FALSE0001117480CHIMERIX INC00011174802024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 29, 2024

Chimerix, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35867 | | 33-0903395 |

| (State or other jurisdiction of | | (Commission File Number) | | (IRS Employer Identification No.) |

| incorporation) | | | | |

| | | | | | | | |

2505 Meridian Parkway, Suite 100 Durham, NC | | 27713 |

| (Address of principal executive offices) | | (Zip Code) |

(919) 806-1074

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | CMRX | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On February 29, 2024, Chimerix, Inc. (the “Company”) announced our financial results for the fourth quarter and full year ended December 31, 2023 in the press release attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 2.02 and the attached Exhibit 99.1 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 2.02 and the attached Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure.

On February 29, 2024, the Company made available an updated corporate presentation (the “Presentation”) that the Company intends to use, in whole or in part, in meetings with investors, analysts and others. The Presentation can be accessed through the “Investors” section of the Company’s website. A copy of the Presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this Item 7.01 and the attached Exhibit 99.2 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 7.01 and the attached Exhibit 99.2 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | |

| Date: February 29, 2024 | | Chimerix, Inc. |

| | |

| | | By: | /s/ Michelle LaSpaluto |

| | | Name: | Michelle LaSpaluto |

| | | Title: | Chief Financial Officer |

Chimerix Reports Fourth Quarter and Year End 2023 Financial Results and Provides Operational Update

– ONC201 ACTION Study Progressing; Reiterate Interim OS Data Expected in 2025, Final OS Data Expected in 2026 –

– Phase 2 ONC201 Data Published in Peer-Reviewed Journal of Clinical Oncology –

– $204 Million in Cash and Equivalents at December 31, 2023 –

– Conference Call at 8:30 a.m. ET Today –

DURHAM, N.C., February 29, 2024 (GLOBE NEWSWIRE) -- Chimerix (NASDAQ:CMRX), a biopharmaceutical company whose mission it is to develop medicines that meaningfully improve and extend the lives of patients facing deadly diseases, today reported financial results for the fourth quarter and full-year ended December 31, 2023 and provided an operational update.

“Following strong clinical development in 2023, we remain very focused on advancing the ONC201 ACTION study, completing ONC206 dose escalation this year and strengthening our executive team as we prepare for potential commercialization of ONC201” said Mike Andriole, Chief Executive Officer of Chimerix. “We are making good progress enrolling our global Phase 3 ACTION study and are excited about the prospect of having interim overall survival data next year. In addition, we are pleased to share that the ONC201 Phase 2 data was recently published in the Journal of Clinical Oncology which further elucidates key characteristics of response and detailed patient-level data.”

“During the fourth quarter, we were delighted to strengthen our Board of Directors with the addition of Lisa Decker, Ph.D., as well as strengthen the management team with the promotion of Michelle LaSpaluto to Chief Financial Officer and the additions of Tom Riga as Chief Operating and Commercial Officer and Pablo Lee, MD, as Vice President of Medical Affairs. We are confident their collective expertise will be invaluable assets to Chimerix as we seek to maximize our future growth potential for patients and shareholders,” added Mr. Andriole.

ONC201

Journal of Clinical Oncology Publication

In February 2024, “ONC201 (dordaviprone) in Recurrent H3 K27M-mutant Diffuse Midline Glioma,” was published in the Journal of Clinical Oncology (JCO), a peer reviewed journal of the American Society of Clinical Oncology (ASCO). The manuscript reports in detail the results of 50 patients with recurrent H3 K27M-DMG treated with monotherapy ONC201 who were evaluable for objective response by Response Assessment in Neuro-Oncology (RANO) high grade glioma (HGG) criteria. ONC201 demonstrated a median overall survival (mOS) of 13.7 months (95% CI: 8.0 - 20.3), with an overall two-year rate of survival of 35% (95% CI: 21-49) from the start of ONC201 treatment post-recurrence. Chimerix previously conducted a natural disease history study (n=43) in the recurrent setting evaluating patients who did not receive ONC201 which showed a mOS of 5.1 months (95% CI: 3.9 - 7.7) with an overall two-year survival rate of 11% (95% CI 3.3-24.2). The top-line data from this JCO publication were previously disclosed by Chimerix. The journal can be accessed at https://ascopubs.org/doi/10.1200/jco.23.01134.

