Blackbaud Investor Presentation Ticker: BLKB March 4, 2024 Exhibit 99.2

Forward-looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements in this presentation consist of, among other things, statements regarding future operating results, all of which are based on current expectations, estimates, and forecasts, and the beliefs and assumptions of the Company’s management. Words such as “believes,” “seeks,” “expects,” “may,” “might,” “should,” “intends,” “could,” “would,” “likely,” “will,” “targets,” “plans,” “anticipates,” “aims,” “projects,” “estimates,” or any variations of such words and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict. Accordingly, they should not be viewed as assurances of future performance, and actual results may differ materially and adversely from those expressed in any forward-looking statements. Factors that could cause actual results to differ materially from the Company’s expectations expressed in this presentation include: expectations for continuing to successfully execute the Company’s growth and operational improvement strategies; expectations of future growth in the social good software solutions market, segments within that market and the Company’s total addressable market; expectations that achieving the Company’s goals will extend its competitive advantage and provide improved product quality and innovative solutions for its customers; expectations that centers of excellence and use of best-of-breed platforms will drive increasing operating efficiency and contribute to margin improvement; expectations that the Company’s financial position provides flexibility to fuel future growth through acquisitions or other opportunities; expectations that past acquisitions have expanded the Company’s customer and market opportunities; risks associated with unfavorable media coverage; risks associated with acquisitions; risks inherent in the expansion of our international operations; risks related to the United Kingdom's departure from the European Union; the possibility of reduced growth or amount of charitable giving; uncertainty regarding increased business and renewals from existing customers; risks associated with implementation of software products; the ability to attract and retain key personnel; risks related to the Company’s leverage, credit facility and stock repurchase program; lengthy sales and implementation cycles; technological changes that make the Company’s products and services less competitive; risks related to the implementation and ultimate success of our stock repurchase program; risk related to the adequacy of our data security procedures and cybersecurity and data protection risks and related liabilities and potential legal proceedings involving us and uncertainty regarding existing legal proceedings and the other risk factors set forth from time to time in the Company’s SEC filings. Factors that could cause or contribute to such differences include, but are not limited to, those summarized under Risk Factors in the Company’s most recent annual report on Form 10-K, and any quarterly reports on Forms 10-Q thereafter, copies of which are available free of charge at the SEC’s website at www.sec.gov or upon request from the Company’s investor relations department. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent the Company’s beliefs and assumptions only as of the date of this presentation. Except as required by law, the Company does not intend, and undertakes no obligation, to revise or update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward- looking statements, even if new information becomes available in the future. Trademark Usage All Blackbaud product names appearing herein are trademarks or registered trademarks of Blackbaud, Inc. This presentation contains trade names, trademarks and service marks of other companies. The Company does not intend its use or display of other parties’ trade names, trademarks and service marks to imply a relationship with, or endorsement or sponsorship of, these other parties. 2

