false

0001034842

0001034842

2024-02-22

2024-02-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): February 22, 2024

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

| 0-29889 |

|

94-3248524 |

| (Commission File No.) |

|

(IRS Employer Identification No.) |

| |

|

|

| 611 Gateway Boulevard |

|

|

| Suite 900 |

|

|

| South San Francisco, CA |

|

94080 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (650) 624-1100

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on

Which

Registered |

| Common Stock, par value $0.001 per share |

|

RIGL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive

Agreement.

Asset Purchase Agreement

On February 22, 2024, Rigel

Pharmaceuticals, Inc. (“Rigel”) entered into an asset purchase agreement (the “Asset Purchase Agreement”)

with Blueprint Medicines Corporation (“Blueprint”) to purchase certain assets comprising the right to research, develop,

manufacture and commercialize pralsetinib, Blueprint’s proprietary RET inhibitor of tyrosine kinase currently approved for the treatment

of metastatic non–small cell lung cancer and advanced thyroid cancer, in the United States. Such assets include, among other things,

applicable intellectual property related to pralsetinib in the United States, including patents, copyrights and trademarks, as well as

clinical regulatory and commercial data and records. Pursuant to the terms of the Asset Purchase Agreement, Rigel has agreed to pay a

purchase price of $15.0 million, $10.0 million of which is payable upon first commercial sale by Rigel and an additional $5.0 million

of which is payable on the first anniversary of the closing date, subject to the completion of certain transition activities,

and up to $97.5 million in future commercial milestone payments and up to $5.0 million in future regulatory milestone payments. The potential regulatory milestones include full regulatory

approval of pralsetinib (or related compounds) for the treatment of adult RET-fusion positive thyroid cancer, and maintenance of the current

regulatory approval of pralsetinib for the treatment of adult RET-fusion positive thyroid cancer during the period beginning on February

22, 2024 and ending on the third anniversary of the first commercial sale of pralsetinib subject to certain conditions. Subject

to the terms and conditions of the Asset Purchase Agreement, Blueprint would be entitled

to tiered royalty payments on net sales of products containing pralsetinib (or related compounds) at

percentages ranging from 10 percent to 30 percent, subject to certain reductions and offsets.

The Asset Purchase Agreement

includes customary representations, warranties and covenants, as well as mutual indemnities covering, among other things, losses arising

from excluded liabilities or inaccuracy of the representations and warranties therein.

Simultaneously and in connection

with entering into the Asset Purchase Agreement, the parties have also entered into certain supporting agreements, including a customary

transition agreement, pursuant to which, during a transition period, Blueprint will transition regulatory and distribution responsibility

for pralsetinib to Rigel.

The foregoing description

of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Asset Purchase Agreement,

a copy of which will be included as an exhibit to Rigel’s Quarterly Report on Form 10-Q for the fiscal period ending March 31, 2024,

to be filed with the U.S. Securities and Exchange Commission (the “SEC”).

Item 2.01. Completion of Acquisition or Disposition

of Assets.

The disclosure under Item

1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements relating to, among other things, Rigel’s agreement with Blueprint, the obligations thereunder and the potential benefits

of Rigel’s acquisition of U.S. rights to pralsetinib, including opportunities in non–small cell lung cancer and thyroid cancer,

Rigel’s ability to leverage its existing commercial infrastructure to market and distribute pralsetinib, Rigel’s ability to

transition pralsetinib to its distribution network and provide patients with access to pralsetinib, the payment and timing of milestone

and royalty payments and Rigel’s ability to start recognizing product sales in the third quarter of 2024 and the market opportunity

for pralsetinib. Any statements contained in this Current Report on Form 8-K that are not statements of historical fact may be deemed

to be forward-looking statements. Forward-looking statements can be identified by words such as “plan,” “potential,”

“may,” “expects,” “will,” “intends” and similar expressions in reference to future periods.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on Rigel’s

current beliefs, expectations and assumptions and hence they inherently involve significant risks, uncertainties and changes in circumstances

that are difficult to predict and many of which are outside of our control. Therefore, you should not rely on any of these forward-looking

statements. Actual results and the timing of events could differ materially from those anticipated in such forward looking statements

as a result of these risks and uncertainties, which include, without limitation, those risks and uncertainties associated with the commercialization

and marketing of pralsetinib; risks that the FDA or other regulatory authorities may make adverse decisions regarding pralsetinib; risks

that pralsetinib may have unintended side effects, adverse reactions or incidents of misuses; the availability of resources to develop

market and distribute pralsetinib; risks related to the transition of pralsetinib to Rigel, including risks related to the effectiveness

of transition services and drug continuity; market competition for pralsetinib ; as well as other risks detailed from time to time in

Rigel’s reports filed with the SEC, including its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 and subsequent

filings. Any forward-looking statement made by us in this Current Report on Form 8-K is based only on information currently available

to us and speaks only as of the date on which it is made. Rigel does not undertake any obligation to update any forward-looking statements,

whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise,

and expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained

herein, except as required by law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: February 22, 2024 |

RIGEL PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Ray Furey, J.D. |

| |

|

Ray Furey, J.D. |

| |

|

Executive Vice President, General Counsel and Corporate Secretary |

v3.24.0.1

Cover

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity File Number |

0-29889

|

| Entity Registrant Name |

RIGEL PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001034842

|

| Entity Tax Identification Number |

94-3248524

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

611 Gateway Boulevard

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

624-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

RIGL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

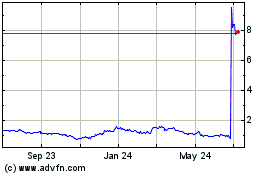

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

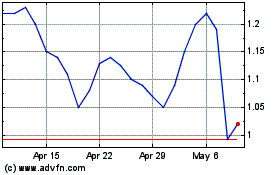

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Apr 2023 to Apr 2024