The Phase 3 ACTION trial is currently enrolling patients at over 130 sites in 13 countries. The trial enrolls patients shortly after completion of front-line radiation therapy that is the standard of care. The study is designed to enroll 450 patients randomized 1:1:1 to receive ONC201 at one of two dosing frequencies or

placebo. Participants are randomized to receive 625mg of ONC201 once per week (the Phase 2 dosing regimen), 625mg twice per week on two consecutive days or placebo. The dose will be scaled by body weight for patients <52.5kg. For more information, please visit clinicaltrials.gov.

ONC206

ONC206 is a second generation ClpP agonist and DRD2 antagonist that has demonstrated monotherapy anti-cancer activity in pre-clinical models in primary CNS tumors and solid tumors outside of the CNS. Phase I dose escalation trials continue at the National Institutes of Health (NIH) and the Pacific Pediatric Neuro-Oncology Consortium (PNOC) in adult and pediatric CNS tumor patients, respectively. To date, ONC206 has been generally well tolerated with no dose limiting toxicities. The dose escalation trials are currently dosing at more frequent dose schedules, which are expected to increase the duration of therapeutic exposure. Chimerix expects to report preliminary safety and pharmacokinetic data from these trials beginning in mid-2024.

Fourth Quarter 2023 Financial Results

Chimerix's balance sheet at December 31, 2023 included $204.5 million of capital available to fund operations, no debt, and approximately 88.9 million outstanding shares of common stock.

Chimerix reported a net loss of $18.2 million, or $0.20 per basic and diluted share, for the fourth quarter of 2023, compared to a net loss of $21.0 million, or $0.24 per basic and diluted share for the fourth quarter of 2022.

Research and development expenses decreased to $15.6 million for the three-month period ended December 31, 2023, compared to $19.3 million for the same period in 2022. This decrease was primarily driven by one-time costs associated with a reduction in force related to the TEMBEXA divestiture in the comparable 2022 period.

General and administrative expenses decreased to $5.2 million for the fourth quarter of 2023, compared to $5.3 million for the same period in 2022.

Full Year 2023 Financial Results

Chimerix reported a net loss of $82.1 million, or $0.93 per basic and diluted share, for the year ended December 31, 2023. For the year ended December 31, 2022, Chimerix recorded net income of $172.2 million, or $1.97 per basic and $1.94 per diluted share. The decrease was primarily driven by the gain on sale of TEMBEXA to Emergent BioSolutions in 2022.

Revenues for 2023 decreased to $0.3 million, compared to $33.8 million in 2022. The decrease was primarily related to deliveries under international TEMBEXA procurement agreements in the comparable 2022 period.

Research and development expenses decreased to $68.8 million for the year ended December 31, 2023, compared to $71.6 million for the year ended December 31, 2022.

General and administrative expenses increased to $24.6 million for the year ended December 31, 2023, compared to $22.1 million for the year ended December 31, 2022.

Conference Call and Webcast

Chimerix will host a conference call and live audio webcast to discuss fourth quarter and full-year 2023 financial results and provide a business update today at 8:30 a.m. ET. To access the live conference call, please dial 646-307-1963 (domestic) or 800-715-9871 (international) at least five minutes prior to the start time and refer to conference ID 6933453. A live audio webcast of the call will also be available on the

Investors section of Chimerix’s website, www.chimerix.com. An archived webcast will be available on the Chimerix website approximately two hours after the event.

About Chimerix

Chimerix is a biopharmaceutical company with a mission to develop medicines that meaningfully improve and extend the lives of patients facing deadly diseases. The Company’s most advanced clinical-stage development program, ONC201, is in development for H3 K27M-mutant glioma.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Forward-looking statements include those relating to, among other things, enrollment and timing of data for the Phase 3 ACTION study, the results of dose escalation trials of ONC206, and the impact of recent changes to the Board of Directors and management team. Among the factors and risks that could cause actual results to differ materially from those indicated in the forward-looking statements are risks related to the timing, completion and outcome of the Phase 3 ACTION study of ONC201; risks associated with repeating positive results obtained in prior preclinical or clinical studies in future studies; risks related to the clinical development of ONC206; and additional risks set forth in the Company's filings with the Securities and Exchange Commission. These forward-looking statements represent the Company's judgment as of the date of this release. The Company disclaims, however, any intent or obligation to update these forward-looking statements.

