0001664703FALSE00016647032024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 15, 2024

___________________________________________

BLOOM ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

001-38598

(Commission File Number)

___________________________________________

| | | | | | | | | | | |

| Delaware | 77-0565408 |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

| | |

| 4353 North First Street, | San Jose, | California | 95134 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| 408 | 543-1500 |

| (Registrant’s telephone number, including area code) |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

___________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | BE | | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On February 15, 2024, Bloom Energy Corporation (the “Company”) announced its financial results for the fourth quarter ended December 31, 2023 and issued a press release, a copy of which is attached hereto as Exhibit 99.1. The press release discloses certain non-GAAP financial measures. A reconciliation to the nearest comparable GAAP equivalent of these non-GAAP measures is contained in tabular form in Exhibit 99.1.

The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated February 15, 2024 |

| 104 | | Cover page interactive data file (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | |

| BLOOM ENERGY CORPORATION |

| | | | | |

| Date: | February 15, 2024 | By: | | | /s/ Gregory Cameron | |

| | | | | | Gregory Cameron | |

| | | | | | President and Chief Financial Officer | |

| | | | | (Principal Financial and Accounting Officer) |

Bloom Energy Reports Fourth Quarter and Full Year 2023 Financial Results with Record Full Year Revenues

SAN JOSE, Calif., February 15, 2024 — Bloom Energy Corporation (NYSE: BE) reported today its financial results for the fourth quarter and the full year ended December 31, 2023. The company had record revenue of $1.3 billion for the full year driven by continued growth in product and service revenue.

Fourth Quarter Highlights

•Revenue of $356.9 million in the fourth quarter of 2023, a decrease of 22.8% compared to $462.6 million in the fourth quarter of 2022. Product and service revenue of $314.4 million in the fourth quarter of 2023, a decrease of 21.4% compared to $400.2 million in the fourth quarter of 2022.

•Gross margin of 25.9% in the fourth quarter of 2023, an increase of 10.5 percentage points compared to 15.4% in the fourth quarter of 2022.

•Non-GAAP gross margin of 27.4% in the fourth quarter of 2023, a decrease of 3.0 percentage points compared to 30.4% in the fourth quarter of 2022.

•Operating profit of $12.9 million in the fourth quarter of 2023, an improvement of $53.5 million compared to operating loss of $40.6 million in the fourth quarter of 2022.

•Non-GAAP operating profit of $27.4 million in the fourth quarter of 2023, a decrease of $31.6 million compared to a non-GAAP operating profit of $59.0 million in the fourth quarter of 2022.

Total Year Highlights

•Revenue of $1,333.5 million in 2023, an increase of 11.2% compared to $1,199.1 million in 2022. Product and service revenue of $1,158.3 million in 2023, an increase of 12.3% compared to $1,031.6 million in 2022.

•Gross margin of 14.8% in 2023, an increase of 2.4 percentage points compared to 12.4% in 2022.

•Non-GAAP gross margin of 25.8% in 2023, an increase of 2.8 percentage points compared to 23.0% in 2022.

•Operating loss of $208.9 million in 2023, an improvement of $52.1 million compared to operating loss of $261.0 million in 2022.

•Non-GAAP operating profit of $19.2 million in 2023, an improvement of $52.7 million compared to a non-GAAP operating loss of $33.5 million in 2022.

“At Bloom Energy, our relentless focus on operational excellence and innovation helped us achieve a year of record revenue in 2023,” said KR Sridhar, Founder, Chairman and CEO of Bloom Energy. “In order to meet the growing demand for fast, efficient, clean energy across industries from data centers to industrial applications, we have continued to develop and commercialize innovative new offerings, including our Combined Heat and Power system announced in 2023, and our Be Flexible load following product™ offering announced this week. We look forward to building on this momentum in 2024 and beyond.”

