false

0001580149

0001580149

2024-03-06

2024-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) March

6, 2024

BioVie Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada |

|

001-39015 |

|

46-2510769 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

680 W Nye Lane Suite 201

Carson City, NV |

|

89703 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| |

|

|

(775) 888-3162

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last

Report)

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share |

BIVI |

The Nasdaq Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

On March 6, 2024, BioVie Inc. (the “Company”) issued

a press release announcing the closing of the Offering (as defined below). A copy of the press release is attached hereto as Exhibit 99.1

and incorporated by reference herein.

In addition, the Company has updated its investor presentation (the “Investor

Presentation”), a copy of which is furnished hereto as Exhibit 99.2 and is incorporated herein by reference. The Investor Presentation

is also available under the “Events and Presentations” tab in the “Investors” section of the Company’s website,

located at www.biovie.com.

The information contained in the Investor Presentation

is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”)

filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes

no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as

its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through

press releases or through other public disclosure.

The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached

hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific

reference in such a filing.

Public Offering

On March 6, 2024, the Company announced that it had closed the previously announced best efforts

public offering (the “Offering”) of 15,000,000 shares (the “Shares”) of its class A common stock,

par value $0.0001 per share (the “Common Stock”), pre-funded warrants (the “Pre-funded Warrants”)

to purchase 6,000,000 shares of Common Stock, and warrants to purchase up to 10,500,000 shares of Common Stock (the “Common Warrants”)

(CUSIP 09074F132) at a combined public offering price of $1.00 per Share, or Pre-funded Warrant, and the associated Common Warrant. The

gross proceeds to the Company from the Offering were approximately $21 million, before deducting placement agent fees and offering expenses

of approximately $2.2 million. The Company intends to use the net proceeds from the Offering primarily for working capital and general

corporate purposes.

Acuitas Warrant

On March 6, 2024, the Company notified Acuitas Group

Holdings, LLC (“Acuitas”) of an adjustment to the exercise price (“Exercise Price”) of the warrant to purchase

shares of Common Stock expiring July 15, 2028 (the “Acuitas Warrant”) that was issued by the Company to Acuitas pursuant

to the Securities Purchase Agreement (the “SPA”), dated as of July 15, 2022, by and between the Company and Acuitas.

Pursuant to Section 3(b) of the Acuitas Warrant, if

the Company, at any time while the Acuitas Warrant is outstanding, issues shares of Common Stock at a price per share less than the Exercise

Price, then the Exercise Price is reduced to such lower price per share. Accordingly, the Company gave notice to Acuitas that, effective

at the close of business on March 6, 2024, the Exercise Price will be adjusted from $1.82 to $1.00, which was the price per share of Common

Stock sold in the Offering.

The foregoing descriptions of the SPA and Acuitas

Warrant are not complete and are subject to and qualified in their entirety by reference to the full text of the SPA and the Acuitas Warrant,

respectively, copies of which are attached as Exhibits 10.1 and 4.1 hereto, respectively, and are incorporated herein by reference.

Forward-Looking Statements

Certain of the statements made in this report are

forward looking, such as those, among others, relating to the Company’s expectations regarding the timing and completion of the

Offering. Actual results or developments may differ materially from those projected or implied in these forward-looking statements. Factors

that may cause such a difference include risks and uncertainties related to completion of the public offering on the anticipated terms

or at all, market conditions and the satisfaction of customary closing conditions related to the Offering. More information about the

risks and uncertainties faced by the Company is contained under the caption “Risk Factors” in the Company’s prospectus

supplement on Form 424B5 filed with the SEC on March 4, 2024. The Company disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: March 6, 2024

| |

BIOVIE INC. |

|

| |

|

|

|

| |

By: |

/s/ Joanne Wendy Kim |

|

| |

Name: |

Joanne Wendy Kim |

|

| |

Title: |

Chief Financial Officer |

|

Exhibit 99.1

BioVie

Inc. Announces Closing of Public Offering

Carson City, Nevada, March 6, 2024 —

BioVie Inc. (Nasdaq: BIVI), (“BioVie” or the “Company”), a clinical-stage

company developing innovative drug therapies to treat chronic debilitating conditions including liver disease and neurological and neuro-degenerative