CONTACTS:

Will O’Connor

Stern Investor Relations

212-362-1200

Will@sternir.com

CHIMERIX, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 27,661 | | | $ | 25,842 | |

| Short-term investments, available-for-sale | 155,174 | | | 191,492 | |

| Accounts receivable | 4 | | | 1,040 | |

| | | |

| Prepaid expenses and other current assets | 6,271 | | | 9,764 | |

| | | |

| Total current assets | 189,110 | | | 228,138 | |

| Long-term investments | 21,657 | | | 48,626 | |

| Property and equipment, net of accumulated depreciation | 224 | | | 227 | |

| Operating lease right-of-use assets | 1,482 | | | 1,964 | |

| Other long-term assets | 301 | | | 386 | |

| | | |

| Total assets | $ | 212,774 | | | $ | 279,341 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,851 | | | $ | 3,034 | |

| Accrued liabilities | 15,592 | | | 17,381 | |

| | | |

| Total current liabilities | 18,443 | | | 20,415 | |

| Line of credit commitment fee | 125 | | | 250 | |

| Lease-related obligations | 1,177 | | | 1,819 | |

| Total liabilities | 19,745 | | | 22,484 | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized at December 31, 2023 and 2022; no shares issued and outstanding as of December 31, 2023 and 2022 | — | | | — | |

| Common stock, $0.001 par value; 200,000,000 shares authorized at December 31, 2023 and 2022; 88,929,300 and 88,054,127 shares issued and outstanding at December 31, 2023 and 2022, respectively | 89 | | | 88 | |

| Additional paid-in capital | 988,457 | | | 970,535 | |

| Accumulated other comprehensive gain (loss), net | 7 | | | (337) | |

| Accumulated deficit | (795,524) | | | (713,429) | |

| Total stockholders’ equity | 193,029 | | | 256,857 | |

| Total liabilities and stockholders’ equity | $ | 212,774 | | | $ | 279,341 | |

CHIMERIX, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Procurement revenue | $ | — | | | $ | — | | | $ | — | | | $ | 31,971 | |

| Contract and grant revenue | 4 | | | 439 | | | 275 | | | 942 | |

| Licensing revenue | — | | | — | | | 49 | | | 536 | |

| Royalty revenue | — | | | 375 | | | — | | | 375 | |

| Total revenues | 4 | | | 814 | | | 324 | | | 33,824 | |

| Cost of goods sold | — | | | — | | | — | | | 447 | |

| Gross Profit | 4 | | | 814 | | | 324 | | | 33,377 | |

| Operating expenses: | | | | | | | |

| Research and development | 15,642 | | | 19,281 | | | 68,788 | | | 71,631 | |

| General and administrative | 5,172 | | | 5,347 | | | 24,601 | | | 22,132 | |

| | | | | | | |

| Total operating expenses | 20,814 | | | 24,628 | | | 93,389 | | | 93,763 | |

| Loss from operations | (20,810) | | | (23,814) | | | (93,065) | | | (60,386) | |

| Other income: | | | | | | | |

| | | | | | | |

| Interest income and other, net | 2,649 | | | 2,737 | | | 10,970 | | | 2,919 | |

| Gain on sale of business, net | — | | | — | | | — | | | 229,670 | |

| (Loss) income before income taxes | (18,161) | | | (21,077) | | | (82,095) | | | 172,203 | |

| Income tax expense | — | | | (117) | | | — | | | 36 | |

| Net (loss) income | (18,161) | | | (20,960) | | | (82,095) | | | 172,167 | |

| Other comprehensive income (loss): | | | | | | | |

| Unrealized gain (loss) on investments, net | 632 | | | (300) | | | 344 | | | (316) | |

| Comprehensive (loss) income | $ | (17,529) | | | $ | (21,260) | | | $ | (81,751) | | | $ | 171,851 | |

| Per share information: | | | | | | | |

| Net (loss) income, basic | $ | (0.20) | | | $ | (0.24) | | | $ | (0.93) | | | $ | 1.97 | |

| Net (loss) income, diluted | (0.20) | | | (0.24) | | | (0.93) | | | 1.94 | |

| | | | | | | |

| Weighted-average shares outstanding, basic | 88,910,300 | | | 88,049,138 | | | 88,604,026 | | | 87,555,110 | |

| Weighted-average shares outstanding, diluted | 88,910,300 | | | 88,049,138 | | | 88,604,026 | | | 88,776,147 | |

