0001640147false00016401472024-02-272024-02-270001640147dei:FormerAddressMember2024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

SNOWFLAKE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | 001-39504 | 46-0636374 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

| |

Suite 3A, 106 East Babcock Street | | | 59715 |

| Bozeman, | Montana | | |

(Address of Principal Executive Offices)1 | | (Zip Code) |

(844) 766-9355

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, $0.0001 par value | | SNOW | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| |

1 The Company is a Delaware corporation with a globally distributed workforce and no corporate headquarters. Under the Securities and Exchange Commission's rules, the Company is required to designate a “principal executive office.” For purposes of this report, it has designated its office in Bozeman, Montana as its principal executive office. |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective February 27, 2024, Frank Slootman retired as Chief Executive Officer of Snowflake Inc. (the “Company”), and Sridhar Ramaswamy was appointed to succeed Mr. Slootman as the Company’s new Chief Executive Officer. Mr. Slootman will remain Chairman of the Company’s board of directors (the “Board”), and Mr. Ramaswamy will serve as a Class III member of the Board.

Prior to his appointment as Chief Executive Officer, Mr. Ramaswamy, age 57, served in various roles at the Company, including as Senior Vice President, Artificial Intelligence, since May 2023. From October 2018 to February 2024, Mr. Ramaswamy served as a Venture Partner at Greylock Partners, a venture capital firm. From January 2019 to May 2023, Mr. Ramaswamy served as Chief Executive Officer of Neeva Inc., a private technology company, which the Company acquired in 2023. From August 2017 to December 2019, Mr. Ramaswamy served as a member of the board of directors of Palo Alto Networks, Inc., a global cybersecurity company. From March 2013 to October 2018, Mr. Ramaswamy served as Senior Vice President, Ads & Commerce at Google, a multinational technology company. From April 2003 to March 2013, Mr. Ramaswamy served in various roles in Google’s engineering group, including as Senior Vice President Engineering. Mr. Ramaswamy holds a B.S. degree in Computer Science from the Indian Institute of Technology Madras and M.S. and Ph.D. degrees in Computer Science from Brown University. Mr. Ramaswamy is qualified to serve on the Board because of his leadership experience and his business and technical experience, including his extensive cloud and infrastructure expertise and his experience in artificial intelligence and machine learning.

The Company entered into an amended and restated offer letter with Mr. Ramaswamy, dated February 27, 2024, in connection with his appointment as Chief Executive Officer. The offer letter has a three-year initial term and provides for at-will employment. In addition, the offer letter provides for, among other things: (i) an annual base salary of $750,000, (ii) an annual incentive bonus under the Company’s Cash Incentive Bonus Plan with a target amount equal to 100% of Mr. Ramaswamy’s annual base salary, subject to the achievement of performance goals as determined from time to time by the compensation committee of the Board (the “Compensation Committee”), and (iii) the following equity awards for shares of the Company’s Class A common stock, each to be granted pursuant to the Company’s 2020 Equity Incentive Plan (the “Plan”) upon subsequent approval by the Compensation Committee or the Board, with vesting subject to Mr. Ramaswamy’s continuous service as the Company’s Chief Executive Officer through each applicable vesting date (collectively referred to as the “Appointment Awards”):

(1) a stock option award, valued at $75,000,000, that will vest in 60 equal monthly installments over the five-year period following the appointment date. Shares received upon exercise of this stock option may not be transferred or disposed of before the earlier of (A) the one-year anniversary of the applicable exercise date and (B) a Change in Control (as defined in the Plan), except in connection with the satisfaction of tax withholding obligations.

(2) a performance-based restricted stock award, valued at $20,000,000 (the “PRSU Award”), to be granted concurrently with, and that will vest on terms consistent with those for, the annual grants of performance-based restricted stock awards to the Company’s other executive officers for fiscal 2025.

(3) a restricted stock unit award, valued at $5,000,000 (the “RSU Award”), which will only be granted following the purchase by Mr. Ramaswamy of at least $5,000,000 of shares of the Company’s Class A common stock on the New York Stock Exchange on or before March 29, 2024 (the “Purchased Shares”). This RSU Award will vest in 16 equal quarterly installments on March 20, June 20, September 20, and December 20 of each year, starting with June 20, 2024 as the first quarterly vesting date. If Mr. Ramaswamy sells or otherwise disposes of any Purchased Shares before the RSU Award is fully vested, then the unvested portion of the RSU Award will be automatically forfeited.

