$”) at specified rates

solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to US$ were made at the rate of RMB

7.0999 to US$1.00, the exchange rate on December 29, 2023 set forth

in the H.10 statistical release of the Federal Reserve Board. The

Company makes no representation that the RMB or US$ amounts

referred to could be converted into US$ or RMB, as the case may be,

at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident,”

“potential,” “continue,” or other similar expressions. Among other

things, quotations from management in this announcement and

Bilibili’s strategic and operational plans, contain forward-looking

statements. Bilibili may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and

Exchange Commission, in its interim and annual reports to

shareholders, in announcements, circulars or other publications

made on the website of The Stock Exchange of Hong Kong Limited (the

“Hong Kong Stock Exchange”), in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including but not limited to statements about Bilibili’s

beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: results of

operations, financial condition, and stock price; Bilibili’s

strategies; Bilibili’s future business development, financial

condition and results of operations; Bilibili’s ability to retain

and increase the number of users, members and advertising

customers, provide quality content, products and services, and

expand its product and service offerings; competition in the online

entertainment industry; Bilibili’s ability to maintain its culture

and brand image within its addressable user communities; Bilibili’s

ability to manage its costs and expenses; PRC governmental policies

and regulations relating to the online entertainment industry,

general economic and business conditions globally and in China and

assumptions underlying or related to any of the foregoing. Further

information regarding these and other risks is included in the

Company’s filings with the Securities and Exchange Commission and

the Hong Kong Stock Exchange. All information provided in this

announcement and in the attachments is as of the date of the

announcement, and the Company undertakes no duty to update such

information, except as required under applicable law.

For investor and media inquiries, please

contact:

In China:

Bilibili Inc.Juliet YangTel: +86-21-2509-9255

Ext. 8523E-mail: ir@bilibili.com

Piacente Financial Communications Helen WuTel:

+86-10-6508-0677E-mail: bilibili@tpg-ir.com

In the United States:

