0001563190FALSE00015631902024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

Compass, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-40291 | | 30-0751604 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

110 Fifth Avenue, 4th Floor New York, New York | | 10011 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (212) 913-9058

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.00001 par value per share | | COMP | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On February 27, 2024, Compass, Inc. (“Compass” or the “Company”) issued a press release (the “Press Release”) and will hold a conference call announcing its financial results for the quarter and year ended December 31, 2023. A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished with this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| | |

Exhibit Number | | Exhibit Title or Description |

| |

| 99.1 | | |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | COMPASS, INC. |

| | | |

| Date: February 27, 2024 | | | | By: | | /s/ Kalani Reelitz |

| | | | | | Kalani Reelitz |

| | | | | | Chief Financial Officer |

Compass, Inc. Reports Fourth Quarter and Full Year 2023 Results

Grows Agent Count and Market Share year-over-year and quarter-over-quarter in Q4

Expects to Be Free Cash Flow Positive for Full Year 2024

New York, NY - February 27, 2024 - Compass, Inc. (NYSE: COMP) (“Compass” or “the Company”), the largest residential real estate brokerage in the United States by transaction volume1, announced its financial results for the fourth quarter and full year ended December 31, 2023.

“Over the past two years, we have successfully navigated the worst residential real estate market in decades and significantly reset our operating expense levels, positioning Compass for what we believe will be significant upside when the market begins to recover,” said Robert Reffkin, Founder and Chief Executive Officer of Compass. “As we reduced operating expenses, we continued to invest in growth, our agents and our technology platform, the industry’s only proprietary first-contact to close platform. We recruited more than 2,000 principal agents without cash or equity sign-on incentives since eliminating those incentives in August 2022 and we increased the number of principal agents 7.7% in Q4 2023 compared to Q4 2022. We grew quarterly market share both year-over-year and quarter-over-quarter2 in Q4 2023 and we continued the trend of strong agent retention, achieving 97% principal agent retention in Q4 2023. In 2023, we continued to build our technology advantage as we added 103 features to our platform including Performance Tracker, Compass AI enhancements and ‘1 Click Title & Escrow.’ ”

Kalani Reelitz, Chief Financial Officer of Compass said, “In January 2023, we announced our 2023 target range of $850 million to $950 million of annualized non-GAAP operating expenses, or OPEX3. We expected to be below the midpoint of that range in Q4 of 2023. One year later, I’m pleased to announce we ended the year below the midpoint goal and expect to further reduce our full year 2024 non-GAAP OPEX to $865 million. We expect non-GAAP OPEX will grow thereafter at a nominal rate of 3-4% per year excluding M&A over the next few years. We have built an operating structure that has set us up for margin expansion when market conditions improve. These reduced non-GAAP OPEX levels have allowed us to significantly improve our cash flow. For the full year of 2023 compared to the full year of 2022, we have been able to achieve a $266 million improvement in our operating cash flow and a $325 million improvement in free cash flow even as revenue declined by $1.1 billion.”

Q4 2023 and Full Year Financial Highlights:

•Revenue in Q4 2023 decreased by 1% year-over-year to $1.1 billion as transactions declined 4.9% driven by macroeconomic factors. For the full year, 2023 revenue was $4.9 billion compared to $6.0 billion in 2022, a decrease of 19%.

•GAAP Net loss in Q4 2023 was $83.7 million, an improvement of $74.4 million or 47% from a Net loss of $158.1 million in Q4 2022. The Net loss for Q4 2023 includes non-cash stock-based compensation expenses of $36.3 million and depreciation and amortization of $21.5 million. For 2023, Net loss was $321.3 million compared to $601.5 million in 2022, a reduction of $280.2 million or 47%.

•Adjusted EBITDA4 (a non-GAAP measure) was ($23.7) million in Q4 2023, compared to ($75.3) million in Q4 2022. This is an improvement of $51.6 million or 69%. In 2023, Adjusted EBITDA was ($38.9) million compared to ($210.0) million in 2022, an improvement of $171 million or 81%.