Greg Cameron, President and CFO of Bloom Energy, added, “This year we reached critical milestones by delivering record revenues and positive Non-GAAP Operating Income. We continue to execute across the company, and I remain excited about Bloom’s future. The last four years have been an amazing professional journey and I’m proud of what we’ve been able to accomplish.”

Chief Financial Officer Transition

Bloom today announced that President and CFO Greg Cameron has notified the company of his intention to depart from his role. The company has retained Caldwell Partners to identify candidates to fill the Chief Financial Officer role. Mr. Cameron’s departure is not the result of any disagreement with the company on any matter relating to the company’s operations, policies, or practices.

Summary of Key Financial Metrics

Summary of GAAP Profit and Loss Statements

| | | | | | | | | | | | | | | | | |

| ($000), except EPS data | Q4'23 | Q3'23 | Q4'22 | FY 23 | FY 22 |

| Revenue | 356,917 | | 400,268 | | 462,577 | | 1,333,470 | | 1,199,125 | |

| Cost of Revenue | 264,526 | | 405,482 | | 391,199 | | 1,135,676 | | 1,050,837 | |

| Gross Profit (Loss) | 92,391 | | (5,214) | | 71,377 | | 197,794 | | 148,288 | |

| Gross Margin | 25.9 | % | (1.3) | % | 15.4 | % | 14.8 | % | 12.4 | % |

| Operating Expenses | 79,452 | | 98,494 | | 111,945 | | 406,701 | | 409,280 | |

| Operating (Loss) Profit | 12,939 | | (103,708) | | (40,568) | | (208,907) | | (260,992) | |

| Operating Margin | 3.6% | (25.9)% | (8.8)% | (15.7)% | (21.8)% |

| Non-operating Expenses | 8,428 | | 65,291 | | 6,604 | | 93,209 | | 40,416 | |

Net (Loss) Profit to Common Stockholders | 4,511 | | (168,999) | | (47,172) | | (302,116) | | (301,408) | |

| GAAP EPS, Basic | $ | 0.02 | | $ | (0.80) | | $ | (0.23) | | $ | (1.42) | | $ | (1.62) | |

| GAAP EPS, Diluted | $ | 0.02 | | $ | (0.80) | | $ | (0.23) | | $ | (1.42) | | $ | (1.62) | |

| | | | | |

Summary of Non-GAAP Financial Information1

| | | | | | | | | | | | | | | | | | |

| ($000), except EPS data | Q4'23 | Q3'23 | Q4'22 | FY 23 | FY 22 | |

| Revenue | 356,917 | | 400,268 | | 462,577 | | 1,333,470 | | 1,199,125 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Cost of Revenue | 259,138 | | 273,888 | | 321,823 | | 989,464 | | 923,052 | | |

| Gross Profit | 97,779 | | 126,380 | | 140,754 | | 344,006 | | 276,073 | | |

| Gross Margin | 27.4% | 31.6% | 30.4% | 25.8% | 23.0% | |

| Operating Expenses | 70,368 | | 74,580 | | 81,722 | | 324,825 | | 309,542 | | |

| Operating Profit (Loss) | 27,411 | | 51,800 | | 59,032 | | 19,181 | | (33,469) | | |

| Operating Margin | 7.7% | 12.9% | 12.8% | 1.4% | (2.8)% | |

| Adjusted EBITDA | 39,760 | | 66,415 | | 74,458 | | 81,791 | | 30,139 | | |

Non-GAAP EPS, Basic | $ | 0.09 | | $ | 0.20 | | $ | 0.27 | | $ | (0.10) | | $ | (0.41) | | |

Non-GAAP EPS, Diluted | $ | 0.07 | | $ | 0.15 | | $ | 0.22 | | $ | (0.10) | | $ | (0.41) | | |

| | | | | | |

1.A detailed reconciliation of GAAP to Non-GAAP financial measures is provided at the end of this press release

Outlook

Bloom provides outlook for the full-year 2024:

•Revenue: $1.4 - $1.6B

•Non-GAAP Gross Margin: ~28%

•Non-GAAP Operating Income: $75 - $100M

Conference Call Details

Bloom will host a conference call today, February 15, 2024, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss its financial results. To participate in the live call, analysts and investors may call toll-free dial-in number: +1 (888) 330-2443 and toll-dial-in-number +1 (240) 789-2728. The conference ID is 4781037. A simultaneous live webcast will also be available under the Investor Relations section on our website at https://investor.bloomenergy.com/. Following the webcast, an archived version will be available on Bloom’s website for one year. A telephonic replay of the conference call will be available for one week following the call, by dialing +1 (800) 770-2030 or +1 (647) 362 9199 and entering passcode 4781037.

Use of Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures as defined by the rules and regulations of the Securities and Exchange Commission (SEC). These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. Bloom urges you to review the reconciliations of its non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in this press release, and not to rely on any single financial measure to evaluate our business. With respect to Bloom’s expectations regarding its 2024 Outlook, Bloom is not able to provide a quantitative reconciliation of non-GAAP gross margin and non-GAAP operating income measures to the corresponding GAAP measures without unreasonable efforts due to the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation expense. Material changes to reconciling items could have a significant effect on future GAAP results and, as such, we believe that any reconciliation provided would imply a degree of precision that could be confusing or misleading to investors.

About Bloom Energy

Bloom Energy empowers businesses and communities to responsibly take charge of their energy. The company’s leading solid oxide platform for distributed generation of electricity and hydrogen is changing the future of energy. Fortune 100 companies turn to Bloom Energy as a trusted partner to deliver lower carbon energy today and a net-zero future. For more information, visit www.bloomenergy.com.

Forward-Looking Statements

This press release contains certain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or the negative of these words or similar terms or expressions that concern Bloom’s expectations, strategy, priorities, plans or intentions. These forward-looking statements include, but are not limited to, Bloom’s expectations regarding: innovation and solutions; customer reaction to Bloom’s products; Bloom’s liquidity position; market demand for energy solutions; and Bloom’s 2024 outlook for revenue and profitability. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results due to a variety of factors including, but not limited to: Bloom’s limited operating history; the emerging nature of the distributed generation market and rapidly evolving market trends; the significant losses Bloom has incurred in the past; the significant upfront costs of Bloom’s Energy Servers and Bloom’s ability to secure financing for its products; Bloom’s ability to drive cost reductions and to successfully mitigate against potential price increases; Bloom’s ability to service its existing debt obligations; Bloom’s ability to be successful in new markets; the ability of the Bloom Energy Server to operate on the fuel source a customer will want; the success of the strategic partnership with SK ecoplant in the United States and international markets; timing and development of an ecosystem for the hydrogen market, including in the South Korean market; continued incentives in the South Korean market; adapting to the new government bidding process in the South Korean market; the timing and pace of adoption of hydrogen for stationary power; the risk of manufacturing defects; the accuracy of Bloom’s estimates regarding the useful life of its Energy Servers; delays in the development and introduction of new products or updates to existing products; Bloom’s ability to secure partners in order to commercialize its electrolyzer and carbon capture products; supply constraints; the availability of rebates, tax credits and other tax benefits; changes in the regulatory landscape; Bloom’s reliance upon a limited number of customers; Bloom’s lengthy sales and installation cycle, construction, utility interconnection and other delays and cost overruns related to the installation of its Energy Servers, including inventories with distributors; business and economic conditions and growth trends in commercial and industrial energy markets; global macroeconomic conditions, including rising interest rates, recession fears and inflationary pressures, or geopolitical events or conflicts; overall electricity generation market; management transitions; Bloom’s ability to protect its intellectual property; and other risks and uncertainties detailed in Bloom’s SEC filings from time to time. More information on potential factors that may impact Bloom’s business are set forth in Bloom’s periodic reports filed with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the SEC on February 21, 2023 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023, as filed with the SEC on May 9, 2023, August 3, 2023, and November 8, 2023, respectively, as well as subsequent reports filed with or furnished to the SEC from time to time. These reports are available on Bloom’s website at www.bloomenergy.com and the SEC’s website at www.sec.gov. Bloom assumes no obligation to, and does not currently intend to, update any such forward-looking statements.