Piacente Financial Communications Brandi

PiacenteTel: +1-212-481-2050E-mail: bilibili@tpg-ir.com

| |

|

BILIBILI INC. |

|

Unaudited Condensed Consolidated Statements of

Operations |

|

(All amounts in thousands, except for share and per share

data) |

| |

| |

For the Three Months Ended |

|

For the Year Ended |

|

|

December31, |

|

September 30, |

|

December31, |

|

December31, |

|

December 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

| Net

revenues: |

|

|

|

|

|

|

|

|

|

|

Mobile games |

1,145,905 |

|

|

991,776 |

|

|

1,006,858 |

|

|

5,021,290 |

|

|

4,021,137 |

|

|

Value-added services (VAS) |

2,349,809 |

|

|

2,595,036 |

|

|

2,857,079 |

|

|

8,715,170 |

|

|

9,910,080 |

|

|

Advertising |

1,512,356 |

|

|

1,638,232 |

|

|

1,929,164 |

|

|

5,066,212 |

|

|

6,412,040 |

|

|

IP derivatives and others (formerly known as E-commerce and

others) |

1,134,416 |

|

|

580,037 |

|

|

555,995 |

|

|

3,096,495 |

|

|

2,184,730 |

|

| Total net

revenues |

6,142,486 |

|

|

5,805,081 |

|

|

6,349,096 |

|

|

21,899,167 |

|

|

22,527,987 |

|

| Cost of

revenues |

(4,892,933 |

) |

|

(4,354,664 |

) |

|

(4,689,114 |

) |

|

(18,049,872 |

) |

|

(17,086,122 |

) |

| Gross

profit |

1,249,553 |

|

|

1,450,417 |

|

|

1,659,982 |

|

|

3,849,295 |

|

|

5,441,865 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

(1,266,149 |

) |

|

(992,303 |

) |

|

(1,125,464 |

) |

|

(4,920,745 |

) |

|

(3,916,150 |

) |

|

General and administrative expenses |

(816,807 |

) |

|

(499,132 |

) |

|

(511,906 |

) |

|

(2,521,134 |

) |

|

(2,122,432 |

) |

|

Research and development expenses |

(1,493,799 |

) |

|

(1,066,155 |

) |

|

(1,327,282 |

) |

|

(4,765,360 |

) |

|

(4,467,470 |

) |

| Total operating

expenses |

(3,576,755 |

) |

|

(2,557,590 |

) |

|

(2,964,652 |

) |

|

(12,207,239 |

) |

|

(10,506,052 |

) |

| Loss from

operations |

(2,327,202 |

) |

|

(1,107,173 |

) |

|

(1,304,670 |

) |

|

(8,357,944 |

) |

|

(5,064,187 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Other

income/(expenses): |

|

|

|

|

|

|

|

|

|

|

Investment loss, net (including impairments) |

(166,815 |

) |

|

(244,961 |

) |

|

(199,004 |

) |

|

(532,485 |

) |

|

(435,644 |

) |

|

Interest income |

108,306 |

|

|

117,722 |

|

|

126,450 |

|

|

281,051 |

|

|

542,472 |

|

|

Interest expense |

(63,558 |

) |

|

(30,064 |

) |

|

(29,181 |

) |

|

(250,923 |

) |

|

(164,927 |

) |

|

Exchange gains/(losses) |

64,648 |

|

|

(23,871 |

) |

|

4,848 |

|

|

(19,745 |

) |

|

(35,575 |

) |

|

Debt extinguishment gain |

842,804 |

|

|

9,771 |

|

|

- |

|

|

1,318,594 |

|

|

292,213 |

|

|

Others, net |

65,242 |

|

|

(40,695 |

) |

|

110,007 |

|

|

157,944 |

|

|

132,640 |

|

| Total other

income/(expenses), net |

850,627 |

|

|

(212,098 |

) |

|

13,120 |

|

|

954,436 |

|

|

331,179 |

|

| Loss before income

tax |

(1,476,575 |

) |

|

(1,319,271 |

) |

|

(1,291,550 |

) |

|

(7,403,508 |

) |

|

(4,733,008 |

) |

|

Income tax |

(20,461 |

) |

|

(17,975 |

) |

|

(5,140 |

) |

|

(104,145 |

) |

|

(78,705 |

) |

| Net loss |

(1,497,036 |

) |

|

(1,337,246 |

) |

|

(1,296,690 |

) |

|

(7,507,653 |

) |

|

(4,811,713 |

) |

|

Net loss/(income) attributable to noncontrolling interests |

2,382 |

|

|

(14,198 |

) |

|

206 |

|

|

10,640 |

|

|

(10,608 |

) |

| Net loss attributable

to the Bilibili Inc.’s shareholders |

(1,494,654 |

) |

|

(1,351,444 |

) |

|

(1,296,484 |

) |

|

(7,497,013 |

) |

|

(4,822,321 |

) |

| Net loss per share, basic |

(3.77 |

) |

|

(3.26 |

) |

|

(3.13 |

) |

|

(18.99 |

) |

|

(11.67 |

) |

| Net loss per ADS, basic |

(3.77 |

) |

|

(3.26 |

) |

|

(3.13 |

) |

|

(18.99 |

) |

|

(11.67 |

) |

| Net loss per share,

diluted |

(3.77 |

) |

|

(3.26 |

) |

|

(3.13 |

) |

|

(18.99 |

) |

|

(11.67 |

) |

| Net loss per ADS, diluted |

(3.77 |

) |

|

(3.26 |

) |

|

(3.13 |

) |

|

(18.99 |

) |

|

(11.67 |

) |

| Weighted average number of

ordinary shares, basic |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

| Weighted average number of

ADS, basic |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

| Weighted average number of

ordinary shares, diluted |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

| Weighted average number of

ADS, diluted |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

The accompanying notes are an integral part of

this press release.

