Filed Pursuant to Rule 424(b)(5)

Registration File No. 333-265492

The information in this preliminary

prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are

part of an effective registration statement filed with the Securities and Exchange Commission. This preliminary prospectus supplement

and the accompanying prospectus are not an offer to sell these securities, and we are not soliciting an offer to buy these securities,

in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated February 26,

2024

Preliminary

Prospectus Supplement

(To Prospectus dated June 21, 2022)

Shares of Common Stock

Pre-Funded Warrants to Purchase Shares of

Common Stock

We are offering shares

of our common stock, par value, $0.001 per share, and pre-funded warrants to purchase (the “Pre-Funded Warrants”) to purchase

up to shares of common stock (and the shares of common stock issuable from time to time upon exercise of the Pre-Funded Warrants)

in this offering. The public offering price of each share of common stock is $ and

the public offering price of each Pre-Funded Warrant to purchase one share of common stock is $ .

We are offering the Pre-Funded Warrants to purchase

shares of common stock (and the shares of common stock issuable from time to time upon exercise of the Pre-Funded Warrants), in lieu of

shares of common stock, to investors whose purchase of shares of common stock in this offering would otherwise result in any such investor,

together with its affiliates, beneficially owning more than 4.99% (or, at the election of such investor, 9.99%) of our outstanding shares

of common stock immediately following the consummation of this offering, in lieu of shares of common stock that would otherwise result

in such investor’s beneficial ownership exceeding 4.99% (or, at the election of such investor, 9.99%) of our outstanding shares

of common stock. Each Pre-Funded Warrant will be exercisable for one share of common stock at an exercise price of $0.001 per share of

common stock, will be exercisable immediately and will expire when exercised in full. The offering price per Pre-Funded Warrant is equal

to the offering price per share of common stock, less $0.001. We are also offering the shares of common stock that are issuable from time

to time upon exercise of the Pre-Funded Warrants.

There is no established public trading market

for the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to list the Pre-Funded Warrants,

nor do we expect the Pre-Funded Warrants to be quoted, on the Nasdaq Capital Market (“Nasdaq”) or any other national securities

exchange or any other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants

will be limited.

Our common stock and our public warrants (the

“Public Warrants”) are listed on Nasdaq under the symbols “NRXP” and “NRXPW”, respectively. On February 23,

2024, the closing price of our common stock was $0.44 and the closing price of our Public Warrants was $0.1101.

As of the date of this prospectus supplement, the aggregate market value

of our common stock held by our non-affiliates, as calculated pursuant to the rules of the Securities and Exchange Commission (the

“SEC”), was $34,842,686, based upon 68,052,122 shares of our outstanding common stock held by non-affiliates at the per share

price of $0.512, the closing sale price of our common stock on Nasdaq on February 9, 2024. Pursuant to General Instruction I.B.6 of Form S-3,

in no event will we sell securities in a public offering with a value exceeding more than one-third of our “public float”

(i.e., the market value of our common stock held by our non-affiliates) in any 12-month period so long as our public float remains below

$75.0 million. We have offered $8,285,501 of securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar

months prior to and including the date of this prospectus supplement.

Investing in our securities involves a high

degree of risk. You should read this prospectus supplement and the accompanying prospectus carefully before you make your investment decision.

See “Risk Factors” beginning on page S-5 of this prospectus supplement, page 10 of the accompanying prospectus,

and the other documents we file or have filed with the SEC that are incorporated by reference in this prospectus supplement and in the

accompanying prospectus, for a discussion of the factors you should consider before investing in our securities.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary

is a criminal offense.

| |

|

Per Share |

|

Per Pre-

Funded

Warrant |

|

Total |

|

| Public offering price |

|

$ |

|

|

$ |

|

$ |

|

|

| Underwriting discounts and commissions(1) |

|

$ |

|

|

$ |

|

$ |

|

|

| Proceeds, before expenses, to us |

|

$ |

|

|

$ |

|

$ |

|

|

(1) Does

not include a non-accountable expense allowance of 1.0% of the gross proceeds of this offering or other expenses payable by the Company

to the underwriter in connection with this offering. In addition, we have agreed to issue the representative of the underwriters, or its

designees, warrants to purchase a number of shares of common stock equal to 5.0% of the aggregate number of shares of common stock sold

in this offering with an assumed exercise price of $ per share, or 110% of the public offering price per share (the “underwriter's

warrants”). See “Underwriting” on page S-10 for additional disclosure regarding underwriting dicsounts, commissions

and expenses.

We have granted the representative of the underwriters a 45-day option

to purchase up to additional shares of common stock and/or Pre-Funded Warrants from us at the same terms and conditions set forth

above.

We are a “smaller reporting company”

under the federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements and

scaled disclosures for this prospectus and future filings. See “Prospectus Supplement Summary—Implication of Being a Smaller

Reporting Company.”

Delivery of the shares of common stock and the

Pre-Funded Warrants offered pursuant to this prospectus supplement and accompanying prospectus is expected to be made on or about ,

2024, subject to satisfaction of customary closing conditions.

Sole Book-Running Manager

The date of this prospectus supplement is February ,

2024

TABLE OF CONTENTS

Prospectus

Supplement

PROSPECTUS

About

This Prospectus Supplement

This prospectus supplement relates to the offering

of our securities. Before buying the securities offered hereby, we urge you to read carefully this prospectus supplement, the accompanying

prospectus, and any free writing prospectus that we have authorized for use in connection with this offering, together with the information

incorporated by reference herein, as described under the heading “Incorporation of Certain Documents by Reference.” These

documents contain important information that you should consider when making your investment decision. This prospectus supplement contains

information about the securities offered hereby.

This document is in two parts. The first part

is this prospectus supplement, which describes the specific terms of the securities we are offering. The second part is the accompanying

prospectus, including the information incorporated by reference therein, which provides more general information, some of which may not

apply to this offering. This prospectus supplement and the information incorporated by reference in this prospectus supplement also may

add to, update and change information contained in, or incorporated by reference into, the accompanying prospectus. Generally, when we

refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between (i) the

information contained in this prospectus supplement and (ii) the information contained in the accompanying prospectus or in any information

incorporated by reference that was filed with the SEC before the date of this prospectus supplement, you should rely on the information

in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having

a later date, for example, information incorporated by reference in this prospectus supplement or the accompanying prospectus, the statement

in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to the registration statement to which the accompanying prospectus

forms a part or to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made

solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties

to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties

or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied

on as accurately representing the current state of our affairs.

