false

0001433551

0001433551

2024-02-15

2024-02-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): February 15, 2024

Sino

Green Land Corp.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53208 |

|

54-0484915 |

|

(State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer

|

of

incorporation) |

|

File

Number) |

|

Identification

No.) |

No.

3 & 5, Jalan Hi Tech 7/7,

Kawasan

Perindustrian Hi Tech 7,

43500

Semenyih, Selangor, Malaysia

(Address

of principal executive offices (zip code))

+603

8727 8732

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2 below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a - 12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13d-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.001 par value |

|

SGLA |

|

The

OTC Markets - Pink Sheets |

JUMPSTART

OUR BUSINESS STARTUPS ACT

The

Company qualifies as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (the

“JOBS Act”) as we do not have more than $1,070,000,000 in annual gross revenue and did not have such amount as of September

30, 2023 our last fiscal year. We are electing to use the extended transition period for complying with new or revised accounting standards

under Section 102(b)(1) of the JOBS Act.

We

may lose our status as an emerging growth company on the last day of our fiscal year during which (i) our annual gross revenue exceeds

$2,000,000,000 or (ii) we issue more than $2,000,000,000 in non-convertible debt in a three-year period. We will lose our status as an

emerging growth company if at any time we are deemed to be a large accelerated filer. We will lose our status as an emerging growth company

on the last day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant

to an effective registration statement.

As

an emerging growth company, we are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley

Act”) and Section 14A(a) and (b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such sections

are provided below:

Section

404(b) of the Sarbanes-Oxley Act requires a public company’s auditor to attest to, and report on, management’s assessment

of its internal controls.

Sections

14A(a) and (b) of the Exchange Act, implemented by Section 951 of the Dodd-Frank Act, require companies to hold shareholder advisory

votes on executive compensation and golden parachute compensation.

As

long as we qualify as an emerging growth company, we will not be required to comply with the requirements of Section 404(b) of the Sarbanes-Oxley

Act and Section 14A(a) and (b) of the Exchange Act.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Current Report on Form 8-K or Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively

the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information

currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words

“anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”,

“plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking

statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties,

assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they

relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events

described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly

from those anticipated, believed, estimated, expected, intended or planned.

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not

intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in

conjunction with our pro forma financial statements and the related notes that will be filed herein.

Item

1.01 Entry into Material Definitive Agreement

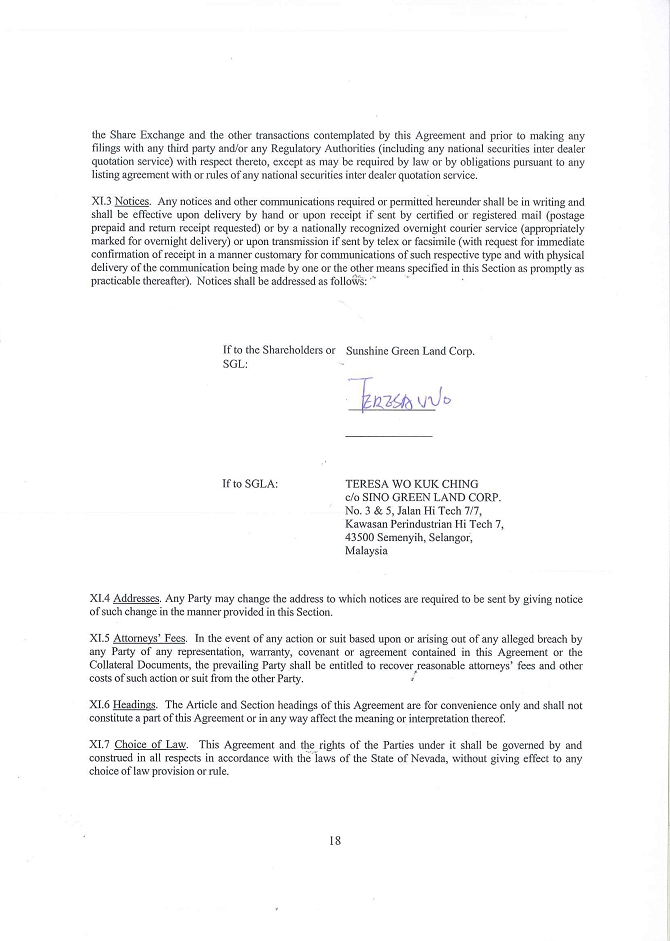

On October 1, 2023, Sino Green Land

Corp. (“SGLA,” or the “Company”) completed its merger with Sunshine Green Land Corp. (“SGL”) and

SLG’s wholly-owned subsidiary, Tian Li Eco Holdings Sdn.Bhd” (“Tian Li”), pursuant to the terms of a definitive

share exchange agreement dated October 1, 2023.

Upon completion of the merger, all

of the outstanding shares of SGL’s common stock were exchanged for 160,349,203 shares of common stock of SGLA and 1,781,658 shares of

preferred stock of SGLA. Prior to the merger, Luo Xiong and spouse Wo Kuk Ching and their immediate family members controlled 65.7% of

SGLA, and 90% of SGL. Following the Merger, Luo Xiong and spouse Wo Kuk Ching and their immediate family members controlled 89.78% of

SGLA. As SGLA and SGL were under common control at the time of the share exchange, the transaction is accounted for as a combination

of entities under common control in a manner similar to the pooling-of-interests method of accounting.

Immediately after completion of such

share exchange, the Company has a total of 161,809,738 issued and outstanding shares of common stock, with authorized share capital for

common shares of 780,000,000.

Consequently,

the Company has ceased to fall under the definition of shell company as define in Rule 12b-2 under the Exchange Act of 1934, as amended

(the “Exchange Act”) and SGL is now a wholly owned subsidiary.

Item

2.01 Completion of Acquisition or Disposition of Assets

As described in Item 1.01 above, On

October 1, 2023, SGLA completed its merger with SGL and SGL’s wholly-owned subsidiary, Tian Li, pursuant to the terms of a definitive

share exchange agreement dated October 1, 2023. As SGLA and SGL were under common control at the time of the share exchange, the transaction

is accounted for as a combination of entities under common control in a manner similar to the pooling-of-interests method of accounting.

As a result of the acquisition of all

the issued and outstanding shares of SGL, the business conducted by SGL’s wholly-owned subsidiary, Tian Li, became the primary

business of SGLA.

FORM

10 DISCLOSURE

As described in Item 1.01 above, On

October 1, 2023, SGLA completed its merger with SGL and SGL’s wholly-owned subsidiary, Tian Li, pursuant to the terms of a definitive

share exchange agreement dated October 1, 2023. As SGLA and SGL were under common control at the time of the share exchange, the transaction

is accounted for as a combination of entities under common control in a manner similar to the pooling-of-interests method of accounting.

As the Company was a shell company

prior to such acquisition is now entering into a business combination, other than a business combination with a shell company, as those

terms are defined in Rule 12b-2 under the Exchange Act, according to Item 2.01(f) of Form 8-K, the registrant is required to disclose

the information that would be required if the registrant were filing a general form for registration of securities under the Exchange

Act on Form 10.

