0000895126false00008951262024-02-202024-02-200000895126us-gaap:CommonClassAMember2024-02-202024-02-200000895126chk:ClassAWarrantsMember2024-02-202024-02-200000895126chk:ClassBWarrantsMember2024-02-202024-02-200000895126chk:ClassCWarrantsMember2024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2024

| | | | | | | | | | | | | | | | | | | | | | | |

| CHESAPEAKE ENERGY CORPORATION |

| (Exact name of Registrant as specified in its Charter) |

| Oklahoma | | 001-13726 | | 73-1395733 |

(State or other jurisdiction of

incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

| 6100 North Western Avenue | Oklahoma City | OK | | 73118 |

| (Address of principal executive offices) | | (Zip Code) |

| | (405) | 848-8000 | | | |

| (Registrant’s telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | CHK | | The Nasdaq Stock Market LLC |

| Class A Warrants to purchase Common Stock | | CHKEW | | The Nasdaq Stock Market LLC |

| Class B Warrants to purchase Common Stock | | CHKEZ | | The Nasdaq Stock Market LLC |

| Class C Warrants to purchase Common Stock | | CHKEL | | The Nasdaq Stock Market LLC |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On February 20, 2024, Chesapeake Energy Corporation (“Chesapeake”) issued a press release reporting fourth quarter and full year 2023 financial and operational results. A copy of the press release and financial information are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

The information contained in the press releases is being furnished, not filed, pursuant to Item 2.02. Accordingly, the information contained in the press releases shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

On February 21, 2024, Chesapeake will make a presentation about its financial and operating results for the fourth quarter and full year of 2023, and its 2024 outlook and capital expenditure program. Chesapeake has made the presentation available on its website at http://investors.chk.com. This information is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Document Description |

| | Chesapeake Energy Corporation press release dated February 20, 2024 |

| | Supplemental Financial Information |

| 104.0 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| CHESAPEAKE ENERGY CORPORATION |

| |

| |

| By: | /s/ MOHIT SINGH |

| Mohit Singh |

| Executive Vice President and Chief Financial Officer |

Date: February 20, 2024

| | | | | |

| Exhibit 99.1 |

| N E W S R E L E A S E | |

FOR IMMEDIATE RELEASE

FEBRUARY 20, 2024

CHESAPEAKE REPORTS FOURTH QUARTER AND FULL-YEAR 2023 FINANCIAL AND OPERATING RESULTS AND ISSUES 2024 OUTLOOK

OKLAHOMA CITY, February 20, 2024 – Chesapeake Energy Corporation (NASDAQ:CHK) today reported fourth quarter and full-year 2023 results and issued 2024 guidance.

Fourth Quarter 2023 Highlights:

•Net cash provided by operating activities of $470 million

•Net income totaled $569 million, or $4.02 per fully diluted share; adjusted net income(1) totaled $185 million, or $1.31 per share

•Adjusted EBITDAX(1) of $635 million; free cash flow(1) of $91 million

•Produced approximately 3.43 bcfe/d net (98% natural gas)

•Closed remaining Eagle Ford divestiture package for approximately $700 million

Full-Year 2023 Highlights:

•Net cash provided by operating activities of $2.4 billion

•Net income totaled $2.4 billion, or $16.92 per fully diluted share; adjusted net income(1) totaled $702 million, or $4.91 per share

•Adjusted EBITDAX(1) of $2.5 billion; free cash flow(1) of $551 million

•Returned approximately $840 million to shareholders, approximately $480 million in dividends and approximately $360 million in share repurchases

•Successfully closed Eagle Ford divestitures; total proceeds greater than $3.5 billion

2024 Outlook Highlights:

•Lowering prior capital expenditure guidance approximately 20% to $1.25 – $1.35 billion through rig count reductions and deferring completions and turn-in-lines

•Capital plan generates a baseline guide of 2.65 – 2.75 bcf/d

•Announced Southwestern Energy merger targeted to close in the second quarter

•Signed LNG SPAs with offtake from Delfin LNG and sale to Gunvor at a JKM linked price

(1) A Non-GAAP measure as defined in the supplemental financial tables available on the company's website at www.chk.com.

Nick Dell’Osso, Chesapeake’s President and Chief Executive Officer, said, “2023 marked another year of strong operational performance for Chesapeake as we delivered approximately $840 million to shareholders via our capital return framework despite a challenging commodity price environment. Our 2024 operating plan is designed to prudently respond to today’s market, further demonstrating our continued focus on capital discipline, operational efficiency, and free cash flow generation to consistently deliver through all demand cycles. Our strategic combination with Southwestern will make our future outlook even stronger, extending America’s energy reach by positioning us to deliver more reliable, affordable, lower carbon energy to markets in need. We are forming the first U.S. independent that can truly compete on a global scale, redefining the natural gas producer to the benefit of our shareholders and energy consumers alike.”

| | | | | | | | |

| | |

| INVESTOR CONTACT: | MEDIA CONTACT: | CHESAPEAKE ENERGY CORPORATION |

Chris Ayres (405) 935-8870 ir@chk.com | Brooke Coe (405) 935-8878 media@chk.com | 6100 North Western Avenue P.O. Box 18496 Oklahoma City, OK 73154 |

Shareholder Return Update

Chesapeake generated $470 million of operating cash flow and $91 million of free cash flow(1) during the fourth quarter. Chesapeake plans to pay its base dividend on March 26, 2023 to shareholders of record at the close of business on March 7, 2023.