Chimerix Corporate Presentation February 29, 2024

2 Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Forward-looking statements include those relating to, among other things, the enrollment and timing of data for the Phase 3 ACTION study, the expected results of Phase 3 ACTION study of ONC201 and dose escalation trials of ONC206, our ability to successfully commercialize our current and future product candidates, the potential for royalty and milestone revenue from strategic collaborations, and projections regarding funding and timing of future data readouts. Among the factors and risks that could cause actual results to differ materially from those indicated in the forward-looking statements are risks related to the timing, completion and outcome of the Phase 3 ACTION study of ONC201; risks associated with repeating positive results obtained in prior preclinical or clinical studies in future studies; risks related to the clinical development of ONC206; and additional risks set forth in the Company's filings with the Securities and Exchange Commission. These forward-looking statements represent the Company's judgment as of the date of this release. The Company disclaims, however, any intent or obligation to update these forward-looking statements.

3 Investment highlights and key catalysts ONC201 Ph 3 trial enrolling - interim OS data expected in 2025, final OS expected in 2026 First-Line H3 K27M-mutant diffuse glioma – The ACTION Study No approved therapies targeting H3 K27M diffuse glioma, an area of high unmet medical need First in class mechanism of action with clinical validation Patent protection thru 2037 (potential additional US patent term extension) ONC206 in dose escalation Investigator reported response in non-H3 K27M mutated recurrent glioblastoma patient Dose escalation on track for completion beginning in mid 2024 $204 million in capital to fund operations as of December 31, 2023, no debt Early-stage pipeline leverages external capital Pre-clinical programs potential to advance to clinic or partner (ONC212, CMX521) Robust business development search and evaluation process Ph 3 ACTION study actively enrolling Significant commercial potential Corporate capability and financial flexibility

4 Regulatory Approval RegistrationalPhase 2Phase 1PreclinicalProgram Deep pipeline across all development stages ONC201 (dordaviprone) H3 K27M-mutant glioma (orphan drug,1 fast track2 and rare pediatric disease designations3) IITs- signal finding, multiple oncology indications/combinations CMX521 SARS-CoV-2 CNS4 tumors ONC206 IND-enabling studies ONC212 TEMBEXA® transacted with Emergent BioSolutions Smallpox (orphan drug designation) 1 Malignant glioma 2 Adult recurrent H3 K27M-mutant high-grade glioma 3 H3 K27M-mutant glioma 4. Central Nervous System Non-CNS4 tumors

ONC201 (dordaviprone) Phase 2 Data Analysis

6 • H3 K27M mutation is predominantly found among diffuse midline gliomas (DMGs) in young adults and children • Frontline radiotherapy remains standard of care with transient benefit; resection often not feasible • DMGs harboring the H3 K27M mutation are WHO Grade IV; historically invariably lethal • Consistently longer OS of ONC201-treated H3 K27M DMG patients across: - Diverse external controls (historical, trials) - Sensitivity analysis (early event censoring) - Isolated tumor locations (thalamus, brainstem) ONC201 data suggests potential to address high unmet need ONC201 Phase 2 (n=50) Natural Disease History4 (n=43) 13.7 (8-20.3) 5.1 (3.9-7.7) Median OS, mo (95% CI) 57% (41-70) 23.6% (11.7-37.9) OS @ 12mo (95% CI) 35% (21-49) 11.1% (3.3-24.2) OS @ 24mo (95% CI) Histone H3 Mutations in CNS Tumors1 Recurrent H3 K27M DMG3 1 Lulla RR et al. Sci Adv. 2016;2(3):e1501354 2 Koschmann, Carl et al, “Clinical efficacy of ONC201 in H3 K27M-mutant diffuse midline glioma is driven by disruption of integrated metabolic and epigenetic pathways”, Cancer Discovery, Aug 16, 2023 3 In company sponsored studies 4 The median OS was 5.1 months for the subset of patients with H3 K27M-mutant diffuse glioma excluding DIPG, CSF dissemination, spinal or leptomeningeal disease (N=12), OS at 12 mos was 25.0%, OS at 24 mos was 16.7% Frontline H3 K27M DMG2

