false

00000

0001530163

0001530163

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 23, 2024

SAMSARA LUGGAGE, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Nevada |

|

000-54649 |

|

26-0299456 |

| (State of incorporation) |

|

(Commission File Number) |

|

(IRS Employer No.) |

135 East 57th Street, Suite 18-130

New York, New York

(Address

of principal executive offices and Zip Code)

(877)

421-1574

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions: (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section

1 – Registrant’s Business and Operations

Item 1.01

Entry Into A Material Definitive Agreement.

On February 23, 2024, Samsara Luggage, Inc., a Nevada corporation

(the “Company”), entered into a Stock Purchase Agreement (the “SPA”) with Ilustrato Pictures International, Inc.,

a Nevada corporation (“ILUS”) which owns 71.1% of the Company. Simultaneous with the execution and delivery of the SPA, the

Company acquired all the equity interests in seven companies owned by ILUS –

| ● | Firebug

Mechanical Equipment LLC |

| ● | Georgia

Fire & Rescue Supply LLC |

| ● | Bright

Concept Detection and Protection System LLC |

| ● | AL

Shola Al Modea Safety and Security LLC, the only entity in which ILUS does not own 100% but

only 51% of the membership interests. |

The acquisition

by the Company of these shares and membership interests, referred to by ILUS as the Emergency Response Technologies “ERT.

The consideration for the sale of the equity interests in the foregoing

companies was paid by the Company by issuing to ILUS 350,000 restricted shares of Series B stock (the “Shares”) and further

milestone payment/s should applicable performance targets referenced in Exhibit B be achieved. As a result, ILUS currently owns 89.1%

of the Company’s voting rights.

Given

the related party nature of the transaction, neither party provided representations and warranties customary of a sale of operating companies.

The

foregoing description of the SPA is not complete and is qualified in its entirety by reference to the text of the SPA, which is filed

as Exhibit 10.18 hereto and which is incorporated herein by reference.

Section 2

– Financial Information

Item 2.01.

Completion of Acquisition or Disposition of Assets.

The

information contained in Item 1.01 above is incorporated herein by reference into this Item 2.01.

Section

3 – Securities and Trading Markets

Item 3.02 Unregistered Sales of Equity Securities.

On

February 27, 2024, the Company issued the Shares to ILUS in consideration for the sale and acquisition of all the equity interests in

each of the seven companies referenced above. The Shares were issued in a private placement that will rely upon an exemption from registration

provided by Section 4(a)(2) of the Securities Act of 1933, as amended, and/or Regulation D promulgated thereunder.

Cautionary

Note Regarding Forward-Looking Statements

This

filing includes “forward-looking statements.” All statements other than statements of historical facts included or incorporated

herein may constitute forward-looking statements. Actual results could vary significantly from those expressed or implied in such statements

and are subject to a number of risks and uncertainties. Although the Company believes that the expectations reflected in the forward-looking

statements are reasonable, the Company can give no assurance that such expectations will prove to be correct. The forward-looking statements

involve risks and uncertainties that affect the Company’s operations, financial performance, and other factors as discussed in

the Company’s filings with the Securities and Exchange Commission (“SEC”). Among the factors that could cause results

to differ materially are those risks discussed in the periodic reports the Company files with the SEC. You are urged to carefully review

and consider the cautionary statements and other disclosures made in those filings, specifically those under the heading “Risk

Factors.” The Company does not undertake any duty to update any forward-looking statement except as required by law.]

Section

9 – Financial Statements and Exhibits

Item 9.01

Financial Statements and Exhibits

(a)

Financial Statements of business Acquired

The Company will file the financial statements required by Item 9.01 (a) of Form 8-K by an

amendment to this Current Report on Form 8-K no later than 71 days from the date this Current Report on Form 8-K is required to be filed.

(b)

Pro Forma Financial Information

The

Company will file the financial statements required by Item 9.01 (a) of Form 8-K by an amendment to this Current Report on Form 8-K no

later than 71 days from the date this Current Report on Form 8-K is required to be filed.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Samsara

Luggage, Inc.

| /s/ John-Paul

Backwell | |

| John-Paul

Backwell, CEO | |

| Date: February

27, 2024 | |

Exhibit

10.18

STOCK

PURCHASE AGREEMENT

This

Stock Purchase Agreement (this “Agreement”) made this 23 day of February 2024, between Samsara Luggage, Inc., a Nevada

corporation (“Buyer”), and Ilustrato Pictures International, Inc., a Nevada corporation (“Seller”).

