February 20, 20240000821026false00008210262024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of Earliest Event Reported): | February 20, 2024 |

__________________________________________

The Andersons, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | | 000-20557 | | 34-1562374 |

| (State of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

1947 Briarfield Boulevard

Maumee, Ohio 43537

(Address of principal executive offices) (Zip Code)

(419) 893-5050

(Registrant’s telephone number, including area code)

__________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

__________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol | | Name of each exchange on which registered: |

| Common stock, $0.00 par value, $0.01 stated value | | ANDE | | The NASDAQ Stock Market LLC |

__________________________________________

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

[☐] Emerging growth company

[☐] If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

The Andersons, Inc. issued a press release announcing its fourth quarter 2023 earnings. This press release is attached as exhibit 99.1 to this filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | The Andersons, Inc. |

| | | |

| February 20, 2024 | | By: | /s/ Brian A. Valentine |

| | | |

| | | Brian A. Valentine |

| | | Executive Vice President

and Chief Financial Officer |

NEWS RELEASE

NEWS RELEASE

The Andersons, Inc. Reports Record Fourth Quarter Results

MAUMEE, OHIO, February 20, 2024 - The Andersons, Inc. (Nasdaq: ANDE) announces financial results for the fourth quarter ended December 31, 2023.

Fourth Quarter Highlights:

•Company reported net income from continuing operations attributable to The Andersons of $51 million, or $1.49 per diluted share, and $55 million, or $1.59 per diluted share, on an adjusted basis

•EBITDA was $131 million for the quarter, and adjusted EBITDA was $135 million

•Trade reported pretax income of $44 million and adjusted pretax income of $47 million

•Renewables reported record pretax income of $60 million and pretax income attributable to the company of $33 million on efficient plant performance and good merchandising results

•Strong balance sheet; healthy cash flows result in a cash balance of $644 million at December 31, 2023

"Renewables had an excellent fourth quarter with record ethanol production and strong corn to ethanol yields at our four ethanol plants. We continued to have great operating performance and also benefited from strong board crush margins. In Trade, our eastern grain assets had good results from improving basis after a later harvest coupled with income from drying wet corn. In Nutrient & Industrial, we had a mixed quarter with year-over-year improvement from our ag supply chain product lines," said President and CEO Pat Bowe. "With these results, we are reporting a 30% year-over-year improvement in adjusted EBITDA for the quarter, leading to a full year adjusted EBITDA of $405 million, just behind last year's record of $412 million, and well above our previously disclosed range of $350-$375 million."

"Looking forward, we acknowledge a shift in fundamentals of the commodity markets with increased global stocks. Our mix of North American storage and ethanol production assets and combined with strength in merchandising positions us well to benefit from these market shifts," added Bowe. "We have seen good results from our recent investments in ingredients supplied for pet and human consumption. We are actively pursuing opportunities for growth in the Renewables space, including carbon reduction plans and increased renewable diesel feedstock merchandising. Across our businesses, we have a robust pipeline of opportunities that include both investment in our facilities and M&A with a strong balance sheet to support this growth."

| | | | | | | | | | | | | | | | | | | | |

| $ in millions, except per share amounts | | | |

| Q4 2023 | Q4 2022 | Variance | YTD 2023 | YTD 2022 | Variance |

| Pretax Income from Continuing Operations | $ | 91.8 | | $ | 31.1 | | $ | 60.7 | | $ | 169.6 | | $ | 194.6 | | $ | (25.0) | |

Pretax Income from Continuing Operations Attributable to the Company1 | 64.5 | | 25.0 | | 39.5 | | 138.2 | | 158.7 | | (20.5) | |

Adjusted Pretax Income (Loss) from Continuing Operations Attributable to the Company1 | 68.4 | | 50.0 | | 18.4 | | 159.1 | | 184.4 | | (25.3) | |

Trade1 | 47.0 | | 52.2 | | (5.2) | | 83.3 | | 120.9 | | (37.6) | |

Renewables1 | 32.7 | | 12.5 | | 20.2 | | 97.7 | | 72.3 | | 25.4 | |

Nutrient & Industrial1 | 2.1 | | 1.7 | | 0.4 | | 25.7 | | 39.2 | | (13.5) | |

Other1 | (13.4) | | (16.4) | | 3.0 | | (47.7) | | (48.0) | | 0.3 | |

Net Income from Continuing Operations Attributable to the Company | 51.2 | | 15.1 | | 36.1 | | 101.2 | | 119.1 | | (17.9) | |

Adjusted Net Income from Continuing Operations Attributable to the Company1 | 54.6 | | 33.8 | | 20.8 | | 118.3 | | 139.4 | | (21.1) | |

| Diluted Earnings Per Share from Continuing Operations (EPS) | 1.49 | | 0.44 | | 1.05 | | 2.94 | | 3.46 | | (0.52) | |

Adjusted Diluted Earnings Per Share from Continuing Operations1 | 1.59 | | 0.98 | | 0.61 | | 3.44 | | 4.05 | | (0.61) | |

EBITDA from Continuing Operations1 | 131.2 | | 78.7 | | 52.5 | | 341.5 | | 386.2 | | (44.7) | |

Adjusted EBITDA from Continuing Operations1 | $ | 135.1 | | $ | 103.7 | | $ | 31.4 | | $ | 405.1 | | $ | 411.9 | | $ | (6.8) | |

| | | | | | |

1 Non-GAAP financial measures; see appendix for explanations and reconciliations.

Cash, Liquidity, and Long-Term Debt Management

"Strong operating cash flows continued into the fourth quarter. Our significant cash position and minimal short-term borrowings resulted in cash in excess of total debt at year end," said Executive Vice President and CFO Brian Valentine. "Our long-term debt to adjusted EBITDA ratio of 1.5 times is well below our stated target of 2.5 times. With a strong balance sheet, we are well-positioned to fund good growth projects with appropriate returns."

