Filed by: Everi Holdings Inc.

(Commission File No.: 001-32622)

pursuant to Rule 425 under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Everi Holdings Inc.

(Commission File No.: 001-32622)

Transcript of the International Game Technology PLC and Everi Holdings Inc.

Joint Investor Call Held on February 29, 2024

Operator

Hello, and thank you for standing by. My name is Regina, and I will be your conference operator today. At this time, I would like to welcome everyone to the Joint IGT and Everi Conference Call. All lines have been placed on mute to prevent any background noise. After the speakers’ remarks, there will be a question-andanswer session. If you would like to ask a question during this time, simply press star and the number one on your telephone keypad. If you’d like to withdraw your question, press star, one again. We do ask that you please limit your questions to one and one follow-up.

I would now like to turn the conference over to Jim Hurley, SVP, Investor Relations at IGT. Please go ahead.

James Hurley

Senior Vice President of Investor Relations of International Game Technology PLC (“IGT”)

Thank you, Regina, and thank you all for joining us for the joint call between IGT and Everi Holdings. Today’s call is hosted by Vince Sadusky, IGT’s Chief Executive Officer; and Randy Taylor, President and CEO of Everi Holdings. After some prepared remarks, Vince, Randy, and other team members will be available for your questions.

During today’s call, and in relation to the announced transaction, we will be making some forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are not guarantees, and our actual results may differ materially from those expressed or implied in the forward-looking statements. The principal risks and uncertainties that could cause our results to differ materially from our current expectations are detailed in the latest IGT and Everi SEC filings. During this call, we will discuss certain non-GAAP financial measures. You’ll find additional disclosures regarding these non-GAAP measures in IGT and Everi's respective filings with the SEC, which are posted on our respective Investor Relations websites.

And now, I’ll turn the call over to Vince Sadusky.

Vincent Sadusky

Chief Executive Officer of IGT

Thank you, Jim. Well, we are excited to have you all join us this morning. By now, you’ve seen the news that IGT intends to spin off its Global Gaming and PlayDigital businesses and merge them with Everi’s existing operations. The combination of two robust gaming platforms with complementary capabilities and geographic footprints creates a comprehensive Global Gaming and FinTech enterprise that is stronger and more valuable together.

Joining me here today from IGT are: Max Chiara, our Chief Financial Officer; Fabio Celadon, Executive Vice President of Strategy and Corporate Development. From Everi, we have Randy Taylor, President and CEO; and Mark Labay, Chief Financial Officer.

Well, last summer, IGT’s Board of Directors began an evaluation of potential strategic alternatives for our Global Gaming and PlayDigital businesses. The goal was to unlock the full value of IGT’s portfolio of market-leading assets. The transaction announced today is a key milestone in that process. The separation of Lottery from Global Gaming and PlayDigital and the merging of Global Gaming and PlayDigital with Everi create two best-in-class global pure play companies. IGT shareholders will retain 100% ownership of a global lottery pure play while participating in the upside from a faster-growing gaming, digital, and FinTech business.

We believe the creation of two more focused companies each with top-notch teams and simplified business models, better positions each company to service its customers and create significant value for stakeholders. It allows for more focused operating and capital allocation strategies, capital structures that are optimized for different business

models, and increased flexibility to pursue organic and inorganic growth strategies. It also provides the opportunity for investors to better appreciate the intrinsic value of each standalone business.

I’ll let Randy expand a bit on the transaction itself.

Randy Taylor

President and Chief Executive Officer of Everi Holdings Inc. (“Everi”)

Thank you, Vince. I’m excited to join Vince on this call this morning and provide more information about the planned merger of Everi and IGT’s Global Gaming and PlayDigital businesses. Transactions announced today include the separation of IGT’s Lottery business from the gaming, digital, and sports betting businesses, which will be spun out into a new company and merged into Everi Holdings.

Once the transaction closes, Everi Holdings will rebrand and rename the company, International Game Technology, Inc. Everi will continue to trade on the New York Stock Exchange, but transition to a new ticker, IGT. Under the terms of the expected merger, current IGT shareholders will receive 103.4 million shares of Everi, and the remaining Lottery business will receive an approximate $2.6 billion cash distribution in the new and refinanced debt of the merged company. Post-closing of this proposed merger, current IGT shareholders will hold approximately 54% of the total shares outstanding, and current Everi shareholders will hold approximately 46%. This transaction has an implied enterprise value of approximately $6 billion for the merged company. We expect estimated P&L annualized run-rate synergies of $75 million and an additional $10 million of CapEx savings that combined company can achieve by the end of the third year post-closing.

As part of this expected merger, the combined company plans to raise $3.7 billion in debt to pay off existing Everi debt, and to pay an estimated $2.6 billion to the remaining IGT global Lottery business. Pro forma net leverage at closing for the merged company is expected to be moderate at a range of 3.2x to 3.4x pro forma expected 2024 adjusted EBITDA. The IGT global Lottery business will receive an estimated $2.2 billion in net distribution and will use these proceeds to repay debt and for general corporate purposes.

Vince will now provide an overview of leadership and governance, and key approvals and conditions necessary for completion of the transaction.

Vincent Sadusky

In terms of leadership and governance, after closing, Mike Rumbolz will become Chairman of the combined business and Randy will remain on the Board of Directors. I will become the company’s CEO, Fabio Celadon will be CFO, Mark Labay will assume the role of Chief Integration Officer. We will be supported by an incredibly talented team across both organizations.

