STATEMENT

OF INVESTMENTS

BNY Mellon High Yield Strategies Fund

December 31, 2023 (Unaudited)

| | | | | | | | | | |

| |

Description

| Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% | | | | | |

Advertising

- 1.2% | | | | | |

Clear Channel Outdoor Holdings, Inc., Sr. Scd. Notes | | 5.13 | | 8/15/2027 | | 825,000 | b,c | 788,087 | |

Clear Channel Outdoor Holdings, Inc., Sr. Scd. Notes | | 9.00 | | 9/15/2028 | | 840,000 | c | 877,120 | |

Outfront Media Capital LLC/Outfront Media Capital Corp., Gtd.

Notes | | 5.00 | | 8/15/2027 | | 734,000 | b,c | 710,073 | |

| | 2,375,280 | |

Aerospace & Defense - 2.6% | | | | | |

Bombardier, Inc., Sr.

Unscd. Notes | | 7.50 | | 2/1/2029 | | 665,000 | b,c | 676,596 | |

Bombardier, Inc., Sr. Unscd. Notes | | 7.88 | | 4/15/2027 | | 670,000 | c | 670,751 | |

Spirit AeroSystems, Inc., Sr. Scd. Notes | | 9.75 | | 11/15/2030 | | 616,000 | b,c | 662,954 | |

TransDigm, Inc., Gtd. Notes | | 4.88 | | 5/1/2029 | | 1,003,000 | b | 938,647 | |

TransDigm, Inc., Gtd. Notes | | 5.50 | | 11/15/2027 | | 500,000 | b | 490,281 | |

TransDigm, Inc., Sr. Scd. Notes | | 6.75 | | 8/15/2028 | | 478,000 | b,c | 489,631 | |

TransDigm, Inc., Sr. Scd. Notes | | 6.88 | | 12/15/2030 | | 870,000 | b,c | 896,670 | |

TransDigm, Inc., Sr. Scd. Notes | | 7.13 | | 12/1/2031 | | 220,000 | c | 230,816 | |

| | 5,056,346 | |

Airlines

- .5% | | | | | |

American Airlines, Inc./Aadvantage Loyalty IP Ltd., Sr. Scd. Notes | | 5.75 | | 4/20/2029 | | 1,078,121 | c | 1,052,146 | |

Automobiles & Components

- 3.6% | | | | | |

Clarios Global LP/Clarios US Finance Co., Gtd. Notes | | 8.50 | | 5/15/2027 | | 890,000 | c | 894,771 | |

Clarios Global LP/Clarios US Finance Co., Sr. Scd. Notes | | 6.75 | | 5/15/2028 | | 1,283,000 | b,c | 1,309,738 | |

Ford Motor Credit Co., LLC, Sr. Unscd. Notes | | 4.00 | | 11/13/2030 | | 1,620,000 | b | 1,454,809 | |

Ford Motor Credit Co., LLC, Sr. Unscd. Notes | | 7.35 | | 3/6/2030 | | 730,000 | b | 784,822 | |

IHO Verwaltungs GmbH, Sr. Scd. Bonds | | 6.00 | | 5/15/2027 | | 1,450,000 | b,c,d | 1,414,329 | |

Real Hero Merger Sub 2, Inc., Sr. Unscd. Notes | | 6.25 | | 2/1/2029 | | 812,000 | c | 700,956 | |

Standard Profil Automotive GmbH, Sr. Scd. Bonds | EUR | 6.25 | | 4/30/2026 | | 675,000 | c | 585,049 | |

| | 7,144,474 | |

Banks - .9% | | | | | |

Citigroup, Inc., Jr. Sub. Notes | | 3.88 | | 2/18/2026 | | 906,000 | b,e | 804,369 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Banks

- .9% (continued) | | | | | |

JPMorgan Chase & Co., Jr. Sub. Bonds, Ser. FF | | 5.00 | | 8/1/2024 | | 930,000 | b,e | 913,623 | |

| | 1,717,992 | |

Building Materials - 3.6% | | | | | |

Builders FirstSource,

Inc., Gtd. Notes | | 4.25 | | 2/1/2032 | | 931,000 | b,c | 841,145 | |

Camelot Return Merger Sub, Inc., Sr. Scd. Notes | | 8.75 | | 8/1/2028 | | 2,021,000 | b,c | 2,053,991 | |

Eco Material Technologies, Inc., Sr. Scd. Notes | | 7.88 | | 1/31/2027 | | 1,091,000 | b,c | 1,092,364 | |

Emerald Debt Merger Sub LLC, Sr. Scd. Notes | | 6.63 | | 12/15/2030 | | 1,378,000 | b,c | 1,409,170 | |

PCF GmbH, Sr. Scd. Bonds | EUR | 4.75 | | 4/15/2026 | | 740,000 | c | 599,354 | |

Standard Industries, Inc., Sr. Unscd. Notes | | 4.75 | | 1/15/2028 | | 497,000 | b,c | 478,800 | |

Summit Materials LLC/Summit Materials Finance Corp., Gtd. Notes | | 7.25 | | 1/15/2031 | | 571,000 | c | 602,022 | |

| | 7,076,846 | |

Chemicals - 3.8% | | | | | |

Iris Holdings, Inc.,

Sr. Unscd. Notes | | 8.75 | | 2/15/2026 | | 1,396,000 | b,c,d | 1,186,516 | |

Italmatch Chemicals SpA, Sr. Scd. Notes | EUR | 10.00 | | 2/6/2028 | | 950,000 | c | 1,086,696 | |

Mativ Holdings, Inc., Gtd. Notes | | 6.88 | | 10/1/2026 | | 503,000 | c | 483,062 | |

NOVA Chemicals Corp., Sr. Unscd. Notes | | 5.00 | | 5/1/2025 | | 1,912,000 | b,c | 1,866,937 | |

Olympus Water US Holding Corp., Sr. Scd. Notes | EUR | 9.63 | | 11/15/2028 | | 365,000 | c | 433,138 | |

Olympus Water US Holding Corp., Sr. Scd. Notes | | 9.75 | | 11/15/2028 | | 1,430,000 | b,c | 1,519,579 | |

WR Grace Holdings LLC, Sr. Unscd. Notes | | 5.63 | | 8/15/2029 | | 880,000 | b,c | 775,374 | |

| | 7,351,302 | |

Collateralized

Loan Obligations Debt - 5.4% | | | | | |

Bain Capital Credit Ltd. CLO, Ser. 2022-5A, Cl. E, (3 Month

TSFR +7.60%) | | 13.00 | | 7/24/2034 | | 1,500,000 | c,f | 1,514,712 | |

Battalion X Ltd. CLO, Ser. 2016-10A, Cl. DR2, (3 Month TSFR

+6.87%) | | 12.27 | | 1/25/2035 | | 1,000,000 | c,f | 845,567 | |

Chenango Park Ltd. CLO, Ser. 2018-1A, Cl. D, (3 Month TSFR

+6.06%) | | 11.46 | | 4/15/2030 | | 1,000,000 | c,f | 893,463 | |

Crown Point 8 Ltd. CLO, Ser. 2019-8A, Cl. ER, (3 Month TSFR

+7.39%) | | 12.81 | | 10/20/2034 | | 2,375,000 | c,f | 2,320,933 | |

Northwoods Capital 27 Ltd. CLO, Ser. 2021-27A, Cl. E, (3 Month

TSFR +7.30%) | | 12.70 | | 10/17/2034 | | 1,150,000 | c,f | 1,029,950 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Collateralized

Loan Obligations Debt - 5.4% (continued) | | | | | |

Octagon Investment Partners 33 Ltd. CLO, Ser. 2017-1A, Cl.