The company generated $251 million and $440 million in cash from operating activities for the fourth quarters of 2023 and 2022, respectively, and generated $122 million and $90 million in cash from operations before working capital changes for the same periods, respectively.

For the full years of 2023 and 2022, the company generated $947 million and $287 million in cash from operating activities, respectively. Cash from operations before working capital changes for the same years was $330 million and $315 million, leading to a December 31, 2023, cash balance of $644 million.

Fourth Quarter Segment Overview

Trade Posts Strong Fourth Quarter Driven by Grain Assets

Trade recorded pretax income of $44 million and adjusted pretax income of $47 million for the quarter, compared to pretax income of $27 million and record adjusted pretax income of $52 million in the fourth quarter of the prior year.

Strong elevation margins in core grain assets through harvest drove the results with strong basis appreciation and drying income from a wet corn crop. The merchandising businesses realized solid results but down from last year, primarily on weakness in the Middle East and North Africa region. Our premium ingredients business experienced significant improvements from the prior year, as recent acquisitions and other growth capital investments provided strong returns.

Ag fundamentals are shifting due to increased global supply. Our mix of assets and merchandising businesses provide a solid foundation for us to benefit from large crops and carry markets. With lower commodity prices, domestic producers are hesitant to forward sell, but our assets are well-positioned for the grains to flow in due course. With continuing global unrest, volatility exists in key international shipping lanes which could provide ongoing merchandising opportunities.

Trade’s fourth quarter adjusted EBITDA was $62 million, compared to fourth quarter 2022 adjusted EBITDA of $72 million. Full year adjusted EBITDA decreased from a record $199 million in 2022 to $155 million in 2023.

Renewables Posts Another Outstanding Quarter

The Renewables segment reported record pretax income of $60 million and pretax income attributable to the company of $33 million in the fourth quarter compared to pretax income of $19 million and pretax income attributable to the company of $13 million in the fourth quarter of 2022. Fourth quarter ethanol board crush margins were up $0.20/gallon and natural gas prices were down when compared to the same quarter in 2022. Our four ethanol plants had record production in the fourth quarter, further capitalizing on the favorable margin environment. Renewable diesel feedstock merchandising results also grew on increased sales volumes and a further diversified product portfolio.

While spot ethanol crush margins have softened into 2024, the first quarter generally experiences seasonally weak margins. Upcoming planned maintenance in the industry and the spring driving rebound should support improved plant economics; however, co-product values are facing headwinds as weaker corn prices are expected to compress feed values.

Renewables recorded EBITDA of $73 million in the fourth quarter of 2023, compared to 2022 fourth quarter EBITDA of $36 million. For the full year, adjusted EBITDA of $230 million in 2023, was a record and an increase of almost $50 million from 2022.

Nutrient & Industrial Shows Improvement on Prior Year

Nutrient & Industrial recorded pretax income of $1 million and adjusted pretax income of $2 million in the fourth quarter, a slight improvement to the prior year, on an adjusted basis. The increased results are primarily due to higher volumes in our core agriculture products. Adjusted results include $2 million of expense related to a standstill payment for a growth project that did not come to fruition. We remain optimistic for a good spring application season as nutrient prices have stabilized, and farm economics should still incentivize application of crop inputs.

Nutrient & Industrial’s current quarter EBITDA was $10 million and adjusted EBITDA was $11 million, comparable to 2022 fourth quarter EBITDA. For the full year, Nutrient & Industrial recorded EBITDA of $61 million and adjusted EBITDA of $62 million in 2023, down from EBITDA of $73 million in 2022.

Conference Call

The company will host a webcast on Wednesday, February 21, 2024, at 11 a.m. ET, to discuss its performance and provide its outlook for 2024. To access the call, please dial 888-317-6003 or 412-317-6061 (international toll) and use elite entry number 7643632. It is recommended that you call 10 minutes before the conference call begins.

To access the webcast, click on the link: https://app.webinar.net/2KMLrbDgaWV and submit the requested information as directed. A replay of the call can also be accessed under the heading "Investors" on the company’s website at www.andersonsinc.com.

Forward-Looking Statements

This release contains forward-looking statements. These statements involve risks and uncertainties that could cause actual results to differ materially. Without limitation, these risks include economic, weather and regulatory conditions, competition, geopolitical risk, and the risk factors set forth from time to time in the company’s filings with the Securities and Exchange Commission. Although the company believes that the assumptions upon which the financial information and its forward-looking statements are based are reasonable, it can give no assurance that these assumptions will prove to be correct.

