false

0001427925

0001427925

2024-03-06

2024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2024

TALPHERA, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-35068

|

|

41-2193603

|

|

(State of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

1850 Gateway Drive, Suite 175

San Mateo, CA 94404

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 216-3500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

TLPH

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On March 6, 2024, Talphera, Inc. (the “Company”) issued a press release announcing its financial results for the three months ended December 31, 2023 and providing a corporate update (the “Release”). A copy of the Release is furnished herewith as Exhibit 99.1.

The information contained in this Item 2.02 and in Exhibit 99.1 shall be deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information contained in this Item 2.02 and in Exhibit 99.1 shall not be incorporated by reference into any filing under the Securities Act or the Exchange Act made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: March 6, 2024

|

TALPHERA, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Raffi Asadorian

|

|

|

|

|

Raffi Asadorian

|

|

|

|

|

Chief Financial Officer

|

|

Exhibit 99.1

Talphera Announces Fourth Quarter 2023 Financial Results and Provides Corporate Update

Company rebranding and corporate transformation to Talphera completed in Q1 2024

First patient enrollment in the NEPHRO CRRT registrational study expected in Q1 2024 with a projected PMA submission by the end of 2024

Cash and investments at December 31, 2023 of $9.4 million together with the royalty and equity financings completed in January 2024 expected to provide cash runway to a potential Niyad™ approval in Q2 2025

Conference call and webcast to be held Wednesday, March 6, 2024 at 4:30 pm ET

SAN MATEO, Calif., March 6, 2024 – Talphera, Inc. (Nasdaq: TLPH), (“Talphera”), a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings, today announced fourth quarter 2023 financial results and provided a corporate update.

“We are excited about our company transformation to Talphera earlier this year. With the divestment of DSUVIA last year and priority focus on our new lead asset, Niyad, we expect a series of significant upcoming milestones. This transformation has generated new interest and investments in Talphera, which has provided us with the capital and commitments projected to support the development of Niyad through a potential FDA approval by the middle of next year,” commented Vince Angotti, Chief Executive Officer of Talphera. “With three decades of nafamostat use in Japan and South Korea, we are looking forward to having the first patient enrolled in the NEPHRO CRRT registrational study, which is expected in the coming weeks. Our priority this year is the successful completion of this trial and the submission of a PMA to the FDA by the end of 2024,” Angotti continued.

Fourth quarter 2023 and recent highlights

|

●

|

In January of this year, the Company announced a corporate rebranding, changing its name from AcelRx Pharmaceuticals, Inc. to Talphera, Inc. (“Talphera”). The decision to rebrand was made following the divestment of assets indicated for acute pain and the shift in focus to its new lead asset, Niyad, reinforcing the Company’s vision of developing and commercializing products to support healthcare providers in optimizing outcomes in medically supervised settings. Talphera began trading on the Nasdaq Global Market under the ticker symbol "TLPH" on January 10, 2024.

|

|

●

|

In January 2024, Talphera announced a total of $26 million in committed capital, including (i) $8 million from a partial monetization of DSUVIA royalties and milestones with Xoma Royalty, and (ii) $18 million in total equity from two existing investors structured as $6 million of equity issued at the first closing, $10 million of committed capital upon the announcement of positive NEPHRO registration trial data, and an additional $2 million commitment if Talphera stock trades above a specified price following that announcement.

|

|

●

|

In December, Talphera hosted a Key Opinion Leader (KOL) panel discussion on Niyad (nafamostat) for use as an anticoagulant in dialysis circuits. The panel featured two thought-leaders in the nephrology and critical care fields, Laurence Busse M.D., M.B.A. (Emory University School of Medicine) and David W. Boldt, M.D. (UCLA Medical Center), who also were co-authors on a recently published market research study reporting current issues with anticoagulants in the dialysis circuit. These KOLs are also principal investigators in the NEPHRO study. To listen to a replay of the event, click here.