At IGT PLC, both Marco Sala and Max Chiara will continue in their existing roles as Executive Chair and Chief Financial Officer, respectively. Renato Ascoli will serve as CEO of the global Lottery business, and I will continue to lead IGT PLC as CEO until the closing of the transaction. In the meantime, IGT PLC’s Board will conduct a search for its next CEO. All voting members of the IGT PLC and Everi Boards have unanimously approved the transaction, which is subject to regulatory approvals and approvals by both IGT and Everi shareholders. De Agostini has agreed to vote in favor of the transaction, which is expected to close in late 2024 or early 2025.

Now, let’s focus on the exciting elements of this transformational merger. The combination creates a comprehensive B2B product portfolio that is a one-stop shop for customers’ land-based gaming, iGaming, sports betting, and FinTech needs. The business has an attractive recurring revenue model with recurring revenue streams from gaming operations, iGaming, and FinTech solutions representing over 60% of pro forma revenue.

The growth outlook for the combined entity is compelling. We expect revenue to grow at a mid-single-digit compound annual rate through 2026, with adjusted EBITDA increasing at an even stronger high single-digit rate. That’s through a mix of organic, top-line growth for the existing businesses, enhanced by significant synergies. We expect to manage the business with a strong balance sheet and conservative leverage profile. Improved cash flow should allow for investments in both organic and inorganic growth, significant debt repayment, and share buybacks.

We have an amazing group of employees at both companies today, so the company will have a best-in-class team with long-standing industry knowledge, relationships, and a proven track record in B2B gaming and FinTech.

Randy Taylor

Combination of IGT’s Global Gaming and PlayDigital, with Everi’s games and FinTech businesses, will increase the scope of our capabilities, creating a combined entity with a more diverse portfolio of products and services with strong recurring revenues.

This slide provides a snapshot of the pro forma combined entity as well as the buildup of both the standalone IGT Global Gaming and PlayDigital and Everi for the last 12 months as of September 30, 2023. By combining the two companies together, revenues would have been $2.6 billion. The pro forma installed base would be approximately 70,000 units with approximately 35% of these units being higher performing premium units, and game sales of over 41,000 game units. The combination of the two businesses is expected to provide a more diverse and balanced revenue base globally with gaming operations contributing approximately 41%, gaming sales approximately 35%, FinTech approximately 14%, and digital approximately 10% of revenues.

Vincent Sadusky

Complementary capabilities create an integrated omni-channel one-stop shop addressing all aspects of the gaming ecosystem. There is significant opportunity to leverage our respective customer relationships to cross-sell the portfolio and support that with a superior customer service proposition.

Together, we have the ability to generate touchpoints across the entire player journey, whether that’s on the casino floor, or on the go in a digital format. The combined studio network ensures significant ongoing R&D capabilities to develop top content across categories. With over 25 dedicated studios around the world, the combined company is positioned to enhance game development capacity. That will support continued investment in the momentum of our most popular land-based digital franchises, such as Wheel of Fortune, Cleopatra, and Cash Machine, in addition to unique offerings like omni-channel jackpot games.

We will also be able to allocate a larger R&D budget to support key strategic initiatives, like the development of premium and multi-level progressive games while maintaining our popular Class II and stepper offerings.

Randy Taylor

I want to spend a few moments providing a brief overview of Everi’s FinTech solutions business. Everi provides a comprehensive suite of financial access, RegTech, player loyalty, and mobile solutions to casino operators that improve efficiencies for our customers’ operations and amplifies the experience for their patrons.

In 2023, we processed nearly 147 million financial access transactions, driving close to $47 billion to casino floors. Our financial access products include standalone and self-service kiosks that allow patrons to access cash as well as cashless solutions where patrons can fund a digital wallet directly or purchase TITO tickets. Our loyalty products enable patrons to directly enroll in the casino’s players club or manage their existing players club account directly through self-service kiosks that we sell and service for our customers. Additionally, casino operators can utilize our loyalty platform to create and manage promotions to increase engagement with their patrons.

Our RegTech products include software solutions that enable casino operators to manage their regulatory compliance requirements required for anti-money laundering programs, as well as certain tax compliance requirements. One of the more exciting opportunities of the combination is the potential to integrate Everi’s FinTech business with IGT systems. By combining FinTech with IGT systems business, which includes casino operating systems, cash management systems, cash solutions, and other proprietary technology, we can seamlessly connect the patron with our casino customers, reducing friction and creating a better patron experience. We believe our combined products and services will provide superior customer support.

One example of this is with our digital wallet, where today the Everi wallet connects to a game either by connecting directly to a casino operating system or through a third-party connection. Our complementary combined offerings should create a best-in-class wallet solution for casino operators and improve the patron experience, which will ultimately increase the adoption of cashless wallet solutions. We plan to improve the operability of features and functions and drive more innovation that broadens the ecosystem of product and service offerings for customers and their patrons. Additionally, there’s an opportunity to leverage IGT’s existing global reach to more rapidly expand Everi’s FinTech products and services into new international markets.

Vincent Sadusky

One of the more compelling aspects of bringing these companies together is the significant synergies that enhance the revenue and profit growth potential of the business. Pro forma 2024 revenue is projected at $2.7 billion, and we expect to deliver mid-single-digit compound annual growth rate through 2026. That’s before any revenue synergies, such as distributing Everi game content into IGT’s existing VLT, international and digital networks, and its FinTech solutions in international and distributed gaming markets. Similarly, there is opportunity to expand IGT’s content

into Everi’s Class II network. And we believe our best-in-class digital and cashless solutions will provide the most compelling product offer for existing and new casino customers.