Non-GAAP Measures

This release contains non-GAAP financial measures. The company believes that pretax income (loss) from continuing operations attributable to the company; adjusted pretax income (loss) from continuing operations attributable to the company; adjusted pretax income (loss) from continuing operations; adjusted net income from continuing operations attributable to the company; adjusted diluted earnings per share from continuing operations; earnings before interest, taxes, depreciation, and amortization (or EBITDA); EBITDA from continuing operations; adjusted EBITDA; adjusted EBITDA from continuing operations; and cash from operations before working capital changes provide additional information to investors and others about its operations, allowing an evaluation of underlying operating performance and liquidity and better period-to-period comparability. The above measures are not and should not be considered as alternatives to net income from continuing operations, pretax income from continuing operations or income (loss) before income taxes from continuing operations, diluted earnings (loss) per share attributable to The Andersons, Inc. common shareholders from continuing operations and cash provided by (used in) operating activities as determined by generally accepted accounting principles. Reconciliations of the GAAP to non-GAAP measures may be found within this press release and the financial tables provided herein.

Company Description

The Andersons, Inc. is a diversified company rooted in agriculture that conducts business in the commodity merchandising, renewables, and nutrient & industrial sectors. Guided by its Statement of Principles, The Andersons is committed to providing extraordinary service to its customers, helping its employees improve, supporting its communities, and increasing the value of the company. For more information, please visit www.andersonsinc.com.

Investor Relations Contact

Mike Hoelter

Vice President, Corporate Controller and Investor Relations

Phone: 419-897-6715

E-mail: investorrelations@andersonsinc.com

The Andersons, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| (in thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| Sales and merchandising revenues | $ | 3,213,000 | | | $ | 4,677,488 | | | $ | 14,750,112 | | | $ | 17,325,384 | |

| Cost of sales and merchandising revenues | 2,995,286 | | | 4,507,465 | | | 14,004,749 | | | 16,641,220 | |

| Gross profit | 217,714 | | | 170,023 | | | 745,363 | | | 684,164 | |

| Operating, administrative and general expenses | 132,712 | | | 127,471 | | | 492,260 | | | 457,556 | |

| Asset impairment | — | | | 9,000 | | | 87,156 | | | 9,000 | |

| Interest expense, net | 8,101 | | | 14,087 | | | 46,867 | | | 56,849 | |

| Other income, net | 14,860 | | | 11,638 | | | 50,483 | | | 33,823 | |

| | | | | | | |

| | | | | | | |

| Income before income taxes from continuing operations | 91,761 | | | 31,103 | | | 169,563 | | | 194,582 | |

| Income tax provision from continuing operations | 13,324 | | | 9,933 | | | 37,034 | | | 39,628 | |

| Net income from continuing operations | 78,437 | | | 21,170 | | | 132,529 | | | 154,954 | |

| Income (loss) from discontinued operations, net of income taxes | — | | | (6,074) | | | — | | | 12,025 | |

| Net income | 78,437 | | | 15,096 | | | 132,529 | | | 166,979 | |

| Net income attributable to the noncontrolling interest | 27,251 | | | 6,072 | | | 31,339 | | | 35,899 | |

| Net income attributable to The Andersons, Inc. | $ | 51,186 | | | $ | 9,024 | | | $ | 101,190 | | | $ | 131,080 | |

| | | | | | | |

Earnings (loss) per share attributable to

The Andersons, Inc. common shareholders: | | | | | | | |

| Basic earnings (loss): | | | | | | | |

| Continuing operations | $ | 1.52 | | | $ | 0.45 | | | $ | 3.00 | | | $ | 3.53 | |

| Discontinued operations | — | | | (0.18) | | | — | | | 0.36 | |

| $ | 1.52 | | | $ | 0.27 | | | $ | 3.00 | | | $ | 3.89 | |

| Diluted earnings (loss): | | | | | | | |

| Continuing operations | $ | 1.49 | | | $ | 0.44 | | | $ | 2.94 | | | $ | 3.46 | |

| Discontinued operations | — | | | (0.18) | | | — | | | 0.35 | |

| $ | 1.49 | | | $ | 0.26 | | | $ | 2.94 | | | $ | 3.81 | |

The Andersons, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

| | | | | | | | | | | |

| (in thousands) | December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 643,854 | | | $ | 115,269 | |