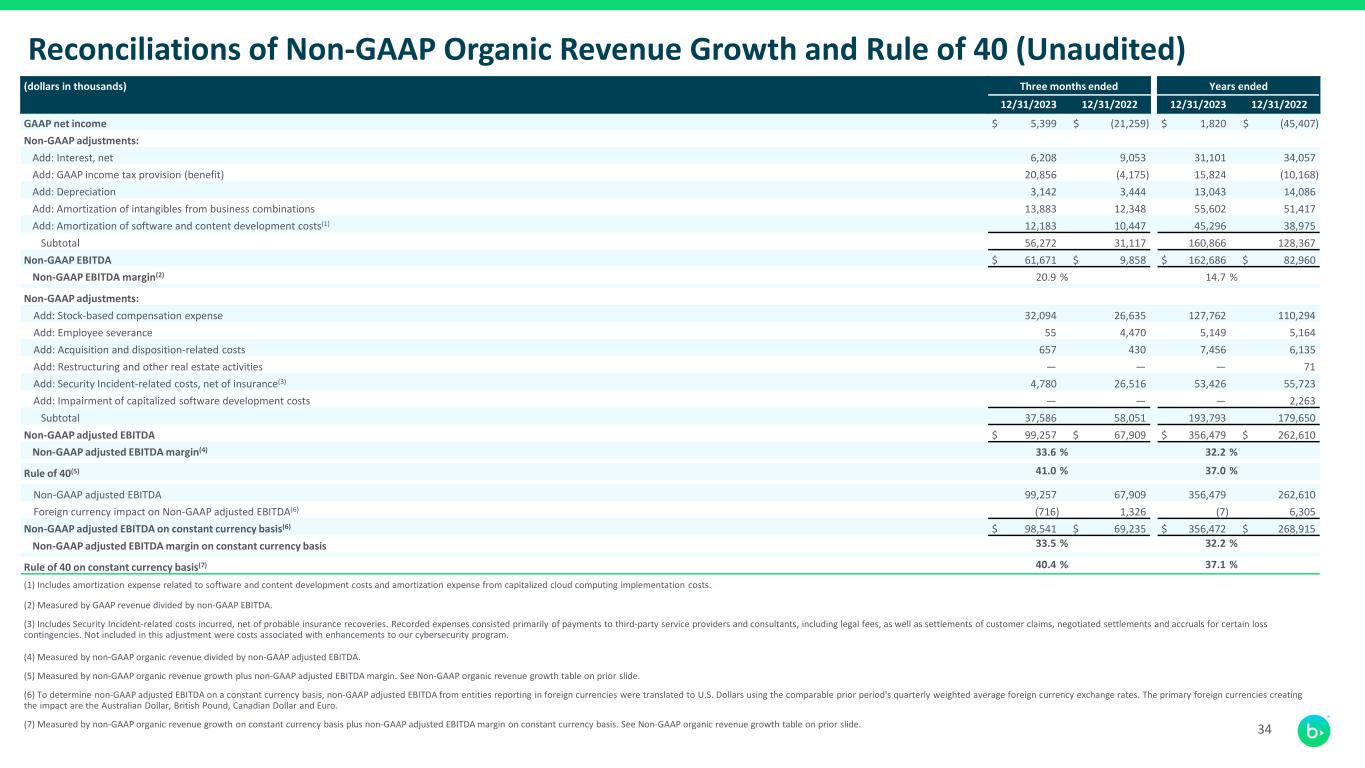

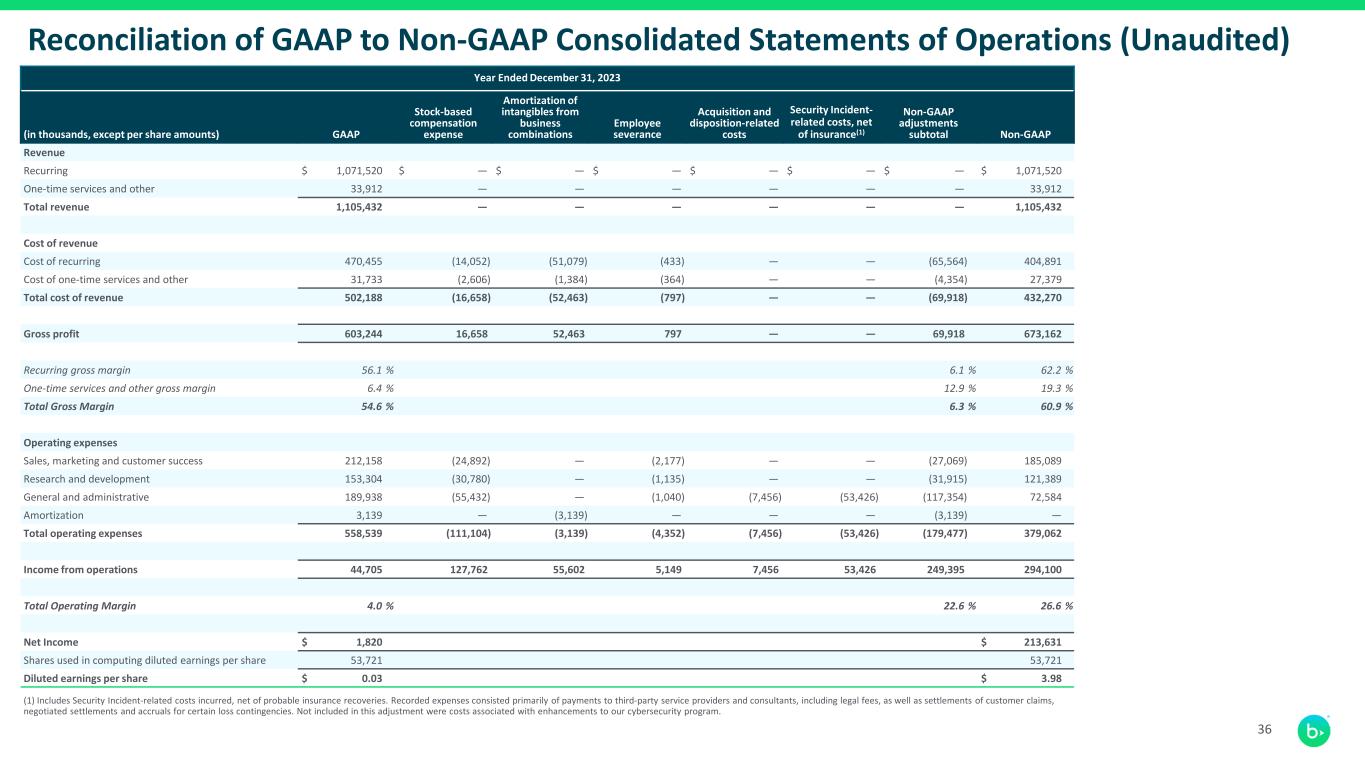

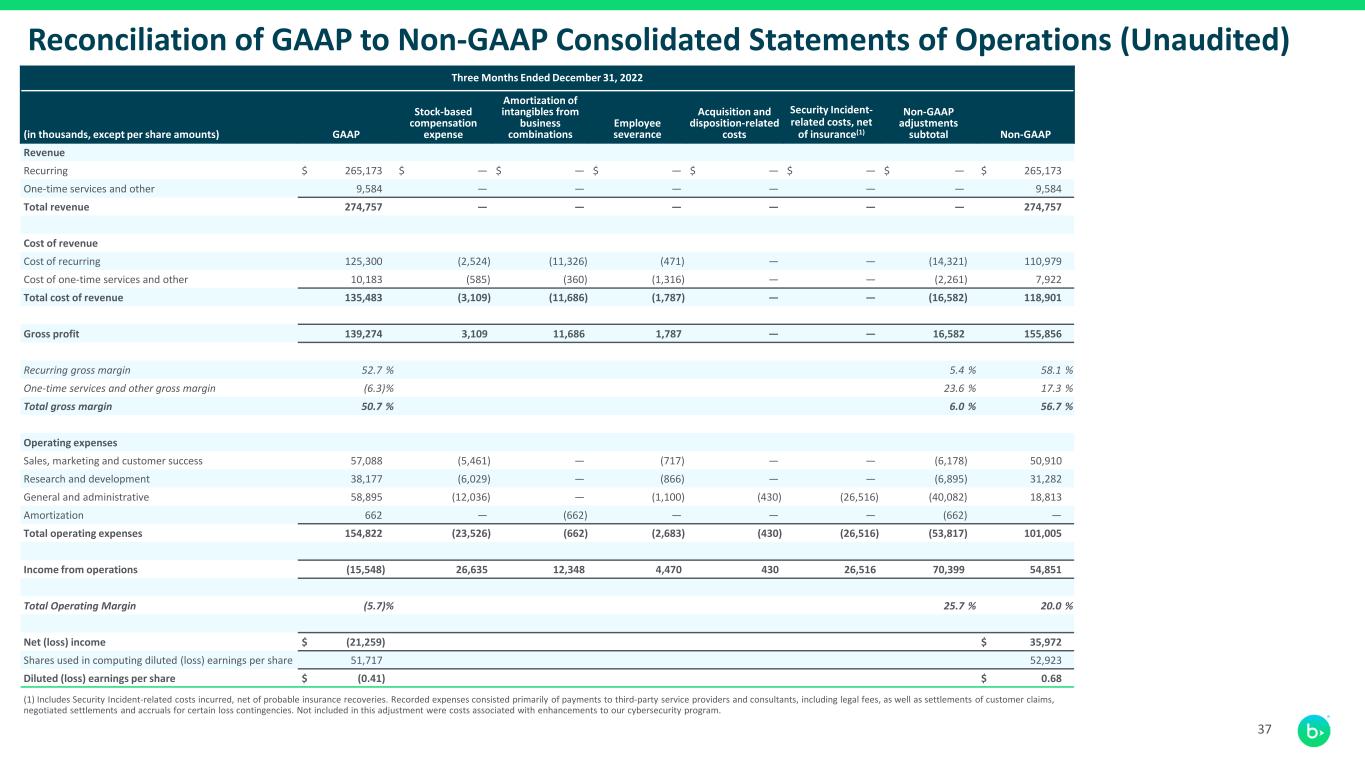

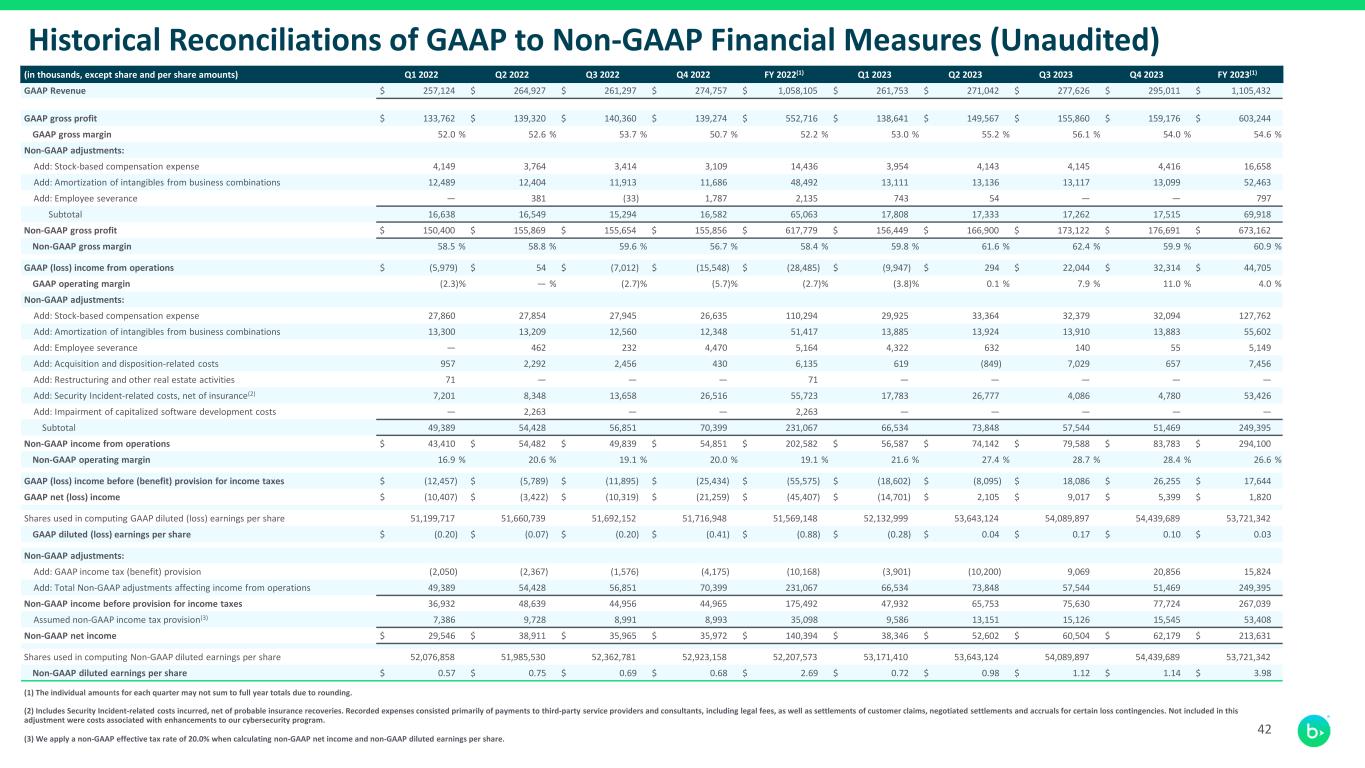

Historical Financials and Non-GAAP Financial Measures 3 Use of Non-GAAP Financial Measures: The Company has provided in this presentation financial information that has not been prepared in accordance with GAAP. The Company uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating the Company’s ongoing operational performance. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial results from period to period with other companies in the Company’s industry, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures may not be completely comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation between companies. The Company believes that these non-GAAP financial measures reflect the Company’s ongoing business in a manner that allows for meaningful period-to-period comparison and analysis of trends in the Company’s business. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures. Blackbaud discusses non-GAAP organic revenue growth measures, including non-GAAP organic revenue growth, non-GAAP organic revenue growth on a constant currency basis, non-GAAP organic recurring revenue growth, and non-GAAP organic recurring revenue growth on a constant currency basis, which Blackbaud believes provide useful information for evaluating the periodic growth of its business as well as growth on a consistent basis. Each measure of non-GAAP organic revenue growth excludes incremental acquisition-related revenue attributable to companies acquired in the current fiscal year. For companies acquired in the immediately preceding fiscal year, if any, each measure of non-GAAP organic revenue growth reflects presentation of full year incremental non-GAAP revenue derived from such companies as if they were combined throughout the prior period, and it includes the current period non-GAAP revenue attributable to those companies. In addition, each measure of non-GAAP organic revenue growth excludes prior period revenue associated with divested businesses. The exclusion of the prior period revenue is intended to present the results of the divested businesses within the results of the combined company for the same period of time in both the prior and current periods. Blackbaud believes this presentation provides a more comparable representation of our current business’ organic revenue growth and revenue run-rate. In these materials, Blackbaud is presenting the following unaudited information: historical recurring and total revenue for the fiscal years ended December 31, 2023 and 2022 and the interim periods therein; calculations for recurring revenue growth and total revenue growth for the twelve month period ended December 31, 2023 and the interim periods therein; and calculations of non-GAAP organic revenue growth, non-GAAP organic recurring revenue growth, non-GAAP organic revenue growth on a constant currency basis and non-GAAP organic recurring revenue growth on a constant currency basis for the same periods. Rule of 40 is defined as non-GAAP organic revenue growth plus non-GAAP adjusted EBITDA margin. Non-GAAP adjusted EBITDA is defined as GAAP net income plus interest, net; income tax provision (benefit); depreciation; amortization of intangible assets from business combinations; amortization of software and content development costs; stock-based compensation; acquisition and disposition-related costs; employee severance; restructuring and other real estate activities; costs, net of insurance, related to the previously disclosed security incident discovered in May 2020 (the "Security Incident"); and impairment of capitalized software development costs. Non-GAAP free cash flow is defined as operating cash flow less capital expenditures, including costs required to be capitalized for software and content development, and capital expenditures for property and equipment. In addition, and in order to provide a meaningful basis for comparison, Blackbaud now uses non-GAAP adjusted free cash flow in analyzing its operating performance. Non-GAAP adjusted free cash flow is defined as operating cash flow less capital expenditures, including costs required to be capitalized for software and content development, capital expenditures for property and equipment, plus cash outflows, net of insurance, related to the Security Incident. Blackbaud believes non-GAAP free cash flow and non-GAAP adjusted free cash flow provide useful measures of the company's operating performance. Non-GAAP adjusted free cash flow is not intended to represent and should not be viewed as the amount of residual cash flow available for discretionary expenditures. Historical Financial Statements Being Presented: In these materials, Blackbaud is presenting the following unaudited historical financial information: historical consolidated balance sheets as of the fiscal years ended December 31, 2023 and 2022 and interim consolidated balance sheets for each of the quarters within fiscal 2023 and 2022; historical consolidated statements of comprehensive income for the fiscal years ended December 31, 2023 and 2022 and interim consolidated statements of comprehensive income for each of the quarters within fiscal 2023 and 2022; historical consolidated statements of cash flows for the fiscal years ended December 31, 2023 and 2022 and interim consolidated statements of cash flows for each of the interim year-to-date periods within fiscal 2023 and 2022; and historical non-GAAP financial information for the fiscal years ended December 31, 2023 and 2022 and for each of the quarters within fiscal 2023 and 2022 as well as reconciliations of the non-GAAP measures to their most directly comparable GAAP measures and related non-GAAP adjustments. Blackbaud is providing this unaudited financial information to allow investors and analysts to more easily access and review the Company’s historical consolidated financial data by including such information in one document. Reconciliation of GAAP to Non-GAAP Financial Measures: Reconciliations of the most directly comparable GAAP measures to non-GAAP financial measures and related adjustments, as well as details of Blackbaud's methodology for calculating non-GAAP organic revenue growth, non-GAAP organic revenue growth on a constant currency basis, non-GAAP organic recurring revenue growth, non-GAAP organic recurring revenue growth on a constant currency basis and Rule of 40 can be found in the Appendix to these materials and on the "Investor Relations" page of the Company's website. Blackbaud has not reconciled forward-looking non-GAAP financial measures contained in this investor material to their most directly comparable GAAP measures. Such reconciliations would require unreasonable efforts at this time to estimate and quantify with a reasonable degree of certainty various necessary GAAP components, including for example those related to compensation, acquisition transactions and integration, tax items or others that may arise. These components and other factors could materially impact the amount of the future directly comparable GAAP measures, which may differ significantly from their non-GAAP counterparts.

Blackbaud Investment Highlights 4 Clear market leader with the most comprehensive solution set of purpose-built and mission critical software and services powering social impact A Rule of 40 company with strong cash flow experiencing an inflection point in financial performance Executing on 5-point operating plan to drive sustained, high single-digit revenue growth and mid-30’s EBITDA margin Launching a meaningful stock repurchase program to reduce shares outstanding by 7% to 10% in 2024

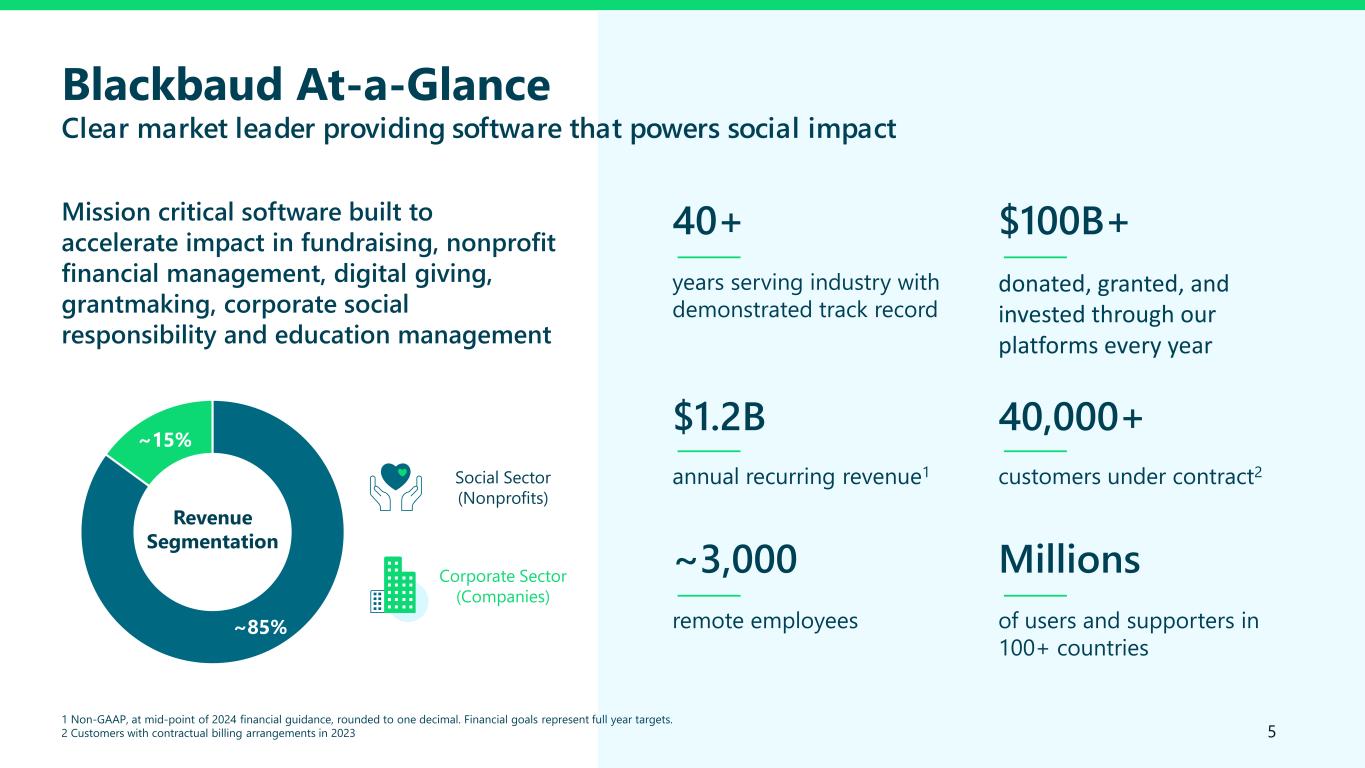

5 Blackbaud At-a-Glance Clear market leader providing software that powers social impact remote employees ~3,000 customers under contract2 40,000+ annual recurring revenue1 $1.2B of users and supporters in 100+ countries Millions Mission critical software built to accelerate impact in fundraising, nonprofit financial management, digital giving, grantmaking, corporate social responsibility and education management years serving industry with demonstrated track record 40+ donated, granted, and invested through our platforms every year $100B+ 1 Non-GAAP, at mid-point of 2024 financial guidance, rounded to one decimal. Financial goals represent full year targets. 2 Customers with contractual billing arrangements in 2023 ~85% ~15% Revenue Segmentation Social Sector (Nonprofits) Corporate Sector (Companies)

Business overview

Blackbaud is the leading provider of software for powering social impact Cloud Software We build, integrate and implement vertical-specific solutions purpose-built for the unique needs of our customers. Data Intelligence Using exclusive data, analytics and expertise, we deliver unparalleled insight and intelligence to the customers we serve. Services We drive impact through dedicated customer support and training, along with strategic and managed services tailored to our customers. Expertise With over four decades of experience, we are the undisputed industry experts on technology for social good. 7

Our core competencies expand what is possible for purpose-driven organizations 8 Fundraising and Engagement Fundraising Peer-to-Peer Fundraising Marketing Financial Management Fund Accounting Financial Aid Management Tuition Management Grant and Award Management Grantmaking Award Management Organizational and Program Management Ticketing Education Management Social Responsibility EVERFI Grantmaking Employee Giving and Volunteering Payment Services Merchant Services Payables Data Intelligence Data Health Insights Performance Services Consulting Services Implementation and Optimization Services

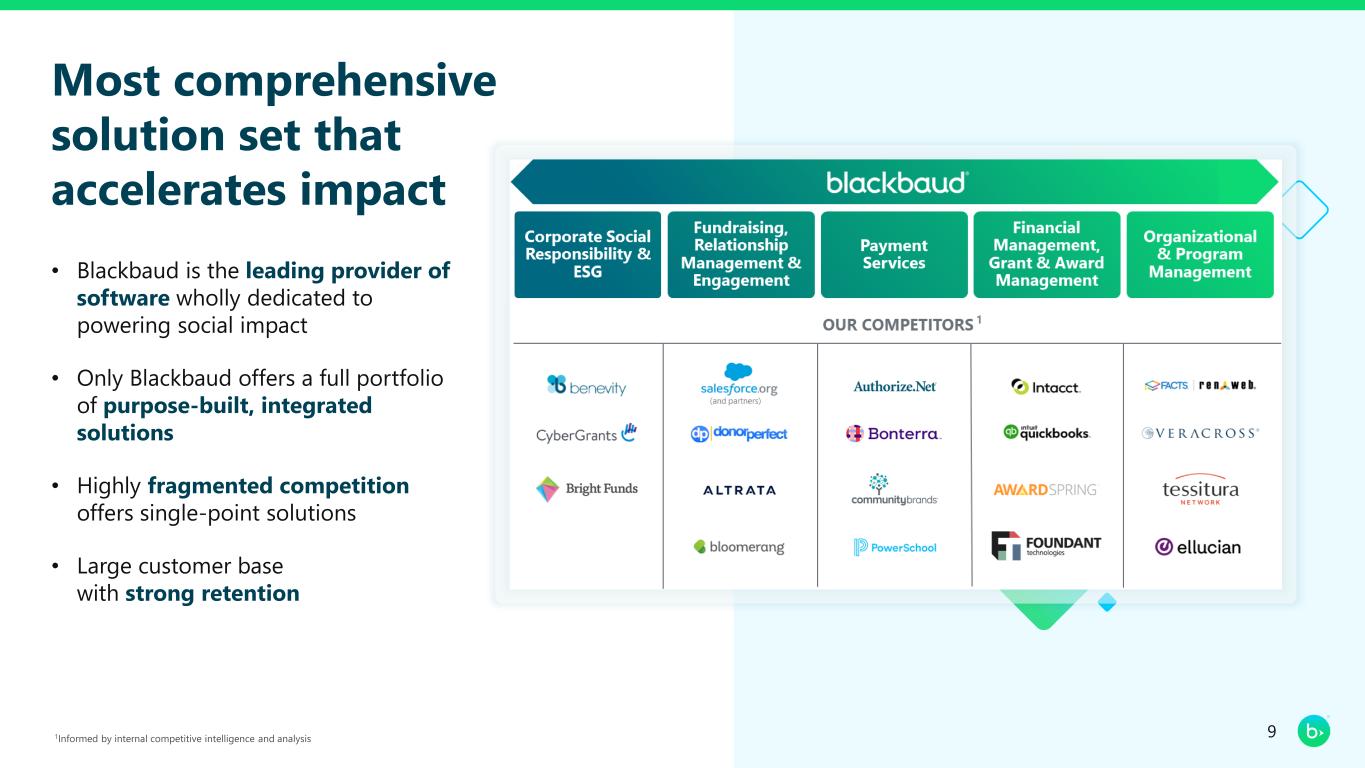

Most comprehensive solution set that accelerates impact • Blackbaud is the leading provider of software wholly dedicated to powering social impact • Only Blackbaud offers a full portfolio of purpose-built, integrated solutions • Highly fragmented competition offers single-point solutions • Large customer base with strong retention 91Informed by internal competitive intelligence and analysis 1

Fueling accelerated impact for our customers $4.3B goal for the Campaign for Carolina exceeded a year early utilizing Blackbaud CRM 300K meals packed by employees for Rise Against Hunger using YourCause® CSRconnect® $400K raised through a virtual event powered by JustGiving® from Blackbaud® Peer-to-Peer Fundraising 200% boost in fundraising, including a $1 million gift, powered by Blackbaud Raiser’s Edge NXT® 100x reduction in time setting up tuition account with Blackbaud’s suite of education management solutions 350% Increase in online donations after adoption of Blackbaud Altru and XTruLink, a Blackbaud partner 10 Sourced from Blackbaud customer stories

Large and underpenetrated total addressable market Fundraising, Relationship Management and Engagement Revenue Penetration: <20% Financial Management, Grant and Award Management Revenue Penetration: <10% Payment Services Revenue Penetration: <20% Organizational and Program Management Revenue Penetration: <10% Corporate Social Responsibility and ESG Revenue Penetration: <5% Sources: FY 2023 Blackbaud Revenue. Global Blackbaud TAM based on IRS data, Canadian Revenue Agency, Private School Universe, IPEDS, Dun & Bradstreet, HIMSS, Guidestar, S&P Global database, Small Business & Entrepreneurship Council, Blackbaud internal data $11.5B $20B+ Blackbaud TAM $3.5B $3.0B $1.5B $1.5B 11

