false000112494100011249412024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

BEACON ROOFING SUPPLY, INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 000-50924 | 36-4173371 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

505 Huntmar Park Drive, Suite 300, Herndon, VA 20170

(Address of Principal Executive Offices) (Zip Code)

(571) 323-3939

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| | | | |

| Common Stock, $0.01 par value | | BECN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 27, 2024, Beacon Roofing Supply, Inc. (the “Company”) issued a press release providing information regarding earnings for the fourth quarter and full year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

On February 27, 2024, the Company delivered a presentation as part of the webcast for the earnings conference call for the fourth quarter and full year ended December 31, 2023. A copy of the presentation is attached hereto as Exhibit 99.2.

The information including Exhibit 99.1 and Exhibit 99.2 in Item 2.02 of this Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Form 8-K shall not be incorporated by reference into any filing under the Securities Act of 1933, except as shall otherwise be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits

| | | | | | | | |

| Exhibit Index |

Exhibit Number |

| Description |

| 99.1 |

| |

| 99.2 |

| |

| 104 |

| Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

|

| BEACON ROOFING SUPPLY, INC. |

|

| | |

Date: February 27, 2024 |

| By: | /s/ Carmelo Carrubba |

| |

| | Carmelo Carrubba |

|

| | Interim Chief Financial Officer |

Exhibit 99.1

BEACON REPORTS FOURTH QUARTER AND FULL YEAR 2023 RESULTS

•Record fourth quarter and full year net sales, strong net income, and highest Adjusted EBITDA in history

•Ambition 2025 execution continued to generate growth with significant contributions from enhanced sales capabilities, greenfield investments, and M&A

•Strong net income margin and double-digit Adjusted EBITDA margin for the third consecutive full year driven by diligent pricing execution, productivity, and improvements from the bottom quintile branch initiative

•Record full year cash flow enabled investment in growth initiatives and returns to shareholders while maintaining balance sheet strength

HERNDON, VA.—(BUSINESS WIRE)— February 27, 2024 — Beacon (Nasdaq: BECN) (the “Company”, “we”, “our”) announced results today for the fourth quarter and full year ended December 31, 2023 (“2023”).

“Our 2023 results demonstrate that our Ambition 2025 strategy has multiple paths to growth and can deliver results in a variety of conditions,” said Julian Francis, Beacon’s President & CEO. “We delivered record fourth quarter and full year sales, strong net income, and our highest Adjusted EBITDA in history. We have reported year-over-year net sales growth for the last 12 quarters highlighting the resiliency of our business model and the necessity of our products. We remained focused on those items within our control, including pricing, operating efficiency, and working capital management. Our ability to generate substantial cash flow allowed us to re-invest in future growth. In 2023, we acquired 21 branches and opened 28 greenfield locations in key markets enhancing our customer reach and service. We also enhanced our sales capabilities by adding to our organizational leadership positions and expanding our sales training program. During the year, we also returned a significant amount of capital to shareholders. We deployed more than $800 million to repurchase all of the outstanding preferred shares on top of approximately $111 million in common share repurchases. In addition, we invested in growth capital including the highest capex in our history while, at the same time, maintaining our net debt leverage at 2.4 times as of year-end. Two years since we announced our Ambition 2025 plan, it has proven to be sustainable and we are well positioned in a large, attractive and growing market. Our over 8,000 team members have built a winning culture and stand ready to continue unlocking the long-term potential of Beacon.”

Fourth Quarter and Full Year Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited; $ in millions, except per share amounts) | | | | | | | |

| Net sales | $ | 2,299.5 | | | $ | 1,969.4 | | | $ | 9,119.8 | | | $ | 8,429.7 | |

| Gross profit | $ | 592.0 | | | $ | 515.6 | | | $ | 2,342.7 | | | $ | 2,235.5 | |

| Gross margin % | 25.7 | % | | 26.2 | % | | 25.7 | % | | 26.5 | % |

| | | | | | | |

| Operating expense | $ | 428.5 | | | $ | 389.3 | | | $ | 1,630.5 | | | $ | 1,532.1 | |

| % of net sales | 18.6 | % | | 19.8 | % | | 17.9 | % | | 18.2 | % |

Adjusted Operating Expense1 | $ | 408.5 | | | $ | 364.3 | | | $ | 1,538.1 | | | $ | 1,430.8 | |

% of net sales1 | 17.8 | % | | 18.5 | % | | 16.9 | % | | 17.0 | % |

| | | | | | | |

Net income (loss) | $ | 95.1 | | | $ | 73.3 | | | $ | 435.0 | | | $ | 458.4 | |

| % of net sales | 4.1 | % | | 3.7 | % | | 4.8 | % | | 5.4 | % |

Adjusted Net Income (Loss)1 | $ | 111.2 | | | $ | 93.2 | | | $ | 507.9 | | | $ | 537.9 | |

% of net sales1 | 4.8 | % | | 4.7 | % | | 5.6 | % | | 6.4 | % |

Adjusted EBITDA1 | $ | 216.7 | | | $ | 178.5 | | | $ | 929.6 | | | $ | 910.0 | |

% of net sales1 | 9.4 | % | | 9.1 | % | | 10.2 | % | | 10.8 | % |

| | | | | | | |

| | | | | | | |

1.Please see the included financial tables for a reconciliation of “Adjusted” non-GAAP financial measures to the most directly comparable GAAP financial measure, as well as further detail on the components driving the net changes over the comparative periods.

Fourth Quarter

Net sales increased 16.8% compared to the prior year to $2.30 billion, a Company record for fourth quarter net sales. The increase in net sales was driven by organic volume growth including greenfields over the last four quarters. Estimated organic volumes (including greenfields) and weighted-average selling price increased approximately 12-13% and 0-1%, respectively. Additionally, acquired branches contributed more than 4% to the increase in fourth quarter net sales.

Residential roofing product sales increased 20.2%, non-residential roofing product sales increased 11.4%, and complementary product sales increased 16.0% compared to the prior year. The increase in residential roofing product sales was primarily due to higher volumes. The increase in non-residential roofing product sales was primarily due to strong underlying market demand. The increase in complementary product sales was largely due to growth in our waterproofing business primarily due to the November 2022 acquisition of Coastal Construction Products. The three-month periods ended December 31, 2023 and 2022 each had 61 business days.

Gross margin decreased to 25.7%, from 26.2% in the prior year, as higher product costs offset higher average selling prices for our products. The increases in operating expense and Adjusted Operating Expense in 2023 were attributable to an increase in payroll and benefits costs, primarily due to increased headcount attributable to acquired branches and greenfields, as well as wage inflation. Both operating expense and Adjusted Operating Expense as a percent of sales were comparatively lower in the fourth quarter of 2023, driven by higher sales combined with cost management.

