Expedia (NASDAQ:EXPE) – Expedia revealed plans

on Monday to cut approximately 1,500 jobs globally, about 9% of its

workforce, as part of an “organizational and technological

transformation.” The decision follows a moderate revenue forecast

for 2024, with declining airfare prices. Expedia’s restructuring

will incur pre-tax charges and cash expenses between $80 million

and $100 million.

Alphabet (NASDAQ:GOOGL) and

Microsoft (NASDAQ:MSFT) – Google Cloud has

criticized Microsoft for cloud computing practices that they claim

seek a harmful monopoly to technological development. Microsoft’s

collaboration with OpenAI has heightened concerns. Microsoft

rejected the claims, citing healthy competition. Both companies

exchanged criticism over licensing agreements. Additionally, Google

plans to relaunch its AI tool for creating images of people soon,

after interruptions due to inaccuracies in historical

representations. Google DeepMind CEO, Demis Hassabis, announced

that the tool would be back in the coming weeks to correct the

detected flaws. Microsoft, in turn, has partnered with French

startup Mistral AI to make its artificial intelligence models

available on Azure, expanding its offerings beyond OpenAI. Mistral

develops large language models, with its latest, Mistral Large, now

accessible to Azure customers. The startup plans to expand to other

platforms soon.

Apple (NASDAQ:AAPL) – Apple is exploring new

wearable devices such as a fitness ring, smart glasses, and AirPods

with cameras. Rumors include a HomePod with a screen, Apple Sports

app, iMessage security update, and the departure of an AirPods

executive. Meanwhile, the Vision Pro faces acceptance

challenges.

Micron Technology (NASDAQ:MU) – Micron

Technology has begun mass production of its high-bandwidth memory

semiconductors (HBM) for Nvidia’s (NASDAQ:NVDA) latest artificial

intelligence chip. The HBM3E will consume 30% less energy and meet

the growing demand for AI.

Broadcom (NASDAQ:AVGO) – Broadcom is selling

its End-User Computing (EUC) unit for $4 billion to KKR (NYSE:KKR),

simplifying its portfolio after the $69 billion acquisition of

VMware. The EUC will operate as an independent entity under KKR’s

current management. In other news, Broadcom CEO Hock Tan’s annual

compensation exceeded $161.8 million last year, driven by a $160.5

million stock award vested over five years. His base salary

remained at $1.2 million, while his total compensation increased by

167%.

Amazon (NASDAQ:AMZN) – Amazon Web Services

Mexico, a branch of Amazon.com, unveiled an investment of over $5

billion to establish a data center cluster in Mexico, in response

to the growing demand for cloud services. The project, located in

Querétaro, will be implemented over 15 years. This investment comes

in a context of “nearshoring,” with companies transferring

operations from Asia to Mexico due to supply chain disruptions

caused by the pandemic.

Alibaba (NYSE:BABA) – Alibaba’s Daraz Group

announced layoffs to streamline and speed up the structure,

according to CEO James Dong. The exact number of layoffs was not

disclosed. Daraz faces financial challenges and seeks

sustainability, focusing on customer experience and product

diversification. Additionally, Alibaba leads a major funding round

for Chinese AI startup Moonshot AI, reflecting its return to

significant investments in pursuit of growth. Valued at about $2.5

billion, Moonshot AI seeks to compete with giants like OpenAI and

Google.

Kroger’s (NYSE:KR) and

Albertsons (NYSE:ACI) – The FTC and eight states

are suing to block the $24.6 billion deal between Kroger’s and

Albertsons, fearing an increase in food prices and negative impacts

on competition. Kroger defends the merger but faces criticism from

lawmakers and unions about potential market harm. The Biden

administration’s attempt to block the merger between Kroger and

Albertsons could significantly influence key states like Nevada and

Arizona, both affected by food inflation. Democrats see this as an

opportunity for electoral appeal, highlighting Americans’ concerns

about high prices.

Charter Communications (NASDAQ:CHTR) and

Altice USA (NYSE:ATUS) – Charter Communications is

considering acquiring Altice USA, a smaller cable provider. Altice

USA’s shares soared with the news, while Charter explores the

deal’s viability with financial advisors.

Vodafone (NASDAQ:VOD) – Vodafone is likely to

have a minority stake in a combined entity with Swisscom’s Fastweb

if a deal on a merger of their Italian operations is reached,

according to sources. The discussions aim to reduce Vodafone’s debt

and consolidate a declining telecom market in Italy.

Walt Disney (NYSE:DIS) – Blackwells Capital, a

Walt Disney shareholder, urges the company to adopt an artificial

intelligence strategy, envisioning up to a 129% increase in share

value. While Disney contests proposals, evidence shows its long

trajectory in technology, including investments in augmented

reality and partnerships to create immersive experiences.

Additionally, David Greenbaum has been appointed president of

Disney Live Action and 20th Century studios, succeeding Sean

Bailey. Disney seeks to recover box office performance, committing

to film quality. Greenbaum, former president of Searchlight

Pictures, brings his experience and creative sensitivity to the new

role.

Boeing (NYSE:BA) – A panel of experts examining

Boeing’s safety practices identified a “disconnect” between

leadership and employees regarding the safety culture, among other

concerns. The report follows fatal accidents involving the 737 MAX

and quality issues. Boeing promises to review the recommendations

and fired the head of the 737 Max program after a recent air

incident. Changes include new leaders and quality measures as the

company faces scrutiny and pressure to resolve manufacturing

issues.