|

|

●

|

Also in December, Talphera announced the publication in the journal Renal Failure of a quantitative market research study evaluating current U.S. physician anticoagulation use during continuous renal replacement therapy (CRRT) in patients with acute kidney injury in the intensive care unit. In the study, a total of 150 U.S. board-certified physicians consisting of critical care medicine specialists and nephrologists who specialize in CRRT were queried about their current CRRT anticoagulation practices. The study resulted in a number of key findings related to physicians’ concerns about currently available therapies, heparin and citrate, as well as the consequences resulting from use of no anticoagulation. The study, lead-authored by Dr. David Boldt, is entitled "Anticoagulation Practices for Continuous Renal Replacement Therapy: A Survey of Physicians from the United States.”

|

|

●

|

In October, Talphera announced the approval of a Niyad Investigational Device Exemption (IDE) by the FDA, allowing the Company to advance Niyad into a single registrational trial. This study – the NEPHRO CRRT study - will evaluate the safety and efficacy of Niyad to support a Premarket Approval application (PMA) projected to be submitted to the FDA by the end of 2024.

|

Fourth Quarter 2023 Financial Information

|

●

|

The cash and cash equivalents balance was $9.4 million as of December 31, 2023. The senior debt with Oxford was fully repaid in the second quarter of 2023.

|

|

●

|

Revenues of $0.3 million for the fourth quarter primarily represent the revenue earned on the sales of DSUVIA by Alora, principally driven by sales to the Department of Defense. Revenues in the prior period are included within the net loss from discontinued operations line item of the Statement of Operations.

|

|

●

|

Combined R&D and SG&A expenses for the fourth quarter of 2023 totaled $4.6 million compared to $5.8 million for the fourth quarter of 2022. Excluding non-cash stock-based compensation expense, these amounts were $4.3 million for the fourth quarter of 2023, compared to $5.2 million for the fourth quarter of 2022. The decrease in combined R&D and SG&A expenses in the fourth quarter of 2023 was primarily due to a reduction in business development and headcount-related expenses, partially offset by an increase in Niyad-related research and development costs.

|

|

●

|

The divestment of DSUVIA represents a discontinued operation; accordingly, all historical operating results for the business are reflected within discontinued operations. For the three months ended December 31, 2023, the Company recognized net loss from continuing operations of $4.5 million. For the three months ended December 31, 2022, the Company recognized a net loss from continuing operations of $5.9 million.

|

|

●

|

Net loss attributable to common shareholders for the fourth quarter of 2023 was $4.5 million, or $0.25 per basic and diluted share, compared to a net loss of $7.5 million, or $1.00 per basic and diluted share, for the fourth quarter of 2022.

|

Conference Call and Webcast Information

Talphera will hold a conference call and webcast at 4:30 p.m. Eastern Standard Time/1:30 p.m. Pacific Standard Time to discuss the results and provide an update on the Company’s business.

Investors who wish to participate in the conference call may do so by dialing 1-800-836-8184 for North American callers, or 1-646-357-8785 (toll applies) for international callers outside of Canada. The conference ID is 74791.The webcast can be accessed here or by visiting the Investors section of the Company's website at www.talphera.com and clicking on the webcast link posted within Investors/News & Events/Upcoming Events section. The webcast will include a slide presentation and a replay will be available on the Talphera website for 90 days following the event.

About Talphera, Inc.

Talphera, Inc. is a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings. Talphera's lead product candidate, Niyad™ is a lyophilized formulation of nafamostat and is currently being studied under an investigational device exemption, or IDE, as an anticoagulant for the extracorporeal circuit, and has received Breakthrough Device Designation status from the FDA. Talphera is also developing two pre-filled syringes in-licensed from its partner Aguettant: Fedsyra™, a pre-filled ephedrine syringe, and PFS-02, a pre-filled phenylephrine syringe.

This release is intended for investors only. For additional information about Talphera, please visit www.talphera.com.