We

hereby provide below information that would be included in a Form 10 registration statement.

Description

of Business

Corporate

History

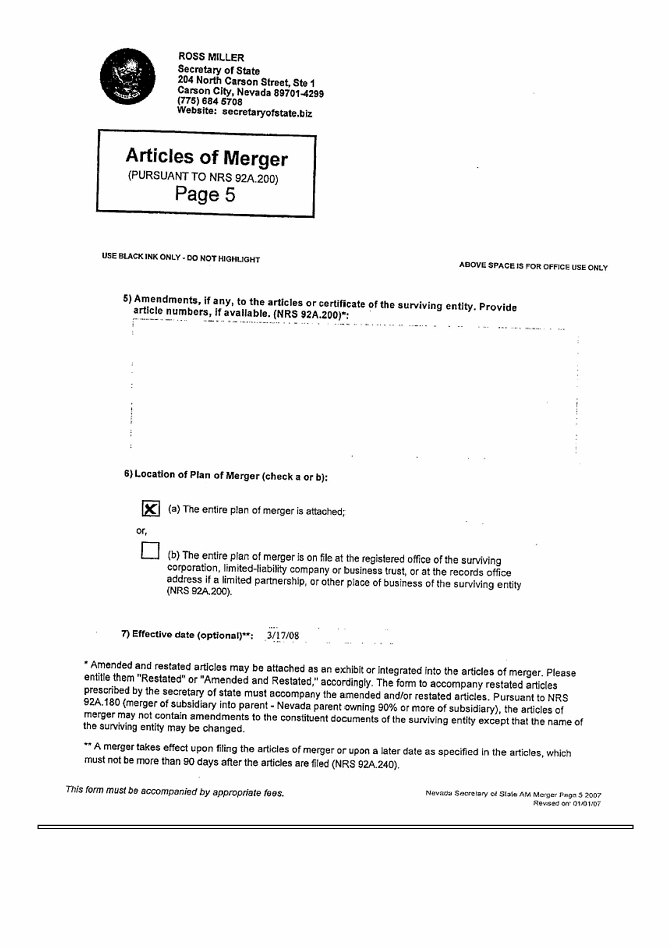

Sino

Green Land Corp. was incorporated under the laws

of the State of Nevada on March 6, 2008, under the name of Henry County Plywood Corporation, as successor by merger to a Virginia corporation

incorporated in May 1948 under the same name. On March 17, 2009, the Company changed its name from “Henry County Plywood Corporation”

to “Sino Green Land Corporation”. During 2009 to 2011, the Company was principally engaged in the wholesale distribution

of premium fruits in China. In 2011, the Company was delinquent in statutory filings, and the last annual report, Form 10-K for the year

ended June 30, 2010, was filed to the SEC on March 31, 2011, and the last Form 10-Q for the period ended September 30, 2011, was filed

to the SEC on November 14, 2011.

On

December 30, 2019, the Eighth District Court of Clark County, Nevada granted the Application for Appointment of Custodian, to Custodian

Ventures LLC. Mr. David Lazar (“Mr. Lazar”), on behalf of the Custodian Ventures LLC, was awarded with custodianship and

appointed as sole officer and director due to the Company’s ineffective board of directors, revocation of corporate charter, and

abandonment of business. On January 7, 2020, Mr. Lazar announced the Court Order and the Change in Principal Officer through Form 8-K

filing. The filing also mentioned the change of Company’s name from “Sino Green Land Corporation” to “Go Silver

Toprich, Inc.”. On June 10, 2020, a settlement agreement was entered between the Company, Custodian Ventures, LLC, and Mr. Lazar.

Pursuant to the agreement, Custodian Ventures LLC shall dismiss its custodianship, and the Company shall resume its business operations,

and each party shall provide each other mutual release. In consideration of the release, the Company was required to pay Custodian Ventures

LLC $15,000 towards its costs and expenses as the settlement to dismiss its custodianship with the Court. On July 2, 2020, the custodianship

was discharged by the Court and Mr. Lazar resigned as sole officer and director of the Company. The former officer, Mr. Luo Xiong (“Mr.

Luo”) was re-appointed as Chief Executive Officer and director of the Company.

Since

July 2, 2020, along with the resumption of the Company’s business operations, Ms. Wo Kuk Ching (“Ms. Wo”), spouse of

Mr. Luo has served as President and director of the Company, Ms. Wong Ching Wing (“Elise”), daughter of Ms. Wo has served

as Chief Financial Officer, Treasurer and director of the Company, and Ms. Wong Erin (“Erin”), another daughter of Ms. Wo

has served as Secretary of the Company, respectively. On August 31, 2020, the Company changed its name from “Go Silver Toprich,

Inc.” back to “Sino Green Land Corporation”.

On

December 2, 2021, Mr. Luo submitted his resignation as Chief Executive Officer and director of the Company to the board of directors

effective June 30, 2021.

Effective

from June 30, 2021, Ms. Wo serves as Chief Executive Officer, and currently holds the positions of Chief Executive

Officer, President, and director of the Company, respectively.

On June 30, 2023, Sunshine Green Land

Corp. (“SGL”) acquired 100% interest in Tian Li Eco Holdings Sdn. Bhd (“Tian Li”).

On October 1, 2023, SGLA acquired

SGL and all of the outstanding shares of SGL’s common stock were exchanged for 160,349,203 shares of common stock of SGLA and

1,781,658 shares of preferred stock of SGLA. As SGLA and SGL were under common control at the time of the share exchange, the transaction

is accounted for as a combination of entities under common control in a manner similar to the pooling-of-interests method of accounting.

Business

Overview

Sino

Green Land Corp. (“SGLA” or the “Company”) is a US holding company incorporated in Nevada. We conduct our business

through our Malaysia subsidiary “Tian Li Eco Holdings Sdn.Bhd” (“Tian Li”), which is an environmental protection

technology, recycling and renewal of plastic waste bottles and packaging materials being recycled and sale of recovered and recycled

products, a company incorporated and based in Malaysia. The Company’s mission is rooted in advocating for waste recycling, renewing

and reusing, aiming for a sustainable environmental future. With its strategic initiatives, the Company’s objective is to become

a prominent environmental recycling entity in Asia over the coming five years.

Tian

Li, based in Selangor, Malaysia, operates under the guidance of a leadership team with over three decades of industry knowledge and experience.

Tian Li’s primary focus is on the environmental protection sector, particularly addressing plastic waste concerns at both regional

and global scales. Tian Li’s operations emphasize in converting waste into reusable resources, contributing to societal well-being

and environmental conservation, while also supporting the principles of a circular economy.

Our

Mission

Tian

Li’s mission is rooted in advocating for waste recycling, aiming for a sustainable environmental future. With its strategic initiatives,

the Company’s objective is to become a prominent environmental recycling entity in Asia over the coming five years.

