UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For

the month of: February 2024 |

|

Commission File Number: 1-14830 |

| GILDAN ACTIVEWEAR INC. |

| (Translation of registrant’s name into English) |

| |

|

600 de Maisonneuve Boulevard West

33rd Floor

Montréal, Québec

Canada H3A 3J2 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form

40-F þ

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GILDAN ACTIVEWEAR INC. |

|

| |

|

|

| Date: February 21, 2024 |

By: |

/s/ Michelle Taylor |

|

| |

|

Name: |

Michelle Taylor |

|

| |

|

Title: |

Vice-President, General Counsel and Corporate Secretary |

|

| |

|

|

|

|

|

EXHIBIT INDEX

Exhibit 99.1

EXECUTION VERSION

December 17, 2023

Sent By Email

Coliseum Capital Management, LLC

105 Rowayton Avenue

Rowayton, Ct, 06853

Attention: Christopher Shackelton, Managing Partner

Dear Mr: Shackelton:

This letter agreement sets forth the entire agreement between Coliseum

Capital Management, LLC (“Coliseum”) and Gildan Activewear Inc. (“Gildan” or the “Company”)

regarding the matters discussed herein (the “Agreement”).

For purposes of this Agreement: (i) “2024 AGM”

means the annual and general meeting of shareholders of Gildan to be held in 2024; (ii) “2025 AGM” means the annual

and general meeting of shareholders of Gildan to be held in 2025; (iii) “2026 AGM” means the annual and general meeting

of shareholders of Gildan to be held in 2026; and (iv) “Affiliated Entity” of a person means any affiliate (as such

term is defined in the Canada Business Corporations Act), general partner or manager of such person or any fund or other investment

vehicle directly or indirectly controlled by, or under management and control of such person. For clarity, the term “Affiliated

Entity” with respect to Coliseum shall include managed accounts pursuant to which Coliseum has voting and dispositive control pursuant

to an investment management agreement for so long as it has such control.

| (a) | Effective immediately upon the execution and delivery of this Agreement by all parties, Gildan shall appoint Christopher Shackelton

(the “Coliseum Nominee”) as a member of the board of directors of Gildan (the “Board”). |

| | | |

| (b) | Gildan will, in connection with each of the 2024 AGM and the 2025 AGM: (i) cause the Company’s slate of director nominees standing

for election, and recommended by or on behalf of the Board, to include the Coliseum Nominee; and (ii) solicit proxies in favour of and

otherwise support and promote the election of the Coliseum Nominee in a manner no less favourable than the manner in which Gildan supports

and promotes its other Board nominees for election at each such meeting. |

| | | |

| (c) | Gildan confirms that it will convene and hold the 2025 Meeting by no later than May 1, 2025. |

| | | |

| (d) | Coliseum acknowledges and agrees that, in the event that the Coliseum Nominee is otherwise prohibited by applicable law or stock exchange

rules from serving on the Board or is otherwise required to resign from the Board, the Coliseum Nominee shall forthwith tender his resignation

from the Board (and any committee thereof) with immediate effect, unless the Board otherwise determines as permitted by applicable law. |

| | | |

| (e) | If, prior to the 2025 AGM, Christopher Shackelton resigns or is removed as a director, or is otherwise unwilling or unable to serve

or stand for election as a director of the Board, Coliseum will be entitled to designate a mutually agreeable replacement nominee, provided

that any such substitute nominee must be acceptable to the Corporate Governance and Social Responsibility Committee of the Board, acting

reasonably, and the Company and the Board shall take all necessary action to appoint such substitute nominee to fill the vacancy resulting

therefrom as promptly as practicable. If any individual that Coliseum designates as a proposed substitute |

nominee is not acceptable to the Corporate Governance and

Social Responsibility Committee of the Board or the Board, Coliseum will be entitled to designate a different individual as the proposed

substitute nominee, and so on, until a substitute nominee who is acceptable to the Corporate Governance and Social Responsibility Committee

of the Board, acting reasonably, has been recommended by the Corporate Governance and Social Responsibility Committee and appointed to

the Board. Any such substitute nominee shall thereafter be deemed to be the Coliseum Nominee for all purposes of this Agreement.

| (f) | Gildan has advised Coliseum that upon appointment to the Board, the Coliseum Nominee shall be entitled to receive the same compensation,

expense reimbursement and benefits of director and officer insurance and any indemnity arrangements available generally to the other directors

of Gildan (subject to the ability of the Coliseum Nominee to direct payment to another entity and to elect to receive any non-cash consideration

in cash), and shall be required to comply with all fiduciary duties (including the duty of confidentiality), policies, procedures, processes,

codes, rules, standards and guidelines generally applicable to directors of Gildan, provided, for greater certainty, that the Coliseum