About Niyad and Nafamostat

Nafamostat is a broad spectrum, synthetic serine protease inhibitor with anticoagulant, anti-inflammatory and potential anti-viral activities. Niyad™ is a lyophilized formulation of nafamostat and is currently being studied under an investigational device exemption (IDE), as an anticoagulant for the extracorporeal circuit, and has received Breakthrough Device Designation Status from the FDA. Talphera’s registrational study of Niyad™, the NEPHRO CRRT (Nafamostat Efficacy in Phase 3 Registrational Continuous Renal Replacement Therapy) study has received central Institutional Review Board (IRB) approval. LTX-608 is a proprietary nafamostat formulation for direct IV infusion that may be investigated and developed for the treatment of acute respiratory distress syndrome (ARDS), disseminated intravascular coagulation (DIC), acute pancreatitis or as an anti-viral treatment, amongst other potential targets.

About the NEPHRO CRRT Study

The NEPHRO Study, which recently received central Institutional Review Board (IRB) approval, is designed as a prospective, double-blinded trial to be conducted at up to 10 U.S. hospital intensive care units. The study will enroll and evaluate 166 adult patients undergoing renal replacement therapy, who cannot tolerate heparin or are at risk for bleeding. The primary endpoint of the study is mean post-filter activated clotting time using Niyad versus placebo over the first 24 hours. Key secondary endpoints include filter lifespan, number of filter changes over 72 hours, number of transfusions over 72 hours and dialysis efficacy (based on urea concentration) over the first 24 hours.

Forward-looking statements

This press release contains forward-looking statements based upon Talphera's current expectations. These and any other forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking terminology such as “approval,” “believe,” “completion,” “enrollment,” “expected,” “expectation,” “may,” “if,” “intends,” “looking forward to,” “performance,” “plans,” “potential,” ”projected,” “upcoming”, “submission,” “successful,” “sufficient,” or the negative of these words or other comparable terminology, and include Talphera’s statements regarding a potential FDA approval of Niyad targeted for the first half of 2025; Talphera’s expectation of first patient enrollment in its NEPHRO CRRT registrational trial by the end of Q1 2024; Talphera’s expectation of the top-line data read out of its NEPHRO CRRT registration trial by the end of Q3 2024; Talphera’s expectation of completion of the NEPHRO CRRT trial with an expected PMA application submitted before the end of 2024; Talphera’s expectation that the committed funding will provide sufficient capital to fund Talphera through a potential approval of Niyad, targeted in the second quarter of 2025; and Talphera’s expected cash operating expenses for 2024, including potential committed capital arising from successful announcement of NEPHRO CRRT trial data and Talphera stock trading price performance. The discussion of strategy, plans or intentions may also include forward-looking statements, which are predictions, projections and other statements about future events that are based on current expectations and assumptions. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied by such statements, including: (i) risks relating to Talphera's product development activities and ongoing commercial business operations; (ii) risks related to the ability of Talphera and its business partners to implement development plans, launch plans, forecasts and other business expectations; (iii) risks related to unexpected variations in market growth and demand for Talphera's commercial and developmental products and technologies; (iv) risks related to Talphera's liquidity and its ability to maintain capital resources sufficient to conduct the required clinical studies; (v) risks relating to Talphera’s ability to obtain regulatory approvals for its developmental product candidates. Although it is not possible to predict or identify all such risks and uncertainties, they may include, but are not limited to, those described under the caption “Risk Factors” and elsewhere in Talphera's annual, quarterly and current reports (i.e., Form 10-K, Form 10-Q and Form 8-K) as filed or furnished with the SEC and any subsequent public filings. You are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date such statements were first made. To the degree financial information is included in this press release, it is in summary form only and must be considered in the context of the full details provided in Talphera's most recent annual, quarterly or current report as filed or furnished with the SEC. Talphera's SEC reports are available at www.talphera.com under the “Investors” tab. Except to the extent required by law, Talphera undertakes no obligation to publicly release the result of any revisions to these forward-looking statements to reflect new information, events or circumstances after the date hereof, or to reflect the occurrence of unanticipated events.