D, (3 Month TSFR +6.56%) | | 11.98 | | 1/20/2031 | | 1,525,000 | c,f | 1,369,997 | |

Octagon Investment Partners 46 Ltd. CLO, Ser. 2020-2A, Cl.

ER, (3 Month TSFR +6.86%) | | 12.26 | | 7/15/2036 | | 2,000,000 | c,f | 1,748,986 | |

OZLM VI Ltd. CLO, Ser. 2014-6A, Cl. DS, (3 Month TSFR +6.31%) | | 11.71 | | 4/17/2031 | | 1,000,000 | c,f | 878,939 | |

| | 10,602,547 | |

Commercial & Professional Services - 6.7% | | | | | |

Adtalem

Global Education, Inc., Sr. Scd. Notes | | 5.50 | | 3/1/2028 | | 496,000 | b,c | 477,625 | |

Albion Financing 1 Sarl/Aggreko Holdings, Inc., Sr. Scd. Notes | | 6.13 | | 10/15/2026 | | 330,000 | c | 327,274 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp.,

Sr. Scd. Notes | | 6.63 | | 7/15/2026 | | 550,000 | c | 547,629 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas

Luxco 4 Sarl, Sr. Scd. Bonds, Ser. 144 | GBP | 4.88 | | 6/1/2028 | | 520,000 | c | 560,495 | |

APX Group, Inc., Sr. Scd. Notes | | 6.75 | | 2/15/2027 | | 1,034,000 | b,c | 1,032,873 | |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc., Gtd.

Notes | | 8.00 | | 2/15/2031 | | 2,008,000 | c | 2,006,965 | |

GTCR W-2 Merger Sub LLC, Sr. Scd. Notes | | 7.50 | | 1/15/2031 | | 863,000 | b,c | 912,512 | |

GTCR W-2 Merger Sub LLC/GTCR W Dutch Finance Sub BV, Sr. Scd.

Bonds | GBP | 8.50 | | 1/15/2031 | | 253,000 | c | 349,656 | |

House of HR Group BV, Sr. Scd. Bonds | EUR | 9.00 | | 11/3/2029 | | 1,240,000 | c | 1,427,002 | |

Neptune BidCo US, Inc., Sr. Scd. Notes | | 9.29 | | 4/15/2029 | | 529,000 | b,c | 493,725 | |

Prime Security Services Borrower LLC/Prime Finance, Inc., Scd.

Notes | | 6.25 | | 1/15/2028 | | 1,429,000 | b,c | 1,421,782 | |

Prime Security Services Borrower LLC/Prime Finance, Inc., Sr.

Scd. Notes | | 3.38 | | 8/31/2027 | | 285,000 | c | 264,429 | |

United Rentals North America, Inc., Gtd. Notes | | 3.75 | | 1/15/2032 | | 998,000 | | 884,155 | |

Verisure Midholding

AB, Gtd. Notes | EUR | 5.25 | | 2/15/2029 | | 2,200,000 | c | 2,325,495 | |

| | 13,031,617 | |

Consumer Discretionary - 12.1% | | | | | |

Allwyn Entertainment

Financing UK PLC, Sr. Scd. Notes | | 7.88 | | 4/30/2029 | | 1,698,000 | b,c | 1,736,205 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Consumer

Discretionary - 12.1% (continued) | | | | | |

Ashton Woods USA LLC/Ashton Woods Finance Co., Sr. Unscd. Notes | | 4.63 | | 4/1/2030 | | 640,000 | b,c | 574,439 | |

Caesars Entertainment, Inc., Sr. Scd. Notes | | 7.00 | | 2/15/2030 | | 790,000 | c | 810,589 | |

Carnival Corp., Gtd. Notes | | 6.00 | | 5/1/2029 | | 2,468,000 | b,c | 2,376,611 | |

Carnival Corp., Gtd. Notes | | 7.63 | | 3/1/2026 | | 1,178,000 | b,c | 1,200,036 | |

Carnival Corp., Sr. Scd. Notes | | 7.00 | | 8/15/2029 | | 302,000 | b,c | 315,513 | |

Carnival Holdings Bermuda Ltd., Gtd. Notes | | 10.38 | | 5/1/2028 | | 564,000 | b,c | 614,305 | |

CCM Merger, Inc., Sr. Unscd. Notes | | 6.38 | | 5/1/2026 | | 1,100,000 | b,c | 1,075,036 | |

Churchill Downs, Inc., Gtd. Notes | | 4.75 | | 1/15/2028 | | 440,000 | b,c | 421,969 | |

Dealer Tire LLC/DT Issuer LLC, Sr. Unscd. Notes | | 8.00 | | 2/1/2028 | | 1,389,000 | b,c | 1,376,728 | |

Everi Holdings, Inc., Gtd. Notes | | 5.00 | | 7/15/2029 | | 1,111,000 | b,c | 1,009,850 | |

Hilton Domestic Operating Co., Inc., Gtd. Notes | | 4.00 | | 5/1/2031 | | 930,000 | b,c | 852,810 | |

International Game Technology PLC, Sr. Scd. Notes | | 5.25 | | 1/15/2029 | | 1,105,000 | b,c | 1,082,705 | |

NCL Corp. Ltd., Gtd. Notes | | 5.88 | | 3/15/2026 | | 1,560,000 | b,c | 1,525,450 | |

NCL Corp. Ltd., Sr. Scd. Notes | | 5.88 | | 2/15/2027 | | 556,000 | b,c | 551,548 | |

NCL Corp. Ltd., Sr. Scd. Notes | | 8.13 | | 1/15/2029 | | 478,000 | c | 499,669 | |

Ontario Gaming GTA LP, Sr. Scd. Notes | | 8.00 | | 8/1/2030 | | 700,000 | b,c | 722,379 | |

Royal Caribbean Cruises Ltd., Gtd. Notes | | 7.25 | | 1/15/2030 | | 546,000 | c | 570,573 | |

Royal Caribbean Cruises Ltd., Sr. Unscd. Notes | | 4.25 | | 7/1/2026 | | 262,000 | c | 253,223 | |

Royal Caribbean Cruises Ltd., Sr. Unscd. Notes | | 5.50 | | 8/31/2026 | | 2,182,000 | b,c | 2,161,867 | |

Scientific Games Holdings LP/Scientific Games US Finco, Inc.,

Sr. Unscd. Notes | | 6.63 | | 3/1/2030 | | 537,000 | b,c | 508,332 | |

Taylor Morrison Communities, Inc., Sr. Unscd. Notes | | 5.13 | | 8/1/2030 | | 538,000 | c | 521,040 | |

Verde Purchaser LLC, Sr. Scd. Notes | | 10.50 | | 11/30/2030 | | 777,000 | c | 783,915 | |

Viking Cruises Ltd., Sr. Unscd. Notes | | 9.13 | | 7/15/2031 | | 761,000 | b,c | 811,444 | |

Windsor Holdings III LLC, Sr. Scd. Notes | | 8.50 | | 6/15/2030 | | 1,172,000 | b,c | 1,226,238 | |

| | 23,582,474 | |

Consumer

Staples - .4% | | | | | |

Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc., Sr. Scd. Notes | | 5.00 | | 12/31/2026 | | 720,000 | b,c | 702,659 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Diversified

