Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

March 01 2024 - 9:14AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number: 001-41324

AKANDA CORP.

(Name of registrant)

| 1a, 1b Learoyd Road |

| New Romney TN28 8XU, United Kingdom |

| (Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On March 1, 2024, Akanda Corp., a corporation

organized under the laws of the Province of Ontario (the “Company”), entered into a securities purchase agreement (the “Purchase

Agreement”) with certain accredited investors in connection with the issuance and sale by the Company in a registered direct offering (the “Offering”) of 367,870 of the Company’s Common Shares, no par value

per share (the “Common Shares” and, such number of Common Shares issued and sold in the Offering, the “Offered Shares”),

at a purchase price of $0.2054 per Offered Share, and pre-funded warrants to purchase 361,972 Common Shares at a purchase price of each

pre-funded warrant equal to the price at which one Common Share is sold in the Offering, minus $0.0001, and the exercise price of each

pre-funded warrant is $0.0001 per share (the “Pre-Funded Warrants” and, such number of Pre-Funded Warrants issued and sold

in the Offering, the “Offered Pre-Funded Warrants”), pursuant to the Company’s effective shelf registration statement

on Form F-3 (File No. 333-276577) and a related base prospectus, together with the related prospectus supplement to be

dated as of March 1, 2024 (such registration statement, base prospectus and prospectus supplement, collectively, the “Registration

Statement”), filed with the Securities and Exchange Commission. The Pre-Funded Warrants are immediately exercisable and may be exercised

at any time until all of the Pre-Funded Warrants are exercised in full, subject to certain beneficial ownership limitations as set forth

in the Pre-Funded Warrant.

Univest Securities LLC is acting as the financial

advisor in connection with the offering.

The gross proceeds to Akanda are estimated to

be approximately $150,000 before deducting the financial advisor fees and other offering expenses. The offering is expected to close

on or about March 4, 2024, subject to the satisfaction of customary closing conditions. Akanda intends to use the net proceeds from this

offering for general working capital and general corporate expenses.

The offering is being made pursuant an effective

shelf registration statement on Form F-3, as amended (File No. 333-276577) previously filed with the Securities and Exchange Commission

(“SEC”) and declared effective on January 29, 2024. The securities may be offered only by means of the prospectus supplement

and the accompanying prospectus that form a part of the registration statement. A final prospectus relating to the Offering will be filed

with the SEC and will be available free of charge on the SEC’s website at http://sec.gov.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AKANDA CORP. |

| |

(Registrant) |

| |

|

|

| Date: March 1, 2024 |

By: |

/s/ Katie Field |

| |

|

Name: |

Katie Field |

| |

|

Title: |

Interim Chief Executive Officer and Director |

2

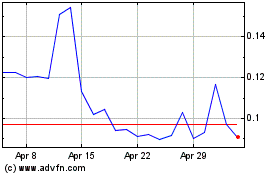

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Akanda (NASDAQ:AKAN)

Historical Stock Chart

From Apr 2023 to Apr 2024