Including fourth quarter base dividends and buybacks, Chesapeake returned approximately $840 million to shareholders in 2023 and over $3.2 billion since 2021. The company completed $1.4 billion of stock buybacks under its two-year, $2 billion authorization that expired on December 31, 2023, redeeming 16 million common shares.

Operations Update

Chesapeake’s net production in the fourth quarter was approximately 3.43 bcfe per day (approximately 98% natural gas and 2% total liquids), utilizing an average of nine rigs to drill 45 wells and place 52 wells on production.

For the full year 2023, the company produced approximately 3.66 bcfe per day (approximately 95% natural gas and 5% total liquids), utilizing an average of 11 rigs to drill 193 wells and place 166 wells on production.

Chesapeake is currently operating nine rigs (five in the Haynesville and four in the Marcellus) and four frac crews (two in each basin). Given current market dynamics, the company plans to defer placing wells on production while reducing rig and completion activity. The company will drop a rig in the Haynesville and Marcellus in March and around mid-year, respectively, and a frac crew in each basin in March. These activity levels will be maintained through year end. Deferring new well production and completion activity will build short-cycle, capital efficient productive capacity which can be activated when consumer demand requires it. The company expects to drill 95 to 115 wells and place 30 to 40 wells on production in 2024.

Chesapeake announced earlier this month the signing of its first LNG Sale and Purchase Agreements (SPA) which represents two long-term SPAs for LNG. Under the SPAs, Chesapeake will purchase approximately 0.5 million tonnes per annum (“mtpa”) of LNG from Delfin LNG at a Henry Hub linked price with a targeted contract start date in 2028. Chesapeake will then deliver the LNG to Gunvor on an FOB basis with the sales price linked to the Japan Korea Marker (“JKM”) for a period of 20 years. These volumes represent 0.5 mtpa of the previously announced up to 2 mtpa HOA with Gunvor.

ESG Update

Chesapeake successfully recertified all assets under the MiQ/EO100™ standard, maintaining 100% independent responsibly sourced gas certification across its entire portfolio.

The company remains committed to achieving its expanded 2035 net zero goal, inclusive of both Scope 1 and Scope 2 GHG emissions. From 2020 to 2022, Chesapeake installed more than 2,000 continuous methane emission monitoring devices and retrofitted more than 19,000 pneumatic devices leading to a 37% and 64% reduction in Scope 1 and 2 GHG emissions intensity and methane emissions intensity, respectively. Chesapeake will continue its work on direct emission reductions while also investing in adjacent technology and businesses to meet its net zero commitment.

Chesapeake’s culture of operational excellence and safety resulted in a ~40% year-over-year combined TRIR improvement, to an industry leading 0.14.

Conference Call Information

Chesapeake plans to conduct a conference call to discuss its recent financial and operating results and its 2024 outlook at 9:00 AM EST on Wednesday, February 21, 2024. The telephone number to access the conference call is 888-317-6003 or 412-317-6061 for international callers. The passcode is 8453967.

Financial Statements, Non-GAAP Financial Measures and 2023 Guidance and Outlook Projections

The company’s 2023 fourth quarter and year-end financial and operational results, along with non-GAAP measures that adjust for items typically excluded by securities analysts, are available on the company’s website. Non-GAAP measures should not be considered as an alternative to GAAP measures. Reconciliations of these non-GAAP measures and other disclosures are provided with the supplemental financial tables available on the company’s website at www.chk.com. Management’s updated guidance for 2024 can be found on the company’s website at www.chk.com.

Headquartered in Oklahoma City, Chesapeake Energy Corporation (NASDAQ:CHK) is powered by dedicated and innovative employees who are focused on discovering and responsibly developing our leading positions in top U.S. oil and gas plays. With a goal to achieve net zero GHG emissions (Scope 1 and 2) by 2035, Chesapeake is committed to safely answering the call for affordable, reliable, lower carbon energy.

Forward-Looking Statements

This release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements include our current expectations or forecasts of future events, including matters relating to the pending merger with Southwestern Energy Company (“Southwestern”), armed conflict and instability in Europe and the Middle East, along with the effects of the current global economic environment, and the impact of each on our business, financial condition, results of operations and cash flows, actions by, or disputes among or between, members of OPEC+ and other foreign oil-exporting countries, market factors, market prices, our ability to meet debt service requirements, our ability to continue to pay cash dividends, the amount and timing of any cash dividends and our ESG initiatives. Forward-looking and other statements in our Annual Report on Form 10-K (“Form 10-K”) regarding our environmental, social and other sustainability plans and goals are not an indication that these statements are necessarily material to investors or required to be disclosed in our filings with the SEC. In addition, historical, current, and forward-looking environmental, social and sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. Forward-looking statements often address our expected future business, financial performance and financial condition, and often contain words such as "expect," “could,” “may,” "anticipate," "intend," "plan," “ability,” "believe," "seek," "see," "will," "would," “estimate,” “forecast,” "target," “guidance,” “outlook,” “opportunity” or “strategy.”