Financials - 5.2% | | | | | |

Encore Capital Group, Inc., Sr. Scd. Notes | GBP | 4.25 | | 6/1/2028 | | 1,570,000 | c | 1,719,668 | |

Garfunkelux Holdco 3 SA, Sr. Scd. Bonds | GBP | 7.75 | | 11/1/2025 | | 910,000 | c | 897,520 | |

Garfunkelux Holdco 3 SA, Sr. Scd. Notes | EUR | 6.75 | | 11/1/2025 | | 1,215,000 | c | 1,070,746 | |

Intrum AB, Sr. Unscd. Notes | EUR | 4.88 | | 8/15/2025 | | 1,190,000 | c | 1,232,415 | |

Nationstar Mortgage Holdings, Inc., Gtd. Notes | | 5.00 | | 2/1/2026 | | 1,430,000 | b,c | 1,399,374 | |

Navient Corp., Sr. Unscd. Notes | | 5.00 | | 3/15/2027 | | 805,000 | b | 777,948 | |

OneMain Finance Corp., Gtd. Notes | | 7.88 | | 3/15/2030 | | 466,000 | | 480,099 | |

PennyMac Financial Services, Inc., Gtd. Notes | | 5.38 | | 10/15/2025 | | 1,047,000 | b,c | 1,035,873 | |

PennyMac Financial Services, Inc., Gtd. Notes | | 7.88 | | 12/15/2029 | | 917,000 | c | 945,245 | |

United Wholesale Mortgage LLC, Sr. Unscd. Notes | | 5.75 | | 6/15/2027 | | 718,000 | b,c | 704,455 | |

| | 10,263,343 | |

Electronic Components - .5% | | | | | |

Sensata Technologies

BV, Gtd. Notes | | 5.88 | | 9/1/2030 | | 980,000 | b,c | 974,690 | |

Energy - 13.2% | | | | | |

Aethon

United BR LP/Aethon United Finance Corp., Sr. Unscd. Notes | | 8.25 | | 2/15/2026 | | 1,867,000 | b,c | 1,878,239 | |

Antero Midstream Partners LP/Antero Midstream Finance Corp.,

Gtd. Notes | | 5.75 | | 3/1/2027 | | 1,340,000 | b,c | 1,330,435 | |

Antero Resources Corp., Gtd. Notes | | 5.38 | | 3/1/2030 | | 835,000 | b,c | 801,308 | |

Blue Racer Midstream LLC/Blue Racer Finance Corp., Sr. Unscd.

Notes | | 6.63 | | 7/15/2026 | | 1,430,000 | b,c | 1,422,700 | |

Chesapeake Energy Corp., Gtd. Notes | | 5.88 | | 2/1/2029 | | 1,081,000 | b,c | 1,060,513 | |

Comstock Resources, Inc., Gtd. Notes | | 6.75 | | 3/1/2029 | | 1,610,000 | b,c | 1,474,393 | |

CQP Holdco LP/Bip-V Chinook Holdco LLC, Sr. Scd. Notes | | 5.50 | | 6/15/2031 | | 490,000 | b,c | 465,015 | |

Energy Transfer LP, Jr. Sub. Bonds, Ser. B | | 6.63 | | 2/15/2028 | | 2,340,000 | b,e | 1,962,651 | |

EnLink Midstream LLC, Gtd. Notes | | 6.50 | | 9/1/2030 | | 1,166,000 | b,c | 1,191,781 | |

EQM Midstream Partners LP, Sr. Unscd. Notes | | 4.00 | | 8/1/2024 | | 660,000 | b | 654,187 | |

EQM Midstream Partners LP, Sr. Unscd. Notes | | 5.50 | | 7/15/2028 | | 969,000 | b | 960,726 | |

Moss Creek Resources Holdings, Inc., Gtd. Notes | | 7.50 | | 1/15/2026 | | 1,090,000 | b,c | 1,088,770 | |

New Fortress Energy, Inc., Sr. Scd. Notes | | 6.75 | | 9/15/2025 | | 570,000 | b,c | 565,908 | |

Noble Finance II LLC, Gtd. Notes | | 8.00 | | 4/15/2030 | | 640,000 | b,c | 666,495 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Energy

- 13.2% (continued) | | | | | |

Northern Oil & Gas, Inc., Sr. Unscd. Notes | | 8.13 | | 3/1/2028 | | 1,050,000 | b,c | 1,064,217 | |

Northriver Midstream Finance LP, Sr. Scd. Notes | | 5.63 | | 2/15/2026 | | 1,050,000 | b,c | 1,019,088 | |

Rockcliff Energy II LLC, Sr. Unscd. Notes | | 5.50 | | 10/15/2029 | | 1,409,000 | b,c | 1,333,553 | |

Rockies Express Pipeline LLC, Sr. Unscd. Notes | | 4.80 | | 5/15/2030 | | 1,396,000 | b,c | 1,279,141 | |

Sitio Royalties Operating Partnership LP/Sitio Finance Corp.,

Sr. Unscd. Notes | | 7.88 | | 11/1/2028 | | 1,307,000 | b,c | 1,355,437 | |

Venture Global Calcasieu Pass LLC, Sr. Scd. Notes | | 3.88 | | 11/1/2033 | | 1,301,000 | b,c | 1,104,091 | |

Venture Global Calcasieu Pass LLC, Sr. Scd. Notes | | 4.13 | | 8/15/2031 | | 600,000 | b,c | 529,372 | |

Venture Global Calcasieu Pass LLC, Sr. Scd. Notes | | 6.25 | | 1/15/2030 | | 246,000 | c | 244,994 | |

Venture Global LNG, Inc., Sr. Scd. Notes | | 8.13 | | 6/1/2028 | | 2,267,000 | b,c | 2,291,499 | |

| | 25,744,513 | |

Environmental

Control - .7% | | | | | |

Covanta Holding Corp., Gtd. Notes | | 4.88 | | 12/1/2029 | | 211,000 | b,c | 184,600 | |

Covanta Holding Corp., Gtd. Notes | | 5.00 | | 9/1/2030 | | 286,000 | | 244,054 | |

Madison IAQ LLC, Sr. Scd. Notes | | 4.13 | | 6/30/2028 | | 224,000 | c | 203,871 | |

Waste Pro USA, Inc., Sr. Unscd. Notes | | 5.50 | | 2/15/2026 | | 828,000 | b,c | 797,886 | |

| | 1,430,411 | |

Food

Products - 2.2% | | | | | |

Boparan Finance PLC, Sr. Scd. Bonds | GBP | 7.63 | | 11/30/2025 | | 240,000 | c | 273,795 | |

Pilgrim's Pride Corp., Gtd. Notes | | 3.50 | | 3/1/2032 | | 1,064,000 | b | 900,905 | |

Post Holdings, Inc., Gtd. Notes | | 4.63 | | 4/15/2030 | | 1,350,000 | c | 1,243,212 | |

Post Holdings, Inc., Gtd. Notes | | 5.50 | | 12/15/2029 | | 760,000 | c | 733,106 | |

US Foods, Inc., Gtd. Notes | | 6.88 | | 9/15/2028 | | 1,044,000 | b,c | 1,075,957 | |

| | 4,226,975 | |

Health

Care - 8.0% | | | | | |

Bausch & Lomb Escrow Corp., Sr. Scd. Notes | | 8.38 | | 10/1/2028 | | 782,000 | b,c | 825,941 | |

Bausch Health Cos., Inc., Sr. Scd. Notes | | 11.00 | | 9/30/2028 | | 965,000 | b,c | 703,948 | |