7 • ONC201 monotherapy exhibited durable, clinically meaningful efficacy in recurrent H3 K27M-mutant DMG - Overall Response Rate (ORR) of 30% (95% CI: 18 - 45%) by RANO HGG and/or LGG dual reader BICR - RANO-HGG criteria assessed by dual reader BICR • ORR 20% (95% CI: 10 – 34%) • Median Duration of Response (DOR) 11.2 months (95% CI: 3.8 – not reached) • Median time to response 8.3 months (range 1.9 – 15.9) • Disease control rate 40% (95% CI: 26 – 55%) • PFS at 6 months 35% (95% CI: 21 – 49%); PFS at 12 months 30% (95% CI: 17 – 44%) - RANO-LGG criteria assessed by dual reader BICR • ORR 26% (95% CI: 15 – 40%) - Overall survival • 12 months: 57% (95% CI:41 – 70%) • 24 months: 35% (95% CI: 21 – 49%) • Improvements observed in performance status and reduction in corticosteroid use • All Serious Adverse Events considered not related to ONC201 by sponsor Phase 2 efficacy for ONC201 in recurrent H3 K27M DMG

8 • Strict selection criteria to ensure responses attributable to single agent treatment • Responses require both imaging and clinical criteria • Dual reader blinded independent central review (BICR) • Growing consensus that assessment of enhancing and non-enhancing disease (RANO- HGG and RANO-LGG criteria) is needed for diffuse midline glioma ONC201 waterfall plot – 30% RANO HGG / LGG response RANO HGG (enhancing) • 20% response • 40% disease control RANO LGG (non-enhancing) • 26% response • 42% disease control ONC201 Ph 2 Efficacy Analysis by BICR in Recurrent H3 K27M-mutant Diffuse Midline Glioma Change > 100%, PR=partial response, MR=minor response, SD=stable disease, NE=not evaluable, PD=progressive disease Arrillaga-Romany, et al, Journal of Clinical Oncology, Feb 2024

9 Clinically meaningful and durable RANO-HGG responses SPD=sum of products of perpendicular diameters (target enhancing lesions per BICR) Only patients with measurable target enhancing lesions by BICR at baseline and with post-baseline evaluations are included. Three patients did not have on-treatment monotherapy MRIs available for BICR; one patient censored prior to first on-treatment MRI ; one patient did not have measurable target lesion. 11.2 months (3.8 – not reached) Duration of response, median (95% CI) 8.3 months (1.9 – 15.9) Time to response, median (range) ONC201 Phase 2 Efficacy Analysis by BICR in Recurrent H3 K27M-mutant Diffuse Midline Glioma

10 Related TEAEsTreatment-related Adverse Events, Integrated Safety Data Set, (N=422 glioma patients) 1 Grade > 3All grades 11.6%56.2%Any Treatment-related AE 2.1%20.1%Fatigue 015.4%Nausea 0.9%11.1%Vomiting 1.9%9.2%Lymphocyte count decreased 1.4%8.5%ALT increased 07.3%Headache 0.2%7.1%White blood cell count decreased 05.7%Decreased appetite 05.2%Hypophosphataemia ONC201 safety 1. Based on available data from October 2023 Investigator brochure Healthy Adult Dose Escalation Study1 Incidence of ONC201-Related Adverse Events (AE) Treatment-related Adverse Events in > 5% Glioma Patients • Treatment-related AEs were generally Grade 1 and transient across the clinical pharmacology program. 625 mg N=45 375 mg N=15 125 mg N=33 51.0%20.0%36.0%Any treatment-related AE 51.0%20.0%36.0%Grade 1 000Grade 2 000Grade 3-5

ONC201 Phase 3 ACTION Study Summary

12 Now enrolling, a randomized, double-blind, placebo-controlled, multicenter international study in 450 newly diagnosed diffuse glioma patients whose tumor harbors an H3 K27M-mutation. Pivotal Phase 3 ACTION trial design 1. Excludes DIPG and spinal tumors • H3 K27M-mutant diffuse glioma1 • Radiation therapy recently completed • KPS > 70 at time of randomization • Stable steroid dose • No prior bevacizumab • No temozolomide within three weeks ONC201 twice weekly (625mg ONC201 day 1 + day 2) ONC201 weekly (625mg ONC201 day 1 + placebo day 2) Placebo (Placebo day 1 + placebo day 2) • Primary: Overall Survival • PFS (alpha-allocated) • Secondary: steroid response, performance status, QoL, neurologic function Key Patient Inclusion EndpointsTreatment

