false

0001616543

0001616543

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 29, 2024

| SENSEONICS

HOLDINGS, INC. |

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware |

|

001-37717 |

|

47-1210911 |

(State or Other

Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

20451 Seneca Meadows Parkway

Germantown, MD 20876-7005 |

| (Address of Principal Executive Office) (Zip Code) |

Registrant's telephone number, including

area code: (301) 515-7260

Not Applicable

Former name or former address, if changed

since last report

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2 below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

SENS |

NYSE American |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On February 29, 2024, Senseonics Holdings, Inc.

(the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023,

as well as information regarding a conference call to discuss these financial results and the Company’s recent corporate highlights

and outlook. This press release has been furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein

by this reference.

The information in this Current Report on Form 8-K,

including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section.

The information contained herein and in the accompanying exhibit is not incorporated by reference in any filing of the Company under the

Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general

incorporation language in any filings.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 29, 2024 |

SENSEONICS HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Rick Sullivan |

| |

Name: |

Rick Sullivan |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

SENSEONICS HOLDINGS, INC. REPORTS FOURTH QUARTER AND FULL YEAR

2023 FINANCIAL RESULTS

GERMANTOWN, MD, February 29, 2024 —Senseonics Holdings, Inc.

(NYSE American: SENS), a medical technology company focused on the development and manufacturing of long-term, implantable continuous

glucose monitoring (CGM) systems for people with diabetes, today reported financial results for the quarter and full year ended December 31,

2023.

Recent Highlights & Accomplishments:

| · | Generated revenue of $8.0 million in the fourth quarter of 2023, representing growth of 44% compared to the prior year period and

revenue of $22.4 million in the full year 2023, representing growth of 37% compared to 2022 |

| · | Brian Hansen appointed President of CGM at Ascensia Diabetes Care, leading the newly created independent business unit and its dedicated

resources and reporting directly to PHC Group, to strengthen Eversense commercial execution |

| · | Medicare expanded access to the Eversense E3 CGM System through implementation of Local Coverage Determinations by three Medicare

Administrative Contractors (MACs) providing coverage for implantable CGM for basal only patients |

| · | Completed the ENHANCE pivotal trial in preparation of the FDA regulatory filing for the 365-day Eversense system expected to be filed

in the coming weeks. |

| · | Drew an additional $10.0 million on the loan facility with Hercules Capital, Inc. further strengthening the balance

sheet |

“2023 was a successful year across the business

for Senseonics. We completed the ENHANCE clinical trial and data analysis to support the imminent FDA submission for our 365-day system,

secured expanded Eversense coverage from UnitedHealthcare and Medicare, and strengthened our balance sheet to provide additional financial

flexibility to continue executing our business plan,” said Tim Goodnow, PhD, President and Chief Executive Officer of Senseonics.

“We are excited about Ascensia’s appointment of Brian Hansen, an industry veteran in the diabetes space with a successful

track record of commercializing advanced technologies, who we believe can lead the acceleration of adoption of Eversense. We believe the

robust Eversense product innovation cycle, including expected approvals of the iCGM designation for the 180-day product and the 365-day

product and the anticipated commercial launch of the 365-day product in Q4, will offer substantial additional benefits to diabetes patients

and positions Senseonics for its next phase of growth.”

Fourth Quarter 2023 Results:

Total revenue for the fourth quarter of 2023 was

$8.0 million compared to $5.6 million for the fourth quarter of 2022. U.S. revenue was $6.1 million in the fourth quarter of 2023 compared

to $3.6 million in the prior year period, and revenue outside the U.S. was $1.9 million in the fourth quarter of 2023 compared to $2.0

million in the prior year period.

Fourth quarter 2023 gross profit of $1.1 million

increased from $0.6 million for the fourth quarter of 2022. The increase in gross margin was primarily driven by an increase in revenue

as volumes increased.

Fourth quarter 2023 sales and marketing and general

and administrative expenses decreased by $0.5 million year-over-year, to $7.3 million. The reduction was the result of efforts to manage

other general and administrative costs across the organization.

Fourth quarter 2023 research and development expenses

decreased by $0.9 million year-over-year, to $10.7 million. The decrease was primarily due to the completion of the ENHANCE pivotal trial.

Net loss was $17.2 million, or $0.03 per share,

in the fourth quarter of 2023 compared to net income of $11.6 million, or $0.02 per share, in the fourth quarter of 2022. Net income decreased

by $28.8 million due to the accounting for embedded derivatives, fair value adjustments and the exchange of a portion of the 2025 notes.

Full Year 2023 Results:

Total revenue for 2023 was $22.4 million compared to $16.4 million

in 2022. U.S. revenue was $14.1 million in 2023 compared to $7.5 million in the prior year, and revenue outside the U.S. was $8.3 million

in 2023 compared to $8.9 million in the prior year period.

Gross profit for 2023 was $3.1 million, an increase from $2.7 million

in 2022. The increase in gross margin was primarily driven by an increase to revenue as volumes increased.