Our

Model

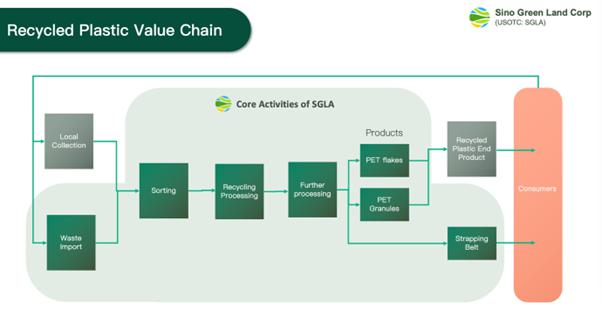

Tian

Li collects and sourcing the raw material such as the PET Bottle Bundle from Cambodia, Southeast Asia and New Zealand. After the raw

material is delivered to the factory, Tian Li will process the sorting, cutting, crushing, washing, cleaning, drying, separating, recycling

processing and further processing, until the materials are finally recycled into plastic end products such flakes, or Strapping belt,

is produced. Thereafter, Tian Li sells it to local or oversea trading companies.

Tian

Li recognizes the increasing importance of PET recycling in the global landscape. As the sector expands, there is noticeable demand from

both brand manufacturers and end-users. Additionally, global governments are showing a heightened focus on environmental policies, providing

further support to the PET recycling industry.

The

PET recycling industry presents several challenges, often acting as barriers to entry for many entities. Tian Li has developed strategies

to address these challenges. For instance, procuring raw materials demands a broad and reliable supply chain network, and the Company

has invested in building such networks over the years. Adhering to international standards for recycled PET is crucial, and Tian Li,

through its technological assets and industry knowledge, aims to produce products that fit within these specifications. Addressing potential

environmental concerns associated with the recycling process, the Company operates with the necessary legal and safety permits. These

are licenses and report from the environmental impact assessment (EIA) and the environment management plan (EMP), and the permits from

the Malaysia Investment Development Authority (MIDA).

Tian

Li’s foundation in the PET recycling domain is further highlighted by its infrastructural assets in Malaysia. The Company houses

several pieces of advanced machinery and equipment together with its capabilities and technologies to produce good quality recycled PET

materials for its customers. Furthermore, the foundational strength of Tian Li and SGLA is its experienced and capable management and

processing teams. The Company’s founders and core team possess a blend of experience and technical knowledge, positioning Tian

Li and SGLA as a notable player in the PET recycling sector.

Our

Products

Product

Offerings:

| |

○ |

Processed through a sequence

of sorting, crushing, washing, separation, and drying, PET Flakes serve as an alternate raw material to traditional polyester. These

flakes find applications in products ranging from staple fibers to strapping belts. |

|

■ |

Intrinsic Viscosity (IV): >0.7 |

| |

■ |

Moisture: <1% |

| |

■ |

PVC Content: <0.01% |

| |

■ |

Foreign Material: <0.02% |

| |

○ |

Tian Li employs superior

raw materials and additives to produce these belts, offering them in varied colors and surface finishes (either smooth or embossed). |

| |

○ |

Recognized for its high tensile strength (comparable

to steel straps, reaching up to 80%), these belts are durable across varying climatic conditions, exhibit heat resistance, and have

enhanced longevity. |

| |

○ |

Product Specifications: |

|

● |

Dimensions: 1100m16mm0.8mm |

| |

● |

Weight: 20KG |

| |

● |

Tensile Strength: 496 Kgf |

| |

● |

Dimensions: 800m19mm1.0mm |

| |

● |

Weight: 20KG |

| |

● |

Tensile Strength: 798 Kgf |

| |

○ |

Sourced from caps and rings of PET bottles,

these HDPE pellets are suited for casting molding applications. Defined by its density (>0.941 g/cm3), HDPE stands as a robust

variant within the polyethylene category. Renowned for its impact resistance, lightweight properties, low moisture absorption, and

high tensile strength, HDPE also exhibits non-toxic and non-staining characteristics. |

Tian

Li’s PET bottle flakes cater to diverse geographical markets, including the Asia-Pacific, Europe, and the Americas, with exports

to nations like Germany, the U.S., Ukraine, Vietnam, Thailand, Malaysia, Indonesia, and Turkey, among others. The global PET fiber

production capacity stands at approximately 60.53 million tons in 2021 (Statista Research Department, March 24, 2023), representing

potential clients for the Company. Tian Li’s PET plastic-steel straps have reached markets in countries such as China, Australia,

Vietnam, Malaysia, Indonesia, and Thailand, with ongoing expansion initiatives. Additionally, Tian Li’s HDPE recycled pellets find

customers in China and Malaysia, suggesting a notable demand in the market.

The

Company’s goals

Tian

Li’s strategic positioning in Semenyih, Malaysia, serves as a logistical advantage, facilitating efficient connections with both

local and international customers via major transportation hubs. This not only ensures reduced delivery times but also minimizes transportation

costs. On a daily basis, Tian Li procures recyclable plastics from local sources, aiming to reduce the amount of non-biodegradable plastics

that might otherwise reach landfills. With a steadfast commitment to the environment, the Company continually seeks enhancements in its

recycling process and pledges to increase its investments in this domain.

Competitive

Strengths

Our

Directors believe that our competitive strengths are as follows:

| ● |

Tian Li’s depth of

understanding in the plastic recycling sector has made the Company attuned to its challenges and intricacies. As such, Tian Li strictly

adheres to the regulations and guidelines set forth by the Malaysian government. Furthermore, the company has integrated practices

from recycling standards observed in developed nations, aligning its operations with international benchmarks. |

| |

|

| ● |

Tian Li’s core expertise is in processing

waste PET beverage and packaging bottles. Through advanced methodologies, Tian Li transforms waste bottles into PET bottle flakes,

which are tailored for PET fiber production. The facility houses over 40 pieces of advanced equipment, emphasizing consistent quality

and innovation. This commitment to technology and research positions Tian Li as a notable entity within the environmental protection

sector. |

| |

|

| ● |

Currently, Tian Li has a production capability

of 50,000 tons of PET waste plastic bottles annually. As the Company plans for the future, there is an envisioned expansion in its

operational scope. Tian Li has also introduced a production line for PET plastic-steel strapping belts, resulting in an annual yield

of 3,000 tons. Additionally, Tian Li produces HDPE recycled pellets from waste plastic bottle components, with an annual output ranging

between 3,500 to 4,000 tons. Due to the quality of the PET bottle flakes and pellets produced, they find applications in various PET-based

productions. Tian Li’s recycled raw materials, being closely comparable to virgin plastics and cost-effectiveness, present a

viable option for its customers, both domestic and international, in the market. |

Market

Overview

Addressing

the Global Plastic Waste Crisis

The

global plastic waste crisis has taken center stage in environmental discussions over recent decades. Since the 1950s, there has been

a staggering surge in plastic production. What began as an annual output of 2 million tons has skyrocketed to an overwhelming 348 million

tons by 2017. Correspondingly, the global plastic industry’s worth has soared to an estimated $522.6 billion. If current trajectories

persist, the industry might potentially double in value by 2040 (Historic day in the campaign to beat plastic pollution: Nations commit

to develop a legally binding agreement, Press release, United Nations Environment Programme (UNEP), Mar 2022).

