0001348362false00013483622024-02-142024-02-14iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 14, 2024

LEXARIA BIOSCIENCE CORP. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-52138 | | 20-2000871 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

100 - 740 McCurdy Road, Kelowna, BC Canada | | V1X 2P7 |

(Address of principal executive offices) | | (Zip Code) |

(250) 765-6424

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.001 per share Warrants to Purchase Common Stock | | LEXX LEXXW | | The Nasdaq Capital Market The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 14, 2024, Lexaria Bioscience Corp., a Nevada corporation (the “Company”), entered into a securities purchase agreement (the “SPA”) with certain institutional investors, pursuant to which the Company agreed to issue and sell to the investors (i) in a registered direct offering, 1,444,741 shares (the “Shares”) of Common Stock, par value $0.001 per share of the Company (the “Common Stock”) at a price of $2.31 per share, and pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 113,702 shares of Common Stock at $2.3099 per share at an exercise price of $0.0001 per share of Common Stock, and (ii) in a concurrent private placement, common stock purchase warrants (the “Private Placement Warrants”), exercisable for an aggregate of up to 1,558,443 shares of Common Stock, at an exercise price of $2.185 per share of Common Stock.

The securities to be issued in the registered direct offering were offered at-the-market under Nasdaq rules and pursuant to the Company’s shelf registration statement on Form S-3 (File 333-262402) (the “Shelf Registration Statement”), initially filed by the Company with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), on January 28, 2022 and declared effective on February 4, 2022. The Pre-Funded Warrants are exercisable upon issuance and will remain exercisable until all Pre-Funded Warrants are exercised in full.

The Private Placement Warrants (and the shares of Common Stock issuable upon the exercise of the Private Placement Warrants) were not registered under the Securities Act, and were offered pursuant to an exemption from the registration requirements of the Securities Act provided under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated under the Securities Act. The Private Placement Warrants are exercisable upon issuance and will expire five years from the issuance date, and in certain circumstances may be exercised on a cashless basis. If we fail for any reason to deliver shares of Common Stock upon the valid exercise of the Pre-Funded Warrants or Private Placement Warrants, subject to our receipt of a valid exercise notice and the aggregate exercise price, by the time period set forth in the Pre-Funded Warrants or Private Placement Warrants, we are required to pay the applicable holder, in cash, as liquidated damages as set forth in the Pre-Funded Warrants and Private Placement Warrants. The Pre-Funded Warrants and Private Placement Warrants also include customary buy-in rights in the event we fail to deliver shares of common stock upon exercise thereof within the time periods set forth in the Pre-Funded Warrants and Private Placement Warrants.

Under the terms of the Pre-Funded Warrants and Private Placement Warrants, a holder will not be entitled to exercise any portion of any such warrant, if, upon giving effect to such exercise, the aggregate number of shares of common stock beneficially owned by the holder (together with its affiliates, any other persons acting as a group together with the holder or any of the holder’s affiliates, and any other persons whose beneficial ownership of common stock would or could be aggregated with the holder’s for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended) would exceed, for the Pre-Funded Warrants, 9.99%; and, for the Private Placement Warrants, 4.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of such warrant, which percentage may be increased at the holder’s election upon 61 days’ notice to the Company subject to the terms of such warrants, provided that such percentage may in no event exceed 9.99%.

On February 16, 2024, the Company closed the registered direct offering and the private placement offering (collectively, the “Offering”), raising gross proceeds of approximately $3.6 million before deducting placement agent fees and other offering expenses payable by the Company. The Company may use the net proceeds from the Offering for research and development studies and the patent and legal costs associated thereto, and for general working capital purposes.

Pursuant to the terms of the SPA, the Company is required within 30 days of February 14, 2024, to file a registration statement on Form S-1 or other appropriate form if the Company is not then S-1 eligible registering the resale of the shares of Common Stock issued and issuable upon the exercise of the Private Placement Warrants. The Company is required to use commercially reasonable efforts to cause such registration to become effective within 60 days of the closing date of the Offering (or within 90 days following the closing of the Offering in case of “full review” of the registration statement by the SEC), and to keep the registration statement effective at all times until no investor owns any Private Placement Warrants or shares issuable upon exercise thereof.

Pursuant to the terms of the SPA, from February 14, 2024, until 60 days thereafter, subject to certain exceptions, we may not issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents, or file any registration statement or any amendment or supplement thereto, other than a prospectus supplement for the Offering and the Form S-1 for the registration of the shares of Common Stock issued and issuable upon the exercise of the Private Placement Warrants.

In connection with the Offering, on February 12, 2024, the Company entered into an engagement agreement (the “Engagement Agreement”) with H.C. Wainwright & Co., LLC (the “Placement Agent”). Pursuant to the terms of the Engagement Agreement, the Company will pay the Placement Agent a cash fee equal to 7.0% of the gross proceeds of the Offering, provided that a reduced cash fee of 6.0% is payable on the gross proceeds received from a certain investor. We will also issue to the Placement Agent 54,546 warrants of the Company (the “Agent Warrants”) equal to 3.5% of the aggregate number of Shares and Pre-funded Warrants issued at the closing. The Agent Warrants expire five years from the commencement of sales of the Offering and have an exercise price of $2.8875 per share of Common Stock. In addition, the Company will reimburse the Placement Agent for a non-accountable expense allowance of $20,000 and accountable legal expenses and other out-of-pocket legal expenses incurred in connection with the Offering in the amount of $50,000.