Sales and marketing and general and administrative expenses for 2023

decreased by $1.7 million year-over-year, to $29.9 million. The reduction was the result of efforts to manage other general and administrative

costs across the organization.

Research and development expenses for 2023 increased

by $9.0 million year-over-year, to $48.8 million. The increase was primarily due to investments in our product pipeline for development

and clinical trials of next generation technologies.

Net loss was $60.4 million, or $0.11 per share,

in 2023 compared to net income of $142.1 million, or $0.30 per share, in 2022. Net income decreased by $202.5 million due to the accounting

for embedded derivatives, fair value adjustments and the exchange of a portion of the 2025 notes.

Cash, cash equivalents, short

and long-term investments were $109.4 million and outstanding indebtedness was $46.1

million as of December 31, 2023.

First Half 2024 Financial Outlook

Senseonics expects first half of 2024 global net

revenue to be nearly $10 million, representing growth of approximately 16% compared to the first half of 2023. Senseonics plans to provide

its full year 2024 financial outlook in the second quarter following a comprehensive analysis of the current commercial

dynamics by the new leadership at the Ascensia Diabetes Care CGM business unit and an updated view on product approval and launch timing and expectations.

Conference Call and Webcast Information:

Company management will host a conference call

at 4:30 pm (Eastern Time) today, February 29, 2024, to discuss these financial results and recent business developments. This conference

call can be accessed live by telephone or through Senseonics' website.

|

Live Teleconference Information:

Dial in number: 888-317-6003

Entry Number: 3711982

International dial in: 412-317-6061 |

Live Webcast Information:

Visit http://www.senseonics.com and

select the "Investor Relations" section |

A replay of the call can be accessed on Senseonics' website http://www.senseonics.com under

"Investor Relations."

About Senseonics

Senseonics Holdings, Inc. ("Senseonics")

is a medical technology company focused on the development and manufacturing of glucose monitoring products designed to transform lives

in the global diabetes community with differentiated, long-term implantable glucose management technology. Senseonics' CGM systems, Eversense®,

Eversense® XL and Eversense® E3 include a small sensor inserted completely under the skin that communicates

with a smart transmitter worn over the sensor. The glucose data are automatically sent every 5 minutes to a mobile app on the user's

smartphone.

Forward Looking Statements

Any statements in this press

release about future expectations, plans and prospects for Senseonics, including the revenue projections under "First Half 2024

Financial Outlook," statements about the changes in leadership within the Ascensia’s CGM business unit, potential strengthened

Eversense® commercial execution, statements regarding increasing patient access and patient and provider adoption, statements

regarding Senseonics’ product pipeline, expected regulatory approvals and timing of the potential commercial launch of the 365-day

product, statements regarding strengthening the Eversense® brand, and other statements containing the words "believe,"

“expect,” “intend,” “may,” “projects,” “will,” “planned,” and

similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995.

Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors,

including: uncertainties inherent in the execution of Ascensia’s independent business unit for the commercialization of Eversense®

E3 CGM system and other commercial initiatives, uncertainties in insurer, regulatory and administrative processes and decisions,

uncertainties inherent in the development and registration of new technology, uncertainties relating to the current economic environment

and such other factors as are set forth in the risk factors detailed in Senseonics’ Annual Report on Form 10-K for the year

ended December 31, 2023, the Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 and Senseonics’

other filings with the SEC under the heading “Risk Factors.” In addition, the forward-looking statements included in this

press release represent Senseonics’ views as of the date hereof. Senseonics anticipates that subsequent events and developments

will cause Senseonics’ views to change. However, while Senseonics may elect to update these forward-looking statements at some

point in the future, Senseonics specifically disclaims any obligation to do so except as required by law. These forward-looking statements

should not be relied upon as representing Senseonics’ views as of any date subsequent to the date hereof.

Investor Contact

Philip Taylor

Gilmartin Group

415-937-5406

Investors@senseonics.com

Senseonics Holdings, Inc.

Consolidated Balance Sheets

(in thousands, except

for share and per share data)

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 75,709 | | |

$ | 35,793 | |

| Short term investments, net | |

| 33,747 | | |

| 108,222 | |

| Accounts receivable, net | |

| 808 | | |

| 127 | |

| Accounts receivable, net - related parties | |

| 3,724 | | |

| 2,324 | |

| Inventory, net | |

| 8,776 | | |

| 7,306 | |

| Prepaid expenses and other current assets | |

| 7,266 | | |

| 7,428 | |

| Total current assets | |

| 130,030 | | |

| 161,200 | |

| | |

| | | |

| | |

| Deposits and other assets | |

| 7,006 | | |

| 3,108 | |

| Long term investments, net | |

| — | | |

| 12,253 | |

| Property and equipment, net | |

| 1,184 | | |

| 1,112 | |

| Total assets | |

$ | 138,220 | | |

$ | 177,673 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity (Deficit) | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,568 | | |