•Operating Cash Flow / Free Cash Flow4 (a non-GAAP measure): during Q4 2023, operating cash flow was ($38.7) million and free cash flow was ($41.0) million, the difference being the treatment of capital expenditures. For 2023, Operating cash flow was ($25.9) million compared to ($291.7) million in 2022, an improvement of $265.8 million or 91%. Free Cash Flow for the full year 2023 was ($37.1) million compared to ($361.8) million in 2022, an improvement of $324.7 million.

1 Compass was ranked number one in sales volume for 2022 by Real Trends in March 2023 for the second year in a row.

2 Q3 2023 national market share has been updated to 4.31%.

3 Non-GAAP OPEX excludes Commissions and other related expenses, Depreciation and amortization, Stock-based compensation and other expenses excluded from the Company’s calculation of Adjusted EBITDA. We calculate non-GAAP OPEX annualized run rate by taking the sum of the quarter’s non-GAAP sales and marketing, operations and support, research and development, and general and administration expenses and multiplying it by four.

4 A reconciliation of GAAP to Non-GAAP measures can be found within the financial statement tables included within this press release.

•Cash and cash equivalents at the end of Q4 2023 was $166.9 million, with no draw of our revolving credit facility. Compared to year-end 2022 of $361.9 million, the cash balance declined $195 million primarily driven by net repayments of drawdowns on the revolving credit facility of $150 million.

Q4 2023 Operational Highlights:

•Platform: the Compass end-to-end technology platform provides real estate agents with the ability to perform their primary workflows, from first contact to close, with a single log-in and without leaving the Compass platform.

◦In 2023, we continued to enhance the platform with 103 features, including Performance Tracker, Compass AI, and ‘1-Click Title & Escrow’.

◦We continued the roll out of our title and escrow business integration into the technology platform in Philadelphia, Washington DC, Maryland and Virginia and plan to roll out this integration feature to all the markets where we currently offer title and escrow services in Q3 2024, including in our newest title & escrow market - Florida.

•National market share in Q4 2023 was 4.41%, an increase of 9 basis points in Q4 2023 compared to Q4 2022 and 10 basis points in Q4 2023 compared to Q3 20235.

•Agents: Average Number of Principal Agents was 14,689 for Q4 2023, a 7.7% increase of 1,046 principal agents from Q4 2022 and a 4.5% increase sequentially of 634 from Q3 2023.6 Compass continued to experience high levels of principal agent retention with 97% agent retention in Q4 2023. In the fourth quarter, we managed out approximately 50 principal agents and 400 total agents with an average gross commission income of less than $10,000, which had the additional benefit of freeing up resources for the rest of our producing agents.

•Transactions: Compass agents closed 40,621 Total Transactions in Q4 2023, a decline of 4.9% compared to Q4 2022 (42,719). Transactions for the entire U.S. residential real estate market declined 9.2% for the same period.7 For the full year of 2023, transactions were 178,848 compared to 211,538 in 2022, a decline of 15.5% compared to a decline of 18.7% for the entire U.S. residential market.

•Gross Transaction Value (“GTV”)8 was $41.8 billion in Q4 2023, a decline of 1.6% compared to Q4 2022 GTV of $42.5 billion, while national market GTV was down 3.7% for the same period. For the full year 2023, GTV was $186.1 billion compared to $230.3 billion in 2022, a decline of 19.2% compared to a national market GTV decline of 17.3%.

Additional information can be found in the Company’s Q4 2023 Earnings Presentation, which can be found in the Investor Relations section of the Compass website at https://investors.compass.com.

