Filed by: Everi Holdings Inc.

(Commission File No.: 001-32622)

pursuant to Rule 425 under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Everi Holdings Inc.

(Commission File No.: 001-32622)

Everi Holdings Inc.

Frequently Asked Questions (FAQs) for Leaders

1. What are the strategic reasons behind this expected merger?

As you are aware, our company continually seeks opportunities to enhance our business and increase profitability. This pursuit often involves evaluating various strategic options, including acquisitions and mergers. We engage in thorough analysis and due diligence to ensure that any potential deal aligns with our long-term objectives and values.

In the case of our expected merger with IGT’s Global Gaming and PlayDigital businesses, we believe we have identified a compelling opportunity. IGT is globally recognized in our industry, known for its expansive reach and impressive track record. Their strength, particularly in the Digital and Gaming sectors, complements our existing strengths and capabilities. The IGT Lottery business will not be included in this expected merger.

After careful consideration, our Board of Directors concluded that they believe the potential of merging with IGT’s Global Gaming and PlayDigital businesses presents a strategic avenue to enhance our industry position, broaden our product and service offerings, and create additional value for our stakeholders. This decision was made with a clear vision of the future and a commitment to the continued success and growth of our combined entity.

We believe this expected merger will position us strongly in the industry and will open new avenues for innovation and growth. We are excited about the possibilities that lie ahead and are committed to a seamless integration process, with a focus on maintaining the high standards of service and excellence that our customers, employees, and partners expect from us.

2. What is the timeline for the expected merger process?

Mergers are complex and require careful planning and regulatory approvals, which means changes do not happen overnight. We are currently targeting the completion of the expected merger by late 2024 or early 2025. Both Everi and IGT will continue to operate as separate companies until the expected merger is completed.

3. How will the expected merger affect our current business and financial goals?

As leaders within our organization, it is important to understand that it is business as usual. Our primary focus remains on fulfilling our existing commitments, meeting customer and patron expectations, and achieving our current financial goals. We must continue to independently execute our plans with the same level of dedication and excellence that has always defined our work.

Once the expected merger closes there will be a strategic review of our combined business plan. This review will be aimed at aligning and setting new financial goals and targets that reflect the strengths and opportunities of our merged entity. As leaders, you will play a key role in this

transition. Your insights and expertise will be invaluable in shaping the direction of our new, combined organization.

We will rely on your leadership to guide your teams through this period of change, maintaining focus and motivation. It is important to communicate that, while our larger strategic goals may evolve to align with the new business landscape, our commitment to excellence and customer satisfaction remains unwavering.

We understand that change can bring uncertainty, but it also brings opportunities for growth and improvement. We encourage you to view this expected merger as a chance to enhance our capabilities and achieve greater success.

Your role in maintaining stability and driving performance during this transition cannot be overstated.

4. What changes in leadership and management structure are anticipated?

Upon closing, Mike Rumbolz, Executive Chairman of Everi is expected to become the Chairman of the Board of the combined company and Randy Taylor is expected to be a member of the Board. Upon closing, Vince Sadusky, CEO of IGT is expected to be named CEO, Fabio Celadon, EVP of Strategy for IGT is expected to be named CFO and Mark Labay is expected to move to the role of Chief Integration Officer. Our leadership team is committed to a seamless integration process, with a focus on maintaining the high standards of service and excellence that define us.

At levels beyond the executive team, we anticipate a thorough and thoughtful evaluation process. The objective of this process will be to assess and align the leadership and management structures across various departments and functions. Our goal is to ensure that we have the most effective leadership in place, capable of driving successful execution and fostering a cohesive, productive work environment.

This evaluation will consider the strengths, experiences, and capabilities of leaders from both organizations. We are committed to making these decisions based on merit, strategic fit, and the overall best interests of our combined company. It is important to note that we expect this process to be carried out with careful consideration and sensitivity to the impact on our people and operations, and that nothing will change prior to closing.

We understand that changes in leadership and management can create a degree of uncertainty. However, we view this as an opportunity to bring together the best of both companies, enhancing our leadership capabilities and positioning us for greater success in the future post-closing.

As more concrete plans are developed regarding the leadership and management structure, we will communicate these changes transparently and provide support to all affected individuals. We value the contributions of all our leaders and managers and are dedicated to providing a smooth transition as we move forward together.

5. How should we prepare our teams for the expected merger?

As leaders within our organization, your role in guiding and preparing your teams for post-closing integration with IGT’s Global Gaming and PlayDigital businesses is crucial. Here are some key ways you can contribute to a successful transition without implementing any plans prior to closing:

1. Maintain Focus on Current Responsibilities: Continue to lead your teams in delivering excellence in your daily responsibilities and ongoing projects. The stability and success of our current operations are vital during this period of change.

