UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)

(Name of Issuer)

Common Stock, par value $0.01

(Title of Class of Securities)

(CUSIP Number)

Christopher P. Davis

Kleinberg, Kaplan, Wolff & Cohen, P.C.

500 Fifth Avenue

New York, NY 10110

(212) 986-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ ].

|

1

|

NAME OF REPORTING PERSONS

Fund 1 Investments, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) [ ]

(b) [ ]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF SHARES

BENEFICIALLY

|

7

|

SOLE VOTING POWER

1,439,146

|

|

OWNED BY

EACH

REPORTING

|

8

|

SHARED VOTING POWER

0

|

|

PERSON

WITH

|

9

|

SOLE DISPOSITIVE POWER

1,439,146

|

| |

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,439,146

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES [ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

16.8%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

OO (Limited Liability Company), HC (Parent Holding Company)

|

The following constitutes Amendment No. 3 (“Amendment No. 3”) to the Schedule 13D previously filed by the

undersigned on September 28, 2023 (as amended, the “Schedule 13D”). This Amendment No. 3 amends the Schedule 13D as specifically set forth herein. Each capitalized term used and not defined herein shall have the meaning assigned to such term in the

Schedule 13D. Except as provided herein, each Item of the Schedule 13D remains unchanged.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby amended and restated in its entirety as follows:

The shares of Common Stock of the Issuer reported herein as being beneficially owned by the Reporting Person was purchased in the open

market for aggregate consideration of $31,134,415.93 using working capital of the Funds.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended to add the following:

On February 28, 2024 (the “Effective Date”), the Issuer and the Reporting Person entered into a cooperation agreement

(the “Cooperation Agreement”).

Pursuant to the Cooperation Agreement, the Issuer has agreed to (i) appoint each of David Heath, Charles Liu and

Michael Kvitko as an observer to the Issuer’s Board of Directors (the “Board”) to serve as such until the conclusion of the Issuer’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”); (ii) nominate each of Messrs. Heath, Liu and Kvitko

(following such nominations, collectively, the “New Directors”) for election to the Board at the 2024 Annual Meeting; and (iii) accept the retirement, effective as of the conclusion of the 2024 Annual Meeting, of three incumbent directors. Following

the successful election of the New Directors to the Board at the 2024 Annual Meeting, the Board shall appoint Mr. Heath to the Compensation Committee of the Board and the Nominating and Corporate Governance Committee of the Board and Messrs. Liu and

Kvitko to the Finance Committee of the Board. From the Effective Date to the Termination Date (as defined below) (the “Standstill Period”), if the Reporting Person satisfies the Minimum Ownership Threshold (as defined in the Cooperation Agreement), the

Reporting Person will have replacement rights with respect to the New Directors, which will be subject to the Board’s approval (not to be unreasonably withheld, conditioned or delayed).

During the Standstill Period, the Reporting Person has agreed to vote all Voting Securities (as defined in the

Cooperation Agreement) beneficially owned by it or its affiliates at the 2024 Annual Meeting in accordance with the Board’s recommendations with respect to any and all proposals, except that the Reporting Person (i) shall be permitted to vote in

accordance with the recommendation of Institutional Shareholder Services Inc. (“ISS”) and Glass, Lewis & Co. LLC (“Glass Lewis”) if ISS and Glass Lewis issue a voting recommendation that differs from the Board’s recommendation with respect to any

proposal (other than as related to the election, removal or replacement of directors) and (ii) may vote in its discretion on any proposal of the Issuer in respect of any Extraordinary Transactions (as defined in the Cooperation Agreement).

The Reporting Person has further agreed that for so long as it owns Excess Shares (as defined in the Cooperation

Agreement), the Reporting Person will vote such Excess Shares in accordance with the Board’s recommendations with respect to any and all proposals presented at each annual or special meeting of stockholder following the conclusion of the 2024 Annual

Meeting, except that the Reporting Person may vote the Excess Shares it its discretion on any proposal of the Issuer in respect of any Extraordinary Transactions.

The Reporting Person has also agreed to certain customary standstill provisions prohibiting it from, among other

things, (i) soliciting proxies; (ii) advising or knowingly encouraging any person with respect to the voting or disposition of any securities of the Issuer, subject to limited exceptions; (iii) making public announcements regarding certain transactions

involving the Issuer; and (iv) taking actions to change or influence the Board, management or the direction of certain of the Issuer’s matters; in each case as further described in the Cooperation Agreement. Until the Termination Date, the Issuer and

Reporting Person have also agreed to certain mutual non-disparagement provisions.