Net income (loss) was $95.1 million, compared to $73.3 million in the prior year. Adjusted EBITDA was $216.7 million, compared to $178.5 million in the prior year. Net income (loss) per common share (“EPS”) on a diluted basis was $1.47, compared to $0.88 in the prior year. Fourth quarter results compared to the prior year period were driven by higher net sales.

In February 2023, Beacon announced an increase in its share repurchase program, pursuant to which the Company may purchase up to $500 million of its common stock (inclusive of the $112 million remaining authorization under the program announced in February 2022). In the fourth quarter of 2023, the Company repurchased and retired $11.0 million of its common stock through open market repurchases. As a result, there were 63.3 million shares of common stock outstanding as of December 31, 2023.

Year ended December 31, 2023

Net sales increased 8.2% compared to the prior year to $9.12 billion, a Company record. The increase in net sales was largely driven by the contributions of acquired branches and greenfields over the last four quarters. Additionally, weighted-average selling price and estimated organic volumes (including greenfields) increased approximately 2-3% and 1-2%, respectively. Additionally, acquired branches contributed more than 4% to the year-over-year increase in net sales.

Residential roofing product sales increased 10.3%, non-residential roofing product sales decreased 2.7%, and complementary product sales increased 18.6% compared to the prior year. The increase in residential roofing product sales was primarily due to higher volumes. The increase in complementary product sales was largely due to growth in our waterproofing business primarily due to the November 2022 acquisition of Coastal Construction Products. The years ended December 31, 2023 and 2022 each had 252 business days.

Gross margin decreased to 25.7%, from 26.5% in the prior year as higher product costs more than offset higher average selling prices for our products. The increases in operating expense and Adjusted Operating Expense in 2023 were largely from acquired branches and greenfields. Excluding these impacts, operating expense from existing branches decreased by approximately 0.9%, or $14.0 million. The comparative decrease was related to a decrease in general and administrative expense due to lower professional fees coupled with a decrease in bad debt expense due to improved collections. On a consolidated basis, both operating expense and Adjusted Operating Expense as a percent of sales were lower year-over-year, largely driven by higher sales combined with cost management.

In July 2023, the Company repurchased all 400,000 issued and outstanding shares of its preferred stock from an affiliate of Clayton, Dubilier & Rice, LLC for $805.4 million, including $0.9 million of accrued but unpaid dividends. The aggregate repurchase price and related transaction fees and expenses were financed by a combination of proceeds from a new senior notes offering, as well as borrowings under our secured credit facility and cash on hand.

Net income (loss) was $435.0 million, compared to $458.4 million in the prior year. Adjusted EBITDA was $929.6 million, compared to $910.0 million in the prior year. Diluted EPS was $(0.43), compared to $5.55 in the prior year. The negative diluted EPS in 2023 is attributable to the $414.6 million preferred stock repurchase premium, which is included as a component of net income (loss) attributable to common stockholders in calculating EPS. See full reconciliation in the consolidated statements of operations below.

In 2023, the Company repurchased and retired $110.9 million of its common stock through a combination of a Rule 10b5-1 repurchase plan and open market transactions. As a result, shares of common stock outstanding decreased, net

of issuance, to 63.3 million as of December 31, 2023, from 64.2 million as of December 31, 2022. As of December 31, 2023, we had approximately $389.1 million available for repurchases remaining under the current Repurchase Program.

To calculate approximate weighted average selling price and product cost changes, we review organic U.S. warehouse sales of the same items sold regionally period over period and normalize the data for non-representative outliers. To calculate estimated volumes, we subtract the change in weighted average selling price, as described above, from the total changes in sales, excluding acquisitions and dispositions. As a result, and especially in high inflationary periods, the weighted average selling price and estimated volume changes may not be directly comparable to changes reported in prior periods.

During the fourth quarter of 2023, we revised our definition of when a branch classification changes from acquired to existing. Previously, the results of operations of branches were designated as acquired until they had been under our ownership for at least four full fiscal quarters at the start of the fiscal reporting period, after which such branches were classified as existing. Under our new definition, the results of operations of branches will be designated as acquired until they have been under our ownership and have contributed to our results of operations for at least 12 calendar months (inclusive of partial month activity), after which such branches are classified as existing. The effect of this change in definition is that the prior year results of operations for branches will be reclassified to existing when the comparable current month’s financial results are also classified as existing.

Please see the included financial tables for a reconciliation of “Adjusted” non-GAAP financial measures to the most directly comparable GAAP financial measure, as well as further detail on the components driving the net changes over the comparative periods.

Earnings Call

The Company will host a conference call and webcast today at 5:00 p.m. ET to discuss these results. Details for the earnings release event are as follows:

| | | | | |

| What: | Beacon Fourth Quarter and Full Year 2023 Earnings Call |

| When: | Tuesday, February 27, 2024 |

| Time: | 5:00 p.m. ET |

| Access: | Register for the conference call or webcast by visiting: |

| | Beacon Investor Relations – Events & Presentations |

Upon registration, participants will receive an email containing event details and unique access codes. To ensure timely access, participants should register for the earnings call at least 10 minutes before the 5:00 p.m. ET start time. An archived copy of the webcast will be available on the Events & Presentations page shortly after the call.

Forward-Looking Statements

This release contains information about management’s view of the Company’s future expectations, plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. In addition, oral statements made by our directors, officers and employees to the investor and analyst communities, media representatives and others, depending upon their nature, may also constitute forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate,” “estimate,” “expect,” “believe,” “will likely result,” “outlook,” “project” and other words and expressions of similar meaning. Investors are cautioned not to place undue reliance on forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company’s Form 10-K for the fiscal year ended December 31, 2022 and subsequent filings with the U.S. Securities and Exchange Commission. The Company may not succeed in addressing these and other risks. Consequently, all forward-looking statements in this release are qualified by the factors, risks and uncertainties contained therein. In addition, the forward-looking statements included in this press release represent the Company’s views as of the date of this press release and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this press release.

About Beacon

Founded in 1928, Beacon is a Fortune 500, publicly traded distributor of building products, including roofing materials and complementary products, such as siding and waterproofing. The Company operates over 530 branches throughout all 50 states in the U.S. and 6 provinces in Canada. Beacon serves an extensive base of nearly 100,000 customers, utilizing its vast branch network and diverse service offerings to provide high-quality products and support throughout the entire business lifecycle. Beacon offers its own private label brand, TRI-BUILT®, and has a proprietary digital account management suite, Beacon PRO+, which allows customers to manage their businesses online. Beacon’s stock is traded on the Nasdaq Global Select Market under the ticker symbol BECN. To learn more about Beacon, please visit www.becn.com.

| | | | | |

| INVESTOR CONTACT | MEDIA CONTACT |

| Binit Sanghvi | Jennifer Lewis |

| VP, Capital Markets and Treasurer | VP, Communications and Corporate Social Responsibility |

| Binit.Sanghvi@becn.com | Jennifer.Lewis@becn.com |

| 972-369-8005 | 571-752-1048 |

BEACON ROOFING SUPPLY, INC.