Outlook

Q1 2024 Outlook:

•Revenue of $975 million to $1,075 million

•Adjusted EBITDA of negative $22 million to negative $40 million

FY 2024 Outlook:

•Non-GAAP OPEX of $855 million - $875 million9

•Expects to be free cash flow positive for full year 2024

We have not reconciled our guidance for Adjusted EBITDA to GAAP Net loss because certain expenses excluded from GAAP Net loss when calculating Adjusted EBITDA cannot be reasonably calculated or predicted at this time. Additionally, we have not reconciled our guidance for non-GAAP OPEX to GAAP OPEX because certain expenses excluded from GAAP OPEX

5 Q3 2023 national market share has been updated to 4.31%.

6 During the first quarter of 2023, we began to utilize an updated methodology for tracking and reporting our agent statistics. The Average Number of Principal Agents and year over year growth reported in this press release is based on the updated methodology.

7 We calculate Total Transactions by taking the sum of all transactions closed on the Compass platform in which our agent represents the buyer or seller in the purchase or sale of a home (excluding rental transactions). We include a single transaction twice when one or more Compass agents represent both the buyer and seller in any given transaction.

8 Gross Transaction Value includes a de minimis number of new development and commercial brokerage transactions.

9 Non-GAAP OPEX excludes Commissions and other related expenses, Depreciation and amortization, Stock-based compensation and other expenses excluded from the Company’s calculation of Adjusted EBITDA. We calculate non-GAAP OPEX annualized run rate by taking the sum of the quarter’s non-GAAP sales and marketing, operations and support, research and development, and general and administration expenses and multiplying it by four. For a reconciliation of GAAP OPEX to non-GAAP OPEX see the financial statement tables included within this press release.

cannot be reasonably calculated or predicted at this time. Accordingly, reconciliations are not available without unreasonable effort.

For a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures on a historical basis, see “Reconciliation of Net Loss Attributable to Compass, Inc. to Adjusted EBITDA”, “Reconciliation of GAAP OPEX to non-GAAP OPEX” and “Reconciliation of GAAP Operating Cash Flow to Free Cash Flow” in the financial statement tables included within this press release.

---------------------------------------------------------------------------------------------------------------------------

Conference Call Information

Management will conduct a conference call to discuss the fourth quarter and full year 2023 results as well as outlook at 5:00 p.m. ET on Tuesday, February 27, 2024. The conference call will be accessible via the Internet on the Compass Investor Relations website https://investors.compass.com. You can also access the audio webcast via the following link: Compass, Inc. 4Q23 Earnings Conference Call.

An audio recording of the conference call will be available for replay shortly after the call's completion. To access the replay, visit the Events and Presentations section on the Compass Investor Relations website at https://investors.compass.com.

Disclosure Channels

Compass uses its Investor Relations website, https://investors.compass.com, as a means of disclosing information which may be of interest or material to its investors and for complying with disclosure obligations under Regulation FD. We intend to announce material information to the public through filings with the Securities and Exchange Commission, or the SEC, the investor relations page on our website (www.compass.com), press releases, public conference calls, public webcasts, our X (formerlyTwitter) feed (@Compass), our Facebook page, our LinkedIn page, our Instagram account, our YouTube channel, and Robert Reffkin’s X (formerly Twitter) feed (@RobReffkin) and Instagram account (@robreffkin). Accordingly, investors should monitor each of these disclosure channels.

