Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 22 2024 - 9:19AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report

of Foreign Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For the

month of February 2024

Commission

File Number: 001-11960

AstraZeneca PLC

1

Francis Crick Avenue

Cambridge

Biomedical Campus

Cambridge

CB2 0AA

United

Kingdom

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F __

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ______

Indicate

by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes __

No X

If

“Yes” is marked, indicate below the file number

assigned to the Registrant in connection with Rule 12g3-2(b):

82-_____________

AstraZeneca PLC

INDEX

TO EXHIBITS

1.

AstraZeneca prices a $5bn bond offering

22 February 2024 07:00 GMT

AstraZeneca prices a $5bn bond offering

AstraZeneca PLC ("AstraZeneca") announces that its wholly owned

subsidiary AstraZeneca Finance LLC, priced a four tranche global

bond offering totalling $5bn on 21 February 2024. The offering is

expected to close on 26 February 2024, subject to customary closing

conditions. The transaction, which is a global offering registered

with the US Securities and Exchange Commission ("SEC"), consists of

the following four tranches:

Notes issued by AstraZeneca Finance LLC and fully and

unconditionally guaranteed by AstraZeneca

● $1.25bn

of fixed rate notes with a coupon of 4.80%,

maturing 26 February 2027;

● $1.25bn

of fixed rate notes with a coupon of 4.85%,

maturing 26 February 2029;

● $1.00bn

of fixed rate notes with a coupon of 4.90%,

maturing 26 February 2031;

and

● $1.50bn

of fixed rate notes with a coupon of 5.00%,

maturing 26 February 2034.

AstraZeneca expects to use the net proceeds of the offering for

general corporate purposes, which may include the refinancing of

existing indebtedness.

Barclays Capital Inc., Citigroup Global Markets Inc., Deutsche

Bank Securities Inc. and J.P. Morgan Securities LLC acted as

joint book-running managers on the transaction. In

addition, and in line with our commitment to Inclusion &

Diversity, four inclusive and diverse firms acted as underwriters

on the transaction: Blaylock Van, LLC, Cabrera Capital Markets LLC,

C.L. King & Associates, Inc. and Stern Brothers &

Co.

The notes will be issued under AstraZeneca's effective shelf

registration statement on Form F-3, which AstraZeneca and

AstraZeneca Finance LLC filed with the SEC on 24 May 2021. The

offering is being made solely by means of the prospectus contained

within that shelf registration statement, along with a prospectus

supplement forming part of the effective registration statement,

which investors should read.

A copy of the prospectus supplement and accompanying prospectus

relating to the offering can be obtained by contacting Barclays

Capital Inc. by telephone at +1-888-603-5847; Citigroup Global

Markets Inc. by telephone at +1-800-831-9146; Deutsche Bank

Securities Inc. toll-free at +1-800-503-4611; or J.P. Morgan

Securities LLC collect at +1-212-834-4533. Readers may also

download these documents for free by visiting the Electronic Data

Gathering, Analysis, and Retrieval (EDGAR) system on the SEC

website at www.sec.gov.

This announcement shall not constitute an offer to sell or the

solicitation of an offer to buy the securities described herein,

nor shall there be any sale of these securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such jurisdiction.

The bond issuance does not impact AstraZeneca's financial guidance

for 2024.

AstraZeneca

AstraZeneca (LSE/STO/Nasdaq: AZN) is a global, science-led

biopharmaceutical company that focuses on the discovery,

development, and commercialisation of prescription medicines in

Oncology, Rare Diseases, and BioPharmaceuticals, including

Cardiovascular, Renal & Metabolism, and Respiratory &

Immunology. Based in Cambridge, UK, AstraZeneca operates in over

100 countries and its innovative medicines are used by millions of

patients worldwide.

Contacts

For details on how to contact the Investor Relations Team, please

click here.

For Media contacts, click here.

Adrian Kemp

Company Secretary

AstraZeneca PLC

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date:

22 February 2024

|

|

By: /s/

Adrian Kemp

|

|

|

Name:

Adrian Kemp

|

|

|

Title:

Company Secretary

|

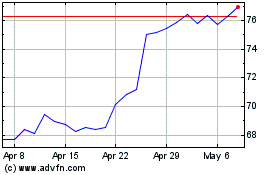

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

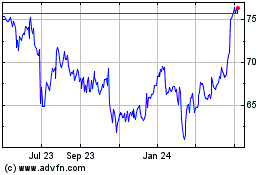

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024