WITNESSETH:

WHEREAS,

Seller owns all the equity interests (collectively, the “Shares”) in the companies (the “Companies”)

listed on Exhibit A;

WHEREAS,

Buyer has agreed to purchase, and Seller has agreed to sell, the Shares.

NOW

THEREFORE, in consideration of the mutual promises, covenants and representations contained herein, the parties herewith agree as follows:

ARTICLE

I

SALE

OF SHARES

1.01 Sale. Subject to the terms and conditions

of this Agreement, simultaneous with the execution and delivery of this Agreement (the “Closing”), Seller shall sell,

assign, transfer, convey and deliver to Buyer, and Buyer shall purchase and acquire from Seller, good and marketable title to the Shares,

free and clear of all pledges, hypothecations, mortgages, liens, encumbrances, options, claims, equities and obligations to other persons

of every kind and character (collectively, “Liens”), except that the Shares will be “restricted securities”

as defined in the Securities Act of 1933, as amended (the “Securities Act”). Seller agrees to sell the Shares for an

aggregate purchase price of 350,000,000 shares of common stock of Buyer (the “Consideration Shares”) which will be

issued as 350,000 Series B Stock and further milestone payment/s should applicable performance targets referenced in Exhibit B be achieved.

1.02

Deliveries by Seller. At the Closing, Seller shall deliver to Buyer the following:

(a)

Certificates representing the Shares, duly endorsed by Seller, and all other documents, instruments and writings required or requested

by Buyer evidencing the transfer of the Shares to Buyer;

(b)

Board Resolutions of Seller authorizing the sale of the Shares as contemplated by this Agreement; and

(c)

All other documents, instruments and writings required by this Agreement to be delivered by Seller at the Closing, all of the books of

account and record of the Companies and any other documents or records relating to the businesses of the Companies.

1.03

Deliveries by Buyer. At the Closing, Buyer shall deliver to Seller the following:

(a)

Certificates representing the Consideration Shares, or an irrevocable instruction letter to the transfer agent of Buyer with respect

to the issuance of the Consideration Shares to Seller;

(b)

Board Resolutions of Buyer authorizing the issuance of the Consideration Shares as contemplated by this Agreement; and

(c)

All other documents, instruments and writings required by this Agreement to be delivered by Buyer at the Closing.

ARTICLE

II

REPRESENTATIONS

AND WARRANTIES OF SELLER

Seller

hereby represents and warrant to Buyer the following:

2.01

Organization. Seller is a Nevada corporation duly organized, validly existing, and in good standing under the laws of that state

and has full power and authority to own, lease and operate its properties and to carry on its business as now being and as heretofore

conducted.

2.02

The Shares. The Shares represent 100% of the equity interests in the Companies on a fully diluted basis, other than with respect

to Al Shola Al Modea Safety and Security LLC, in which the Shares represent a 51% owned by Seller. The Shares are fully paid and non-assessable,

free of any Liens, except for restrictions on transfer imposed by federal and state securities laws. There are no outstanding subscriptions,

pre-emptive rights, options, rights, warrants, convertible securities, or other agreements or commitments obligating Seller or any of

the Companies to issue or to transfer any additional shares of its capital stock. None of the outstanding shares of any of the Companies

are subject to any proxies, voting agreements, rights of first refusal or any other kind of stock restriction agreements. Seller is the

record and beneficial owner of the Shares, holds the Shares free and clear of any Liens and has the absolute right to sell and transfer

the Shares to Buyer as provided in this Agreement without the consent of any other person or entity. Upon transfer of the Shares to Buyer

hereunder, Buyer will acquire good and marketable title to the Shares free and clear of any Lien, other than applicable securities laws.

2.03

Ability to Carry Out Obligations. Seller is fully able, authorized and empowered to execute and deliver this Agreement and any

other agreement or instrument contemplated by this Agreement and to perform its covenants and agreements hereunder and thereunder. This

Agreement and any such other agreement or instrument, upon execution and delivery by the Seller (and assuming due execution and delivery

hereof and thereof by Buyer hereto and thereto), will constitute a valid and legally binding obligation of Seller, in each case enforceable

against it of them in accordance with its terms. The execution and delivery of this Agreement by Seller and the performance by Seller

of its obligations hereunder will not cause, constitute, or conflict with or result in (a) any breach or violation of any of the provisions

of, or constitute a default under any license, indenture, mortgage, charter, instrument, articles of incorporation, bylaws, or any other

agreement or instrument to which any of the Companies or Seller is a party, or by which they or their assets may be bound, nor will any

consents or authorizations of any party be required, (b) an event that would cause Seller or any of the Companies to be liable to any

party, (c) an event that would result in the creation or imposition of any Lien on any asset of the Companies or upon the Shares, or

(d) violate any law, statute, ordinance, regulation, judgment, order, injunction, decree or award of any court or governmental or quasi

governmental agency against, or binding upon Seller and/or any of the Companies or upon any of their respective properties or assets.