The profit outlook is equally compelling. Pro forma adjusted EBITDA is projected for each approximately $1 billion in 2024. We expect it to grow at a high single-digit compound annual rate through 2026, including $75 million of identified cost savings in three main areas. The biggest opportunity is with supply chain and input cost optimization that comes with greater purchase volume. Other areas include streamlined operations and the consolidation of the existing real estate footprint. P&L improvement, in addition to CapEx efficiencies with the installed base, are expected to drive higher conversion of adjusted EBITDA to cash flow from the pro forma mid-50% level to approximately 70% over the next three to five years. This should generate over $800 million in pro forma adjusted cash flow in 2026. The modest leverage profile and high cash flow generation allows for a balanced capital allocation strategy that includes investment in both organic and inorganic growth, significant debt repayment, and share buybacks.

The conclusion of the strategic evaluation and transaction is clearly the news of the day, but I’d like to spend a few minutes on the post-transaction profile of IGT’s remaining global Lottery business. Upon the successful completion of the transaction, IGT’s remaining operations will be comprised of its current global Lottery business and corporate support functions. That establishes the company as a premier pure play lottery business with a diversified contract mix, broad global reach, and leading positions in important markets. The Lottery business will have an attractive financial profile, including an enhanced capital structure with low pro forma net debt leverage of approximately 2.5x shortly following the closing of the transaction. We will have more time to expand on our Lottery business when IGT reports earnings on March 12.

Randy Taylor

As noted earlier, the transaction needs to clear regulatory approvals and shareholder votes. We currently expect it to close in the late 2024 or early 2025.

Before we open the call to your questions, there are clearly many compelling benefits to bringing these businesses together. We strongly believe it has the potential to create the most long-term value for both IGT and Everi shareholders through the organic growth outlook, synergies, and the potential re-rating of the business through the increased scale and diversification the combination offers.

Now, we’ll open the call for your questions.

Operator

At this time, I’d like to remind everyone in order to ask a question, press star, followed by the number one on your telephone keypad. We do ask that you please limit your questions to one and one follow-up. Our first question will come from the line of Barry Jonas with Truist Securities. Please go ahead.

Barry Jonas

Truist Securities, Inc.

Hey, guys. Good morning and congrats on this transformative announcement. I wanted to start and see if maybe you could give some background on how the deal came together and why you both think this was the best move for each company. Thanks.

Vincent Sadusky

Yes. I’ll start off from the IGT perspective. As you know, we’ve had two years now really of record results for the company and yet we continue to trade at an inferior multiple by any measure, cash return, yield, shorthand multiple, et cetera, to both our lottery peers and our gaming peers. And so, that made it even clearer that we really needed to do something strategically.

We’ve been talking about this for quite some time as a Board. We’re really methodical about it. We made the announcement all the way back in the beginning of the summer, and we feel like we really left no stone unturned in terms of the conversations we’ve had with counterparties and thinking about all the various alternatives along with our advisors that is how to best generate real value for our shareholders going forward. It was pretty clear that separation of the businesses for all the reasons I mentioned here and we’ve chatted about in the past was really key to unlocking value, and having these two companies -- these two separate businesses within the same company be disaggregated and go along their own pathway from the opportunity to generate incremental focus in each individual business as well as capital policies.

This journey led us to the conviction that our gaming business had -- has significant growth opportunity going forward and it would take a significant offer in a sales scenario to convince us, the Board and management, that we should realize a gain and be done with this business. The combination -- the separation is really enhanced by combining with another entity. And when we had our conversations with Randy and Mike and the Everi team, it became really clear to us that this is absolutely the best alternative. We don’t feel like there’s a lot of -- any leakage in terms of negative synergies or divestitures that are necessary.

We are in amazingly complementary product lines, given their strength in FinTech. We’re not in FinTech. We’re in systems. We’re both pursuing cashless but with different industry-leading competencies. They’re strengthened in Class II. Ours is really, as of late in the last couple of years, in the MLP premium space and historical strength in the lab space. Our international footprint, Everi’s good game titles, being desirous of expanding into international markets, but it’s an expensive endeavor to undertake without having significant scale. I can go on and on, but it really-- we really ultimately decided this was the best alternative.

So, separation made a lot of sense and separating with a great partner like Everi with these complementary strengths really, really was the best alternative and not even close to anything else that we had pursued or worked on.

Randy Taylor

Look, I don’t think there’s a lot to add there, Barry. I think Vince covered all the things that I would have covered. I just think that the management teams have worked very well together in trying to understand how complementary we are with each other. I think Vince hit on the areas we talked about. FinTech we think can really enhance the systems business. We think it will actually allow us to get outside of the U.S. faster, clearly for us to get global. That was going to be a big endeavor and that’s a big cost. So, we look at this as just a great opportunity for our shareholders to see how this combined company can really improve the overall shareholder value. So, it’s been a great process.

Barry Jonas

Great. And then just as a follow-up, Vince, you talked about seeing minimal negative synergies. I think historically in this space, negative synergies have been somewhat a factor in M&A. So, maybe just honing in a little bit more on that. And I guess specifically, you’ve been working on separating Lottery and Gaming for a while. Is there any negative aspects there? And are there ways to manage that from a relationship or contractual perspective? Thank you.