| |

|

BILIBILI INC. |

|

Notes to Unaudited Financial Information |

|

(All amounts in thousands, except for share and per share

data) |

| |

| |

For the Three Months Ended |

|

For the Year Ended |

|

|

December31, |

|

September 30, |

|

December31, |

|

December31, |

|

December31, |

|

|

2022 |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses included

in: |

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

14,908 |

|

18,808 |

|

15,014 |

|

69,096 |

|

63,724 |

|

Sales and marketing expenses |

17,815 |

|

13,523 |

|

13,960 |

|

59,041 |

|

56,649 |

|

General and administrative expenses |

136,681 |

|

155,511 |

|

150,226 |

|

554,976 |

|

596,950 |

|

Research and development expenses |

85,391 |

|

116,195 |

|

87,859 |

|

357,570 |

|

415,321 |

| Total |

254,795 |

|

304,037 |

|

267,059 |

|

1,040,683 |

|

1,132,644 |

| |

|

BILIBILI INC. |

|

Unaudited Condensed Consolidated Balance

Sheets |

|

(All amounts in thousands, except for share and per share

data) |

| |

|

|

December 31, |

|

December31, |

|

|

2022 |

|

2023 |

|

|

RMB |

|

RMB |

|

|

|

|

|

|

Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

10,172,584 |

|

7,191,821 |

|

Time deposits |

4,767,972 |

|

5,194,891 |

|

Restricted cash |

14,803 |

|

50,000 |

|

Accounts receivable, net |

1,328,584 |

|

1,573,900 |

|

Prepayments and other current assets |

3,545,493 |

|

2,063,362 |

|

Short-term investments |

4,623,452 |

|

2,653,065 |

|

Total current assets |

24,452,888 |

|

18,727,039 |

| Non-current

assets: |

|

|

|

|

Property and equipment, net |

1,227,163 |

|

714,734 |

|

Production cost, net |

1,929,622 |

|

2,066,066 |

|

Intangible assets, net |

4,326,790 |

|

3,627,533 |

|

Goodwill |

2,725,130 |

|

2,725,130 |

|

Long-term investments, net |

5,651,018 |

|

4,366,632 |

|

Other long-term assets |

1,517,959 |

|

931,933 |

|

Total non-current assets |

17,377,682 |

|

14,432,028 |

| Total

assets |

41,830,570 |

|

33,159,067 |

|

Liabilities |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

4,291,656 |

|

4,333,730 |

|

Salary and welfare payables |

1,401,526 |

|

1,219,355 |

|

Taxes payable |

316,244 |

|

345,250 |

|

Short-term loan and current portion of long-term debt |

6,621,386 |

|

7,455,753 |

|

Deferred revenue |

2,819,323 |

|

2,954,088 |

|

Accrued liabilities and other payables |

1,643,269 |

|

1,795,519 |

|

Total current liabilities |

17,093,404 |

|

18,103,695 |

| Non-current

liabilities: |

|

|

|

|

Long-term debt |

8,683,150 |

|

646 |

|

Other long-term liabilities |

814,429 |

|

650,459 |

|

Total non-current liabilities |

9,497,579 |

|

651,105 |

| Total

liabilities |

26,590,983 |

|

18,754,800 |

| |

|

|

|

| Total

Bilibili Inc.’s shareholders’ equity |

15,237,828 |

|

14,391,900 |

| Noncontrolling

interests |

1,759 |

|

12,367 |

| Total

shareholders’ equity |

15,239,587 |

|

14,404,267 |

| |

|

|

|

| Total

liabilities and shareholders’ equity |

41,830,570 |

|

33,159,067 |

| |

|

BILIBILI INC. |

|

Unaudited Selected Condensed Consolidated Cash Flows

Data |

|

(All amounts in thousands, except for share and per share

data) |

| |

| |

For the Three Months Ended |

|

For the Year Ended |

|

|

December31, |

|

September30, |

|

December31, |

|

December31, |

|

December 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash (used in)/ provided by |