Consolidated Statements of Operations

(In millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | % of

Net Sales | | 2022 | | % of

Net Sales | | 2023 | | % of

Net Sales | | 2022 | | % of

Net Sales |

| (Unaudited) | | | | | | | | |

| Net sales | $ | 2,299.5 | | | 100.0 | % | | $ | 1,969.4 | | | 100.0 | % | | $ | 9,119.8 | | | 100.0 | % | | $ | 8,429.7 | | | 100.0 | % |

| Cost of products sold | 1,707.5 | | | 74.3 | % | | 1,453.8 | | | 73.8 | % | | 6,777.1 | | | 74.3 | % | | 6,194.2 | | | 73.5 | % |

| Gross profit | 592.0 | | | 25.7 | % | | 515.6 | | | 26.2 | % | | 2,342.7 | | | 25.7 | % | | 2,235.5 | | | 26.5 | % |

| Operating expense: | | | | | | | | | | | | | | | |

| Selling, general and administrative | 383.0 | | | 16.7 | % | | 350.3 | | | 17.8 | % | | 1,454.3 | | | 15.9 | % | | 1,372.9 | | | 16.3 | % |

| Depreciation | 25.6 | | | 1.0 | % | | 19.7 | | | 1.0 | % | | 91.2 | | | 1.1 | % | | 75.1 | | | 0.9 | % |

| Amortization | 19.9 | | | 0.9 | % | | 19.3 | | | 1.0 | % | | 85.0 | | | 0.9 | % | | 84.1 | | | 1.0 | % |

| | | | | | | | | | | | | | | |

| Total operating expense | 428.5 | | | 18.6 | % | | 389.3 | | | 19.8 | % | | 1,630.5 | | | 17.9 | % | | 1,532.1 | | | 18.2 | % |

| Income (loss) from operations | 163.5 | | | 7.1 | % | | 126.3 | | | 6.4 | % | | 712.2 | | | 7.8 | % | | 703.4 | | | 8.3 | % |

| Interest expense, financing costs and other | 37.1 | | | 1.6 | % | | 25.4 | | | 1.3 | % | | 126.1 | | | 1.4 | % | | 83.7 | | | 1.0 | % |

| | | | | | | | | | | | | | | |

| Income (loss) before income taxes | 126.4 | | | 5.5 | % | | 100.9 | | | 5.1 | % | | 586.1 | | | 6.4 | % | | 619.7 | | | 7.3 | % |

| Provision for (benefit from) income taxes | 31.3 | | | 1.4 | % | | 27.6 | | | 1.4 | % | | 151.1 | | | 1.6 | % | | 161.3 | | | 1.9 | % |

| Net income (loss) | 95.1 | | | 4.1 | % | | 73.3 | | | 3.7 | % | | 435.0 | | | 4.8 | % | | 458.4 | | | 5.4 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Reconciliation of net income (loss) to net income (loss) attributable to common stockholders: | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 95.1 | | | 4.1 | % | | $ | 73.3 | | | 3.7 | % | | $ | 435.0 | | | 4.8 | % | | $ | 458.4 | | | 5.4 | % |

| Dividends on Preferred Stock | — | | | — | % | | (6.0) | | | (0.3) | % | | (13.9) | | | (0.2) | % | | (24.0) | | | (0.3) | % |

| Undistributed income allocated to participating securities | — | | | — | % | | (8.7) | | | (0.4) | % | | (34.1) | | | (0.4) | % | | (54.8) | | | (0.7) | % |

| Repurchase Premium | — | | | — | % | | — | | | — | % | | (414.6) | | | (4.5) | % | | — | | | — | % |

| Net income (loss) attributable to common stockholders | $ | 95.1 | | | 4.1 | % | | $ | 58.6 | | | 3.0 | % | | $ | (27.6) | | | (0.3) | % | | $ | 379.6 | | | 4.4 | % |

| | | | | | | | | | | | | | | |

| Weighted-average common stock outstanding: | | | | | | | | | | | | | | | |

| Basic | 63.4 | | | | | 65.1 | | | | | 63.7 | | | | | 67.1 | | | |

| Diluted | 64.8 | | | | | 66.4 | | | | | 63.7 | | | | | 68.4 | | | |

| | | | | | | | | | | | | | | |

| Net income (loss) per common share: | | | | | | | | | | | | | | | |

| Basic | $ | 1.50 | | | | | $ | 0.90 | | | | | $ | (0.43) | | | | | $ | 5.66 | | | |

| Diluted | $ | 1.47 | | | | | $ | 0.88 | | | | | $ | (0.43) | | | | | $ | 5.55 | | | |

BEACON ROOFING SUPPLY, INC.

Consolidated Balance Sheets

(In millions)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 84.0 | | | $ | 67.7 | |

| Accounts receivable, net | 1,140.2 | | | 1,009.1 | |

| Inventories, net | 1,227.9 | | | 1,322.9 | |

| Prepaid expenses and other current assets | 444.6 | | | 417.8 | |

| | | |

| Total current assets | 2,896.7 | | | 2,817.5 | |

| Property and equipment, net | 436.4 | | | 337.0 | |

| Goodwill | 1,952.6 | | | 1,916.3 | |

| Intangibles, net | 403.5 | | | 447.7 | |

| Operating lease right-of-use assets, net | 503.6 | | | 467.6 | |

| Deferred income taxes, net | 2.1 | | | 9.9 | |

| Other assets, net | 12.8 | | | 7.5 | |

| | | |

| Total assets | $ | 6,207.7 | | | $ | 6,003.5 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 942.8 | | | $ | 821.0 | |

| Accrued expenses | 498.6 | | | 448.0 | |

| Current portion of operating lease liabilities | 89.7 | | | 94.5 | |

| Current portion of finance lease liabilities | 26.2 | | | 16.1 | |

| Current portion of long-term debt | 10.0 | | | 10.0 | |

| | | |

| Total current liabilities | 1,567.3 | | | 1,389.6 | |

| Borrowings under revolving lines of credit, net | 80.0 | | | 254.9 | |

| Long-term debt, net | 2,192.3 | | | 1,606.4 | |

| Deferred income taxes, net | 20.1 | | | 0.2 | |

| Other long-term liabilities | 0.5 | | | — | |

| Operating lease liabilities | 423.7 | | | 382.1 | |

| Finance lease liabilities | 100.3 | | | 67.0 | |

| | | |

| | | |

| | | |

| Total liabilities | 4,384.2 | | | 3,700.2 | |

| | | |

| Convertible Preferred Stock | — | | | 399.2 | |

| | | |

| Stockholders’ equity: | | | |

| Common stock | 0.6 | | | 0.6 | |

| Undesignated preferred stock | — | | | — | |

| Additional paid-in capital | 1,218.4 | | | 1,187.2 | |

| Retained earnings | 618.8 | | | 728.8 | |

| Accumulated other comprehensive income (loss) | (14.3) | | | (12.5) | |

| Total stockholders’ equity | 1,823.5 | | | 1,904.1 | |

| Total liabilities and stockholders’ equity | $ | 6,207.7 | | | $ | 6,003.5 | |

BEACON ROOFING SUPPLY, INC.