13 Design provides multiple paths for success Interim data expected in 2025 and final data in 2026 Second OS Interim • ~246 events • Success at HR~0.64 Final OS • ~327 events • Success at HR~0.73 PFS by RANO HGG(2) • ~286 events • Success at HR~0.68 1. Overall Survival (OS) 2. Progression-free survival (PFS). PFS may provide valuable data for regulatory discussions. 3. Hazard Ratio Independent comparisons for each ONC201 arm versus control will be made at each timepoint. Powering assumptions 0.65 expected HR for OS and 0.60 expected HR for PFS First OS(1) Interim • ~164 events • Success at HR(3)~0.52

ONC201 Market Opportunity Assessment

15 (1) Ostrom QT, et al. Neuro Oncol. 2022;24(Suppl 5):v1-v95; (2) Patient numbers and percentages are estimates (weighted avg per sample size) derived from a review of the literature from (2012-2023): (Aihara K, et al. Neuro Oncol. 2014;16(1):140-6; Feng J, et al. Hum Pathol. 2015;46(11):1626-32; Solomon DA, et al. Brain Pathol. 2016;26(5):569-80;Ryall S, et al. Acta Neuropathol Commun. 2016;4(1):93; Aboian MS, et al. AJNR Am J Neuroradiol. 2017;38(4):795-800; Wang L, et al. Hum Pathol. 2018;78:89-96; Castel D, et al. Acta Neuropathol Commun. 2018;6(1):117; Karremann M, et al. Neuro Oncol. 2018;20(1):123-131; Aboian MS, et al. AJNR Am J Neuroradiol. 2019;40(11):1804-1810; Dorfer C, et al. Acta Neurochir (Wien). 2021;163(7):2025-2035; Sievers P, et al. Neuro Oncol. 2021;23(1):34-43; Mackay A, et al. Cancer Cell. 2017;32(4):520-537 e5; Huang T, et al. Oncotarget. 2018;9(98):37112-37124; Schreck KC, et al. J Neurooncol. 2019;143(1):87-93; Chiba K, et al. World Neurosurg. 2020;134:e530-e539; Mukasa A, et al. Neuro Oncol. 2014;16(Suppl 3):iii9-iii10; Castel D, et al. Acta Neuropathol. 2015;130(6):815-27; Khuong-Quang DA, et al. Acta Neuropathol. 2012;124(3):439-47; Roux A, et al. Neuro Oncol. 2020;22(8):1190-1202; Giagnacovo M, et al. Childs Nerv Syst. 2020;36(4):697-704; Wu G, et al. Nat Genet. 2014;46(5):444-450; Wu G, et al. Nat Genet. 2012;44(3):251-3; Taylor KR, et al. Nat Genet. 2014;46(5):457-461; Saratsis AM, et al. Acta Neuropathol. 2014;127(6):881-95; Erker C, et al. Neuro Oncol. 2022;24(1):141-152; Buczkowicz P, et al. Acta Neuropathol. 2014;128(4):573-81; Daoud EV, et al. J Neuropathol Exp Neurol. 2018;77(4):302-311; Chai RC, et al. Acta Neuropathol Commun. 2020;8(1):40; Yi S, et al. Neurosurgery. 2019;84(5):1072-1081; Gessi M, et al. Acta Neuropathol. 2015;130(3):435-7; Alvi MA, et al. Mod Pathol. 2019;32(9):1236-1243; Crotty EE, et al. J Neurooncol. 2020;148(3):607-617; Dono A, et al. J Clin Neurosci. 2020;82(Pt A):1-8; Akinduro OO, et al. J Neurosurg Spine. 2021;35(6):834-843; Nakata S, et al. Brain Tumor Pathol. 2017;34(3):113-119; Nomura M, et al. Acta Neuropathol. 2017;134(6):941-956; Eschbacher KL, et al. Am J Surg Pathol. 2021;45(8):1082-1090; D'Amico RS, et al. J Neurooncol. 2018;140(1):63-73; Korshunov A, et al. Acta Neuropathol. 2015;129(5):669-78; Aibaidula A, et al. Neuro Oncol. 2017;19(10):1327-1337.) • ~40% of 4,000+ midline gliomas are expected to harbor the H3 K27M mutation2 • ~2% of 17,000+ non-midline gliomas are expected to harbor the H3 K27M mutation2 • Each year it is estimated that ~2,000 patients are affected by H3 K27M-mutant glioma in the U.S; ~5,000 patients in the top seven global markets (by extrapolation of the estimated US incidence rate to the top seven markets) • No approved therapies specifically for H3 K27M mutant glioma Thalamic 220 patients (52%) Pineal 40 patients (20%) Cerebellum 240 patients (22%) Brainstem (excluding pons) 270 patients (50%) Non-midline ~350 patients (~2%) Ventricle 250 patients (71%) Pons 290 patients (75%) Spinal cord 370 patients (49%) Approximately 21,000 gliomas reported in the U.S. each year, affecting all locations in the brain1 Estimated # of U.S. H3 K27M+ Patients by Tumor Location (rate of positivity)2

