00014792902/23/2024FALSE00014792902024-02-232024-02-23

| | | | | | | | |

UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | |

| | |

FORM 8-K

| | | | | | | | |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): February 23, 2024

| | | | | | | | |

| | |

| Revance Therapeutics, Inc. |

| (Exact name of registrant as specified in its charter) | |

| | |

| | | | | | | | |

| Delaware | 001-36297 | 77-0551645 |

| (State or other jurisdiction of incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

1222 Demonbreun Street, Suite 2000, Nashville, Tennessee, 37203

(Address of principal executive offices and zip code)

(615) 724-7755

(Registrant’s telephone number, including area code)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

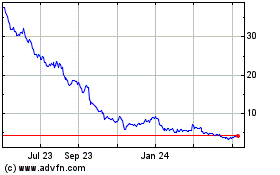

| Common Stock, $0.001 par value | RVNC | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On February 26, 2024, Revance Therapeutics, Inc. (the “Company”) and Ajinomoto Althea, Inc. dba Ajinmoto Bio-Pharma Services, a contract development and manufacturing organization (“ABPS”), entered into Amendment No. 2 to the Technology Transfer, Validation and Commercial Fill/Finish Services Agreement (the “Amendment”) in connection with the supply of DAXXIFY®. ABPS provides drug product manufacturing services for the Company at its aseptic manufacturing facility in San Diego, California. The Company entered into the Technology Transfer, Validation and Commercial Fill/Finish Services Agreement with ABPS on March 14, 2017 and Amendment No. 1 to the Technology Transfer, Validation and Commercial Fill/Finish Services Agreement on December 18, 2020 (together with the Amendment, the “Services Agreement”), as previously disclosed on Current Reports on Form 8-K filed on March 15, 2017 and December 22, 2020, respectively.

The Amendment, among other things, extended the term of the ABPS Services Agreement through December 31, 2027 (unless sooner terminated by either party in accordance with the terms of the Services Agreement) and modified our remedies with respect to non-conforming products and delays.

The foregoing summary of the terms of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K, portions of which may be subject to confidential treatment.

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On February 28, 2024, the Company issued a press release announcing its financial results for the three months and fiscal year ended December 31, 2023 and the Company's financial outlook for 2024. The press release also provided an update regarding the commercialization of the Company's aesthetics portfolio, DAXXIFY® therapeutics launch and other corporate developments. A copy of the press release regarding the financial results is furnished as Exhibit 99.1 to this report.

The information in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this report shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

On January 8, 2024, the Company announced that Mr. Sjuts is stepping down from his current position as President of the Company, effective as of March 31, 2024. In connection with the elimination of his role and Mr. Sjuts’ separation from the Company, the Company entered into a separation and consulting agreement, dated February 23, 2024 (the “Separation Agreement”), with Mr. Sjuts providing for (i) a release of claims against the Company, (ii) cash severance payments to Mr. Sjuts in an amount equal to 18 months of Mr. Sjuts’ 2023 base salary, paid in equal installments on the Company’s regular payroll schedule over the 18 month period following the separation date; and (iii) certain health care continuation benefits. The Separation Agreement also provides for a consulting period from April 1, 2024 through March 31, 2025 (the “Consulting Period”). During the Consulting Period, Mr. Sjuts’s current outstanding options, restricted stock, performance stock and performance stock units will continue to be eligible to vest.

The preceding summary of the terms of the Separation Agreement is qualified in its entirety by reference to, and should be read in connection with, the complete copy of the Separation Agreement, a copy of which has been filed as Exhibit 10.2 hereto and incorporated by reference herein.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | | | | |

| Number | | Description |

| | |

| | |

| | |

| 104 | | Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | February 28, 2024 | Revance Therapeutics, Inc. |

| | | |

| | By: | /s/ Tobin C. Schilke |

| | | Tobin C. Schilke |

| | | Chief Financial Officer |

AMENDMENT NO. 2 TO THE

TECHNOLOGY TRANSFER, VALIDATION AND

COMMERCIAL FILL/FINISH SERVICES AGREEMENT

THIS AMENDMENT NO. 2 (this “Amendment”) is made and entered into as of February 23, 2024 (the “Amendment Effective Date”), by and between Revance Therapeutics, Inc., (“Client”), and Ajinomoto Althea, Inc., dba Ajinomoto Bio-Pharma Services, a California (formerly Delaware) corporation (“ABPS”).

WHEREAS, Client, and ABPS are parties to that certain Technology Transfer, Validation and Commercial Fill/Finish Services Agreement with an Effective Date of March 14, 2017 (the “Agreement”), as amended by Amendment No. 1 to the Technology Transfer, Validation and Commercial Fill/Finish Services Agreement, effective December 18, 2020 (the "Amendment #1"); and

WHEREAS, the parties desire to further amend the Agreement as set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree that the Agreement is amended as follows:

A.The Agreement and Amendment #1 shall be known collectively as the “Services Agreement.” Unless otherwise defined herein, capitalized terms used in this Amendment shall have the respective meanings ascribed thereto in the Services Agreement.

B.The following sections or subsections of the Services Agreement are hereby replaced, in their entirety, as follows:

2.5 Delays & Yields:

2.5 (a) The parties acknowledge and agree that all Production timelines and target yields are approximate and subject to risks and uncertainties inherent, for example, in technology transfer and the biopharmaceutical industry generally and in the Production materials and technologies. Except for the remedies for delays set forth in (b) below, ABPS shall not be responsible for timeline delays or revisions or lower than expected yields unless (i) such delays or lower yields are caused by ABPS’s negligence or willful misconduct or failure to use commercially reasonable efforts and (ii) the relevant binding yield or timeline is set forth in the SOW, and the binding yield or timeline and applicable tolerance and remedies are set forth in the SOW, and in all cases subject to Article 12. Specifically and without limitation, ABPS is not responsible for delays due to lack of delivery or delays in reviews, approvals, information, documents, (pre)payments or other items to be supplied by Client or its selected vendors, nor for delays caused by delivery delays, variation from Specifications or variable performance of Bulk Compound or other Components (except in the event of ABPS’s negligence or willful misconduct as set forth in section 2.9(a)). The parties agree to negotiate in good faith an appropriate yield target, tolerances and minimum obligation per Batch following the validation of Client’s process and the subsequent Production and release of [*] Batches of Client Product, along with Batch price adjustments (up or down) in the event of a shortfall due to the fault of ABPS, or in the event of excess or below minimum yield. To minimize delays, ABPS will maintain such Component management activities as are described in an SOW.

2.5 (b) Any Batch (i) for which the Bulk Compound was received by ABPS at least [*] days prior to the Fill Date (ii) whose Fill Date is later than the Fill Date scheduled in a timely-received and accepted purchase order and (iii) which lateness is caused solely by matters within the responsibility of ABPS and reasonably within its control (excluding e.g. significant changes in vendor lead times, vendor delays not caused by ABPS, ongoing major or critical investigations, force majeure, acts or omissions of Client or its agents including delays in providing reviews, information, materials or approvals) will be considered an “ABPS Delay”. An ABPS Delay shall be measured as the number of days the Fill Date is delayed from the accepted Fill Date. ABPS will provide a percentage discount on the Purchase Price in the

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [*], HAS BEEN OMITTED BECAUSE REVANCE THERAPEUTICS, INC., HAS DETERMINED THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM TO REVANCE THERAPEUTICS, INC., IF PUBLICLY DISCLOSED.