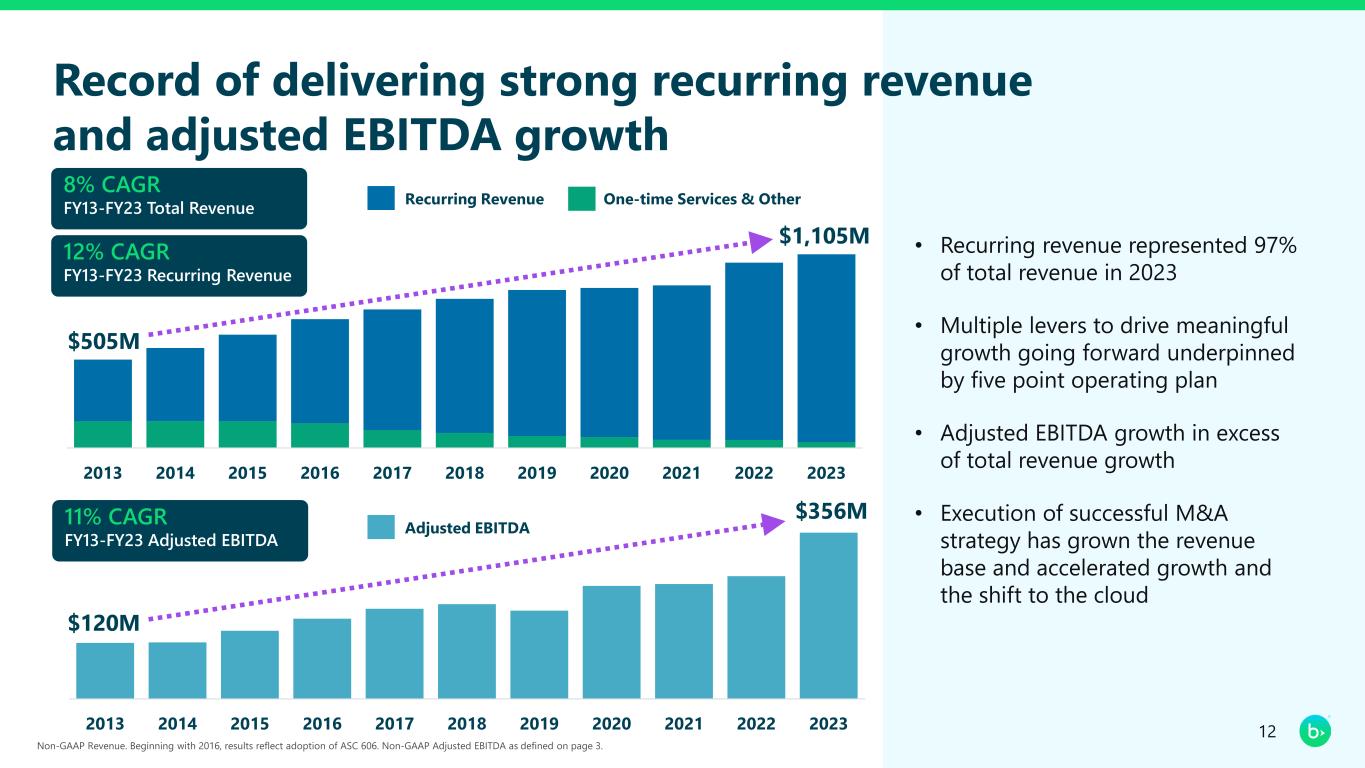

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Record of delivering strong recurring revenue and adjusted EBITDA growth 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Recurring Revenue One-time Services & Other $1,105M $505M • Recurring revenue represented 97% of total revenue in 2023 • Multiple levers to drive meaningful growth going forward underpinned by five point operating plan • Adjusted EBITDA growth in excess of total revenue growth • Execution of successful M&A strategy has grown the revenue base and accelerated growth and the shift to the cloud 8% CAGR FY13-FY23 Total Revenue 12% CAGR FY13-FY23 Recurring Revenue 12 Non-GAAP Revenue. Beginning with 2016, results reflect adoption of ASC 606. Non-GAAP Adjusted EBITDA as defined on page 3. $356M $120M Adjusted EBITDA11% CAGR FY13-FY23 Adjusted EBITDA

Update on operational initiatives

Keen attention to cost management Modernized approach to pricing and multi- year customer contracts Transactional revenue optimization and expansion Bookings growth and acceleration Five point operating plan driving improved financial performance 14 Product Innovation and delivery

Adding substantial value for customers through product delivery and innovation New donation forms that fully integrate with Blackbaud’s payment processing and CRM software and enable customers to raise more money while reduce processing costs 15 Optimized Donation Forms New add-on capability within Raiser’s Edge NXT® that gives fundraisers access to AI- driven insights to support planned and major gift fundraising Prospect Insights Pro for Raiser’s Edge NXT® A first-of-its-kind AI-powered, social impact reporting and storytelling solution for corporate social responsibility (CSR) and social impact teams of all sizes Impact EdgeTM With new generative AI capabilities, fundraisers on JustGiving are able to quickly and easily create personal stories to share with their networks. JustGiving’s research shows that pages that include a clear and personal story raise around 65% more than those that don’t JustGiving Storywriter New development transforms the Good Move activity-tracking mobile app into a powerful mobile participant center for Blackbaud TeamRaiser® peer to peer fundraising events Good MoveTM In summer 2023, launched next generation Intelligence for Good® strategy with an extensive agenda of initiatives and investments targeted at making artificial intelligence more accessible, powerful and responsible across the social impact sector Intelligence for Good® 1

Direct sales force focused on signing new logos as well as upsell and cross-sell opportunities 16 2 Select recent sales wins across Social Sector and Corporate Sector end markets Note: Sample of sales wins in trailing twelve months ended 12/31/23

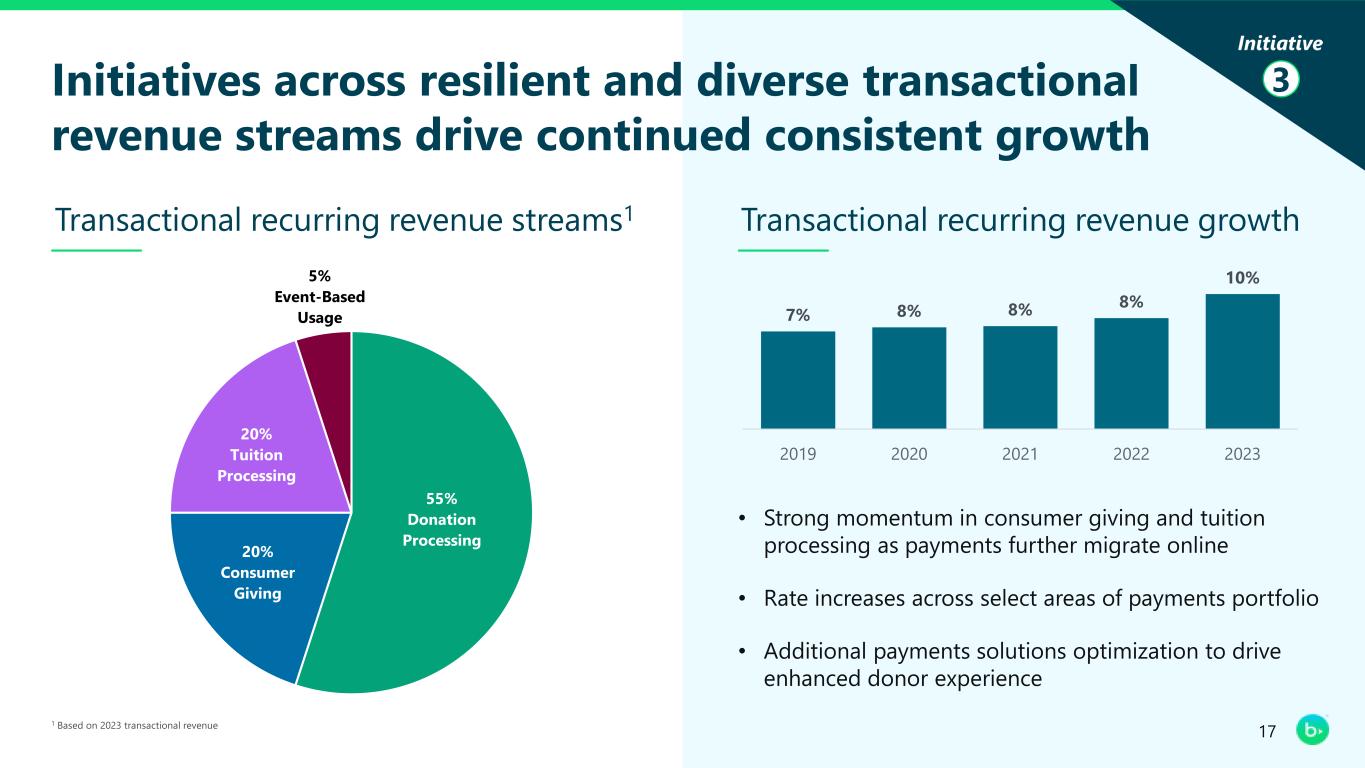

55% Donation Processing 20% Consumer Giving 20% Tuition Processing 5% Event-Based Usage Initiatives across resilient and diverse transactional revenue streams drive continued consistent growth 17 3 • Strong momentum in consumer giving and tuition processing as payments further migrate online • Rate increases across select areas of payments portfolio • Additional payments solutions optimization to drive enhanced donor experience Transactional recurring revenue streams1 Transactional recurring revenue growth 1 Based on 2023 transactional revenue 7% 8% 8% 8% 10% 2019 2020 2021 2022 2023

Modernized renewal pricing provides better economics and visibility PRIOR APPROACH NEW APPROACH (since March 2023) Renewal Term Mix of annual and multi-year renewal contracts Primarily 3-year contract renewal terms Rate Increase at Renewal Mid-single digit rate increase upon renewal Mid- to high-teens rate increase upon renewal Embedded Escalator in Multi-Year Contracts No embedded annual price increase on multi-year contracts Mid- to high-single digit rate increase embedded in both years 2 & 3 Illustration of Rate Increase on a 3-Year Contract Renewal Mid- to High-Teens Mid- to High-Single Digits Mid- to High-Single Digits Year 1 Year 2 Year 3 4 18

2023 35% 2024 30% 2025 25% 2026 10% Contract renewal distribution creates sustainable longer-term growth 19 4 2023 renewal cohort now complete; Revenue uplift from 2023 cohort more than doubles in 2024 1 As of end of July 2023, excludes new bookings Mix of contracts eligible for renewal rate increase by renewal year1 ~5% ~25% ~60% ~85% 100% 100% 100% 100% Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 FY23 FY24 >2x increase % of revenue opportunity recognized for 2023 cohort (Completed) (Underway)

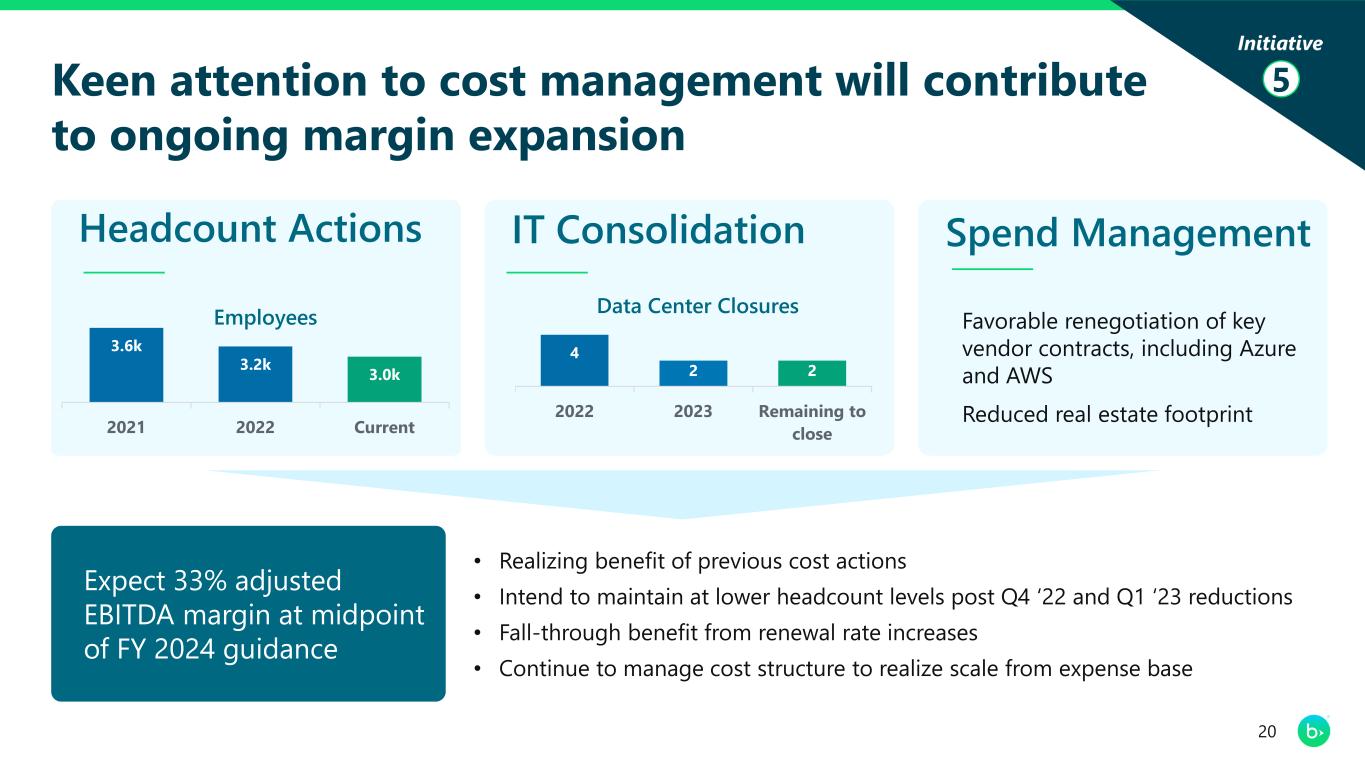

Keen attention to cost management will contribute to ongoing margin expansion 20 5 Headcount Actions Spend Management Favorable renegotiation of key vendor contracts, including Azure and AWS Reduced real estate footprint IT Consolidation 4 2 2 2022 2023 Remaining to close Data Center Closures Expect 33% adjusted EBITDA margin at midpoint of FY 2024 guidance • Realizing benefit of previous cost actions • Intend to maintain at lower headcount levels post Q4 ‘22 and Q1 ‘23 reductions • Fall-through benefit from renewal rate increases • Continue to manage cost structure to realize scale from expense base 3.6k 3.2k 3.0k 2021 2022 Current Employees

Financial Outlook (updated 3/4/2024)