16 • No approved therapies for H3 K27M mutant glioma, ONC201 is the leading program targeting this mutation globally • Potential market opportunity ~$750 million • Approximately 5,000 patients in top seven markets1 • Ultra-orphan indication drug pricing • H3 K27M mutations most often in children / young adults • Low barriers to adoption - No effective alternative therapies - High unaided awareness among neuro-oncologists - Mutation routinely identified by existing diagnostics - Longer-term, potentially combinable with other glioma therapies • Patent protection for lead indication into 2037 - potential U.S. patent term extension (up to five years) H3 K27M-mutant glioma: rapid ramp to peak revenue expected 1. By extrapolation of the estimated US incidence rate to the top seven markets

17 Potential for ONC201 beyond brain tumors • Single agent responses in Ph 2 neuroendocrine trial of ONC201 observed in subset (PCPG) • PCPG are adrenal-related tumors with elevated DRD2 expression • Five patients have been treated > 1 year • Fewer short-term and potential long-term toxicities than other paraganglioma therapies ONC201 efficacy results in dopamine-secreting tumors outside the brain Ph 2 Study of ONC201 in Neuroendocrine Tumors in investigator- reported data from clinical trial NCT # (NT03034200) 1. https://aacrjournals.org/clincancerres/article/28/9/1773/694456/Phase-II-Study-of-ONC201-in-Neuroendocrine-Tumors

ONC201 Mechanism of Action

19 • ONC201 can selectively induce apoptosis in cancer cells by altering the activity of two protein targets • DRD2 antagonism - DRD2 is a G protein-coupled neuroreceptor that regulates Ras signaling - ONC201 antagonizes DRD2, inhibiting Ras signaling pathways • ClpP agonism - ClpP normally degrades misfolded proteins in mitochondria - ONC201 modifies ClpP conformation, promoting excess degradation of specific mitochondrial proteins important for cancer cell viability ONC201 directly engages DRD2 and ClpP ONC201 upregulates integrated stress response, inactivates Akt/ERK, and selectively induces tumor cell death ClpP=caseinolytic protease P; OXPHOS=oxidative phosphorylation; DRD2=Dopamine receptor D2; ATF4=activating transcription factor 4; CHOP=C/EBP-homologous protein; ERK=extracellular-regulated kinase;

20 Mechanism and frontline clinical efficacy in H3 K27M DMG Mitochondrial effects reverse H3 K27me3-loss hallmark of H3 K27M H3 K27me3-loss reversal evident in ONC201- treated H3 K27M patients Front-line ONC201 following RT survival benefit Increased confidence in Ph3 dose Provides ClpP connection to H3 K27M Anchors MOA directly to targeting H3 K27M Extends documented benefit to front-line, pediatrics, and brainstem

ONC206

22 ONC206: oral brain penetrant DRD2 antagonist + ClpP agonist 1. PDB 6CM4 2. PDB 6DL7 DRD21 ClpP2 ONC206 • Second generation imipridone • Increased potency • Indications beyond H3 K27M-mutant glioma • Monotherapy efficacy across multiple preclinical models of CNS and non-CNS tumors • Tumor regression in patient-derived xenografts • Oral dose escalation trials with intensified dosing are ongoing in CNS cancers • Monotherapy response in recurrent GBM patient without the H3 K27M mutation - Differentiated from ONC201 glioma responses that were exclusive to H3 K27M