Investor Contacts:

Talphera

Raffi Asadorian, CFO

650-216-3500

investors@talphera.com

LifeSci Advisors

Kevin Gardner

617-283-2856

kgardner@lifesciadvisors.com

Chris Calabrese

917-680-5608

ccalabrese@lifesciadvisors.com

###

|

Selected Financial Data

|

|

(in thousands, except per share data)

|

|

(unaudited)

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31

|

|

|

December 31

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Statement of Comprehensive Income (Loss) Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

281 |

|

|

$ |

- |

|

|

$ |

651 |

|

|

$ |

- |

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development (1)

|

|

|

1,769 |

|

|

|

612 |

|

|

|

5,546 |

|

|

|

3,341 |

|

|

Selling, general and administrative (1)

|

|

|

2,795 |

|

|

|

5,227 |

|

|

|

11,994 |

|

|

|

17,011 |

|

|

Impairment of property and equipment

|

|

|

- |

|

|

|

47 |

|

|

|

- |

|

|

|

4,948 |

|

|

Total operating costs and expenses

|

|

|

4,564 |

|

|

|

5,886 |

|

|

|

17,540 |

|

|

|

25,300 |

|

|

Loss from operations

|

|

|

(4,283 |

) |

|

|

(5,886 |

) |

|

|

(16,889 |

) |

|

|

(25,300 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

- |

|

|

|

(188 |

) |

|

|

(134 |

) |

|

|

(1,116 |

) |

|

Interest income and other (expense) income, net

|

|

|

(227 |

) |

|

|

137 |

|

|

|

6,736 |

|

|

|

366 |

|

|

Non-cash interest income on liability related to sale of future royalties

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,136 |

|

|

Gain on extinguishment of liability related to sale of future royalties

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

84,052 |

|

|

Total other (expense) income

|

|

|

(227 |

) |

|

|

(51 |

) |

|

|

6,602 |

|

|

|

84,438 |

|

|

Net (loss) income before income taxes

|

|

|

(4,510 |

) |

|

|

(5,937 |

) |

|

|

(10,287 |

) |

|

|

59,138 |

|

|

Benefit (provision) for income taxes

|

|

|

5 |

|

|

|

1 |

|

|

|

- |

|

|

|

(13 |

) |

|

Net (loss) income from continuing operations

|

|

|

(4,505 |

) |

|

|

(5,936 |

) |

|

|

(10,287 |

) |

|

|

59,125 |

|

|

Net loss from discontinued operations

|

|

|

(12 |

) |

|

|

(1,548 |

) |

|

|

(8,110 |

) |

|

|

(11,370 |

) |

|

Net (loss) income

|

|

|

(4,517 |

) |

|

|

(7,484 |

) |

|

|

(18,397 |

) |

|

|

47,755 |

|

|

Deemed dividends related to Series A Redeemable Convertible Preferred Stock

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(186 |

) |

|

Income allocated to participating securities

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,240 |

) |

|

Net (loss) income attributable to Common Shareholders, basic

|

|

$ |

(4,517 |

) |

|

$ |

(7,484 |

) |

|

$ |

(18,397 |

) |

|

$ |

42,329 |

|

|

Net (loss) income attributable to Common Shareholders, diluted

|

|

$ |

(4,517 |

) |

|

$ |

(7,484 |

) |

|

$ |

(18,397 |

) |

|

$ |

42,342 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share attributable to stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) earnings per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from continuing operations

|

|

$ |

(0.25 |

) |

|

$ |

(0.80 |

) |

|

$ |

(0.72 |

) |

|

$ |

7.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from disconstinued operations

|

|

$ |

(0.00 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.57 |

) |

|

$ |

(1.54 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(0.25 |

) |

|

$ |

(1.00 |

) |

|

$ |

(1.29 |

) |

|

$ |

5.73 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted (loss) earnings per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from continuing operations