SOW (excluding Components costs) for the Batch(es) affected by an ABPS Delay according to the following table:

| | | | | |

| ABPS Delay | Discount |

[*] days delay | [*] |

[*] days delay | [*] |

[*] days or more delay | [*] |

2.12 (b) Within [*] days of Client’s receipt of ABPS’s Batch release documentation under Section 5.1, Client shall notify ABPS as to whether to return, retain or dispose of remaining Client-Supplied Components, and shall provide shipping instructions for Client Product. Regardless of location or contemplated or actual further processing of Client Product Batch(es), title and risk of loss for Client Product shall pass to Client on the earliest of (i) expiration of such [*] day period, or resolution of a rejected Product dispute under Section 5.1(c), whichever is later; or (ii) release by Client; or (iii) shipment of such materials to Client or its designee. If case (i) or (ii) occurs before shipment ABPS will begin assessing a storage fee for all such materials at the price set forth in the SOW, or, if none, at ABPS’s then-current rates. Storage fees may also be assessed, beginning [*] days after cessation or interruption of Production, for retained Client-Supplied Components and Client equipment. Storage may be at ABPS’s or its qualified subcontractors’ storage facilities. If ABPS is storing any of the foregoing items for Client, ABPS may destroy such items at Client’s expense, upon [*] days’ notice of intent to destroy and opportunity to take delivery prior to the scheduled shipment for destruction.

Section 2.15 Competing Products [*].

3.1 Term: This Agreement shall commence on the Effective Date and will continue until December 31, 2027, unless sooner terminated pursuant to this Section 3.1 or Section 3.2 herein (the “Term”).

3.2 (c) Termination for Convenience: Client shall have the right to terminate this Agreement, without cause, with [*] written notice to ABPS, subject to payment of amounts due under Sections 2.9(a) (components), 2.4(b) (accepted purchase orders), and 3.3 (cancellation) in addition to any Take or Pay obligations under the SOW. ABPS shall have the right to terminate this Agreement, without cause, with [*] written notice to Client. For clarity, both parties must fulfill their obligations that accrue during the notice period, including any accepted purchase orders or cancellation fees if applicable, Dedicated Capacity, Obligated Capacity and related take or pay obligations set forth in a SOW.

5.1 Acceptance and Non-Conforming Client Product: ABPS shall promptly ship any Client Product samples required in the SOW for each lot within [*] business days of the Fill Date. Within [*] days from the date of ABPS’s testing and release of Batch(es) of Client Product, ABPS shall promptly forward to Client, or Client’s designee, copies of the Released Executed Batch Record. Within [*] days after receipt by Client of such documentation, Client shall determine whether Client Product conforms to the quantity ordered, the Specifications and has been manufactured in accordance with cGMP and, if so, notify ABPS of its acceptance of such Client Product.

5.1 (a) If Client does not notify ABPS that any Batch of Client Product does not conform to the Specifications and cGMP (a “non-conformity” or “defect”) and reject such Batch within the above time period, then Client shall be deemed to have accepted the Client Product and waived its right to revoke acceptance. Notwithstanding the foregoing, Client shall have the right to revoke acceptance in the event of a Batch defect or non-conformity that (i) existed at the time of shipment by ABPS under section 2.7; (ii) was not discoverable at the time of delivery by reasonable testing, inspection and review by Client; (iii) was caused by ABPS’s failure to adhere to cGMP or the MBR; (iv) Client gives notice thereof to ABPS within [*]

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [*], HAS BEEN OMITTED BECAUSE REVANCE THERAPEUTICS, INC., HAS DETERMINED THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM TO REVANCE THERAPEUTICS, INC., IF PUBLICLY DISCLOSED.

days of the earliest to occur of the events listed in clauses 2.12(b)(i)-(iii); and (v) Client has timely met its take or pay obligations under the relevant SOW during the 12-month period prior to the disposition of the Batch having such defect/non-conformity (a “Limited Latent Defect”).

5.1 (b) If Client believes any Batch of Client Product does not conform to the Specifications and cGMP, it shall notify ABPS by telephone of its rejection of such Batch, including a detailed explanation of the non-conformity, and shall confirm such notice in writing via overnight delivery to ABPS within the above-prescribed [*] day acceptance period. Upon receipt of such notice, ABPS will investigate such alleged non-conformity, and (i) if ABPS agrees such Client Product is non-conforming, deliver to Client a corrective action plan within [*] days after receipt of Client’s written notice of non-conformity, or such additional time as is reasonably required e.g. if such investigation or plan requires data from sources other than Client or ABPS, or (ii) if ABPS disagrees with Client’s determination that the Batch of Client Product is non-conforming, ABPS shall so notify Client by telephone within such [*] day period and confirm such notice in writing by overnight delivery.

5.1 (c) If the parties dispute whether rejected Client Product is conforming or non-conforming, samples of the Batch of Client Product will be submitted to a mutually acceptable laboratory or consultant for resolution, whose determination of conformity or non-conformity, and the cause thereof if non-conforming, shall be binding upon the parties. Client and ABPS shall share equally the costs of such laboratory or consultant, except as set forth in Section 5.2.

5.1 (d) Manufacturing deviations and investigations which occur during Production of Client Product and which do not cause the Production to be non-compliant with cGMP, (which may include non-compliance under a 483 warning letter or OAI), shall not be deemed to cause Client Product to be non-conforming. ABPS shall not be liable for any non-conformity arising from Client’s instructions or defective, contaminated or non-conforming Client-Supplied Components, except for ABPS’ negligence or willful misconduct as set forth under 2.9(a).

5.2 Exclusive Remedy for Non-Conforming Product:

5.2 (a) In the event ABPS agrees, or the independent laboratory determines, that the Batch of Client Product is non-conforming solely as a result of the negligence of ABPS including its failure to adhere to the terms of this Agreement (or cGMP) and Client timely rejects the Batch, then ABPS, as Client’s exclusive remedy, shall at its expense, and subject to Client, at [*] expense (subject to [*] Section 5.3 of the Agreement) supplying the replacement Bulk Compound and any other Client-Supplied Components, either (i) refund any amounts previously paid for such Batch and cancel any remaining invoice for such Batch or (ii) replace such non-conforming Client Product within [*] days from receipt of replacement Bulk Compound from Client. In such event, the Obligated Capacity shall be reduced by the Purchase Price of the Batch if the Batch is not replaced and, ABPS shall also reimburse Client for any independent laboratory fees paid by Client under Section 5.1(c). In the event such Client Product is determined by the independent laboratory to be conforming, or to be non-conforming due to the act or omission of Client, then Client shall reimburse ABPS for ABPS’s portion of such laboratory’s fees.

5.2 (b) For clarity and by way of example, if Client Product is non-conforming due to non-conforming Bulk Compound or other Components (except for ABPS’ negligence or willful misconduct as set forth under 2.9(a)) or other matters within the responsibilities of Client, then Client will not be entitled to the foregoing remedy.

5.2 (c) Failure to Supply. In the event of a failure to supply and release at least [*] of the Batches (excluding replacement Batches) under accepted purchasing orders covering any period of [*] days solely as a result of the negligence of ABPS including its failure to adhere to the terms of this Agreement (or cGMP) the Parties will meet and agree on and implement a delivery improvement action plan within [*] business days. If after implementation of such

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [*], HAS BEEN OMITTED BECAUSE REVANCE THERAPEUTICS, INC., HAS DETERMINED THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM TO REVANCE THERAPEUTICS, INC., IF PUBLICLY DISCLOSED.

action plan there is subsequently a failure to supply and release at least [*] of the Batches (excluding replacement Batches) under accepted purchasing orders covering any [*] day period solely as a result of the negligence of ABPS including its failure to adhere to the terms of this Agreement (or cGMP) then Client shall have the right to terminate this Agreement immediately by notice, including the right to cancel outstanding purchase orders without a cancellation fee under section 3.3, and in such case will be responsible only for paying for services properly performed and non-cancellable commitments of ABPS up to the date of termination.