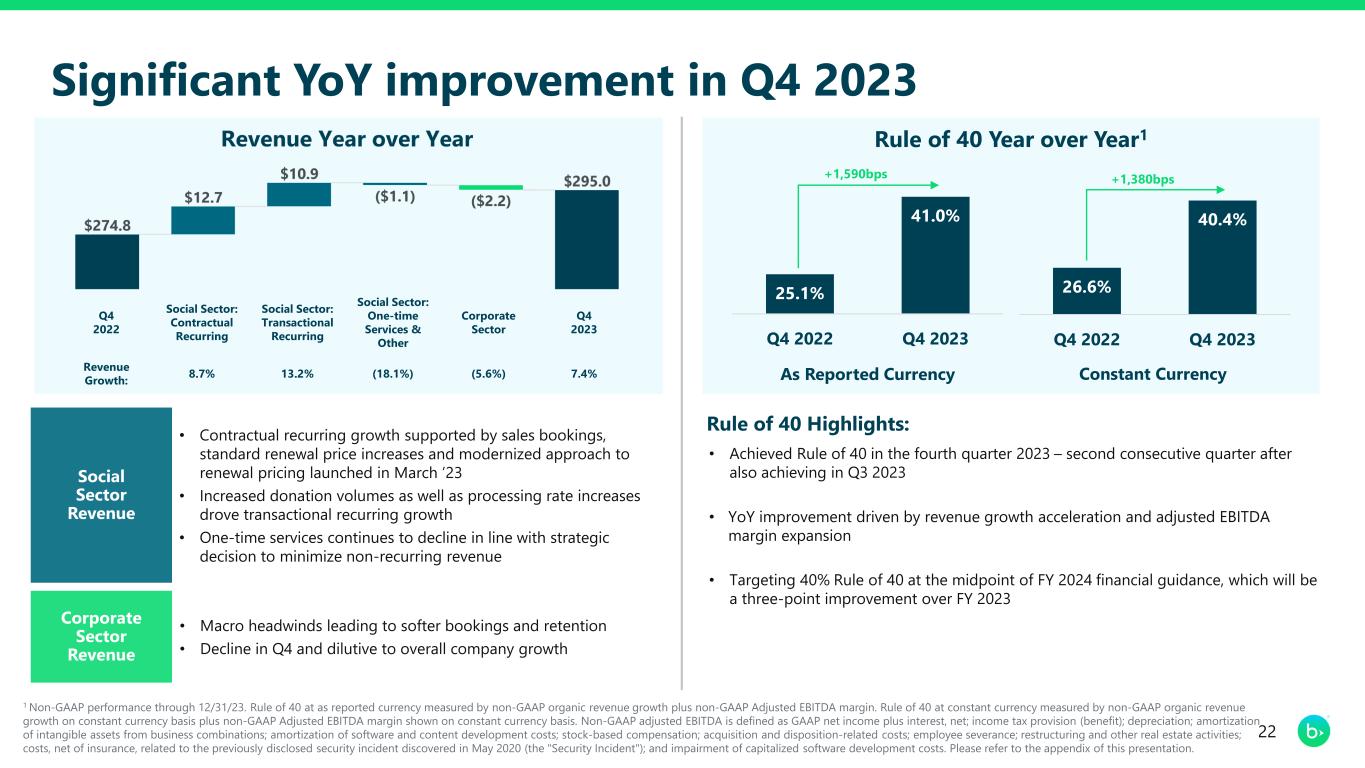

Significant YoY improvement in Q4 2023 22 Social Sector Revenue • Achieved Rule of 40 in the fourth quarter 2023 – second consecutive quarter after also achieving in Q3 2023 • YoY improvement driven by revenue growth acceleration and adjusted EBITDA margin expansion • Targeting 40% Rule of 40 at the midpoint of FY 2024 financial guidance, which will be a three-point improvement over FY 2023 25.1% 41.0% Q4 2022 Q4 2023 • Contractual recurring growth supported by sales bookings, standard renewal price increases and modernized approach to renewal pricing launched in March ’23 • Increased donation volumes as well as processing rate increases drove transactional recurring growth • One-time services continues to decline in line with strategic decision to minimize non-recurring revenue • Macro headwinds leading to softer bookings and retention • Decline in Q4 and dilutive to overall company growth Rule of 40 Highlights: 1 Non-GAAP performance through 12/31/23. Rule of 40 at as reported currency measured by non-GAAP organic revenue growth plus non-GAAP Adjusted EBITDA margin. Rule of 40 at constant currency measured by non-GAAP organic revenue growth on constant currency basis plus non-GAAP Adjusted EBITDA margin shown on constant currency basis. Non-GAAP adjusted EBITDA is defined as GAAP net income plus interest, net; income tax provision (benefit); depreciation; amortization of intangible assets from business combinations; amortization of software and content development costs; stock-based compensation; acquisition and disposition-related costs; employee severance; restructuring and other real estate activities; costs, net of insurance, related to the previously disclosed security incident discovered in May 2020 (the "Security Incident"); and impairment of capitalized software development costs. Please refer to the appendix of this presentation. Rule of 40 Year over Year1 26.6% 40.4% Q4 2022 Q4 2023 Constant CurrencyAs Reported Currency +1,380bps+1,590bps Corporate Sector Revenue Q4 2022 Social Sector: Contractual Recurring Social Sector: Transactional Recurring Social Sector: One-time Services & Other Corporate Sector Q4 2023 Revenue Growth: 8.7% 13.2% (18.1%) (5.6%) 7.4%

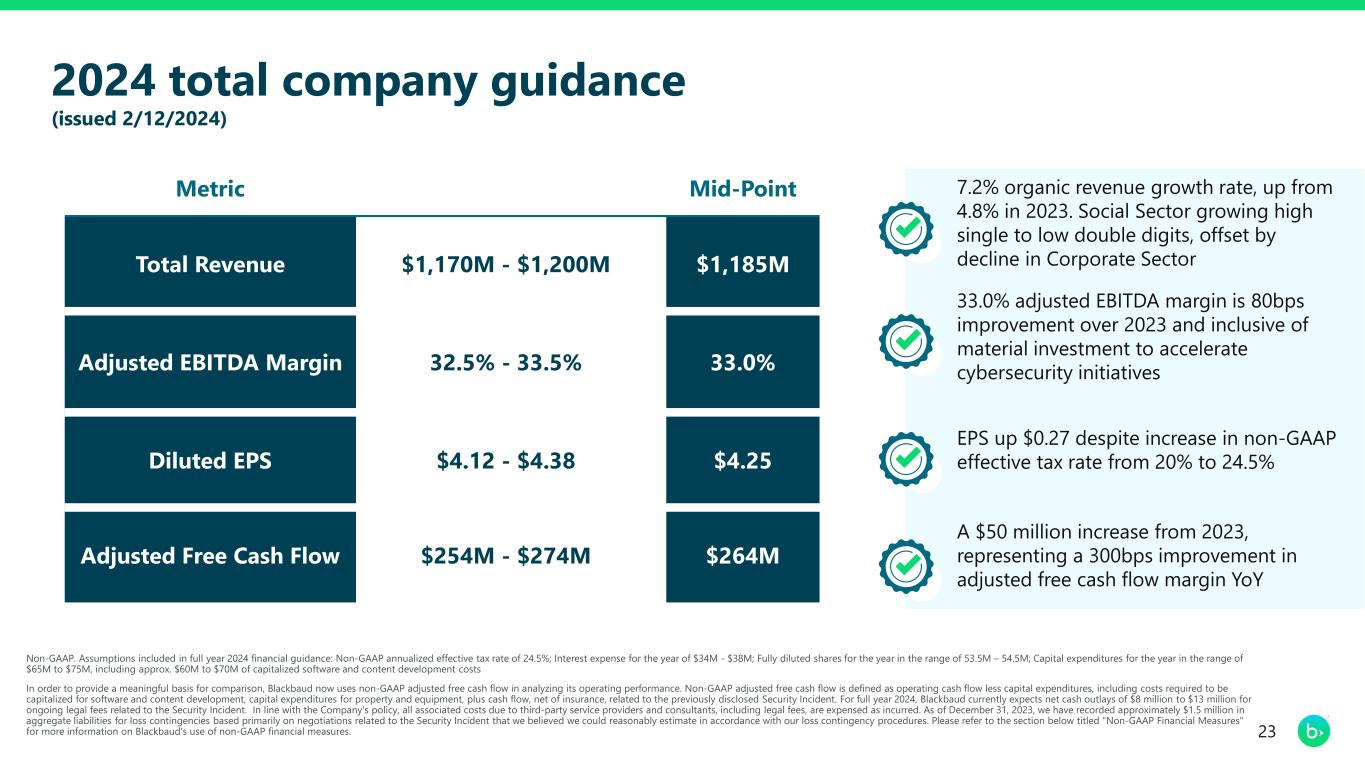

2024 total company guidance (issued 2/12/2024) Non-GAAP. Assumptions included in full year 2024 financial guidance: Non-GAAP annualized effective tax rate of 24.5%; Interest expense for the year of $34M - $38M; Fully diluted shares for the year in the range of 53.5M – 54.5M; Capital expenditures for the year in the range of $65M to $75M, including approx. $60M to $70M of capitalized software and content development costs In order to provide a meaningful basis for comparison, Blackbaud now uses non-GAAP adjusted free cash flow in analyzing its operating performance. Non-GAAP adjusted free cash flow is defined as operating cash flow less capital expenditures, including costs required to be capitalized for software and content development, capital expenditures for property and equipment, plus cash flow, net of insurance, related to the previously disclosed Security Incident. For full year 2024, Blackbaud currently expects net cash outlays of $8 million to $13 million for ongoing legal fees related to the Security Incident. In line with the Company's policy, all associated costs due to third-party service providers and consultants, including legal fees, are expensed as incurred. As of December 31, 2023, we have recorded approximately $1.5 million in aggregate liabilities for loss contingencies based primarily on negotiations related to the Security Incident that we believed we could reasonably estimate in accordance with our loss contingency procedures. Please refer to the section below titled "Non-GAAP Financial Measures" for more information on Blackbaud's use of non-GAAP financial measures. 23 Metric Mid-Point Total Revenue $1,170M - $1,200M $1,185M Adjusted EBITDA Margin 32.5% - 33.5% 33.0% Diluted EPS $4.12 - $4.38 $4.25 Adjusted Free Cash Flow $254M - $274M $264M 7.2% organic revenue growth rate, up from 4.8% in 2023. Social Sector growing high single to low double digits, offset by decline in Corporate Sector 33.0% adjusted EBITDA margin is 80bps improvement over 2023 and inclusive of material investment to accelerate cybersecurity initiatives EPS up $0.27 despite increase in non-GAAP effective tax rate from 20% to 24.5% A $50 million increase from 2023, representing a 300bps improvement in adjusted free cash flow margin YoY

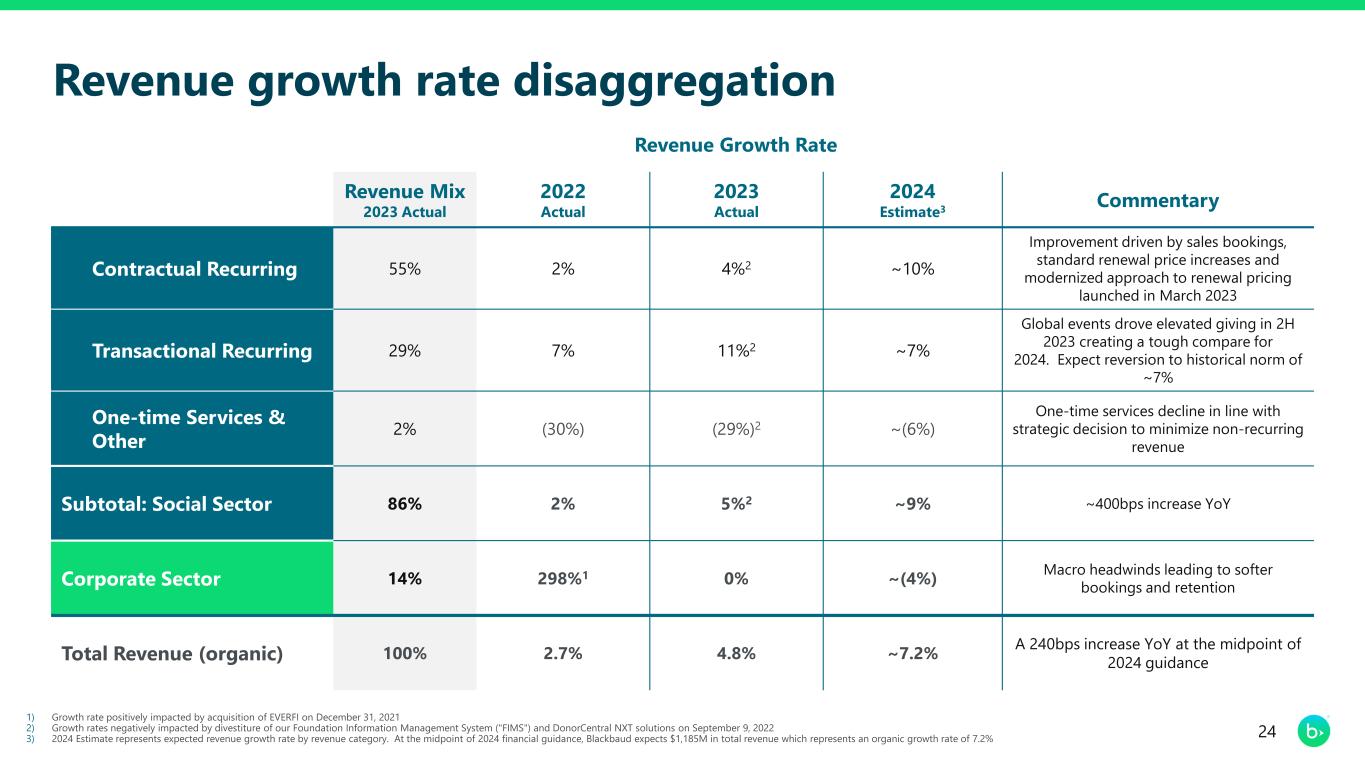

Revenue growth rate disaggregation 24 Revenue Mix 2023 Actual 2022 Actual 2023 Actual 2024 Estimate3 Commentary Contractual Recurring 55% 2% 4%2 ~10% Improvement driven by sales bookings, standard renewal price increases and modernized approach to renewal pricing launched in March 2023 Transactional Recurring 29% 7% 11%2 ~7% Global events drove elevated giving in 2H 2023 creating a tough compare for 2024. Expect reversion to historical norm of ~7% One-time Services & Other 2% (30%) (29%)2 ~(6%) One-time services decline in line with strategic decision to minimize non-recurring revenue Subtotal: Social Sector 86% 2% 5%2 ~9% ~400bps increase YoY Corporate Sector 14% 298%1 0% ~(4%) Macro headwinds leading to softer bookings and retention Total Revenue (organic) 100% 2.7% 4.8% ~7.2% A 240bps increase YoY at the midpoint of 2024 guidance Revenue Growth Rate 1) Growth rate positively impacted by acquisition of EVERFI on December 31, 2021 2) Growth rates negatively impacted by divestiture of our Foundation Information Management System ("FIMS") and DonorCentral NXT solutions on September 9, 2022 3) 2024 Estimate represents expected revenue growth rate by revenue category. At the midpoint of 2024 financial guidance, Blackbaud expects $1,185M in total revenue which represents an organic growth rate of 7.2%