Mr. Ramaswamy will also participate in the Company’s Severance and Change in Control Plan (the “Severance Plan”) as a “Tier 1 Covered Employee,” as further described in the section titled “Executive Compensation—Potential Payments Upon Termination or Change in Control” in the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on May 25, 2023 (File No. 001-39504) and the Company’s Current Report on Form 8-K filed with the SEC on August 23, 2023 (File No. 001-39504) (the “August 2023 8-K"). The Severance Plan is attached as Exhibit 10.7 to the August 2023 8-K. In addition to the benefits in the Severance Plan, upon any termination of Mr. Ramaswamy that would qualify as an Involuntary Termination, other than during any Change in Control Determination Period (each as defined in the Severance Plan) (a “Qualifying Termination”), Mr. Ramaswamy will be entitled to accelerated vesting of the unvested portion of his PRSU Award. If the Qualifying Termination occurs prior to the first anniversary of Mr. Ramaswamy’s appointment as Chief Executive Officer, 100% of the unvested portion of the PRSU Award will accelerate and if the Qualifying Termination occurs between the first and second anniversaries of his appointment, 50% of the unvested portion of the PRSU Award will accelerate. The Company has also agreed not to amend the Severance Plan in any materially adverse manner with respect to the Appointment Awards and any other equity awards held by Mr. Ramaswamy as of February 27, 2024 for a period of five years. Further, Mr. Ramaswamy will continue to be nominated to serve as a member of the Board for so long as he serves as the Company’s Chief Executive Officer. The foregoing description of Mr. Ramaswamy’s offer letter does not purport to be complete and is qualified in its entirety by reference to the offer letter, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference. Mr. Ramaswamy has also entered into the Company’s standard form of indemnification agreement, the form of which has been filed as Exhibit 10.10 to the Company’s Registration Statement on Form S-1, filed with the SEC on August 24, 2020 (File No. 333-248280).

Other than the offer letter, there is no arrangement or understanding between Mr. Ramaswamy and the Company or any other person pursuant to which Mr. Ramaswamy was appointed as Chief Executive Officer of the Company that would require disclosure under Item 401(b) of Regulation S-K under the Securities Act of 1933, as amended. Additionally, there is no family relationship between Mr. Ramaswamy and any other person that would require disclosure under Item 401(d) of Regulation S-K. There are no transactions involving the Company and Mr. Ramaswamy that the Company would be required to report pursuant to Item 404(a) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | |

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | Snowflake Inc. |

| | |

| Dated: February 28, 2024 | | |

| | By: | /s/ Michael P. Scarpelli |

| | | Michael P. Scarpelli |

| | | Chief Financial Officer |

February 27, 2024

Sridhar Ramaswamy

Via Email/DocuSign

Dear Sridhar:

This letter confirms that, effective as of February 27, 2024 (the “Transition Date”), you will transition from your current role with Snowflake Inc. (the “Company”) into the role of Chief Executive Officer. This letter confirms the terms and conditions of your employment in that role. The terms set forth herein shall supersede and replace, in their entirety, all existing terms of your employment with the Company, except for the terms set forth in the agreements specifically referred to herein (which agreements shall survive).

Position. You will serve in a full-time capacity as Chief Executive Officer, reporting to the Board of Directors (the “Board”), based in our office located in San Mateo. You will also be appointed to the Board as a Class III Director and will continue to be nominated to serve on the Board so long as you continue to serve as the Company’s Chief Executive Officer.

Employee Benefits. You will continue to be eligible to participate in the Company’s standard benefits, subject to the terms and conditions of such plans and programs. Subject to the other provisions of this letter agreement, the Company may change compensation and benefits from time to time at its discretion.

Salary. Your annual base salary will be $750,000, payable biweekly in accordance with the Company’s standard payroll practices for salaried employees. This salary will be subject to adjustment pursuant to the Company’s employee compensation policies in effect from time to time.

Annual Bonus. You will be eligible for incentive bonus compensation with a target bonus equal to 100% of your annual base salary, subject to the achievement of Company performance goals as determined by the Compensation Committee of the Board, and subject to the terms of any plan governing such bonus.

