Filed Pursuant to Rule 424(b)(3)

Registration No. 333-271703

PROSPECTUS SUPPLEMENT NO. 5

(to Prospectus dated May 12, 2023)

4,448,713 Shares of Common Stock

This prospectus supplement

updates, amends, and supplements the prospectus dated May 12, 2023 (as amended and supplemented, the “Prospectus”),

which forms a part of our Registration Statement on Form S-1 (Registration No. 333-271703).

This prospectus supplement

is being filed to update, amend, and supplement the information in the Prospectus with the information contained in our Current Reports

on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”) on February 20, 26 and 28, 2024 (the “Current

Reports”), to disclose, among other things, a 1-for-19 reverse stock split of the Company’s outstanding common stock which

became effective at 12:01 A.M. Eastern Time on February 28, 2024, as more fully described below. Accordingly, we have attached the Current

Reports to this prospectus supplement.

This prospectus supplement

is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered

with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement

updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future

reference.

Our common stock is traded

on the Nasdaq Capital Market (“Nasdaq”) under the symbol “ATNF”. On February 27, 2024, the last reported

sale price for our common stock as reported on Nasdaq was $0.195 per share.

INVESTING IN OUR SECURITIES

INVOLVES SUBSTANTIAL RISKS. SEE THE SECTION TITLED “RISK FACTORS” BEGINNING ON PAGE 5 OF THE PROSPECTUS TO READ ABOUT FACTORS

YOU SHOULD CONSIDER BEFORE BUYING OUR SECURITIES.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

OR ACCURACY OF THE PROSPECTUS OR THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus supplement is February

28, 2024.

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13

OR 15(d) OF THE

SECURITIES EXCHANGE ACT

OF 1934

Date of Report (Date of earliest

event reported): February 20, 2024

180 LIFE SCIENCES CORP.

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto, CA |

|

94306 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (650) 507-0669

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ Stock Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On February 12, 2024,

the judge in 180 Life Sciences Corp.’s (the “Company’s”) pending lawsuit in the U.S. District Court Northern

District of California, San Jose Division, granted a Motion for Partial Summary Judgment against AmTrust International Underwriters DAC

(“AmTrust”), which was the premerger directors’ and officers’ insurance policy underwriter for the Company

and the Company’s excess insurance carrier, Freedom Specialty Insurance Company (“Freedom”), and ordered as

follows:

(a) AmTrust

is obligated under its insurance policy with the Company to advance to the Company all defense costs in excess of the deductible that

the Company has advanced or will advance to Dr. Marlene Krauss, the Company’s former Chief Executive Officer and Director, and George

Hornig, the former Chairman of the Board of Directors, in connection with certain subpoenas issued by the Securities and Exchange Commission;

and

(b) upon

exhaustion of the AmTrust insurance policy, Freedom is obligated to do the same pursuant to its excess liability insurance policy with

the Company.

This Order applies until

the final disposition of the case, but does not constitute a final judgment, and both the Company and the two insurers retain their rights

to contest all applicable issues at trial, which is scheduled for May 12, 2025.

The AmTrust insurance policy has a limit of $3 million and the Freedom

insurance policy has a limit of $2 million.

It is unclear whether the defendants will take steps to appeal this

order, the outcome of any such appeal, the timing of our receipt of any funds we may receive pursuant to the order related to reimbursement

of amounts related to the Securities and Commission subpoenas, if any, or such amounts that we may ultimately receive.

A final judgment following

trial could potentially confirm these obligations of the insurers or, alternatively, reverse and require the Company to repay all or certain

portions of such advance payments. There is no assurance at this time as to what the final judgment may entail.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

180 LIFE SCIENCES CORP. |

| |

|

|

| Date: February 20, 2024 |

By: |

/s/ James N. Woody, M.D., Ph.D. |

| |

|

James N. Woody, M.D., Ph.D. |

| |

|

Chief Executive Officer |

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): February 26,

2024

180 LIFE SCIENCES

CORP.

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

3000

El Camino Real, Bldg. 4,

Suite 200

Palo

Alto, CA |

|

94306 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (650) 507-0669

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ

Stock Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ

Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02. Unregistered Sales of Equity Securities.

On February 21, 2024, the

holder of pre-funded warrants to purchase shares of common stock of 180 Life Sciences Corp. (the “Company”), at an

exercise price of $0.0001 per share, exercised warrants to purchase 1,111,878 shares of common stock for $111.19 of cash, and was issued

1,111,878 shares of common stock upon exercise thereof. The exercise of the warrants was exempt from registration pursuant to Section

4(a)(2) of the Securities Act of 1933, as amended. The resale of the shares of common stock issuable upon exercise of the warrants was

registered under a registration statement declared effective under the Securities Act.

After the issuance described

above (which is in process), the Company will have 11,270,710 shares of common stock issued and outstanding.

Item 8.01.

Other Events.

On February 26, 2024, the

Company issued a press release announcing that its Board of Directors has approved a one-for-19 reverse stock split (the “Reverse

Stock Split”) of the Company’s outstanding common stock. A copy of the press release is filed herewith as Exhibit 99.1

and is incorporated by reference into this Item 8.01.