Vincent Sadusky

Yes. No, I would agree with you. We look back in the industry and you’ve had equipment supplier, acquire equipment supplier and kind of one or two entities in particular historically were aggressive in that area. And I think if you look back on it, you’d find that there was pretty aggressive cost cutting, and ultimately, a lot of the historical titles, once they became older, there was a reduction in the overall R&D and a streamlining of the hardware.

So, you pass forward and you look back, and ultimately, the combination didn’t yield, that classic kind of marketing thing, one plus one equals three. In this particular case, when you look at where the significant revenue streams lie for each one of these companies, they’re very different. In fact, where we overlap in areas like mechanical stepper and in Class III games, it’s very, very small, it’s a very small percentage of the overall business. And even in those particular categories, we expand our IP library significantly. And I think, over time, the opportunity to streamline hardware, for sure, is something that will drive a lot of the benefit. But clearly, increasing that IP library and also having this very significant network of international studios, I think, positions the company really well for continuing its growth journey and being very competitive in this space. And ultimately, that’s what it’s all about. I think it’s all about the opportunity to continue to develop world-class, leading games. And the way you increase your chances is to have this very strong studio network as well as a really terrific, great IP library. There’s a lot of learnings that have gone into the investment in R&D over the years to develop successful games and also determine what’s not successful, as well as this international footprint capability. That international growth opportunity is something that IGT has, I think, a very bright future going forward. We’ve competed very, very well in North America in the last several years. And I think the international space is one where we deserve a much greater share. And I think the combination makes us stronger to be able to really exploit those titles that have been created in North America for Everi into adjacent markets. So, I think that’s pretty neat.

And then also, not enough time to get into it today, but the combination of systems and FinTech that Randy touched upon, as well as the future of cashless, there’s really no complete cashless solution out there. Everyone is kind of delivering a half loaf. We feel very strongly about our IP. Everi is very strong with their IP. I think that combination, coupled with the FinTech infrastructure that they built, which is unprecedented in North America, is really exciting about -- to offer clearly the best-in-class product.

And then also, when you look at the portfolio of offering, I think as businesses and industries evolve, the larger players want to deal with other large players. It’s just more efficient. And there’s pricing efficiencies, there’s combination, there’s creative combinations that can be offered in terms of commercialization. And I think having this portfolio that covers really A to Z in a casino, and I think that one slide that kind of shows all the different customer touchpoints, this makes us more valuable, especially to the larger casino customers around the world.

Barry Jonas

Great. Thank you so much and congratulations.

Vince Sadusky

Thank you.

Randy Taylor

Thanks, Barry.

Operator

Your next question comes from the line of Jeffrey Stantial with Stifel. Please go ahead.

Jeffrey Stantial

Stifel, Nicolaus & Company

Hey. Good morning, everyone. Thanks for taking our question, and congrats on the announcement. Starting off, Vince and Randy, in the prepared remarks you walked through a mid-single-digit organic growth for three-year CAGR before any sort of top-line synergies between the two companies. Can you just unpack this a bit more? Where do you see the most growth coming from? And have you baked in any assumptions in that figure on market share gains across any of your, kind of, core product verticals?

Randy Taylor

Yes. Good question. I mean, really, the mid-single-digit growth on the top line is the combination of our individual business plans. So, really, no assumptions made around the synergy opportunity on the top line. As we get into it, we’ve done some preliminary work, and we really do think there is opportunity, as we mentioned, not only to exploit some of Everi’s titles internationally, but also Everi is very strong in a Class II environment. And IGT has not been that strong in Class II despite having a pretty terrific historical IP lottery and game titles.

So, we think there’s some real opportunities there, as well as the good work that our teams will do together in making our systems business really the best in the world. So, I think those -- that growth profile is based upon what we believe we will achieve, and that’s a combination of growth in the market, as well as, I think, pretty modest but continuing to grow share.

Vincent Sadusky

Yes. I would just say that we both looked at it in a realistic manner and didn’t really bake in a lot of revenue synergies, but I think we think there are a lot of opportunities out there. So, I think the way we’ve built the model and how we’re looking at the growth right now is really moderate, and I think there’s upside.

Randy Taylor

Yes. To me, this is one of these combinations that it’s very straightforward, it’s simple math, and I think that should give us all confidence that there’s great opportunity for cash flow growth because we’ve really built it based upon the very specific identification of cost synergies and without the promise or need to drive revenue synergies. But we do feel very strongly that we have the opportunity for revenue synergies as well.

Jeffrey Stantial

Okay. Great. Thanks, Randy. And then for my follow-up, I think you talked about this a little bit in the prepared remarks, Vince, but based on the, we’ll say, lack of overlap here, no required divestitures are expected. But maybe looking at that a little bit differently, I mean, you are going to be boasting arguably the most diverse portfolio out there following the merger. With that in mind, do you think there’s any assets in this portfolio that you might look to or be willing to monetize for the right price that maybe appear a bit more non-core under the pro forma strategy?

Vincent Sadusky

No, we don’t. We are -- as you know, IGT has been engaged in divestitures over the years out of its PLC, primarily on the lottery side. But right now, it’s got a gaming portfolio that it feels -- is really complementary, from our iCasino offering to our sports betting offering, right on down for each one of our product lines. And I would say really the same thing for Everi FinTech.

Randy Taylor

I just -- I don’t think that we look at any of this -- any of our products or services as something that at this point in time we’d be looking to do anything with. We know there’s regulatory approvals that we have to go through, but we feel pretty confident where we sit right now.

Vincent Sadusky

Yes. This is a competitive industry, so we feel like there’s plenty of competition post combination.

Jeffrey Stantial

Very clear. Thank you, both, and congrats again.