Safe Harbor Statement

This press release includes forward-looking statements, which are statements other than statements of historical facts, and statements in the future tense. These statements include, but are not limited to, statements regarding our future performance, including expected financial results for the first quarter of 2024, planned non-GAAP OPEX and free cash flow expectations for the full year of 2024, and our expectations for operational achievements. Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date of this press release, and are subject to risks and uncertainties, including but not limited to: general economic conditions, economic and industry downturns, the health of the U.S. real estate industry, and risks generally incident to the ownership of residential real estate; the effect of monetary policies of the federal government and it’s agencies; rising interest rates; ongoing industry antitrust class action litigation (including lawsuits filed against us) or any related regulatory activities; any decreases in our gross commission income or the percentage of commissions that we collect; declining home inventory levels; our ability to carefully manage our expense structure; adverse economic, real estate or business conditions in geographic areas where our business is concentrated and/or impacting high-end markets; our ability to continuously innovate, improve and expand our platform, including tools and features integrating machine learning and artificial intelligence; our ability to expand our operations and to offer additional integrated services; our ability to realize expected benefits from our joint ventures; our ability to compete successfully; our ability to attract and retain highly qualified personnel and to recruit agents; our ability to re-accelerate our business growth given our current expense structure; fluctuation in our quarterly results and other operating metrics; the loss of one or more key personnel; actions by our agents or employees that could adversely affect our reputation and subject us to liability; our ability to pursue acquisitions that are successful and can be integrated into our existing operations; changes in mortgage underwriting standards; our ability to maintain or establish relationships with third-party service providers; the impact of cybersecurity incidents and the potential loss of critical and confidential information; the reliability of our fraud detection processes and information security systems; depository banks not honoring our escrow and trust deposits; adoption of alternatives to full-service agents by consumers; our ability to develop and maintain an effective system of disclosure controls and internal control over financial reporting; covenants in our debt agreements that may restrict our borrowing capacity or operating activities; our abilities to use net operating losses and other tax attributes; changes in, and our reliance on, accounting standards, assumptions, estimates and business data; the dependability of our platform and software; our ability to maintain our company culture; our ability to obtain or maintain adequate insurance coverage; processing, storage, and use of personal information and other data, and compliance

with privacy laws and regulations; natural disasters and catastrophic events; the effect of the claims, lawsuits, government investigations and other proceedings; changes in federal or state laws that would require our agents to be classified as employees; our ability to protect our intellectual property rights and our reliance on the intellectual property rights of third parties; the impact of having a multi-class structure of common stock; and other risks set forth in our annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q. Significant variation from the assumptions underlying our forward-looking statements could cause our actual results to vary, and the impact could be significant. Accordingly, actual results could differ materially from those predicted or implied or such uncertainties could cause adverse effects on our results. Reported results should not be considered as an indication of future performance.

More information about factors that could adversely affect our business, financial condition and results of operations, or that could cause actual results to differ from those expressed or implied in our forward-looking statements is included under the captions “Risk Factors,” “Legal Proceedings” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent annual report on Form 10-K and our subsequent quarterly reports on Form 10-Q, copies of which are available on the Investor Relations page of our website at https://investors.compass.com/ and on the SEC website at www.sec.gov. All information herein speaks as of the date hereof and all forward-looking statements contained herein are based on information available to us as of the date hereof, and we do not assume any obligation to update these statements as a result of new information or future events. Undue reliance should not be placed on the forward-looking statements in this press release.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared in accordance with GAAP, we present Adjusted EBITDA, non-GAAP OPEX, and Free Cash Flow, which are non-GAAP financial measures, in this press release. We use Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies and to communicate with our board of directors concerning our financial performance. We believe Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow are also helpful to investors, analysts and other interested parties because they can assist in providing a more consistent and comparable overview of our operations across our historical financial periods. Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow have limitations as analytical tools. Therefore, you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Because of these limitations, you should consider Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow alongside other financial performance measures, including net loss attributable to Compass, Inc., GAAP OPEX, operating cash flows and our other GAAP measures. In evaluating Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments reflected in this press release. Our presentation of Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow should not be construed to imply that our future results will be unaffected by the types of items excluded from these calculations of Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow. Adjusted EBITDA, non-GAAP OPEX and Free Cash Flow are not presented in accordance with GAAP and the use of these terms vary from others in our industry. Reconciliations of these non-GAAP measures have been provided in the financial statement tables included within this press release, and investors are encouraged to review these reconciliations.

About Compass

Compass is the largest residential real estate brokerage in the United States by transaction volume. Founded in 2012 and based in New York City, Compass provides an end-to-end platform that empowers its residential real estate agents to deliver exceptional service to seller and buyer clients. The platform includes an integrated suite of cloud-based software for customer relationship management, marketing, client service, brokerage services and other critical functionality, all custom-built for the real estate industry. Compass agents utilize the platform to grow their business, save time and manage their business more effectively. For more information on how Compass empowers real estate agents, one of the largest groups of small business owners in the country, please visit www.compass.com.