Consolidated Statements of Cash Flows

(In millions)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Operating Activities | | | |

| Net income (loss) | $ | 435.0 | | | $ | 458.4 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 176.2 | | | 159.2 | |

| Stock-based compensation | 28.0 | | | 27.6 | |

| Certain interest expense and other financing costs | 2.2 | | | 5.2 | |

| | | |

| Gain on sale of fixed assets and other | (15.6) | | | (4.1) | |

| Deferred income taxes | 27.3 | | | 30.1 | |

| | | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (104.7) | | | (111.4) | |

| Inventories | 129.1 | | | (117.7) | |

| Prepaid expenses and other current assets | (27.5) | | | (36.3) | |

| Accounts payable and accrued expenses | 141.6 | | | (15.2) | |

| Other assets and liabilities | (3.8) | | | 5.3 | |

| Net cash provided by (used in) operating activities | 787.8 | | | 401.1 | |

| | | |

| Investing Activities | | | |

| Capital expenditures | (122.9) | | | (90.1) | |

| Acquisition of business, net | (119.0) | | | (309.2) | |

| | | |

| Proceeds from sale of assets | 17.5 | | | 5.2 | |

| Purchases of investments | (1.2) | | | (1.5) | |

| Net cash provided by (used in) investing activities | (225.6) | | | (395.6) | |

| | | |

| Financing Activities | | | |

| Borrowings under revolving lines of credit | 2,374.2 | | | 2,781.3 | |

| Payments under revolving lines of credit | (2,550.7) | | | (2,520.6) | |

| | | |

| Payments under term loan | (10.0) | | | (10.0) | |

| Borrowings under senior notes | 600.0 | | | — | |

| | | |

| Payment of debt issuance costs | (8.0) | | | — | |

| | | |

| Payments under equipment financing facilities and finance leases | (21.2) | | | (12.1) | |

| Repurchase of convertible Preferred Stock | (805.7) | | | — | |

| Repurchase and retirement of common stock, net | (110.9) | | | (388.1) | |

| | | |

| Payment of dividends on Preferred Stock | (18.9) | | | (24.0) | |

Proceeds from disgorgement of short-swing profits1 | 5.9 | | | — | |

| Proceeds from issuance of common stock related to equity awards | 12.7 | | | 16.7 | |

| Payment of taxes related to net share settlement of equity awards | (13.8) | | | (5.7) | |

| Net cash provided by (used in) financing activities | (546.4) | | | (162.5) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 0.5 | | | (1.1) | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 16.3 | | | (158.1) | |

| Cash and cash equivalents, beginning of period | 67.7 | | | 225.8 | |

| Cash and cash equivalents, end of period | $ | 84.0 | | | $ | 67.7 | |

| | | |

| Supplemental Cash Flow Information | | | |

| | | |

| | | |

| Cash paid during the period for: | | | |

| Interest | $ | 111.3 | | | $ | 83.4 | |

Income taxes, net of refunds2 | $ | 120.6 | | | $ | 157.1 | |

1.During the year ended December 31, 2023, the Company received payments of $5.9 million from a stockholder related to short-swing trading profits disgorged pursuant to Section 16(b) of the Securities Exchange Act of 1934. The payments were recorded to additional paid-in capital on the consolidated balance sheets.

2.Year ended December 31, 2022 amount includes $18.6 million related to the transition period from October 1, 2021 to December 31, 2021.

BEACON ROOFING SUPPLY, INC.

Consolidated Sales by Line of Business

(Unaudited; in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales by Line of Business |

| Three Months Ended December 31, | | Year-over-Year Change |

| 2023 | | 2022 | |

| Net Sales | | Mix % | | Net Sales | | Mix % | | $ | | % |

| Residential roofing products | $ | 1,162.8 | | | 50.6 | % | | $ | 967.1 | | | 49.1 | % | | $ | 195.7 | | | 20.2 | % |

| Non-residential roofing products | 626.7 | | | 27.2 | % | | 562.6 | | | 28.6 | % | | 64.1 | | | 11.4 | % |

| Complementary building products | 510.0 | | | 22.2 | % | | 439.7 | | | 22.3 | % | | 70.3 | | | 16.0 | % |

| $ | 2,299.5 | | | 100.0 | % | | $ | 1,969.4 | | | 100.0 | % | | $ | 330.1 | | | 16.8 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

Sales by Business Day1,2 |

| Three Months Ended December 31, | | Year-over-Year Change |

| 2023 | | 2022 | |

| Net Sales | | Mix % | | Net Sales | | Mix % | | $ | | % |

| Residential roofing products | $ | 19.1 | | | 50.6 | % | | $ | 15.9 | | | 49.1 | % | | $ | 3.2 | | | 20.2 | % |

| Non-residential roofing products | 10.3 | | | 27.2 | % | | 9.2 | | | 28.6 | % | | 1.1 | | | 11.4 | % |

| Complementary building products | 8.3 | | | 22.2 | % | | 7.2 | | | 22.3 | % | | 1.1 | | | 16.0 | % |

| $ | 37.7 | | | 100.0 | % | | $ | 32.3 | | | 100.0 | % | | $ | 5.4 | | | 16.8 | % |

1.The three-month periods ended December 31, 2023 and 2022 each had 61 business days.

2.Dollar and percentage changes may not recalculate due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales by Line of Business |

| Year Ended December 31, | | Year-over-Year Change |

| 2023 | | 2022 | |

| Net Sales | | Mix % | | Net Sales | | Mix % | | $ | | % |

| Residential roofing products | $ | 4,652.0 | | | 51.0 | % | | $ | 4,217.9 | | | 50.0 | % | | $ | 434.1 | | | 10.3 | % |

| Non-residential roofing products | 2,395.7 | | | 26.3 | % | | 2,464.3 | | | 29.2 | % | | (68.6) | | | (2.7) | % |

| Complementary building products | 2,072.1 | | | 22.7 | % | | 1,747.5 | | | 20.8 | % | | 324.6 | | | 18.6 | % |

| $ | 9,119.8 | | | 100.0 | % | | $ | 8,429.7 | | | 100.0 | % | | $ | 690.1 | | | 8.2 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

Sales by Business Day1,2 |

| Year Ended December 31, | | Year-over-Year Change |

| 2023 | | 2022 | |

| Net Sales | | Mix % | | Net Sales | | Mix % | | $ | | % |

| Residential roofing products | $ | 18.5 | | | 51.0 | % | | $ | 16.8 | | | 50.0 | % | | $ | 1.7 | | | 10.3 | % |

| Non-residential roofing products | 9.5 | | | 26.3 | % | | 9.8 | | | 29.2 | % | | (0.3) | | | (2.7) | % |

| Complementary building products | 8.2 | | | 22.7 | % | | 6.9 | | | 20.8 | % | | 1.3 | | | 18.6 | % |

| $ | 36.2 | | | 100.0 | % | | $ | 33.5 | | | 100.0 | % | | $ | 2.7 | | | 8.2 | % |

1.The years ended December 31, 2023 and 2022 each had 252 business days.