5.3 Lost Bulk Compound: In the case where Client Product is non-conforming such that Client is entitled to remedies under section 5.2, or Bulk Compound or Peptide is lost or damaged due to the negligence or willful misconduct of ABPS, then as Client’s exclusive remedy for any Bulk Compound or Peptide loss or damage, Client shall be entitled to reimbursement by ABPS for the original cost of the lost Bulk Compound or Peptide, up to [*] or [*] of the amounts due ABPS (excluding the cost of Components) for the Batch(es) at issue, whichever is less, such reimbursements to be limited to [*] Batches (or the corresponding quantity of Bulk Compound or Peptide) in any calendar year. For clarity, Client is responsible for losses of Bulk Compound or Peptide not caused by the negligence or willful misconduct of ABPS or in excess of such amounts, and for maintaining its own insurance, including property insurance, in amounts adequate to cover such losses.

C.Except as amended by this Amendment, all other terms and conditions of the Services Agreement shall remain in full force and effect.

D.This Amendment may be executed in any number of counterparts, each of which will be deemed an original, but all of which together will constitute one and the same instrument. Any signature page delivered by facsimile or electronic image transmission shall be binding to the same extent as an original signature page.

IN WITNESS WHEREOF, the parties hereto have executed this Amendment to be effective as of the Amendment Effective Date.

| | | | | | | | | | | |

| CLIENT | | ABPS | |

By: | /s/ Tobin Schilke | By: | /s/ Bert Barbose |

Name: | Tobin Schilke | Name: | Bert Barbose |

Title: | CFO | Title: | President & COO |

Date: | 2/26/2024 | Date: | 2/26/2024 |

| | | |

| /s/ MK | | |

| Marc Korenberg | | |

| Senior Vice President, Finance | | |

| 2/26/2024 | | |

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [*], HAS BEEN OMITTED BECAUSE REVANCE THERAPEUTICS, INC., HAS DETERMINED THE INFORMATION (I) IS NOT MATERIAL AND (II) WOULD LIKELY CAUSE COMPETITIVE HARM TO REVANCE THERAPEUTICS, INC., IF PUBLICLY DISCLOSED.

February 23, 2024 (the “Execution Date”) Electronic Mail

Dustin S. Sjuts

Revance Therapeutics, Inc.

Re: Separation Agreement

Dear Dustin:

This letter sets forth the substance of the mutual separation agreement (the “Agreement”) that Revance Therapeutics, Inc. (the “Company”) is offering to you to aid in your employment transition.

1.SEPARATION DATE. Your last day of work as the Company’s President, and your employment termination date, will be March 31, 2024 (the “Separation Date”). On the Separation Date, the Company will pay you all salary accrued through the Separation Date, and any accrued vacation balance earned through the Separation Date, subject to standard payroll deductions and withholdings. You are entitled to these payments regardless of whether or not you sign this Agreement.

2.Transition Period.

(a)Duties & Schedule. Between now and the Separation Date (the “Transition Period”), you will remain an employee of the Company and will be expected to transition your duties and responsibilities and perform other duties and tasks as reasonably requested by the Chief Executive Officer of the Company. You will not be required to work a full-time schedule during the Transition Period. During the Transition Period, you must continue to comply with all of the Company’s policies and procedures and with all of your statutory and contractual obligations to the Company (including, without limitation, your obligations under this Agreement and your Employee Proprietary Information and Invention Assignment and Arbitration Agreement, attached hereto as Exhibit A (the “PIIA”)). You agree to perform your duties in good faith.

(b)Compensation/Benefits. During the Transition Period, your base salary will remain the same, and you will continue to be eligible for the Company’s standard benefits, subject to the terms and conditions applicable to such plans and programs.

(c)Termination. Nothing in this Agreement alters your employment at-will status. Either you or the Company may terminate your employment at any time during the Transition Period, with or without Cause (as defined in the Revance Therapeutics, Inc. Executive Severance Benefit Plan (the “Severance Plan”)), upon written notice to the other.

3.SEVERANCE BENEFITS. If you: (i) sign this Agreement and allow the releases set forth herein to become effective; (ii) comply with all of your legal and contractual obligations to the Company and remain an employee in good standing during the Transition Period; and (iii) on the Separation Date, sign the Separation Date Release attached as Exhibit B and allow the releases contained therein to become effective, then the Company will provide you with the following severance benefits:

(a)Cash Severance. The Company will pay you severance in an amount equal to eighteen (18) months of your base salary in effect during 2023, paid in equal installments on the Company’s regular payroll schedule over the eighteen (18) month period following the Separation Date; provided, however, that no payments will be made prior to the first business day to occur on or after the 60th day following the Separation Date. On the first business day to occur on or after the 60th day following the Separation Date, you will receive in a lump sum the cash severance you would have received on or prior to such date under the original schedule, with the balance being paid as originally scheduled.

(b)Health Care Continuation Coverage.

(i)COBRA. To the extent provided by the federal COBRA law or, if applicable, state insurance laws, and by the Company’s current group health insurance policies, you will be eligible to continue your group health insurance benefits at your own expense. Later, you may be able to convert to an individual policy through the provider of the Company’s health insurance, if you wish.

(ii)COBRA Premiums. If you timely elect continued coverage under COBRA, the Company will pay your COBRA premiums to continue your coverage (including coverage for eligible dependents, if applicable) (“COBRA Premiums”) through the period (the “COBRA Premium Period”) starting on the Separation Date and ending on the earliest to occur of: (i) the date that is eighteen (18) months after the Separation Date; (ii) the date you become eligible for group health insurance coverage through a new employer; or (iii) the date you cease to be eligible for COBRA continuation coverage for any reason, including plan termination. In the event you become covered under another employer's group health plan or otherwise cease to be eligible for COBRA during the COBRA Premium Period, you must immediately notify the Company in writing of such event. Notwithstanding the foregoing, if the Company determines, in its sole discretion, that it cannot pay the COBRA Premiums without a substantial risk of violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), the Company instead shall pay to you, on the first day of each calendar month, a fully taxable cash payment equal to the applicable COBRA premiums for that month (including premiums for you and your eligible dependents who have elected and remain enrolled in such COBRA coverage), subject to applicable tax withholdings (such amount, the “Special Cash Payment”), for the remainder of the COBRA Premium Period. You may, but are not obligated to, use such Special Cash Payments toward the cost of COBRA premiums. On the thirtieth (30th) day following your Separation from Service, the Company will make the first payment to you under this paragraph, in a lump sum, equal to the aggregate Special Cash Payments that the Company would have paid to you through such date had the Special Cash Payments commenced on the first day of the first month following the Separation from Service through such thirtieth (30th) day, with the balance of the Special Cash Payments paid thereafter on the schedule described above.