Investor Contact

Rich Simonelli

richard.simonelli@compass.com

Media Contact

Rory Golod

rory@compass.com

Compass, Inc.

Condensed Consolidated Balance Sheets

(In millions, unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 166.9 | | | $ | 361.9 | |

| Accounts receivable, net of allowance | 36.6 | | | 36.6 | |

| Compass Concierge receivables, net of allowance | 24.0 | | | 42.9 | |

| Other current assets | 54.5 | | | 76.5 | |

| Total current assets | 282.0 | | | 517.9 | |

| Property and equipment, net | 151.7 | | | 192.5 | |

| Operating lease right-of-use assets | 408.5 | | | 483.2 | |

| Intangible assets, net | 77.6 | | | 99.3 | |

| Goodwill | 209.8 | | | 198.4 | |

| Other non-current assets | 30.7 | | | 41.8 | |

| Total assets | $ | 1,160.3 | | | $ | 1,533.1 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 18.4 | | | $ | 28.1 | |

| Commissions payable | 59.6 | | | 48.0 | |

| Accrued expenses and other current liabilities | 90.8 | | | 164.9 | |

| Current lease liabilities | 98.9 | | | 94.6 | |

| Concierge credit facility | 24.8 | | | 31.9 | |

| Revolving credit facility | — | | | 150.0 | |

| Total current liabilities | 292.5 | | | 517.5 | |

| Non-current lease liabilities | 410.2 | | | 486.5 | |

| Other non-current liabilities | 25.6 | | | 8.4 | |

| Total liabilities | 728.3 | | | 1,012.4 | |

| Stockholders’ equity | | | |

| Common stock | — | | | — | |

| Additional paid-in capital | 2,946.5 | | | 2,713.6 | |

| Accumulated deficit | (2,517.8) | | | (2,196.5) | |

| Total Compass, Inc. stockholders' equity | 428.7 | | | 517.1 | |

| Non-controlling interest | 3.3 | | | 3.6 | |

| Total stockholders' equity | 432.0 | | | 520.7 | |

| Total liabilities and stockholders' equity | $ | 1,160.3 | | | $ | 1,533.1 | |

Compass, Inc.

Condensed Consolidated Statements of Operations

(In millions, except share and per share data, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 1,096.4 | | | $ | 1,107.2 | | | $ | 4,885.0 | | | $ | 6,018.0 | |

| Operating expenses: | | | | | | | |

| Commissions and other related expense (1) | 895.9 | | | 918.8 | | | 4,007.0 | | | 4,936.1 | |

| Sales and marketing (1) | 102.9 | | | 130.8 | | | 435.4 | | | 575.1 | |

| Operations and support (1) | 79.6 | | | 83.5 | | | 326.9 | | | 392.4 | |

| Research and development (1) | 44.4 | | | 63.4 | | | 184.5 | | | 360.3 | |

| General and administrative (1) | 32.4 | | | 41.1 | | | 125.7 | | | 208.1 | |

| Restructuring costs | 2.7 | | | 1.2 | | | 30.4 | | | 49.1 | |

| Depreciation and amortization | 21.5 | | | 21.2 | | | 90.0 | | | 86.3 | |

| Total operating expenses | 1,179.4 | | | 1,260.0 | | | 5,199.9 | | | 6,607.4 | |

| Loss from operations | (83.0) | | | (152.8) | | | (314.9) | | | (589.4) | |

| Investment income, net | 1.6 | | | 1.3 | | | 8.5 | | | 2.8 | |

| Interest expense | (1.6) | | | (1.3) | | | (10.8) | | | (3.6) | |

| Loss before income taxes and equity in loss of unconsolidated entity | (83.0) | | | (152.8) | | | (317.2) | | | (590.2) | |