Nominee shall be permitted to share confidential information with Coliseum and its representatives, subject to preserving the confidentiality

of that information, and Coliseum further acknowledges and agrees that upon receiving such confidential information, Coliseum may be considered

to be in a “special relationship” with the Company pursuant to applicable securities laws and subject to restrictions on trading

securities of the Company. |

| | | |

| (g) | Coliseum hereby represents, warrants and covenants to Gildan that the Coliseum Nominee is not currently, nor will he be for the duration

of the Standstill Period, a member of the board of directors of alphabroder. |

| (a) | Effective as of the date of this Agreement and continuing until the close of the 2025 AGM, Coliseum agrees that it will, at any meeting

of shareholders of Gildan at which Coliseum or its Affiliated Entity is entitled to vote, where the election or appointment of directors

is being sought from shareholders, and in any action relating to the election or appointment of directors by written consent of the shareholders

of Gildan: (i) vote, or cause to be voted, all common shares of Gildan that Coliseum and its Affiliated Entities beneficially own or exercise

control or direction over in favour of the individuals nominated by management of Gildan for election or appointment to the Board and

against or withhold on any resolution to elect individuals other than those nominated by management of Gildan; and (ii) not vote, and

cause to not be voted, the common shares of Gildan that Coliseum and its Affiliated Entities beneficially own or exercise control or direction

over (X) against or to withhold such votes on any of the individuals nominated by management of Gildan for election or appointment to

the Board and (Y) for or in favour of any proposals or resolutions to remove any member of the Board nominated by management of Gildan. |

| (b) | Coliseum and Gildan acknowledge and agree that should the Board determine at any time during the Standstill Period (as defined below)

to adopt an ISS compliant shareholder rights plan on customary terms, Coliseum will vote, or cause to be voted, all common shares of Gildan

that Coliseum and its Affiliated Entities beneficially own or exercise control or direction over in favour of such plan. |

| (c) | Coliseum confirms that it currently intends to acquire, in accordance with and subject to applicable law, market conditions and the

trading policies of the Company, additional common shares of Gildan with the hope of becoming the largest shareholder of the Company.

|

| 3 | Standstill. Effective as of the date of this Agreement and continuing until the close of the 2025 AGM, neither Coliseum nor

any of its Affiliated Entities, will, whether acting alone or “jointly or in concert” (within the meaning of applicable securities

laws) with any other person or entity, unless specifically consented to in writing by the Board, directly or indirectly: |

| (a) | make, or induce any person to make, any unsolicited take-over bid, material asset purchase or any other unsolicited merger or unsolicited

going-private transaction involving a material portion of the assets or securities of Gildan or its Affiliated Entities (each an “Extraordinary

Transaction”); |

| (b) | other than in accordance with Section 2(a), engage in, participate in, or in any way initiate, any “solicitation” (as

such term is defined in the Canada Business Corporations Act and in any applicable securities laws) of proxies or consents, with respect

to the voting of any securities of Gildan; |

| (c) | seek, alone or jointly or in concert with others, (i) to requisition or call a meeting of the shareholders of Gildan, (ii) to obtain

representation on, or nominate or propose the nomination of any candidate for election to, the Board, other than as expressly provided

in this Agreement, or (iii) to effect the removal of any member of the Board or otherwise alter the composition of the Board, other than

as expressly provided in this Agreement; |

| (d) | submit, or induce any person to submit, any shareholder proposal to Gildan or the Board; or |

| (e) | enter into any agreements or understandings with any person with respect to the foregoing, or assist or support any person to take

any action inconsistent with the foregoing. |

Notwithstanding the foregoing, the provisions of this Section 3 shall cease

to apply if, after the date hereof: (i) a third party enters into any agreement with Gildan agreeing to acquire, in any manner, at least

50% or more of the outstanding shares, (ii) a third party enters into any agreement with Gildan agreeing to acquire, in any manner, a

material portion of the assets of Gildan, or (iii) after the commencement of a proxy contest by a third party other than Coliseum or any

of its Affiliated Entities, there is elected to the Board, without the agreement of the Board as constituted immediately prior to the

election, new directors comprising more than 50% of the members of the Board as constituted immediately following such election.