2.Dollar and percentage changes may not recalculate due to rounding.

BEACON ROOFING SUPPLY, INC.

Non-GAAP Financial Measures

(Unaudited; in millions)

Non-GAAP Financial Measures

To provide investors with additional information regarding our financial results, we prepare certain financial measures that are not calculated in accordance with GAAP, specifically:

•Adjusted Operating Expense. We define Adjusted Operating Expense as operating expense, excluding the impact of the adjusting items (as described below).

•Adjusted Net Income (Loss). We define Adjusted Net Income (Loss) as net income (loss), excluding the impact of the adjusting items (as described below).

•Adjusted EBITDA. We define Adjusted EBITDA as net income (loss), excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, and the adjusting items (as described below).

We use these supplemental non-GAAP measures to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts that are used when allocating resources. We expect to compute our non-GAAP financial measures consistently using the same methods each period.

We believe these non-GAAP measures are useful measures because they permit investors to better understand changes over comparative periods by providing financial results that are unaffected by certain items that are not indicative of ongoing operating performance.

While we believe that these non-GAAP measures are useful to investors when evaluating our business, they are not prepared and presented in accordance with GAAP, and therefore should be considered supplemental in nature. These non-GAAP measures should not be considered in isolation or as a substitute for other financial performance measures presented in accordance with GAAP. These non-GAAP financial measures may have material limitations including, but not limited to, the exclusion of certain costs without a corresponding reduction of net income for the income generated by the assets to which the excluded costs relate. In addition, these non-GAAP financial measures may differ from similarly titled measures presented by other companies.

BEACON ROOFING SUPPLY, INC.

Non-GAAP Financial Measures (continued)

(Unaudited; in millions)

Adjusting Items to Non-GAAP Financial Measures

The impact of the following expense (income) items is excluded from each of our non-GAAP measures (the “adjusting items”):

•Acquisition costs. Represent certain direct and incremental costs related to acquisitions, including: amortization of intangible assets; professional fees, branch integration expenses, travel expenses, employee severance and retention costs, and other personnel expenses classified as selling, general and administrative; gains/losses related to changes in fair value of contingent consideration or holdback liabilities; and amortization of debt issuance costs. Acquisition costs are impacted by the timing and size of the acquisitions. We exclude acquisition costs from our non-GAAP financial measures to provide a useful comparison of our operating results to prior periods and to our peer companies because such amounts vary significantly based on the magnitude of the acquisition and do not reflect our core operations.

•Restructuring costs. Represent costs stemming from headcount rationalization efforts and certain rebranding costs; impact of divestitures; costs related to changing our fiscal year end; amortization of debt issuance costs; debt refinancing and extinguishment costs; and abandoned lease costs. We exclude restructuring costs from our non-GAAP financial measures, as such items vary significantly based on the magnitude of the restructuring activity and also do not reflect expected future operating expenses. Additionally, these costs do not necessarily provide meaningful insight into the current or past core operations of our business.

•COVID-19 impacts. Represent costs directly related to the COVID-19 pandemic. Beginning January 1, 2023, we determined COVID-19 impacts should no longer be considered an adjusting item. This change was applied prospectively.

The following table presents the pre-tax impact of the adjusting items on our consolidated statements of operations for each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Expense | | Non-Operating Expense | | | | |

| SG&A1 | | Amortization | | | | Interest Expense | | | | | | Total |

| Three Months Ended December 31, 2023 | | | | | | | | | | | | | |

| Acquisition costs | $ | 1.6 | | | $ | 19.9 | | | | | $ | 1.1 | | | | | | | $ | 22.6 | |

| Restructuring costs | (1.5) | | | — | | | | | 0.5 | | | | | | | (1.0) | |

| COVID-19 impacts | — | | | — | | | | | — | | | | | | | — | |

| Total adjusting items | $ | 0.1 | | | $ | 19.9 | | | | | $ | 1.6 | | | | | | | $ | 21.6 | |

| Three Months Ended December 31, 2022 | | | | | | | | | | | | | |

| Acquisition costs | $ | 2.6 | | | $ | 19.3 | | | | | $ | 1.1 | | | | | | | $ | 23.0 | |

| Restructuring costs | 2.8 | | | — | | | | | 0.3 | | | | | | | 3.1 | |

| COVID-19 impacts | 0.3 | | | — | | | | | — | | | | | | | 0.3 | |

| Total adjusting items | $ | 5.7 | | | $ | 19.3 | | | | | $ | 1.4 | | | | | | | $ | 26.4 | |

| | | | | | | | | | | | | |

| Year Ended December 31, 2023 | | | | | | | | | | | | | |

| Acquisition costs | $ | 6.9 | | | $ | 85.0 | | | | | $ | 4.1 | | | | | | | $ | 96.0 | |

| Restructuring costs | 0.5 | | | — | | | | | 1.5 | | | | | | | 2.0 | |

| COVID-19 impacts | — | | | — | | | | | — | | | | | | | — | |

| Total adjusting items | $ | 7.4 | | | $ | 85.0 | | | | | $ | 5.6 | | | | | | | $ | 98.0 | |

| Year Ended December 31, 2022 | | | | | | | | | | | | | |

| Acquisition costs | $ | 6.3 | | | $ | 84.1 | | | | | $ | 4.0 | | | | | | | $ | 94.4 | |

| Restructuring costs | 8.9 | | | — | | | | | 1.2 | | | | | | | 10.1 | |

| COVID-19 impacts | 2.0 | | | — | | | | | — | | | | | | | 2.0 | |

| Total adjusting items | $ | 17.2 | | | $ | 84.1 | | | | | $ | 5.2 | | | | | | | $ | 106.5 | |

1.Selling, general and administrative expense (“SG&A”).

BEACON ROOFING SUPPLY, INC.