| Income tax (expense) benefit | (0.1) | | | (0.5) | | | 0.4 | | | 0.9 | |

| Equity in loss of unconsolidated entity | (0.7) | | | (4.7) | | | (3.3) | | | (12.2) | |

| Net loss | (83.8) | | | (158.0) | | | (320.1) | | | (601.5) | |

| Net loss (income) attributable to non-controlling interests | 0.1 | | | (0.1) | | | (1.2) | | | — | |

| Net loss attributable to Compass, Inc. | $ | (83.7) | | | $ | (158.1) | | | $ | (321.3) | | | $ | (601.5) | |

| Net loss per share attributable to Compass, Inc., basic and diluted | $ | (0.17) | | | $ | (0.36) | | | $ | (0.69) | | | $ | (1.40) | |

| Weighted-average shares used in computing net loss per share attributable to Compass, Inc., basic and diluted | 483,710,540 | | | 436,568,882 | | | 466,522,935 | | | 428,169,180 | |

(1) Total stock-based compensation expense included in the condensed consolidated statements of operations is as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Commissions and other related expense | $ | — | | | $ | 22.9 | | | $ | 11.6 | | | $ | 59.0 | |

| Sales and marketing | 8.6 | | | 9.3 | | | 35.0 | | | 42.0 | |

| Operations and support | 4.5 | | | 3.3 | | | 16.1 | | | 15.6 | |

| Research and development | 11.3 | | | 12.3 | | | 45.7 | | | 57.5 | |

| General and administrative | 11.9 | | | 13.6 | | | 49.8 | | | 60.4 | |

| Total stock-based compensation expense | $ | 36.3 | | | $ | 61.4 | | | $ | 158.2 | | | $ | 234.5 | |

Compass, Inc.

Condensed Consolidated Statements of Cash Flows

(In millions, unaudited)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Operating Activities | | | |

| Net loss | $ | (320.1) | | | $ | (601.5) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 90.0 | | | 86.3 | |

| Stock-based compensation | 158.2 | | | 234.5 | |

| Equity in loss of unconsolidated entity | 3.3 | | | 12.2 | |

| Change in acquisition related contingent consideration | 2.6 | | | (2.2) | |

| Bad debt expense | 4.4 | | | 7.3 | |

| Amortization of debt issuance costs | 0.7 | | | 0.9 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (3.5) | | | 6.5 | |

| Compass Concierge receivables | 18.0 | | | (11.7) | |

| Other current assets | 21.4 | | | 17.6 | |

| Other non-current assets | 9.1 | | | 9.8 | |

| Operating lease right-of-use assets and operating lease liabilities | (1.2) | | | 5.8 | |

| Accounts payable | (9.8) | | | (4.8) | |

| Commissions payable | 11.6 | | | (15.9) | |

| Accrued expenses and other liabilities | (10.6) | | | (36.5) | |

| Net cash used in operating activities | (25.9) | | | (291.7) | |

| Investing Activities | | | |

| Investment in unconsolidated entity | (1.2) | | | (15.0) | |

| Capital expenditures | (11.2) | | | (70.1) | |

| Payments for acquisitions, net of cash acquired | 0.7 | | | (15.0) | |

| Net cash used in investing activities | (11.7) | | | (100.1) | |

| Financing Activities | | | |

| Proceeds from exercise of stock options | 4.5 | | | 9.0 | |

| Proceeds from issuance of common stock under the Employee Stock Purchase Plan | 2.5 | | | 2.3 | |

| Taxes paid related to net share settlement of equity awards | (23.5) | | | (23.5) | |

| Proceeds from drawdowns on Concierge credit facility | 55.4 | | | 59.0 | |

| Repayments of drawdowns on Concierge credit facility | (62.5) | | | (43.3) | |

| Proceeds from drawdowns on Revolving credit facility | 75.0 | | | 150.0 | |

| Repayments of drawdowns on Revolving credit facility | (225.0) | | | — | |

| Proceeds from issuance of common stock in connection with the Strategic Transaction | 32.3 | | | — | |