For greater certainty, nothing in this Section 3 shall limit in any respect

Coliseum’s or its representatives ability to (i) communicate privately with the Board or any officers of Gildan with respect to

any of the actions, activities or matters restricted by this Section 3 including to make one or more confidential proposals to the Board,

provided that the Board shall be under no obligation to accept any such proposal and that the party making such proposal shall not under

any circumstances make any public disclosure of the making of such proposal except with the prior written consent of Gildan, (ii) make

any factual statement to comply with any subpoena or other legal process or respond to a request for information from any governmental

authority, and (iii) tender securities to or vote in favour of an Extraordinary Transaction. For the avoidance of doubt the restrictions

set forth in this Section 3 shall not affect the rights or obligations of the Coliseum Nominee in his capacity as a director of the Company.

| 4 | Extended Term. Notwithstanding anything to the contrary in this Agreement, the provisions of Section 2 and Section 3 of this

Agreement shall continue to apply in full force and effect from the close of the 2025 AGM until the business day immediately before the

2026 AGM, provided the Coliseum Nominee remains a director on the Board. |

| 5 | Issuance of Press Release. As soon as practicable following the execution of this Agreement, Gildan and Coliseum shall jointly

issue the press release attached hereto as Schedule “A” (the “Press Release”). Gildan shall coordinate

the filing of such Press Release and bear the related expenses associated with the dissemination of such Press Release. None of the parties

hereto shall make any public announcements, disclosure or statements (including in any filing with the Canadian or U.S. securities regulators

or any other regulatory or governmental agency, including any stock exchange) that are inconsistent with, or otherwise contrary to, the

statements in the Press Release issued pursuant to this Section 4, except, in each case, as required by applicable law. |

| 6 | Legal Expenses. Gildan shall pay up to CAD$75,000 plus HST as a reimbursement for Coliseum’s reasonable and documented

legal expenses incurred in the preparation of the execution of this Agreement and all related filings, matters and activities by wire

transfer of immediately available funds to Coliseum within five days of Coliseum submitting evidence reasonably satisfactory

to Gildan in support of such expenses. |

| 7 | Miscellaneous. This Agreement shall be governed by and construed in accordance with the laws of the province of Ontario and

the federal laws of Canada applicable therein. This letter agreement may be amended only by a written instrument duly executed by Coliseum

and Gildan. No failure or delay by any party in exercising any right or remedy hereunder will operate as a waiver thereof. This Agreement

may be executed in counterparts and delivered by email/PDF. |

[Signature page follows.]

Yours truly,

| |

GILDAN ACTIVEWEAR INC. |

|

| |

|

|

|

Per: |

“Craig A. Leavitt” |

|

| |

|

Craig A. Leavitt |

|

| |

|

Interim President and Chief Executive Officer |

|

| |

|

|

|

| |

Per: |

“Donald C. Berg” |

|

| |

|

Donald C. Berg |

|

| |

|

Chairman of the Board |

|

| |

|

|

|

| |

|

|

|

|

|

ACKNOWLEDGED AND AGREED this 17 day of December, 2023.

| |

COLISEUM CAPITAL MANAGEMENT, LLC |

|

| |

|

|

|

Per: |

“Christopher Shackelton” |

|

| |

|

Christopher Shackelton |

|

| |

|

Managing Partner |

|

| |

|

|

|

|

|

Schedule “A”

Press Release

(See attached)

Gildan Welcomes Chris Shackelton to its Board of Directors, along

with Support from Coliseum Capital Management

| |

• |

|

Chris Shackelton invited to join Board of Directors |

| |

|

|

|

| |

• |

|

Coliseum committed to support full slate of Board nominees at 2024 and 2025 AGMs |

| |

• |

|

Coliseum intends to grow its position, with hope of becoming largest shareholder |

Montreal, December 17, 2023 — Gildan Activewear Inc.

(GIL: TSX and NYSE) (“Gildan” or “the Company”) today announced a support agreement with Coliseum Capital Management,

LLC (“Coliseum”), pursuant to which Coliseum will support Gildan’s full slate of Board nominees at each of the 2024

and 2025 Annual Meetings of Shareholders. In connection with the agreement, and after meeting with members of Gildan’s Board of

Directors, Coliseum currently intends to make an additional investment in Gildan through market purchases during insider open window periods.

Additionally, Chris Shackelton, a Co-Founder and Managing Partner of Coliseum has been invited to join Gildan’s Board of Directors

and has been appointed effective today.

Chris Shackelton said, “It is a privilege to serve on this

Board and represent shareholders at this critical juncture. The Coliseum team has long been impressed by Gildan’s business. This

agreement is a clear reflection of our conviction in the Company’s strategy, leadership, board and bright future. Gildan is remarkably

well-positioned, and I look forward to helping the Company execute on its growth strategy and drive meaningfully shareholder value creation.”

Donald C. Berg, Chair of Gildan’s Board of Directors said,

“We appreciate Coliseum’s long-standing partnership, engagement, and alignment to support our mutual goal of enhancing long-term

shareholder value. Coliseum’s intent to further invest in Gildan is a testament to its belief in the Company’s leadership,

board, strategic plan and capability to deliver value.”

“We are delighted to welcome Chris Shackelton to Gildan’s

Board of Directors. He is a highly experienced director and successful investor whom we believe will further strengthen the Board for

the benefit of all shareholders,” said Mr. Berg.