4.EQUITY AWARDS. Vesting of all of your outstanding equity awards granted under the Company’s 2014 Equity Incentive Plan and the Company’s 2014 Inducement Plan, which are set forth on Exhibit C hereto, will continue to vest through the period of time that you are performing consulting services for the Company pursuant to the Consulting Agreement attached hereto as Exhibit D (as further described below in Section 5). Any such equity awards structured as options or stock appreciation rights will remain exercisable until the date that is three months after the end of the term of the Consulting Agreement (subject to earlier expiration in accordance with the terms of such awards, including in the event of a change in control or corporate transaction involving the Company). Your right to exercise any vested shares, and all other rights and obligations with respect to your equity awards will be as set forth in the applicable award agreement and plan documents. Except as necessary to give effect to the terms described in this paragraph, your equity awards shall continue to be governed by the terms of the applicable grant notices, award agreements and the applicable plan documents.

5.CONSULTING AGREEMENT. If you: (i) timely return this fully signed Agreement to the Company and allow it to become effective; (ii) adequately perform your Transition Period duties and are not subject to termination of employment by the Company for Cause prior to March 31, 2024; (iii) comply fully with your obligations hereunder; and (iv) sign the Release on the Separation Date and allow that Release to become effective, then the Company will enter into the Consulting Agreement attached hereto as Exhibit D.

6.Other Compensation Or Benefits. You acknowledge that, except as expressly provided in this Agreement, you will not receive any additional compensation, severance or benefits after the Separation Date, with the exception of any vested right you may have under the express terms of a written ERISA-qualified benefit plan (e.g., 401(k) account).

7.Expense Reimbursements. You agree that, within ten (10) days after the Separation Date, you will submit your final documented expense reimbursement statement reflecting all business expenses you incurred through the Separation Date, if any, for which you seek reimbursement. The Company will reimburse you for these expenses pursuant to its regular business practice.

8.Return of Company Property. By no later than the close of business on the Separation Date, you shall coordinate with the Company the return of all Company documents (and all copies thereof) and other Company property in your possession or control; provided, however, you shall be permitted to keep your Company computer following the Company’s deletion of all confidential or proprietary information from the Computer to its satisfaction. You agree that you will make a diligent search to locate any such documents, property and information within the timeframe referenced above. In addition, if you have used any personally owned computer, server, or e-mail system to receive, store, review, prepare or transmit any confidential or proprietary data, materials or information of the Company, then within five (5) business days after the Separation Date, you must provide the Company with a computer-useable copy of such information and then permanently delete and expunge such confidential or proprietary information from those systems without retaining any reproductions (in whole or inpart); and if requested, you will provide a declaration verifying that you have complied with the above. Notwithstanding the foregoing, during the term of your consulting agreement with the Company, you may retain such Company property and other information necessary for your provision of consulting services (collectively, the “Company Property”), and the retention of Company Property during the term of your consulting agreement will not constitute a breach of this Agreement and will not prevent you from receiving the severance benefits provided hereunder.

Your timely compliance with the provisions of this paragraph is a precondition to your receipt of the severance benefits provided hereunder.

9.Proprietary Information Obligations. Both during and after your Consulting Period, you acknowledge your continuing obligations under your PIIA, including your obligations not to use or disclose any confidential or proprietary information of the Company.

10.Nondisparagement. You agree not to disparage the Company and its officers, directors, employees, shareholders and agents, in any manner likely to be harmful to them or their business, business reputations or personal reputations; provided that you may respond accurately and fully to any question, inquiry or request for information when required by legal process (e.g., a valid subpoena or other similar compulsion of law) or as part of a government investigation. In addition, nothing in this provision or this Agreement is intended to prohibit or restrain you in any manner from making disclosures that are protected under the whistleblower provisions of federal or state law or regulation. The Company further agrees to direct its officers and directors not to make any written or oral statements about you that are disparaging or intended to be injurious; provided that the Company (and its directors and officers) may respond accurately and fully to any question, inquiry or request for information when required by legal process (e.g., a valid subpoena or other similar compulsion of law) or as part of a government investigation; and provided further that the Company’s communications internally and by legal requirement (e.g., SEC filings) announcing your departure shall not violate this section. Nothing in this Agreement prevents you from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that you have reason to believe is unlawful.

11.No Voluntary Adverse Action; and Cooperation. You agree that you will

not voluntarily provide assistance, information or advice, directly or indirectly (including through agents or attorneys), to any person or entity in connection with any proposed or pending litigation, arbitration, administrative claim, cause of action, or other formal proceeding of any kind brought against the Company, its parent or subsidiary entities, affiliates, officers, directors, employees or agents, nor shall you induce or encourage any person or entity to bring any such claims; provided that you may respond accurately and fully to any question, inquiry or request for information when required by legal process (e.g., a valid subpoena or other similar compulsion of law) or as part of a government investigation. In addition, you agree to voluntarily cooperate with the Company if you have knowledge of facts relevant to any existing or future litigation or arbitration initiated by or filed against the Company by making yourself reasonably available without further compensation for interviews with the Company or its legal counsel, for preparing for and providing deposition testimony, and for preparing for and providing trial testimony. The Company shall pay you for all out-of-pocket expenses reasonably incurred in furtherance of this section.

12.NO ADMISSIONS. You understand and agree that the promises and payments in consideration of this Agreement shall not be construed to be an admission of any liability or obligation by the Company to you or to any other person, and that the Company makes no such admission.

13.Release Of Claims.

(a)General Release. In exchange for the consideration provided to you under this Agreement to which you would not otherwise be entitled, you hereby generally and completely release the Company, and its affiliated, related, parent and subsidiary entities, and its and their current and former directors, officers, employees, stockholders, partners, agents, attorneys, predecessors, successors, insurers, affiliates, and assigns (collectively, the “Released Parties”) from any and all claims, liabilities and obligations, both known and unknown, that arise out of or are in any way related to events, acts, conduct, or omissions occurring prior to or on the date you sign this Agreement (collectively, the “Released Claims”).

(b)Scope of Release. The Released Claims include, but are not limited to: (i) all claims arising out of or in any way related to your employment with the Company, or the termination of that employment; (ii) all claims related to your compensation or benefits from the Company, including salary, bonuses, commissions, vacation, paid time off, expense reimbursements, severance pay, fringe benefits, stock, stock options, or any other ownership, equity, or profits interests in the Company; (iii) all claims for breach of contract, wrongful termination, and breach of the implied covenant of good faith and fair dealing; (iv) all tort claims, including claims for fraud, defamation, emotional distress, and discharge in violation of public policy; and (v) all federal, state, and local statutory claims, including claims for discrimination, harassment, retaliation, attorneys’ fees, or other claims arising under the federal Civil Rights Act of 1964 (as amended), the federal Americans with Disabilities Act of 1990, the federal Age Discrimination in Employment Act of 1967 (as amended) (the “ADEA”), the Tennessee Fair Employment Practices Law, the Tennessee Human Rights Act, the Tennessee Handicap Act, and the Tennessee Disability Act.

(c)ADEA Waiver. You acknowledge that you are knowingly and voluntarily waiving and releasing any rights you may have under the ADEA, and that the consideration given for the waiver and release in

this Section is in addition to anything of value to which you are already entitled. You further acknowledge that you have been advised, as required by the ADEA, that: (i) your waiver and release do not apply to any rights or claims that may arise after the date that you sign this Agreement; (ii) you should consult with an attorney prior to signing this Agreement (although you may choose voluntarily not to do so); (iii) you have twenty-one (21) days to consider this Agreement (although you may choose voluntarily to sign it earlier); (iv) you have seven (7) days following the date you sign this Agreement to revoke your acceptance (by providing written notice of your revocation to me); and (v) this Agreement will not be effective until the date upon which the revocation period has expired unexercised, which will be the eighth day after you sign this Agreement (“Effective Date”).