The Reverse Stock Split is

expected to become effective on February 28, 2024 at 12:01 p.m. Eastern Time (the “Effective Time”), with shares to

begin trading on a split-adjusted basis at market open on February 28, 2024. In connection with the Reverse Stock Split, every 19 shares

of the Company’s common stock issued and outstanding as of the Effective Time will be automatically converted into one share of

the Company’s common stock.

The reverse split will effect

all issued and outstanding shares of common stock. All outstanding options, warrants, and other securities entitling their holders to

purchase or otherwise receive shares of common stock will be adjusted as a result of the reverse split, as required by the terms of each

security. The number of shares available to be awarded under the Company’s equity incentive plans will also be appropriately adjusted.

Following the reverse split, the par value of the Common Stock will remain unchanged at $0.0001 par value per share. The reverse split

will not change the authorized number of shares of common stock or preferred stock. No fractional shares will be issued in connection

with the reverse split, and stockholders who would otherwise be entitled to receive a fractional share will instead receive one whole

share of common stock in lieu of such fractional share.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

180 LIFE SCIENCES CORP. |

| |

|

|

| Date: February 26, 2024 |

By: |

/s/ James N. Woody, M.D., Ph.D. |

| |

|

James N. Woody, M.D., Ph.D. |

| |

|

Chief Executive Officer |

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): February 26, 2024

180 LIFE SCIENCES CORP.

(Exact Name of

Registrant as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto,

CA |

|

94306 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (650) 507-0669

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on

which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ Stock Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders

The information set forth in Item

5.03 is hereby incorporated into this Item 3.03 by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

Reverse Stock

Split

As

discussed in greater detail in Item 5.07 of the Current Report on Form 8-K filed by 180 Life Sciences Corp. (the “Company,”

“we,” “our,” or “us”) with the Securities and Exchange Commission on February

16, 2024, on February 16, 2024, at a Special Meeting of the Stockholders (the “Special Meeting”), of the Company,

the stockholders of the Company approved an amendment to the Company’s Second Amended and Restated Certificate of Incorporation,

as amended, to effect a reverse stock split of our issued and outstanding shares of our common stock, par value $0.0001 per share, by

a ratio of between one-for-four to one-for-forty, inclusive, with the exact ratio to be set at a whole number to be determined by our

Board of Directors or a duly authorized committee thereof in its discretion, at any time after approval of the amendment and prior to

February 16, 2025 (the “Stockholder Authority”).

On

February 16, 2024, and following the Special Meeting, the Company’s Board of Directors (the “Board”), with the

Stockholder Authority, approved an amendment to our Second Amended and Restated Certificate of Incorporation to effect a reverse stock

split of our common stock at a ratio of 1-for-19 (the “Reverse Stock Split”). The Reverse Stock Split is more fully

described in the Company’s definitive proxy statement, which was filed with the Securities and Exchange Commission (the “Commission”)

on December 26, 2023.

On

February 26, 2024, we filed a Certificate of Amendment to our Second Amended and Restated Certificate of Incorporation, as amended (the

“Certificate of Amendment”) with the Secretary of State of the State of Delaware to effect the Reverse Stock Split.

A copy of the Certificate of Amendment is attached hereto as Exhibit 3.1 and is incorporated by reference herein.

Pursuant

to the Certificate of Amendment, the Reverse Stock Split will be effective on February 28, 2024 at 12:01 a.m. Eastern Time (the “Effective

Time”). The shares of the Company’s common stock are expected to begin trading on the NASDAQ Capital Market (“NASDAQ”)

on a post-split basis on February 28, 2024, with new CUSIP number: 68236V302. No change was made to the trading symbol for the Company’s

shares of common stock or public warrants, “ATNF” and “ATNFW”, respectively, in connection with the Reverse Stock

Split.

At the Effective Time, every nineteen (19) shares of issued and outstanding common stock will be converted into one (1) share of issued

and outstanding common stock, and the total outstanding shares of common stock will be reduced from approximately 11.3 million to approximately

0.6 million, without giving effect to any rounding up of fractional shares. The Company’s transfer agent, Continental Stock Transfer

& Trust Company (“Continental”), will serve as exchange agent for the Reverse Stock Split and will provide instructions

to stockholders of record regarding the Reverse Stock Split, to the extent applicable.

Because the Certificate of

Amendment did not reduce the number of authorized shares of our common stock, the effect of the Reverse Stock Split was to increase the

number of shares of our common stock available for issuance relative to the number of shares issued and outstanding. The Reverse Stock

Split did not alter the par value of our common stock or modify any voting rights or other terms of our common stock.

No fractional shares will

be issued in connection with the Reverse Stock Split. Stockholders of record who otherwise would be entitled to receive fractional shares,

will be entitled to have their fractional shares rounded up to the nearest whole share. No stockholders will receive cash in lieu of

fractional shares.