CHEPLAPHARM Arzneimittel GmbH, Sr. Scd. Notes | | 5.50 | | 1/15/2028 | | 860,000 | b,c | 814,130 | |

CHS/Community Health Systems, Inc., Sr. Scd. Notes | | 5.25 | | 5/15/2030 | | 1,313,000 | b,c | 1,099,935 | |

CHS/Community Health Systems, Inc., Sr. Scd. Notes | | 5.63 | | 3/15/2027 | | 1,590,000 | b,c | 1,479,404 | |

CHS/Community Health Systems, Inc., Sr. Scd. Notes | | 8.00 | | 3/15/2026 | | 203,000 | c | 202,506 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Health

Care - 8.0% (continued) | | | | | |

Cidron Aida Finco Sarl, Sr. Scd. Bonds | GBP | 6.25 | | 4/1/2028 | | 710,000 | c | 856,557 | |

Encompass Health Corp., Gtd. Notes | | 4.63 | | 4/1/2031 | | 760,000 | | 700,236 | |

HealthEquity, Inc., Gtd. Notes | | 4.50 | | 10/1/2029 | | 667,000 | b,c | 620,149 | |

Jazz Securities DAC, Sr. Scd. Notes | | 4.38 | | 1/15/2029 | | 1,090,000 | b,c | 1,015,989 | |

LifePoint Health, Inc., Sr. Scd. Notes | | 9.88 | | 8/15/2030 | | 1,873,000 | b,c | 1,895,178 | |

Medline Borrower LP, Sr. Scd. Notes | | 3.88 | | 4/1/2029 | | 437,000 | c | 395,640 | |

Medline Borrower LP, Sr. Unscd. Notes | | 5.25 | | 10/1/2029 | | 414,000 | c | 390,781 | |

Option Care Health, Inc., Gtd. Notes | | 4.38 | | 10/31/2029 | | 1,503,000 | b,c | 1,360,168 | |

Organon & Co./Organon Foreign Debt Co-Issuer BV, Sr. Scd.

Notes | | 4.13 | | 4/30/2028 | | 630,000 | b,c | 580,477 | |

Tenet Healthcare Corp., Sr. Scd. Notes | | 4.25 | | 6/1/2029 | | 1,100,000 | b | 1,025,297 | |

Tenet Healthcare Corp., Sr. Scd. Notes | | 4.63 | | 6/15/2028 | | 720,000 | | 687,556 | |

Tenet Healthcare Corp., Sr. Scd. Notes | | 6.75 | | 5/15/2031 | | 890,000 | b,c | 910,737 | |

| | 15,564,629 | |

Industrial

- 2.3% | | | | | |

Artera Services LLC, Sr. Scd. Notes | | 9.03 | | 12/4/2025 | | 624,955 | b,c | 591,786 | |

Chart Industries, Inc., Sr. Scd. Notes | | 7.50 | | 1/1/2030 | | 1,520,000 | b,c | 1,590,675 | |

Dycom Industries, Inc., Gtd. Notes | | 4.50 | | 4/15/2029 | | 554,000 | b,c | 514,721 | |

Husky III Holding Ltd., Sr. Unscd. Notes | | 13.00 | | 2/15/2025 | | 842,000 | b,c,d | 840,415 | |

TK Elevator US Newco, Inc., Sr. Scd. Notes | | 5.25 | | 7/15/2027 | | 1,000,000 | b,c | 983,037 | |

| | 4,520,634 | |

Information

Technology - 3.4% | | | | | |

AthenaHealth Group, Inc., Sr. Unscd. Notes | | 6.50 | | 2/15/2030 | | 2,777,000 | b,c | 2,522,939 | |

Central Parent, Inc./CDK Global, Inc., Sr. Scd. Notes | | 7.25 | | 6/15/2029 | | 1,090,000 | b,c | 1,112,447 | |

Cloud Software Group, Inc., Sr. Scd. Notes | | 6.50 | | 3/31/2029 | | 988,000 | b,c | 941,812 | |

Elastic NV, Sr. Unscd. Notes | | 4.13 | | 7/15/2029 | | 1,227,000 | b,c | 1,127,989 | |

SS&C Technologies, Inc., Gtd. Notes | | 5.50 | | 9/30/2027 | | 970,000 | b,c | 956,767 | |

| | 6,661,954 | |

Insurance

- 2.4% | | | | | |

Acrisure LLC/Acrisure Finance, Inc., Sr. Scd. Notes | | 4.25 | | 2/15/2029 | | 1,530,000 | b,c | 1,383,068 | |

Acrisure LLC/Acrisure Finance, Inc., Sr. Unscd. Notes | | 7.00 | | 11/15/2025 | | 1,360,000 | c | 1,357,774 | |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer,

Sr. Scd. Notes | | 6.75 | | 4/15/2028 | | 925,000 | b,c | 946,881 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Insurance

- 2.4% (continued) | | | | | |

Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer,

Sr. Unscd. Notes | | 6.75 | | 10/15/2027 | | 1,100,000 | c | 1,097,250 | |

| | 4,784,973 | |

Internet Software & Services - 1.5% | | | | | |

Cogent Communications

Group, Inc., Gtd. Notes | | 7.00 | | 6/15/2027 | | 820,000 | b,c | 824,867 | |

Go Daddy Operating Co., LLC/GD Finance Co., Inc., Gtd. Notes | | 5.25 | | 12/1/2027 | | 1,210,000 | c | 1,186,796 | |

Uber Technologies, Inc., Gtd. Notes | | 4.50 | | 8/15/2029 | | 990,000 | b,c | 946,283 | |

| | 2,957,946 | |

Materials

- 5.9% | | | | | |

ARD Finance SA, Sr. Scd. Notes | | 6.50 | | 6/30/2027 | | 792,160 | b,c,d | 370,957 | |

Clydesdale Acquisition Holdings, Inc., Gtd. Notes | | 8.75 | | 4/15/2030 | | 1,633,000 | b,c | 1,524,531 | |

Clydesdale Acquisition Holdings, Inc., Sr. Scd. Notes | | 6.63 | | 4/15/2029 | | 840,000 | c | 826,799 | |

Kleopatra Finco Sarl, Sr. Scd. Bonds | EUR | 4.25 | | 3/1/2026 | | 1,117,000 | c | 1,022,297 | |

LABL, Inc., Sr. Scd. Notes | | 6.75 | | 7/15/2026 | | 970,000 | b,c | 944,323 | |

LABL, Inc., Sr. Scd. Notes | | 9.50 | | 11/1/2028 | | 605,000 | b,c | 611,806 | |

LABL, Inc., Sr. Unscd. Notes | | 10.50 | | 7/15/2027 | | 1,048,000 | b,c | 1,006,264 | |

Mauser Packaging Solutions Holding Co., Scd. Notes | | 9.25 | | 4/15/2027 | | 333,000 | c | 327,219 | |

Mauser Packaging Solutions Holding Co., Sr. Scd. Notes | | 7.88 | | 8/15/2026 | | 1,456,000 | b,c | 1,483,054 | |

Pactiv Evergreen Group Issuer, Inc./Pactiv Evergreen Group

Issuer LLC, Sr. Scd. Notes | | 4.00 | | 10/15/2027 | | 1,130,000 | b,c | 1,057,256 | |

Sealed Air Corp., Gtd. Notes | | 5.00 | | 4/15/2029 | | 1,100,000 | b,c | 1,064,910 | |