The accompanying prospectus is part of a registration

statement that we filed with the SEC using a shelf registration process on Form S-3 (File No. 333-265492), which such registration

statement was originally filed on June 9, 2022, and declared effective by the SEC on June 21, 2022. Under the shelf registration

process, from time to time, we may offer and sell any of the securities described in the accompanying prospectus separately or together

with other securities described therein.

You should rely only on the information contained

in, or incorporated by reference into, this prospectus supplement, the accompanying prospectus, the information incorporated by reference

herein, and any related free writing prospectus that we authorized to be distributed to you. Neither we nor the underwriters have authorized

anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should

not rely on it. Neither we nor the underwriters is making an offer to sell the securities in any jurisdiction where the offer or sale is

not permitted, and you should not consider this prospectus supplement or the accompanying prospectus to be an offer or solicitation relating

to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. You should

assume that the information contained in this prospectus supplement, the accompanying prospectus, any related free writing prospectus

that we have authorized to be delivered to you and the information incorporated by reference herein and therein is accurate only as of

their respective dates, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus, and any related

free writing prospectus or of any sale of securities. Our business, financial condition, results of operations and prospects may have

changed since those dates. Furthermore, you should not consider this prospectus supplement or the accompanying prospectus to be an offer

or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful

for you to receive such an offer or solicitation.

Unless otherwise indicated, information contained

in this prospectus supplement and the accompanying prospectus or the information incorporated by reference herein or therein concerning

our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market

share, is based on information from our own management estimates and research, as well as from industry and general publications and

research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge

of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions

and estimates of our and our industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a

variety of factors, including those described in the section entitled “Risk Factors” in this prospectus supplement and the

accompanying prospectus, and in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on May 1, 2023, and in our

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, filed

with the SEC on May 15,

2023, August 14,

2023, and November 14,

2023, respectively, which are incorporated by reference into this prospectus supplement. These and other important factors could

cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking

Statements.”

This prospectus supplement, the accompanying

prospectus, and the information incorporated herein and therein by reference includes trademarks, service marks and trade names owned

by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement

or the accompanying prospectus are the property of their respective owners.

In this prospectus, the terms “NRx,”

“the Company,” “we,” “us” and “our” refer to NRx Pharmaceuticals, Inc.

We are offering to sell, and are seeking offers

to buy, the securities only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus supplement

and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside

the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about

and observe any restrictions relating to the offering of the securities and the distribution of this prospectus supplement and the accompanying

prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used

in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and

the accompanying prospectus to or by any person in any jurisdiction in which it is unlawful for such person to make such an offer or

solicitation.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the information

incorporated by reference herein include “forward-looking statements” within the meaning of the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of 1995, which may include, but are not limited to, statements regarding

our financial outlook, product development, business prospects, and market and industry trends and conditions, as well as our strategies,

plans, objectives, and goals. These forward-looking statements are based on current beliefs, expectations, estimates, forecasts, and

projections of, as well as assumptions made by, and information currently available to, our management. Words such as “expect,”

“anticipate,” “should,” “believe,” “hope,” “target,” “project,”

“goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,”

“could,” “would,” “seek,” “plan,” “intend,” “shall,” and variations

of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements.

These forward- looking statements are, by their

nature, subject to significant risks and uncertainties, many of which involve factors or circumstances that are beyond our control. These

risks and uncertainties include, but are not limited to, our relatively limited operating history; our ability to expand, retain and

motivate our employees and manage our growth; risks associated with general industry conditions and competition; general economic factors,

including interest rate and currency exchange rate fluctuations; the ongoing effects of the COVID-19 endemic; the impact of pharmaceutical

industry regulation and health care legislation in the United States and internationally; global trends toward health care cost containment;

technological advances, new products and patents attained by competitors; challenges inherent in new product development, including obtaining

regulatory approval; our ability to accurately predict future market conditions; our ability to regain and maintain compliance with Nasdaq’s

listing standards; maintain compliance with the terms of our indebtedness; manufacturing difficulties or delays; changes in laws, rules or

regulations relating to any aspect of our business operations, or general economic, market and business conditions; financial instability

of international economies and sovereign risk; dependence on the effectiveness of our patents and other protections for innovative products;

and the exposure to litigation, including patent litigation, and/or regulatory actions. Furthermore, there can be no guarantees with

respect to pipeline products that the products will receive the necessary regulatory approvals or that they will prove to be commercially

successful. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from

those set forth in the forward-looking statements. We assume no obligation and does not intend to update or otherwise revise any forward-looking

statement, whether as a result of new information, future events or otherwise, except as required by applicable law. As a result of these

and other risks, uncertainties and assumptions, forward-looking events and circumstances discussed herein might not occur in the way

that tour management expects, if at all. Accordingly, you should not place reliance on any forward-looking statement, and all forward-looking

statements are herein qualified by reference to the cautionary statements set forth above.

You also should carefully review the risk factors

and cautionary statements described in the other documents we file or furnish from time to time with the SEC, including our Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The

forward-looking statements included in this prospectus supplement, the accompanying prospectus and any other offering material, or in

the documents incorporated by reference into this prospectus supplement, the accompanying prospectus and any other offering material,

are made only as of the date of the prospectus supplement, the accompanying prospectus, any other offering material or the incorporated

document.

We do not assume any obligation to update any

forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

Prospectus

Supplement Summary

This summary does not contain all of the information

that you should consider before investing in our securities offered pursuant to this prospectus supplement and the accompanying prospectus.

Before making an investment decision, you should carefully read the entire prospectus supplement and the accompanying prospectus, including

the “Risk Factors” sections in this prospectus supplement and the accompanying prospectus and in the information incorporated

herein and therein by reference, as well as our financial statements, including the accompanying notes thereto, and the other information

incorporated by reference to this prospectus supplement and the accompanying prospectus, and the information in any related free writing

prospectus that we may authorize for use in connection with this offering of our securities.

Overview

NRx Pharmaceuticals

is a clinical-stage biopharmaceutical company developing therapeutics based on its NMDA platform for the treatment of central nervous

system disorders, specifically suicidal bipolar depression, chronic pain and PTSD. The Company is developing NRX-101, an FDA-designated

investigational Breakthrough Therapy for suicidal treatment-resistant bipolar depression and chronic pain. NRx has partnered with Alvogen

and Lotus around the development and marketing of NRX-101 for the treatment of suicidal bipolar depression. NRX-101 additionally has

potential to act as a non-opioid treatment for chronic pain, as well as a treatment for complicated UTI.