(d)Excluded Claims. Notwithstanding the foregoing, the following are not included in the Released Claims (the “Excluded Claims”): (i) any rights or claims for indemnification you may have pursuant to any written indemnification agreement with the Company to which you are a party or under applicable law; (ii) any rights which are not waivable as a matter of law; and (iii) any claims for breach of this Agreement. You hereby represent and warrant that, other than the Excluded Claims, you are not aware of any claims you have or might have against any of the Released Parties that are not included in the Released Claims. You understand that nothing in this Agreement limits your ability to file a charge or complaint with any Government Agency. While this Agreement does not limit your right to receive an award for information provided to the Securities and Exchange Commission, you understand and agree that, to the maximum extent permitted by law, you are otherwise waiving any and all rights you may have to individual relief based on any claims that you have released and any rights you have waived by signing this Agreement.

(e) The Company represents that as of the Execution Date, it is not aware of any claims against you that are in any way related to events, acts, conduct, or omissions occurring prior to or on the date you sign this Agreement.

14.REPRESENTATIONS. You hereby represent that you have been paid all compensation owed and for all hours worked, have received all the leave and leave benefits and protections for which you are eligible, pursuant to the Family and Medical Leave Act or otherwise, and have not suffered any on-the-job injury for which you have not already filed a claim.

15.SECTION 409A. Notwithstanding anything herein to the contrary, (i) if at the time of your termination of employment with the Company, you are a “specified employee” as defined in Section 409A of the Code and the applicable guidance and regulations thereunder (collectively, “Section 409A”), and the deferral of the commencement of any payments or benefits otherwise payable hereunder as a result of such termination of employment is necessary in order to prevent any accelerated or additional tax under Section 409A, then the Company will defer the commencement of the payment of any such payments or benefits hereunder (without any reduction in such payments or benefits ultimately paid or provided to you) until the first business day to occur following the date that is six (6) months following your termination of employment with the Company (or the earliest date as is permitted under Section 409A); and (ii) if any other payments of money or other benefits due to you hereunder could cause the application of an accelerated or additional tax under Section 409A, such payments or other benefits shall be deferred if deferral will make such payment or other benefits compliant under Section 409A, or otherwise such payment or other benefits shall be restructured, to the extent possible, in a manner, determined by the Company’s Board of the Directors, that does not cause such an accelerated or additional tax. In the event that payments under this Agreement are deferred pursuant to this Section 15 in order to prevent any accelerated tax or additional tax under Section 409A, then such payments shall be paid at the time specified under this Section 15 without any interest thereon. The Company shall consult with you in good faith regarding the implementation of this Section 15; provided, that neither the Company nor any of its employees or representatives shall have any liability to you with respect thereto. Notwithstanding anything to the contrary herein, to the extent required by Section 409A, a termination of employment shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment of amounts or benefits upon or following a termination of employment unless such termination is also a “separation from service” within the meaning of Section 409A and, for purposes of any such provision of this Agreement, references to a “resignation,” “termination,” “termination of employment” or like terms shall mean separation from service. For purposes of Section 409A, each payment made under this Agreement shall be designated as a “separate payment” within the meaning of the Section 409A. Notwithstanding anything to the contrary herein, except to the extent any expense, reimbursement or in-kind benefit provided pursuant to this Agreement does not constitute a “deferral of compensation” within the meaning of Section 409A, (A) the amount of expenses eligible for reimbursement or in-kind benefits provided to you during any calendar year will not affect the amount of expenses eligible for reimbursement or in- kind benefits provided to you in any other calendar year; (B) the reimbursements for expenses for which you are entitled to be reimbursed shall be made on or before the last day of the calendar year following the calendar year in which the applicable expense is incurred; and (C) the right to payment or reimbursement or in-kind benefits hereunder may not be liquidated or exchanged for any other benefit.

16.DISPUTE RESOLUTION. To ensure the timely and economical resolution of disputes that may arise in connection with your employment with the Company, you and the Company agree that any and all disputes, claims, or causes of action arising from or relating to the enforcement, breach, performance, negotiation, execution,

or interpretation of this Agreement, your employment, or the termination of your employment, including but not limited to statutory claims, shall be resolved pursuant to the Federal Arbitration Act, 9 U.S.C. §1-16, and to the fullest extent permitted by law by final, binding and confidential arbitration, by a single arbitrator, conducted by JAMS, Inc. (“JAMS”) under the then applicable JAMS Employment rules (which can be found at the following web address: https://www.jamsadr.com/rules- employment-arbitration/). By agreeing to this arbitration procedure, both you and the Company waive the right to resolve any such dispute through a trial by jury or judge or administrative proceeding. The Company acknowledges that you will have the right to be represented by legal counsel at any arbitration proceeding. In addition, all claims, disputes, or causes of action under this paragraph, whether by you or the Company, must be brought in an individual capacity, and shall not be brought as a plaintiff (or claimant) or class member in any purported class or representative proceeding, nor joined or consolidated with the claims of any other person or entity. The arbitrator may not consolidate the claims of more than one person or entity, and may not preside over any form of representative or class proceeding. To the extent that the preceding sentences regarding class claims or proceedings are found to violate applicable law or are otherwise found unenforceable, any claim(s) alleged or brought on behalf of a class shall proceed in a court of law rather than by arbitration. The arbitrator shall: (a) have the authority to compel adequate discovery for the resolution of the dispute and to award such relief as would otherwise be permitted by law; and (b) issue a written arbitration decision, to include the arbitrator’s essential findings and conclusions and a statement of the award. The arbitrator shall be authorized to award any or all remedies that you or the Company would be entitled to seek in a court of law. The Company shall pay all JAMS’ arbitration fees in excess of the amount of court fees that would be required of you if the dispute were decided in a court of law. Nothing in this Agreement is intended to prevent either you or the Company from obtaining injunctive relief in court to prevent irreparable harm pending the conclusion of any such arbitration. Any awards or orders in such arbitrations may be entered and enforced as judgments in the federal and state courts of any competent jurisdiction.

17.MISCELLANEOUS. This Agreement, including Exhibits A, B, C and D, constitutes the complete, final and exclusive embodiment of the entire agreement between you and the Company with regard to the subject matter hereof. It is entered into without reliance on any promise or representation, written or oral, other than those expressly contained herein, and it supersedes any other agreements, promises, warranties or representations concerning its subject matter. This Agreement may not be modified or amended except in a writing signed by both you and a duly authorized officer of the Company. This Agreement will bind the heirs, personal representatives, successors and assigns of both you and the Company, and inure to the benefit of both you and the Company, their heirs, successors and assigns. If any provision of this Agreement is determined to be invalid or unenforceable, in whole or in part, this determination shall not affect any other provision of this Agreement and the provision in question shall be modified so as to be rendered enforceable in a manner consistent with the intent of the parties insofar as possible under applicable law. This Agreement shall be construed and enforced in accordance with the laws of the State of Tennessee without regard to conflicts of law principles. Any ambiguity in this Agreement shall not be construed against either party as the drafter. Any waiver of a breach of this Agreement, or rights hereunder, shall be in writing and shall not be deemed to be a waiver of any successive breach or rights hereunder. This Agreement may be executed in counterparts which shall be deemed to be part of one original, and facsimile and signatures transmitted by PDF shall be equivalent to original signatures.

If this Agreement is acceptable to you, please sign below and return the original to me within twenty-one (21) days. The Company’s offer contained herein will automatically expire if we do not receive the fully signed Agreement within this timeframe.