Non-GAAP Financial Measures (continued)

(Unaudited; in millions)

Adjusted Operating Expense

The following table presents a reconciliation of operating expense, the most directly comparable financial measure as measured in accordance with GAAP, to Adjusted Operating Expense for each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating expense | $ | 428.5 | | | $ | 389.3 | | | $ | 1,630.5 | | | $ | 1,532.1 | |

| Acquisition costs | (21.5) | | | (21.9) | | | (91.9) | | | (90.4) | |

| Restructuring costs | 1.5 | | | (2.8) | | | (0.5) | | | (8.9) | |

| COVID-19 impacts | — | | | (0.3) | | | — | | | (2.0) | |

| Adjusted Operating Expense | $ | 408.5 | | | $ | 364.3 | | | $ | 1,538.1 | | | $ | 1,430.8 | |

| | | | | | | |

| Net sales | $ | 2,299.5 | | | $ | 1,969.4 | | | $ | 9,119.8 | | | $ | 8,429.7 | |

| Operating expense as % of sales | 18.6 | % | | 19.8 | % | | 17.9 | % | | 18.2 | % |

| Adjusted Operating Expense as % of sales | 17.8 | % | | 18.5 | % | | 16.9 | % | | 17.0 | % |

Adjusted Net Income (Loss)

The following table presents a reconciliation of net income (loss), the most directly comparable financial measure as measured in accordance with GAAP, to Adjusted Net Income (Loss) for each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 95.1 | | | $ | 73.3 | | | $ | 435.0 | | | $ | 458.4 | |

| Adjusting items: | | | | | | | |

| Acquisition costs | 22.6 | | | 23.0 | | | 96.0 | | | 94.4 | |

| Restructuring costs | (1.0) | | | 3.1 | | | 2.0 | | | 10.1 | |

| COVID-19 impacts | — | | | 0.3 | | | — | | | 2.0 | |

| Total adjusting items | 21.6 | | | 26.4 | | | 98.0 | | | 106.5 | |

Less: tax impact of adjusting items1 | (5.5) | | | (6.5) | | | (25.1) | | | (27.0) | |

| Total adjustments, net of tax | 16.1 | | | 19.9 | | | 72.9 | | | 79.5 | |

| Adjusted Net Income (Loss) | $ | 111.2 | | | $ | 93.2 | | | $ | 507.9 | | | $ | 537.9 | |

| | | | | | | |

| Net sales | $ | 2,299.5 | | | $ | 1,969.4 | | | $ | 9,119.8 | | | $ | 8,429.7 | |

| Net income (loss) as % of sales | 4.1 | % | | 3.7 | % | | 4.8 | % | | 5.4 | % |

| Adjusted Net Income (Loss) as % of sales | 4.8 | % | | 4.7 | % | | 5.6 | % | | 6.4 | % |

1.Amounts represent tax impact on adjustments that are not included in our income tax provision (benefit) for the periods presented. The tax impact of adjustments for the three months ended December 31, 2023 and 2022 were calculated using a blended effective tax rate of 25.5% and 24.6%, respectively. The tax impact of adjustments for the year ended December 31, 2023 and 2022 were calculated using a blended effective tax rate of 25.6% and 25.4%, respectively.

BEACON ROOFING SUPPLY, INC.

Non-GAAP Financial Measures (continued)

(Unaudited; in millions)

Adjusted EBITDA

The following table presents a reconciliation of net income (loss), the most directly comparable financial measure as measured in accordance with GAAP, to Adjusted EBITDA for each of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | $ | 95.1 | | | $ | 73.3 | | | $ | 435.0 | | | $ | 458.4 | |

| Interest expense, net | 38.9 | | | 26.3 | | | 131.9 | | | 86.3 | |

| Income taxes | 31.3 | | | 27.6 | | | 151.1 | | | 161.3 | |

| Depreciation and amortization | 45.5 | | | 39.0 | | | 176.2 | | | 159.2 | |

| Stock-based compensation | 5.8 | | | 6.6 | | | 28.0 | | | 27.6 | |

Acquisition costs1 | 1.6 | | | 2.6 | | | 6.9 | | | 6.3 | |

Restructuring costs1 | (1.5) | | | 2.8 | | | 0.5 | | | 8.9 | |

COVID-19 impacts1 | — | | | 0.3 | | | — | | | 2.0 | |

| Adjusted EBITDA | $ | 216.7 | | | $ | 178.5 | | | $ | 929.6 | | | $ | 910.0 | |

| | | | | | | |

| Net sales | $ | 2,299.5 | | | $ | 1,969.4 | | | $ | 9,119.8 | | | $ | 8,429.7 | |

| Net income (loss) as % of sales | 4.1 | % | | 3.7 | % | | 4.8 | % | | 5.4 | % |

| Adjusted EBITDA as % of sales | 9.4 | % | | 9.1 | % | | 10.2 | % | | 10.8 | % |

1.Amounts represent adjusting items included in SG&A; remaining adjusting item balances are embedded within the other line item balances reported in this table.

FEBRUARY 27, 2024 2023 Q4 & FULL YEAR 2023 EARNINGS PRESENTATION Exhibit 99.2

becn.com2 Disclosure Notice This presentation contains information about management's view of the Company's future expectations, plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. In addition, oral statements made by our directors, officers and employees to the investor and analyst communities, media representatives and others, depending upon their nature, may also constitute forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or current facts and often use words such as “anticipate,” “estimate,” “expect,” “believe,” “will likely result,” “outlook,” “project” and other words and expressions of similar meaning. Investors are cautioned not to place undue reliance on forward-looking statements. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's Form 10-K for the fiscal year ended December 31, 2022 and subsequent filings with the U.S. Securities and Exchange Commission. The Company may not succeed in addressing these and other risks. Consequently, all forward-looking statements in this presentation are qualified by the factors, risks and uncertainties contained therein. In addition, the forward-looking statements included in this presentation represent the Company's views as of the date of this presentation and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this presentation. This presentation contains references to certain financial measures that are not presented in accordance with United States Generally Accepted Accounting Principles (“GAAP"). The Company uses non-GAAP financial measures to evaluate financial performance, analyze underlying business trends and establish operational goals and forecasts that are used when allocating resources. The Company believes these non-GAAP financial measures permit investors to better understand changes over comparative periods by providing financial results that are unaffected by certain items that are not indicative of ongoing operating performance. While the Company believes these measures are useful to investors when evaluating performance, they are not prepared and presented in accordance with GAAP, and therefore should be considered supplemental in nature. The Company’s non-GAAP financial measures should not be considered in isolation or as a substitute for other financial performance measures presented in accordance with GAAP. These non-GAAP financial measures may have material limitations including, but not limited to, the exclusion of certain costs without a corresponding reduction of net income for the income generated by the assets to which the excluded costs relate. In addition, these non-GAAP financial measures may differ from similarly titled measures presented by other companies. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure can be found in the Appendix as well as the Company’s latest Form 8-K, filed with the SEC on February 27, 2024.