In addition, pursuant to certain “lock-up” agreements (each, a “Lock-Up Agreement”) that were required to be entered into as a condition to the closing of the SPA, our officers and directors have agreed, for a period of 30 days from the closing date of the Offering, not to engage in any of the following, whether directly or indirectly, without the consent of the purchaser under the SPA: offer to sell, sell, contract to sell pledge, grant, lend, or otherwise transfer or dispose of our common stock or any securities convertible into or exercisable or exchangeable for Common Stock (the “Lock-Up Securities”); enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Lock-Up Securities; make any demand for or exercise any right or cause to be filed a registration statement, including any amendments thereto, with respect to the registration of any Lock-Up Securities; enter into any transaction, swap, hedge, or other arrangement relating to any Lock-Up Securities subject to customary exceptions; or publicly disclose the intention to do any of the foregoing.

The foregoing does not purport to be a complete description of each of the Engagement Agreement, the Engagement Agreement Amendment, the Pre-Funded Warrants, the Private Placement Warrants, the Agent Warrants and the SPA is qualified in its entirety by reference to the full text of each such document, which are filed as Exhibits 1.1, 1.2, 4.1, 4.2, 4.3 and 10.1, respectively, to this Current Report on Form 8-K (this “Form 8-K”) and incorporated herein by reference.

Sichenzia Ross Ference Carmel, LLP, securities counsel to the Company, delivered an opinion as to the validity of the Shares, Pre-Funded Warrants and shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, a copy of which is filed as Exhibit 5.1 to this Form 8-K and is incorporated herein by reference.

Item 3.02 Unregistered Sale of Equity Securities.

The applicable information set forth in Item 1.01 of this Form 8-K with respect to the issuance of Private Placement Warrants is incorporated herein by reference.

Cautionary Statement Regarding Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements that express the Company’s intentions, beliefs, expectations, strategies, predictions or any other statements related to the Company’s future activities, or future events or conditions, which can be identified by terminology such as “may,” “will,” “expects,” “anticipates,” “aims,” “potential,” “future,” “intends,” “plans,” “believes,” “estimates,” “continue,” “likely to” and other similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are not historical facts and are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions made by its management, including, without limitation, the intended use of proceeds upon consummation of the Offering. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict, many of which are beyond the Company’s control, including, among other things, the Company’s ability to maintain its listing of Common Stock on the Nasdaq Capital Market, and those risks that may be included in the periodic reports and other filings that the Company files from time to time with the SEC, which may cause the Company’s actual results, performance and achievements to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this Form 8-K, except as required by applicable law.

Item 8.01. Other Events.

On February 15, 2024, the Company issued a press release announcing the pricing of the Offering, a copy of which is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 8.01 of this Form 8-K.

On February 16, 2024, the Company issued a press release announcing the closing of the Offering, a copy of which is attached hereto as Exhibit 99.2 and is incorporated by reference into this Item 8.01 of this Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. | | Description |

1.1 | | Engagement Agreement by and between the Company and H.C. Wainwright & Co., LLC, dated February 12, 2024 |

1.2# | | Engagement Agreement Amendment by and between the Company and H.C. Wainwright & Co., LLC, dated February 15, 2024 |

4.1 | | Form of Pre-Funded Warrant |

4.2 | | Form of Private Placement Warrant |

4.3 | | Form of Agent Warrant |

5.1 | | Opinion of Sichenzia Ross Ference Carmel LLP |

10.1 | | Form of Securities Purchase Agreement |

23.1 | | Sichenzia Ross Ference Carmel LLP (Contained in Exhibit 5.1 above) |

99.1 | | Press Release, dated February 15, 2024 |

99.2 | | Press Release, dated February 16, 2024 |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

# Portions of this exhibit (indicated by asterisks) have been omitted in accordance with Item 601(b)(10) of Regulation S-K. The registrant hereby agrees to furnish supplementally copies of the omitted portions of this exhibit to the SEC upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

LEXARIA BIOSCIENCE CORP. | |

| |

/s/ Chris Bunka | |

Name: Chris Bunka | |

Title: CEO, Principal Executive Officer | |

| |

Date: February 16, 2024 | |

nullnullnullnullnullnullnullnullnull

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

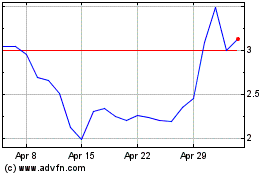

Lexaria Bioscience (NASDAQ:LEXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lexaria Bioscience (NASDAQ:LEXX)

Historical Stock Chart

From Apr 2023 to Apr 2024