Randy Taylor

Thank you.

Vincent Sadusky

Thanks.

Operator

Your next question comes from the line of Chad Beynon with Macquarie. Please go ahead.

Chad Beynon

Macquarie Research

Hi. Good morning, all. Thanks for taking my question. Congrats on the announcement. First, just wanted to ask about the leverage. I know that’s in the release just in terms of what the pro forma leverage will be. It’s obviously an interesting time with potential rate cuts. How are you thinking about kind of the medium-term leverage of this new company, the potential free cash flow, if it could pay a dividend? Just kind of how the capital allocation mantra will come out of this deal? Thanks.

Vincent Sadusky

Yes. So, I think I’ll start it, and then Fabio or Max can kind of add on to this. One of the things that we both agreed on early on was, it will be really important to ensure that our leverage profile out of the gate was reasonable.

So, take kind of a worst-case scenario based off of our combined cash flow without any -- maybe any liberties with synergies, and let’s back into what the right capital structure is. And that really will be important to have the flexibility to continue to invest in the business and to be able to do shareholder-friendly things to keep investors excited with our capital policy as well as the operations of the cash flow generation from the operations of the business. We have mentioned what we believe that the leverage profile could be at closing, and that’s simply just based upon the view of our individual businesses operating throughout 2024 until the closing. And then going forward -- and we’ve got our financing package in place, of course, and going forward, the opportunity to reduce interest as well as reducing our principal, we think, has real potential to really further enhance our returns.

Massimiliano Chiara

Executive Vice President, Chief Financial Officer and Treasurer of IGT

So, let me start from a RemainCo perspective, from a PLC -- this is Max Chiara speaking, from a PLC RemainCo perspective. So, we are in the early innings of the separation work, but again, when you think about our net debt at the end of September, $5.3 billion, you consider the cash that will be made available through the separation and the combination back to the IGT PLC, which is a net $2.2 billion figure. You can -- we expect the resulting net leverage position shortly after closing will remain to be around 2.5x. You may remember this was our low end of the range in

our long-term target, so that would allow us to really tick the box on one of the most important targets that we announced back in 2021 when we had our Investor Day.

And again, I would like to conclude this answer with a consideration about the importance of having for IGT RemainCo, adding a low leverage is maintaining a strong financial position and low leverage profile would provide a maximum opportunity to pursue any and all compelling growth opportunities that might materialize in the future. Most importantly, we have some large contracts that are coming up for the new ones, as well as we recently renewed and extended existing contracts. So, we have been talking about our CapEx cycle for some time, and that is going to come up. And so, adding a low leverage at the start of that cycle is a very good thing.

Chad Beynon

Thank you for that, Max. That was actually going to be my next question. My followup, maybe just kind of thinking about non-gaming opportunities. Recently Everi has expanded with their Venuetize acquisition into, let’s call it, non-gaming payments businesses. And I think that TAM and the growth opportunity investors found that to be strong. Are there other maybe non-gaming, kind of non-traditional synergistic opportunities that could come out of this? Or should we expect for the combined company to really focus on the traditional pieces of gaming, land-based, and digital? Thanks.

Vincent Sadusky

Yes. I think, to be honest, we -- that’s a smaller part of the universe of opportunities that we've looked at just given the time constraints of getting to this combination. And we will get into, of course, our planning activities post-closing.

So, I don’t want to make too strong of a statement about our strategic objectives going forward on a combined basis. I’ll just say that in the B2B gaming space, we feel as if there can be a handful of industry leaders that are creating great games, that are enjoying really the resurgence in slot play around the world post-COVID, and then also enjoying the expansion of iCasino is that will certainly take place- continue to take place throughout the world and over the next several years in North America in particular. And there’s really only a few players that can honestly offer omni-channel jackpot play and we are one of those. So, now with more titles and more geographies, it’s our goal to lead in this space. And this is something that’s becoming I think more and more important to operators to have seamless transition between digital and land-based gaming.

And then the -- if you can be an expert in the ancillary services that also are very helpful to casino customers, we think that is a significant enhancement. And in North America, Everi has certainly done that. And the thing that’s really great about Everi, in addition to their longstanding leadership position at FinTech, is their entrepreneurial perspective. And I think their willingness to reach out into adjacencies, make some small bets, and see what the opportunity is there. And I think that’s pretty neat, and personally, I’m interested in exploring that more. But I think the industrial logic of the large cashflow generation capability from this combination is pretty clear in the B2B space.

Randy Taylor

And I would just add, look, when we looked at Venuetize, it still is really entertainment based. And so, I think it fits well. I think, given the size of the company going forward, I think there’ll be opportunities to be looked at. But I agree with Vincent, I think there’s just a lot of opportunity in the current gaming space that we’re at. And I think big guys and products like that will just be things that we’ll add kind of on the outskirts.

Chad Beynon

Thank you, both. Appreciate it.

Randy Taylor

Thanks.

Vincent Sadusky

Thank you.

Operator

Your next question comes from the line of George Sutton with Craig-Hallum Capital. Please go ahead.

George Sutton

Craig-Hallum Capital Group LLC

Thank you. I’m very intrigued by the combination of the Everi digital wallet with what IGT brings to this. I wondered if you could get a little more specific on that patron experience? And what you’re getting by bringing these together competitively?

Vincent Sadusky

Yes. I think, you understand the products and services that both companies offer. So, ideally, you have a system that enables the machines to be able to interact with the digital wallet, and also a lot of touchpoints to actually get people to enroll in a digital wallet. And all those things really are present in IGT and Everi’s current capabilities.