Trivium Packaging Finance BV, Sr. Scd. Notes | | 5.50 | | 8/15/2026 | | 1,358,000 | b,c | 1,333,765 | |

| | 11,573,181 | |

Media

- 11.3% | | | | | |

Altice Financing SA, Sr. Scd. Bonds | | 5.75 | | 8/15/2029 | | 1,045,000 | b,c | 928,737 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 4.25 | | 1/15/2034 | | 510,000 | c | 415,123 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 4.50 | | 5/1/2032 | | 1,056,000 | b | 905,826 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 4.75 | | 2/1/2032 | | 1,290,000 | b,c | 1,139,199 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 5.00 | | 2/1/2028 | | 1,290,000 | b,c | 1,235,256 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 5.13 | | 5/1/2027 | | 385,000 | b,c | 372,216 | |

CCO Holdings LLC/CCO Holdings Capital Corp., Sr. Unscd. Notes | | 7.38 | | 3/1/2031 | | 780,000 | b,c | 801,051 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Media

- 11.3% (continued) | | | | | |

CSC Holdings LLC, Gtd. Notes | | 5.38 | | 2/1/2028 | | 1,321,000 | b,c | 1,168,125 | |

CSC Holdings LLC, Gtd. Notes | | 5.50 | | 4/15/2027 | | 625,000 | b,c | 578,104 | |

CSC Holdings LLC, Gtd. Notes | | 11.25 | | 5/15/2028 | | 661,000 | c | 681,534 | |

CSC Holdings LLC, Sr. Unscd. Bonds | | 5.25 | | 6/1/2024 | | 1,380,000 | b | 1,351,905 | |

CSC Holdings LLC, Sr. Unscd. Notes | | 5.75 | | 1/15/2030 | | 430,000 | b,c | 268,122 | |

DIRECTV Financing LLC/DIRECTV Financing Co-Obligor, Inc., Sr.

Scd. Notes | | 5.88 | | 8/15/2027 | | 890,000 | b,c | 836,953 | |

DISH DBS Corp., Gtd. Notes | | 7.75 | | 7/1/2026 | | 984,000 | b | 686,379 | |

DISH Network Corp., Sr. Scd. Notes | | 11.75 | | 11/15/2027 | | 2,468,000 | b,c | 2,578,250 | |

Gray Television, Inc., Gtd. Notes | | 5.88 | | 7/15/2026 | | 290,000 | c | 282,356 | |

Gray Television, Inc., Gtd. Notes | | 7.00 | | 5/15/2027 | | 710,000 | b,c | 675,533 | |

iHeartCommunications, Inc., Sr. Scd. Notes | | 6.38 | | 5/1/2026 | | 1,000,000 | b | 853,543 | |

Nexstar Media, Inc., Gtd. Notes | | 4.75 | | 11/1/2028 | | 1,190,000 | c | 1,097,519 | |

Scripps Escrow, Inc., Gtd. Notes | | 5.88 | | 7/15/2027 | | 1,019,000 | c | 906,263 | |

Summer BidCo BV, Sr. Unscd. Bonds | EUR | 9.00 | | 11/15/2025 | | 1,503,019 | c,d | 1,656,676 | |

TEGNA, Inc., Gtd. Notes | | 4.75 | | 3/15/2026 | | 960,000 | c | 934,512 | |

Virgin Media Finance PLC, Gtd. Notes | | 5.00 | | 7/15/2030 | | 630,000 | b,c | 556,235 | |

Virgin Media Secured Finance PLC, Sr. Scd. Notes | | 5.50 | | 5/15/2029 | | 667,000 | c | 645,234 | |

Ziggo Bond Co. BV, Gtd. Notes | | 5.13 | | 2/28/2030 | | 559,000 | b,c | 468,190 | |

| | 22,022,841 | |

Metals

& Mining - 2.5% | | | | | |

Arsenal AIC Parent LLC, Sr. Scd. Notes | | 8.00 | | 10/1/2030 | | 900,000 | b,c | 940,149 | |

Cleveland-Cliffs, Inc., Gtd. Notes | | 6.75 | | 4/15/2030 | | 528,000 | b,c | 536,094 | |

FMG Resources August 2006 Pty Ltd., Sr. Unscd. Notes | | 6.13 | | 4/15/2032 | | 690,000 | b,c | 695,930 | |

Novelis Corp., Gtd. Notes | | 3.25 | | 11/15/2026 | | 1,220,000 | c | 1,149,318 | |

Taseko Mines Ltd., Sr. Scd. Notes | | 7.00 | | 2/15/2026 | | 1,658,000 | b,c | 1,575,728 | |

| | 4,897,219 | |

Real

Estate - 3.8% | | | | | |

Greystar Real Estate Partners LLC, Sr. Scd. Notes | | 7.75 | | 9/1/2030 | | 800,000 | b,c | 839,080 | |

Ladder Capital Finance Holdings LLLP/Ladder Capital Finance

Corp., Gtd. Notes | | 5.25 | | 10/1/2025 | | 1,644,000 | b,c | 1,623,260 | |

Park Intermediate Holdings LLC/PK Domestic Property LLC/PK

Finance Co-Issuer, Sr. Scd. Notes | | 4.88 | | 5/15/2029 | | 870,000 | c | 806,265 | |

Rithm Capital Corp., Sr. Unscd. Notes | | 6.25 | | 10/15/2025 | | 2,067,000 | b,c | 2,036,966 | |

RLJ Lodging Trust LP, Sr. Scd. Notes | | 4.00 | | 9/15/2029 | | 1,530,000 | b,c | 1,376,469 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Real

Estate - 3.8% (continued) | | | | | |

Service Properties Trust, Sr. Unscd. Notes | | 4.50 | | 3/15/2025 | | 680,000 | | 664,707 | |

| | 7,346,747 | |

Retailing

- 6.0% | | | | | |

1011778 BC ULC/New Red Finance, Inc., Sr. Scd. Notes | | 3.88 | | 1/15/2028 | | 1,422,000 | b,c | 1,344,427 | |

Advance Auto Parts, Inc., Gtd. Notes | | 5.95 | | 3/9/2028 | | 450,000 | b | 448,090 | |

Beacon Roofing Supply, Inc., Gtd. Notes | | 4.13 | | 5/15/2029 | | 641,000 | c | 585,038 | |

Beacon Roofing Supply, Inc., Sr. Scd. Notes | | 4.50 | | 11/15/2026 | | 690,000 | c | 672,879 | |

Fertitta Entertainment LLC/Fertitta Entertainment Finance Co.,

Inc., Sr. Scd. Notes | | 4.63 | | 1/15/2029 | | 940,000 | b,c | 853,760 | |

Foundation Building Materials, Inc., Gtd. Notes | | 6.00 | | 3/1/2029 | | 635,000 | b,c | 571,602 | |

PetSmart, Inc./PetSmart Finance Corp., Gtd. Notes | | 7.75 | | 2/15/2029 | | 1,610,000 | b,c | 1,567,573 | |

PetSmart, Inc./PetSmart Finance Corp., Sr. Scd. Notes | | 4.75 | | 2/15/2028 | | 720,000 | b,c | 679,337 | |

SRS Distribution, Inc., Gtd. Notes | | 6.00 | | 12/1/2029 | | 1,119,000 | b,c | 1,044,661 | |

Staples, Inc., Sr. Scd. Notes | | 7.50 | | 4/15/2026 | | 1,190,000 | c | 1,108,178 | |

Staples, Inc., Sr. Unscd. Notes | | 10.75 | | 4/15/2027 | | 310,000 | c | 226,194 | |

White Cap Buyer LLC, Sr. Unscd. Notes | | 6.88 | | 10/15/2028 | | 1,531,000 | b,c | 1,483,940 | |

White Cap Parent LLC, Sr. Unscd. Notes | | 8.25 | | 3/15/2026 | | 310,000 | c,d | 308,966 | |

Yum! Brands, Inc., Sr. Unscd. Notes | | 4.75 | | 1/15/2030 | | 820,000 | b,c | 795,732 | |

| | 11,690,377 | |

Semiconductors

& Semiconductor Equipment - .7% | | | | | |

Entegris Escrow Corp., Gtd. Notes | | 5.95 | | 6/15/2030 | | 1,360,000 | b,c | 1,353,340 | |

Technology Hardware & Equipment - 1.3% | | | | | |

McAfee Corp., Sr. Unscd.