23 CNS Tumors Glioblastoma1 Medulloblastoma2 ONC206 monotherapy activity CNS and non-CNS cancer models 1. Theeler et al, SNO 2020 2. Malhotra et al, ISPNO 2020 3. Hu et al, Cancers 2020 4. Tucker et al, American Journal of Cancer Research, 2022 5. Baek et al, SABCS 2023 ARK1 Human Endometrial Cancer Xenograft (100mg/kg BW; 6 wks)3 Non-CNS Solid Tumors Cholangiocarcinoma1 Endometrial cancer3 Pheochromocytoma/paraganglioma Ovarian cancer4 Triple-negative breast cancer5 Transgenic Medulloblastoma Model2 Weeks P<0.05 S ur vi va l Control ONC206 (100mg/kg QW) ONC206 (120mg/kg QW) BCM2665 Human TNBC PDX (ONC206 100mg/kg BW; Carboplatin - CRB 50mg/kg QW )5

24 ONC206 dose escalation to more frequent dosing ongoing 1. Dose level 6 was conducted in adults only 2. Pediatric dose scaled by body weight 3. As of publication date February 29, 2024 • No DLTs observed with weekly dosing3 • Similar safety profile in adults and pediatrics • Majority of treatment-related AEs are mild to moderate • Most common treatment- related events are fatigue, lymphocyte count decreased, and vomiting • No dose related toxicity with dose escalation3 – dose escalation continuing 0 100 200 300 400 500 600 700 800 900 1000 1100 1200 1 2 3 4 5 6 7 8 9 10 11 O N C 20 6 m g /w e ek Dose level2 50 m g B ID 15 0 m g Q D 10 0 m g B ID 15 0 m g B ID 20 0 m g B ID 50 m g 10 0 m g 15 0 m g 20 0 m g 30 0 m g 35 0 m g Once weekly dosing 3 consecutive days dosing 1 Dose escalation on track for completion in mid 2024

25 1. Rapidly Emerging Antiviral Drug Development Initiative Ongoing pipeline development • ONC212 GPR132 + ClpP agonist - GLP-tox studies complete, potential to advance to IND, work performed with support from acedemic grants - Preclinical studies are ongoing to evaluate additional oncology indications and predictive biomarkers for ONC212 for clinical development • CMX521 anti-SARS-CoV-2 preclinical activity - Monotherapy efficacy in mouse-adapted SARS-CoV-2- MA10 model across multiple endpoints - $2m grant to fund research collaboration with University of North Carolina/READDI1

Corporate Update

27 Emergent BioSolutions is an experienced biodefense company collaborating with government agencies to protect public health Terms summary: • $238 million received upfront at closing in Q3 2022 • Up to an additional $124 million in potential BARDA procurement milestones • 20% royalty on future U.S. gross profit with volumes above 1.7 million courses of therapy • 15% royalty of all international gross profit • Up to an additional $12.5 million in development milestones TEMBEXA® deal term summary

28 Financial strength supports development through key catalysts ONC201 Ph 3 trial enrolling - interim OS data expected in 2025, final OS expected in 2026 First-Line H3 K27M-mutant diffuse glioma – The ACTION Study No approved therapies targeting H3 K27M diffuse glioma, an area of high unmet medical need First in class mechanism of action with clinical validation Patent protection thru 2037 (potential additional US patent term extension) ONC206 in dose escalation Investigator reported response in non-H3 K27M mutated recurrent glioblastoma patient Dose escalation on track for completion beginning in mid 2024 $204 million in capital to fund operations as of December 31, 2023, no debt Early-stage pipeline leverages external capital Pre-clinical programs potential to advance to clinic or partner (ONC212, CMX521) Robust business development search and evaluation process Ph 3 ACTION study actively enrolling Significant commercial potential Corporate capability and financial flexibility

Chimerix Corporate Presentation

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

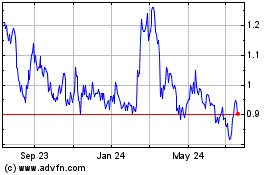

Chimerix (NASDAQ:CMRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

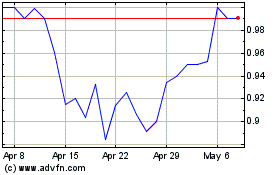

Chimerix (NASDAQ:CMRX)

Historical Stock Chart

From Apr 2023 to Apr 2024