| Accounts receivable, net | 762,549 | | | 1,248,878 | |

| Inventories | 1,166,700 | | | 1,731,725 | |

| Commodity derivative assets – current | 178,083 | | | 295,588 | |

| | | |

| Other current assets | 55,777 | | | 74,493 | |

| Total current assets | 2,806,963 | | | 3,465,953 | |

| Other assets: | | | |

| Goodwill | 127,856 | | | 129,342 | |

| Other intangible assets, net | 85,579 | | | 100,907 | |

| Right of use assets, net | 54,234 | | | 61,890 | |

| | | |

| Other assets, net | 87,010 | | | 87,175 | |

| Total other assets | 354,679 | | | 379,314 | |

| Property, plant and equipment, net | 693,365 | | | 762,729 | |

| Total assets | $ | 3,855,007 | | | $ | 4,607,996 | |

| | | |

| Liabilities and equity | | | |

| Current liabilities: | | | |

| Short-term debt | $ | 43,106 | | | $ | 272,575 | |

| Trade and other payables | 1,055,473 | | | 1,423,633 | |

| Customer prepayments and deferred revenue | 187,054 | | | 370,524 | |

| Commodity derivative liabilities – current | 90,849 | | | 98,519 | |

| Current maturities of long-term debt | 27,561 | | | 110,155 | |

| | | |

| Accrued expenses and other current liabilities | 232,288 | | | 245,916 | |

| Total current liabilities | 1,636,331 | | | 2,521,322 | |

| Long-term lease liabilities | 31,659 | | | 37,147 | |

| Long-term debt, less current maturities | 562,960 | | | 492,518 | |

| Deferred income taxes | 58,581 | | | 64,080 | |

| | | |

| Other long-term liabilities | 49,089 | | | 63,160 | |

| Total liabilities | 2,338,620 | | | 3,178,227 | |

| Total equity | 1,516,387 | | | 1,429,769 | |

| Total liabilities and equity | $ | 3,855,007 | | | $ | 4,607,996 | |

The Andersons, Inc.

Consolidated Statements of Cash Flows

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Operating Activities | | | | | | | |

| Net income from continuing operations | $ | 78,437 | | | $ | 21,170 | | | $ | 132,529 | | | $ | 154,954 | |

| Income (loss) from discontinued operations, net of income taxes | — | | | (6,074) | | | — | | | 12,025 | |

| Net income | 78,437 | | | 15,096 | | | 132,529 | | | 166,979 | |

Adjustments to reconcile net income to cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 31,306 | | | 33,476 | | | 125,106 | | | 134,742 | |

| Bad debt expense, net | 5,438 | | | 973 | | | 11,519 | | | 6,001 | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation expense | 3,493 | | | 3,495 | | | 12,857 | | | 11,192 | |

| Deferred federal income tax | 6,696 | | | 810 | | | (1,596) | | | (20,009) | |

| | | | | | | |

| Gain on sale of business from continuing operations | — | | | — | | | (5,643) | | | — | |

| Asset impairment | — | | | 11,818 | | | 87,156 | | | 11,818 | |

Gain on sale of business from discontinued operations | — | | | — | | | — | | | (27,091) | |

| Damaged inventory | — | | | 17,328 | | | — | | | 17,328 | |

| Other | (10,535) | | | 7,275 | | | (10,698) | | | 14,073 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts and notes receivable | 62,705 | | | (250,537) | | | 468,968 | | | (391,403) | |

| Inventories | (175,883) | | | (179,995) | | | 572,235 | | | 56,859 | |

| Commodity derivatives | 12,027 | | | 170,300 | | | 111,506 | | | 65,399 | |

| Other current and non-current assets | 4,481 | | | 8,936 | | | 6,529 | | | 10,936 | |

| Payables and other current and non-current liabilities | 232,498 | | | 601,512 | | | (563,718) | | | 230,293 | |

Net cash provided by operating activities | 250,663 | | | 440,487 | | | 946,750 | | | 287,117 | |

| Investing Activities | | | | | | | |

| Acquisition of businesses, net of cash acquired | (313) | | | (20,245) | | | (24,698) | | | (20,245) | |

| Purchases of property, plant and equipment and capitalized software | (41,725) | | | (36,037) | | | (150,443) | | | (108,284) | |

| Proceeds from sale of assets | 424 | | | 497 | | | 3,506 | | | 5,307 | |

| Purchase of investments | — | | | — | | | (1,730) | | | (2,105) | |

| Proceeds from sale of business from continuing operations | — | | | — | | | 10,318 | | | 5,171 | |

| Proceeds from sale of Rail assets | — | | | — | | | 2,871 | | | 36,706 | |

| Proceeds from sale of business from discontinued operations | — | | | — | | | — | | | 56,302 | |

| Purchases of Rail assets | — | | | (3,994) | | | — | | | (31,458) | |

| Other | 4,998 | | | 3,958 | | | 6,297 | | | 5,704 | |

Net cash used in investing activities | (36,616) | | | (55,821) | | | (153,879) | | | (52,902) | |

| Financing Activities | | | | | | | |

| Net (payments) receipts under short-term lines of credit | 27,456 | | | (382,591) | | | (233,696) | | | (21,273) | |

| Proceeds from issuance of short-term debt | — | | | — | | | — | | | 350,000 | |

| Payments of short-term debt | — | | | — | | | — | | | (550,000) | |

| Proceeds from issuance of long-term debt | — | | | — | | | 100,000 | | | — | |

| Payments of long-term debt | (6,886) | | | (7,460) | | | (49,620) | | | (30,045) | |

| | | | | | | |

| Distributions to noncontrolling interest owner | (2,114) | | | (9,980) | | | (46,418) | | | (44,910) | |

| | | | | | | |

| Dividends paid | (6,602) | | | (6,347) | | | (25,373) | | | (24,609) | |

| | | | | | | |

| Common stock repurchased | — | | | (5,952) | | | (1,747) | | | (12,721) | |

| | | | | | | |

| Other | (1) | | | 2,111 | | | (7,139) | | | (1,172) | |

| Net cash provided by (used in) financing activities | 11,853 | | | (410,219) | | | (263,993) | | | (334,730) | |

| Effect of exchange rates on cash and cash equivalents | (101) | | | 51 | | | (293) | | | (660) | |

| Increase (decrease) in Cash and cash equivalents | 225,799 | | | (25,502) | | | 528,585 | | | (101,175) | |

Cash and cash equivalents at the beginning of the period | 418,055 | | | 140,771 | | | 115,269 | | | 216,444 | |

Cash and cash equivalents at the end of the period | $ | 643,854 | | | $ | 115,269 | | | $ | 643,854 | | | $ | 115,269 | |

The Andersons, Inc.