Although we believe the expectations and forecasts reflected in our forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. No assurance can be given that such forward-looking statements will be correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

•conservation measures and technological advances could reduce demand for natural gas and oil;

•negative public perceptions of our industry;

•competition in the natural gas and oil exploration and production industry;

•the volatility of natural gas, oil and NGL prices, which are affected by general economic and business conditions, as well as increased demand for (and availability of) alternative fuels and electric vehicles;

•risks from regional epidemics or pandemics and related economic turmoil, including supply chain constraints;

•write-downs of our natural gas and oil asset carrying values due to low commodity prices;

•significant capital expenditures are required to replace our reserves and conduct our business;

•our ability to replace reserves and sustain production;

•uncertainties inherent in estimating quantities of natural gas, oil and NGL reserves and projecting future rates of production and the amount and timing of development expenditures;

•drilling and operating risks and resulting liabilities;

•our ability to generate profits or achieve targeted results in drilling and well operations;

•leasehold terms expiring before production can be established;

•risks from our commodity price risk management activities;

•uncertainties, risks and costs associated with natural gas and oil operations;

•our need to secure adequate supplies of water for our drilling operations and to dispose of or recycle the water used;

•pipeline and gathering system capacity constraints and transportation interruptions;

•our plans to participate in the LNG export industry;

•terrorist activities and/or cyber-attacks adversely impacting our operations;

•risks from failure to protect personal information and data and compliance with data privacy and security laws and regulations;

•disruption of our business by natural or human causes beyond our control;

•a deterioration in general economic, business or industry conditions;

•the impact of inflation and commodity price volatility, including as a result of armed conflict and instability in Europe and the Middle East, along with the effects of the current global economic environment, on our business, financial condition, employees, contractors, vendors and the global demand for natural gas and oil and on U.S. and global financial markets;

•our inability to access the capital markets on favorable terms;

•the limitations on our financial flexibility due to our level of indebtedness and restrictive covenants from our indebtedness;

•our actual financial results after emergence from bankruptcy may not be comparable to our historical financial information;

•risks related to acquisitions or dispositions, or potential acquisitions or dispositions, including risks related to the pending merger with Southwestern, such as the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the possibility that our stockholders may not approve the issuance of our common stock in connection with the proposed transaction; the possibility that the stockholders of Southwestern may not approve the merger agreement; the risk that we or Southwestern may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to limitation on our ability to pursue alternatives to the merger; risks related to change in control or other provisions in certain agreements that may be triggered upon completion of the merger; risks related to the merger agreement’s restrictions on business activities prior to the effective time of the merger; risks related to loss of management personnel, other key employees, customers, suppliers, vendors, landlords, joint venture partners and other business partners following the merger; risks related to disruption of management time from ongoing business operations due to the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of our common stock or Southwestern’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected; and the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits;

•our ability to achieve and maintain ESG certifications, goals and commitments;

•legislative, regulatory and ESG initiatives, addressing environmental concerns, including initiatives addressing the impact of global climate change or further regulating hydraulic fracturing, methane emissions, flaring or water disposal;

•federal and state tax proposals affecting our industry;

•risks related to an annual limitation on the utilization of our tax attributes, which is expected to be triggered upon completion of the Merger, as well as trading in our common stock, additional issuances of common stock, and certain other stock transactions, which could lead to an additional, potentially more restrictive, annual limitation; and

•other factors that are described under Risk Factors in Item 1A of Part I of our Form 10-K.

We caution you not to place undue reliance on the forward-looking statements contained in this release, which speak only as of the filing date, and we undertake no obligation to update this information. We urge you to carefully review and consider the disclosures in this release and our filings with the SEC that attempt to advise interested parties of the risks and factors that may affect our business.

| | |

CHESAPEAKE ENERGY CORPORATION - SUPPLEMENTAL TABLES |

| | |

CONSOLIDATED BALANCE SHEETS (unaudited) |

| | | | | | | | | | | | | | |

| ($ in millions, except per share data) | | December 31, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 1,079 | | | $ | 130 | |

| Restricted cash | | 74 | | | 62 | |

| Accounts receivable, net | | 593 | | | 1,438 | |

| Short-term derivative assets | | 637 | | | 34 | |

| Assets held for sale | | — | | | 819 | |

| Other current assets | | 226 | | | 215 | |

| Total current assets | | 2,609 | | 2,698 |

| Property and equipment: | | | | |

| Natural gas and oil properties, successful efforts method | | | | |

| Proved natural gas and oil properties | | 11,468 | | | 11,096 | |

| Unproved properties | | 1,806 | | | 2,022 | |

| Other property and equipment | | 497 | | | 500 | |

| Total property and equipment | | 13,771 | | | 13,618 | |

| Less: accumulated depreciation, depletion and amortization | | (3,674) | | | (2,431) | |