Our patent

estate contains broad disclosure of the synergistic combination of NMDA and 5-HT2A antagonist drugs in the treatment of mental health

disorders and chronic pain. Our foundation product, NRX-101 (D-cycloserine/lurasidone), is being studied initially for the treatment

of bipolar depression in patients with suicidality, has been awarded Fast Track designation, Breakthrough Therapy designation, a Special

Protocol Agreement (SPA), and a Biomarker Letter of Support by the U.S. Food and Drug Administration. To our knowledge, NRX-101 is the

only oral antidepressant demonstrated to reduce suicidal ideation in a phase 2 trial. NRX-101 is covered by four families of U.S. and

foreign patents, including a composition of matter patent (U.S. Patent No. 10,583,138 and foreign counterparts).

Nasdaq

Compliance

Minimum

Bid Price Requirement

On April 18,

2023, we received a written notification from the Listing Qualifications Staff (the “Staff”) of the Nasdaq Stock Market indicating

that we were not in compliance with Nasdaq Listing Rule 5450(a)(1), as closing bid price for our common stock was below $1.00 per

share for the last 30 consecutive business days. We were provided with an initial compliance period of 180 calendar days to regain compliance

with the Nasdaq Listing Rule 5450(a)(1), which expired on October 16, 2023. On October 17, 2023, we received a notice

from the Staff indicating that based upon our non-compliance with Nasdaq Listing Rule 5450(a)(1), our securities were subject to

delisting unless we timely requested a hearing before the Nasdaq Hearings Panel (the “Panel”). We timely requested a hearing

before the Panel, which was held on January 4, 2024.

On January 16,

2024, the Panel granted our request for an exception to the Nasdaq Listing Rules until April 16, 2024, to demonstrate compliance

with the Minimum Bid Price Requirement. Such exception is subject to the following conditions: (1) our filing of all necessary documentation

required to transfer our listing from the Nasdaq Global Market to the Nasdaq on or before January 19, 2024; and (2) our demonstrating

compliance with Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”) on or before April 16,

2024. On February 1, 2024, the Nasdaq Stock Market informed us that it had approved our application to transfer our listing. Our

securities were transferred to Nasdaq at the opening of business on January 19, 2024.

Market

Value of Listed Securities Requirement

On July 20,

2023, we received a written notification from the Staff of the Nasdaq Stock Market indicating that we were not in compliance with Nasdaq

Listing Rule 5450(b)(2)(A), as we had not maintained a minimum market value of listed securities (“MVLS”) of $50,000,000

for the last 33 consecutive business days.

We were

provided with an initial compliance period of 180 calendar days, or until January 22, 2024, to regain compliance with the MVLS requirement.

To regain compliance, our MVLS was required to meet or exceed $50,000,000 for a minimum period of ten consecutive business days prior

to January 22, 2024. As explained above, on February 1, 2024, the Nasdaq Stock Market informed us that it had approved our

application to transfer our listing. Our securities were transferred to Nasdaq at the opening of business on January 19, 2024.

Recent Developments

Alvogen Partnership

On February 7, 2024, the Company entered into

the First Amendment (the “Amendment”) to the Exclusive, Global - Development, Supply, Marketing & License Agreement (as

amended, the “License Agreement”), effective as of the same date. Pursant to the term of the Amendment, the Company will receive

$5 million of the first milestone, which NRx will use to fund development of NRX-101 through the phase 2 meeting with Food and Drug Administration

(“FDA”). As compensation for advancing the milestone, Alvogen, Inc. (“Alvogen”) and Lotus Pharmaceutical Co. Ltd.

will receive warrants to purchase up to an aggregate of 4,195,978 shares of the Company's common stock, at a strike price of $0.40 with

a three year term. The second portion of the milestone will be $4 million and, as before, be triggered by a positive response to the Company's

planned end of phase 2 meeting with FDA.

Pursuant to the License Agreement, we remain

eligible to receive up to $320,000,000 in future development and sales milestones, as well as royalty payment escalating to mid-teen

percentages on Net Sales (as defined in the License Agreement), subject to the achievement of certain sales volumes. Additionally, Alvogen

will be responsible for future development and commercialization costs for NRX-101 in Suicidal Bipolar Depression.

Amendment to Convertible Promissory Note

On February 9, 2024, the Company entered into

Amendment #3 to Convertible Promissory Note (the “Third Amendment”), with Streeterville Capital, LLC (“Streeterville”

or the “Lender”). Pursuant to the Third Amendment, the Company and Streeterville agreed to further amend the terms of that

certain Convertible Promissory Note dated November 4, 2022, in the original principal amount of $11,020,000, as amended by the amendments

to the Convertible Promissory Note dated March 30, 2023 and July 7, 2023 (as amended, the “Note”). In accordance with the

Third Amendment, the Company and Streeterville agreed to amend the redemption provisions of the Note. In particular, the Company agreed

to pay Streeterville an amount in cash equal to $1,100,000 on February 12, 2024. In addition, beginning on or before February 29, 2024,

on or before the last day of each month until July 31, 2024, the Company shall pay Streeterville an amount equal to $400,000 in cash,

less any amount satisfied by the delivery of Redemption Conversion Shares (as defined in the Note).

Launch of HOPE Therapeutics, Inc.

On February 26, 2024, the Company launched HOPE

Therapeutics, Inc. (“HOPE Therapeutics”), a subsidiary of the Company, at the BIO CEO & Investor Conference 2024. The

Company’s management is proposing to award 50% of founding shares in HOPE Therapeutics to current shareholders together with a royalty

coupon with an expected ex-dividend date in the near future, all subject to board approval. The dividend is expected to be available to

all shareholders who sign a covenant not to engage in short sales of the Company’s stock, subject to board approval. HOPE Therapeutics

anticipates having manufactured ketamine supplies for shipment under 503a pharmacy regulations by July 1, 2024.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company”

as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations,

including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company

until the last day of the fiscal year in which (i) the market value of our common stock held by non-affiliates exceeds $250 million

as of the prior June 30, or (ii) our annual revenue exceeded $100 million during such completed fiscal year and the market

value of our common stock held by non-affiliates exceeds $700 million as of the prior June 30.

Corporate Information

We were incorporated under the laws of the State

of Delaware on September 18, 2017 under the name Big Rock Partners Acquisition Corp. Upon the closing of the business combination

with NeuroRx, Inc. on May 24, 2021, we changed our name to NRx Pharmaceuticals, Inc. Our principal executive offices are

located at 1201 Orange Street, Suite 600, Wilmington, Delaware 19801, our mailing address is 1201 North Market Street, Suite 111,

Wilmington, DE 19801 and our telephone number is (484) 254-6134. Our website address is www.nrxpharma.com. The information contained

in, or accessible through, our website does not constitute a part of this prospectus supplement or the accompanying prospectus. We have

included our website address in this prospectus supplement solely as an inactive textual reference.