2. Foster a Positive and Proactive Attitude: Encourage your teams to view the expected merger as an opportunity for growth and development. Your attitude as a leader will set the tone for your team, so it is important to remain positive and forward-thinking.

3. Encourage Open Communication: Keep the lines of communication open with your team. Share updates about the expected merger as they become available and encourage team members to voice their questions. Your role in facilitating transparent and honest dialogue is key.

4. Promote Adaptability and Openness to Change: Prepare your team for the changes that an expected merger brings post-closing. Encourage flexibility and an openness to new ways of working. Highlight the potential for new opportunities, learning, and collaboration.

5. Engage with Expected Merger Communications: Stay informed about the expected merger process and developments. Use the information provided through official channels to keep your team updated and aligned with the overall expected post-closing merger strategy.

6. Share with Senior Leadership any questions or items not previously expected: We have tried to anticipate most questions; however, it is likely we have not anticipated every challenge. Please share with senior leadership so a thoughtful and proper response can be provided.

Your leadership, guidance, and the example you set will be instrumental to a smooth integration planning process, and post-closing transition. We believe your dedication, combined with the collective efforts of your team, will be a driving force in realizing the successful future of the proposed merger. Let us work together to make the planning process and eventual transition a success.

6. How will we ensure smooth cultural integration?

We are keenly aware of the critical role our company culture and core values play in our collective identity and success. Both our organization and IGT have a strong history of cultivating positive work environments and adhering to business practices that benefit our employees, customers, and communities. This shared focus forms a solid foundation for the proposed merger, providing fundamental alignment in our business approach and people management.

Post-closing, our leadership team will be focused on not only preserving, but also enhancing the best aspects of both organizations' cultures. We recognize that the strength of our company lies in our employees, who are the cornerstone of our success. Our commitment is to continue fostering an environment that is both attractive and rewarding for all team members, current and future.

We plan to:

•Engage in Open Dialogue: We will facilitate open and honest conversations with employees at all levels. This dialogue is essential to understand and address any questions or suggestions regarding the eventual integration of our cultures and values.

•Unified Vision and Values: Our goal is to emerge from this expected merger with a unified vision and a set of values that encapsulate the strengths of both companies. We

see this as a unique opportunity to reinforce our commitment to excellence, innovation, and a positive workplace culture.

•Inclusive Decision-Making: We plan to involve representatives from various levels and departments in the decision-making processes related to cultural integration. This inclusive approach provides for the consideration of diverse perspectives.

We are enthusiastic about the opportunities this expected merger presents. Our aim is to ensure that our combined company will be a place of pride for all employees. We believe that by working together, respecting each other's cultures, and focusing on our shared values, we can create a stronger, more dynamic organization post-closing.

7. Are there any anticipated changes in operations or processes?

In the immediate future, our day-to-day operations will continue as usual. Our primary focus remains on delivering the high-quality service and performance that our customers, suppliers, and partners expect. It is business as usual, and we all play a vital role in maintaining the smooth operation of our company.

Like any dynamic business, we will continue to review and refine our operations to remain competitive and effective. This ongoing evolution is a standard part of how we operate and is not tied to the expected merger process.

As we move forward, we expect any planning for changes to our operations post-closing to be communicated clearly and in advance. We are committed to making the future transition as seamless as possible, and that any adjustments are made thoughtfully and with ample support for our teams.

We see the expected merger as an opportunity for growth and improvement. We encourage everyone to stay engaged, provide feedback, and be open to the evolving opportunities this expected merger will bring. Together, we will navigate this period of change while continuing to excel in our daily responsibilities.

8. How will we handle redundancies and restructuring?

As we proceed with the expected merger with IGT’s Global Gaming and PlayDigital businesses, it is natural to have questions about the impact on our organizational structure and our team. In the immediate future, we do not anticipate any changes until the merger closes. Our focus is on maintaining our current operations and ensuring that our day-to-day activities continue smoothly.

Mergers, by their nature, involve a process of planning and evaluation for post-closing integration. As we work through planning for and, after closing, implementing the integration with IGT’s businesses, we will be assessing how best to combine our resources and capabilities to create a stronger, more efficient organization post-closing.

At this stage, it is too early to speculate what changes might occur, including any potential restructuring or changes in staffing. We are committed to a thoughtful and strategic approach to integration planning, one that values the contributions of all our employees and seeks to capitalize on the strengths of both companies.

Should there be any plans for post-closing changes in the future, our priority will be to communicate these as early and as transparently as possible. We understand the importance of

clarity and certainty for all our employees, and we are committed to providing support and information throughout this process.

We also want to emphasize that we are focused on the well-being of our employees and the long-term health of our company. We value the hard work and dedication of our team, and we seek to navigate this period with respect and care for every member of our organization.