| | | | |

| Total property and equipment, net | | 10,097 | | | 11,187 | |

| Long-term derivative assets | | 74 | | | 47 | |

| Deferred income tax assets | | 933 | | | 1,351 | |

| Other long-term assets | | 663 | | | 185 | |

| Total assets | | $ | 14,376 | | | $ | 15,468 | |

| | | | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 425 | | | $ | 603 | |

| Accrued interest | | 39 | | | 42 | |

| Short-term derivative liabilities | | 3 | | | 432 | |

| Other current liabilities | | 847 | | | 1,627 | |

| Total current liabilities | | 1,314 | | | 2,704 | |

| Long-term debt, net | | 2,028 | | | 3,093 | |

| Long-term derivative liabilities | | 9 | | | 174 | |

| Asset retirement obligations, net of current portion | | 265 | | | 323 | |

| Other long-term liabilities | | 31 | | | 50 | |

| Total liabilities | | 3,647 | | | 6,344 | |

| Contingencies and commitments | | | | |

| Stockholders' equity: | | | | |

| Common stock, $0.01 par value, 450,000,000 shares authorized: 130,789,936 and 134,715,094 shares issued | | 1 | | | 1 | |

| Additional paid-in capital | | 5,754 | | | 5,724 | |

| Retained earnings | | 4,974 | | | 3,399 | |

| Total stockholders' equity | | 10,729 | | | 9,124 | |

| Total liabilities and stockholders' equity | | $ | 14,376 | | | $ | 15,468 | |

| | |

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| ($ in millions, except per share data) | | | | | | | | |

| Revenues and other: | | | | | | | | |

| Natural gas, oil and NGL | | $ | 763 | | | $ | 2,201 | | | $ | 3,547 | | | $ | 9,892 | |

| Marketing | | 513 | | | 935 | | | 2,500 | | | 4,231 | |

| Natural gas and oil derivatives | | 533 | | | 988 | | | 1,728 | | | (2,680) | |

| Gains on sales of assets | | 139 | | | 2 | | | 946 | | | 300 | |

| Total revenues and other | | 1,948 | | | 4,126 | | | 8,721 | | | 11,743 | |

| Operating expenses: | | | | | | | | |

| Production | | 63 | | | 126 | | | 356 | | | 475 | |

| Gathering, processing and transportation | | 190 | | | 257 | | | 853 | | | 1,059 | |

| Severance and ad valorem taxes | | 31 | | | 55 | | | 167 | | | 242 | |

| Exploration | | 8 | | | 9 | | | 27 | | | 23 | |

| Marketing | | 514 | | | 936 | | | 2,499 | | | 4,215 | |

| General and administrative | | 32 | | | 40 | | | 127 | | | 142 | |

| Separation and other termination costs | | 2 | | | 5 | | | 5 | | | 5 | |

| Depreciation, depletion and amortization | | 379 | | | 453 | | | 1,527 | | | 1,753 | |

| | | | | | | | |

| Other operating expense, net | | 3 | | | 17 | | | 18 | | | 49 | |

| Total operating expenses | | 1,222 | | | 1,898 | | | 5,579 | | | 7,963 | |

| Income from operations | | 726 | | | 2,228 | | | 3,142 | | | 3,780 | |

| Other income (expense): | | | | | | | | |

| Interest expense | | (22) | | | (40) | | | (104) | | | (160) | |

| Losses on purchases, exchanges or extinguishments of debt | | — | | | (5) | | | — | | | (5) | |

| Other income | | 31 | | | 7 | | | 79 | | | 36 | |

| Total other income (expense) | | 9 | | | (38) | | | (25) | | | (129) | |

| Income before income taxes | | 735 | | | 2,190 | | | 3,117 | | | 3,651 | |

| Income tax expense (benefit) | | 166 | | | (1,390) | | | 698 | | | (1,285) | |

| Net income | | 569 | | 3,580 | | 2,419 | | 4,936 |

| Deemed dividend on warrants | | — | | | (67) | | | — | | | (67) | |

| Net income available to common stockholders | | $ | 569 | | | $ | 3,513 | | | $ | 2,419 | | | $ | 4,869 | |

| Earnings per common share: | | | | | | | | |

| Basic | | $ | 4.34 | | | $ | 26.16 | | | $ | 18.21 | | | $ | 38.71 | |

| Diluted | | $ | 4.02 | | | $ | 24.00 | | | $ | 16.92 | | | $ | 33.36 | |

| Weighted average common shares outstanding (in thousands): | | | | | | | | |

| Basic | | 130,999 | | 134,275 | | 132,840 | | 125,785 |

| Diluted | | 141,491 | | 146,346 | | 142,976 | | 145,961 |

| | |

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| ($ in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | | |

| Net income | | $ | 569 | | | $ | 3,580 | | | $ | 2,419 | | | $ | 4,936 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

| Depreciation, depletion and amortization | | 379 | | | 453 | | | 1,527 | | | 1,753 | |

| Deferred income tax expense (benefit) | | 109 | | | (1,351) | | | 428 | | | (1,332) | |

| Derivative (gains) losses, net | | (533) | | | (988) | | | (1,728) | | | 2,680 | |

| Cash receipts (payments) on derivative settlements, net | | 187 | | | (716) | | | 354 | | | (3,561) | |