The

Offering

| Issuer |

NRx Pharmaceuticals, Inc. |

| |

|

| Common stock offered by us |

shares of our common stock. |

| |

|

|

Pre-Funded Warrants offered by us

|

Pre-Funded Warrants to

purchase up

to shares

of common stock to certain investors whose purchase of shares of common stock in this offering would otherwise result in any such

investor, together with such investor’s affiliates and certain related parties, beneficially owning more than 4.99% (or, at

the election of an investor, 9.99%) of our outstanding shares of common stock immediately following the consummation of this

offering. The purchase price of each Pre-Funded Warrant is equal to the price per share at which the shares of common stock are

being sold in this offering, minus $0.001. The exercise price of each Pre-Funded Warrant will equal $0.001 per share. Each

Pre-Funded Warrant will be exercisable upon issuance and will expire when exercised in full. This prospectus supplement and the

accompanying prospectus also relate to the offering of the shares of common stock issuable upon exercise of the Pre-Funded Warrants.

See “Description of Securities Offered” on page S-14 of this prospectus supplement. |

| |

|

| Public offering price |

$ per share of common stock and $ per Pre-Funded Warrant to purchase one share of common stock. |

| |

|

| Shares of common stock to be outstanding after this offering(1) |

shares ( shares if the representative of the underwriters exercises its option in full to purchase up to additional shares of common stock and/or Pre-Funded Warrants in full and assuming full exercise of any Pre-Funded Warrants issued in this offering). |

| |

|

| Underwriters’ option to purchase additional shares of common stock and/or Pre-Funded Warrants |

The representative of the underwriters has an

option, exercisable for 45 days after the date of this prospectus supplement, to purchase up to an additional shares of common stock and/or

Pre-Funded Warrants from us at the public offering prices, less underwriting discounts and commissions.

|

| |

|

| Lock-up agreements |

We and our executive officers and directors have agreed, that subject to certain exceptions, we and our directors and officers will not, until 90 days after the closing of this offering, offer, pledge, sell, contract to sell, grant, lend, or otherwise transfer or dispose of, directly or indirectly of any of our shares of common stock. |

| |

|

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and general corporate purposes. We may also use the proceeds from this offering to repay the Note issued to Streeterville. The Note bears interest at a rate of 9% per annum and matures in August 2024. See “Use of Proceeds” on page S-8. |

| |

|

| Risk factors |

An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement and other information included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| |

|

| Nasdaq Capital Market symbol |

Our common stock is traded on Nasdaq under the symbol “NRXP.” There is no established public trading market for the Pre-Funded Warrants and we do not expect a market to develop. We do not intend to apply to list the Pre-Funded Warrants on any national securities exchange or other nationally recognized trading system. Without an active market, the liquidity of the Pre-Funded Warrants will be limited. |

| |

|

(1) The number of shares of our

common stock outstanding after this offering is based on 86,675,580 shares of common stock outstanding as of February 26, 2024 and

excludes:

| |

· |

3,450,000 shares of common

stock issuable upon the exercise of the Public Warrants, at an exercise price of $11.50 per share; |

| |

· |

2,746,961 shares of common stock reserved for future issuance pursuant to outstanding option awards,

with a weighted average exercise price of $2.48 per share; |

| |

· |

2,312,462 shares of common stock available for grants under the NRx 2021 Omnibus Incentive

Plan (the “2021 Plan”); |

| |

· |

up to 45,000,000 shares

of common stock issuable upon conversion of the Note; |

| |

· |

3,000,000 shares of common stock issuable upon the conversion of 3,000,000 shares of Series A Convertible Preferred Stock

(the “Series A Preferred Stock”) at a conversion price of $0.40 per share; |

| |

|

|

| |

· |

3,000,000 shares of common stock issuable upon the exercise of warrants issued to certain investors pursuant to a securities

purchase agreement dated as of August 28, 2023 (the “August 2023 Purchase Agreement”), at an exercise price

of $0.40 per share; and |

| |

· |

4,195,978 shares of common stock issuable upon the exercise of the

Alvogen Warrants issued to Alvogen, at an exercise price of $0.40 per share. |

Except as otherwise indicated, all information

in this prospectus supplement assumes no exercise of the underwriters’ option to purchase up to

additional shares of common

stock and/or Pre-Funded Warrants, no exercise of the underwriter’s warrants, no sale of any Pre-Funded Warrants in this offering,

and no exercise or settlement of outstanding options, warrants or conversion of securities convertible into shares of common stock.

RISK FACTORS

An investment in our securities involves a high degree of risk.

Prior to making a decision about investing in our securities, you should consider carefully the specific risk factors discussed in the

sections entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K for

the year ended December 31, 2022, as filed with the SEC on March 31,

2023, as amended on May 1,

2023, and May 26,

2023, which are incorporated into this prospectus supplement and the accompanying prospectus by reference in their entirety, as updated

or superseded by the risks and uncertainties described under similar headings in our Quarterly Reports on Form 10-Q, our Current

Reports on Form 8-K, and the other documents that are filed after the date hereof and incorporated by reference into this prospectus

supplement and the accompanying prospectus, together with other information in this prospectus supplement and the accompanying prospectus

and any free writing prospectus that we may authorize for use in connection with this offering. These risks and uncertainties are not

the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently view as

immaterial, may also impair our business. Past financial performance may not be a reliable indicator of future performance, and historical

trends should not be unduly relied upon to anticipate results or trends in future periods. If any of the risks or uncertainties described

in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations

and cash flow could be materially and adversely affected. In that case, the trading price of our common stock could decline and you might

lose all or part of your investment. Please also read carefully the section above titled “Cautionary Note Regarding Forward-Looking

Statements.”

Risks Related to our Common Stock and this Offering

If we fail to meet the applicable continued

listing requirements of Nasdaq, our common stock may be delisted, in which case the liquidity and market price of our common stock could

decline.

Our common stock is currently listed on Nasdaq.

In order to maintain that listing, we must satisfy certain continued listing requirements. In the past, we have received deficiency letters

from Nasdaq for failing to maintain compliance with such listing requirements. For example, on July 20, 2023, we received a written

notification from the Staff indicating that we were not in compliance with Nasdaq Listing Rule 5450(b)(2)(A) because we had

not maintained a minimum MVLS of $50,000,000 for the previous 33 consecutive business days. We were provided an initial compliance period

of 180 calendar days, or until January 22, 2024, to regain compliance with the minimum MVLS requirement. Additionally, on April 18,

2023, we received a written notification from the Staff indicating we were not in compliance with

Nasdaq Listing Rule 5450(a)(1), and were provided an initial compliance period of 180 calendar days, or until October 16, 2023,

to regain compliance. On October 17, 2023, we received a written notification from the Staff indicating that based upon our non-compliance

with Nasdaq Listing Rule 5450(a)(1), our securities were subject to delisting unless we timely requested a hearing before

the Panel, which such hearing was timely requested and subsequently held on January 4, 2024. On January 16, 2024, the Panel

granted our request for an exception to the Nasdaq Listing Rules until April 16, 2024, to demonstrate compliance with the Minimum

Bid Price Requirement, subject to our filing all necessary documentation required to transfer our listing from the Nasdaq Global Market

to Nasdaq on or before January 19, 2024, and our demonstrating compliance with the Minimum Bid Price Requirement on or before April 16,

2024. On February 1, 2024, the Nasdaq Stock Market informed us that it had approved our application to transfer our listing to Nasdaq.