Adjusted Net Income from Continuing Operations Attributable to The Andersons, Inc.

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| (in thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| Net income from continuing operations | $ | 78,437 | | | $ | 21,170 | | | $ | 132,529 | | | $ | 154,954 | |

| Net income attributable to noncontrolling interests | 27,251 | | | 6,072 | | | 31,339 | | | 35,899 | |

Net income from continuing operations attributable to The Andersons, Inc. | 51,186 | | | 15,098 | | | 101,190 | | | 119,055 | |

| Adjustments: | | | | | | | |

| Asset impairment including equity method investments | — | | | 9,000 | | | 45,413 | | | 13,455 | |

| Transaction related compensation | 3,212 | | | — | | | 7,818 | | | — | |

| Goodwill impairment | 686 | | | — | | | 686 | | | — | |

| Gain on cost method investment | — | | | — | | | (4,798) | | | — | |

| Gain on sale of assets | — | | | — | | | (5,643) | | | (3,762) | |

| Gain on deconsolidation of joint venture | — | | | — | | | (6,544) | | | — | |

| Insured inventory expenses (recoveries) | — | | | 15,993 | | | (16,080) | | | 15,993 | |

Income tax impact of adjustments1 | (520) | | | (6,248) | | | (3,775) | | | (5,308) | |

| Total adjusting items, net of tax | 3,378 | | | 18,745 | | | 17,077 | | | 20,378 | |

Adjusted net income from continuing operations attributable to The Andersons, Inc. | $ | 54,564 | | | $ | 33,843 | | | $ | 118,267 | | | $ | 139,433 | |

| | | | | | | |

| Diluted earnings per share attributable to The Andersons, Inc. common shareholders from continuing operations | $ | 1.49 | | | $ | 0.44 | | | $ | 2.94 | | | $ | 3.46 | |

| | | | | | | |

Impact on diluted earnings per share from continuing operations | $ | 0.10 | | | $ | 0.54 | | | $ | 0.50 | | | $ | 0.59 | |

| Adjusted diluted earnings per share attributable to The Andersons, Inc. common shareholders from continuing operations | $ | 1.59 | | | $ | 0.98 | | | $ | 3.44 | | | $ | 4.05 | |

1 The income tax impact of adjustments is taken at the statutory tax rate of 25% with the exception of certain transaction related compensation, goodwill impairments, and impairments of equity method investments in both 2023 and 2022, respectively.

Adjusted net income (loss) attributable to The Andersons, Inc. from continuing operations reflects reported net income (loss) available to The Andersons, Inc. common shareholders from continuing operations after the removal of specified items described above. Adjusted diluted earnings (loss) from continuing operations per share reflects the fully diluted EPS of The Andersons, Inc. after removal of the effect on EPS as reported of specified items described above. Management believes that Adjusted net income (loss) attributable to The Andersons, Inc. from continuing operations and Adjusted diluted earnings (loss) from continuing operations per share are useful measures of The Andersons, Inc. performance as they provide investors additional information about the operations of the company allowing better evaluation of underlying business performance and better comparability to previous periods. These non-GAAP financial measures are not intended to replace or be alternatives to Net income attributable to The Andersons, Inc. and Diluted earnings attributable to The Andersons, Inc. common shareholders as reported, the most directly comparable GAAP financial measures, or any other measures of operating results under GAAP. Earnings amounts described above have been divided by the company’s average number of diluted shares outstanding for each respective period in order to arrive at an adjusted diluted earnings (loss) from continuing operations per share amount for each specified item.

The Andersons, Inc.

Segment Data

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total |

Three months ended December 31, 2023 | | | | | | | | | |

| Sales and merchandising revenues | $ | 2,212,434 | | | $ | 795,236 | | | $ | 205,330 | | | $ | — | | | $ | 3,213,000 | |

| Gross profit | 126,064 | | | 65,257 | | | 26,393 | | | — | | | 217,714 | |

| Operating, administrative and general expenses | 88,097 | | | 7,933 | | | 24,091 | | | 12,591 | | | 132,712 | |

| Other income (loss), net | 11,839 | | | 3,401 | | | 439 | | | (819) | | | 14,860 | |

| Income (loss) before income taxes from continuing operations | 43,807 | | | 59,988 | | | 1,374 | | | (13,408) | | | 91,761 | |

| Income attributable to the noncontrolling interests | — | | | 27,251 | | | — | | | — | | | 27,251 | |

Income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 43,807 | | | $ | 32,737 | | | $ | 1,374 | | | $ | (13,408) | | | $ | 64,510 | |

Adjustments to income (loss) before income taxes from continuing operations2 | 3,212 | | | — | | | 686 | | | — | | | 3,898 | |