| Share-based compensation | | 8 | | | 6 | | | 33 | | | 22 | |

| Gains on sales of assets | | (139) | | | (2) | | | (946) | | | (300) | |

| Exploration | | 3 | | | 4 | | | 12 | | | 14 | |

| Losses on purchases, exchanges or extinguishments of debt | | — | | | 5 | | | — | | | 5 | |

| Other | | (20) | | | 12 | | | 6 | | | 31 | |

| Changes in assets and liabilities | | (93) | | | 47 | | | 275 | | | (123) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash provided by operating activities | | 470 | | 1,050 | | 2,380 | | 4,125 |

| Cash flows from investing activities: | | | | | | | | |

| Capital expenditures | | (379) | | | (524) | | | (1,829) | | | (1,823) | |

| Business combination, net | | — | | | — | | | — | | | (1,967) | |

| Contributions to investments | | (82) | | | (18) | | | (231) | | | (18) | |

| Proceeds from divestitures of property and equipment | | 566 | | | (2) | | | 2,533 | | | 407 | |

| Net cash provided by (used in) investing activities | | 105 | | (544) | | 473 | | (3,401) |

| Cash flows from financing activities: | | | | | | | | |

| Proceeds from New Credit Facility | | — | | | 1,600 | | | 1,125 | | | 1,600 | |

| Payments on New Credit Facility | | — | | | (550) | | | (2,175) | | | (550) | |

| Proceeds from Exit Credit Facility | | — | | | 2,328 | | | — | | | 9,583 | |

| Payments on Exit Credit Facility | | — | | | (2,999) | | | — | | | (9,804) | |

| Funds held for transition services | | (91) | | | — | | | — | | | — | |

| Proceeds from warrant exercise | | — | | | 24 | | | — | | | 27 | |

| Debt issuance and other financing costs | | — | | | (17) | | | — | | | (17) | |

| Cash paid to repurchase and retire common stock | | (42) | | | (406) | | | (355) | | | (1,073) | |

| Cash paid for common stock dividends | | (75) | | | (424) | | | (487) | | | (1,212) | |

| Net cash used in financing activities | | (208) | | | (444) | | | (1,892) | | | (1,446) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | | 367 | | 62 | | 961 | | (722) |

| Cash, cash equivalents and restricted cash, beginning of period | | 786 | | 130 | | 192 | | 914 |

| Cash, cash equivalents and restricted cash, end of period | | $ | 1,153 | | | $ | 192 | | | $ | 1,153 | | | $ | 192 | |

| | | | | | | | |

| Cash and cash equivalents | | $ | 1,079 | | | $ | 130 | | | $ | 1,079 | | | $ | 130 | |

| Restricted cash | | 74 | | | 62 | | | 74 | | | 62 | |

| Total cash, cash equivalents and restricted cash | | $ | 1,153 | | | $ | 192 | | | $ | 1,153 | | | $ | 192 | |

| | |

NATURAL GAS, OIL AND NGL PRODUCTION AND AVERAGE SALES PRICES (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,801 | | | 2.15 | | | — | | | — | | | — | | | — | | | 1,801 | | | 2.15 | |

| Haynesville | | 1,497 | | | 2.41 | | | — | | | — | | | — | | | — | | | 1,497 | | | 2.41 | |

| Eagle Ford | | 52 | | | 2.42 | | | 6 | | | 82.49 | | | 7 | | | 25.67 | | | 129 | | | 6.30 | |

| Total | | 3,350 | | | 2.27 | | | 6 | | | 82.49 | | | 7 | | | 25.67 | | | 3,427 | | | 2.42 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 2.88 | | | | | 78.35 | | | | | | | | | |

| Average Realized Price (including realized derivatives) | | | | 2.87 | | | | | 82.49 | | | | | 25.67 | | | | | 3.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,941 | | | 5.35 | | | — | | | — | | | — | | | — | | | 1,941 | | | 5.35 | |

| Haynesville | | 1,572 | | | 5.17 | | | — | | | — | | | — | | | — | | | 1,572 | | | 5.17 | |

| Eagle Ford | | 127 | | | 4.30 | | | 52 | | | 84.55 | | | 16 | | | 26.31 | | | 538 | | | 10.03 | |

| Total | | 3,640 | | | 5.24 | | | 52 | | | 84.55 | | | 16 | | | 26.31 | | | 4,051 | | | 5.90 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 6.26 | | | | | 82.64 | | | | | | | | | |

| Average Realized Price (including realized derivatives) | | | | 3.40 | | | | | 64.67 | | | | | 26.31 | | | | | 3.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,834 | | | 2.22 | | | — | | | — | | | — | | | — | | | 1,834 | | | 2.22 | |

| Haynesville | | 1,551 | | | 2.30 | | | — | | | — | | | — | | | — | | | 1,551 | | | 2.30 | |

| Eagle Ford | | 85 | | | 2.25 | | | 21 | | | 77.80 | | | 10 | | | 25.62 | | | 274 | | | 7.64 | |