Equity. You have been granted various equity awards with respect to the Company’s Class A common stock (the “Common Stock”). Those equity awards will continue to be governed in all respects by the terms of the applicable equity agreements, grant notices, and equity plans (each an "Equity Arrangement”). In addition, subject to the approval of the Board (or an authorized committee thereof) and to you being the Company’s Chief Executive Officer on the date of grant, you will be granted the following new awards in connection with your transition to Chief Executive Officer, each of which will be granted under and subject to the terms of the Company’s 2020 Equity Incentive Plan (the “Plan”), the applicable award agreement issued thereunder, and the Company’s policies in effect from time to time, all of which will control in the event of any conflict with this letter agreement:

•Stock Option Award: A non-qualified stock option award (the “Stock Option Award”) with respect to shares of Common Stock with a value of USD $75,000,000, with the number of shares to be determined by the Board based on the Black-Scholes valuation on the date of grant using the Company’s standard methodology but taking into account the Minimum Holding Requirement (as defined below), rounded up to the nearest whole share. The Stock Option Award will be able to be exercised in either a net exercise or through a broker-assisted cashless exercise, provided that, in either case, such net or cashless exercise shall not result in short-swing liability under Section 16(b) of the Securities Exchange Act of 1934, as amended, will have an exercise price equal to the Fair Market Value (as defined in the Plan) of a share of Common Stock on the date of grant, and will have a seven (7)-year term. The Stock Option Award will vest in sixty (60) equal monthly installments over the five (5)-year period following the Transition Date, subject to your employment as the Company’s Chief Executive Officer through each such vesting date. In addition, shares of Common Stock received upon exercise of the Stock Option Award may not be directly or indirectly sold, transferred, hypothecated, pledged, or otherwise disposed of before the earlier of (i) the one (1)-year anniversary of the exercise date (the “Minimum Holding Requirement”) or (ii) a Change in Control (as defined in the Plan). For the avoidance of doubt, shares of Common Stock that are withheld or sold for the purposes of satisfying tax withholding obligations are exempt from the Minimum Holding Requirement. To enforce the requirements in this section, the Company, in its discretion, may take any action it determines reasonable or necessary, including requiring that the shares of Common Stock be moved to the Company’s transfer agent and attaching applicable legends to them.

•Additional RSU Award: Contingent upon (i) your purchase of shares of Common Stock on the New York Stock Exchange with a fair market value of USD $5,000,000 within thirty (30) days following the first trading day of the first open trading window (pursuant to the Company’s Insider Trading Policy) after the Transition Date (the “Stock Purchase”), and (ii) your provision of evidence to the Company that the Stock Purchase has been consummated, a restricted stock unit award with respect to a number of shares of Common Stock equal to USD $5,000,000 divided by the average daily closing price of a share of Common Stock on the New York Stock Exchange for the last twenty (20) trading days ending on the fifth (5th) trading day before the date of grant, rounded up to the nearest whole share (the “Additional RSU Award”). The Additional RSU Award will vest in quarterly installments on the Quarterly Vest Dates over a period of four (4) years, with the first vesting date being the second Quarterly Vest Date that follows the Transition Date, in each case subject to your employment as the Company’s Chief Executive Officer on such vesting date. The “Quarterly Vest Dates” for purposes of the Additional RSU Award and PRSU Award (defined below) will fall on the 20th of March, June, September, and December of each year. Notwithstanding the foregoing, if you sell or otherwise dispose of any of the shares of Common Stock acquired in the Stock Purchase (other than upon a Change in Control, as defined in the Plan) prior to the date on which the Additional RSU Award is fully vested, you will automatically forfeit the then-unvested portion of the Additional RSU Award. To enforce the requirements in this section, the Company, in its discretion, may take any action it determines reasonable or necessary, including requiring that the shares of Common Stock be moved to the Company’s transfer agent and attaching applicable legends to them.

•PRSU Award: A performance-based restricted stock award (the “PRSU Award” and, together with the Additional RSU Award and the Stock Option Award, the “Appointment Awards”) with respect to a number of shares of Common Stock equal to USD $20,000,000, with the number of shares determined using the same methodology used to establish the number of shares granted to other members of the executive leadership team in calendar 2024, granted at the same time that annual performance-based restricted stock units are granted to other members of the executive leadership team in calendar 2024, and subject to the same performance metrics and vesting terms as are applicable to other members of the executive leadership team with respect to such grants. Vesting of the PRSU Award is contingent on your employment as the Company’s Chief Executive Officer on each vesting date.

Proprietary Information and Inventions Agreement. You remain subject to the terms of the Employee Proprietary Information and Inventions Assignment Agreement that you previously executed.