disorders, today announced the closing of its previously announced best efforts public offering

of 15,000,000 shares of its common stock, pre-funded warrants to purchase 6,000,000 shares of its common stock (“Pre-funded Warrants”)

and warrants to purchase up to 10,500,000 shares of common stock (the "Common Warrants") at a combined public offering price

of $1.00 per share (or Pre-funded Warrant) and associated Common Warrant. The Common Warrants have an exercise price of $1.50 per share

and are immediately exercisable upon issuance for a period of five years following the date of issuance. The gross proceeds to the Company

from the offering are approximately $21,000,000, before deducting placement agent fees and offering expenses. The Company intends to use

the net proceeds from the offering primarily for working capital and general corporate purposes.

ThinkEquity

acted as sole placement agent for the offering.

The securities were offered and sold pursuant to a

shelf registration statement on Form S-3 (File No. 333-274083), including a base prospectus, filed with the U.S. Securities and Exchange

Commission (the “SEC”) on August 18, 2023 and declared effective on August 28, 2023. A final prospectus supplement and accompanying

prospectus describing the terms of the offering was filed with the SEC and is available on its website at www.sec.gov. Copies of the final

prospectus supplement and the accompanying prospectus relating to the offering may also be obtained, when available, from the offices

of ThinkEquity, 17 State Street, 41st Floor, New York, New York 10004.

This press release shall not constitute an offer to

sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such

an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or

jurisdiction.

About BioVie Inc.

BioVie Inc. (NASDAQ: BIVI) is a clinical-stage company

developing innovative drug therapies for the treatment of neurological and neurodegenerative disorders and advanced liver disease. In