2.04

Compliance with Laws. Neither Seller nor any of the Companies are (i) in violation of any judgment, order, injunction, award or

decree which is binding on any of them or any of their assets, properties, operations or business which violation, by itself or in conjunction

with any other such violation, would materially and adversely affect the consummation of the transaction contemplated hereby; or (ii)

in violation of any law or regulation or any other requirement of any governmental body, court or arbitrator relating to him or it, or

to his or its assets, operations or businesses which violation, by itself or in conjunction with other violations of any other law, regulation

or other requirement, would materially adversely affect the consummation of the transaction contemplated hereby. Each of the Companies

has complied in all material respects, with, and is not in violation of any, federal, state, or local statute, law, and/or regulation

applicable to it. No consents of any third parties, including, but not limited to, governmental or other regulatory agencies, federal,

state or municipal, are required to be received by or on the part of any of the Companies or the Seller for the execution and delivery

of this Agreement and the performance of their respective obligations hereunder.

2.05

Transfer Restrictions. Seller acknowledges that the Consideration Shares being acquired pursuant to this Agreement may be sold,

pledged, assigned, hypothecated, or otherwise transferred (“Transfer”) only pursuant to an effective registration statement

under the Securities Act, or pursuant to an exemption from registration under the Securities Act.

2.06

Investment Intent. Seller is acquiring the Consideration Shares for its own account for investment, and not with a view toward

distribution thereof.

2.07

Restrictions on Transferability. (a) Buyer is aware of the restrictions of transferability of the Consideration Shares and further

understands the certificates shall bear the following legend.

THIS

SECURITY HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”),

IN RELIANCE UPON THE EXEMPTION FROM REGISTRATION PROVIDED IN SECTIONS 4(1) AND 4(2) AND REGULATION D UNDER THE ACT. AS SUCH, THE PURCHASE

OF THIS SECURITY WAS MADE WITH THE INTENT OF INVESTMENT AND NOT WITH A VIEW FOR DISTRIBUTION. THEREFORE, ANY SUBSEQUENT TRANSFER OF THIS

SECURITY OR ANY INTEREST THEREIN WILL BE UNLAWFUL UNLESS IT IS REGISTERED UNDER THE ACT OR UNLESS AN EXEMPTION FROM REGISTRATION IS AVAILABLE.

(b)

Buyer understands that the Consideration Shares may only be disposed of pursuant to either (i) an effective registration statement under

the Securities Act, or (ii) an exemption from the registration requirements of the Securities Act, and in the absence of such a registration

statement or exemption, Buyer may have to hold the Consideration Shares indefinitely.

ARTICLE

III

REPRESENTATIONS

AND WARRANTIES OF BUYER

Buyer

hereby represents and warrant to Seller the following:

3.01

Organization. Buyer is a Nevada corporation duly organized, validly existing, and in good standing under the laws of that state

and has full power and authority to own, lease and operate its properties and to carry on its business as now being and as heretofore

conducted.

3.02

The Consideration Shares. The Consideration Shares are fully paid and non-assessable, free of any Liens, except for restrictions

on transfer imposed by federal and state securities laws.

3.03

Ability to Carry Out Obligations. Buyer is fully able, authorized and empowered to execute and deliver this Agreement and any

other agreement or instrument contemplated by this Agreement and to perform its covenants and agreements hereunder and thereunder. This

Agreement and any such other agreement or instrument, upon execution and delivery by Buyer (and assuming due execution and delivery hereof

and thereof by Seller), will constitute a valid and legally binding obligation of Buyer, in each case enforceable against it of them

in accordance with its terms. The execution and delivery of this Agreement by Buyer and the performance by Buyer of its obligations hereunder

will not cause, constitute, or conflict with or result in (a) any breach or violation of any of the provisions of, or constitute a default

under any license, indenture, mortgage, charter, instrument, articles of incorporation, bylaws, or any other agreement or instrument

to which Buyer is a party, or by which its assets may be bound, nor will any consents or authorizations of any party be required, (b)

an event that would cause Buyer to be liable to any party, (c) an event that would result in the creation or imposition of any Lien on

any asset of Buyer or upon the Consideration Shares, or (d) violate any law, statute, ordinance, regulation, judgment, order, injunction,

decree or award of any court or governmental or quasi-governmental agency against, or binding upon Buyer or upon any of its properties

or assets.