However,

this surge in plastic production and its subsequent pollution presents monumental challenges that ripple across ecosystems. Climate change,

biodiversity reduction, and the broad spectrum of environmental pollution are all exacerbated by this pervasive plastic proliferation.

The consequences, if left unaddressed, could lead to irreversible environmental damages.

Beyond

the environmental toll, there are significant health concerns related to plastic pollution. These implications span from potential disruptions

in human fertility and hormonal imbalances to metabolic irregularities and concerning neurological effects. Notably, the open burning

of plastics has also become a significant contributor to atmospheric pollution.

As

global efforts intensify to limit global warming to within 1.5°C, a projection that stands out is the anticipated contribution of

plastics to this crisis. By 2050, emissions stemming from plastic-related processes might constitute up to 15% of the globally permissible

emissions.

Marine

life bears the brunt of this crisis, with over 800 marine and coastal species under threat due to plastic pollution. From ingestion to

entanglement, the dangers are extensive. Alarmingly, marine ecosystems are burdened with around 11 million tons of plastic debris annually.

Unless current practices are recalibrated, this figure might see a twofold increase by 2040 (UNEP, Mar 2022).

Recycled-PET

as a Solution to the Global Plastic Waste Crisis

The

emergence of recycled-PET (R-PET) as a solution presents hope in addressing the intensifying global plastic waste crisis. By embracing

the reclamation and repurposing of PET plastics, there is a potential to markedly reduce the volume of waste directed to landfills and

oceans. This approach simultaneously curtails the reliance on the production of virgin plastics, resulting in significant cuts in carbon

emissions and the conservation of crucial resources.

R-PET

champions the principles of a circular economy, a sustainable model where resources undergo continuous recycling and repurposing to extend

their lifecycle, thus reducing environmental harm. Such a holistic approach starkly deviates from the age-old linear economic model characterized

by a “produce, use, discard” sequence.

Incorporating

R-PET into industrial processes can substantially attenuate the environmental footprints of sectors heavily dependent on plastics. For

instance, producing R-PET consumes roughly 75% less energy compared to its virgin counterpart and can curtail greenhouse gas emissions

by a commendable 70%.

Additionally,

leveraging R-PET in product manufacturing can bolster the image of companies, positioning them as champions of environmental consciousness.

This strategic alignment does not merely offer a solution to the plastic waste conundrum but also augments brand standing in the market.

Given the discernible shift towards sustainable products among consumers, companies employing R-PET can potentially foster increased

brand loyalty from this growing eco-conscious demographic.

The

Recycled-PET Global Market Overview

The

global recycled-PET (R-PET) market is showcasing notable momentum. As of 2023, this burgeoning sector is estimated to be worth around

US$11 billion, and if current trends persist, it’s poised to burgeon to a significant US$15 billion by 2028. This forecast points

to a robust compound annual growth rate (CAGR) of 6.5% over the anticipated five-year span. (Recycled PET Market, Global Forecast to

2028, Markets and Markets, June 2023)

Several

pivotal factors are propelling this market surge. Foremost, there’s an unmistakable transformation in consumer behavior patterns.

As individuals worldwide become more attuned to the far-reaching environmental consequences of plastic waste, their purchasing habits

evolve. It is now evident that consumers are gravitating away from excessively packaged products, opting instead for items that underscore

eco-friendliness as a key characteristic.

Furthermore,

the role of governmental bodies cannot be understated. Many international administrations are ardently endorsing recycling and the principles

of a circular economy. Through a plethora of policies, they are setting the stage to encourage and, in certain instances, mandate sustainable

business conduct and elevated recycling standards. In certain jurisdictions, the integration of recycled materials has become a cornerstone

of packaging regulations. These legal frameworks are supplemented with precise targets for recycled content, nudging manufacturers to

embed environmental stewardship within their product development and design ethos.

From

an economic perspective, the R-PET realm is presenting an intriguing landscape. In certain jurisdictions, particularly the EU, the advent

of mandatory recycling directives means that the demand for food-grade R-PET is consistently outpacing the available supply. Consequently,

its price per ton has reached a premium of around 1,500 Euros in September 2022 (Plastics and Sustainability Trends in September 2022,

czapp.com, Oct 2022), which is a significant increment from a base valuation pegged at 400 Euros.

Opportunities

for Recycled-PET in the Asia-Pacific Region

The

Asia-Pacific region, a dominant global nexus for production, is abuzz with activity. With a multitude of multinational entities spread

across diverse sectors such as food & beverage, personal care, and household products, it’s an area that presents a myriad

of opportunities. This operational vibrancy inherently fosters a growing demand for recycled PET, setting an optimistic trajectory for

our firm. One can gauge the strength and potential of this sector by examining key metrics. For instance, pivotal export territories,

especially the European R-PET market, are projected to escalate to an impressive US$3.9 billion by 2028. Growing at a Compound Annual

Growth Rate (CAGR) of 6.1%, these figures shed light on the surging demand and potential of the R-PET domain (Recycled PET Market, Global

Forecast to 2028, Markets and Markets, Jun 2023).

Moreover,

the regulatory landscape in this region is evolving in favor of sustainability. Several countries have made strides in introducing frameworks

that promote the incorporation of recycled materials, with a specific emphasis on packaging. These legislative advancements not only

fortify the market landscape but also significantly amplify the demand for the R-PET industry. When we couple these dynamics with the

region’s swift economic evolution, rapid urbanization, and an expanding middle-class demographic, the resulting synergy augments

consumption patterns. This is particularly evident in sectors like food & beverage, which unfolds a plethora of market vistas for

our initiative.

Our

Organization

Employees

As

at the date of this report, we had a total of 21 employees, out of which 9 were foreign workers from Indonesia, Myanmar and Bengal.

We are subject to certain approvals for employment of foreign workers and have obtained letters of approval by the Ministry of Home Affairs

of Malaysia.

Reports

to Security Holders

You

may read and copy any materials the Company files with the Commission in the Commission’s Public Reference Section, Room 1580,

100 F Street N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Section by calling the

SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and

other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

Risk

Factors

An

investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other

information contained in this report before deciding to invest in our common stock.

Risks

Related to our Business

There is substantial doubt about Sunshine

Green Land’s ability to continue as a going concern.

For the year

ended June 30, 2023, Sunshine Green Land incurred a net loss of $1,003,693 and used cash in operating activities of $959,289. These factors

raise substantial doubt about the Sunshine Green Land’s ability to continue as a going concern within one year after the date the

financial statements are issued. In addition, Sunshine Green Land’s independent registered public accounting firm, in their report on

Sunshine Green Land’s June 30, 2023, audited financial statements, raised substantial doubt about the Sunshine Green Land’s ability

to continue as a going concern. No assurance can be given that any future financing, if needed, will be available or, if available, that

it will be on terms that are satisfactory to the Company. Even if the Company is able to obtain additional financing, if needed, it may

contain undue restrictions on its operations, in the case of debt financing, or cause substantial dilution for its stockholders, in the

case of equity financing.

We have identified material weaknesses in

our disclosure controls and procedures and internal control over financial reporting.

We identified

material weaknesses in our internal controls over financial reporting. A material weakness is a deficiency, or a combination of deficiencies,

in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial

statements will not be prevented or detected on a timely basis.