I wish you good luck in your future endeavors.

Sincerely,

Revance Therapeutics, Inc.

By: /s/ Mark J. Foley

Mark J. Foley

Chief Executive Officer

Accepted and Agreed:

By:__/s/ Dustin Sjuts____________________

Dustin Sjuts

Date

Exhibit A

PROPRIETARY INFORMATION AND INVENTIONS AGREEMENT

This exhibit has been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Registrant undertakes to provide such information to the Securities and Exchange Commission upon request.

Exhibit B

SEPARATION DATE RELEASE

In exchange for the consideration provided to me under this Agreement to which I would not otherwise be entitled, I hereby generally and completely release the Company, and its affiliated, related, parent and subsidiary entities, and its and their current and former directors, officers, employees, shareholders, partners, agents, attorneys, predecessors, successors, insurers, affiliates, and assigns (collectively, the “Released Parties”) from any and all claims, liabilities and obligations, both known and unknown, that arise out of or are in any way related to events, acts, conduct, or omissions occurring prior to or on the date I sign this Agreement (collectively, the “Released Claims”).

The Released Claims include, but are not limited to: (i) all claims arising out of or in any way related to my employment with the Company, or the termination of that employment; (ii) all claims related to my compensation or benefits from the Company, including salary, bonuses, commissions, vacation, paid time off, expense reimbursements, severance pay, fringe benefits, stock, stock options, or any other ownership, equity, or profits interests in the Company; (iii) all claims for breach of contract, wrongful termination, and breach of the implied covenant of good faith and fair dealing; (iv) all tort claims, including claims for fraud, defamation, emotional distress, and discharge in violation of public policy; and (v) all federal, state, and local statutory claims, including claims for discrimination, harassment, retaliation, attorneys’ fees, or other claims arising under the federal Civil Rights Act of 1964 (as amended), the federal Americans with Disabilities Act of 1990, the federal Age Discrimination in Employment Act of 1967 (as amended) (the “ADEA”), the Tennessee Fair Employment Practices Law, the Tennessee Human Rights Act, the Tennessee Handicap Act, and the Tennessee Disability Act.

I acknowledge that I am knowingly and voluntarily waiving and releasing any rights I may have under the ADEA and that the consideration given for the waiver and release in this Section is in addition to anything of value to which I am already entitled. I further acknowledge that I have been advised, as required by the ADEA, that: (i) my waiver and release do not apply to any rights or claims that may arise after the date that I sign this Agreement; (ii) I should consult with an attorney prior to signing this Agreement (although I may choose voluntarily not to do so); (iii) I have twenty-one (21) days to consider this Agreement (although I may choose voluntarily to sign it earlier); (iv) I have seven (7) days following the date I sign this Separation Date Release to revoke my acceptance (by providing written notice of my revocation); and (v) this release will not be effective until the date upon which the revocation period has expired unexercised, which will be the eighth day after I sign this Separation Date Release.

Notwithstanding the foregoing, the following are not included in the Released Claims (the “Excluded Claims”): (i) any rights or claims for indemnification I may have pursuant to any written indemnification agreement with the Company to which I am a party or under applicable law; (ii) any rights which are not waivable as a matter of law; and (iii) any claims for breach of this Agreement. I hereby represent and warrant that, other than the Excluded Claims,I am not aware of any claims I have or might have against any of the Released Parties that are not included in the Released Claims.

I understand that nothing in this Agreement limits my ability to file a charge or complaint with any Government Agency. While this Agreement does not limit my right to receive an award for information provided to the Securities and Exchange Commission, I understand and agree that, to maximum extent permitted by law, I am otherwise waiving any and all rights I may have to individual relief based on any claims that I have released and any rights I have waived by signing this Agreement.

I hereby represent that I have been paid all compensation owed and for all hours worked, have received all the leave and leave benefits and protections for which I a m eligible, pursuant to the Family and Medical Leave Act or otherwise, and have not suffered any on-the- job injury for which I have not already filed a claim.

By:__/s/ Dustin Sjuts____________________

Dustin Sjuts

Date:__________________

The Company represents that as of the Execution Date, it is not aware of any claims against you that are in any way related to events, acts, conduct, or omissions occurring prior to or on the date you sign this Agreement.

By:__/s/ Mark J. Foley____________________

Mark J. Foley

Chief Executive Officer

Date:__2/23/24_________

Exhibit C

EQUITY AWARDS

This exhibit has been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Registrant undertakes to provide such information to the Securities and Exchange Commission upon request.

Exhibit D

CONSULTING AGREEMENT

Effective Date: April 1, 2024

This Consulting Agreement (the “Agreement”) is made as of the Effective Date set forth above by and between Revance Therapeutics Inc. (“Client”) and the entity named on the signature page hereto (“Consultant”).

1.Engagement of Services. Subject to the terms of this Agreement, Consultant will render the nonexclusive services (the “Services”) set forth in the Project Assignment attached hereto as Exhibit A (the “Project Assignment”). Consultant will be free of control and direction from the Client (other than general oversight and control over the results of the Services), and will have exclusive control over the manner and means of performing the Services, including the choice of place and time. Consultant will provide, at Consultant’s own expense, a place of work and all equipment, tools and other materials necessary to complete the Services; however, to the extent necessary to facilitate performance of the Services, Client may, in its discretion, make certain of its equipment or facilities available to Consultant at Consultant’s request. While on the Client’s premises, Consultant agrees to comply with Client’s then-current access rules and procedures, including those related to safety, security and confidentiality. Consultant agrees and acknowledges that Consultant has no expectation of privacy with respect to Client’s telecommunications, networking or information processing systems (including stored computer files, email messages and voice messages) and that Consultant’s activities, including the sending or receiving of any files or messages, on or using those systems may be monitored, and the contents of such files and messages may be reviewed and disclosed, at any time, without notice.

2.Compensation. Client will pay Consultant the fee set forth in the Project Assignment for Services rendered pursuant to this Agreement as Consultant’s sole compensation for such Services. Consultant will be reimbursed only for expenses that are expressly required for the Project Assignment or that have been approved in advance in writing by Client, provided Consultant has furnished such documentation for authorized expenses as Client may reasonably request. Upon termination of this Agreement for any reason, Consultant will be paid fees on the basis stated in the Project Assignment(s) for work that has been completed.

3.Ownership of Work Product. Consultant hereby irrevocably assigns to Client all right, title and interest worldwide in and to any deliverables specified in a Project Assignment and to any ideas, concepts, processes, discoveries, developments, formulae, information, materials, improvements, designs, artwork, content, software programs, other works of authorship, and any other work product created, conceived or developed by Consultant (whether alone or jointly with others) for Client during the term of this Agreement, including all copyrights, patents, trademarks, trade secrets, and other intellectual property rights therein (including all rights to priority and rights to file patent applications and/or registered designs) (collectively, the “Work Product”). Consultant retains no rights to use the Work Product and agrees not to challenge the validity of Client’s ownership of, or intellectual property rights in, the Work Product. Consultant agrees to execute, at Client’s request and expense, all documents and other instruments necessary or desirable to confirm such assignment. Consultant hereby irrevocably appoints Client as Consultant’s attorney-in-fact for the purpose of executing such documents on Consultant’s behalf, which appointment is coupled with an interest.

