Form 424B3 - Prospectus [Rule 424(b)(3)]

March 01 2024 - 4:48PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

Registration No. 333-239185

PROSPECTUS SUPPLEMENT NO. 86

(to Prospectus dated July 17, 2020)

Nikola Corporation

Up to 53,390,000 Shares of Common Stock

Up to 23,890,000 Shares of Common Stock Issuable Upon Exercise of Warrants

This prospectus supplement supplements the prospectus dated July 17, 2020 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-239185). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Amendment No. 1 to Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 1, 2024 (the “Amendment No. 1 to Annual Report”). Accordingly, we have attached the Amendment No. 1 to Annual Report to this prospectus supplement.

The Prospectus and this prospectus supplement relates to the issuance by us of up to an aggregate of up to 23,890,000 shares of our common stock, $0.0001 par value per share (“Common Stock”), which consists of (i) up to 890,000 shares of Common Stock that are issuable upon the exercise of 890,000 warrants (the “Private Warrants”) originally issued in a private placement in connection with the initial public offering of VectoIQ and (ii) up to 23,000,000 shares of Common Stock that are issuable upon the exercise of 23,000,000 warrants (the “Public Warrants” and, together with the Private Warrants, the “Warrants”) originally issued in the initial public offering of VectoIQ.

The Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”) of (i) up to 53,390,000 shares of Common Stock (including up to 890,000 shares of Common Stock that may be issued upon exercise of the Private Warrants) and (ii) up to 890,000 Private Warrants.

Our Common Stock is listed on the Nasdaq Global Select Market under the symbol “NKLA”. On February 29, 2024, the closing price of our Common Stock was $0.7442.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

See the section entitled “Risk Factors” beginning on page 7 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March 1, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-38495

Nikola Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | | 82-4151153 |

(State or other jurisdiction of

incorporation or organization) | | | (I.R.S. Employer Identification No.) |

| | | |

| 4141 E Broadway Road | | | 85040 |

Phoenix, Arizona | | | |

| (Address of Principal Executive Offices) | | | (Zip Code) |

(480) 581-8888

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | NKLA | | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant on June 30, 2023, based on the closing price of $1.38 for shares of the Registrant’s common stock as reported by The Nasdaq Stock Market LLC, was approximately $1.0 billion. Shares of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had outstanding 1,335,615,165 shares of common stock as of February 26, 2024.

| | | | | | | | | | | | | | |

Auditor Name: Ernst & Young LLP | | Auditor Location: Phoenix, Arizona | | Auditor PCAOB ID: 0042 |

Nikola Corporation

Form 10-K/A

(Amendment No. 1)

For the Fiscal Year Ended December 31, 2023

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K of Nikola Corporation (the “Company”, "we", "us" or "our") for the fiscal year ended December 31, 2023, originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 28, 2024 (the “Original Filing”).

This Amendment is being filed to revise Part II “Item 9B. Other Information” by adding information regarding Rule 10b5-1 trading arrangements terminated and adopted by certain of its officers during the three month period ended December 31, 2023, which was inadvertently omitted from the Original Filing.

In addition, as required by Rule 12b-15 of the Securities and Exchange Act of 1934 (the “Exchange Act”), a new certification by the Company’s principal executive officer and principal financial officer is filed herewith as Exhibit 31.2 to this Amendment under Item 15, pursuant to Rule 13a-14(a) or 15d-14(a) of the Exchange Act. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certification has been omitted. The Company is also not including new certifications under Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) (Section 906 of the Sarbanes-Oxley Act of 2002), as no financial statements are being filed with this Amendment.

Other than as expressly set forth herein, this Amendment does not, and does not purport to, amend, update or restate the information in the Original Filing or reflect any events that have occurred after the Original Filing was made. Information not affected by this Amendment remains unchanged and reflects the disclosures made at the time as of which the Original Filing was made. This Amendment should be read together with the Original Filing and the Company’s other filings with the SEC.