Notes | | 7.38 | | 2/15/2030 | | 1,260,000 | b,c | 1,152,379 | |

Western Digital Corp., Gtd. Notes | | 4.75 | | 2/15/2026 | | 1,354,000 | b | 1,329,233 | |

| | 2,481,612 | |

Telecommunication

Services - 6.4% | | | | | |

Altice France Holding SA, Sr. Scd. Notes | EUR | 8.00 | | 5/15/2027 | | 1,365,000 | c | 869,828 | |

Altice France Holding SA, Sr. Scd. Notes | | 10.50 | | 5/15/2027 | | 1,513,000 | c | 981,391 | |

Altice France SA, Sr. Scd. Notes | | 5.50 | | 1/15/2028 | | 1,965,000 | b,c | 1,619,877 | |

Altice France SA, Sr. Scd. Notes | | 8.13 | | 2/1/2027 | | 1,305,000 | b,c | 1,204,052 | |

C&W Senior Financing DAC, Sr. Unscd. Notes | | 6.88 | | 9/15/2027 | | 883,000 | b,c | 823,565 | |

Frontier Communications Holdings LLC, Scd. Notes | | 6.75 | | 5/1/2029 | | 560,000 | c | 501,339 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | a | Value

($) | |

Bonds

and Notes - 124.7% (continued) | | | | | |

Telecommunication

Services - 6.4% (continued) | | | | | |

Frontier Communications Holdings LLC, Sr. Scd. Notes | | 5.88 | | 10/15/2027 | | 458,000 | c | 442,854 | |

Frontier Communications Holdings LLC, Sr. Scd. Notes | | 8.75 | | 5/15/2030 | | 1,710,000 | b,c | 1,760,460 | |

Iliad Holding SASU, Sr. Scd. Notes | | 6.50 | | 10/15/2026 | | 1,669,000 | b,c | 1,666,928 | |

Lumen Technologies, Inc., Sr. Scd. Notes | | 4.00 | | 2/15/2027 | | 1,031,000 | c | 666,346 | |

Telecom Italia Capital SA, Gtd. Notes | | 7.72 | | 6/4/2038 | | 690,000 | | 703,501 | |

Telesat Canada/Telesat LLC, Sr. Scd. Notes | | 5.63 | | 12/6/2026 | | 997,000 | b,c | 612,373 | |

Zayo Group Holdings, Inc., Sr. Scd. Notes | | 4.00 | | 3/1/2027 | | 869,000 | b,c | 697,629 | |

| | 12,550,143 | |

Utilities

- 6.6% | | | | | |

Calpine Corp., Sr. Scd. Notes | | 4.50 | | 2/15/2028 | | 435,000 | c | 414,022 | |

Calpine Corp., Sr. Unscd. Notes | | 4.63 | | 2/1/2029 | | 1,695,000 | b,c | 1,576,005 | |

Calpine Corp., Sr. Unscd. Notes | | 5.00 | | 2/1/2031 | | 755,000 | b,c | 693,109 | |

Clearway Energy Operating LLC, Gtd. Notes | | 3.75 | | 1/15/2032 | | 850,000 | b,c | 741,502 | |

NextEra Energy Operating Partners LP, Gtd. Notes | | 3.88 | | 10/15/2026 | | 827,000 | b,c | 788,028 | |

NextEra Energy Operating Partners LP, Sr. Unscd. Notes | | 7.25 | | 1/15/2029 | | 727,000 | c | 761,556 | |

NRG Energy, Inc., Gtd. Notes | | 3.88 | | 2/15/2032 | | 650,000 | b,c | 557,196 | |

NRG Energy, Inc., Gtd. Notes | | 5.25 | | 6/15/2029 | | 610,000 | b,c | 591,405 | |

NRG Energy, Inc., Jr. Sub. Bonds | | 10.25 | | 3/15/2028 | | 1,090,000 | b,c,e | 1,135,868 | |

PG&E Corp., Sr. Scd. Notes | | 5.00 | | 7/1/2028 | | 1,077,000 | b | 1,048,574 | |

Pike Corp., Gtd. Notes | | 5.50 | | 9/1/2028 | | 705,000 | b,c | 672,507 | |

Pike Corp., Sr. Unscd. Notes | | 8.63 | | 1/31/2031 | | 218,000 | c | 229,356 | |

Solaris Midstream Holdings LLC, Gtd. Notes | | 7.63 | | 4/1/2026 | | 1,865,000 | c | 1,892,421 | |

Vistra Corp., Jr. Sub. Bonds | | 7.00 | | 12/15/2026 | | 501,000 | b,c,e | 494,171 | |

Vistra Operations Co. LLC, Gtd. Notes | | 4.38 | | 5/1/2029 | | 403,000 | c | 376,651 | |

Vistra Operations Co. LLC, Gtd. Notes | | 7.75 | | 10/15/2031 | | 930,000 | c | 966,585 | |

| | 12,938,956 | |

Total Bonds

and Notes

(cost $239,063,310) | | 243,678,167 | |

| | | | | | | | | |

Floating Rate Loan Interests - 12.6% | | | | | |

Advertising - .1% | | | | | |

Clear Channel Outdoor

Holdings, Inc., Term Loan B, (1-3 Month TSFR +3.76%) | | 9.12 | | 8/21/2026 | | 253,415 | f | 251,249 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal

Amount ($) | a | Value

($) | |

Floating

Rate Loan Interests - 12.6% (continued) | | | | | |

Automobiles & Components

- .6% | | | | | |

First Brands Group LLC, 2022 Incremental Term Loan, (3 Month TSFR +5.43%) | | 10.88 | | 3/30/2027 | | 794,321 | f | 789,857 | |

First Brands Group LLC, First Lien 2021 Term Loan, (6 Month

TSFR +5.43%) | | 10.88 | | 3/30/2027 | | 269,308 | f | 267,625 | |

| | 1,057,482 | |

Chemicals - .4% | | | | | |

Nouryon USA LLC, Extended

Dollar Term Loan, (3 Month TSFR +4.10%) | | 9.47 | | 4/3/2028 | | 401,548 | f | 403,618 | |

SCIH Salt Holdings, Inc., First Lien Incremental Term Loan

B-1, (1 Month TSFR +4.11%) | | 9.47 | | 3/16/2027 | | 388,595 | f | 389,718 | |

| | 793,336 | |

Commercial & Professional Services - 1.3% | | | | | |

Indy

US Holdco LLC, 2023 Incremental Dollar Term Loan, (1 Month TSFR +6.25%) | | 11.61 | | 3/6/2028 | | 1,195,919 | f | 1,172,748 | |