Period of Employment. The term of your employment will continue until at least February 27, 2027, unless terminated earlier pursuant to the terms set forth herein (the “Initial Term”). Following the Initial Term, this letter agreement will automatically be renewed for additional terms of one year on the last day of the Initial Term and each subsequent anniversary of the last day of the Initial Term (the Initial Term and any annual extension of the term of the Agreement, referenced herein as the “Term”), unless either party hereto gives the other party written notice of non-renewal at least ninety (90) days prior to such last day or anniversary of the then-current Term. Notwithstanding the foregoing, your employment with the Company remains “at will,” meaning that either you or the Company may terminate your employment at any time and for any reason, with or without cause or notice. Although your job duties, title, compensation, and benefits, as well as the Company’s personnel policies and procedures, may change from time to time, the “at will” nature of your employment may only be changed in an express written agreement signed by you and an officer of the Company specifically authorized by the Board to sign such agreement or by an authorized Board member. Upon the termination of your employment, and to the extent requested in writing by the Company, you agree to resign from all positions you may hold with the Company or any of its affiliated entities at such time, including as a member of the Board, if applicable.

Severance. You will be eligible for severance benefits as a Tier I employee under the Company’s Severance and Change in Control Plan (as amended from time to time, the “Severance Plan”). In addition, (1) if your employment is terminated prior to the first anniversary of the Transition Date in a termination that would qualify as an Involuntary Termination, other than during the Change in Control Determination Period (each as defined in the Severance Plan) (a “Qualifying Termination”), you will be entitled to accelerated vesting of the unvested portion of the PRSU Award, based on actual achievement amounts or levels for the performance-based vesting condition(s) through the date of termination (or, if the Qualifying Termination occurs during any performance period, assuming achievement of target amounts or levels for the applicable performance-based vesting condition); or (2) if your employment is terminated between the first and second anniversaries of the Transition Date in a Qualifying Termination, you will be entitled to accelerated vesting of 50% of the unvested portion of the PRSU Award, based on actual achievement amounts or levels for the performance-based vesting condition(s) through the date of termination, in each case subject to the conditions and timing set forth in the Severance Plan. For the avoidance of doubt, the acceleration benefits set forth in the previous sentence do not apply to any equity awards outstanding as of the Transition Date, the Stock Option Award, the Additional RSU Award, or other future equity awards that you may receive during the term of your employment. Additionally, the Severance Plan may not be terminated or amended in a manner materially adverse to you solely with respect to your Appointment Awards and any other equity awards outstanding as of the Transition Date until the fifth anniversary of the Transition Date.

Other Details:

Except as set forth herein, you shall devote your full business time, attention, skill, and best business efforts to the performance of your duties under this Agreement. You have disclosed, and Snowflake acknowledges, that you serve as a member of the board of directors of the Brown Corporation (“Brown”). Snowflake shall permit you to fulfill your board member responsibilities to Brown during your employment generally outside of regular work hours (except with respect to attendance at board meetings, which may occur during regular work hours), provided such service does not pose a material conflict of interest to Snowflake, prevent you from satisfactorily fulfilling your duties as the Chief Executive Officer of Snowflake, or otherwise cause you to violate any statutory, contractual, or common law duties you may owe to Snowflake. Snowflake acknowledges that it does not have the ability to and shall not direct or influence you in any way with respect to your involvement with Brown.

Amendment. This letter agreement supersedes and replaces all prior offer letters and employment agreements between you and the Company. This letter agreement (except for terms reserved to the Company’s discretion) may not be amended or modified except by an express written agreement signed by you and a duly authorized member of the Board.