So, when I say we truly would be the only one software complete solution, we don’t have to install hardware into machines, retrofit them at cost and with third-party hardware. We don’t need to ask someone else’s permission to be able to provide that opportunity. I think both companies have invested a significant amount in R&D, and I think we have a lot of credibility in the gaming space, the system space at IGT’s front, and certainly in the FinTech side on Everi’s front.

So, I think bringing these things together will offer not only a compelling offering, because again, the two solutions we’re working on are limited by our capabilities, but also in interacting with our very valuable casino customers. I think we both bring a lot of credibility to the table, and I think they will definitely want to listen and understand our proposition. And I think that puts us in an advantageous position versus the competitive set.

Randy Taylor

Yes. I mean, I totally agree. I just think -- I think it allows us to accelerate what we’re doing today in the cashless area. So, it’s very exciting from an Everi standpoint.

George Sutton

So, relative to your expectations for late ’24, early ’25 close, and just the regulatory requirement required, can you just walk through what some of those key regulatory requirements? Obviously, we’re familiar with HSR and FTC, but beyond that, from a gaming perspective.

Randy Taylor

Yes. Look, I think, from a regulatory standpoint, look, there’s the global footprint of IGT’s. They’ve clearly got more licenses, but we have a significant amount of licenses in North America. There’s overlap in that license area. Look, I think it’s one of those things that we’re going to work our way through. But we’re both well-licensed companies, and that should not be something that’s overly burdensome. If we know there’s antitrust out there, we’ll work through that process, but we feel the timing that we’ve laid out, late ‘24 and early ‘25, is very manageable.

Vincent Sadusky

Yes. I would just say on the antitrust front, there’s clearly even with this combination there’s competitors who are larger out there.

And with regard to gaming regulators, one of the things that is very positive is both companies are seasoned, long-standing, very highly compliant, reputable, known entities and they’re public companies. So, we think that we give the regulators in any jurisdiction a lot of comfort around this combination. This is not combining with a, let’s say, a large digital entity based outside of the U.S. that’s involved in gray markets, black markets, where there’s a lot of promises of divestitures that in order to get regulators, especially in North America, to get comfortable with the deal. These are two known entities that have been incredibly compliant and two of the best actors in the industry.

Operator

Our next question will come from the line of David Katz with Jefferies. Please go ahead.

David Katz

Jefferies LLC

Hi. Good morning, everyone, and congratulations all around. Obviously, this was a lengthy and complex process and a lot of work. I do want to try and step down a layer, if we can, into the studios, the leadership teams within the various components of gaming. Sort of following the people has usually been critically important. Vince, you talked about this just a little bit, but anything you can share about which studios or which people be running gaming, et cetera? And then I have one quick follow-up.

Vincent Sadusky

Yes, sure, and thanks for recognizing the length and the complexity. Yes, I will say that the carveout nature of IGT needing to go through that process in order to do something strategic with its land-based gaming and Play Digital operation was one of the drivers of what’s taking a lot of time and an incredible amount of effort. But obviously, all worth it to get us to this point to be able to do this fine strategic transaction.

With regard to the studios, that is the -- whether you’re in kind of my old business media, you’re in the gaming business, that creative element is, of course, the key towards your future success. Yes, I would say from the IGT side, we’ve been at this for a long time, attempting to improve our capabilities in each one of these gaming categories, in particular, in premium. And we’ve had some really good recent success over the last couple of years, and with that, we’ve -- we’re continuing to refine our process. Even during kind of the pre-COVID era, when IGT was in a difficult position with high leverage, one of the things it did not do when it enacted several cost reduction plans is reduce its amount of investment in R&D, recognizing that, that was absolutely key towards future growth.

And game development is a process. It takes a lot of time to develop great games. And as you start to develop better games, right, you’ve got -- you start to recognize the attributes of what’s working, et cetera. And success doesn’t always repeat in the same studios. So, having really good, smart, creative people located in a lot of different geographies has been a key for us to be competitive in all these spaces from premium to the VLTs and certainly in digital.

With regard to Everi, Everi being a smaller company, we’re really -- we think it’s really remarkable the great success that they’ve had with fewer resources yet being very competitive in various game categories. As I mentioned, most of these are complementary to where IGT is most competitive. So, kind of on a go forward basis, obviously, talking about the people and the product and the development process, all of that is critically important to get right. And we just get very excited about the ability to have a larger R&D budget and have more people involved in the creative process and the learnings that we’ve individually had to take our best practices and have our teams really have the opportunity to maximize the R&D spend to increase our chances for success.

David Katz

Got it. This all looks like it makes a ton of sense. One quick follow-up, please, if I may. Any light you can shed on what the tax impact to IGT shareholders might be or could be or some tools for us to figure it out or maybe this is just a simple question on capital gains. It’ll help.

Massimiliano Chiara

Yes. Dave, this is Max Chiara again. So, we have added a page to the appendix of the presentation illustrated today that basically highlight from a tax point of view that there is limited tax leakage at the PLC level due to the benefit of participating to the tax exemption regime as a UK corporation, as a UK PLC company. So, we are estimating about $100 million of tax leakage, which obviously are deducted from the $2.6 billion payment.

And the reason why -- one of the reasons why we, at the end of the day, decided to go with a taxable transaction is because that provides the most flexibility for both RemainCo and for MergeCo to pursue other strategic alternatives as standalone entities and including all the different capital allocation strategies with greater flexibility. And lastly, this transaction is taxable to IGT shareholders as well. So, there is an impact that is approximately 30% of the fair market value of the distribution.