Adjusted income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 47,019 | | | $ | 32,737 | | | $ | 2,060 | | | $ | (13,408) | | | $ | 68,408 | |

| | | | | | | | | |

Three months ended December 31, 2022 | | | | | | | | | |

| Sales and merchandising revenues | $ | 3,624,563 | | | $ | 797,818 | | | $ | 255,107 | | | $ | — | | | $ | 4,677,488 | |

| Gross profit | 113,726 | | | 27,239 | | | 29,058 | | | — | | | 170,023 | |

| Operating, administrative and general expenses | 77,725 | | | 7,197 | | | 25,660 | | | 16,889 | | | 127,471 | |

| Other income (loss), net | 10,513 | | | 981 | | | 313 | | | (169) | | | 11,638 | |

| Income (loss) before income taxes from continuing operations | 27,232 | | | 18,582 | | | 1,717 | | | (16,428) | | | 31,103 | |

| Income attributable to the noncontrolling interests | — | | | 6,072 | | | — | | | — | | | 6,072 | |

Income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 27,232 | | | $ | 12,510 | | | $ | 1,717 | | | $ | (16,428) | | | $ | 25,031 | |

Adjustments to income (loss) before income taxes from continuing operations2 | 24,993 | | | — | | | — | | | — | | | 24,993 | |

Adjusted income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 52,225 | | | $ | 12,510 | | | $ | 1,717 | | | $ | (16,428) | | | $ | 50,024 | |

1 Income (loss) from continuing operations before income taxes attributable to The Andersons, Inc. for each operating segment is defined as net sales and merchandising revenues plus identifiable other income less all identifiable operating expenses, including interest expense for carrying working capital and long-term assets and is reported net of the noncontrolling interest share of income.

2 Additional information on the individual adjustments that are included in the adjustments to income (loss) from continuing operations before income taxes can be found in the Reconciliation to EBITDA and Adjusted EBITDA table.

The Andersons, Inc.

Segment Data (continued)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total |

Twelve months ended December 31, 2023 | | | | | | | | | |

| Sales and merchandising revenues | $ | 10,426,083 | | | $ | 3,380,632 | | | $ | 943,397 | | | $ | — | | | $ | 14,750,112 | |

| Gross profit | 409,950 | | | 202,397 | | | 133,016 | | | — | | | 745,363 | |

| Operating, administrative and general expenses | 308,470 | | | 32,737 | | | 103,342 | | | 47,711 | | | 492,260 | |

| Other income, net | 29,988 | | | 15,056 | | | 2,391 | | | 3,048 | | | 50,483 | |

| Income (loss) before income taxes from continuing operations | 96,234 | | | 91,175 | | | 25,049 | | | (42,895) | | | 169,563 | |

| Income attributable to the noncontrolling interests | — | | | 31,339 | | | — | | | — | | | 31,339 | |

Income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 96,234 | | | $ | 59,836 | | | $ | 25,049 | | | $ | (42,895) | | | $ | 138,224 | |

Adjustments to income (loss) before income taxes from continuing operations2 | (12,942) | | | 37,906 | | | 686 | | | (4,798) | | | 20,852 | |

Adjusted income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 83,292 | | | $ | 97,742 | | | $ | 25,735 | | | $ | (47,693) | | | $ | 159,076 | |

| | | | | | | | | |

Twelve months ended December 31, 2022 | | | | | | | | | |

| Sales and merchandising revenues | $ | 13,047,537 | | | $ | 3,178,539 | | | $ | 1,099,308 | | | $ | — | | | $ | 17,325,384 | |

| Gross profit | 407,707 | | | 126,995 | | | 149,462 | | | — | | | 684,164 | |

| Operating, administrative and general expenses | 273,592 | | | 30,730 | | | 106,003 | | | 47,231 | | | 457,556 | |

| Other income (loss), net | 12,661 | | | 20,731 | | | 3,001 | | | (2,570) | | | 33,823 | |

| Income (loss) before income taxes from continuing operations | 95,225 | | | 108,221 | | | 39,162 | | | (48,026) | | | 194,582 | |

| Income attributable to the noncontrolling interests | — | | | 35,899 | | | — | | | — | | | 35,899 | |

Income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 95,225 | | | $ | 72,322 | | | $ | 39,162 | | | $ | (48,026) | | | $ | 158,683 | |

Adjustments to income (loss) before income taxes from continuing operations2 | 25,686 | | | — | | | — | | | — | | | 25,686 | |

Adjusted income (loss) before income taxes from continuing operations attributable to The Andersons, Inc.1 | $ | 120,911 | | | $ | 72,322 | | | $ | 39,162 | | | $ | (48,026) | | | $ | 184,369 | |

1 Income (loss) from continuing operations before income taxes attributable to The Andersons, Inc. for each operating segment is defined as net sales and merchandising revenues plus identifiable other income less all identifiable operating expenses, including interest expense for carrying working capital and long-term assets and is reported net of the noncontrolling interest share of income.

2 Additional information on the individual adjustments that are included in the adjustments to income (loss) from continuing operations before income taxes can be found in the Reconciliation to EBITDA and Adjusted EBITDA table. All adjustments are consistent with the EBITDA reconciliation with the exception of a $42.7 million difference in the Renewables segment which represents the asset impairment expense attributable to the non-controlling interest that is already represented in Income attributable to the noncontrolling interest within the reconciliation above.

The Andersons, Inc.

Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Continuing Operations | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total | | | |

Three months ended December 31, 2023 | | | | | | | | | | | | | |

Net income (loss)1 | $ | 43,807 | | | $ | 59,988 | | | $ | 1,374 | | | $ | (26,732) | | | $ | 78,437 | | | | | |

| Interest expense (income) | 5,999 | | | 737 | | | 1,367 | | | (2) | | | 8,101 | | | | | |

| Tax provision | — | | | — | | | — | | | 13,324 | | | 13,324 | | | | | |

| Depreciation and amortization | 9,450 | | | 12,184 | | | 7,750 | | | 1,922 | | | 31,306 | | | | | |

EBITDA1 | 59,256 | | | 72,909 | | | 10,491 | | | (11,488) | | | 131,168 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Transaction related compensation | 3,212 | | | — | | | — | | | — | | | 3,212 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Goodwill impairment | — | | | — | | | 686 | | | — | | | 686 | | | | | |

| Total adjusting items | 3,212 | | | — | | | 686 | | | — | | | 3,898 | | | | | |

Adjusted EBITDA1 | $ | 62,468 | | | $ | 72,909 | | | $ | 11,177 | | | $ | (11,488) | | | $ | 135,066 | | | | | |

| | | | | | | | | | | | | |

Three months ended December 31, 2022 | | | | | | | | | | | | | |

Net income (loss) from continuing operations | $ | 27,232 | | | $ | 18,582 | | | $ | 1,717 | | | $ | (26,361) | | | $ | 21,170 | | | | | |

| Interest expense (income) | 10,282 | | | 2,441 | | | 1,994 | | | (630) | | | 14,087 | | | | | |

| Tax provision | — | | | — | | | — | | | 9,933 | | | 9,933 | | | | | |

| Depreciation and amortization | 9,054 | | | 15,443 | | | 6,834 | | | 2,145 | | | 33,476 | | | | | |

EBITDA from continuing operations | 46,568 | | | 36,466 | | | 10,545 | | | (14,913) | | | 78,666 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Asset impairment | 9,000 | | | — | | | — | | | — | | | 9,000 | | | | | |

| | | | | | | | | | | | | |

Insured inventory expenses | 15,993 | | | — | | | — | | | — | | | 15,993 | | | | | |

| Total adjusting items | 24,993 | | | — | | | — | | | — | | | 24,993 | | | | | |

Adjusted EBITDA from continuing operations | $ | 71,561 | | | $ | 36,466 | | | $ | 10,545 | | | $ | (14,913) | | | $ | 103,659 | | | | | |

1 Amounts for the three months ended December 31, 2023, contain no activity from discontinued operations. As such, references to EBITDA and EBITDA from continuing operations, as well as, Adjusted EBITDA and Adjusted EBITDA from continuing operations will yield the same results for the three months ended December 31, 2023.

Adjusted EBITDA is defined as earnings before interest, taxes and depreciation and amortization, adjusted for specified items. The company calculates adjusted EBITDA by removing the impact of specified items and adding back the amounts of interest expense, tax expense and depreciation and amortization to net income (loss). Management believes that adjusted EBITDA is a useful measure of the company’s performance as it provides investors additional information about the company’s operations allowing better evaluation of underlying business performance and improved comparability to prior periods. Adjusted EBITDA is a non-GAAP financial measure and is not intended to replace or be an alternative to net income (loss), the most directly comparable GAAP financial measure.

The Andersons, Inc.

Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| (in thousands) | Trade | | Renewables | | Nutrient & Industrial | | Other | | Total | | | | |

Twelve months ended December 31, 2023 | | | | | | | | | | | | | |

Net income (loss)1 | $ | 96,234 | | | $ | 91,175 | | | $ | 25,049 | | | $ | (79,929) | | | $ | 132,529 | | | | | |

| Interest expense (income) | 35,234 | | | 6,385 | | | 7,016 | | | (1,768) | | | 46,867 | | | | | |

| Tax provision | — | | | — | | | — | | | 37,034 | | | 37,034 | | | | | |

| Depreciation and amortization | 36,109 | | | 51,408 | | | 29,268 | | | 8,321 | | | 125,106 | | | | | |

EBITDA1 | 167,577 | | | 148,968 | | | 61,333 | | | (36,342) | | | 341,536 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| Transaction related compensation | 7,818 | | | — | | | — | | | — | | | 7,818 | | | | | |

| Asset impairment including equity method investment | 963 | | | 87,156 | | | — | | | — | | | 88,119 | | | | | |

| Gain on sale of assets | (5,643) | | | — | | | — | | | — | | | (5,643) | | | | | |

| Insured inventory recoveries | (16,080) | | | — | | | — | | | — | | | (16,080) | | | | | |

| Gain on deconsolidation of joint venture | — | | | (6,544) | | | — | | | — | | | (6,544) | | | | | |

| Goodwill impairment | — | | | — | | | 686 | | | — | | | 686 | | | | | |

| Gain on cost method investment | — | | | — | | | — | | | (4,798) | | | (4,798) | | | | | |

| Total adjusting items | (12,942) | | | 80,612 | | | 686 | | | (4,798) | | | 63,558 | | | | | |