Arbitration. Any dispute, controversy or claim arising out of or relating to either: (a) this letter agreement, its enforcement, performance, arbitrability or interpretation, or because of an alleged breach, default, or misrepresentation in connection with any of its provisions, or (b) your employment with the Company or termination of employment, including in each case any alleged violation of statute, common law or public policy, will be submitted to and decided by final and binding arbitration. Arbitration will be administered exclusively by JAMS, and held in the JAMS office closest to the location where you primarily performed services for the Company, before a single arbitrator, in accordance with the then-current JAMS rules and the Federal Arbitration Act, 9 U.S.C. § 1-16 (“FAA”), as modified by the terms and conditions contained in this paragraph. The arbitrator will have the authority to compel adequate discovery for the resolution of the dispute and to award such relief as would otherwise be permitted by law. If any party prevails on a statutory claim that affords the prevailing party attorneys’ fees and costs, then the arbitrator may award reasonable attorneys’ fees and costs to the prevailing party. Any dispute as to who is a prevailing party and/or the reasonableness of any fee or costs will be resolved by the arbitrator. By initialing below, you agree to waive all rights to a jury trial. The Company acknowledges that you will have the right to be represented by legal counsel at any arbitration proceeding, at your own expense. This section does not apply to an action or claim that cannot be subject to mandatory arbitration as a matter of law, including, without limitation, sexual assault disputes and sexual harassment disputes as defined in the FAA, to the extent such claims are not permitted by applicable laws to be submitted to mandatory arbitration and the applicable laws are not preempted by the FAA or otherwise invalid (collectively, the “Excluded Claims”). In the event you intend to bring multiple claims, including one of the Excluded Claims listed above, you understand that the Excluded Claims may be filed with a court, while any other claims will remain subject to mandatory arbitration. The arbitrator will issue a written arbitration decision regarding the disposition of each claim, the relief, if any is awarded as to each claim, the reasons for the award, and the arbitrator’s essential findings and conclusions on which the award is based. The Company will pay all JAMS’ arbitration fees in excess of the amount of court fees that would be required of you if the dispute were decided in a court of law. This agreement to arbitrate is freely and knowingly negotiated between you and the Company in good faith and is mutually entered into between the parties. You and the Company agree that arbitration is to each party’s advantage. You and the Company further agree that the mutual promises to arbitrate disputes, along with the other consideration provided to you in exchange for this agreement, provide full, adequate, and bargained-for consideration for this mutual agreement to arbitrate, which is binding and is a mutual condition of your employment. You understand and agree that you are giving up certain rights otherwise afforded to you by civil court actions, including but not limited to the right to a jury trial. Nothing in this letter agreement is intended to prevent either you or the Company from obtaining

injunctive relief in court to prevent irreparable harm pending the conclusion of any such arbitration. You understand and acknowledge your right to participate in a proceeding with any appropriate federal, state, or local government agency enforcing discrimination laws; make any truthful statements or disclosures required by law, regulation, or legal process; and request or receive confidential legal advice.

You accept this arbitration clause: SR (initial here)

* * *

This letter, together with your Proprietary Information and Inventions Agreement, Equity Arrangements (with such term deemed to include the award agreements setting forth the grants made pursuant to this letter), and the Severance Plan, form the complete and exclusive statement of your employment agreement with the Company and supersede any other agreements or promises made to you by anyone, whether oral or written, with respect to the subject matter hereof. If any provision of this letter agreement is determined to be invalid or unenforceable, in whole or in part, this determination will not affect any other provision of this letter agreement and the provision in question will be modified so as to be rendered enforceable in a manner consistent with the intent of the parties insofar as possible under applicable law. This letter agreement may be delivered and executed via facsimile, electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act or other applicable law) or other transmission method and will be deemed to have been duly and validly delivered and executed and be valid and effective for all purposes.

Please sign and date this letter agreement below to indicate your agreement with its terms.

| | | | | | | | |

| SNOWFLAKE INC. | | ACCEPTED AND AGREED TO: |

| | |

| | |

| /s/ Michael Speiser | | /s/ Sridhar Ramaswamy |

| By: Michael Speiser | | By: Sridhar Ramaswamy |

| Lead Independent Director | | |

| | |

| Date: February 27, 2024 | | Date: February 27, 2024 |

| | |

| | |

Cover Page

|

Feb. 27, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity Registrant Name |

SNOWFLAKE INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39504

|

| Entity Tax Identification Number |

46-0636374

|

| Entity Address, Address Line One |

Suite 3A, 106 East Babcock Street

|

| Entity Address, City or Town |

Bozeman,

|

| Entity Address, State or Province |

MT

|

| Entity Address, Postal Zip Code |

59715

|

| City Area Code |

844

|

| Local Phone Number |

766-9355

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value

|

| Trading Symbol |

SNOW

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001640147

|

| Former Address |

|

| Entity Information [Line Items] |

|

| Entity Address, Address Line One |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

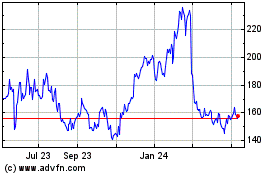

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

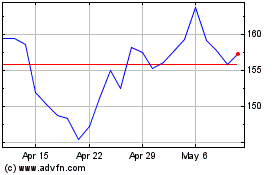

Snowflake (NYSE:SNOW)

Historical Stock Chart

From Apr 2023 to Apr 2024