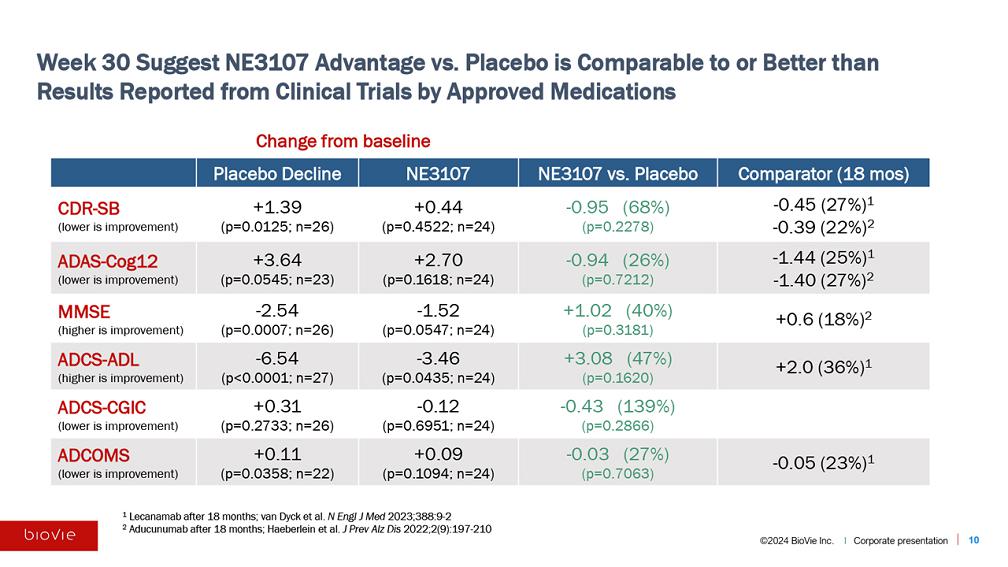

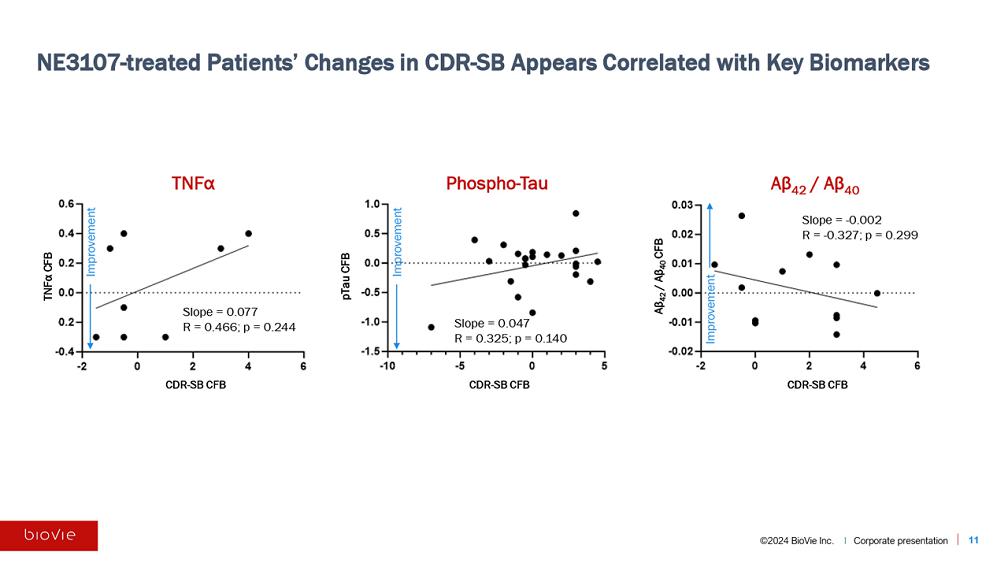

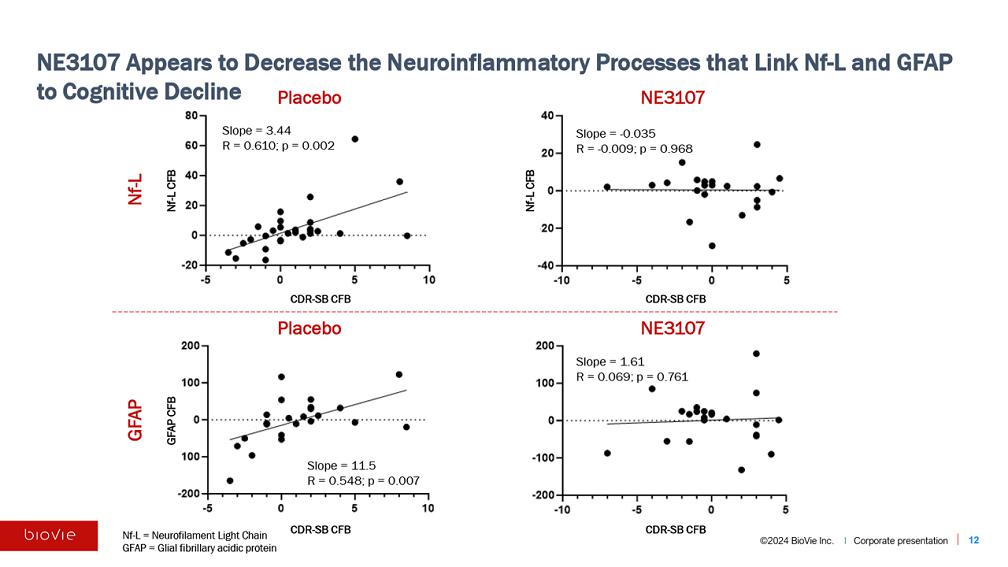

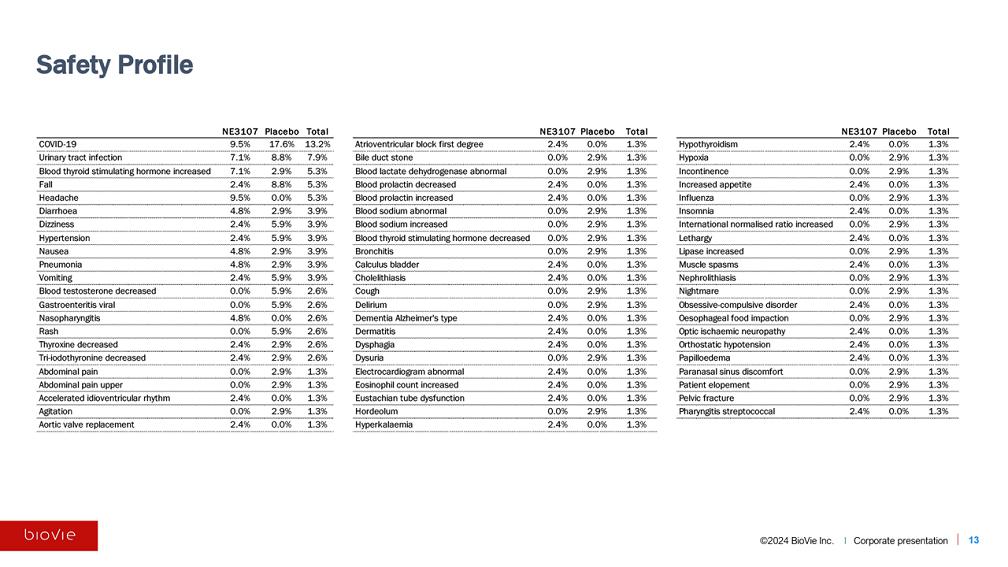

neurodegenerative disease, the Company’s drug candidate NE3107 inhibits inflammatory activation of ERK and NFkB (e.g., TNF signaling)

that leads to neuroinflammation and insulin resistance, but not their homeostatic functions (e.g., insulin signaling and neuron growth

and survival). Both are drivers of Alzheimer’s and Parkinson’s diseases. The Company conducted and reported efficacy data

on its randomized, double-blind, placebo-controlled, parallel-group, multicenter study to evaluate NE3107 in patients who have mild to

moderate Alzheimer's disease (NCT04669028). Results of a Phase 2 investigator-initiated trial (NCT05227820) showing NE3107-treated patients

experienced improved cognition and biomarker levels were presented at the Clinical Trial in Alzheimer’s Disease annual conference

in December 2022. An estimated six million Americans suffer from Alzheimer’s. A Phase 2 study of NE3107 in Parkinson’s disease

(NCT05083260) has completed, and data presented at the International Conference on Alzheimer's and Parkinson's Disease and Related Neurological

Disorders conference in Gothenburg, Sweden in March 2023 showed significant improvements in “morning on” symptoms and clinically

meaningful improvement in motor control in patients treated with a combination of NE3107 and levodopa vs. patients treated with levodopa