| Total | | 3,470 | | | 2.25 | | | 21 | | | 77.80 | | | 10 | | | 25.62 | | | 3,659 | | | 2.66 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 2.74 | | | | | 77.63 | | | | | | | | | |

| Average Realized Price (including realized derivatives) | | | | 2.64 | | | | | 72.89 | | | | | 25.62 | | | | | 2.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2022 |

| | Natural Gas | | Oil | | NGL | | Total |

| | MMcf per day | | $/Mcf | | MBbl per day | | $/Bbl | | MBbl per day | | $/Bbl | | MMcfe per day | | $/Mcfe |

| Marcellus | | 1,836 | | | 6.03 | | | — | | | — | | | — | | | — | | | 1,836 | | | 6.03 | |

| Haynesville | | 1,611 | | | 5.92 | | | — | | | — | | | — | | | — | | | 1,611 | | | 5.92 | |

| Eagle Ford | | 127 | | | 5.64 | | | 51 | | | 96.10 | | | 16 | | | 36.76 | | | 529 | | | 11.76 | |

| Powder River Basin | | 10 | | | 5.45 | | | 2 | | | 95.18 | | | 1 | | | 53.96 | | | 26 | | | 10.66 | |

| Total | | 3,584 | | | 5.96 | | | 53 | | | 96.07 | | | 17 | | | 37.48 | | | 4,002 | | | 6.77 | |

| | | | | | | | | | | | | | | | |

| Average NYMEX Price | | | | 6.64 | | | | | 94.23 | | | | | | | | | |

| Average Realized Price (including realized derivatives) | | | | 3.67 | | | | | 66.36 | | | | | 37.48 | | | | | 4.32 | |

| | |

| CAPITAL EXPENDITURES ACCRUED (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| ($ in millions) | | | | | | | | |

| Drilling and completion capital expenditures: | | | | | | | | |

| Marcellus | | $ | 119 | | | $ | 123 | | | $ | 443 | | | $ | 461 | |

| Haynesville | | 187 | | | 216 | | | 891 | | | 834 | |

| Eagle Ford | | — | | | 64 | | | 222 | | | 414 | |

| Powder River Basin | | — | | | — | | | — | | | 22 | |

| Total drilling and completion capital expenditures | | 306 | | | 403 | | | 1,556 | | | 1,731 | |

| Non-drilling and completion - field | | 50 | | | 41 | | | 150 | | | 115 | |

| Non-drilling and completion - corporate | | 20 | | | 23 | | | 76 | | | 90 | |

| Total capital expenditures | | $ | 376 | | | $ | 467 | | | $ | 1,782 | | | $ | 1,936 | |

| | |

| NON-GAAP FINANCIAL MEASURES |

As a supplement to the financial results prepared in accordance with U.S. GAAP, Chesapeake’s quarterly earnings releases contain certain financial measures that are not prepared or presented in accordance with U.S. GAAP. These non-GAAP financial measures include Adjusted Net Income, Adjusted Diluted Earnings Per Common Share, Adjusted EBITDAX, Free Cash Flow, Adjusted Free Cash Flow and Net Debt. A reconciliation of each financial measure to its most directly comparable GAAP financial measure is included in the tables below. Management believes these adjusted financial measures are a meaningful adjunct to earnings and cash flows calculated in accordance with GAAP because (a) management uses these financial measures to evaluate the company’s trends and performance, (b) these financial measures are comparable to estimates provided by certain securities analysts, and (c) items excluded generally are one-time items or items whose timing or amount cannot be reasonably estimated. Accordingly, any guidance provided by the company generally excludes information regarding these types of items.

Chesapeake's definitions of each non-GAAP measure presented herein are provided below. Because not all companies use identical calculations, Chesapeake’s non-GAAP measures may not be comparable to similarly titled measures of other companies.

Adjusted Net Income: Adjusted Net Income is defined as net income (loss) adjusted to exclude unrealized (gains) losses on natural gas and oil derivatives, (gains) losses on sales of assets, and certain items management believes affect the comparability of operating results, less a tax effect using applicable rates. Chesapeake believes that Adjusted Net Income facilitates comparisons of the company's period-over-period performance, which many investors use in making investment decisions and evaluating operational trends and performance. Adjusted Net Income should not be considered an alternative to, or more meaningful than, net income (loss) as presented in accordance with GAAP.

Adjusted Diluted Earnings Per Common Share: Adjusted Diluted Earnings Per Common Share is defined as diluted earnings (loss) per common share adjusted to exclude the per diluted share amounts attributed to unrealized (gains) losses on natural gas and oil derivatives, (gains) losses on sales of assets, and certain items management believes affect the comparability of operating results, less a tax effect using applicable rates. Chesapeake believes that Adjusted Diluted Earnings Per Common Share facilitates comparisons of the company's period-over-period performance, which many investors use in making investment decisions and evaluating operational trends and performance. Adjusted Diluted Earnings Per Common Share should not be considered an alternative to, or more meaningful than, earnings (loss) per common share as presented in accordance with GAAP.