| Payments related to acquisitions, including contingent consideration | (14.6) | | | (17.5) | |

| Other | (1.5) | | | (0.6) | |

| Net cash (used in) provided by financing activities | (157.4) | | | 135.4 | |

| | | |

| Net decrease in cash and cash equivalents | (195.0) | | | (256.4) | |

| Cash and cash equivalents at beginning of period | 361.9 | | | 618.3 | |

| Cash and cash equivalents at end of period | $ | 166.9 | | | $ | 361.9 | |

Compass, Inc.

Reconciliation of Net Loss Attributable to Compass, Inc. to Adjusted EBITDA

(In millions, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss attributable to Compass, Inc. | $ | (83.7) | | | $ | (158.1) | | | $ | (321.3) | | | $ | (601.5) | |

| Adjusted to exclude the following: | | | | | | | |

| Depreciation and amortization | 21.5 | | | 21.2 | | | 90.0 | | | 86.3 | |

| Investment income, net | (1.6) | | | (1.3) | | | (8.5) | | | (2.8) | |

| Interest expense | 1.6 | | | 1.3 | | | 10.8 | | | 3.6 | |

| Stock-based compensation | 36.3 | | | 61.4 | | | 158.2 | | | 234.5 | |

| Income tax expense (benefit) | 0.1 | | | 0.5 | | | (0.4) | | | (0.9) | |

| Restructuring costs | 2.7 | | | 1.2 | | | 30.4 | | | 49.1 | |

Acquisition-related expenses(1) | (0.6) | | | (1.5) | | | 1.9 | | | 11.2 | |

Litigation charges(2) | — | | | — | | | — | | | 10.5 | |

| Adjusted EBITDA | $ | (23.7) | | | $ | (75.3) | | | $ | (38.9) | | | $ | (210.0) | |

(1) For the three months ended December 31, 2023 and 2022, acquisition-related expenses includes a $0.9 million loss and a $0.3 million gain, respectively, as a result of changes in the fair value of contingent consideration and gains of $1.5 million and $1.2 million, respectively, related to acquisition consideration treated as compensation expense over the underlying retention periods. For the years ended December 31, 2023 and 2022, acquisition-related expenses includes a $1.3 million loss and a $2.2 million gain, respectively, as a result of changes in the fair value of contingent consideration and expense of $0.6 million and $13.4 million, respectively, related to acquisition consideration treated as compensation expense over the underlying retention periods.

(2) Represents a charge of $10.5 million incurred during the year ended December 31, 2022 in connection with the Realogy Holdings Corp. matter.

Compass, Inc.

Reconciliation of Operating Cash Flow to Free Cash Flow

(In millions, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net cash used in operating activities | $ | (38.7) | | | $ | (117.8) | | | $ | (25.9) | | | $ | (291.7) | |

| Less: | | | | | | | |

| Capital expenditures | (2.3) | | | (13.2) | | | (11.2) | | | (70.1) | |

| Free cash flow | $ | (41.0) | | | $ | (131.0) | | | $ | (37.1) | | | $ | (361.8) | |

Compass, Inc.

Reconciliation of GAAP Operating Expenses to Non-GAAP Operating Expenses

(In millions, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP Commissions and other related expense | $ | 895.9 | | | $ | 918.8 | | | $ | 4,007.0 | | | $ | 4,936.1 | |

| Adjusted to exclude the following: | | | | | | | |

| Stock-based compensation | — | | | (22.9) | | | (11.6) | | | (59.0) | |

| Non-GAAP Commissions and other related expense | $ | 895.9 | | | $ | 895.9 | | | $ | 3,995.4 | | | $ | 4,877.1 | |

| | | | | | | |

| GAAP Sales and marketing | $ | 102.9 | | | $ | 130.8 | | | $ | 435.4 | | | $ | 575.1 | |