3.04

Compliance with Laws. Buyer is not (i) in violation of any judgment, order, injunction, award or decree which is binding on it

or any of its assets, properties, operations or business which violation, by itself or in conjunction with any other such violation,

would materially and adversely affect the consummation of the transaction contemplated hereby; or (ii) in violation of any law or regulation

or any other requirement of any governmental body, court or arbitrator relating to him or it, or to his or its assets, operations or

businesses which violation, by itself or in conjunction with other violations of any other law, regulation or other requirement, would

materially adversely affect the consummation of the transaction contemplated hereby. No consents of any third parties, including, but

not limited to, governmental or other regulatory agencies, federal, state, or municipal, are required to be received by or on the part

of Buyer for the execution and delivery of this Agreement and the performance of its obligations hereunder.

ARTICLE

IV

INDEMNIFICATION

4.01

Claims Against the Companies and Seller.

(a)

The Companies and the Seller, jointly and severally, shall indemnify and hold Buyer harmless from and against any loss, damage, or expense

(including reasonable attorneys’ fees) suffered by Buyer and caused by or arising out of any claim made against any of the Companies:

(i)

for any foreign, federal, state or local tax of any kind arising out of or by reason of the existence or operations of a Company and/or

Seller prior to the Closing, including, without limitation, any payroll taxes owed by a Company on account of compensation paid to any

employee of the Company prior to such date;

(ii)

in respect of any salary, bonus, wages, or other compensation of any kind owed by a Company to its employees for services rendered on

or prior to the Closing;

(iii)

for any damages to the environment caused by or arising out of any pollution resulting from or otherwise attributable to the operation

of the business of a Company prior to the Closing;

(iv)

in respect of any payable of the Company incurred prior to the Closing;

(v)

in respect of any liability or indebtedness for borrowed money or otherwise incurred on or before the Closing, including, without limitation,

with respect to the execution and performance of this Agreement; and

(vi)

for expenses required to be borne by a Company and/or Seller under the provisions of this Agreement.

(b)

Other Matters. The Companies and Seller, jointly and severally, shall also indemnify and hold Buyer harmless from and against

any loss, damage or expense (including reasonable attorneys’ fees) suffered by Buyer and caused by or arising out of (i) any breach or

default in the performance by a Company or Seller of any covenant or agreement of a Company or Seller contained in this Agreement, (ii)

any breach of warranty or inaccurate or erroneous representation made by a Company or Seller herein or in any Exhibit, certificate or

other instrument delivered by or on behalf of a Company and the Seller pursuant hereto, and (iii) any and all actions, suits, proceedings,

claims, demands, judgments, costs and expenses (including reasonable legal and accounting fees) incident to any of the foregoing.

4.02

Claims Against the Buyer. The Buyer shall indemnify and hold harmless the Seller and the Companies from and against all loss,

damage or expense (including reasonable attorneys’ fees) suffered by the Seller or any of the Companies and caused by or arising out

of (i) any breach or default in the performance by Buyer of any covenant or agreement of Buyer contained in this Agreement, (ii) any

breach of warranty or inaccurate or erroneous representation made by Buyer herein or in any certificate or other instrument delivered

by or on behalf of the Buyer pursuant hereto and (iii) any and all actions, suits, proceedings, claims, demands, judgments, costs and

expenses (including reasonable legal and accounting fees) incident to the foregoing.

4.03

Indemnification Non-Exclusive. The foregoing indemnification provision is in addition to, and not derogation of any statutory,

equitable or common law remedy any party may have for breach of representation, warranty, covenant, or agreement.

ARTICLE

V

MISCELLANEOUS

5.01

Captions and Headings. The article and paragraph headings throughout this Agreement are for convenience and reference only, and

shall in no way be deemed to define, limit, or add to the meaning of any provision of this Agreement.

5.02

No Oral Change. This Agreement and any provision hereof, may not be waived, changed, modified, or discharged, orally, but only

by an agreement in writing signed by the party against whom enforcement of any waiver, change, modification, or discharge is sought.