Item 9B. Other Information

(b) Trading Plans

During the three months ended December 31, 2023, no director or officer adopted or terminated any contract, instruction or written plan for the purchase or sale of securities of the Company pursuant to Rule 10b5-1(c) or any non-Rule 10b5-1 trading arrangement (as defined in Item 408(c) of Regulation S-K), except as provided below:

Joseph R. Pike, our Chief Human Resources Officer, on November 9, 2023, terminated his Rule 10b5-1 trading arrangement adopted on August 9, 2023. No sales were made under such plan prior to its termination. On November 9, 2023, Mr. Pike adopted a Rule 10b5-1 trading arrangement which provides for the potential sale of up to 119,063 shares of common stock and up to 126,695 shares of common stock issuable upon exercise of options through March 3, 2025. This trading arrangement is intended to satisfy the affirmative defense of Rule 10b5-1(c) under the Exchange Act.

Britton M. Worthen, our Chief Legal Officer and Secretary, on November 9, 2023, terminated his Rule 10b5-1 trading arrangement adopted on August 8, 2023. No sales were made under such plan prior to its termination. On November 15, 2023, Mr. Worthen adopted a Rule 10b5-1 trading arrangement which provides for the potential sale of up to 178,594 shares of common stock and up to 1,000,000 shares of common stock issuable upon exercise of options through December 31, 2024. This trading arrangement is intended to satisfy the affirmative defense of Rule 10b5-1(c) under the Exchange Act.

Anastasiya Pasterick, our former Chief Financial Officer, on November 20, 2023, terminated her Rule 10b5-1 trading arrangement adopted on August 22, 2023. No sales were made under such plan prior to its termination.

PART IV

Item 15. Exhibits and Financial Statement Schedules

1.Financial Statements: The information concerning our financial statements and Report of Independent Registered Public Accounting Firm required by this Item is incorporated by reference in the Original Filing to the section of the Original Filing in Item 8, titled “Financial Statements and Supplementary Data.”

2.Financial Statement Schedules: No schedules are required.

3.The exhibits listed in the following Index to Exhibits are filed or incorporated by reference as part of this report.

| | | | | | | | |

| # | |

| # | |

| # | |

| # | |

| | |

| | |

| * | Master Industrial Agreement by and among Nikola Corporation, CNH Industrial N.V. and Iveco S.p.A., dated September 3, 2019, as amended by Amendment to Master Industrial Agreement, dated December 26, 2019, Second Amendment to Master Industrial Agreement, dated January 31, 2020, and Third Amendment to Master Industrial Agreement, dated February 28, 2020 (incorporated by reference to Exhibit 10.13 to the S-4). |

| * | |

| * | |

| * | |

| * | |

| * | |

| * | |

| * | |

| + | |

| * | |

| * | |

| * | |

| *

+ | |

| * | |

| * | |

| * | |

| | | | | | | | |

| | |

| * | |

| * | |

| * | |

| * | |

| | |

| + | |

| | |

| | |

| | |

| | |

| +

@ | |

| @ | |

| @ | |

| @ | |

| @ | |

| 31.2 | ** | Certification of Principal Executive Officer Pursuant to Rules 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| ^

@ | |

| @ | |

| 101 | ** | Inline XBRL ("iXBRL") for the information under Part II, Item 9B, “Other Information” of this Amendment No. 1 on Form 10-K/A. |

| 101.INS | | XBRL Instance Document |

| 101.SCH | | XBRL Taxonomy Extension Schema Document |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document |

| | | | | | | | |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

__________________________

| | | | | | | | |

| + | The schedules and exhibits to this agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request. |

| | |

| # | Indicates management contract or compensatory plan or arrangement. |

| | |

| * | Portions of this exhibit have been redacted in accordance with Item 601(b)(10)(iv) of Regulation S-K. |

| | |

| ^ | In accordance with Item 601(b)(32)(ii) of Regulation S-K and SEC Release No. 34-47986, the certification furnished in Exhibit 32.1 is deemed to accompany the Original Filing and will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or deemed to be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933 except to the extent that the registrant specifically incorporates it by reference. |

| | |

| @ | Filed or furnished with the Original Filing. |

| | |

| ** | Filed herewith. |

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Amendment No. 1 to Annual Report on Form 10-K/A to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | NIKOLA CORPORATION |

| | | |

| Date: March 1, 2024 | | By: | /s/ Stephen J. Girsky |

| | | Stephen J. Girsky |

| | | President, Chief Executive Officer and Acting Chief Financial Officer |

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

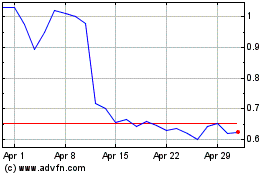

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Apr 2023 to Apr 2024