| Adjusted to exclude the following: | | | | | | | |

| Stock-based compensation | (8.6) | | | (9.3) | | | (35.0) | | | (42.0) | |

| Non-GAAP Sales and marketing | $ | 94.3 | | | $ | 121.5 | | | $ | 400.4 | | | $ | 533.1 | |

| | | | | | | |

| GAAP Operations and support | $ | 79.6 | | | $ | 83.5 | | | $ | 326.9 | | | $ | 392.4 | |

| Adjusted to exclude the following: | | | | | | | |

| Stock-based compensation | (4.5) | | | (3.3) | | | (16.1) | | | (15.6) | |

| Acquisition-related expenses | 0.6 | | | 1.5 | | | (1.9) | | | (11.2) | |

| Non-GAAP Operations and support | $ | 75.7 | | | $ | 81.7 | | | $ | 308.9 | | | $ | 365.6 | |

| | | | | | | |

| GAAP Research and development | $ | 44.4 | | | $ | 63.4 | | | $ | 184.5 | | | $ | 360.3 | |

| Adjusted to exclude the following: | | | | | | | |

| Stock-based compensation | (11.3) | | | (12.3) | | | (45.7) | | | (57.5) | |

| Non-GAAP Research and development | $ | 33.1 | | | $ | 51.1 | | | $ | 138.8 | | | $ | 302.8 | |

| | | | | | | |

| GAAP General and administrative | $ | 32.4 | | | $ | 41.1 | | | $ | 125.7 | | | $ | 208.1 | |

| Adjusted to exclude the following: | | | | | | | |

| Stock-based compensation | (11.9) | | | (13.6) | | | (49.8) | | | (60.4) | |

| Litigation charge | — | | | — | | | — | | | (10.5) | |

| Non-GAAP General and administrative | $ | 20.5 | | | $ | 27.5 | | | $ | 75.9 | | | $ | 137.2 | |

Compass, Inc.

Non-GAAP Operating Expenses Excluding Commissions and Other Related Expense

(In millions, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31,

2022 | | June 30,

2022 | | September 30,

2022 | | December 31,

2022 | | March 31,

2023 | | June 30,

2023 | | September 30,

2023 | | December 31,

2023 |

| Sales and marketing | $ | 134.3 | | | $ | 143.7 | | | $ | 133.6 | | | $ | 121.5 | | | $ | 106.7 | | | $ | 104.3 | | | $ | 95.1 | | | $ | 94.3 | |

| Operations and support | 96.5 | | | 97.8 | | | 89.6 | | | 81.7 | | | 75.0 | | | 79.8 | | | 78.4 | | | 75.7 | |

| Research and development | 91.3 | | | 88.3 | | | 72.1 | | | 51.1 | | | 38.5 | | | 32.8 | | | 34.4 | | | 33.1 | |

| General and administrative | 40.4 | | | 36.6 | | | 32.7 | | | 27.5 | | | 23.1 | | | 21.4 | | | 10.9 | | | 20.5 | |

| Total non-GAAP operating expenses excluding commissions and other related expense | $ | 362.5 | | | $ | 366.4 | | | $ | 328.0 | | | $ | 281.8 | | | $ | 243.3 | | | $ | 238.3 | | | $ | 218.8 | | | $ | 223.6 | |

Cover

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity Registrant Name |

Compass, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40291

|

| Entity Tax Identification Number |

30-0751604

|

| Entity Address, Address Line One |

110 Fifth Avenue, 4th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10011

|

| Local Phone Number |

913-9058

|

| City Area Code |

(212)

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.00001 par value per share

|

| Trading Symbol |

COMP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001563190

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

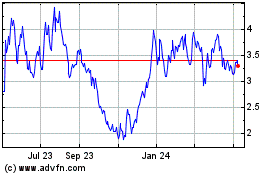

Compass (NYSE:COMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Compass (NYSE:COMP)

Historical Stock Chart

From Apr 2023 to Apr 2024