The material

weaknesses identified include (i) the Company did not maintain a functioning independent audit committee and did not maintain an independent

board; (ii) the Company had inadequate segregation of duties; and (iii) the Company had an insufficient number of personnel with an appropriate

level of U.S. GAAP knowledge and experience and ongoing training in the application of U.S. GAAP and SEC disclosure requirements commensurate

with the Company’s financial reporting requirements.

If not remediated,

our failure to establish and maintain effective disclosure controls and procedures and internal control over financial reporting could

result in material misstatements in our financial statements and a failure to meet our reporting and financial obligations, each of which

could have a material adverse effect on our financial condition and the trading price of our common stock.

Any

major disruption at our waste treatment plants, such as a breakdown of machinery, power or utilities shortage, could adversely affect

our business, financial conditions, results of operations.

Our

business is dependent on the uninterrupted operation of our waste treatment plants. If the use or efficiency of our waste treatment plants

is hampered or disrupted due to power or water shortages or breakdowns, or if our machinery and equipment is damaged due to accident,

fire or other natural disasters, our ability to process plastic recycle products and deliver our products in a timely manner, and thus

our ability to generate revenue, may be materially affected. Furthermore, our waste treatment processes require a stable source of electricity,

and there is no guarantee that the local electricity supply would be sufficiently reliable or stable for consumption at all times. If

we are unable to manage or reduce periods of interruption of power supply, our waste treatment capacities at our waste treatment plants

may be limited, delayed or halted, which could have an adverse effect on our business, operations, financial performance, financial condition,

results of operations. Furthermore, in the case of a breakdown or failure in our machinery or equipment, suitable replacements of relevant

machinery may not be readily available in the market in a timely manner or at all. Any disruptions affecting our waste treatment plants

may lead to delays in fulfilling contract obligations, and our business, operations, financial performance, financial condition, and

results of operations may be materially and adversely affected.

Our

success is dependent on the continuous efforts of our key management and operation personnel, and we may not be able to find suitable

replacement in case of loss of service of any of them.

The

Company’s success also will depend in large part on the continued service of its key operational and management personnel, including

executive staff, research and development, engineering, marketing and sales staff. Most specifically, including Ms. Wo Kuk Ching, our

Chairman, CEO and Executive Director, Mr. Luo Xiong, our Vice president who oversees new partnerships, as well as implementation of our

methodology, partnership retention, overall management and future growth. We rely on the expertise and experience of our key management

personnel in developing business strategies, managing business operations and maintaining relationships with our customers. While there

had been no key management and operation personnel who left us during these years, there is no assurance that there will be no such incidents

in the future. If we lose the services of any of our key management personnel, we may not be able to find a suitable replacement with

comparable knowledge and experience in a timely manner, and our business, operations, financial performance, financial condition, results

of operations may be materially and adversely affected.

We

rely on foreign workers for our operations

Our

Company presently operates in a labor intensive industry and we depend on foreign labor for our predominantly manual operations such

as manual sorting of collected waste.

As

at the date of this report, we had a total of 21 employees, out of which 9 were foreign workers. We are subject to certain approvals

for employment of foreign workers and have obtained letters of approval by the Ministry of Home Affairs of Malaysia. As advised by our

legal advisers as to Malaysia law, there is no fixed quota on the number of foreign workers we can employ or any pre-determined foreign

workers to local workers ratio as mandated by the Ministry of Home Affairs of Malaysia as the approval for intake of foreign workers

is based on the actual requirement of the employer. Such an approval is applied by the employer on an as-needed basis. As such, we can

increase the quota of foreign workers as long as an application for intake of foreign workers is first submitted to, and approval for

such application is obtained from, the Ministry of Home Affairs of Malaysia.

We

have been in compliance with the relevant laws and regulations governing the employment of foreign workers in all material respects during

these years. While our Directors confirmed that we had fully complied with the relevant laws and regulations relating to foreign workers

in all material respects during these years, there is no assurance that the Malaysian government will not impose additional conditions

or restrictions on the intake of foreign workers allowed or change the foreign worker policy or the laws and regulations relating to

foreign workers, and we may not be able to replace our foreign workers with local workers, or we may have to incur additional cost for

recruiting local workers. This may in turn materially and adversely affect our business, operations, financial performance, financial

condition, results of operations. Further, any increase in competition for foreign workers, especially skilled workers, will also increase

the general labour wages paid by us to our foreign workers, which will have an adverse impact on our costs of operations and may in turn

materially and adversely affect our results of operations.

We

generally do not enter into long-term agreements with our customers. If we fail to retain our existing customers or attract new customers,

our business, financial conditions and results of operations may be materially and adversely affected.

We

do not enter into long-term agreements with most of our customers, and our customers have no obligation to engage us again for future

to purchase recycled products from us as it is the industry practice to not enter into such long-term agreements with our customers.

There is no assurance that our current or future agreements, with our major customers can be negotiated on terms and prices equivalent

to or more favourable than current terms and prices. If we fail to retain our existing customers or attract new customers, our revenue

and profitability, which is dependent on the number and scale of recycle products that we are able to sell, may be materially and adversely

affected.

Cross

Border Sales Transactions

Cross-border

sales transactions carry a risk of changes in import tax and/or duties related to the import and export of our product, which can result

in pricing changes, which will affect revenues and earnings. Cross border sales transactions carry other risks including, but not limited

to, changing regulations, wait times, customs inspection and lost or damaged product.

We

will need to raise funding, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when

needed may force us to delay, limit or terminate our product development efforts or other operations.

We

will need to seek funds soon, through public or private equity or debt financings, government or other third-party funding, marketing

and distribution arrangements and other collaborations, strategic alliances or a combination of these approaches. Raising funds in the

current economic environment may present additional challenges. It is not certain that we have accounted for all costs and expenses of

future development and regulatory compliance. Even if we believe we have sufficient funds for our current or future operating plans,

we may seek additional capital if market conditions are favourable or if we have specific strategic considerations.

Our

future growth may be limited.

The

Company’s ability to achieve its expansion objectives and to manage its growth effectively depends upon a variety of factors, including

the Company’s ability to further develop use of methodology, to attract and retain skilled employees, to successfully position

and market the Company, to protect its existing intellectual property, to capitalize on the potential opportunities it is pursuing with

third parties, and sufficient funding. To accommodate growth and compete effectively, the Company will need working capital to maintain

adequate operating levels, develop additional procedures and controls and increase, train, motivate and manage its work force. There

is no assurance that the Company’s personnel, systems, procedures and controls will be adequate to support its potential future

operations.

We

are dependent on third parties for the supply of raw materials.

Our

continuing success depends on the availability, cost and quality of the raw materials for the Plastic recycle products. The cost of raw

materials amounted to approximately MYR3.3 million, and MYR10.7 million respectively, representing approximately 94% and 97% of our cost

of sales for FY2022 and FY2023 respectively. Cost of raw materials refers to cost incurred by our Company to purchase recoverable items

from our suppliers, which is the key components of cost of sales attributable to the recycled products segment. The increase in cost

of raw materials from MYR3.3 million in FY2022 to MYR10.7 million in FY2023 was mainly due to the sales increase and new machinery testing.