Our securities were transferred from the Nasdaq Global Market to Nasdaq at the opening of business on January 19, 2024.

If our common stock is delisted, an active trading

market for our common stock may not be sustained and the market price of our common stock could decline. Delisting of our common stock

could adversely affect our ability to raise additional capital through the public or private sale of equity securities, would significantly

affect the ability of investors to trade our securities and would negatively affect the value and liquidity of our common stock. Delisting

could also have other negative results, including the potential loss of confidence by employees, the loss of institutional investor interest

and fewer business development opportunities.

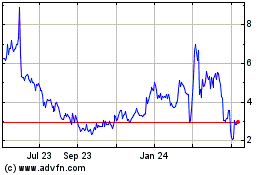

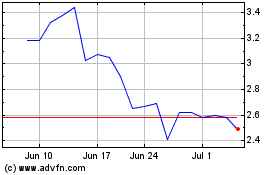

Fluctuations in the price of our common

stock, including as a result of actual or anticipated sales of shares by us and/or our directors, officers or stockholders, may make

our common stock more difficult to resell.

The market price and trading volume of our common

stock have been, and may continue to be, subject to significant fluctuations due not only to general stock market conditions, but also

to changes in sentiment in the market regarding the industry in which we operate, our operations, business prospects or liquidity, or

this offering. In addition to the risk factors discussed in our periodic reports and in this prospectus supplement, the price and volume

volatility of our common stock may be affected by actual or anticipated sales of common stock by us and/or our directors, officers or

stockholders, whether in the market, in connection with business acquisitions, in this offering or in subsequent public offerings. Stock

markets in general have at times experienced extreme volatility unrelated to the operating performance of particular companies. These

broad market fluctuations may adversely affect the trading price of our common stock, regardless of our operating results.

As a result, these fluctuations in the market

price and trading volume of our common stock may make it difficult to predict the market price of our common stock in the future, cause

the value of your investment to decline and make it more difficult to resell our common stock.

Management will have broad discretion as

to the use of the net proceeds of this offering, and we may use the net proceeds in ways in which you and other stockholders may disagree.

We currently intend to use the net proceeds of

this offering as described in the section entitled “Use of Proceeds” on page S-8. However, our management will have

broad discretion over the use and investment of the net proceeds from this offering, and, accordingly, investors in this offering will

need to rely upon the judgment of our management with respect to the use of proceeds, with only limited information concerning our specific

intentions Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds.

Investors in this offering will experience

immediate and substantial dilution in the net tangible book value per share of our common stock.

The public offering price of our common

stock will be substantially higher than the net tangible book value per share. Therefore, if you purchase shares of common stock in

this offering, you will pay a price per share that substantially exceeds our net tangible book value per share after this offering.

If you purchase shares of common stock in this offering, you will suffer immediate and substantial dilution of

$ per share, representing the difference between the public

offering price of $ per share in this offering and our as

adjusted net tangible book value per share as of September 30, 2023, after giving effect to this offering, and after

underwriting discounts and commissions and estimated offering expenses payable by us. Please refer to the section below entitled

“Dilution” for more information.

You may experience future dilution as a result of future equity

offerings or acquisitions.

In order to raise additional capital, we may

in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at

prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any future offering

at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other

securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares

of our common stock, or securities convertible or exchangeable into our common stock, in future transactions or acquisitions may be higher

or lower than the price per share paid by investors in this offering.

In addition, we may engage in one or more potential

acquisitions in the future, which could involve issuing our common stock as some or all of the consideration payable by us to complete

such acquisitions. If we issue common stock or securities linked to our common stock, the newly issued securities may have a dilutive

effect on the interests of the holders of our common stock. Additionally, future sales of newly issued shares used to effect an acquisition

could depress the market price of our common stock.

The Pre-Funded Warrants are speculative

in nature and may never have any value.

Commencing on the date of issuance, holders of

Pre-Funded Warrants may exercise their rights to acquire our common stock and pay an exercise price per share equal to $0.001 per share,

subject to certain adjustments, without expiration. Following this offering, the market value of the Pre-Funded Warrants, if any, is uncertain

and there can be no assurance that the market price of our common stock will ever equal or exceed their imputed offering price.

There is no public market for the Pre-Funded

Warrants being offered in this offering.

There is no established public trading market

for the Pre-Funded Warrants to purchase shares of our common stock being offered in this offering, and we do not expect a market to develop.

In addition, we do not intend to apply to list the Warrants on any national securities exchange or other nationally recognized trading

system. Without an active market, the liquidity of the Pre-Funded Warrants will be limited.

Holders of Pre-Funded Warrants will have

no rights as a common stockholder until such holders exercise their Pre-Funded Warrants and acquire our common stock.

Until holders of Pre-Funded Warrants acquire shares

of our common stock upon exercise of such warrants, holders of the Warrants will have no rights with respect to the shares of our common

stock underlying such Pre-Funded Warrants. Upon exercise of the Pre-Funded Warrants, the holders will be entitled to exercise the rights

of a common stockholder only as to matters for which the record date occurs after the exercise date.

We do not anticipate paying cash dividends

and, accordingly, stockholders must rely on share appreciation for any return on their investment.

We currently intend to retain our future earnings,

if any, to fund the development and growth of our businesses and do not anticipate that we will declare or pay any cash dividends on

our capital stock in the foreseeable future. See the section titled “Dividend Policy” in this prospectus supplement. In addition,

our ability to pay dividends is limited by covenants of our existing and outstanding indebtedness and may be limited by covenants of

any future indebtedness we incur. As a result, capital appreciation, if any, of our common stock will be your sole source of gain on

your investment for the foreseeable future. Investors seeking cash dividends should not invest in our common stock.

Our

common stock may become the target of a “short squeeze”.