$ | 419 | |

| Accrued expenses and other current liabilities | |

| 11,744 | | |

| 14,616 | |

| Accrued expenses and other current liabilities, related parties | |

| 945 | | |

| 837 | |

| Note payable, current portion, net | |

| — | | |

| 15,579 | |

| Derivative liability, current portion | |

| — | | |

| 20 | |

| Total current liabilities | |

| 17,257 | | |

| 31,471 | |

| | |

| | | |

| | |

| Long-term debt and notes payables, net | |

| 41,195 | | |

| 56,383 | |

| Derivative liabilities | |

| 102 | | |

| 52,050 | |

| Other liabilities | |

| 6,214 | | |

| 2,689 | |

| Total liabilities | |

| 64,768 | | |

| 142,593 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Preferred stock and additional paid-in-capital, subject to possible redemption: $0.001 par value per share; 12,000 shares and 12,000 shares issued and outstanding as of December 31, 2023 and December 31, 2022 | |

| 37,656 | | |

| 37,656 | |

| Total temporary equity | |

| 37,656 | | |

| 37,656 | |

| | |

| | | |

| | |

| Stockholders’ equity (deficit): | |

| | | |

| | |

| Common stock, $0.001 par value per share; 900,000,000 shares authorized as of December 31, 2023 and December 31, 2022; 530,364,237 shares and 479,637,138 shares issued and outstanding as of December 31, 2023 and December 31, 2022 | |

| 530 | | |

| 480 | |

| Additional paid-in capital | |

| 904,535 | | |

| 806,488 | |

| Accumulated other comprehensive loss | |

| (11 | ) | |

| (678 | ) |

| Accumulated deficit | |

| (869,258 | ) | |

| (808,866 | ) |

| Total stockholders' equity (deficit) | |

| 35,796 | | |

| (2,576 | ) |

| Total liabilities, temporary equity and

stockholders’ equity (deficit) | |

$ | 138,220 | | |

$ | 177,673 | |

Senseonics Holdings, Inc.

Consolidated Statements of Operations and Comprehensive

(Loss) Income

(in thousands, except for share and per share

data)

| | |

Years Ended | |

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| Revenue, net | |

$ | 1,655 | | |

$ | 656 | |

| Revenue, net - related parties | |

| 20,735 | | |

| 15,733 | |

| Total revenue | |

| 22,390 | | |

| 16,389 | |

| Cost of sales | |

| 19,299 | | |

| 13,663 | |

| Gross profit | |

| 3,091 | | |

| 2,726 | |

| | |

| | | |

| | |

| Expenses: | |

| | | |

| | |

| Research and development expenses | |

| 48,752 | | |

| 39,719 | |

| Selling, general and administrative expenses | |

| 29,942 | | |

| 31,634 | |

| Operating loss | |

| (75,603 | ) | |

| (68,627 | ) |

| Other income (expense), net: | |

| | | |

| | |

| Interest income | |

| 5,362 | | |

| 1,824 | |

| Gain (Loss) on fair value adjustment of option | |

| — | | |

| 43,745 | |

| Exchange related gain, net | |

| 14,109 | | |

| — | |

| Gain (Loss) on extinguishment of debt and option | |

| — | | |

| (101 | ) |

| Interest expense | |

| (11,110 | ) | |

| (18,703 | ) |

| Gain (Loss) on change in fair value of derivatives | |

| 6,648 | | |

| 184,221 | |

| Impairment cost | |

| — | | |

| (138 | ) |

| Other income (expense) | |

| 202 | | |

| (102 | ) |

| Total other income, net | |

| 15,211 | | |

| 210,746 | |

| | |

| | | |

| | |

| Net (Loss) Income | |

| (60,392 | ) | |

| 142,119 | |

| Other comprehensive income (loss) | |

| | | |

| — | |

| Unrealized gain (loss) on marketable securities | |

| 667 | | |

| (466 | ) |

| Total other comprehensive gain (loss) | |

| 667 | | |

| (466 | ) |

| Total comprehensive (loss) income | |

$ | (59,725 | ) | |

$ | 141,653 | |

| | |

| | | |

| | |

| Basic net (loss) income per common share | |

$ | (0.11 | ) | |

$ | 0.30 | |

| Basic weighted-average shares outstanding | |

| 567,974,492 | | |

| 467,952,475 | |

| | |

| | | |

| | |

| Diluted net loss per common share | |

$ | (0.11 | ) | |

$ | (0.11 | ) |

| Diluted weighted-average shares outstanding | |

| 567,974,492 | | |

| 618,205,605 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

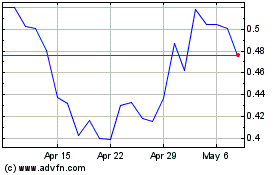

Senseonics (AMEX:SENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Senseonics (AMEX:SENS)

Historical Stock Chart

From Apr 2023 to Apr 2024