|

|

$ |

(0.25 |

) |

|

$ |

(0.80 |

) |

|

$ |

(0.72 |

) |

|

$ |

7.25 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operations

|

|

$ |

(0.00 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.57 |

) |

|

$ |

(1.53 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(0.25 |

) |

|

$ |

(1.00 |

) |

|

$ |

(1.29 |

) |

|

$ |

5.72 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing net (loss) income per share of common stock, basic

|

|

|

18,369 |

|

|

|

7,466 |

|

|

|

14,264 |

|

|

|

7,385 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing net (loss) income per share of common stock, diluted

|

|

|

18,369 |

|

|

|

7,466 |

|

|

|

14,264 |

|

|

|

7,407 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes the following non-cash stock-based compensation expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$ |

115 |

|

|

$ |

104 |

|

|

$ |

498 |

|

|

$ |

570 |

|

|

Selling, general and administrative

|

|

|

196 |

|

|

|

524 |

|

|

|

1,212 |

|

|

|

2,069 |

|

|

Discontinued operations

|

|

|

- |

|

|

|

24 |

|

|

|

19 |

|

|

|

250 |

|

|

Total

|

|

$ |

311 |

|

|

$ |

652 |

|

|

$ |

1,729 |

|

|

$ |

2,889 |

|

|

Selected Balance Sheet Data

|

|

(in thousands)

|

| |

|

December 31, 2023

|

|

|

December 31, 2022(1)

|

|

| |

|

(Unaudited)

|

|

|

Cash, cash equivalents, restricted cash and investments

|

|

$ |

9,381 |

|

|

$ |

20,770 |

|

|

Total assets

|

|

|

20,395 |

|

|

|

47,487 |

|

|

Total liabilities

|

|

|

6,290 |

|

|

|

25,673 |

|

|

Total stockholders' equity

|

|

|

14,105 |

|

|

|

21,814 |

|

(1) Derived from the audited financial statements as of that date included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, as recast to reflect discontinued operations and filed with the Company’s Current Report on Form 8-K on August 1, 2023.

|

Reconciliation of Non-GAAP Financial Measures

|

|

(Operating expenses less stock-based compensation expense and impairment of property and equipment)

|

|

(in thousands)

|

|

(unaudited)

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31

|

|

|

December 31

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (GAAP):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$ |

1,769 |

|

|

$ |

612 |

|

|

$ |

5,546 |

|

|

$ |

3,341 |

|

|

Selling, general and administrative

|

|

|

2,795 |

|

|

|

5,227 |

|

|

|

11,994 |

|

|

|

17,011 |

|

|

Impairment of property and equipment

|

|

|

- |

|

|

|

47 |

|

|

|

- |

|

|

|

4,948 |

|

|

Total operating expenses

|

|

|

4,564 |

|

|

|

5,886 |

|

|

|

17,540 |

|

|

|

25,300 |

|

|

Less stock-based compensation expense and impairment of property and equipment

|

|

|

311 |

|

|

|

675 |

|

|

|

1,710 |

|

|

|

7,587 |

|

|

Operating expenses (non-GAAP)

|

|

$ |

4,253 |

|

|

$ |

5,211 |

|

|

$ |

15,830 |

|

|

$ |

17,713 |

|

v3.24.0.1

Document And Entity Information

|

Mar. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TALPHERA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 06, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35068

|

| Entity, Tax Identification Number |

41-2193603

|

| Entity, Address, Address Line One |

1850 Gateway Drive, Suite 175

|

| Entity, Address, City or Town |

San Mateo

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94404

|

| City Area Code |

650

|

| Local Phone Number |

216-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TLPH

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001427925

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

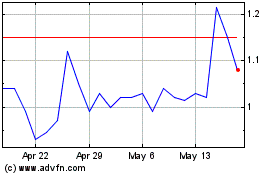

Talphera (NASDAQ:TLPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Talphera (NASDAQ:TLPH)

Historical Stock Chart

From Apr 2023 to Apr 2024