We

generally do not enter into any agreements with our suppliers other than on a purchase order basis. The prices and supply of raw materials

depend on factors beyond our control, including economic conditions, competition, availability of quality suppliers, production levels

and transportation costs in Malaysia and Overseas. There is no assurance that there will not be such incidents in the future. If we are

unable to procure the required raw materials from our suppliers in a timely manner (for example, as a result of the suspension of operations

or liquidation or bankruptcy of the supplier), or if the cost of raw materials exceeds our budgeted cost, or if any of our key suppliers

is unable to continue providing the raw materials we need or fail to supply the necessary raw materials at prices and on terms and conditions

we consider acceptable, and we are unable to find suitable replacement of the suppliers nor pass on the additional costs to our customers,

there may be a material and adverse effect on our business, operations, financial performance, financial condition, results of operations.

We

may not be successful in our potential business combinations.

The

Company may, in the future, pursue acquisitions of other complementary businesses and technology licensing arrangements. The Company

may also pursue strategic alliances and joint ventures that leverage its core products and industry experience to expand its product

offerings and geographic presence. The Company has limited experience with respect to acquiring other companies and limited experience

with respect to forming collaborations, strategic alliances and joint ventures.

If

the Company were to make any acquisitions, it may not be able to integrate these acquisitions successfully into its existing business

and could assume unknown or contingent liabilities. Any future acquisitions the Company makes, could also result in large and immediate

write-offs or the incurrence of debt and contingent liabilities, any of which could harm the Company’s operating results. Integrating

an acquired company also may require management resources that otherwise would be available for ongoing development of the Company’s

existing business.

We

are required to comply with applicable laws and regulations.

Arising

from the operations of our Company, we are required to comply with laws and regulations applicable to, among others, workplace safety,

employment of foreign workers, environment and road traffic. In the event that we fail to comply with any of the applicable laws and

regulations, we may be subject to penalties imposed by the authorities which include, but are not limited to, being fined and/or issued

with remedial or stop-work orders which may materially and adversely affect our business, operations, financial performance, financial

condition, results of operations.

We

are imposed to environmental liability.

Our

business operations are subject to environmental laws and regulations, in particular on the emission, discharge or deposit of waste into

the environment pursuant to the laws of Malaysia. Though we had no material non-compliance with applicable environmental laws and regulations,

as these laws and regulations may continue to evolve, there is no assurance that we will continue to be in compliance with all the applicable

laws and regulations, and we may incur additional costs in complying with such laws and regulations. Any violation of the relevant environmental

laws and regulations may lead to substantial fines, clean-up costs and environmental liabilities or even suspension of operations that

could materially and adversely affect our business, operations, financial performance, financial condition, results of operations.

We

intend to expand our capacity by capital investment in new machinery and system, which may result in an increase in depreciation expenses,

plant and machinery operating costs, repair and maintenance costs and cash flow used in investing activities.

In

order to secure more customers in Malaysia and overseas and expand the scale of our operations and customer base, our Directors intend

to apply an aggregate of approximately MYR10 million (equivalent to approximately US$.2.3 million) in capital investment in facilities,

plants, machineries and/or equipment to enhance production efficiency and capacities.

As

a result, our cash flow used in investing activities is expected to increase, and assuming all other things remain unchanged and such

investment have been fully deployed, our depreciation expenses, plant and machinery operating costs and repair and maintenance costs

will increase and this may in turn have a material adverse effect on our business, operations, financial performance, financial condition,

results of operations.

Any

further disruptions from an uptick in new infections related to COVID-19 may materially harm out business prospects.

Further

upticks in infection, and the related enforcement of governmental restrictions would materially hinder our ability to grow, as it would

make it could interrupt our supply chain, as well as the financial condition of our intended customer base.

We

may need further financing for our existing business and future growth.

We

may require additional funding for our existing business and growth plans. We have estimated our funding requirements in order to implement

our growth plans.

In

the event that the costs of implementing our growth plans exceed our funding estimates significantly or that we come across opportunities

to grow through expansion plans which cannot be predicted at this juncture, and our funds generated from our operations prove insufficient

for such purposes, we may need to raise additional funds to meet these funding requirements. We will consider obtaining such funding

from new issuance of equity, debt instruments and/or external bank borrowings, as appropriate. In addition, we may need to obtain additional

equity or debt financing for other business opportunities that our Group deems favourable to our future growth and prospects. Funding

through the new issuance of equity may lead to a dilution in the interests of the Shareholders. An increase in debt financing may be

accompanied by conditions that restrict our ability to pay dividends or require us to seek lenders’ consent for payment of dividends,

or restrict our freedom to operate our business by requiring lenders’ consent for certain corporate actions. In addition, there

is no assurance that we will be able to obtain additional financing on terms that are favourable and acceptable. If we are not able to

secure adequate financing, our business and growth may be negatively affected.

Risks

Related to Our Operation in Malaysia

The

development of the industry we operate in is highly dependent on the Malaysian government’s environmental protection policies,

which may change from time to time.

As

a business operating in Malaysia, we are subject to the laws and regulations of Malaysia, which can be complex and evolve rapidly. The

Malaysian government has the power to exercise significant oversight and discretion over the conduct of our business, and the environmental

regulations to which we are subject may change rapidly and with little notice to us or our shareholders. As a result, the application,

interpretation, and enforcement of new and existing laws and regulations in Malaysia are often uncertain. In addition, these laws and

regulations may be interpreted and applied inconsistently by different agencies or authorities, and inconsistently with our current policies

and practices. New laws, regulations, and other government directives in Malaysia may also be costly to comply with, and such compliance

or any associated inquiries or investigations or any other government actions may:

| |

● |

Delay

or impede our development, |

| |

|

|

| |

● |

Result

in negative publicity or increase our operating costs, |

| |

|

|

| |

● |

Require

significant management time and attention, and |

| |

|

|

| |

● |

Subject

us to remedies, administrative penalties and even criminal liabilities that may harm our business, including fines assessed for our

current or historical operations, or demands or orders that we modify or even cease our business practices. |

The

promulgation of new laws or regulations, or the new interpretation of existing laws and regulations, in each case that restrict or otherwise

unfavorably impact the ability or manner in which we conduct our business and could require us to change certain aspects of our business

to ensure compliance, which could decrease demand for our services, reduce revenues, increase costs, require us to obtain more licenses,

permits, approvals or certificates, or subject us to additional liabilities. To the extent any new or more stringent measures are required

to be implemented, our business, financial condition and results of operations could be adversely affected as well as materially decrease

the value of our common stock.

Changes

in Malaysian economic, political and social conditions, as well as government policies, may affect our businesses and the industry we

operate in.

Our

major assets and business operations are located in Malaysia. Therefore, our business, operations, financial performance, financial condition

and results of operations are significantly exposed to the economic, political and social conditions in Malaysia as well as government

policies, which in turn may impact our customers in Malaysia who buy our recycle products from us. There is no assurance that the demand

for our products in Malaysia will not decrease in the future. For instance, an economic downturn in Malaysia may lead to a decrease in

the demand for our products in the market, thereby materially and adversely affecting our business, financial conditions and results

of operations.