Neptune BidCo US, Inc., Dollar Term Loan B, (3 Month TSFR

+5.10%) | | 10.51 | | 4/11/2029 | | 874,150 | f | 800,818 | |

Prometric Holdings, Inc., First Lien Term Loan, (1 Month TSFR

+5.36%) | | 10.72 | | 1/29/2025 | | 624,367 | f | 624,858 | |

| | 2,598,424 | |

Consumer Discretionary - 1.3% | | | | | |

Bally's Corp., Facility

Term Loan B, (3 Month TSFR +3.51%) | | 8.93 | | 10/2/2028 | | 922,646 | f | 876,957 | |

ECL Entertainment LLC, Facility Term Loan B, (1 Month TSFR

+4.75%) | | 10.11 | | 9/2/2030 | | 563,920 | f | 566,175 | |

J&J Ventures Gaming LLC, 2023 Delayed Draw Term Loan,

(1 Month TSFR +4.25%) | | 9.72 | | 4/26/2028 | | 752,143 | f | 741,801 | |

J&J Ventures Gaming LLC, 2023 Delayed Draw Term Loan,

(1 Month TSFR +4.36%) | | 9.72 | | 4/26/2028 | | 417,857 | f | 412,112 | |

| | 2,597,045 | |

Consumer Staples - .4% | | | | | |

Hunter Douglas, Inc.,

Tranche Term Loan B-1, (3 Month TSFR +3.50%) | | 8.88 | | 2/26/2029 | | 666,938 | f | 665,604 | |

Diversified Financials - 1.0% | | | | | |

BHN Merger Sub, Inc.,

Second Lien Term Loan, (1 Month TSFR +7.10%) | | 12.46 | | 6/15/2026 | | 430,000 | f | 425,700 | |

Edelman Financial Center, Term Loan B, (1 Month TSFR +6.86%) | | 12.22 | | 7/20/2026 | | 270,000 | f | 270,506 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal

Amount ($) | a | Value

($) | |

Floating

Rate Loan Interests - 12.6% (continued) | | | | | |

Diversified Financials

- 1.0% (continued) | | | | | |

Nexus Buyer LLC, Initial Term Loan, (1 Month TSFR +3.85%) | | 9.21 | | 11/9/2026 | | 668,260 | f | 662,870 | |

Russell Investments US, 2025 New Term Loan, (1 Month TSFR

+3.60%) | | 8.96 | | 5/30/2025 | | 700,000 | f | 657,563 | |

| | 2,016,639 | |

Energy - .6% | | | | | |

WaterBridge Midstream Operating, Initial Term Loan, (3 Month

TSFR +6.01%) | | 11.39 | | 6/21/2026 | | 1,150,747 | f | 1,153,918 | |

Food Products - .5% | | | | | |

Max

US Bidco, Inc., Initial Term Loan, (3 Month TSFR +5.00%) | | 10.35 | | 10/2/2030 | | 1,120,000 | f | 1,049,720 | |

Industrial - .5% | | | | | |

Powerteam Services

LLC, First Lien Initial Term Loan, (3 Month TSFR +3.35%) | | 8.70 | | 3/6/2025 | | 129,314 | f | 122,086 | |

Revere Power LLC, Term Loan B, (1 Month TSFR +4.25%) | | 9.71 | | 3/30/2026 | | 775,925 | f | 688,245 | |

Revere Power LLC, Term Loan C, (1 Month TSFR +4.25%) | | 9.71 | | 3/30/2026 | | 67,952 | f | 60,274 | |

| | 870,605 | |

Information Technology - .9% | | | | | |

Quest Software, Inc.,

First Lien Initial Term Loan, (3 Month TSFR +4.40%) | | 9.78 | | 2/1/2029 | | 1,091,847 | f | 839,510 | |

RealPage, Inc., Second Lien Initial Term Loan, (1 Month TSFR

+6.50%) | | 11.86 | | 4/23/2029 | | 410,000 | f | 410,943 | |

UKG, Inc., 2021 Second Lien Incremental Term Loan, (3 Month

TSFR +5.35%) | | 10.76 | | 5/3/2027 | | 530,000 | f | 532,035 | |

| | 1,782,488 | |

Insurance - 1.3% | | | | | |

Amynta Agency Borrower,

2023 Refinancing Term Loan, (3 Month TSFR +5.10%) | | 10.44 | | 2/28/2028 | | 807,975 | f | 809,995 | |

Asurion LLC, Second Lien Term Loan B-3, (1 Month TSFR +5.36%) | | 10.72 | | 2/3/2028 | | 770,000 | f | 735,989 | |

Asurion LLC, Term Loan B-4, (1 Month TSFR +5.36%) | | 10.72 | | 1/20/2029 | | 1,097,772 | f | 1,038,679 | |

| | 2,584,663 | |

Internet Software & Services - 1.6% | | | | | |

MH Sub I LLC, 2023

May New Term Loan, (1 Month TSFR +4.25%) | | 9.61 | | 5/3/2028 | | 1,084,550 | f | 1,068,282 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal

Amount ($) | a | Value

($) | |

Floating

Rate Loan Interests - 12.6% (continued) | | | | | |

Internet Software &

Services - 1.6% (continued) | | | | | |

MH Sub I LLC, Second Lien Term Loan, (1 Month TSFR +6.25%) | | 11.61 | | 2/23/2029 | | 570,000 | f | 535,290 | |

Pug LLC, Term Loan B-2, (1 Month TSFR +4.36%) | | 9.71 | | 2/16/2027 | | 817,908 | f | 813,819 | |

Weddingwire, Inc., Term Loan, (3 Month TSFR +4.50%) | | 9.89 | | 1/31/2028 | | 788,025 | f | 788,025 | |

| | 3,205,416 | |

Technology Hardware & Equipment - .7% | | | | | |

McAfee Corp., Term

Loan B, (1 Month TSFR +3.85%) | | 9.19 | | 3/1/2029 | | 1,374,534 | f | 1,372,534 | |

Telecommunication Services

- .7% | | | | | |

CCI Buyer, Inc., First Lien Initial Term Loan, (3 Month TSFR +4.00%) | | 9.35 | | 12/17/2027 | | 1,267,402 | f | 1,265,589 | |

Utilities - .7% | | | | | |

Eastern

Power LLC, Term Loan, (1 Month TSFR +3.86%) | | 9.22 | | 10/2/2025 | | 1,429,715 | f | 1,409,270 | |

Total Floating

Rate Loan Interests

(cost $24,144,134) | | 24,673,982 | |

Description | | | | | Shares | | Value

($) | |

Common

Stocks - .0% | | | | | |

Media

- .0% | | | | | |

Altice

USA, Inc., Cl. A

(cost $163,083) | | | | | | 8,400 | g | 27,300 | |

Description | 1-Day

Yield

(%) | | | | Shares | | Value

($) | |

Investment

Companies - 2.3% | | | | | |

Registered

Investment Companies - 2.3% | | | | | |

Dreyfus

Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost

$4,491,762) | | 5.43 | | | | 4,491,762 | h | 4,491,762 | |

Total

Investments (cost $267,862,289) | | 139.6% | 272,871,211 | |

Liabilities, Less Cash and Receivables | | (39.6%) | (77,345,484) | |

Net Assets | | 100.0% | 195,525,727 | |

TSFR—Term

Secured Overnight Financing Rate Reference Rates

EUR—Euro

GBP—British Pound

a Amount stated in U.S. Dollars unless otherwise noted above.

b Security,

or portion thereof, has been pledged as collateral for the fund’s Revolving Credit and Security Agreement.