In recent years, the securities of several companies

have increasingly experienced significant and extreme volatility in stock price due to short sellers of common stock and buy-and-hold

decisions of longer investors, resulting in what is sometimes described as a “short squeeze.” Short squeezes have caused

extreme volatility in those companies and in the market and have led to the price per share of those companies to trade at a significantly

inflated rate that is disconnected from the underlying value of the company. Sharp rises in a company’s stock price may force traders

in a short position to buy the shares to avoid even greater losses. Many investors who have purchased shares in those companies at an

inflated rate face the risk of losing a significant portion of their original investment as the price per share has declined steadily

as interest in those shares have abated. We may be a target of a short squeeze, and investors may lose a significant portion or all of

their investment if they purchase our shares at a rate that is significantly disconnected from our underlying value.

We are subject to certain contractual obligations

and limitations on our ability to consummate future financings under the Promissory Note issued by us to Streeterville on November 4,

2022, as amended in March 2023, July 2023, and February 2024.

Pursuant to the securities purchase agreement

we entered into in connection with the issuance of the Note to Streeterville, we are subject to certain restrictions on our ability to

issue securities during the term of the Note. Specifically, we agreed to obtain the Lender’s consent prior to issuing any debt

securities or certain equity securities where the pricing of such equity securities is tied to the public trading price of our common

stock. Furthermore, we also must offer the Lender the right to purchase up to 10% of future equity and debt securities offerings, subject

to certain exceptions and limitations, during the term of the Note.

Further, we have agreed to make certain monthly

redemption payments at the request of the Lender. Our failure to pay such redemptions, when due, may result in defaults under our agreements

with the Lender. If we are in default with respect to our obligations under the Note, the Lender may consider the Note immediately due

and payable and may elect to substantially increase the interest rate of the Note. We may not have the required funds to pay the required

note redemptions and such redemptions, or penalties in connection therewith, may have an adverse effect on our cash flows, results of

operations, and ability to pay our other debts as they come due.

Use

of Proceeds

We estimate that the net proceeds from this offering

will be approximately $ (or approximately $ million if the

underwriters exercise in full their option to purchase additional shares of common stock and/or Pre-Funded Warrants), based on a public

offering price of $ per share or $ per Pre-Funded Warrant, and after deducting

underwriting discounts and commissions and estimated offering expenses payable by us.

We expect to use any proceeds that we receive

from this offering for working capital and general corporate purposes. We may also use the proceeds from this offering to repay the Note

issued to Streeterville. The Note bears interest at a rate of 9% per annum and matures in August 2024. Accordingly, we retain broad

discretion over the use of the net proceeds from this offering. The precise amount and timing of the application of such proceeds will

depend upon our liquidity needs and the availability and cost of other capital over which we have little or no control. As of the date

of this prospectus supplement, we cannot specify with certainty all of the particular uses, and the respective amounts we may allocate

to those uses, for the net proceeds we receive.

DIVIDEND POLICY

We have never declared or paid any cash dividends

on our capital stock. We currently intend to retain all available funds and future earnings, if any, for the operation and expansion

of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to

our dividend policy will be made at the discretion of our board of directors (the “Board”) after considering our financial

condition, results of operations, capital requirements, business prospects and other factors the Board deems relevant, and subject to

the restrictions contained in any financing instruments. Our ability to declare dividends may also be limited by restrictive covenants

pursuant to any other future debt financing agreements.

Dilution

If you invest in our securities, you will experience

immediate dilution to the extent of the difference between the public offering price per share of common stock that you pay in this offering

and the as adjusted net tangible book value per share after this offering (excluding the shares of common stock issuable upon exercise

of the Pre-Funded Warrants). The net tangible book value of our common stock as of September 30, 2023, was approximately $(6,217,449),

or $(0.09) per share. Net tangible book value per share of our common stock is equal to total assets minus intangible assets, goodwill,

and equity investments, less total liabilities, dividend by the total number of shares of common stock issued and outstanding as of September 30,

2023.

After giving effect to the issuance and sale of shares

of common stock offered hereby at a public offering price of $ per share and Pre-Funded Warrants to purchase

up to shares of common stock at a public offering price of $ per Pre-Funded Warrant, and after deducting underwriting discounts

and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2023,

would have been approximately $ million, or $ per

share. The change represents an immediate increase in the net tangible book value per share of our common stock of $ per

share to existing stockholders and an immediate dilution of $ per share to new investors purchasing common

stock in this offering.

If holders of Pre-Funded Warrants exercise the

Pre-Funded Warrants in full, the as adjusted net tangible book value per share of common stock after giving effect to this offering (but

not the exercise of the underwriters’ option to purchase additional shares and/or Pre-Funded Warrants) would be $ per share, and

the dilution in net tangible book value per share to investors purchasing common stock in this offering would be $ per share.

The following table illustrates this per share

dilution, assuming the the underwriters do not exercise their option to purchase additional shares of common stock and the holders of

the Pre-Funded Warrants do not exercise any of the Pre-Funded Warrants:

| Public offering price per share |

|

|

|

|

|

$ |

|

|

| Net tangible book value per share as of September 30, 2023 |

|

$ |

(0.09 |

) |

|

|

|

|

| Increase in as adjusted net tangible book value per share attributable

to this offering |

|

$ |

|

|

|

|

|

|

| As adjusted net tangible book value per share as of September 30, 2023,

after giving effect to this offering |

|

|

|

|

|

$ |

|

|

| Dilution per share to new investors participating in the offering |

|

|

|

|

|

$ |

|

|

The information above assumes that the

underwriters do not exercise their option to purchase additional shares of common stock and/or Pre-Funded Warrants. If the

underwriters exercise in full their option to purchase additional

shares

of common stock and/or Pre-Funded Warrants, our adjusted net tangible book value after this offering would be approximately $

,

or

$

per share, representing an increase in net tangible book value of approximately $

per

share to existing stockholders and immediate dilution in net tangible book value of approximately $

per

share to investors participating in this offering.

The table above is based on 83,919,554 shares

of common stock outstanding as of September 30, 2023, and excludes:

| |

· |

3,450,000 shares of common

stock issuable upon the exercise of the Public Warrants, at an exercise price of $11.50 per share; |

| |

· |

2,548,849 shares of common

stock reserved for future issuance pursuant to outstanding option awards, with a weighted average exercise price of $3.32 per share; |

| |

· |

964,214 shares of common

stock available for future grants under the 2021 Plan; |

| |

· |

up to 45,000,000 shares

of common stock issuable upon conversion of the Note; |

| |

|

|

| |

· |

3,000,000 shares of

common stock issuable upon the conversion of 3,000,000 shares of Series A Preferred Stock at a conversion price of $0.40 per

share; |

| |

|

|

| |

· |

3,000,000 shares

of common stock issuable upon the exercise of warrants issued to certain investors pursuant to the August 2023 Purchase Agreement,

at an exercise price of $0.40 per share; and |

| |

|

|

| |

· |

the shares of common stock

issuable upon exercise of the underwriters warrants issued in this offering. |

To the extent outstanding options or

warrants are exercised, including any of the Pre-Funded Warrants, or outstanding convertible securities are converted into shares of

common stock, there will be further dilution to investors. In addition, to the extent that we issue additional equity securities in

connection with future capital raising activities, our then-existing stockholders may experience dilution.