Adjusted EBITDAX: Adjusted EBITDAX is defined as net income (loss) before interest expense, income tax expense (benefit), depreciation, depletion and amortization expense, exploration expense, unrealized (gains) losses on natural gas and oil derivatives, separation and other termination costs, (gains) losses on sales of assets, and certain items management believes affect the comparability of operating results. Adjusted EBITDAX is presented as it provides investors an indication of the company's ability to internally fund exploration and development activities and service or incur debt. Adjusted EBITDAX should not be considered an alternative to, or more meaningful than, net income (loss) as presented in accordance with GAAP.

Free Cash Flow: Free Cash Flow is defined as net cash provided by (used in) operating activities less cash capital expenditures. Free Cash Flow is a liquidity measure that provides investors additional information regarding the company's ability to service or incur debt and return cash to shareholders. Free Cash Flow should not be considered an alternative to, or more meaningful than, net cash provided by (used in) operating activities, or any other measure of liquidity presented in accordance with GAAP.

Adjusted Free Cash Flow: Adjusted Free Cash Flow is defined as net cash provided by (used in) operating activities less cash capital expenditures and cash contributions to investments, adjusted to exclude certain items management believes affect the comparability of operating results. Adjusted Free Cash Flow is a liquidity measure that provides investors additional information regarding the company's ability to service or incur debt and return cash to shareholders and is used to determine Chesapeake's quarterly variable dividend. Adjusted Free Cash Flow should not be considered an alternative to, or more meaningful than, net cash provided by (used in) operating activities, or any other measure of liquidity presented in accordance with GAAP.

Net Debt: Net Debt is defined as GAAP total debt excluding premiums, discounts, and deferred issuance costs less cash and cash equivalents. Net Debt is useful to investors as a widely understood measure of liquidity and leverage, but this measure should not be considered as an alternative to, or more meaningful than, total debt presented in accordance with GAAP.

| | |

RECONCILIATION OF NET INCOME AVAILABLE TO COMMON STOCKHOLDERS TO ADJUSTED NET INCOME (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| ($ in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income available to common stockholders (GAAP) | | $ | 569 | | | $ | 3,513 | | | $ | 2,419 | | | $ | 4,869 | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Unrealized gains on natural gas and oil derivatives | | (347) | | (1,702) | | | (1,278) | | (895) | |

| Separation and other termination costs | | 2 | | 5 | | | 5 | | 5 | |

| Gains on sales of assets | | (139) | | | (2) | | | (946) | | | (300) | |

| Other operating expense, net | | 4 | | | 25 | | | 22 | | | 78 | |

| Other interest expense | | — | | | — | | | — | | | 12 | |

| Losses on purchases, exchanges or extinguishments of debt | | — | | | 5 | | | — | | | 5 | |

| | | | | | | | |

| | | | | | | | |

| Other | | (18) | | | 9 | | | (37) | | | (10) | |

Deferred income tax benefit(a) | | — | | | (1,351) | | | — | | | (1,332) | |

Tax effect of adjustments(b) | | 114 | | | 49 | | | 517 | | | 14 | |

| Adjusted net income available to common stockholders (Non-GAAP) | | $ | 185 | | | $ | 551 | | | $ | 702 | | | $ | 2,446 | |

| Deemed dividend on warrants | | — | | | 67 | | | — | | | 67 | |

| Adjusted net income (Non-GAAP) | | $ | 185 | | | $ | 618 | | | $ | 702 | | | $ | 2,513 | |

| | | | | |

| (a) | During the three and twelve month periods ended December 31, 2022, we recorded a net deferred tax asset of $1.3 billion as a result of a partial release of the valuation allowance for potential tax benefits that will more likely than not be realized. |

| (b) | The three and twelve month periods ended December 31, 2023 include a tax effect attributed to the reconciling adjustments using a statutory rate of 23%. The three and twelve month periods ended December 31, 2022 include tax effects attributed to the reconciling adjustments using blended rates of 3.0% and 1.3%, respectively. |

| | |

RECONCILIATION OF EARNINGS PER COMMON SHARE TO ADJUSTED DILUTED EARNINGS PER COMMON SHARE (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| ($/share) | | 2023 | | 2022 | | 2023 | | 2022 |

| Earnings per common share (GAAP) | | $ | 4.34 | | | $ | 26.16 | | | $ | 18.21 | | | $ | 38.71 | |

| Effect of dilutive securities | | (0.32) | | | (2.16) | | | (1.29) | | | (5.35) | |

| Diluted earnings per common share (GAAP) | | $ | 4.02 | | | $ | 24.00 | | | $ | 16.92 | | | $ | 33.36 | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Unrealized gains on natural gas and oil derivatives | | (2.44) | | | (11.63) | | | (8.94) | | | (6.13) | |

| Separation and other termination costs | | 0.01 | | | 0.03 | | | 0.04 | | | 0.03 | |

| Gains on sales of assets | | (0.99) | | | (0.02) | | | (6.62) | | | (2.06) | |

| Other operating expense, net | | 0.03 | | | 0.17 | | | 0.15 | | | 0.53 | |

| Other interest expense | | — | | | — | | | — | | | 0.08 | |

| Losses on purchases, exchanges or extinguishments of debt | | — | | | 0.04 | | | — | | | 0.04 | |