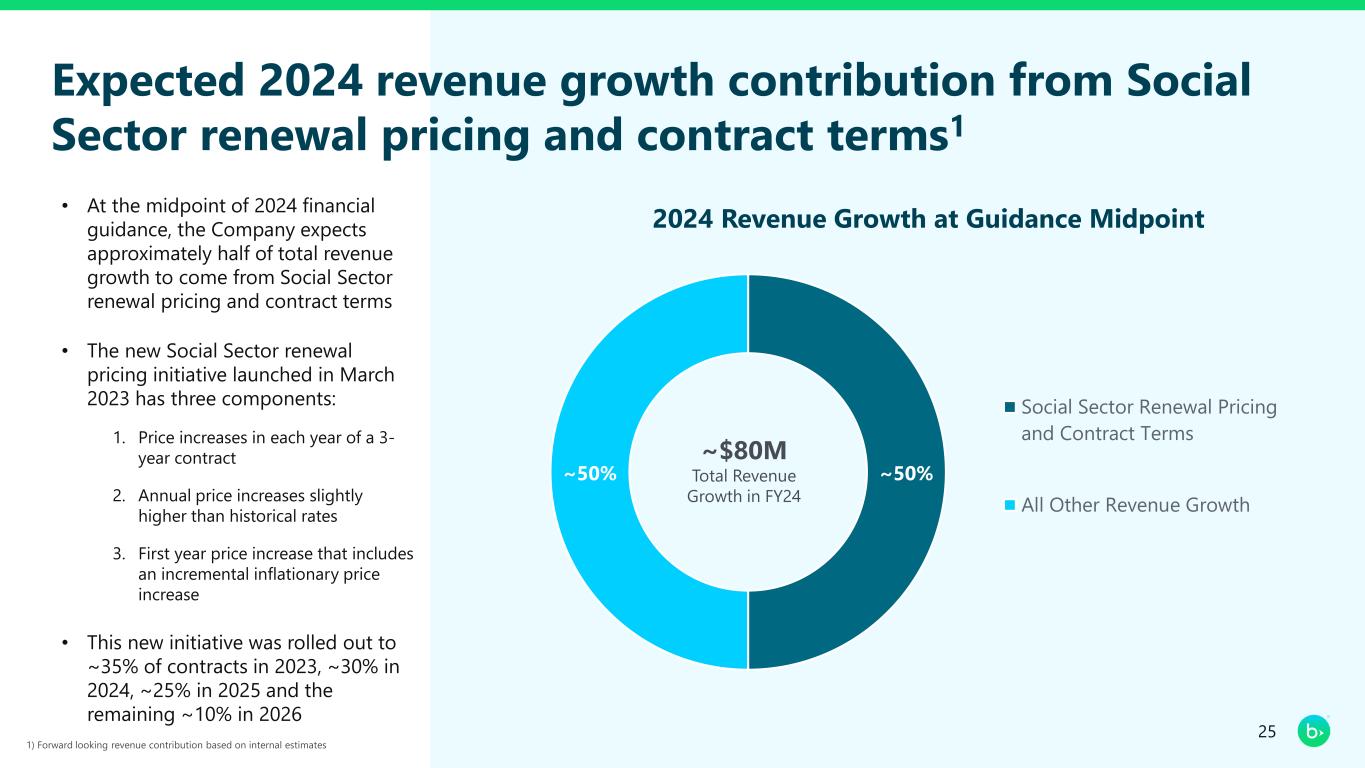

25 Expected 2024 revenue growth contribution from Social Sector renewal pricing and contract terms1 ~50%~50% 2024 Revenue Growth at Guidance Midpoint Social Sector Renewal Pricing and Contract Terms All Other Revenue Growth ~$80M Total Revenue Growth in FY24 • At the midpoint of 2024 financial guidance, the Company expects approximately half of total revenue growth to come from Social Sector renewal pricing and contract terms • The new Social Sector renewal pricing initiative launched in March 2023 has three components: 1. Price increases in each year of a 3- year contract 2. Annual price increases slightly higher than historical rates 3. First year price increase that includes an incremental inflationary price increase • This new initiative was rolled out to ~35% of contracts in 2023, ~30% in 2024, ~25% in 2025 and the remaining ~10% in 2026 1) Forward looking revenue contribution based on internal estimates

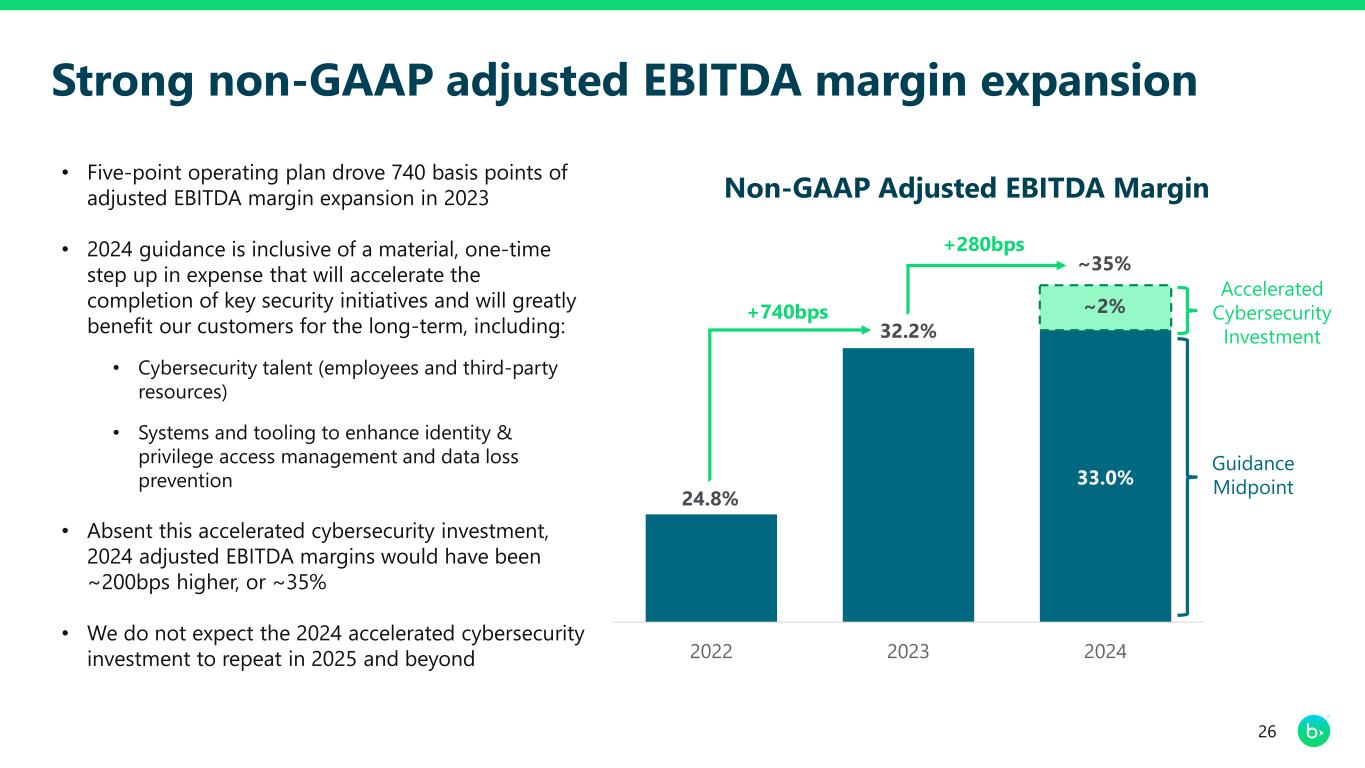

Strong non-GAAP adjusted EBITDA margin expansion 26 • Five-point operating plan drove 740 basis points of adjusted EBITDA margin expansion in 2023 • 2024 guidance is inclusive of a material, one-time step up in expense that will accelerate the completion of key security initiatives and will greatly benefit our customers for the long-term, including: • Cybersecurity talent (employees and third-party resources) • Systems and tooling to enhance identity & privilege access management and data loss prevention • Absent this accelerated cybersecurity investment, 2024 adjusted EBITDA margins would have been ~200bps higher, or ~35% • We do not expect the 2024 accelerated cybersecurity investment to repeat in 2025 and beyond 24.8% 32.2% 33.0% 2022 2023 2024 +740bps ~35% +280bps Guidance Midpoint Accelerated Cybersecurity Investment Non-GAAP Adjusted EBITDA Margin ~2%

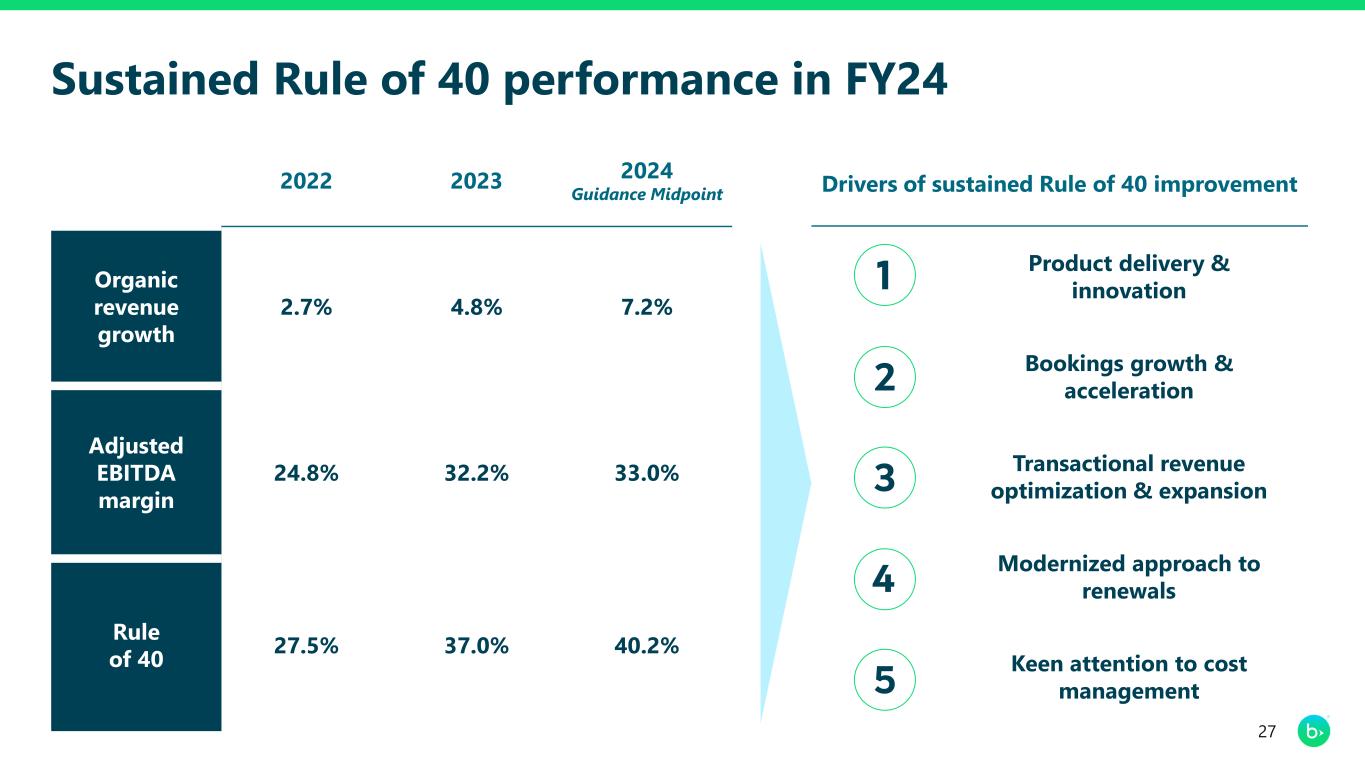

27 2022 2023 2024 Guidance Midpoint Organic revenue growth 2.7% 4.8% 7.2% Adjusted EBITDA margin 24.8% 32.2% 33.0% Rule of 40 27.5% 37.0% 40.2% Sustained Rule of 40 performance in FY24 Drivers of sustained Rule of 40 improvement Product delivery & innovation Bookings growth & acceleration Transactional revenue optimization & expansion Modernized approach to renewals Keen attention to cost management

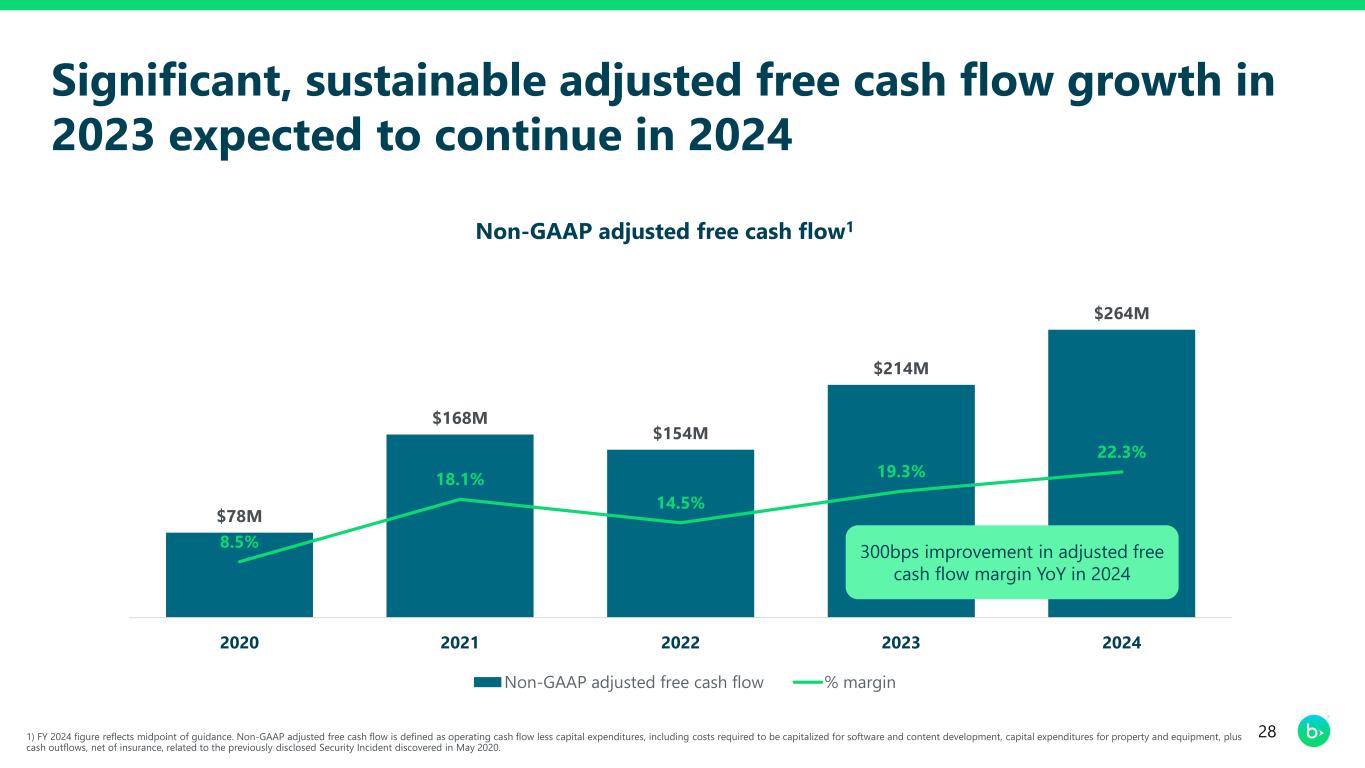

Significant, sustainable adjusted free cash flow growth in 2023 expected to continue in 2024 28 $78M $168M $154M $214M $264M 8.5% 18.1% 14.5% 19.3% 22.3% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% $0 $50 $100 $150 $200 $250 $300 2020 2021 2022 2023 2024 Non-GAAP adjusted free cash flow1 Non-GAAP adjusted free cash flow % margin 1) FY 2024 figure reflects midpoint of guidance. Non-GAAP adjusted free cash flow is defined as operating cash flow less capital expenditures, including costs required to be capitalized for software and content development, capital expenditures for property and equipment, plus cash outflows, net of insurance, related to the previously disclosed Security Incident discovered in May 2020. 300bps improvement in adjusted free cash flow margin YoY in 2024