UNDERWRITING

EF Hutton LLC is acting as representative of each

of the underwriters named below (the “Representative”). Subject to the terms and conditions set forth in an underwriting agreement

between us and the Representative, we have agreed to sell to each underwriter named below such securities set forth opposite its name

in the below table at the public offering price, less the underwriting discounts and commissions set forth on the cover page of this prospectus.

|

Underwriter |

|

Number of

Shares of

Common

Stock |

|

|

Number of

Pre-Funded

Warrants |

|

| EF Hutton LLC |

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

The underwriting agreement provides that, subject

to the terms and conditions contained therein, the underwriters are obligated to take and pay for all of the shares of common stock in

the offering if any of the shares of common stock are purchased, other than the shares of common stock covered by the over-allotment option

described below. If an underwriter defaults, the underwriting agreement provides that the purchase commitments of the non-defaulting underwriters

may be increased or the underwriting agreement may be terminated.

Over-Allotment Option

We have granted to the Representative an option,

exercisable no later than 45 calendar days after the date of the underwriting agreement, to purchase up to an additional shares

of common stock and/or Pre-Funded Warrants (15% of shares and shares subject to Pre-Funded Warrants sold in this offering) at the public

offering prices, less the underwriting discounts. If the Representative exercises this option, it will be obligated, subject to conditions

contained in the underwriting agreement, to purchase a number of additional shares and/or Pre-Funded Warrants on the same terms as those

on which the shares and Pre-Funded Warrants are being offered.

Discounts and Commissions

The underwriters propose to offer the shares of

common stock and Pre-Funded Warrants initially at the public offering prices on the cover page of this prospectus. After the initial offering,

the public offering prices, concession or any other term of the offering may be changed.

The following table summarizes the underwriting

discounts and commissions and proceeds, before expenses, to us, assuming both no exercise and full exercise of the over-allotment option:

| |

|

Per

Share |

|

|

Per

Pre-Funded

Warrant |

|

|

Total Without

Over-Allotment

Option |

|

|

Total With

Over-Allotment

Option |

|

| Public offering price |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Underwriting discounts and commissions (8.0%)(1) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Proceeds to us, before fees and expenses |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| (1) |

We have agreed to pay a non-accountable expense allowance to the Representative equal to 1% of the gross proceeds received in this offering which is not included in the underwriting discounts and commission. |

We estimate expenses payable by us in connection

with this offering, other than the underwriting discounts and commissions and non-accountable expense allowance referred to above, will

be approximately $ ($ if the over-allotment option is exercised in full), which includes certain expenses incurred by the underwriters

in connection with this offering that will be reimbursed by us. We have agreed to reimburse the Representative for all reasonable out-of-pocket

costs and expenses incident to the performance of its obligations under the underwriting agreement (including, without limitation, the

fees and expenses of its outside attorneys), provided that, excluding certain expenses related to indemnification and Blue-Sky and FINRA

filings, if any, such costs and expenses shall not exceed $100,000.

We have also agreed to indemnify the underwriters

against certain liabilities, including civil liabilities under the Securities Act or to contribute to payments that the underwriters may

be required to make in respect of those liabilities.

Underwriters’ Warrants

Upon

closing of this offering, we have agreed to issue to the Representative warrants, or the underwriter warrants, to purchase shares

of our common stock (5% of the aggregate number of shares of common stock and Pre-Funded Warrants sold in this offering) as a portion

of the underwriting compensation payable to the underwriters in connection with this offering. The underwriter warrants will be exercisable

at a per share exercise price equal to 110% of the public offering price per share in this offering. The underwriter warrants are exercisable

at any time and from time to time, in whole or in part, during the four and one half year period commencing 180 days from the commencement

of sales in this offering.

In addition, the warrants provide for registration

rights upon request, in certain cases. The sole demand registration right provided will not be greater than four and one-half years beginning

on the Initial Exercise Date in compliance with FINRA Rule 5110(g)(8)(C). The piggyback registration rights provided will not be greater

than five years from the initial exercise date of the underwriter warrants in compliance with FINRA Rule 5110(g)(8)(D). We will bear all

fees and expenses attendant to registering the securities issuable on exercise of the warrants other than underwriting commissions incurred

and payable by the holders. The exercise price and number of shares issuable upon exercise of the warrants may be adjusted in certain

circumstances including in the event of a stock dividend or our recapitalization, reorganization, merger or consolidation. However, the

warrant exercise price or underlying shares will not be adjusted for issuances of shares of common stock at a price below the warrant

exercise price.

Tail Financing

We agreed to pay the Representative a cash fee

equal to eight percent (8%) of the gross proceeds received by us from the sale of any equity, debt and/or equity derivative instruments

to any investor actually introduced by the Representative to us during the term of engagement with it, in connection with any public or

private financing or capital raise (each a “Tail Financing”), and such Tail Financing is consummated at any time during the

term of our engagement with them or within the six month period following the expiration or termination of our engagement with them (the

“Tail Period”), provided that such Tail Financing is by a party actually introduced to the Company in an offering in which

we had direct knowledge of such party’s participation

Lock-Up Agreements

In connection with this offering, our executive

officers and directors have agreed with the Representative that, subject to certain customary exceptions, without the prior written consent

of the Representative, for a period commencing on the date of the lock-up agreement and ending on the date that is the 90 days after the

closing of the offering, that they shall not offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase

any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or

indirectly, any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable for shares of

capital stock of the Company.

Company Standstill

In connection with this offering, we have agreed

that, without the prior written consent of the Representative, for a period commencing on the date of the underwriting agreement and ending

on the date that is 90 days after the closing of the offering, we will not (i) offer, pledge, sell, contract to sell, sell any option

or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer

or dispose of, directly or indirectly, any shares of capital stock of the Company or any securities convertible into or exercisable or

exchangeable for shares of capital stock of the Company, (ii) file or caused to be filed any registration statement with the Commission

relating to the offering of any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable

for shares of capital stock of the Company, (iii) complete any offering of debt securities of the Company, other than entering into a

line of credit with a traditional bank, or (iv) enter into any swap or other arrangement that transfers to another, in whole or in part,

any of the economic consequences of ownership of capital stock of the Company, whether any such transaction described in clause (i), (ii),

(iii) or (iv) above is to be settled by delivery of shares of capital stock of the Company or such other securities, in cash or otherwise.