David Katz

Thank you very much.

Operator

Our next question will come from the line of Joe Stauff with Susquehanna. Please go ahead.

Joseph Stauff

Susquehanna International Group

Thank you. Good morning. Congrats. Very interesting transaction. I wanted to ask maybe, I know that it’s a little bit earlier, but maybe say the path to completion and kind of the bigger steps and/or the mileposts that you’ll need to accomplish to be able to close. So, you know, maybe most importantly, you know, say the regulatory process that you have, obviously there is going to be some angst about just the regulatory environment overall here in the U.S. And if you could maybe put some of the more relevant dates on the calendar as we kind of think about timing to close and so forth.

Vincent Sadusky

Yes. I’m not sure there’s much to add my earlier comment other than the first thing we’ll need to do is to do our filings, which we are -- the teams have already been working on that pre-close, so that will start the clock. And then, as you know, we’ll prepare proxy statements, go to our shareholders, if there’s any SEC comments, et cetera, the normal process. I can’t really offer up anything more than what I’ve said earlier regarding our complementary nature, our good standing with regulators, and the fact that post-closing there will be larger competitors out there. So, that’s our perspective.

Joseph Stauff

Okay. Fair enough. I do realize it’s a little difficult to comment on, but I appreciate it. And outside of the U.S., are there any—doesn’t seem to us that there are really any other jurisdictions where investors would look at as, say, a higher hurdle with respect to regulatory clearance. Is that a fair assessment?

Vincent Sadusky

Yes, it is. Again, when you think about it, Everi primarily operates in North America, so the impact internationally is de minimis. IGT continues to be the lion’s share overall of the commercial activity in those markets.

Joseph Stauff

Understood. Thanks very much and congrats.

Vincent Sadusky

Thank you.

Operator

Our final question will come from the line of David Hargreaves with Barclays. Please go ahead.

David Hargreaves

Barclays

Hi. I’m wondering if there are any specific terms of the 5% notes that require those to be redeemed in connection with this transaction or whether they might potentially remain outstanding afterwards. And then would -- I assume, to the extent they need to come out, it would be 102.5 call. Could you please confirm that?

Randy Taylor

On the note side, I’ll turn it over to Mark. But I don’t think we have any issues there, but go ahead Mark.

Mark Labay

Executive Vice President, Chief Financial Officer and Treasurer of Everi

Look, Dave, I think if we contemplate this transaction where we’re talking about the debt profile of the transaction, refinancing what we have outstanding and a lot of it obviously depends on the timing of the close, there is no -- if it closes early in late 2024, there is a little bit of a premium on the call bringing a little early but otherwise it should be pretty straightforward transaction for us.

David Hargreaves

But you anticipate, call, not a change of control offer?

Mark Labay

It will be -- there will be a change of control in there too. So, yes, I mean we do believe that, that could be the -- a possible outcome we’re looking into it all.

David Hargreaves

Okay. And then with respect to the IGT debt pay down, are there any specific bond instruments that you would target there that we should be thinking about?

Massimiliano Chiara

Yes. So, first -- this is Max again. So, first of all, we have secured the consent from our banking group to proceed with this transaction. We have committed to reduce by 50% our existing term loan exposure. We have about $800 million, so $400 million are allocated -- are going to be allocated to the terminal. The rest will be allocated to that instrument as we see fit, as we get closer to the execution of the transaction, keeping in mind the typical boundaries, maturity extension, economic terms, and viability of the transaction.

So, all in all, we think this is a great new deleveraging opportunity for IGT RemainCo. And also, by the way, we have also -- part of the consent, we have also agreed to reduce our revolver commitment by about 20%, as obviously, we are looking forward to a relatively smaller company going forward. So, I think we have resized the revolver appropriately to the new RemainCo perimeter. But all in all, we’re confident we can move forward with that transaction pretty efficiently as we get closer to the execution date.

David Hargreaves

That’s helpful. Congrats. This company is going to be relevant for the next (inaudible). So, great job. Thank you.

Vincent Sadusky

Thank you.

Randy Taylor

Thanks.

Operator

And that does conclude today’s conference call. We thank you all for joining, and you may now disconnect your lines.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed Transaction”) between Everi Holdings Inc. (“Everi”), International Game Technology PLC (“IGT”), Ignite Rotate LLC (“Spinco”) and Ember Sub LLC (“Merger Sub”), Everi, IGT and Spinco will file relevant materials with the Securities and Exchange Commission (“SEC”). Everi will file a registration statement on Form S-4 that will include a joint proxy statement/prospectus relating to the Proposed Transaction, which will constitute a proxy statement and prospectus of Everi and a proxy statement of IGT. A definitive proxy statement/prospectus will be mailed to stockholders of Everi and a definitive proxy statement will be mailed to shareholders of IGT. INVESTORS AND SECURITY HOLDERS OF EVERI ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, AND INVESTORS AND SECURITY HOLDERS OF IGT ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EVERI, IGT AND SPINCO, AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Everi or IGT through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Everi will be available free of charge on Everi’s website at www.everi.com or by contacting Everi’s Investor Relations Department at Everi Holdings Inc., Investor Relations, 7250 S. Tenaya Way, Suite 100, Las Vegas, NV 89113. Copies of the documents filed with the SEC by IGT will be available free of charge on IGT’s website at