Further,

any changes in the policies implemented by the government of Malaysia which may result in currency and interest rate fluctuations, inflation,

capital restrictions, price and wage controls, expropriation and changes in taxes and duties detrimental to our business may materially

affect our operations, financial performance and future growth. Unfavourable changes in the social, economic and political conditions

of Malaysia or in the Malaysian government policies in the future may have a negative impact on our operations and business in Malaysia,

which will in turn adversely affect the overall financial performance of our Company. In addition, Malaysia foreign exchange control

may limit our ability to utilise our cash effectively and affect our ability to receive dividends and other payments from our Malaysian

subsidiaries.

We

are subject to currency conversion and exchange rate risk.

Since

a substantial amount of our income and profit is denominated in MYR, any fluctuations in the value of MYR may adversely affect the amount

of dividends, if any, payable to the Shares in S$ to our Shareholders. There is no assurance that the Malaysian government will not impose

more restrictive or additional foreign exchange controls. Any imposition, variation or removal of exchange controls may lead to less

independence in the Malaysian government’s conduct of its domestic monetary policy and increased exposure of the Malaysia economy

to the potential risks and vulnerability of external developments in the international markets.

Furthermore,

fluctuations in the value of MYR against other currencies will create foreign currency translation gains or losses and may have an adverse

effect on our business, operations, financial performance, financial condition and results of operations. Any imposition, variation or

removal of foreign exchange controls may adversely affect the value, translated or converted into S$, of our net assets, earnings or

any declared dividends. Consequently, this may adversely affect our ability to pay dividends or satisfy other foreign exchange requirements.

We

are subject to the foreign exchange legislation and regulations in Malaysia.

Local

and foreign investors are subject to Foreign Exchange Administration Rules in Malaysia. The legislations in Malaysia governing exchange

control are the Financial Services Act 2013 (“FSA”) and Islamic Financial Services Act 2013 (“IFSA”). In exercise

of the power conferred by the FSA and IFSA, Bank Negara Malaysia, which is the central bank of Malaysia (“Bank Negara”),

has issued Foreign Exchange Administration Notices (“FEA Notices”) which embody its general permissions and directions. The

FEA Notices read together with Schedule 14 of the FSA and IFSA set out the circumstances in which the specific approval of the Bank Negara

must be obtained by residents and non-residents to remit funds to and from Malaysia. The FEA Notices are reviewed regularly by Bank Negara

in line with the changing environment. As at the Latest Practicable Date, foreign investors are free to repatriate capital, divestment

proceeds, profits, dividends, rental, fees and interests arising from investments in Malaysia provided that the repatriation is made

in foreign currency. Any future restriction by the FEA Notices on repatriation of funds may limit our ability on dividends distribution

to the Shareholders from business operations in Malaysia.

However,

there is no assurance that the relevant rules and regulations on foreign exchange control in Malaysia will not change. In the event that

there is any adverse change in the foreign exchange rules and regulations relating to the borrowing or repatriation of foreign currency,

our business and results of operation may be materially and adversely affected.

Risks

Related to the Market for our Stock

The

OTC and share value.

Our

Common Stock trades over the counter, which may deprive stockholders of the full value of their shares. Our stock is quoted via the Over-The-Counter

(“OTC”) Pink Sheets under the ticker symbol “SGLA”. Therefore, our Common Stock is expected to have fewer market

makers, lower trading volumes, and larger spreads between bid and asked prices than securities listed on an exchange such as the New

York Stock Exchange or the NASDAQ Stock Market. These factors may result in higher price volatility and less market liquidity for our

Common Stock.

Low

market price

A

low market price would severely limit the potential market for our Common Stock. Our Common Stock is expected to trade at a price substantially

below $5.00 per share, subjecting trading in the stock to certain Commission rules requiring additional disclosures by broker-dealers.

These rules generally apply to any non-NASDAQ equity security that has a market price share of less than $5.00 per share, subject to

certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure

schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers

who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions,

the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent

to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid

and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact

and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing

before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information

for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed upon broker-dealers

by such requirements could discourage broker-dealers from effecting transactions in our Common Stock.

Lack

of market and state blue sky laws

Investors

may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws. The holders of our shares of Common Stock

and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant

state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the shares

available for trading on the OTC, investors should consider any secondary market for our securities to be a limited one. We intend to

seek coverage and publication of information regarding our Company in an accepted publication which permits a “manual exemption.”

This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the

security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to

be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer’s

balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal

year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a

non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities.

Most of the accepted manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment

Service, and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that

they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions

and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota,

Tennessee, Vermont, and Wisconsin.

Accordingly,

our shares of Common Stock should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

Penny

stock regulations

We

will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our Common Stock. The Commission

has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price

less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our Common

Stock will become a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock

Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than

established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the

purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect

the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary

market.

For

any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure

schedule prepared by the Commission relating to the penny stock market. Disclosure is also required to be made about sales commissions

payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements

are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market

in penny stock.

We

do not anticipate that our Common Stock will qualify for exemption from the Penny Stock Rule. In any event, even if our Common Stock

were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the Commission the

authority to restrict any person from participating in a distribution of penny stock, if the Commission finds that such a restriction

would be in the public interest.

Rule

144 Risks

Sales

of our Common Stock under Rule 144 could reduce the price of our stock. There are 10,000,000 issued and outstanding shares of our Common

Stock held by affiliates that Rule 144 of the Securities Act defines as restricted securities.

These

shares will be subject to the resale restrictions of Rule 144, since we have ceased being deemed a “shell company”. In general,

persons holding restricted securities, including affiliates, must hold their shares for a period of at least nine months, may not sell

more than 1.0% of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage

transaction at the market price. The availability for sale of substantial amounts of Common Stock under Rule 144 could reduce prevailing

market prices for our securities.

No

audit or compensation committee

Because

we do not have an audit or compensation committee, stockholders will have to rely on our entire Board of Directors, none of which are

independent, to perform these functions. We do not have an audit or compensation committee comprised of independent directors. Indeed,

we do not have any audit or compensation committee. These functions are performed by our Board of Directors as a whole. No members of

our Board of Directors are independent directors. Thus, there is a potential conflict in that Board members who are also part of management

will participate in discussions concerning management compensation and audit issues that may affect management decisions.

Security

laws exposure

We

are subject to compliance with securities laws, which exposes us to potential liabilities, including potential rescission rights. We

may offer to sell our shares of our Common Stock to investors pursuant to certain exemptions from the registration requirements of the

Securities Act, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the

applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering.

We may not seek any legal opinion to the effect that any such offering would be exempt from registration under any federal or state law.

Instead, we may elect to relay upon the operative facts as the basis for such exemption, including information provided by investor themselves.

If

any such offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it

so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under

state law in those states where the securities may be offered without registration in reliance on the partial pre-emption from the registration

or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful

in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally,

if we did not in fact qualify for the exemptions upon which we have relied, we may become subject to significant fines and penalties

imposed by the Commission and state securities agencies.