Mr. Berg took the opportunity to correct misinformation about the

Board’s succession plans that had been publicly disseminated, “Our succession plan has been a multi-year, careful, and deliberate

process which included the former CEO at appropriate times throughout the process. It resulted in a well thought out rationale for the

Board’s unanimous decision to appoint Vince Tyra as the new CEO. With the support of one of our largest shareholders, we will continue

our outreach to other shareholders to ensure the facts and conclusions surrounding the succession process are transparent, as well as

the Board’s confidence in Gildan’s trajectory,” concluded Mr. Berg.

Coliseum has agreed to abide by certain customary standstill and

voting commitments in connection with the agreement. A copy of the agreement will be filed on SEDAR+ at www.sedarplus.ca.

About Christopher S. Shackelton

Christopher S. Shackelton is a Managing Partner of Coliseum Capital

Management, LLC, which he Co-Founded in 2005. He has served on the boards of eight public companies. He currently serves as Chairman of

both ModivCare Inc. and Lazydays Holdings Inc., as well as a director on the board of Universal Technical Institute Inc. Previously he

was a director on the boards of LHC Group Inc., BioScrip, Inc., Advanced Emissions Solutions, Inc., Rural/Metro Corp., and Interstate

Hotels & Resorts, Inc. Additionally, he currently serves as a Trustee for several charitable not-for-profit organizations. Earlier

in his career, he held positions at Morgan Stanley & Co. and Watershed Asset Management LLC. He is a graduate of Yale College.

Caution Concerning Forward-Looking Statements

Certain statements included in this press release constitute “forward-looking

statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and Canadian securities legislation

and regulations and are subject to important risks, uncertainties, and assumptions. This forward-looking information includes, amongst

others, information with respect to the support agreement entered into with Coliseum and the expected benefits to the Company and its

shareholders. Forward-looking statements generally can be identified by the use of conditional or forward-looking terminology such as

“may”, “will”, “expect”, “intend”, “estimate”, “project”, “assume”,

“anticipate”, “plan”, “foresee”, “believe”, or “continue”, or the negatives

of these terms or variations of them or similar terminology. All forward-looking information is based on our beliefs as well as assumptions

based on information available at the time the assumption was made and on our experience and perception of historical trends, current

conditions, results and expected future developments, as well as other factors deemed appropriate in the circumstances.

Forward-looking information is inherently uncertain and the results

or events predicted in such forward-looking information may differ materially from actual results or events. Material factors, which could

cause actual results or events to differ materially from a conclusion or projection in such forward-looking information, include, but

are not limited to changes in general economic and financial conditions globally or in one or more of the markets we serve and our ability

to implement our growth strategies and plans.

There can be no assurance that the expectations represented by our

forward-looking statements will prove to be correct. The purpose of the forward-looking statements is to provide the reader with a description

of management’s expectations regarding the Company’s future financial performance and may not be appropriate for other purposes.

Furthermore, unless otherwise stated, the forward-looking statements contained in this press release are made as of the date hereof, and

we do not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result

of new information, future events, or otherwise unless required by applicable legislation or regulation. The forward-looking statements

contained in this press release are expressly qualified by this cautionary statement.

About Gildan

Gildan is a leading manufacturer of everyday basic apparel. The Company’s

product offering includes activewear, underwear and socks, sold to a broad range of customers, including wholesale distributors, screenprinters

or embellishers, as well as to retailers that sell to consumers through their physical stores and/or e-commerce platforms and to global

lifestyle brand companies. The Company markets its products in North America, Europe, Asia Pacific, and Latin America, under a diversified

portfolio of Company-owned brands including Gildan®, American Apparel®, Comfort Colors®, GOLDTOE®, Peds®, in addition

to the Under Armour® brand through a sock licensing agreement providing exclusive distribution rights in the United States and Canada.

Gildan owns and operates vertically integrated, large-scale manufacturing

facilities which are primarily located in Central America, the Caribbean, North America, and Bangladesh. Gildan operates with a strong

commitment to industry-leading labour, environmental and governance practices throughout its supply chain in accordance with its comprehensive

ESG program embedded in the Company’s long-term business strategy. More information about the Company and its ESG practices and

initiatives can be found at www.gildancorp.com.

|

Investor inquiries:

Jessy Hayem, CFA

Vice-President, Head of Investor Relations

(514) 744-8511

jhayem@gildan.com |

|

Media inquiries:

Genevieve Gosselin

Director, Global Communications and Corporate Marketing

(514) 343-8814

ggosselin@gildan.com |

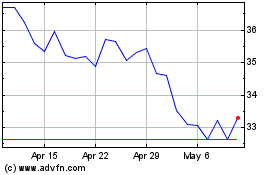

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

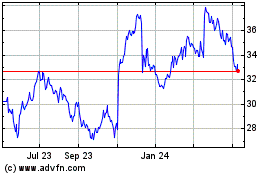

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Apr 2023 to Apr 2024