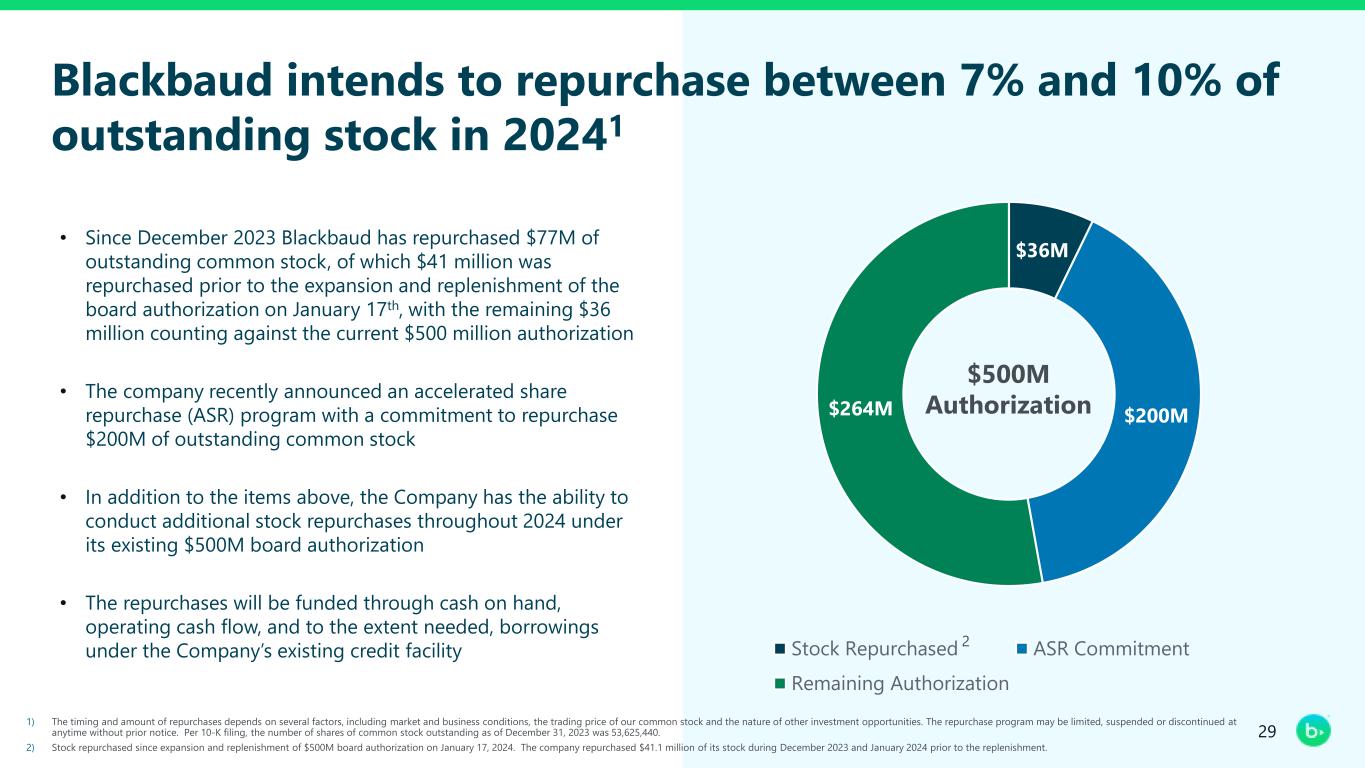

Blackbaud intends to repurchase between 7% and 10% of outstanding stock in 20241 29 $36M $200M$264M Stock Repurchased ASR Commitment Remaining Authorization • Since December 2023 Blackbaud has repurchased $77M of outstanding common stock, of which $41 million was repurchased prior to the expansion and replenishment of the board authorization on January 17th, with the remaining $36 million counting against the current $500 million authorization • The company recently announced an accelerated share repurchase (ASR) program with a commitment to repurchase $200M of outstanding common stock • In addition to the items above, the Company has the ability to conduct additional stock repurchases throughout 2024 under its existing $500M board authorization • The repurchases will be funded through cash on hand, operating cash flow, and to the extent needed, borrowings under the Company’s existing credit facility $500M Authorization 1) The timing and amount of repurchases depends on several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities. The repurchase program may be limited, suspended or discontinued at anytime without prior notice. Per 10-K filing, the number of shares of common stock outstanding as of December 31, 2023 was 53,625,440. 2) Stock repurchased since expansion and replenishment of $500M board authorization on January 17, 2024. The company repurchased $41.1 million of its stock during December 2023 and January 2024 prior to the replenishment. 2

Stock Repurchases Accretive M&A Debt Repayment 7% to 10% repurchase in 2024 under $500M authorization Minimally expect to repurchase stock to offset dilution from annual stock- based compensation (SBC) Target acquisition opportunities with high synergy value and a focus on vertical end markets already served by other Blackbaud products Manage debt balance to maintain optimal capital structure Long-term capital allocation strategy focused on maximizing shareholder value 30The timing and amount of repurchases depends on several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities. The repurchase program may be limited, suspended or discontinued at anytime without prior notice.

Blackbaud Investment Highlights 31 Clear market leader with the most comprehensive solution set of purpose-built and mission critical software and services powering social impact A Rule of 40 company with strong cash flow experiencing an inflection point in financial performance Executing on 5-point operating plan to drive sustained, high single-digit revenue growth and mid-30’s EBITDA margin Launching a meaningful stock repurchase program to reduce shares outstanding by 7% to 10% in 2024

Appendix

33 Historical Reconciliations of GAAP and Non-GAAP Organic Revenue Growth (Unaudited) (dollars in thousands) Years ended Three months ended Year ended Three months ended 12/31/2023 12/31/2022 12/31/2023 09/30/2023 06/30/2023 03/31/2023 12/31/2022 12/31/2022 09/30/2022 06/30/2022 03/31/2022 GAAP revenue $ 1,105,432 $ 1,058,105 $ 295,011 $ 277,626 $ 271,042 $ 261,753 $ 1,058,105 $ 274,757 $ 261,297 $ 264,927 $ 257,124 GAAP revenue growth 4.5 % 7.4 % 6.2 % 2.3 % 1.8 % Less: Non-GAAP revenue from divested businesses(1) — (3,535) — — — — (3,535) (10) (912) (1,304) (1,309) Non-GAAP organic revenue(2) $ 1,105,432 $ 1,054,570 $ 295,011 $ 277,626 $ 271,042 $ 261,753 $ 1,054,570 $ 274,747 $ 260,385 $ 263,623 $ 255,815 Non-GAAP organic revenue growth 4.8 % 7.4 % 6.6 % 2.8 % 2.3 % Non-GAAP organic revenue(2) $ 1,105,432 $ 1,054,570 $ 295,011 $ 277,626 $ 271,042 $ 261,753 1,054,570 $ 274,747 $ 260,385 $ 263,623 $ 255,815 Foreign currency impact on Non-GAAP organic revenue(3) 431 — (1,284) (1,942) 980 2,677 — — — — — Non-GAAP organic revenue on constant currency basis(3) $ 1,105,863 $ 1,054,570 $ 293,727 $ 275,684 $ 272,022 $ 264,430 $ 1,054,570 $ 274,747 $ 260,385 $ 263,623 $ 255,815 Non-GAAP organic revenue growth on constant currency basis 4.9 % 6.9 % 5.9 % 3.2 % 3.4 % GAAP recurring revenue 1,071,520 1,011,733 287,381 269,001 262,390 252,748 1,011,733 265,173 249,387 252,507 244,666 GAAP recurring revenue growth 5.9 % 8.4 % 7.9 % 3.9 % 3.3 % Less: Non-GAAP recurring revenue from divested businesses(1) — (3,439) — — — — (3,439) (1) (893) (1,266) (1,279) Non-GAAP organic recurring revenue(2) $ 1,071,520 $ 1,008,294 $ 287,381 $ 269,001 $ 262,390 $ 252,748 $ 1,008,294 $ 265,172 $ 248,494 $ 251,241 $ 243,387 Non-GAAP organic recurring revenue growth 6.3 % 8.4 % 8.3 % 4.4 % 3.8 % Non-GAAP organic recurring revenue(2) $ 1,071,520 $ 1,008,294 $ 287,381 $ 269,001 $ 262,390 $ 252,748 1,008,294 $ 265,172 $ 248,494 $ 251,241 $ 243,387 Foreign currency impact on non-GAAP organic recurring revenue(3) 482 — (1,157) (1,749) 916 2,472 — — — — — Non-GAAP organic recurring revenue on constant currency basis(3) $ 1,072,002 $ 1,008,294 $ 286,224 $ 267,252 $ 263,306 $ 255,220 $ 1,008,294 $ 265,172 $ 248,494 $ 251,241 $ 243,387 Non-GAAP organic recurring revenue growth on constant currency basis 6.3 % 7.9 % 7.5 % 4.8 % 4.9 % (1) Non-GAAP revenue from divested businesses excludes revenue associated with divested businesses. The exclusion of the prior period revenue is to present the results of the divested business with the results of the combined company for the same period of time in both the prior and current periods. (2) Non-GAAP organic revenue and non-GAAP organic recurring revenue for the prior year periods presented herein may not agree to non-GAAP organic revenue presented in the respective prior period quarterly financial information solely due to the manner in which non-GAAP organic revenue growth is calculated. (3) To determine non-GAAP organic revenue growth and non-GAAP organic recurring revenue growth on a constant currency basis, revenues from entities reporting in foreign currencies were translated to U.S. Dollars using the comparable period's quarterly weighted average foreign currency exchange rates. The primary foreign currencies creating the impact are the Australian Dollar, British Pound, Canadian Dollar and Euro.

34 Reconciliations of Non-GAAP Organic Revenue Growth and Rule of 40 (Unaudited) (dollars in thousands) Three months ended Years ended 12/31/2023 12/31/2022 12/31/2023 12/31/2022 GAAP net income $ 5,399 $ (21,259) $ 1,820 $ (45,407) Non-GAAP adjustments: Add: Interest, net 6,208 9,053 31,101 34,057 Add: GAAP income tax provision (benefit) 20,856 (4,175) 15,824 (10,168) Add: Depreciation 3,142 3,444 13,043 14,086 Add: Amortization of intangibles from business combinations 13,883 12,348 55,602 51,417 Add: Amortization of software and content development costs(1) 12,183 10,447 45,296 38,975 Subtotal 56,272 31,117 160,866 128,367 Non-GAAP EBITDA $ 61,671 $ 9,858 $ 162,686 $ 82,960 Non-GAAP EBITDA margin(2) 20.9 % 14.7 % Non-GAAP adjustments: Add: Stock-based compensation expense 32,094 26,635 127,762 110,294 Add: Employee severance 55 4,470 5,149 5,164 Add: Acquisition and disposition-related costs 657 430 7,456 6,135 Add: Restructuring and other real estate activities — — — 71 Add: Security Incident-related costs, net of insurance(3) 4,780 26,516 53,426 55,723 Add: Impairment of capitalized software development costs — — — 2,263 Subtotal 37,586 58,051 193,793 179,650 Non-GAAP adjusted EBITDA $ 99,257 $ 67,909 $ 356,479 $ 262,610 Non-GAAP adjusted EBITDA margin(4) 33.6 % 32.2 % Rule of 40(5) 41.0 % 37.0 % Non-GAAP adjusted EBITDA 99,257 67,909 356,479 262,610 Foreign currency impact on Non-GAAP adjusted EBITDA(6) (716) 1,326 (7) 6,305 Non-GAAP adjusted EBITDA on constant currency basis(6) $ 98,541 $ 69,235 $ 356,472 $ 268,915 Non-GAAP adjusted EBITDA margin on constant currency basis 33.5 % 32.2 % Rule of 40 on constant currency basis(7) 40.4 % 37.1 % (1) Includes amortization expense related to software and content development costs and amortization expense from capitalized cloud computing implementation costs. (2) Measured by GAAP revenue divided by non-GAAP EBITDA. (3) Includes Security Incident-related costs incurred, net of probable insurance recoveries. Recorded expenses consisted primarily of payments to third-party service providers and consultants, including legal fees, as well as settlements of customer claims, negotiated settlements and accruals for certain loss contingencies. Not included in this adjustment were costs associated with enhancements to our cybersecurity program. (4) Measured by non-GAAP organic revenue divided by non-GAAP adjusted EBITDA. (5) Measured by non-GAAP organic revenue growth plus non-GAAP adjusted EBITDA margin. See Non-GAAP organic revenue growth table on prior slide. (6) To determine non-GAAP adjusted EBITDA on a constant currency basis, non-GAAP adjusted EBITDA from entities reporting in foreign currencies were translated to U.S. Dollars using the comparable prior period's quarterly weighted average foreign currency exchange rates. The primary foreign currencies creating the impact are the Australian Dollar, British Pound, Canadian Dollar and Euro. (7) Measured by non-GAAP organic revenue growth on constant currency basis plus non-GAAP adjusted EBITDA margin on constant currency basis. See Non-GAAP organic revenue growth table on prior slide.

35 Reconciliation of GAAP to Non-GAAP Consolidated Statements of Operations (Unaudited) Three Months Ended December 31, 2023 (in thousands, except per share amounts) GAAP Stock-based compensation expense Amortization of intangibles from business combinations Employee severance Acquisition and disposition-related costs Security Incident- related costs, net of insurance(1) Non-GAAP adjustments subtotal Non-GAAP Revenue Recurring $ 287,381 $ — $ — $ — $ — $ — $ — $ 287,381 One-time services and other 7,630 — — — — — — 7,630 Total revenue 295,011 — — — — — — 295,011 Cost of revenue Cost of recurring 127,897 (3,760) (12,753) — — — (16,513) 111,384 Cost of one-time services and other 7,938 (656) (346) — — — (1,002) 6,936 Total cost of revenue 135,835 (4,416) (13,099) — — — (17,515) 118,320 Gross profit 159,176 4,416 13,099 — — — 17,515 176,691 Recurring gross margin 55.5 % 5.7 % 61.2 % One-time services and other gross margin (4.0)% 13.1 % 9.1 % Total gross margin 54.0 % 5.9 % 59.9 % Operating expenses Sales, marketing and customer success 52,120 (6,389) — — — — (6,389) 45,731 Research and development 38,602 (8,050) — — — — (8,050) 30,552 General and administrative 35,356 (13,239) — (55) (657) (4,780) (18,731) 16,625 Amortization 784 — (784) — — — (784) — Total operating expenses 126,862 (27,678) (784) (55) (657) (4,780) (33,954) 92,908 Income from operations 32,314 32,094 13,883 55 657 4,780 51,469 83,783 Total operating margin 11.0 % 17.4 % 28.4 % Net Income $ 5,399 $ 62,179 Shares used in computing diluted earnings per share 54,440 54,440 Diluted earnings per share $ 0.10 $ 1.14 (1) Includes Security Incident-related costs incurred, net of insurance recoveries. Recorded expenses consisted primarily of payments to third-party service providers and consultants, including legal fees, as well as settlements of customer claims, negotiated settlements and accruals for certain loss contingencies. Not included in this adjustment were costs associated with enhancements to our cybersecurity program.