These restrictions above do not apply in certain

situations, including, among others:

| |

● |

the issuance and sale of shares of common stock and/or Pre-Funded Warrants (including any shares of common stock issuable upon exercise of the Pre-Funded Warrants) to be sold on connection with the offering; |

| |

● |

the issuance by the Company of shares of common stock upon the exercise of a stock option or warrant or the conversion of a security outstanding on the date hereof; and |

| |

● |

the issuance by the Company of stock options, shares of capital stock of the Company or other awards under any equity compensation plan of the Company. |

Nasdaq Listing

Our

common stock and the Public Warrants are listed on Nasdaq under the symbols “NRXP” and “NRXPW”, respectively.

Price Stabilization, Short Positions and Penalty

Bids

In connection with this offering, the underwriters

may engage in transactions that stabilize, maintain or otherwise affect the price of our common stock. Specifically, the underwriters

may over-allot in connection with this offering by selling more shares of common stock than are set forth on the cover page of this prospectus.

This creates a short position in our common stock for its own account. The short position may be either a covered short position or a

naked short position. In a covered short position, the number of shares of common stock over-allotted by the underwriters is not greater

than the number of shares of our common stock that they may purchase in the over-allotment option. In a naked short position, the number

of shares of our common stock involved is greater than the number of shares of common stock in the over-allotment option. To close out

a short position, the underwriters may elect to exercise all or part of the over-allotment option. The underwriters may also elect to

stabilize the price of our common stock or reduce any short position by bidding for, and purchasing, our common stock in the open market.

The underwriters may also impose a penalty bid.

This occurs when a particular underwriter or dealer repays selling concessions allowed to it for distributing a security in this offering

because the underwriter repurchases that security in stabilizing or short covering transactions.

Finally, the underwriters may bid for, and purchase,

shares of our common stock in market making transactions, including “passive” market making transactions as described below.

These activities may stabilize or maintain the

market price of our common stock at a price that is higher than the price that might otherwise exist in the absence of these activities.

The underwriters are not required to engage in these activities and may discontinue any of these activities at any time without notice.

In connection with this offering, the underwriters

and selling group members, if any, or their affiliates may engage in passive market making transactions in our common stock immediately

prior to the commencement of sales in this offering, in accordance with Rule 103 of Regulation M under the Exchange Act. Rule 103

generally provides that:

| |

● |

a passive market maker may not effect transactions or display bids for our common stock in excess of the highest independent bid price by persons who are not passive market makers; |

| |

● |

net purchases by a passive market maker on each day are generally limited to 30% of the passive market maker’s average daily trading volume in our common stock during a specified two-month prior period or 200 shares, whichever is greater, and must be discontinued when that limit is reached; and |

| |

● |

passive market making bids must be identified as such. |

Electronic Distribution

A prospectus in electronic format may be made

available on the websites maintained by the underwriters. The Representative may agree to allocate a number of shares to underwriters

for sale to their online brokerage account holders. Internet distributions will be allocated by the Representative to underwriters that

may make internet distributions on the same basis as other allocations. In connection with the offering, the underwriters or syndicate

members may distribute prospectuses electronically. No forms of electronic prospectus other than prospectuses that are printable as Adobe®

PDF will be used in connection with this offering.

Other than the prospectus in electronic format,

the information on any underwriter’s website and any information contained in any other website maintained by an underwriter is

not part of the prospectus or the registration statement of which this prospectus forms a part, has not been approved and/or endorsed

by us or any underwriter in its capacity as underwriter and should not be relied upon by investors.

Affiliations

Each underwriter and its affiliates may provide,

from time to time, investment banking and financial advisory services to us in the ordinary course of business, for which they may receive

customary fees and commissions.

Foreign Regulatory Restrictions on Purchase

of our Shares

We have not taken any action to permit a public

offering of our shares outside the United States or to permit the possession or distribution of this prospectus outside the United States.

People outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions

relating to this offering of our shares and the distribution of this prospectus outside the United States.

DESCRIPTION

OF SECURITIES BEING OFFERED

The following is a description of our capital

stock and certain provisions of our Second Amended and Restated Certificate of Incorporation, Amended and Restated By-Laws, and certain

provisions of applicable law. The following is only a summary and is qualified by applicable law and by the provisions of our Second Amended

and Restated Certificate of Incorporation and Amended and Restated By-Laws, copies of which are included as exhibits to the registration

statement of which this prospectus forms a part. We are incorporated in the State of Delaware. The rights of our stockholders are generally

covered by Delaware law and our Second Amended and Restated Certificate of Incorporation and Amended and Restated By-Laws. The terms of

our capital stock are therefore subject to Delaware law.

We are offering shares of our common stock

and Pre-Funded Warrants to purchase shares of our common stock. We are also registering the shares of common stock issuable from time

to time upon exercise of the Pre-Funded Warrants offered hereby.

General

Our authorized capital stock consists of 500,000,000

shares of common stock, $0.001 par value per share, and 50,000,000 shares of preferred stock, $0.001 par value per share. As of the date

of this prospectus supplement (i) 86,675,580 shares of common stock were issued and outstanding; and (ii) 3,000,000 shares of

Series A Preferred Stock were issued and outstanding.

Common Stock

The material terms and provisions of our common

stock are described under the caption “Description of Capital Stock” in the accompanying prospectus and are incorporated herein

by reference.

Pre-Funded Warrants

The following summary of certain terms and provisions

of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions

of the Pre-Funded Warrant, the form of which will be filed as an exhibit to a Current Report on Form 8-K in connection with this offering

and incorporated by reference into the registration statement of which this prospectus supplement forms a part. Prospective investors

should carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete description of the terms and conditions

of the Pre-Funded Warrants.

The Pre-Funded Warrants will be issued in certificated

form only.

Duration and exercise price

Each Pre-Funded Warrant offered hereby has an

initial exercise price per share equal to $0.001. The Pre-Funded Warrants are immediately exercisable and have an indefinite term. The

exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock

dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price.

Exercisability

The Pre-Funded Warrants will be exercisable, at

the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for

the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below).

A holder (together with its affiliates) may not exercise any portion of such holder’s Pre-Funded Warrant to the extent that the

holder would own more than 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding shares of common stock immediately after

exercise, except that upon prior notice from the holder to us, the holder may increase the amount of ownership of outstanding shares of

common stock after exercising the holder’s Pre-Funded Warrants up to 9.99% of the number of shares of common stock outstanding immediately

after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants.

No fractional shares of common stock will be issued in connection with the exercise of a Pre-Funded Warrant. In lieu of fractional shares,

we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next

whole share.

Cashless exercise

The Pre-Funded Warrants may be exercised, in whole