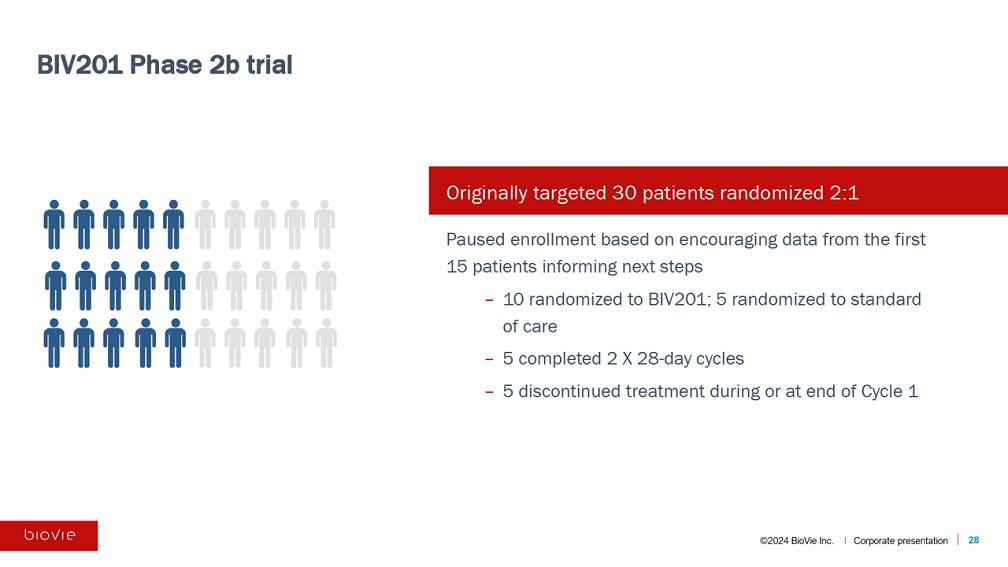

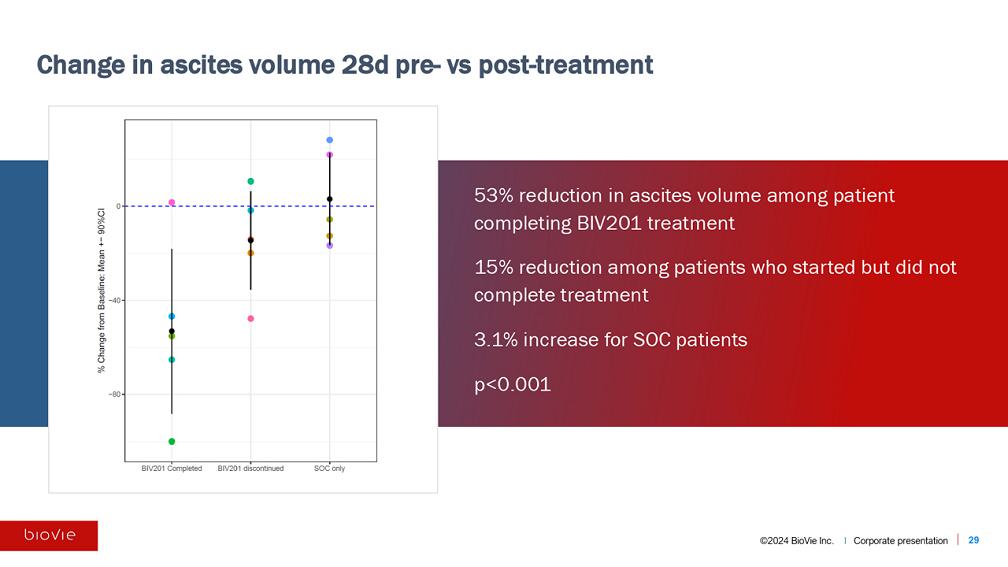

alone, and no drug-related adverse events. In liver disease, the Company’s Orphan drug candidate BIV201 (continuous infusion terlipressin),

with U.S Food and Drug Administration (“FDA”) Fast Track status, is being evaluated and discussed with guidance received from

the FDA regarding the design of Phase 3 clinical testing of BIV201 for the treatment of ascites due to chronic liver cirrhosis. The active

agent is approved in the U.S. and in about 40 countries for related complications of advanced liver cirrhosis. For more information, visit

http://www.bioviepharma.com/.

Forward-Looking Statements

This press release contains forward-looking statements,

which may be identified by words such as "expect," "look forward to," "anticipate" "intend," "plan,"

"believe," "seek," "estimate," "will," "project" or words of similar meaning. Although

BioVie Inc. believes such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations

will be attained. Actual results may vary materially from those expressed or implied by the statements herein due to the Company's ability

to successfully raise sufficient capital on reasonable terms or at all, available cash on hand and contractual and statutory limitations

that could impair our ability to pay future dividends, our ability to complete our pre-clinical or clinical studies and to obtain approval

for our product candidates, our ability to successfully defend potential future litigation, changes in local or national economic conditions

as well as various additional risks, many of which are now unknown and generally out of the Company's control, and which are detailed

from time to time in reports filed by the Company with the SEC, including quarterly reports on Form 10-Q, reports on Form 8-K and annual

reports on Form 10-K. BioVie Inc. does not undertake any duty to update any statements contained herein (including any forward-looking

statements), except as required by law.

For Investor Relations Inquiries:

Bruce Mackle

Managing Director, LifeSci Advisors, LLC

bmackle@lifesciadvisors.com

For Media Relations Inquiries:

Melyssa Weible

Managing Partner, Elixir Health Public Relations

mweible@elixirhealthpr.com

Exhibit 99.2

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

BioVie (NASDAQ:BIVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioVie (NASDAQ:BIVI)

Historical Stock Chart

From Apr 2023 to Apr 2024