9. What communication strategy should we follow with our teams and external stakeholders?

As leaders, your role in the communication strategy during our expected merger with IGT is pivotal. We believe effective communication is indeed the cornerstone of a successful merger process. We are committed to keeping all our employees and external stakeholders informed and engaged. Recognizing the global spread of our teams and the challenges of synchronizing communications across different time zones, we have developed a comprehensive communication strategy.

10. How will performance and success be measured pre-closing?

As we proceed with the expected merger with IGT’s Global Gaming and PlayDigital businesses, it is essential to define how we will measure performance and success during this period. During the period it will be business as usual, focusing on our business objectives while planning for the expected merger.

•Adherence to 2024 Plans: Our leaders are expected to maintain their focus on the plans and goals established for 2024. Executing these plans effectively remains the top priority. We will measure success based on how well we continue to meet these pre-defined objectives and targets.

•Effective Team Management: Equally important is the need for leaders to stay connected with their teams, particularly regarding the expected merger's impact. We will assess how effectively our leaders are supporting their teams, addressing questions, and facilitating a smooth transition.

•Remote Employee Inclusion: Recognizing the challenges of engaging remote employees, special emphasis will be placed on inclusive and effective communication. Success in this area will be measured by the level of engagement and feedback from remote team members.

•Communication as a Priority: Clear, consistent, and transparent communication is vital during this time. The quality and effectiveness of communication, both within teams and across the organization, will be a key metric of success.

Our performance and success will be gauged by our ability to achieve our existing business goals, while also effectively managing the people aspect of the expected merger. This includes supporting our teams, especially those working remotely, and providing robust communication throughout the organization.

We are dedicated to providing the necessary resources and support to our leaders and teams to achieve these objectives. By working together with focus and dedication, we can navigate this transition successfully and emerge stronger as a unified company.

11. How will customer relationships and ongoing projects be managed during the expected merger?

As we move forward with the expected merger process with IGT’s businesses, our primary commitment is to the ongoing success and stability of our current projects and the relationships we have with our customers and their patrons. Given the typically extended timeline required to finalize such an expected merger in the gaming industry, our day-to-day operations, including all ongoing projects, will continue as planned.

12. How can we provide feedback about the expected merger process?

Effective communication is a cornerstone of a successful merger process, and we are fully committed to keeping all our employees informed and engaged. Recognizing the global spread of our teams and the challenges of synchronizing communications across different time zones, we have developed the previously noted comprehensive communication strategy to provide everyone with timely and relevant updates.

We recognize that clear and consistent communication is vital. Our aim is to ensure that every employee, regardless of their location or role, feels informed, involved, and supported throughout this process. We encourage everyone to actively participate in this dialogue as we move forward.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed Transaction”) between Everi Holdings Inc. (“Everi”), International Game Technology PLC (“IGT”), Ignite Rotate LLC (“Spinco”) and Ember Sub LLC (“Merger Sub”), Everi, IGT and Spinco will file relevant materials with the Securities and Exchange Commission (“SEC”). Everi will file a registration statement on Form S-4 that will include a joint proxy statement/prospectus relating to the Proposed Transaction, which will constitute a proxy statement and prospectus of Everi and a proxy statement of IGT. A definitive proxy statement/prospectus will be mailed to stockholders of Everi and a definitive proxy statement will be mailed to shareholders of IGT. INVESTORS AND SECURITY HOLDERS OF EVERI ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, AND INVESTORS AND SECURITY HOLDERS OF IGT ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EVERI, IGT AND SPINCO, AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Everi or IGT through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Everi will be available free of charge on Everi’s website at www.everi.com or by contacting Everi’s Investor Relations Department at Everi Holdings Inc., Investor Relations, 7250 S. Tenaya Way, Suite 100, Las Vegas, NV 89113. Copies of the documents filed with the SEC by IGT will be available free of charge on IGT’s website at www.igt.com or by contacting IGT’s Investor Relations Department at International Game Technology PLC, Investor Relations, 10 Memorial Boulevard, Providence, RI 02903.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities of Everi, IGT, Spinco or Merger Sub, or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Everi or IGT. However, Everi and IGT and each of their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the Proposed Transaction. Information about the directors and executive officers of Everi may be found in its most recent Annual Report on Form 10-K and in its most recent proxy statement for its annual meeting of stockholders, in each case as filed with the SEC. Information about the directors, executive officers and members of senior management of IGT is set forth in its most recent Annual Report on Form 20-F as filed with the

SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, related to Everi, IGT and the proposed spin-off of IGT’s Global Gaming and PlayDigital businesses (the “Spinco Business”), and the proposed acquisition of the Spinco Business by Everi. All statements other than statements of historical fact are forward-looking statements for purposes of federal and state securities laws. These forward-looking statements involve risks and uncertainties that could significantly affect the financial or operating results of Everi, IGT, the Spinco Business, or the combined company. These forward-looking statements may be identified by terms such as “anticipate,” “believe,” “foresee,” “estimate,” “expect,” “intend,” “plan,” “project,” “forecast,” “may,” “will,” “would,” “could” and “should” and the negative of these terms or other similar expressions. Forward-looking statements in this communication include, among other things, statements about the potential benefits and synergies of the Proposed Transaction, including enhancement of Everi’s industry position, increase of profitability, broadening of Everi’s products and service offerings, creation of additional value, growth opportunities for the combined company, and avenues of innovation; the integration process; leadership and governance of the combined company, future financial and operating results, goals, objectives and expectations; and the anticipated timing of closing of the Proposed Transaction. In addition, all statements that address operating performance, events or developments that Everi or IGT expects or anticipates will occur in the future — including statements relating to creating value for stakeholders, benefits of the Proposed Transaction to customers, employees, stakeholders and other constituents of the combined company and IGT, separating and integrating the companies, cost savings and the expected timetable for completing the Proposed Transaction — are forward-looking statements. These forward-looking statements involve substantial risks and uncertainties that could cause actual results, including the actual results of Everi, IGT, the Spinco Business, or the combined company, to differ materially from those expressed or implied by such statements. These risks and uncertainties include, among other things, risks related to the possibility that the conditions to the consummation of the Proposed Transaction will not be satisfied (including the failure to obtain necessary regulatory, stockholder and shareholder approvals or any necessary waivers, consents, or transfers, including for any required licenses or other agreements) in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits of the Proposed Transaction, including the possibility that Everi and IGT may be unable to achieve the expected benefits, synergies and operating efficiencies in connection with the Proposed Transaction within the expected timeframes or at all and to successfully separate and/or integrate the Spinco Business; the ability to retain key personnel; negative effects of the announcement or the consummation of the proposed acquisition on the market price of the capital stock of Everi and IGT and on Everi’s and IGT’s operating results; risks relating to the value of Everi’s shares to be issued in the Proposed Transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Proposed Transaction (the “Merger Agreement”); changes in the extent and characteristics of the common stockholders of Everi and ordinary shareholders of IGT and its effect pursuant to the Merger Agreement for the Proposed Transaction on the number of shares of Everi common stock issuable pursuant to the Proposed Transaction, magnitude of the dividend payable to Everi’s stockholders pursuant to the Proposed Transaction and the extent of indebtedness to be incurred by Everi in connection with the Proposed Transaction; significant transaction costs, fees, expenses and charges (including unknown liabilities and risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects); operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining employee, customer, or other business, contractual, or operational relationships following the Proposed Transaction announcement or closing of the Proposed Transaction); failure to consummate or delay in consummating the Proposed Transaction for any reason; risks related to competition in the gaming and lottery industry; issues and costs arising from the separation and integration of acquired companies and businesses and the timing and impact of accounting adjustments; risks related to the financing of the Proposed Transaction, Everi’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the Proposed Transaction; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies and other external factors that Everi and IGT cannot control; regulation and litigation matters relating to the Proposed Transaction or otherwise impacting Everi, IGT, Spinco, the combined company or the gaming industry generally; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business divestitures; effects on earnings of any significant impairment of goodwill or intangible assets; risks related to intellectual property, privacy matters, and cyber security (including losses and other consequences from failures, breaches, attacks, or disclosures involving information technology infrastructure and data); other business effects (including the effects of industry, market, economic, political, or regulatory conditions); and other risks and uncertainties, including, but not limited to, those described in Everi’s Annual Report on Form 10-K on file with the SEC and from time to time in other filed reports including Everi’s Quarterly Reports on Form 10-Q, and those described in IGT’s Annual Report on Form 20-F on file with the SEC and from time to time in other filed reports including IGT’s Current Reports on Form 6-K.

A further description of risks and uncertainties relating to Everi can be found in its most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and relating to IGT can be found in its most recent Annual Report on Form 20-F and Current Reports on Form 6-K, all of which are filed with the SEC and available at www.sec.gov.

Everi does not intend to update forward-looking statements as the result of new information or future events or developments, except as required by law.

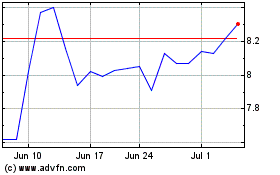

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

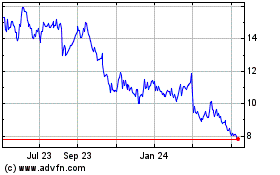

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024