4.Other Rights. If Consultant has any rights, including without limitation “artist’s rights” or “moral rights,” in the Work Product that cannot be assigned, Consultant hereby unconditionally and irrevocably grants to Client an exclusive (even as to Consultant), worldwide, fully paid and royalty-free, irrevocable, perpetual license, with rights to sublicense through multiple tiers of sublicensees, to use, reproduce, distribute, create derivative works of, publicly perform and publicly display the Work Product in any medium or format, whether now known or later developed.

5.License to Preexisting IP. Consultant agrees not to use or incorporate into Work Product any intellectual property developed by any third party or by Consultant other than in the course of performing services for Client (“Preexisting IP”) unless the Preexisting IP has been specifically identified and described in the applicable Project Assignment.

6.Representations and Warranties. Consultant represents and warrants that: (a) the Services will be performed in a professional manner and in accordance with the industry standards and the Work Product will comply with the requirements and specifications set forth in the applicable Project Assignment, (b) the Work Product will be an original work of Consultant, (c) Consultant has the right and unrestricted ability to assign the ownership of Work Product to Client as set forth in Section 3, (d) neither the Work Product nor any element thereof will infringe upon or misappropriate any right of any person, whether contractual, statutory or common law, and (e) Consultant will comply with all applicable federal, state, local and foreign laws governing self-employed individuals. Consultant agrees to indemnify and hold Client harmless from any and all damages, costs, claims, expenses or other liability

(including reasonable attorneys’ fees) arising from or relating to the breach or alleged breach by Consultant of this Agreement, including any of the representations and warranties set forth in this Section 5. 7.Independent Contractor Relationship. Consultant’s relationship with Client is that of an independent contractor, and nothing in this Agreement is intended to, or should be construed to, create a partnership, agency, joint venture or employment relationship between Client and any of Consultant’s employees or agents. Consultant is not authorized to make any representation, contract or commitment on behalf of Client. Consultant (if Consultant is an individual) and Consultant’s employees will not be entitled to any of the benefits that Client may make available to its employees, including, but not limited to, group health or life insurance, profit-sharing or retirement benefits. Because Consultant is an independent contractor, Client will not withhold or make payments for social security, make unemployment insurance or disability insurance contributions, or obtain workers’ compensation insurance on behalf of Consultant. Consultant is solely responsible for, and will file, on a timely basis, all tax returns and payments required to be filed with, or made to, any federal, state or local tax authority with respect to the performance of Services and receipt of fees under this Agreement. Consultant is solely responsible for, and must maintain adequate records of, expenses incurred in the course of performing Services under this Agreement. No part of Consultant’s compensation will be subject to withholding by Client for the payment of any social security, federal, state or any other employee payroll taxes. Client will regularly report amounts paid to Consultant by filing Form 1099-NEC with the Internal Revenue Service as required by law.

8.Confidential Information. During the term of this Agreement and thereafter Consultant (i) will not use or permit the use of Client’s Confidential Information in any manner or for any purpose not expressly set forth in this Agreement, (ii) will hold such Confidential Information in confidence and protect it from unauthorized use and disclosure, and (iii) will not disclose such Confidential Information to any third parties except as set forth in this section and in Section 9 . below. Notwithstanding the foregoing or anything to the contrary in this Agreement or any other agreement between Client and Consultant, nothing in this Agreement shall limit Consultant’s right to report possible violations of law or regulation with any federal, state, or local government agency. “Confidential Information” as used in this Agreement means all information disclosed by Client to Consultant, whether during or before the term of this Agreement, that is not generally known in the Client’s trade or industry and will include, without limitation: (a) concepts and ideas relating to the development and distribution of content in any medium or to the current, future and proposed products or services of Client or its subsidiaries or affiliates; (b) trade secrets, drawings, inventions, know-how, software programs, and software source documents; (c) information regarding plans for research, development, new service offerings or products, marketing and selling, business plans, business forecasts, budgets and unpublished financial statements, licenses and distribution arrangements, prices and costs, suppliers and customers; (d) existence of any business discussions, negotiations or agreements between the parties; and (e) any information regarding the skills and compensation of employees, contractors or other agents of Client or its subsidiaries or affiliates. Confidential Information also includes proprietary or confidential information of any third party who may disclose such information to Client or Consultant in the course of Client’s business. Confidential Information does not include information that (x) is or becomes a part of the public domain through no act or omission of Consultant, (y) is disclosed to Consultant by a third party without restrictions on disclosure, or (z) was in Consultant’s lawful possession without obligation of confidentiality prior to the disclosure and was not obtained by Consultant either directly or indirectly from Client. In addition, this section will not be construed to prohibit disclosure of Confidential Information to the extent that such disclosure is required by law or valid order of a court or other governmental authority; provided, however, that Consultant will first have given notice to Client and will have made a reasonable effort to obtain a protective order requiring that the Confidential Information so disclosed be used only for the purposes for which the order was issued. All Confidential Information furnished to Consultant by Client is the sole and exclusive property of Client or its suppliers or customers. Upon request by Client, Consultant agrees to promptly deliver to Client the original and any copies of the Confidential Information. Notwithstanding the foregoing nondisclosure obligations, pursuant to 18 U.S.C. Section 1833(b), Consultant will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made: (1) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or (2) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

9.Term and Termination.

9.1 Term. The initial term of this Agreement is for one (1) year from the Effective Date set forth above, unless earlier terminated as provided in this Agreement.

9.2 Termination. Without waiving any other rights or remedies, Client may terminate this Agreement immediately upon Consultant’s material breach of any legal or contractual obligation to Client (including any material breach by Dustin Sjuts). Further, either party may terminate this Agreement at any time, for any reason, upon 30 days written notice to the other party. Upon termination of this Agreement by either party, Client will pay only those consulting fees and expenses incurred through and including the effective date of such termination.

9.3 Survival. The rights and obligations contained in Sections 3 (“Ownership of Work Product”), 4 (“Other Rights”), 5 (“License to Preexisting IP”), 5 (“Representations and Warranties”), 8 (“Confidential Information”) and 11 (“Non-solicitation”) will survive any termination or expiration of this Agreement. 10.No Conflicts.

10.1 Consultant will refrain from any activity, and will not enter into any agreement or make any commitment, that is inconsistent or incompatible with Consultant’s obligations under this Agreement, including Consultant’s ability to perform the Services. Consultant represents and warrants that Consultant is not subject to any contract or duty that would be breached by Consultant’s entering into or performing Consultant’s obligations under this Agreement or that is otherwise inconsistent with this Agreement.

10.2 In addition, during the term of this Agreement, in order to protect Client’s trade secrets and confidential and proprietary information, Consultant agrees that Consultant will not engage or invest in, own, manage, operate, finance, control, or participate in the ownership, management, operation, financing, or control of, be employed by, or otherwise provide services to a Competing Business (as defined below) anywhere in the Restricted Territory (as defined below); provided, however, that consulting with, being employed by, rendering services for or otherwise assisting a division of an organization if the division for which Consultant performs services does not engage in the Competing Business, but where another division of the organization does engage in the Competing Business so long as the Competing Business is not the primary business of the organization as a whole (it being agreed that all divisions and the primary business of each of the Restricted Entities engage in the Business) and Consultant has no interaction whatsoever with the division of such organization that does engage in the Competing Business; provided, further, that Client’s Chief Executive Officer may approve any exception to this provision in his sole discretion. Owning up to a 1% equity interest in any Competing Business shall not be deemed a breach or violation of this section. “Competing Business” shall mean any business engaged (whether directly or indirectly) in the research, development or commercialization of products or services competitive with those of Client or its subsidiaries. “Restricted Territory” means any geographical or market area where Client or its subsidiaries engages in business.