Each certificate that immediately

prior to the Effective Time represented shares of our common stock (“Old Certificates”) shall thereafter represent

that number of shares of our common stock into which the shares of our common stock represented by the Old Certificate shall have been

combined, subject to the adjustment for fractional shares as described above. Unless otherwise requested by the stockholder, Continental

will be issuing all of the post-split shares in paperless, “book-entry” form, and unless otherwise requested by the

stockholder, Continental will hold the shares in an account set up for the stockholder. All book-entry or other electronic positions

representing issued and outstanding shares of our common stock will be automatically adjusted. Those stockholders holding our common

stock in “street name” will receive instructions from their brokers.

In addition, the number of

shares of common stock issuable upon exercise of our stock options and other equity awards (including shares reserved for issuance under

the Company’s equity compensation plans) were proportionately adjusted by the applicable administrator, using the 1-for-19 ratio,

and rounded down to the nearest whole share, to be effective at the Effective Time, pursuant to the terms of the Company’s equity

plans. The conversion rates of our preferred stock (of which none are outstanding) will also be adjusted in a ratio of 1-for-19. The

number of shares issuable upon exercise of our outstanding warrants to purchase shares of common stock outstanding at the Effective Time

will also be equitably adjusted pursuant to the terms of such securities in connection with the 1-for-19 Reverse Stock Split. In addition,

the exercise price for each outstanding stock option and warrant will be increased in inverse proportion to the 1-for-19 split ratio

such that upon an exercise, the aggregate exercise price payable by the optionee or warrant holder to the Company for the shares subject

to the option or warrant will remain approximately the same as the aggregate exercise price prior to the Reverse Stock Split, subject

to the terms of such securities.

Further, pursuant to the

terms of the Company’s Class K Special Voting Shares (the “Voting Stock”), following the Effective Time, the

Voting Stock is now convertible into a number of shares of common stock equal to, and votes a number of voting shares equal to, 14 shares.

Each stockholder’s

percentage ownership interest in the Company and proportional voting power remains virtually unchanged as a result of the Reverse Stock

Split, except for minor changes and adjustments that will result from rounding fractional shares into whole shares. The rights and privileges

of the holders of shares of common stock will be substantially unaffected by the Reverse Stock Split.

The above description of

the Certificate of Amendment and the Reverse Stock Split is a summary of the material terms thereof and is qualified in its entirety

by reference to the Certificate of Amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated

herein by reference.

Reason for the Reverse Stock Split

The Company is effecting

the Reverse Stock Split to satisfy the $1.00 minimum bid price requirement, as set forth in Nasdaq Listing Rule 5550(a)(2), for continued

listing on The NASDAQ Capital Market. As previously disclosed in a Current Report on Form 8-K filed with the Securities and Exchange

Commission on September 8, 2023, on September 7, 2023, the Company received a deficiency letter from the Listing Qualifications Department

(the “Staff”) of the Nasdaq Stock Market (“Nasdaq”) notifying the Company that, for the preceding

30 consecutive business days, the closing bid price for the common stock was trading below the minimum $1.00 per share requirement for

continued inclusion on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”).

In accordance with Nasdaq Rules, the Company has been provided an initial period of 180 calendar days, or until March 5, 2024 (the “Compliance

Date”), to regain compliance with the Bid Price Requirement. If at any time before the Compliance Date the closing bid price

for the Company’s common stock is at least $1.00 for a minimum of 10 consecutive business days, the Staff will provide the Company

written confirmation of compliance with the Bid Price Requirement. By effecting the Reverse Stock Split, the Company expects that the

closing bid price for the common stock will increase above the $1.00 per share requirement.

Item 8.01. Other Events

The

information provided in Item 5.03 is hereby incorporated by reference.

The

Company has a registration statement on Form S-3 (File No. 333-265416) and three registration statements on Form S-8 (File No. 333-259918,

File No. 333-266716 and File No. 333-274276) on file with the Commission. Commission regulations permit the Company to incorporate by

reference future filings made with the Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, prior to the termination of the offerings covered by registration statements filed on Form S-3 or Form S-8. The information

incorporated by reference is considered to be part of the prospectus included within each of those registration statements. Information

in this Item 8.01 of this Current Report on Form 8-K is therefore intended to be automatically incorporated by reference

into each of the active registration statements listed above, thereby amending them. Pursuant to Rule 416(b) under the Securities Act,

the amount of undistributed shares of common stock deemed to be covered by the effective registration statements of the Company described

above are proportionately reduced as of the Effective Time to give effect to the Reverse Stock Split.

Item 9.01 Financial Statements, Pro

Forma Financial Information and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: February 28, 2024

| |

180 LIFE SCIENCES CORP. |

| |

|

| |

By: |

/s/ James N. Woody, M.D., Ph.D. |

| |

|

Name: |

James N. Woody, M.D., Ph.D. |

| |

|

Title: |

Chief Executive Officer |

4

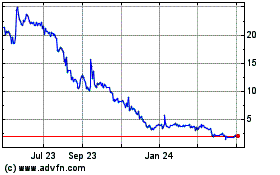

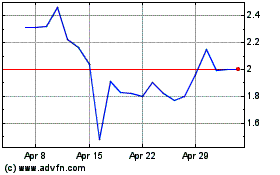

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Mar 2024 to Apr 2024

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Apr 2023 to Apr 2024