| | | | | | | | |

| | | | | | | | |

| Other | | (0.13) | | | 0.06 | | | (0.26) | | | (0.07) | |

Deferred income tax benefit(a) | | — | | | (9.22) | | | — | | | (9.12) | |

Tax effect of adjustments(b) | | 0.81 | | | 0.33 | | | 3.62 | | | 0.10 | |

| | | | | | | | |

| Adjusted diluted earnings available to common stockholders per common share (Non-GAAP) | | $ | 1.31 | | | $ | 3.76 | | | $ | 4.91 | | | $ | 16.76 | |

| Deemed dividend on warrants | | — | | | 0.46 | | | — | | | 0.46 | |

| Adjusted diluted earnings per common share (Non-GAAP) | | $ | 1.31 | | | $ | 4.22 | | | $ | 4.91 | | | $ | 17.22 | |

| | | | | |

| (a) | During the three and twelve month periods ended December 31, 2022, we recorded a net deferred tax asset of $1.3 billion as a result of a partial release of the valuation allowance for potential tax benefits that will more likely than not be realized. |

| (b) | The three and twelve month periods ended December 31, 2023 include a tax effect attributed to the reconciling adjustments using a statutory rate of 23%. The three and twelve month periods ended December 31, 2022 include tax effects attributed to the reconciling adjustments using blended rates of 3.0% and 1.3%, respectively. |

| | |

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDAX (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| ($ in millions) | | | | | | | | |

| Net income (GAAP) | | $ | 569 | | | $ | 3,580 | | | $ | 2,419 | | | $ | 4,936 | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Interest expense | | 22 | | | 40 | | | 104 | | | 160 | |

| Income tax expense (benefit) | | 166 | | | (1,390) | | | 698 | | | (1,285) | |

| Depreciation, depletion and amortization | | 379 | | | 453 | | | 1,527 | | | 1,753 | |

| Exploration | | 8 | | | 9 | | | 27 | | | 23 | |

| Unrealized gains on natural gas and oil derivatives | | (347) | | | (1,702) | | | (1,278) | | | (895) | |

| Separation and other termination costs | | 2 | | | 5 | | | 5 | | | 5 | |

| Gains on sales of assets | | (139) | | | (2) | | | (946) | | | (300) | |

| Other operating expense, net | | 4 | | | 25 | | | 22 | | | 78 | |

| | | | | | | | |

| Losses on purchases, exchanges or extinguishments of debt | | — | | | 5 | | | — | | | 5 | |

| | | | | | | | |

| Other | | (29) | | | 9 | | | (65) | | | (10) | |

| Adjusted EBITDAX (Non-GAAP) | | $ | 635 | | | $ | 1,032 | | | $ | 2,513 | | | $ | 4,470 | |

| | |

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO ADJUSTED FREE CASH FLOW (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| ($ in millions) | | | | | | | | |

| Net cash provided by operating activities (GAAP) | | $ | 470 | | | $ | 1,050 | | | $ | 2,380 | | | $ | 4,125 | |

| Cash capital expenditures | | (379) | | | (524) | | | (1,829) | | | (1,823) | |

| Free cash flow (Non-GAAP) | | 91 | | | 526 | | | 551 | | | 2,302 | |

| | | | | | | | |

| Cash paid for acquisition costs | | — | | | — | | | — | | | 23 | |

| Cash contributions to investments | | (82) | | | (18) | | | (231) | | | (18) | |

Free cash flow associated with divested assets(a) | | (48) | | | (235) | | | (243) | | | (235) | |

| Adjusted free cash flow (Non-GAAP) | | $ | (39) | | | $ | 273 | | | $ | 77 | | | $ | 2,072 | |

| | | | | |

| (a) | In March and April of 2023, we closed two divestitures of certain Eagle Ford assets to WildFire Energy I LLC and INEOS Upstream Holdings Limited, respectively. Due to the structure of these transactions, both of which had an effective date of October 1, 2022, the cash generated by these assets was delivered to the respective buyers through a reduction in the proceeds we received at the closing of each transaction. Additionally, in November 2023, we closed the divestiture of the final portion of our Eagle Ford assets to SilverBow Resources, Inc., with an effective date of February 1, 2023 and the cash generated by these assets was delivered to the buyer through a reduction in the proceeds we received at the closing of the transaction. |

| | |

RECONCILIATION OF TOTAL DEBT TO NET DEBT (unaudited) |

| | | | | | | | |

| ($ in millions) | | December 31, 2023 |

| Total debt (GAAP) | | $ | 2,028 | |

| Premiums and issuance costs on debt | | (78) | |

| Principal amount of debt | | 1,950 | |

| Cash and cash equivalents | | (1,079) | |

| Net debt (Non-GAAP) | | $ | 871 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassAWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassBWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=chk_ClassCWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

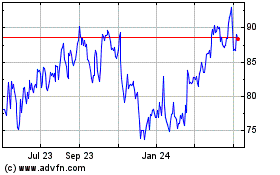

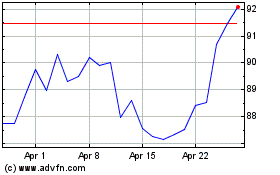

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024