c Security

exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may

be resold in transactions exempt from registration, normally to qualified institutional buyers. At December

31, 2023, these securities were valued at $221,022,044 or 113.04% of net assets.

d Payment-in-kind security and interest may be paid in additional

par.

e Security

is a perpetual bond with no specified maturity date. Maturity date shown is next reset date of the bond.

f Variable

rate security—interest rate resets periodically and rate shown is the interest rate in effect at period

end. Security description also includes the reference rate and spread if published and available.

g Non-income

producing security.

h Investment

in affiliated issuer. The investment objective of this investment company is publicly available and can

be found within the investment company’s prospectus.

| | | | | | |

Forward

Foreign Currency Exchange Contracts | |

Counterparty/

Purchased

Currency | Purchased

Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized

Appreciation (Depreciation) ($) |

Barclays Capital, Inc. |

Euro | 1,500,000 | United

States Dollar | 1,632,958 | 1/11/2024 | 23,836 |

United States Dollar | 14,446,646 | Euro | 13,205,000 | 1/11/2024 | (138,663) |

United States Dollar | 5,127,826 | British Pound | 4,090,000 | 1/11/2024 | (85,876) |

Goldman Sachs & Co.

LLC |

United States Dollar | 76,272 | British Pound | 60,000 | 1/11/2024 | (213) |

Euro | 845,000 | United States Dollar | 921,700 | 1/11/2024 | 11,627 |

United

States Dollar | 519,351 | Euro | 480,000 | 1/11/2024 | (10,823) |

Gross

Unrealized Appreciation | | | 35,463 |

Gross

Unrealized Depreciation | | | (235,575) |

See

notes to financial statements.

STATEMENT

OF INVESTMENTS

BNY Mellon High Yield Strategies Fund

December 31, 2023 (Unaudited)

The

following is a summary of the inputs used as of December 31, 2023 in

valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level

2- Other Significant Observable Inputs | | Level 3-Significant Unobservable

Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Collateralized

Loan Obligations | - | 10,602,547 | | - | 10,602,547 | |

Corporate

Bonds | - | 233,075,620 | | - | 233,075,620 | |

Equity

Securities - Common Stocks | 27,300 | - | | - | 27,300 | |

Floating

Rate Loan Interests | - | 24,673,982 | | - | 24,673,982 | |

Investment

Companies | 4,491,762 | - | | - | 4,491,762 | |

Other

Financial Instruments: | | |

Forward Foreign Currency Exchange Contracts†† | - | 35,463 | | - | 35,463 | |

Liabilities

($) | | |

Other Financial Instruments: | | |

Forward

Foreign Currency Exchange Contracts†† | - | (235,575) | | - | (235,575) | |

† See Statement of Investments for additional detailed categorizations,

if any.

†† Amount

shown represents unrealized appreciation (depreciation) at period end.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles

(“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive

releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants.

The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic

946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance

with GAAP, which may require the use of management estimates and assumptions. Actual results could differ

from those estimates.

The fair value of a financial instrument is the amount that

would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy

that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives

the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally,

GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly

and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced

disclosures around valuation inputs and techniques used during annual and interim periods.

Various

inputs are used in determining the value of the fund’s investments relating to fair value measurements.

These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted

prices in active markets for identical investments.

Level 2—other significant

observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including

the fund’s own assumptions in determining the fair value of investments).

The

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated

with investing in those securities.

Changes in valuation techniques may result

in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used

to value the fund’s investments are as follows:

The Trust’s Board of Trustees (the “Board”)

has designated the Adviser as the fund’s valuation designee to make all fair value determinations with

respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule

2a-5 under the Act.

Registered investment companies that are not traded on an exchange are valued

at their net asset value and are generally categorized within Level 1 of the fair value hierarchy.

Investments

in debt securities, excluding short-term investments (other than U.S. Treasury Bills)financial futures

and forward foreign currency exchange contracts (“forward contracts”) are valued each business day

by one or more independent pricing services (each, a “Service”) approved by the Board.

Investments

for which quoted bid prices are readily available and are representative of the bid side of the market

in the judgment of a Service are valued at the mean between the quoted bid prices (as obtained by a Service

from dealers in such securities) and asked prices (as calculated by a Service based upon its evaluation

of the market for such securities). Securities are valued as determined by a Service, based on methods

which include consideration of the following: yields or prices of securities of comparable quality, coupon,

maturity and type; indications as to values from dealers; and general market conditions. The Services

are engaged under the general supervision of the Board. These securities are generally categorized within

Level 2 of the fair value hierarchy.U.S. Treasury Bills are valued at the mean price between quoted bid

prices and asked prices by the Service. These securities are generally categorized within Level 2 of

the fair value hierarchy.

When market quotations or official closing

prices are not readily available, or are determined not to accurately reflect fair value, such as when

the value of a security has been significantly affected by events after the close of the exchange or

market on which the security is principally traded (for example, a foreign exchange or market), but before

the fund calculates its net asset value, the fund may value these investments at fair value as determined

in accordance with the procedures approved by the Board. Certain factors may be considered when fair

valuing investments such as: fundamental analytical data, the nature and duration of restrictions on

disposition, an evaluation of the forces that influence the market in which the securities are purchased

and sold, and public trading in similar securities of the issuer or comparable issuers. These securities

are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs

used.

For securities where observable inputs are limited, assumptions about market activity

and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at

the prevailing rates of exchange.

Financial futures, which are traded on

an exchange, are valued at the last sales price on the securities exchange on which such securities are

primarily traded or at the last sales price on the national securities market on each business day and

are generally categorized within Level 1 of the fair value hierarchy. Forward contracts are valued at

the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

Derivatives:

A

derivative is a financial instrument whose performance is derived from the performance of another asset.

Each type of derivative instrument that was held by the fund at December 31, 2023 is discussed below.

Forward

Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge

its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle

foreign currency transactions or as a part of its investment strategy. When executing forward contracts,

the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the

future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract

increases between the date the forward contract is opened and the date the forward contract is closed.

The fund realizes a gain if the value of the contract decreases between those dates. With respect to

purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between

the date the forward contract is opened and the date the forward contract is closed. The fund realizes

a gain if the value of the contract increases between those dates. Any realized or unrealized gains or

losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed

to foreign currency risk as a result of changes in value of underlying financial instruments. The fund

is also exposed to credit risk associated with counterparty non-performance on these forward contracts,

which is generally limited to the unrealized gain on each open contract. This risk may be mitigated by

Master Agreements, if any, between the fund and the counterparty and the posting of collateral, if any,

by the counterparty to the fund to cover the fund’s exposure to the counterparty.

At

December 31, 2023, accumulated net unrealized appreciation on investments was $4,808,810, consisting

of $8,955,890 gross unrealized appreciation and $4,147,080 gross unrealized depreciation.

At

December 31, 2023, the cost of investments for federal income tax purposes was substantially the same

as the cost for financial reporting purposes (see the Statement of Investments).

Additional

investment related disclosures are hereby incorporated by reference to the annual and semi-annual reports

previously filed with the SEC on Form N-CSR.

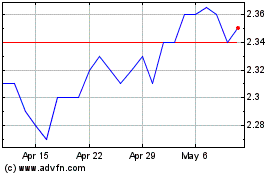

BNY Mellon High Yield St... (NYSE:DHF)

Historical Stock Chart

From Mar 2024 to Apr 2024

BNY Mellon High Yield St... (NYSE:DHF)

Historical Stock Chart

From Apr 2023 to Apr 2024