In connection with the Cooperation Agreement, the Board has determined that each of the Reporting Person and its

affiliates (including, but not limited to, any private investment vehicle managed by the Reporting Person) is an “Exempt Person” under the Issuer’s Stockholder Protection Rights Agreement, dated as of December 6, 2023, as amended on February 28, 2024

(the “Rights Agreement”), and shall not constitute an “Acquiring Person” for so long as the Reporting Person and its affiliates do not beneficially own, in the aggregate, in excess of 30% of the then-outstanding shares of the Common Stock and (ii)

otherwise comply with the terms of the Cooperation Agreement. Additionally, the Reporting Person has agreed that it shall never acquire or seek to acquire ownership (including, but not limited to, beneficial ownership) of, among other things, any

securities of the Issuer such that after giving effect to such Acquisition (as defined in the Cooperation Agreement), the Reporting Person and/or any of its affiliates or controlled associates directly or indirectly beneficially owns or has economic

exposure in excess of 30% of the then-outstanding shares of Common Stock.

The Cooperation Agreement will terminate on the date that is the earlier of (i) 30 days prior to the opening of the

window for the submission of stockholder director nominations for the Issuer’s 2025 annual meeting of stockholders and (ii) 150 days prior to the one-year anniversary of the 2024 Annual Meeting (the earlier of (i) and (ii), the “Termination Date”). The

Issuer has agreed to reimburse the reasonable and documented expenses incurred by the Reporting Person in connection with the Cooperation Agreement, which shall not exceed $150,000.

Concurrently with the execution of the Cooperation Agreement, a private investment vehicle managed by the Reporting

Person irrevocably withdrew its demand to inspect certain books and records of the Issuer pursuant to Section 220 of the General Corporation Law of the State of Delaware and any and all related materials and notices submitted to the Issuer in

connection therewith or related thereto.

The foregoing description of the Cooperation Agreement does not purport to be complete and is qualified in its entirety

by reference to the Cooperation Agreement, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

(a) The aggregate percentage of shares of Common Stock reported owned by the Reporting Person

is based upon 8,544,345 shares of Common Stock outstanding, as of November 22, 2023, which is the total number of shares of Common Stock outstanding as reported in the Issuer’s Quarterly Report on Form 10‑Q filed with the Securities and Exchange

Commission on December 6, 2023.

As of the close of business on the date hereof, the Reporting Person beneficially owned

1,439,146 shares of Common Stock, constituting approximately 16.8% of all of the outstanding shares of Common Stock.

(b) The Reporting Person has sole power (i) to vote or direct the vote of, and (ii) to dispose

or direct the disposition of, the 1,439,146 shares of Common Stock held by the Funds.

(c) During the past sixty (60) days, the Reporting Person has not entered into any transactions

in the Common Stock except as set forth on Schedule 1 hereto.

(d)

Pleasant Lake Onshore Feeder Fund, LP has the right to receive or the power to direct the receipt of distributions or dividends from, or the proceeds

from the transfer of, the reported securities.

(e) Not Applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D

is hereby amended to add the following:

On February 28, 2024, the Reporting Person and the Issuer entered into the Cooperation Agreement

as defined and described in Item 4 above and attached as Exhibit 99.1 hereto.

Item 7. Material to be Filed as Exhibits.

Item 7 is hereby amended to add the following exhibit:

|

99.1 |

Cooperation Agreement, dated February 28, 2024 (incorporated by reference to Ex. 10.1 to the Issuer’s Current Report on Form 8-K, filed with the

Securities and Exchange Commission on February 29, 2024).

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth

in the Statement is true, complete and correct.

Dated: March 1, 2024

|

FUND 1 INVESTMENT, LLC

|

|

| |

|

|

By:

|

/s/ Benjamin C. Cable

|

|

| |

Benjamin C. Cable

Chief Operating Officer

|

|

SCHEDULE 1

Transactions in the Common Stock of the Issuer by Reporting Person During the Past 60 Days:

|

Date

|

Buy/Sell

|

Security

|

Approximate

Price Per Share or Option, as Applicable1

|

Number of Shares Bought/(Sold) or Underlying Options

|

| |

|

|

|

|

|

|

|

02/29/2024

|

BUY

|

Common Stock

|

30.5085

|

|

70,804

|

|

|

03/01/2024

|

BUY

|

Common Stock

|

31.3311

|

|

39,000

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

1 Excluding any brokerage fees.

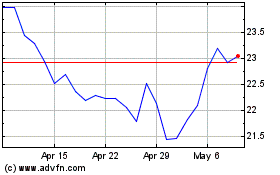

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Apr 2023 to Apr 2024