5.03

Non-Waiver. Except as otherwise expressly provided herein, no waiver of any covenant, condition, or provision of this Agreement

shall be deemed to have been made unless expressly in writing and signed by the party against whom such waiver is charged; and (i) the

failure of any party to insist in any one or more cases upon the performance of any of the provisions, covenants, or conditions of this

Agreement or to exercise any option herein contained shall not be construed as a waiver or relinquishment for the future of any such

provisions, covenants, or conditions, (ii) the acceptance of performance of anything required by this Agreement to be performed with

knowledge of the breach or failure of a covenant, condition, or provision hereof shall not be deemed a waiver of such breach or failure,

and (iii) no waiver by any party of one breach by another party shall be construed as a waiver with respect to any other or subsequent

breach.

5.04

Entire Agreement. This Agreement, including any and all attachments hereto, if any, contain the entire Agreement and understanding

between the parties hereto, and supersede all prior agreements and understandings.

5.05

Partial Invalidity. In the event that any condition, covenant, or other provision of this Agreement is held to be invalid or void

by any court of competent jurisdiction, it shall be deemed severable from the remainder of this Agreement and shall in no way affect

any other condition, covenant, or other provision of this Agreement. If such condition, covenant, or other provision is held to be

invalid due to its scope or breadth, it is agreed that it shall be deemed to remain valid to the extent permitted by law.

5.06

Counterparts. This Agreement may be executed simultaneously in one or more counterparts, each of which shall be deemed an original,

but all of which together shall constitute one and the same instrument. Facsimile and other electronic signatures will be acceptable

to all parties.

5.07

Binding Effect. This Agreement shall inure to and be binding upon the successors and assigns of each of the parties to this Agreement.

5.08

Mutual Cooperation. The parties hereto shall cooperate with each other to achieve the purpose of this Agreement, and shall execute

such other and further documents and take such other and further actions as may be necessary or convenient to effect the transaction

described herein.

5.09

Governing Law. This Agreement shall be governed by and construed in accordance with the law of the State of Nevada applicable

to agreements made and to be performed therein without giving effect to conflicts of law principles.

[Remainder

of Page Intentionally Omitted; Signature Pages to Follow]

IN

WITNESS WHEREOF, the parties hereto have caused this Stock Purchase Agreement to be duly executed as of the day and year first above

written.

| |

BUYER: |

| |

|

|

SAMSARA LUGGAGE, INC. |

| |

|

|

|

| |

By: |

/s/ John-Paul Backwell |

| |

|

Name: |

John-Paul Backwell |

| |

|

Title: |

CEO |

| |

|

|

|

| |

SELLER: |

| |

|

| |

ILUSTRATO PICTURES INTERNATIONAL, INC. |

| |

|

|

|

| |

By: |

/s/ Nicolas Link |

| |

|

Name: |

Nicolas Link |

| |

|

Title: |

CEO |

Exhibit

A

| ● | Firebug

Mechanical Equipment LLC (Firebug Group –

U.A.E.) |

| ● | Georgia

Fire & Rescue Supply LLC (Georgia Fire) |

| ● | Bright

Concept Detection and Protection System LLC (BCD Fire) |

| ● | Bull

Head Products Inc (Bull Head) |

| ● | The

Vehicle Converters (TVC) |

| ● | AL

Shola Al Modea Safety and Security LLC (ASSS) |

Exhibit B

| Tranche |

|

Timeframe and Conditions |

|

Amount |

|

Paid By |

|

Paid To |

| 1 |

|

Paid on closing |

|

350,000,000 SAML Shares |

|

SAML |

|

ILUS |

| 2 |

|

Within 30

days of Year End 2024 Audited Financials *Based on Year End 2024 Forecast being met - Revenue target: $ 20,000,000 |

|

Cash payment of $5,000,000 or SAML Restricted Shares to the equivalent value |

|

SAML |

|

ILUS |

| 3 |

|

Within 30 days of Year End 2025 Audited Financials

*Based on Year End 2025 Forecast being met - Revenue target: $ 32,000,000 |

|

Cash payment of $5,000,000 or SAML Restricted Shares to the equivalent value |

|

SAML |

|

ILUS |

| * | Payments for Tranches 2 and 3 are paid in proportion to the

percentage of Revenue target achieved and capped at 100% of the Revenue target. |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

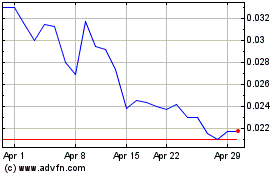

Samsara Luggage (PK) (USOTC:SAML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Samsara Luggage (PK) (USOTC:SAML)

Historical Stock Chart

From Apr 2023 to Apr 2024