BP Plc (NYSE:BP) – BP Plc is quietly resuming

investments in oil and gas, aiming to boost returns, but the lack

of clear communication is hurting share value, says activist

investor Bluebell Capital Partners. The company needs to clarify

its strategy to boost the market.

Chevron (NYSE:CVX) – Chevron warned that its

planned acquisition of Hess (NYSE:HES) might be

disrupted, as Exxon Mobil (NYSE:XOM) and China

National Offshore Oil Corporation claim the deal would trigger

their right to increase their stakes in a project in Guyana. The

companies are negotiating to resolve the deadlock.

UnitedHealth Group (NYSE:UNH) – A failure in a

UnitedHealth system that resulted in nationwide prescription fill

disruptions was caused by a ransomware attack by the group known as

“Blackcat,” also identified as “ALPHV” and “Noberus”.

Citigroup (NYSE:C) and JPMorgan

Chase (NYSE:JPM) – Citigroup appointed Viswas Raghavan as

the new head of banking, coming from JPMorgan, amid an

administrative restructuring. Raghavan will report directly to CEO

Jane Fraser. JPMorgan, in turn, announced Doug Petno and Filippo

Gori as co-directors of global banking.

Wells Fargo (NYSE:WFC) – Wells Fargo promoted

company veteran Erik Karanik to boost the growth of its independent

consulting business. Now head of independent solutions in the

wealth and investment management unit, he will work with CEO Barry

Sommers to strengthen the company’s multichannel model.

Berkshire Hathaway (NYSE:BRK.B) – Berkshire

Hathaway shares, led by Warren Buffett, fell on Monday due to

investor concerns following US government warnings about a lawsuit

against its energy company, PacifiCorp. Buffett tempered

expectations, mentioning the challenge of wildfires and limited

lucrative investment opportunities.

Coinbase Global (NASDAQ:COIN) – Coinbase

Global, a cryptocurrency brokerage, saw its shares rise 4.7% in

pre-market trading, following a 17% increase on Monday, driven by

Bitcoin’s recovery. Bitcoin, the leading digital asset, rose to

$56,600. Other crypto-related companies also saw gains, with

MicroStrategy (NASDAQ:MSTR) up 6.5% and

Marathon Digital (NASDAQ:MARA) advancing 8.6%.

Earnings

Hims & Hers (NYSE:HIMS) – The

consumer-focused health platform saw an 18.2% increase in

pre-market trading. Hims & Hers reported a profit of 1 cent per

share and revenue of $247 million in the fourth quarter, while

analysts surveyed by LSEG expected a loss of 2 cents per share and

revenue of $246 million. Additionally, the company provided an

outlook for current quarter revenue and adjusted EBITDA that

significantly exceeded analysts’ expectations.

Unity Software (NYSE:U) – Unity fell 17% in

pre-market trading after releasing a current quarter adjusted

EBITDA outlook significantly below analysts’ expectations. Unity

exceeded fourth-quarter revenue expectations but projected earnings

between $45 million and $50 million, well below the consensus

estimate of $113 million from analysts surveyed by FactSet.

Zoom Video (NASDAQ:ZM) – The videoconferencing

company’s shares rose 11.7% in pre-market trading after releasing a

fourth-quarter earnings report that exceeded expectations. Zoom

reported a profit of $1.42 per share, excluding items, with revenue

totaling $1.15 billion. Meanwhile, analysts surveyed by LSEG

expected a profit of $1.15 per share and revenues of $1.13 billion.

Additionally, the company announced a $1.5 billion share buyback

program.

CarGurus (NASDAQ:CARG) – The online car trading

platform experienced a 10% drop in pre-market trading due to its

weak projection for the current quarter. CarGurus informed

investors to expect earnings per share between 24 and 29 cents,

along with estimated revenues between $201 million and $221

million. This contrasted with analysts’ expectations surveyed by

LSEG, who anticipated earnings per share of 31 cents and revenues

of $236 million. This discrepancy was highlighted in a quarterly

report that exceeded Wall Street’s forecasts in both aspects.

STAAR Surgical (NASDAQ:STAA) – Shares of an

ophthalmic product company fell about 3.9% in pre-market trading

after releasing a fourth-quarter financial report that fell short

of expectations, along with a cautious projection. Staar reported a

profit of 16 cents per share, below analysts’ estimate of 17 cents

per share, according to FactSet. Moreover, the company estimated

its full-year revenue between $335 million and $340 million, while

analysts expected $349 million.

iRobot (NASDAQ:IRBT) – iRobot shares initially

rose 10% but fell 1.9% in pre-market trading. The company reported

a loss of $63.6 million ($2.28 per share) in the last quarter, with

revenue of $307.5 million. The revenue projection for 2024 is

between $825 million and $865 million. The cancellation of the

acquisition by Amazon and layoffs were announced.

Workday (NASDAQ:WDAY) – Workday’s adjusted

earnings exceeded analysts’ expectations surveyed by LSEG, formerly

known as Refinitiv, by 10 cents per share, reaching $1.57. On the

other hand, revenue was in line with the consensus estimate of

$1.92 billion. Additionally, Workday reaffirmed its fiscal year

2025 subscription revenue forecast. Shares are down -7.7% in

Tuesday’s pre-market trading.

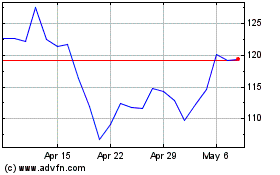

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024