|

|

|

|

|

|

|

|

|

|

operating activities |

(707,255 |

) |

|

277,384 |

|

640,396 |

|

(3,911,370 |

) |

|

266,622 |

| |

|

BILIBILI INC. |

|

Unaudited Reconciliations of GAAP and Non-GAAP

Results |

|

(All amounts in thousands, except for share and per share

data) |

| |

| |

For the Three Months Ended |

|

For the Year Ended |

|

|

December31, |

|

September30, |

|

December31, |

|

December31, |

|

December 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

| |

|

|

|

|

|

|

|

|

|

|

Loss from operations |

(2,327,202 |

) |

|

(1,107,173 |

) |

|

(1,304,670 |

) |

|

(8,357,944 |

) |

|

(5,064,187 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

| Share-based compensation

expenses |

254,795 |

|

|

304,037 |

|

|

267,059 |

|

|

1,040,683 |

|

|

1,132,644 |

|

| Amortization expense related

to intangible assets acquired through business acquisitions |

48,151 |

|

|

47,734 |

|

|

47,734 |

|

|

192,637 |

|

|

191,770 |

|

| Expenses related to

organizational optimization |

251,736 |

|

|

- |

|

|

- |

|

|

341,386 |

|

|

- |

|

| Termination expenses of

certain game projects |

416,708 |

|

|

- |

|

|

354,811 |

|

|

525,762 |

|

|

354,811 |

|

| Adjusted loss from

operations |

(1,355,812 |

) |

|

(755,402 |

) |

|

(635,066 |

) |

|

(6,257,476 |

) |

|

(3,384,962 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net loss |

(1,497,036 |

) |

|

(1,337,246 |

) |

|

(1,296,690 |

) |

|

(7,507,653 |

) |

|

(4,811,713 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

| Share-based compensation

expenses |

254,795 |

|

|

304,037 |

|

|

267,059 |

|

|

1,040,683 |

|

|

1,132,644 |

|

| Amortization expense related

to intangible assets acquired through business acquisitions |

48,151 |

|

|

47,734 |

|

|

47,734 |

|

|

192,637 |

|

|

191,770 |

|

| Income tax related to

intangible assets acquired through business acquisitions |

(5,625 |

) |

|

(5,563 |

) |

|

(5,563 |

) |

|

(29,259 |

) |

|

(22,376 |

) |

| Loss on fair value change in

investments in publicly traded companies |

59,688 |

|

|

137,358 |

|

|

76,839 |

|

|

52,665 |

|

|

32,964 |

|

| Gain on repurchase of

convertible senior notes |

(842,804 |

) |

|

(9,771 |

) |

|

- |

|

|

(1,318,594 |

) |

|

(292,213 |

) |

| Expenses related to

organizational optimization |

251,736 |

|

|

- |

|

|

- |

|

|

341,386 |

|

|

- |

|

| Termination expenses of

certain game projects |

416,708 |

|

|

- |

|

|

354,811 |

|

|

525,762 |

|

|

354,811 |

|

| Adjusted net

loss |

(1,314,387 |

) |

|

(863,451 |

) |

|

(555,810 |

) |

|

(6,702,373 |

) |

|

(3,414,113 |

) |

| Net loss/(income) attributable

to noncontrolling interests |

2,382 |

|

|

(14,198 |

) |

|

206 |

|

|

10,640 |

|

|

(10,608 |

) |

| Adjusted net loss

attributable to the Bilibili Inc.’s shareholders |

(1,312,005 |

) |

|

(877,649 |

) |

|

(555,604 |

) |

|

(6,691,733 |

) |

|

(3,424,721 |

) |

| |

|

BILIBILI INC. |

|

Unaudited Reconciliations of GAAP and Non-GAAP Results

(Continued) |

|

(All amounts in thousands, except for share and per share

data) |

|

|

| |

For the Three Months Ended |

|

For the Year Ended |

|

|

December31, |

|

September 30, |

|

December31, |

|

December31, |

|

December 31, |

|

|

2022 |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Adjusted net loss per share, basic |

(3.31 |

) |

|

(2.12 |

) |

|

(1.34 |

) |

|

(16.95 |

) |

|

(8.29 |

) |

| Adjusted net loss per ADS,

basic |

(3.31 |

) |

|

(2.12 |

) |

|

(1.34 |

) |

|

(16.95 |

) |

|

(8.29 |

) |

| Adjusted net loss per share,

diluted |

(3.31 |

) |

|

(2.12 |

) |

|

(1.34 |

) |

|

(16.95 |

) |

|

(8.29 |

) |

| Adjusted net loss per ADS,

diluted |

(3.31 |

) |

|

(2.12 |

) |

|

(1.34 |

) |

|

(16.95 |

) |

|

(8.29 |

) |

| Weighted average number of

ordinary shares, basic |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

| Weighted average number of

ADS, basic |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

| Weighted average number of

ordinary shares, diluted |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

| Weighted average number of

ADS, diluted |

396,083,505 |

|

|

413,983,020 |

|

|

414,793,013 |

|

|

394,863,584 |

|

|

413,210,271 |

|

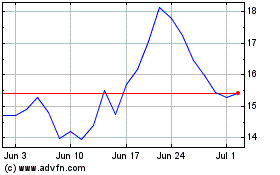

Bilibili (NASDAQ:BILI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bilibili (NASDAQ:BILI)

Historical Stock Chart

From Apr 2023 to Apr 2024