36 Year Ended December 31, 2023 (in thousands, except per share amounts) GAAP Stock-based compensation expense Amortization of intangibles from business combinations Employee severance Acquisition and disposition-related costs Security Incident- related costs, net of insurance(1) Non-GAAP adjustments subtotal Non-GAAP Revenue Recurring $ 1,071,520 $ — $ — $ — $ — $ — $ — $ 1,071,520 One-time services and other 33,912 — — — — — — 33,912 Total revenue 1,105,432 — — — — — — 1,105,432 Cost of revenue Cost of recurring 470,455 (14,052) (51,079) (433) — — (65,564) 404,891 Cost of one-time services and other 31,733 (2,606) (1,384) (364) — — (4,354) 27,379 Total cost of revenue 502,188 (16,658) (52,463) (797) — — (69,918) 432,270 Gross profit 603,244 16,658 52,463 797 — — 69,918 673,162 Recurring gross margin 56.1 % 6.1 % 62.2 % One-time services and other gross margin 6.4 % 12.9 % 19.3 % Total Gross Margin 54.6 % 6.3 % 60.9 % Operating expenses Sales, marketing and customer success 212,158 (24,892) — (2,177) — — (27,069) 185,089 Research and development 153,304 (30,780) — (1,135) — — (31,915) 121,389 General and administrative 189,938 (55,432) — (1,040) (7,456) (53,426) (117,354) 72,584 Amortization 3,139 — (3,139) — — — (3,139) — Total operating expenses 558,539 (111,104) (3,139) (4,352) (7,456) (53,426) (179,477) 379,062 Income from operations 44,705 127,762 55,602 5,149 7,456 53,426 249,395 294,100 Total Operating Margin 4.0 % 22.6 % 26.6 % Net Income $ 1,820 $ 213,631 Shares used in computing diluted earnings per share 53,721 53,721 Diluted earnings per share $ 0.03 $ 3.98 (1) Includes Security Incident-related costs incurred, net of probable insurance recoveries. Recorded expenses consisted primarily of payments to third-party service providers and consultants, including legal fees, as well as settlements of customer claims, negotiated settlements and accruals for certain loss contingencies. Not included in this adjustment were costs associated with enhancements to our cybersecurity program. Reconciliation of GAAP to Non-GAAP Consolidated Statements of Operations (Unaudited)

37 Three Months Ended December 31, 2022 (in thousands, except per share amounts) GAAP Stock-based compensation expense Amortization of intangibles from business combinations Employee severance Acquisition and disposition-related costs Security Incident- related costs, net of insurance(1) Non-GAAP adjustments subtotal Non-GAAP Revenue Recurring $ 265,173 $ — $ — $ — $ — $ — $ — $ 265,173 One-time services and other 9,584 — — — — — — 9,584 Total revenue 274,757 — — — — — — 274,757 Cost of revenue Cost of recurring 125,300 (2,524) (11,326) (471) — — (14,321) 110,979 Cost of one-time services and other 10,183 (585) (360) (1,316) — — (2,261) 7,922 Total cost of revenue 135,483 (3,109) (11,686) (1,787) — — (16,582) 118,901 Gross profit 139,274 3,109 11,686 1,787 — — 16,582 155,856 Recurring gross margin 52.7 % 5.4 % 58.1 % One-time services and other gross margin (6.3)% 23.6 % 17.3 % Total gross margin 50.7 % 6.0 % 56.7 % Operating expenses Sales, marketing and customer success 57,088 (5,461) — (717) — — (6,178) 50,910 Research and development 38,177 (6,029) — (866) — — (6,895) 31,282 General and administrative 58,895 (12,036) — (1,100) (430) (26,516) (40,082) 18,813 Amortization 662 — (662) — — — (662) — Total operating expenses 154,822 (23,526) (662) (2,683) (430) (26,516) (53,817) 101,005 Income from operations (15,548) 26,635 12,348 4,470 430 26,516 70,399 54,851 Total Operating Margin (5.7)% 25.7 % 20.0 % Net (loss) income $ (21,259) $ 35,972 Shares used in computing diluted (loss) earnings per share 51,717 52,923 Diluted (loss) earnings per share $ (0.41) $ 0.68 (1) Includes Security Incident-related costs incurred, net of probable insurance recoveries. Recorded expenses consisted primarily of payments to third-party service providers and consultants, including legal fees, as well as settlements of customer claims, negotiated settlements and accruals for certain loss contingencies. Not included in this adjustment were costs associated with enhancements to our cybersecurity program. Reconciliation of GAAP to Non-GAAP Consolidated Statements of Operations (Unaudited)

38 Year Ended December 31, 2022 (in thousands, except per share amounts) GAAP Stock-based compensation expense Amortization of intangibles from business combinations Employee severance Acquisition and disposition-related costs Restructuring and other real estate activities Security Incident- related costs, net of insurance(1) Impairment of capitalized software development costs Non-GAAP adjustments subtotal Non-GAAP Revenue Recurring $ 1,011,733 $ — $ — $ — $ — $ — $ — $ — $ — $ 1,011,733 One-time services and other 46,372 — — — — — — — — 46,372 Total revenue 1,058,105 — — — — — — — — 1,058,105 Cost of revenue Cost of recurring 463,449 (11,258) (47,085) (521) — — — — (58,864) 404,585 Cost of one-time services and other 41,940 (3,178) (1,407) (1,614) — — — — (6,199) 35,741 Total cost of revenue 505,389 (14,436) (48,492) (2,135) — — — — (65,063) 440,326 Gross profit 552,716 14,436 48,492 2,135 — — — — 65,063 617,779 Recurring gross margin 54.2 % 5.8 % 60.0 % One-time services and other gross margin 9.6 % 13.3 % 22.9 % Total Gross Margin 52.2 % 6.2 % 58.4 % Operating expenses Sales, marketing and customer success 221,455 (21,409) — (717) — — — — (22,126) 199,329 Research and development 156,913 (24,207) — (866) — — — — (25,073) 131,840 General and administrative 199,908 (50,242) — (1,446) (6,135) (71) (55,723) (2,263) (115,880) 84,028 Amortization 2,925 — (2,925) — — — — — (2,925) — Total operating expenses 581,201 (95,858) (2,925) (3,029) (6,135) (71) (55,723) (2,263) (166,004) 415,197 Income from operations (28,485) 110,294 51,417 5,164 6,135 71 55,723 2,263 231,067 202,582 Total Operating Margin (2.7)% 21.8 % 19.1 % Net (loss) income $ (45,407) $ 140,394 Shares used in computing diluted (loss) earnings per share 51,569 52,208 Diluted (loss) earnings per share $ (0.88) $ 2.69 (1) Includes Security Incident-related costs incurred, net of probable insurance recoveries. Recorded expenses consisted primarily of payments to third-party service providers and consultants, including legal fees, as well as settlements of customer claims, negotiated settlements and accruals for certain loss contingencies. Not included in this adjustment were costs associated with enhancements to our cybersecurity program. Reconciliation of GAAP to Non-GAAP Consolidated Statements of Operations (Unaudited)

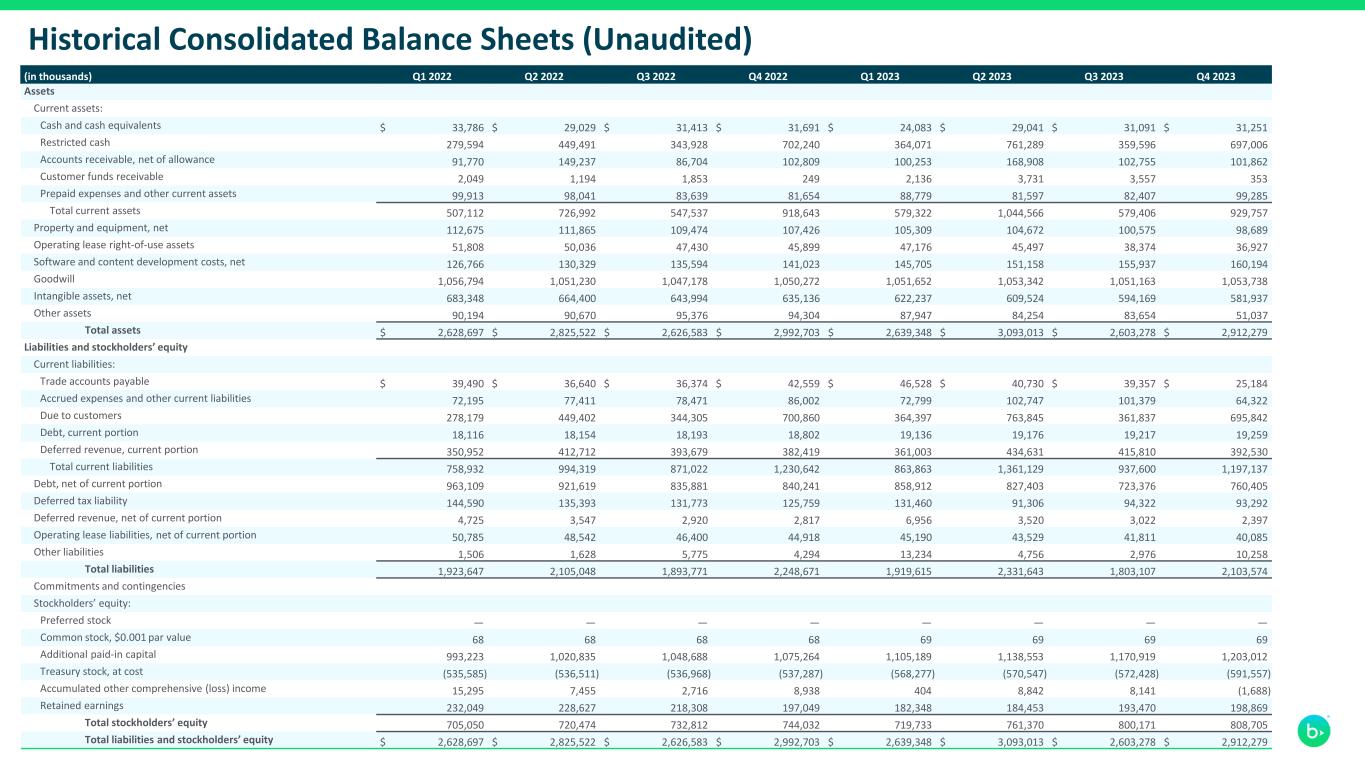

39 Historical Consolidated Balance Sheets (Unaudited) (in thousands) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Assets Current assets: Cash and cash equivalents $ 33,786 $ 29,029 $ 31,413 $ 31,691 $ 24,083 $ 29,041 $ 31,091 $ 31,251 Restricted cash 279,594 449,491 343,928 702,240 364,071 761,289 359,596 697,006 Accounts receivable, net of allowance 91,770 149,237 86,704 102,809 100,253 168,908 102,755 101,862 Customer funds receivable 2,049 1,194 1,853 249 2,136 3,731 3,557 353 Prepaid expenses and other current assets 99,913 98,041 83,639 81,654 88,779 81,597 82,407 99,285 Total current assets 507,112 726,992 547,537 918,643 579,322 1,044,566 579,406 929,757 Property and equipment, net 112,675 111,865 109,474 107,426 105,309 104,672 100,575 98,689 Operating lease right-of-use assets 51,808 50,036 47,430 45,899 47,176 45,497 38,374 36,927 Software and content development costs, net 126,766 130,329 135,594 141,023 145,705 151,158 155,937 160,194 Goodwill 1,056,794 1,051,230 1,047,178 1,050,272 1,051,652 1,053,342 1,051,163 1,053,738 Intangible assets, net 683,348 664,400 643,994 635,136 622,237 609,524 594,169 581,937 Other assets 90,194 90,670 95,376 94,304 87,947 84,254 83,654 51,037 Total assets $ 2,628,697 $ 2,825,522 $ 2,626,583 $ 2,992,703 $ 2,639,348 $ 3,093,013 $ 2,603,278 $ 2,912,279 Liabilities and stockholders’ equity Current liabilities: Trade accounts payable $ 39,490 $ 36,640 $ 36,374 $ 42,559 $ 46,528 $ 40,730 $ 39,357 $ 25,184 Accrued expenses and other current liabilities 72,195 77,411 78,471 86,002 72,799 102,747 101,379 64,322 Due to customers 278,179 449,402 344,305 700,860 364,397 763,845 361,837 695,842 Debt, current portion 18,116 18,154 18,193 18,802 19,136 19,176 19,217 19,259 Deferred revenue, current portion 350,952 412,712 393,679 382,419 361,003 434,631 415,810 392,530 Total current liabilities 758,932 994,319 871,022 1,230,642 863,863 1,361,129 937,600 1,197,137 Debt, net of current portion 963,109 921,619 835,881 840,241 858,912 827,403 723,376 760,405 Deferred tax liability 144,590 135,393 131,773 125,759 131,460 91,306 94,322 93,292 Deferred revenue, net of current portion 4,725 3,547 2,920 2,817 6,956 3,520 3,022 2,397 Operating lease liabilities, net of current portion 50,785 48,542 46,400 44,918 45,190 43,529 41,811 40,085 Other liabilities 1,506 1,628 5,775 4,294 13,234 4,756 2,976 10,258 Total liabilities 1,923,647 2,105,048 1,893,771 2,248,671 1,919,615 2,331,643 1,803,107 2,103,574 Commitments and contingencies Stockholders’ equity: Preferred stock — — — — — — — — Common stock, $0.001 par value 68 68 68 68 69 69 69 69 Additional paid-in capital 993,223 1,020,835 1,048,688 1,075,264 1,105,189 1,138,553 1,170,919 1,203,012 Treasury stock, at cost (535,585) (536,511) (536,968) (537,287) (568,277) (570,547) (572,428) (591,557) Accumulated other comprehensive (loss) income 15,295 7,455 2,716 8,938 404 8,842 8,141 (1,688) Retained earnings 232,049 228,627 218,308 197,049 182,348 184,453 193,470 198,869 Total stockholders’ equity 705,050 720,474 732,812 744,032 719,733 761,370 800,171 808,705 Total liabilities and stockholders’ equity $ 2,628,697 $ 2,825,522 $ 2,626,583 $ 2,992,703 $ 2,639,348 $ 3,093,013 $ 2,603,278 $ 2,912,279

40 Historical Consolidated Statements of Comprehensive Income (Unaudited) (in thousands, except share and per share amounts) Q1 2022 Q2 2022 Q3 2022 Q4 2022 FY 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023 Revenue Recurring $ 244,666 $ 252,507 $ 249,387 $ 265,173 $ 1,011,733 $ 252,748 $ 262,390 $ 269,001 $ 287,381 $ 1,071,520 One-time services and other 12,458 12,420 11,910 9,584 46,372 9,005 8,652 8,625 7,630 33,912 Total revenue 257,124 264,927 261,297 274,757 1,058,105 261,753 271,042 277,626 295,011 1,105,432 Cost of revenue Cost of recurring 112,174 114,487 111,488 125,300 463,449 114,500 113,926 114,132 127,897 470,455 Cost of one-time services and other 11,188 11,120 9,449 10,183 41,940 8,612 7,549 7,634 7,938 31,733 Total cost of revenue 123,362 125,607 120,937 135,483 505,389 123,112 121,475 121,766 135,835 502,188 Gross profit 133,762 139,320 140,360 139,274 552,716 138,641 149,567 155,860 159,176 603,244 Operating expenses Sales, marketing and customer success 55,216 52,737 56,414 57,088 221,455 54,385 53,191 52,462 52,120 212,158 Research and development 39,952 38,333 40,451 38,177 156,913 40,591 36,146 37,965 38,602 153,304 General and administrative 43,762 47,391 49,860 58,895 199,908 52,838 59,148 42,596 35,356 189,938 Amortization 811 805 647 662 2,925 774 788 793 784 3,139 Restructuring — — — — — — — — — — Total operating expenses 139,741 139,266 147,372 154,822 581,201 148,588 149,273 133,816 126,862 558,539 (Loss) income from operations (5,979) 54 (7,012) (15,548) (28,485) (9,947) 294 22,044 32,314 44,705 Interest expense (7,599) (8,976) (9,337) (9,891) (35,803) (10,662) (11,167) (9,620) (8,473) (39,922) Other income, net 1,121 3,133 4,454 5 8,713 2,007 2,778 5,662 2,414 12,861 (Loss) income before (benefit) provision for income taxes (12,457) (5,789) (11,895) (25,434) (55,575) (18,602) (8,095) 18,086 26,255 17,644 Income tax (benefit) provision (2,050) (2,367) (1,576) (4,175) (10,168) (3,901) (10,200) 9,069 20,856 15,824 Net (loss) income $ (10,407) $ (3,422) $ (10,319) $ (21,259) $ (45,407) $ (14,701) $ 2,105 $ 9,017 $ 5,399 $ 1,820 (Loss) earnings per share Basic $ (0.20) $ (0.07) $ (0.20) $ (0.41) $ (0.88) $ (0.28) $ 0.04 $ 0.17 $ 0.10 $ 0.03 Diluted $ (0.20) $ (0.07) $ (0.20) $ (0.41) $ (0.88) $ (0.28) $ 0.04 $ 0.17 $ 0.10 $ 0.03 Common shares and equivalents outstanding Basic weighted average shares 51,199,717 51,660,739 51,692,152 51,716,948 51,569,148 52,132,999 52,642,411 52,704,974 52,697,294 52,546,406 Diluted weighted average shares 51,199,717 51,660,739 51,692,152 51,716,948 51,569,148 52,132,999 53,643,124 54,089,897 54,439,689 53,721,342 Other comprehensive (loss) income Foreign currency translation adjustment (2,132) (10,398) (11,536) 7,906 (16,160) 2,158 3,055 (4,794) 4,630 5,049 Unrealized gain (loss) on derivative instruments, net of tax 10,905 2,558 6,797 (1,684) 18,576 (10,692) 5,383 4,093 (14,459) (15,675) Total other comprehensive income (loss) 8,773 (7,840) (4,739) 6,222 2,416 (8,534) 8,438 (701) (9,829) (10,626) Comprehensive (loss) income $ (1,634) $ (11,262) $ (15,058) $ (15,037) $ (42,991) $ (23,235) $ 10,543 $ 8,316 $ (4,430) $ (8,806)