becn.com3 PRESIDENT & CHIEF EXECUTIVE OFFICER JULIAN FRANCIS

becn.com CEO Perspective *Non-GAAP measure; see Appendix for definition and reconciliation Notes: Percentages within the Net Income ($M) and Adjusted EBITDA* ($M) bar charts represent each metric as a % of net sales. All quarterly information and comparisons reflect Continuing Operations. 2.5%1.4% Record Q4 sales • Growth across all three LOBs, stable pricing YoY • Ambition 2025 driving top-line growth Strong net income and record Q4 Adj. EBITDA* • Gross margin exceeded guidance on our Q3 call • Bottom quintile branch initiative contributed to bottom-line • Operating leverage improved YoY Record full-year Operating Cash Flow • Accelerated Ambition 2025 initiatives • Maintained balance sheet capacity Continued to expand our commercial and waterproofing footprint in Q1 • Acquired Roofers Supply of Greenville and Metro Sealant 4 8.3%5.6%1.8% +1.1%+28.0%+11.8%+2.0% 20 26.0 +6.2% 6.1% 6.9% 8.4 12.3 13.0 7.4% 8.3% 13.0% 11.6%13.0% 11.6% +6.9% +28.8% +7.0% +6.9% +28.8% +7.0% $1,577 $1,755 $1,969 $2,300 Q4'20 Q4'21 Q4'22 Q4'23 Net Sales ($M) / YoY (%) +11.3% +14.1 16.8 6.4% 6.2% 7.2 7.0% 9.1% 9.4% $179 $217 Q4'22 Q4'23 Adj. EBITDA* ($M) 9.1% 9.4% $73 $93$95 $111 GAAP Adj. NI* Net Income ($M) Q4'22 Q4'23 3.7% 4.1 4.7% 4.8

becn.com5 • Engaged drivers to reduce emissions via “Turn it Off” program • Contracted to power over 30 branches with renewable energy from community solar • Promoted Giving Tuesday to drive donations to Beacon CaReS fund for employees in crisis Executing on Ambition 2025 Initiatives Exceeded Ambition 2025 sales and shareholder return targets in 2023 DRIVING OPERATIONAL EXCELLENCE BUILDING A WINNING CULTURE DRIVING ABOVE MARKET GROWTH CREATING SHAREHOLDER VALUE • Bottom Quintile Branch initiative contributed ~$15M to the bottom-line in Q4 YoY • Branch & OTC optimization driving productivity & improving customer service • Sales per hour worked at highest fourth quarter since tracking began in Q1’20 • Acquired 6 branches and opened 11 greenfield locations in Q4 enhancing customer service • Digital sales growth +28% Q4 YoY, high residential sales adoption at ~22% in Q4 • Customer Experience model driving improved operating performance and sales growth • Record Q4 net sales and Adjusted EBITDA* • Repurchased all preferred shares for ~$804M & CD&R exited common stock • Repurchased ~$111M in common stock in ’23 • Retained financial flexibility, ample capacity to invest with net debt leverage* of 2.4x as of 12/31 *Non-GAAP measure; see Appendix for definition and reconciliation

becn.com6 VICE PRESIDENT & INTERIM CHIEF FINANCIAL OFFICER CARMELO CARRUBBA

becn.com7 Q4 2023 Sales and Mix Net sales up 16.8% • Organic growth including greenfield locations drove top-line growth • Acquisitions added ~4% to the top-line growth • Average selling prices stable YoY Residential sales up 20.2% • Shingle volumes benefited from R&R activity including storm demand • Selling prices higher LSD% YoY, August price increase well executed • Single family new construction demand improving Non-residential sales up 11.4% • Volumes up mid-teens, contractor destocking complete • Solid repair & reroofing demand • Prices down LSD% YoY Complementary sales up 16.0% • Continued growth in waterproofing • Total siding volumes higher • Prices stable YoY with exception of lumber +1.1%$1,969 $2,300 Net Sales ($M) / YoY (%) Q4'22 Q4'23 +16.8% 51% 27% 22% Net Sales Mix Residential Non-residential Complementary $967 $563 $440 $1,163 $627 $510 Residential Non-residential Complementary Net Sales by Line of Business (LOB) ($M) Q4'22 Q4'23 +20.2% +11.4% +16.0%

becn.com8 100 145 137 139 121 148 146 152 144 171 173 156 135 186 186 168 Sales Per Hour Worked*** (Indexed to Q1’20) *Non-GAAP measure; see Appendix for definition and reconciliation **Quarter ending headcount does not include acquisitions completed in the last four quarters ***Hours worked reflect all company-wide hourly employees, but excludes salaried/commission-based personnel Notes: All quarterly information and comparisons reflect Continuing Operations. Percentages within the bar charts represent each metric as a % of net sales. Q4 2023 Margin and Expense Gross margin down ~50 bps YoY • Price-cost negative YoY, inventory profit roll-off • Decline slightly offset by higher residential mix Adj. OpEx* 17.8% of sales, down 70 bps YoY • Investments in Ambition 2025 continued • Greenfield & acquired branches added ~$24M YoY • Inflation in wages, benefits and incentive comp partially offset by lower T&E and fleet expenses YoY • Significant focus on bottom-quintile branch initiatives and productivity 6,544 6,894 7,303 7,289 7,245 7,149 7,469 7,624 7,813 Headcount** 25.4% 26.3% 26.2% 25.7% Q4'20 Q4'21 Q4'22 Q4'23 Gross Margin $389 $364 $429 $409 GAAP Adj. OpEx* Operating Expense ($M) Q4'22 Q4'23 18.5% 17.8%18.6%19.8%

becn.com9 Strong Balance Sheet, Continued Capacity to Invest Strong fourth quarter cash flow generation • OCF of $262M, >120% of Adjusted EBITDA* • Generated $788M in OCF FY’23 Ample balance sheet capacity and liquidity • Net debt leverage* 2.4x at 12/31 • Liquidity of $1.3B as of 12/31 Investing in growth and returns • Record full year capex to modernize fleet & facilities and drive growth & efficiencies • Acquisition pipeline remains active • Repurchased $11M shares in Q4, $111M in ‘23 • Reduced shares outstanding to 63.3M as of 12/31 compared to 64.2M at prior year end *Non-GAAP measure; see Appendix for definition and reconciliation **Calculation for these periods include amounts derived from combined operations – see Appendix for further detail ***Maturities shown as of Q4’23; excl impact of debt issuance cost amortization & required $10M annual paydown of 2028 Term Loan $50 ($162) ($25) $268 $320 $101 $258 $167 $262 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Operating Cash Flow ($M) GAAP $1,162 $1,462 $1,549 $1,389 $1,323 $1,293 $1,353 $1,308 $1,228 Net Inventory ($M) 5.3 4.7 4.8 2.9 2.4 2.1 2.1 2.3 2.5 2.0 2.0 2.1 1.9 2.7 2.4 Net Debt Leverage* $600 2023 2024 2025 2026 2027 2028 2029 2030 Q4’23 Debt Maturity by Year ($M)*** ABL Term loan Secured Notes Unsecured Notes $384 $350 $975 $0 $0 $0 $0