Adjusted EBITDA1 | $ | 154,635 | | | $ | 229,580 | | | $ | 62,019 | | | $ | (41,140) | | | $ | 405,094 | | | | | |

| | | | | | | | | | | | | |

Twelve months ended December 31, 2022 | | | | | | | | | | | | | |

Net income (loss) from continuing operations | $ | 95,225 | | | $ | 108,221 | | | $ | 39,162 | | | $ | (87,654) | | | $ | 154,954 | | | | | |

| Interest expense (income) | 42,551 | | | 8,775 | | | 7,298 | | | (1,775) | | | 56,849 | | | | | |

| Tax provision | — | | | — | | | — | | | 39,628 | | | 39,628 | | | | | |

| Depreciation and amortization | 35,953 | | | 63,458 | | | 26,634 | | | 8,697 | | | 134,742 | | | | | |

EBITDA from continuing operations | 173,729 | | | 180,454 | | | 73,094 | | | (41,104) | | | 386,173 | | | | | |

| Adjusting items impacting EBITDA: | | | | | | | | | | | | | |

| Gain on sale of assets | (3,762) | | | — | | | — | | | — | | | (3,762) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Asset impairment including equity method investments | 13,455 | | | — | | | — | | | — | | | 13,455 | | | | | |

| | | | | | | | | | | | | |

Insured inventory expenses | 15,993 | | | — | | | — | | | — | | | 15,993 | | | | | |

| Total adjusting items | 25,686 | | | — | | | — | | | — | | | 25,686 | | | | | |

Adjusted EBITDA from continuing operations | $ | 199,415 | | | $ | 180,454 | | | $ | 73,094 | | | $ | (41,104) | | | $ | 411,859 | | | | | |

1 Amounts for the twelve months ended December 31, 2023, contain no activity from discontinued operations. As such, references to EBITDA and EBITDA from continuing operations, as well as, Adjusted EBITDA and Adjusted EBITDA from continuing operations will yield the same results for the twelve months ended December 31, 2023.

Adjusted EBITDA is defined as earnings before interest, taxes and depreciation and amortization, adjusted for specified items. The company calculates adjusted EBITDA by removing the impact of specified items and adding back the amounts of interest expense, tax expense and depreciation and amortization to net income (loss). Management believes that adjusted EBITDA is a useful measure of the company’s performance as it provides investors additional information about the company’s operations allowing better evaluation of underlying business performance and improved comparability to prior periods. Adjusted EBITDA is a non-GAAP financial measure and is not intended to replace or be an alternative to net income (loss), the most directly comparable GAAP financial measure.

Andersons, Inc.

Cash from Operations Before Working Capital Changes

A non-GAAP financial measure

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

Cash provided by operating activities | $ | 250,663 | | | $ | 440,487 | | | $ | 946,750 | | | $ | 287,117 | |

| Changes in operating assets and liabilities | | | | | | | |

| Accounts receivable | 62,705 | | | (250,537) | | | 468,968 | | | (391,403) | |

| Inventories | (175,883) | | | (179,995) | | | 572,235 | | | 56,859 | |

| Commodity derivatives | 12,027 | | | 170,300 | | | 111,506 | | | 65,399 | |

| Other current and non-current assets | 4,481 | | | 8,936 | | | 6,529 | | | 10,936 | |

| Payables and other current and non-current liabilities | 232,498 | | | 601,512 | | | (563,718) | | | 230,293 | |

| Total changes in operating assets and liabilities | 135,828 | | | 350,216 | | | 595,520 | | | (27,916) | |

Adjusting items impacting cash from operations before

working capital changes: | | | | | | | |

| Less: Insured inventory recoveries | — | | | — | | | (16,080) | | | — | |

| Less: Unrealized foreign currency losses on receivables | 7,270 | | | — | | | (4,818) | | | — | |

| | | | | | | |

| Cash from operations before working capital changes | $ | 122,105 | | | $ | 90,271 | | | $ | 330,332 | | | $ | 315,033 | |

Cash from operations before working capital changes is defined as cash provided by (used in) operating activities before the impact of changes in working capital within the statement of cash flows. The company calculates cash from operations by eliminating the effect of changes in accounts receivable, inventories, commodity derivatives, other current and non-current assets, and payables and other current and non-current liabilities; and adjusted by specific items from the cash provided by (used in) operating activities. Management believes that cash from operations before working capital changes is a useful measure of the company’s performance as it provides investors additional information about the company’s operations allowing better evaluation of underlying business performance and improved comparability to prior periods. Cash from operations before working capital changes is a non-GAAP financial measure and is not intended to replace or be an alternative to cash provided by (used in) operating activities, the most directly comparable GAAP financial measure.

v3.24.0.1

Cover page

|

Feb. 20, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 20, 2024

|

| Entity Registrant Name |

Andersons, Inc.

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

000-20557

|

| Entity Tax Identification Number |

34-1562374

|

| Entity Address, Address Line One |

1947 Briarfield Boulevard

|

| Entity Address, City or Town |

Maumee

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43537

|

| City Area Code |

419

|

| Local Phone Number |

893-5050

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.00 par value, $0.01 stated value

|

| Trading Symbol |

ANDE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000821026

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

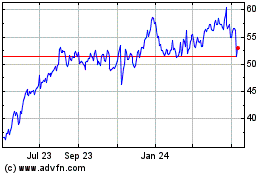

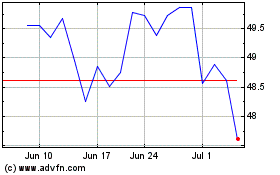

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024