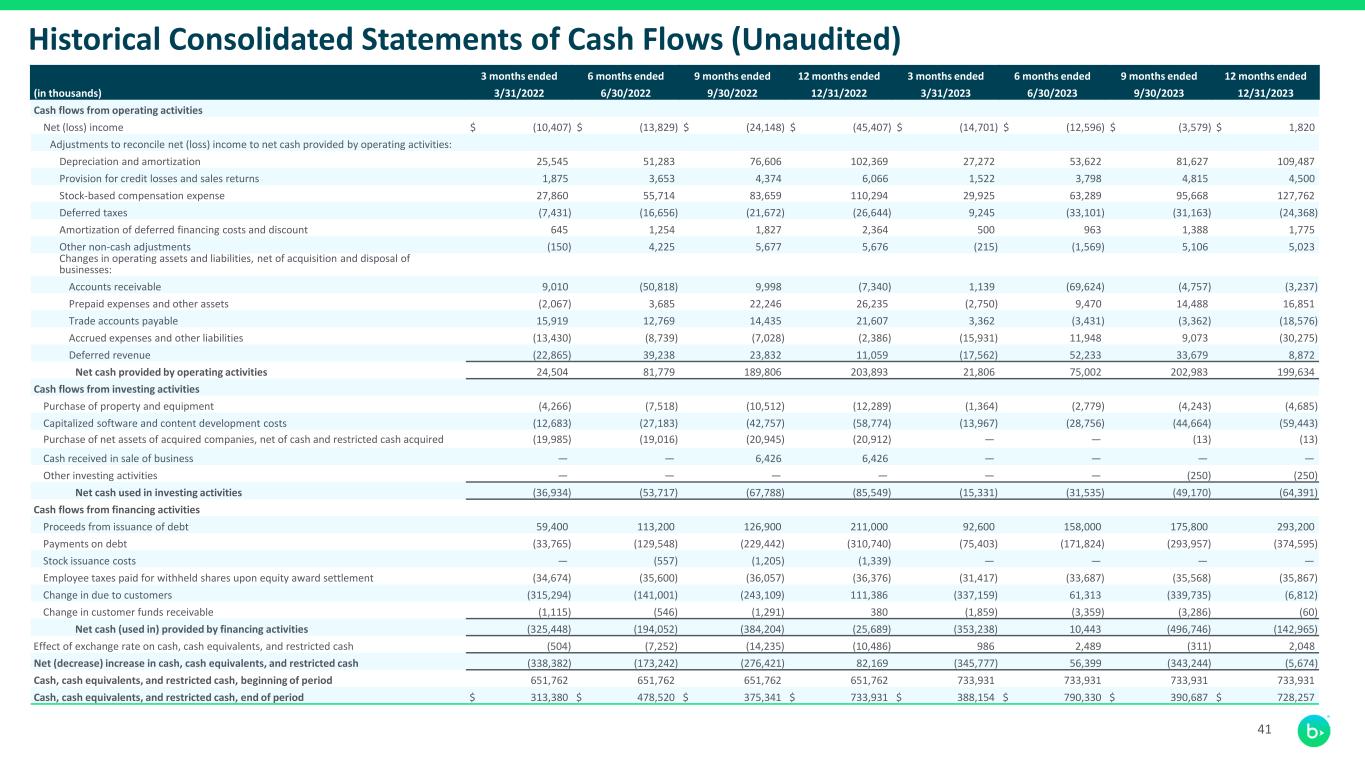

41 Historical Consolidated Statements of Cash Flows (Unaudited) 3 months ended 6 months ended 9 months ended 12 months ended 3 months ended 6 months ended 9 months ended 12 months ended (in thousands) 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 9/30/2023 12/31/2023 Cash flows from operating activities Net (loss) income $ (10,407) $ (13,829) $ (24,148) $ (45,407) $ (14,701) $ (12,596) $ (3,579) $ 1,820 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization 25,545 51,283 76,606 102,369 27,272 53,622 81,627 109,487 Provision for credit losses and sales returns 1,875 3,653 4,374 6,066 1,522 3,798 4,815 4,500 Stock-based compensation expense 27,860 55,714 83,659 110,294 29,925 63,289 95,668 127,762 Deferred taxes (7,431) (16,656) (21,672) (26,644) 9,245 (33,101) (31,163) (24,368) Amortization of deferred financing costs and discount 645 1,254 1,827 2,364 500 963 1,388 1,775 Other non-cash adjustments (150) 4,225 5,677 5,676 (215) (1,569) 5,106 5,023 Changes in operating assets and liabilities, net of acquisition and disposal of businesses: Accounts receivable 9,010 (50,818) 9,998 (7,340) 1,139 (69,624) (4,757) (3,237) Prepaid expenses and other assets (2,067) 3,685 22,246 26,235 (2,750) 9,470 14,488 16,851 Trade accounts payable 15,919 12,769 14,435 21,607 3,362 (3,431) (3,362) (18,576) Accrued expenses and other liabilities (13,430) (8,739) (7,028) (2,386) (15,931) 11,948 9,073 (30,275) Deferred revenue (22,865) 39,238 23,832 11,059 (17,562) 52,233 33,679 8,872 Net cash provided by operating activities 24,504 81,779 189,806 203,893 21,806 75,002 202,983 199,634 Cash flows from investing activities Purchase of property and equipment (4,266) (7,518) (10,512) (12,289) (1,364) (2,779) (4,243) (4,685) Capitalized software and content development costs (12,683) (27,183) (42,757) (58,774) (13,967) (28,756) (44,664) (59,443) Purchase of net assets of acquired companies, net of cash and restricted cash acquired (19,985) (19,016) (20,945) (20,912) — — (13) (13) Cash received in sale of business — — 6,426 6,426 — — — — Other investing activities — — — — — — (250) (250) Net cash used in investing activities (36,934) (53,717) (67,788) (85,549) (15,331) (31,535) (49,170) (64,391) Cash flows from financing activities Proceeds from issuance of debt 59,400 113,200 126,900 211,000 92,600 158,000 175,800 293,200 Payments on debt (33,765) (129,548) (229,442) (310,740) (75,403) (171,824) (293,957) (374,595) Stock issuance costs — (557) (1,205) (1,339) — — — — Employee taxes paid for withheld shares upon equity award settlement (34,674) (35,600) (36,057) (36,376) (31,417) (33,687) (35,568) (35,867) Change in due to customers (315,294) (141,001) (243,109) 111,386 (337,159) 61,313 (339,735) (6,812) Change in customer funds receivable (1,115) (546) (1,291) 380 (1,859) (3,359) (3,286) (60) Net cash (used in) provided by financing activities (325,448) (194,052) (384,204) (25,689) (353,238) 10,443 (496,746) (142,965) Effect of exchange rate on cash, cash equivalents, and restricted cash (504) (7,252) (14,235) (10,486) 986 2,489 (311) 2,048 Net (decrease) increase in cash, cash equivalents, and restricted cash (338,382) (173,242) (276,421) 82,169 (345,777) 56,399 (343,244) (5,674) Cash, cash equivalents, and restricted cash, beginning of period 651,762 651,762 651,762 651,762 733,931 733,931 733,931 733,931 Cash, cash equivalents, and restricted cash, end of period $ 313,380 $ 478,520 $ 375,341 $ 733,931 $ 388,154 $ 790,330 $ 390,687 $ 728,257

42 Historical Reconciliations of GAAP to Non-GAAP Financial Measures (Unaudited) (in thousands, except share and per share amounts) Q1 2022 Q2 2022 Q3 2022 Q4 2022 FY 2022(1) Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023(1) GAAP Revenue $ 257,124 $ 264,927 $ 261,297 $ 274,757 $ 1,058,105 $ 261,753 $ 271,042 $ 277,626 $ 295,011 $ 1,105,432 GAAP gross profit $ 133,762 $ 139,320 $ 140,360 $ 139,274 $ 552,716 $ 138,641 $ 149,567 $ 155,860 $ 159,176 $ 603,244 GAAP gross margin 52.0 % 52.6 % 53.7 % 50.7 % 52.2 % 53.0 % 55.2 % 56.1 % 54.0 % 54.6 % Non-GAAP adjustments: Add: Stock-based compensation expense 4,149 3,764 3,414 3,109 14,436 3,954 4,143 4,145 4,416 16,658 Add: Amortization of intangibles from business combinations 12,489 12,404 11,913 11,686 48,492 13,111 13,136 13,117 13,099 52,463 Add: Employee severance — 381 (33) 1,787 2,135 743 54 — — 797 Subtotal 16,638 16,549 15,294 16,582 65,063 17,808 17,333 17,262 17,515 69,918 Non-GAAP gross profit $ 150,400 $ 155,869 $ 155,654 $ 155,856 $ 617,779 $ 156,449 $ 166,900 $ 173,122 $ 176,691 $ 673,162 Non-GAAP gross margin 58.5 % 58.8 % 59.6 % 56.7 % 58.4 % 59.8 % 61.6 % 62.4 % 59.9 % 60.9 % GAAP (loss) income from operations $ (5,979) $ 54 $ (7,012) $ (15,548) $ (28,485) $ (9,947) $ 294 $ 22,044 $ 32,314 $ 44,705 GAAP operating margin (2.3)% — % (2.7)% (5.7)% (2.7)% (3.8)% 0.1 % 7.9 % 11.0 % 4.0 % Non-GAAP adjustments: Add: Stock-based compensation expense 27,860 27,854 27,945 26,635 110,294 29,925 33,364 32,379 32,094 127,762 Add: Amortization of intangibles from business combinations 13,300 13,209 12,560 12,348 51,417 13,885 13,924 13,910 13,883 55,602 Add: Employee severance — 462 232 4,470 5,164 4,322 632 140 55 5,149 Add: Acquisition and disposition-related costs 957 2,292 2,456 430 6,135 619 (849) 7,029 657 7,456 Add: Restructuring and other real estate activities 71 — — — 71 — — — — — Add: Security Incident-related costs, net of insurance(2) 7,201 8,348 13,658 26,516 55,723 17,783 26,777 4,086 4,780 53,426 Add: Impairment of capitalized software development costs — 2,263 — — 2,263 — — — — — Subtotal 49,389 54,428 56,851 70,399 231,067 66,534 73,848 57,544 51,469 249,395 Non-GAAP income from operations $ 43,410 $ 54,482 $ 49,839 $ 54,851 $ 202,582 $ 56,587 $ 74,142 $ 79,588 $ 83,783 $ 294,100 Non-GAAP operating margin 16.9 % 20.6 % 19.1 % 20.0 % 19.1 % 21.6 % 27.4 % 28.7 % 28.4 % 26.6 % GAAP (loss) income before (benefit) provision for income taxes $ (12,457) $ (5,789) $ (11,895) $ (25,434) $ (55,575) $ (18,602) $ (8,095) $ 18,086 $ 26,255 $ 17,644 GAAP net (loss) income $ (10,407) $ (3,422) $ (10,319) $ (21,259) $ (45,407) $ (14,701) $ 2,105 $ 9,017 $ 5,399 $ 1,820 Shares used in computing GAAP diluted (loss) earnings per share 51,199,717 51,660,739 51,692,152 51,716,948 51,569,148 52,132,999 53,643,124 54,089,897 54,439,689 53,721,342 GAAP diluted (loss) earnings per share $ (0.20) $ (0.07) $ (0.20) $ (0.41) $ (0.88) $ (0.28) $ 0.04 $ 0.17 $ 0.10 $ 0.03 Non-GAAP adjustments: Add: GAAP income tax (benefit) provision (2,050) (2,367) (1,576) (4,175) (10,168) (3,901) (10,200) 9,069 20,856 15,824 Add: Total Non-GAAP adjustments affecting income from operations 49,389 54,428 56,851 70,399 231,067 66,534 73,848 57,544 51,469 249,395 Non-GAAP income before provision for income taxes 36,932 48,639 44,956 44,965 175,492 47,932 65,753 75,630 77,724 267,039 Assumed non-GAAP income tax provision(3) 7,386 9,728 8,991 8,993 35,098 9,586 13,151 15,126 15,545 53,408 Non-GAAP net income $ 29,546 $ 38,911 $ 35,965 $ 35,972 $ 140,394 $ 38,346 $ 52,602 $ 60,504 $ 62,179 $ 213,631 Shares used in computing Non-GAAP diluted earnings per share 52,076,858 51,985,530 52,362,781 52,923,158 52,207,573 53,171,410 53,643,124 54,089,897 54,439,689 53,721,342 Non-GAAP diluted earnings per share $ 0.57 $ 0.75 $ 0.69 $ 0.68 $ 2.69 $ 0.72 $ 0.98 $ 1.12 $ 1.14 $ 3.98 (1) The individual amounts for each quarter may not sum to full year totals due to rounding. (2) Includes Security Incident-related costs incurred, net of probable insurance recoveries. Recorded expenses consisted primarily of payments to third-party service providers and consultants, including legal fees, as well as settlements of customer claims, negotiated settlements and accruals for certain loss contingencies. Not included in this adjustment were costs associated with enhancements to our cybersecurity program. (3) We apply a non-GAAP effective tax rate of 20.0% when calculating non-GAAP net income and non-GAAP diluted earnings per share.

43 Historical Reconciliations of GAAP to Non-GAAP Financial Measures (Unaudited) 3 months ended 6 months ended 9 months ended 12 months ended 3 months ended 6 months ended 9 months ended 12 months ended (in thousands) 3/31/2022 6/30/2022 9/30/2022 12/31/2022 3/31/2023 06/30/2023 09/30/2023 12/31/2023 GAAP net cash provided by operating activities 24,504 81,779 189,806 203,893 21,806 75,002 202,983 199,634 GAAP operating cash flow margin 9.5 % 15.7 % 24.2 % 19.3 % 8.3 % 14.1 % 25.0 % 18.1 % Non-GAAP adjustments: Less: purchase of property and equipment (4,266) (7,518) (10,512) (12,289) (1,364) (2,779) (4,243) (4,685) Less: capitalized software and content development costs (12,683) (27,183) (42,757) (58,774) (13,967) (28,756) (44,664) (59,443) Non-GAAP free cash flow $ 7,555 $ 47,078 $ 136,537 $ 132,830 $ 6,475 $ 43,467 $ 154,076 $ 135,506 Non-GAAP free cash flow margin 2.9 % 9.0 % 17.4 % 12.6 % 2.5 % 8.2 % 19.0 % 12.3 % Non-GAAP adjustments: Add: Security Incident-related cash flows, net of insurance 823 5,164 9,536 20,864 9,223 15,822 23,100 78,010 Non-GAAP adjusted free cash flow $ 8,378 $ 52,242 $ 146,073 $ 153,694 $ 15,698 $ 59,289 $ 177,176 $ 213,516 Non-GAAP adjusted free cash flow margin 3.3 % 10.0 % 18.6 % 14.5 % 6.0 % 11.1 % 21.9 % 19.3 %

Thank you