No

cash dividends

Because

we do not intend to pay any cash dividends on our Common Stock, our stockholders will not be able to receive a return on their shares

unless they sell them. We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate

paying any cash dividends on shares of our Common Stock in the foreseeable future. Unless we pay dividends, our stockholders will not

be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares

of our Common Stock when desired.

Delayed

adoption of accounting standards

We

have delayed the adoption of certain accounting standards through an opt-in right for emerging growth companies. We have elected to use

the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, which

allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies

until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies

that comply with public company effective dates.

Management’s

discussion and analysis of financial condition and results of operation

The

following discussion and analysis should be read in conjunction with our financial statements and related notes thereto.

Forward

Looking Statements

The

following information specifies certain forward-looking statements of the management of our Company. Forward-looking statements are statements

that estimate the happening of future events and are not based on historical fact. Forward-looking statements may be identified by the

use of forward-looking terminology, such as may, shall, could, expect, estimate, anticipate, predict, probable, possible, should, continue,

or similar terms, variations of those terms or the negative of those terms. The forward-looking statements specified in the following

information statement have been compiled by our management on the basis of assumptions made by management and considered by management

to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to

be inferred from those forward-looking statements.

The

assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future

events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result,

the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among

reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially

from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements.

We cannot guaranty that any of the assumptions relating to the forward-looking statements specified in the following information are

accurate, and we assume no obligation to update any such forward-looking statements. Such forward-looking statements include statements

regarding our anticipated financial and operating results, our liquidity, goals, and plans.

All

forward-looking statements in this Form 10 are based on information available to us as of the date of this report, and we assume no obligation

to update any forward-looking statements.

Overview

The

Company was incorporated under the laws of the State of Nevada on March 6, 2008, under the name of Henry County Plywood Corporation,

as successor by merger to a Virginia corporation incorporated in May 1948 under the same name. On March 17, 2009, the Company changed

its name from “Henry County Plywood Corporation” to “Sino Green Land Corporation”. During 2009 to 2011, the Company

was principally engaged in the wholesale distribution of premium fruits in China. In 2011, the Company was delinquent in statutory filings,

and the last annual report, Form 10-K for the year ended June 30, 2010, was filed to the SEC on March 31, 2011, and the last Form 10-Q

for the period ended September 30, 2011, was filed to the SEC on November 14, 2011.

On

December 30, 2019, the Eighth District Court of Clark County, Nevada granted the Application for Appointment of Custodian, to Custodian

Ventures LLC. Mr. David Lazar (“Mr. Lazar”), on behalf of the Custodian Ventures LLC, was awarded with custodianship and

appointed as sole officer and director of the due to the Company’s ineffective board of directors, revocation of corporate charter,

and abandonment of business. On January 7, 2020, Mr. Lazar announced the Court Order and the Change in Principle Officer through Form

8-K filing. The filing also mentioned the change of Company’s name from “Sino Green Land Corporation” to “Go

Silver Toprich, Inc.”. On June 10, 2020, a settlement agreement was entered between the Company, Custodian Ventures, LLC, and Mr.

Lazar. Pursuant to the agreement, Custodian Ventures LLC shall dismiss its custodianship, and the Company shall resume its business operations,

and each party shall provide each other mutual release. In consideration of the release, the Company was required to pay Custodian Ventures

LLC $15,000 towards its costs and expenses as the settlement to dismiss its custodianship with the Court. On July 2, 2020, the custodianship

was discharged by the Court and Mr. Lazar resigned as sole officer and director of the Company. The former officer, Mr. Luo Xiong (“Mr.

Luo”) was re-appointed as Chief Executive Officer and director of the Company.

Since

July 2, 2020, along with the resumption of the Company’s business operations, Ms. Wo Kuk Ching (“Ms. Wo”), spouse of

Mr. Luo has served as President and director of the Company, Ms. Wong Ching Wing (“Elise”), daughter of Ms. Wo has served

as Chief Financial Officer, Treasurer and director of the Company, and Ms. Wong Erin (“Erin”), another daughter of Ms. Wo

has served as Secretary of the Company, respectively. On August 31, 2020, the Company changed its name from “Go Silver Toprich,

Inc.” back to “Sino Green Land Corporation”.

On

December 2, 2021, Mr. Luo submitted his resignation as Chief Executive Officer and director of the Company to the board of directors

effective June 30, 2021.

Effective

from June 30, 2021, Ms. Wo serves as Chief Executive Officer.

Ms.

Wo currently holds the positions of Chief Executive Officer, President, and director of the Company, respectively.

Business

Overview

Sino

Green Land Corp. (“SGLA” or the “Company”) is a US holding company incorporated in Nevada. We conduct our business

through our Malaysia subsidiary “Tian Li Eco Holdings Sdn. Bhd” (“Tian Li”), which is an environmental protection

technology, recycling and renewal of plastic waste bottles and packaging materials being recycled and sale of recovered and recycled

products, a company incorporated and based in Malaysia. With the mission to rooted in advocating for waste recycling, aiming for a sustainable

environmental future. With its strategic initiatives, the company’s objective is to become a prominent environmental recycling

entity in Asia over the coming five years.

Results

of Operations

| | |

Years Ended June 30, | | |

| |

| | |

2023 | | |

2022 | | |

Change | |

| Net revenues | |

$ | 636,482 | | |

| 100 | % | |

$ | 1,145,808 | | |

| 100 | % | |

$ | (509,326 | ) | |

| (44 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| (1,052,261 | ) | |

| (165 | )% | |

| (1,230,898 | ) | |

| (107 | )% | |

| (178,637 | ) | |

| (15 | )% |

| Gross profit (loss) | |

| (415,779 | ) | |

| (65 | )% | |

| (85,090 | ) | |

| (7 | )% | |

| (330,689 | ) | |

| (389 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expense | |

| (570,823 | ) | |

| (90 | )% | |

| (333,121 | ) | |

| (29 | )% | |

| 237,702 | | |

| 71 | % |

| Interest income | |

| 266 | | |

| 0 | % | |

| 4 | | |

| 0 | % | |

| 262 | | |

| 6550 | % |

| Other income | |

| - | | |

| 0 | % | |

| 1,748 | | |

| 0 | % | |

| (1,748 | ) | |

| (0 | )% |

| Interest expense | |

| (17,357 | ) | |

| (3 | )% | |

| - | | |

| (0 | )% | |

| 17,357 | | |

| 100 | % |

| Income taxes | |

| - | | |

| (0 | )% | |

| - | | |

| (0 | )% | |

| - | | |

| (0 | )% |

| Net loss | |

$ | (1,003,693 | ) | |

| (158 | )% | |

$ | (416,459 | ) | |

| (36 | )% | |

$ | (587,234 | ) | |

| 141 | % |

Net

Revenues

Net

revenues totaled $636,482 for the year ended June 30, 2023, a drop of $509,326, or 44%, as compared to the revenue for the year ended

June 30, 2022. The decrease in net revenues was mainly due to a decrease in sales of plastic recycle products as a result of the

decrease in orders from the third parties.

Cost

of Revenues

Cost