11.Non-solicitation. Consultant agrees that during the term of this Agreement, and for a period of twelve (12) months thereafter, Consultant will not, directly or indirectly, on his own behalf or on behalf of any third party, (a) solicit, encourage, provide advice or induce any employee or consultant of Revance to terminate his or her employment or engagement with Revance (or renegotiate the terms of their employment or separation thereof) or (b) hire any person who was employed by Revance at any time during a twelve (12) month period immediately prior to the Separation Date; provided, however, that broad general public solicitations and advertisements not directed at employees or contractors to Revance, and the extension of offers to persons who respond to such general solicitations and advertisements, will not be deemed violations of this provision.

12.Successors and Assigns. Consultant may not subcontract or otherwise delegate or assign this Agreement or any of its obligations under this Agreement without Client’s prior written consent. Any attempted assignment in violation of the foregoing will be null and void. Subject to the foregoing, this Agreement will be for the benefit of Client’s successors and assigns, and will be binding on Consultant’s assignees.

13.Notices. Any notice required or permitted by this Agreement will be in writing and will be delivered as follows with notice deemed given as indicated: (i) by personal delivery when delivered personally; (ii) by overnight courier upon written verification of receipt; (iii) by email (provided, however, if the sender receives an automatically generated notification that such email was not delivered, such attempted email notice shall be ineffective and deemed to not have been given); or (iv) by certified or registered mail, return receipt requested, upon verification of receipt. Notice will be sent to the addresses set forth below or such other address as either party may specify in writing.

14.Governing Law. This Agreement will be governed in all respects by the laws of the United States of America and by the laws of the State of Tennessee, without giving effect to any conflicts of laws principles that require the application of the law of a different jurisdiction.

15.Severability. Should any provisions of this Agreement be held by a court of law to be illegal, invalid or unenforceable, the legality, validity and enforceability of the remaining provisions of this Agreement will not be affected or impaired thereby.

16.Waiver. The waiver by Client of a breach of any provision of this Agreement by Consultant will not operate or be construed as a waiver of any other or subsequent breach by Consultant.

17.Injunctive Relief for Breach. Consultant’s obligations under this Agreement are of a unique character that gives them particular value; breach of any of such obligations will result in irreparable and continuing damage to Client for which there will be no adequate remedy at law; and, in the event of such breach, Client will be entitled to injunctive relief and/or a decree for specific performance, and such other and further relief as may be proper (including monetary damages if appropriate).

18.Entire Agreement. This Agreement (together with the separation agreement between Client and Dustin Sjuts) constitutes the entire agreement between the parties relating to this subject matter and supersedes all prior or contemporaneous oral or written agreements concerning such subject matter. The terms of this Agreement will govern all services undertaken by Consultant for Client; provided, however, that in the event of any conflict between the terms of this Agreement and any Project Assignment, the terms of the applicable Project Assignment will control, provided that the Project Assignment specifically calls out the applicable Section number of this Agreement to be superseded and has been signed by an authorized officer of Client. This Agreement may only be changed or amended by mutual agreement of authorized representatives of the parties in writing. This Agreement may be executed in two or more counterparts, each of which will be deemed an original, but all of which together will constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act or other applicable law) or other transmission method and any counterpart so delivered will be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[Remainder of page intentionally left blank]

The parties have executed this Agreement as of the Effective Date.

| | | | | | | | |

| CLIENT: | |

Revance Therapeutics Inc |

By: | /s/ Mark J. Foley |

| Name: | Mark Foley |

| Title: | Chief Executive Officer |

| | | | | |

CONSULTANT: [name] |

| Dustin Sjuts |

Name of Consultant (Please Print) |

| /s/ Dustin Sjuts |

Signature |

| Founder |

Title (if applicable) |

| [email] |

Email |

| Address: | |

| |

| |

| Phone Number: | |

EXHIBIT A

Project Assignment #1 Under Consulting Agreement Dated: April 1, 2024

Project:

Consultant will provide consulting services to Client as directed by Client’s Chief Executive Officer (the “Consulting Services”). All Consulting Services will be performed by Dustin Sjuts. Consultant will exercise the highest degree of professionalism and utilize its expertise and creative talents in performing the Consulting Services. Consultant agrees to perform the Consulting Services throughout the term on an as-needed basis, up to a maximum of an average of eight (8) hours per week.

Fees And Reimbursement:

Provided that Consultant: (i) performs the Consulting Services to Client’s satisfaction (as determined by Client in its sole discretion); and (ii) complies with all contractual obligations to Client, then Client will pay Consultant consulting fees at the rate of $1,500 per month (the “Consulting Fees”). The monthly amount of the Consulting Fees will be paid on or around the last business day of each calendar month during the term.

Vesting of all of Consultant’s outstanding equity awards granted under the Company’s 2014 Equity Incentive Plan and the Company’s 2014 Inducement Plan, which are set forth on Exhibit C to Consultant’s Separation Agreement, dated February 23, 2024, will continue to vest through the period of time that Consultant is performing consulting services. Any such equity awards structured as options or stock appreciation rights will remain exercisable until the date that is three months after the date on which the Consultant ceases to provide services pursuant to the Consulting Agreement (subject to earlier expiration in accordance with the terms of such awards, including in the event of a change in control or corporate transaction involving the Company).

If, during the term of this Agreement, a Change in Control (as defined in Client’s 2014 Equity Incentive Plan and Client’s 2014 Inducement Plan) becomes effective, then Client will accelerate the vesting of Mr. Sjuts’s equity awards consistent with the terms set forth in the governing plan documents and award agreements.

The parties have executed this Project Assignment as of the date first written above.

| | | | | | | | |

| CLIENT: | |

Revance Therapeutics Inc |

By: | /s/ Mark J. Foley |

| Name: | Mark Foley |

| Title: | Chief Executive Officer |

| | | | | |

CONSULTANT: [name] |

| Dustin Sjuts |

Name of Consultant (Please Print) |

| /s/ Dustin Sjuts |

Signature |

| Founder |

Title (if applicable) |

| [email] |

Email |

Revance Reports Fourth Quarter and Full Year 2023 Financial Results,

Provides Corporate Update

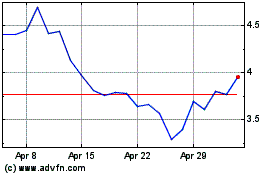

–Q4 and full year 2023 product revenue (DAXXIFY® and RHA® Collection) of $58.5 million and $212.7 million, representing approximately 28% and 80% YoY growth, respectively.

–Q4 DAXXIFY volume up 22% over Q3 2023, with over two-thirds of Q4 revenue attributable to reordering accounts.

–2024 product revenue guidance of at least $280 million, supporting blockbuster potential in U.S. aesthetics.

–DAXXIFY for cervical dystonia on track for commercial launch mid-year; Permanent J-Code for DAXXIFY received January 2024.

–2023 GAAP and non-GAAP OPEX on the low end of previously announced guidance ranges; 2024 GAAP and non-GAAP OPEX guidance of $460 million to $490 million and $290 million to $310 million, respectively.

–Cash, cash equivalents and short-term investments of $253.9 million as of December 31, 2023; Management anticipates achieving positive Adjusted EBITDA in 2025.

–Conference call and webcast today at 4:30 p.m. ET.

NASHVILLE, Tenn. —(BUSINESS WIRE)— February 28, 2024 - Revance Therapeutics, Inc. (RVNC, www.revance.com), today reported financial results for the fourth quarter and full year ended December 31, 2023 and provided a corporate update.

Financial Highlights