www.igt.com or by contacting IGT’s Investor Relations Department at International Game Technology PLC, Investor Relations, 10 Memorial Boulevard, Providence, RI 02903.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities of Everi, IGT, Spinco or Merger Sub, or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Everi or IGT. However, Everi and IGT and each of their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the Proposed Transaction. Information about the directors and executive officers of Everi may be found in its most recent Annual Report on Form 10-K and in its most recent proxy statement for its annual meeting of stockholders, in each case as filed with the SEC. Information about the directors, executive officers and members of senior management of IGT is set forth in its most recent Annual Report on Form 20-F as filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, related to Everi, IGT and the proposed spin-off of IGT’s Global Gaming and PlayDigital businesses (the “Spinco Business”), and the proposed acquisition of the Spinco Business by Everi. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws. These forward-looking statements involve risks and uncertainties that could significantly affect the financial or operating results of Everi, IGT, the Spinco Business, or the combined company. These forward-looking statements may be identified by terms such as “anticipate,” “believe,” “foresee,” “estimate,” “expect,” “intend,” “plan,” “project,” “forecast,” “may,” “will,” “would,” “could” and “should” and the negative of these terms or other similar expressions. Forward-looking statements in this communication include, among other things, statements about the potential benefits and synergies of the Proposed Transaction, including future financial and operating results, plans, objectives, expectations and intentions; and the anticipated timing of closing of the Proposed Transaction. In addition, all statements that address operating performance, events or developments that Everi or IGT expects or anticipates will occur in the future — including statements relating to creating value for stockholders and shareholders, benefits of the Proposed Transaction to customers, employees, stockholders and other constituents of the combined company and IGT, separating and integrating the companies, cost savings and the expected timetable for completing the Proposed Transaction — are forward-looking statements. These forward-looking statements involve substantial risks and uncertainties that could cause actual results, including the actual results of Everi, IGT, the Spinco Business, or the combined company, to differ materially from those expressed or implied by such statements. These risks and uncertainties include, among other things, risks related to the possibility that the conditions to the consummation of the Proposed Transaction will not be satisfied (including the failure to obtain necessary regulatory, stockholder and shareholder approvals or any necessary waivers, consents, or transfers, including for any required licenses or other agreements) in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits of the Proposed Transaction, including the possibility that Everi and IGT may be unable to achieve the expected benefits, synergies and operating efficiencies in connection with the Proposed Transaction within the expected timeframes or at all and to successfully separate and/or integrate the Spinco Business; the ability to retain key personnel; negative effects of the announcement or the consummation of the proposed acquisition on the market price of the capital stock of Everi and IGT and on Everi’s and IGT’s operating results; risks relating to the value of Everi’s shares to be issued in the Proposed Transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Proposed Transaction (the “Merger Agreement”); changes in the extent and characteristics of the common stockholders of Everi and ordinary shareholders of IGT and its effect pursuant to the Merger Agreement for the Proposed Transaction on the number of shares of Everi common stock issuable pursuant to the Proposed Transaction, magnitude of the dividend payable to Everi’s stockholders pursuant to the Proposed Transaction and the extent of indebtedness to be incurred by Everi in connection with the Proposed Transaction; significant transaction costs, fees, expenses and charges (including unknown liabilities and risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects); expected or targeted future financial and operating

performance and results; operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining employee, customer, or other business, contractual, or operational relationships following the Proposed Transaction announcement or closing of the Proposed Transaction); failure to consummate or delay in consummating the Proposed Transaction for any reason; risks relating to any resurgence of the COVID-19 pandemic or similar public health crises; risks related to competition in the gaming and lottery industry; dependence on significant licensing arrangements, customers, or other third parties; issues and costs arising from the separation and integration of acquired companies and businesses and the timing and impact of accounting adjustments; risks related to the financing of the Proposed Transaction, Everi’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the Proposed Transaction; economic changes in global markets, such as currency exchange, inflation and interest rates, and recession; government policies (including policy changes affecting the gaming industry, taxation, trade, tariffs, immigration, customs, and border actions) and other external factors that Everi and IGT cannot control; regulation and litigation matters relating to the Proposed Transaction or otherwise impacting Everi, IGT, Spinco, the combined company or the gaming industry generally; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business divestitures; effects on earnings of any significant impairment of goodwill or intangible assets; risks related to intellectual property, privacy matters, and cyber security (including losses and other consequences from failures, breaches, attacks, or disclosures involving information technology infrastructure and data); other business effects (including the effects of industry, market, economic, political, or regulatory conditions); and other risks and uncertainties, including, but not limited to, those described in Everi’s Annual Report on Form 10-K on file with the SEC and from time to time in other filed reports including Everi’s Quarterly Reports on Form 10-Q, and those described in IGT’s Annual Report on Form 20-F on file with the SEC and from time to time in other filed reports including IGT’s Current Reports on Form 6-K.

A further description of risks and uncertainties relating to Everi can be found in its most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and relating to IGT can be found in its most recent Annual Report on Form 20-F and Current Reports on Form 6-K, all of which are filed with the SEC and available at www.sec.gov.

Everi does not intend to update the forward-looking statements contained in this communication as the result of new information or future events or developments, except as required by law.

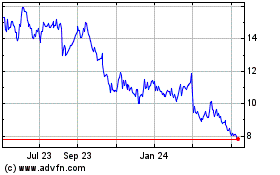

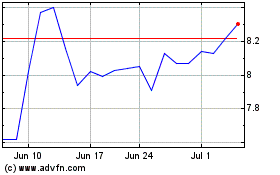

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024