Form 8-K - Current report

February 23 2024 - 7:50AM

Edgar (US Regulatory)

0001576427false00015764272024-02-232024-02-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February 23, 2024

Date of Report (Date of earliest event reported)

CRITEO S.A.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| France | | 001-36153 | | Not Applicable |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 32 Rue Blanche | Paris | France | | 75009 |

| (Address of principal executive offices) | | | | (Zip Code) |

+33 17 585 0939

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| American Depositary Shares, each representing one ordinary share, nominal value €0.025 per share | CRTO | Nasdaq Global Select Market | |

| Ordinary Shares, nominal value €0.025 per share* | | Nasdaq Global Select Market | |

*Not for trading, but only in connection with the registration of the American Depositary Shares.

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| ITEM 7.01 | Regulation FD Disclosure. |

On February 23, 2024, Criteo S.A. (the “Company”), issued a press release.

The full text of the Press Release is attached hereto as Exhibit 99.1.

| | | | | |

| ITEM 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Criteo S.A. |

| | |

| Date: February 23, 2024 | By: | /s/ Ryan Damon |

| Name: | Ryan Damon |

| Title: | Chief Legal and Corporate Affairs Officer |

Criteo Comments on Letter from Petrus Advisers

NEW YORK – February 23, 2024–Criteo S.A. (NASDAQ: CRTO) (“Criteo” or the “Company”), the commerce media company, today issued the following statement in response to the recent letter made public by Petrus Advisers:

Criteo’s Board and management team maintain a regular dialogue with our shareholders and value constructive input toward the shared goal of enhancing shareholder value. While we do not comment on discussions with specific shareholders, it is important to note that members of Criteo’s management team and Board have held a number of discussions with Petrus Advisers over the past three years. We are carefully reviewing their letter and hope to continue to engage constructively with them.

Our Board and management team are laser focused on executing Criteo’s strategy and have a proven track record of taking decisive action to drive near- and long-term, sustainable value for shareholders:

a.We are seeing strong results from our strategy to be the AdTech partner of choice for Commerce Media; Criteo achieved double-digit growth in 2023 for the second consecutive year.

b.In 2023, we achieved the historic milestone of crossing $1 billion in Contribution ex-TAC for the first time in Criteo’s history, with more than 50% coming from non-Retargeting solutions. We also achieved adjusted EBITDA of 30%, including over $70 million of annualized savings.

c.We are increasing our leading market share in Retail Media, having surpassed $200 million in annual revenue.

d.In Q4 of 2023, we delivered record top line with organic growth acceleration.

e.We are disciplined in our approach to capital allocation to drive value, which includes returning capital to shareholders through share buybacks. Having completed over $125 million in share repurchases in 2023, the Board approved an additional $150 million to be added to our existing share repurchase authorization. As previously communicated, we have accelerated our share buyback in Q1 2024 under a new 10b5-1 plan.

f.Our Board comprises eight highly qualified and diverse directors, seven of whom are independent, and we continuously review the composition of our Board to ensure alignment with our plan, including the appointment last year of Frederik van der Kooi, who brings extensive experience in building and scaling profitable global advertising businesses.

We look forward to an ongoing dialogue with all shareholders as we continue to advance our value creation strategy.

Evercore is serving as financial advisor to Criteo and Skadden, Arps, Slate, Meagher & Flom LLP is serving as its legal counsel.

About Criteo

Criteo (NASDAQ: CRTO) is the global commerce media company that enables marketers and media owners to drive better commerce outcomes. Its industry leading Commerce Media Platform connects thousands of marketers and media owners to deliver richer consumer experiences from product discovery to purchase. By powering trusted and impactful advertising, Criteo supports an open internet that encourages discovery, innovation, and choice. For more information, please visit www.criteo.com.

Contacts

Criteo Investor Relations

Melanie Dambre, m.dambre@criteo.com

Criteo Public Relations

Jessica Meyers, j.meyers@criteo.com

OR

Camilla Scassellati-Sforzolini, Warren Rizzi

FGS Global

Criteo@FGSGlobal.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

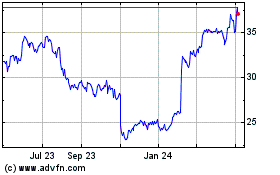

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

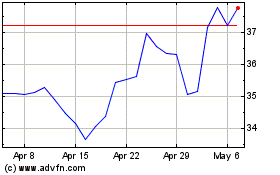

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Apr 2023 to Apr 2024