PRESIDENT & CHIEF EXECUTIVE OFFICER JULIAN FRANCIS

becn.com11 Reflections on a Record 2023 *Non-GAAP measure; see Appendix for definition and reconciliation Execution on Ambition 2025 strategy has accelerated Beacon’s momentum Delivered on A25 net sales target Net sales growth of 8% to a full year record $9.1B Strong net income and record Adj. EBITDA* Net income of $435M, Adj. EBITDA* of $920M and third consecutive full year of DD Adj. EBITDA* margin Building a Winning Culture Launched employee stock purchase program, continuing to enhance benefit & safety programs Delivered on A25 shareholder returns target Over $900 million in shareholder returns through common and preferred stock redemptions Accelerated greenfield investment Added 28 new greenfield locations bringing A25 total to 45 Executed on M&A pipeline Closed on 9 acquisitions in 2023 adding 21 branches Record digital, private label & national accounts sales Achieved highest residential digital adoption Bottom Quintile Branch initiative delivered Improved BQB branches adding $21M to the bottom- line, total A25 contribution of $57M

becn.com12 2024 market outlook • Residential shipments to be down on lower expected storm demand partially offset by higher non-storm repair & re-reroofing • Single-family starts and new construction activity expected to improve, existing home sales recovering from a low level • Non-residential market demand expected to remain softer reflecting ABI reading below 50 Q1’24 expectations • January 2024 sales per day down ~4% YoY*; Q1’24 net sales expected to be up HSD% YoY • Gross margins expected to be in the ~24.5% range on LOB and geographic mix plus greenfield and acquired branches are dilutive • OpEx % of sales higher YoY on A25 investments and ensuring staffing for expected seasonal ramp Full Year 2024 indications • Expect net sales growth of MSD% YoY, including contributions from previously announced acquisitions • Gross margin expected to be in the mid-25 percent range, margin enhancing initiatives offset by higher non-res mix • Adjusted EBITDA** of $920 – $980M, higher OpEx on new greenfield and acquired locations Focused on accomplishing Ambition 2025 goals • Continued acceleration in greenfield investment to yield more than 25 new locations in 2024 • Expect to remain acquisitive consistent with the enhanced M&A pipeline • Committed to generating returns for our shareholders and prudent balance sheet management Closing Thoughts *Percentages adjusted for one more selling day in Jan ‘24 as compared to Jan ’23 **Non-GAAP measure; see Appendix for definition and reconciliation Note: 2024 has 2 more selling days as compared to 2023 LOB – Line of business Ambition 2025 has demonstrated multiple paths to growth and profitability

becn.com14 Reconciliations: Non-GAAP Financial Measures RESULTS BY QUARTER (CONTINUING OPERATIONS) We define Adjusted Operating Expense as operating expense (as reported on a GAAP basis) excluding the impact of amortization, acquisition costs, restructuring costs, and costs directly related to the COVID-19 pandemic. We define Adjusted EBITDA as net income (loss) from continuing operations excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock- based compensation, acquisition costs, restructuring costs, and costs directly related to the COVID-19 pandemic. Beginning January 1, 2023, the Company determined that COVID-19 impacts should no longer be considered an adjusting item and the change was applied prospectively. * Three months ended 3/31/2020 amount includes the impact of non-cash accelerated intangible asset amortization of $142.6 million related to the write-off of certain trade names in connection with the Company’s rebranding efforts. For additional information see our latest Form 8-K, filed with the SEC on February 27, 2024.

becn.com15 NET DEBT LEVERAGE We define Net Debt Leverage as gross total debt less cash, divided by Adjusted EBITDA for the trailing four quarters. * Historical quarterly Adjusted EBITDA totals used in the calculation of Net Debt Leverage are presented on an as-reported basis, therefore the calculations for the periods ended March 31, June 30, and September 30, 2020 are based on Adjusted EBITDA from combined operations (see slide 16 for reconciliations). Beginning with the period ended December 31, 2020, the Company began presenting its Interior Products business as discontinued operations, therefore the calculations of Net Debt Leverage for the periods ended December 31, 2020 and forward are based on Adjusted EBITDA from continuing operations (see slide 14 for reconciliations). Reconciliations: Non-GAAP Financial Measures

becn.com16 CERTAIN 2019-2020 RESULTS BY FISCAL QUARTER (COMBINED OPERATIONS) Reconciliations: Non-GAAP Financial Measures ($M) 6/30/2019 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 Net income (loss) 31.0$ 27.4$ (23.4)$ (122.6)$ (6.7)$ 71.9$ Interest expense, net 40.2 38.4 34.7 35.6 35.3 32.7 Income taxes 5.2 20.8 (9.6) (81.8) 46.6 18.1 Depreciation and amortization* 69.4 69.5 63.9 204.9 61.8 60.6 Stock-based compensation 4.6 3.5 5.2 4.7 3.5 3.8 Acquisition costs 5.7 3.8 3.8 (2.8) 1.6 1.8 Restructuring costs 1.7 5.7 19.7 0.9 2.0 1.2 COVID-19 impacts — — — — 3.4 0.8 Adjusted EBITDA (Combined) 157.8$ 169.1$ 94.3$ 38.9$ 147.5$ 190.9$ Three Months Ended This table is presented for purposes of reconciling Adjusted EBITDA amounts utilized in the calculation of Net Debt Leverage for historical periods presented on slide 15. We define Adjusted EBITDA as net income (loss) excluding the impact of interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, acquisition costs, restructuring costs, and costs directly related to the COVID-19 pandemic. * Three months ended 3/31/2020 amount includes the impact of non-cash accelerated intangible asset amortization of $142.6 million related to the write-off of certain trade names in connection with the Company’s rebranding efforts.

becn.com17 *Composed of Acquisition and Restructuring costs 2024 GUIDANCE: ADJUSTED EBITDA Reconciliations: Non-GAAP Financial Measures

v3.24.0.1

Cover

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity Registrant Name |

BEACON ROOFING SUPPLY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-50924

|

| Entity Tax Identification Number |

36-4173371

|

| Entity Address, Address Line One |

505 Huntmar Park Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Herndon

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

20170

|

| City Area Code |

571

|

| Local Phone Number |

323-3939

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

BECN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001124941

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

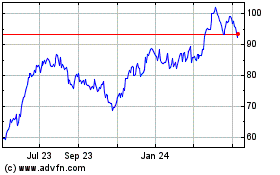

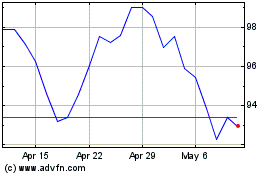

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From Apr 2024 to May 2024

Beacon Roofing Supply (NASDAQ:BECN)

Historical Stock Chart

From May 2023 to May 2024