The Investor Relations section of Bloom’s website at investor.bloomenergy.com contains a significant amount of information about Bloom Energy, including financial and other information for investors. Bloom encourages investors to visit this website from time to time, as information is updated and new information is posted.

| | | | | |

Investor Relations: Ed Vallejo Bloom Energy +1 (267) 370-9717 | Media: Amanda Song Bloom Energy press@bloomenergy.com |

Consolidated Balance Sheets

(in thousands, except share data)

| | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| Assets | | | | |

| Current assets: | | | | |

Cash and cash equivalents1 | | $ | 664,593 | | | $ | 348,498 | |

Restricted cash1 | | 46,821 | | | 51,515 | |

Accounts receivable less allowance for credit losses of $119 as of December 31, 2023 and $119 as of December 31, 20221, 2 | | 340,740 | | | 250,995 | |

Contract assets3 | | 41,366 | | | 46,727 | |

Inventories1 | | 502,515 | | | 268,394 | |

Deferred cost of revenue4 | | 45,984 | | | 46,191 | |

Prepaid expenses and other current assets1, 5 | | 51,148 | | | 43,643 | |

| Total current assets | | 1,693,167 | | | 1,055,963 | |

Property, plant and equipment, net1 | | 493,352 | | | 600,414 | |

Operating lease right-of-use assets1, 6 | | 139,732 | | | 126,955 | |

Restricted cash1 | | 33,764 | | | 118,353 | |

| Deferred cost of revenue | | 3,454 | | | 4,737 | |

Other long-term assets1, 7 | | 50,208 | | | 40,205 | |

| Total assets | | $ | 2,413,677 | | | $ | 1,946,627 | |

| Liabilities and stockholders’ equity | | | | |

| Current liabilities: | | | | |

Accounts payable1, 8 | | $ | 132,078 | | | $ | 161,770 | |

| Accrued warranty | | 19,326 | | | 17,332 | |

Accrued expenses and other current liabilities1, 9 | | 130,879 | | | 144,183 | |

Deferred revenue and customer deposits1, 10 | | 128,922 | | | 159,048 | |

Operating lease liabilities1, 11 | | 20,245 | | | 16,227 | |

| Financing obligations | | 38,972 | | | 17,363 | |

| Recourse debt | | — | | | 12,716 | |

Non-recourse debt1 | | — | | | 13,307 | |

| Total current liabilities | | 470,422 | | | 541,946 | |

Deferred revenue and customer deposits1, 12 | | 19,140 | | | 56,392 | |

Operating lease liabilities1, 13 | | 141,939 | | | 132,363 | |

| Financing obligations | | 405,824 | | | 442,063 | |

| Recourse debt | | 842,006 | | | 273,076 | |

Non-recourse debt1, 14 | | 4,627 | | | 112,480 | |

| Other long-term liabilities | | 9,049 | | | 9,491 | |

| Total liabilities | | $ | 1,893,007 | | | $ | 1,567,811 | |

| | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| Commitments and contingencies | | | | |

| Stockholders’ equity: | | | | |

Common stock: $0.0001 par value; Class A shares — 600,000,000 shares authorized, and 224,717,533 shares and 189,864,722 shares issued and outstanding and Class B shares — 600,000,000 shares authorized, and no shares and 15,799,968 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively. | | 21 | | | 20 | |

| Additional paid-in capital | | 4,370,343 | | | 3,906,491 | |

| Accumulated other comprehensive loss | | (1,687) | | | (1,251) | |

| Accumulated deficit | | (3,866,599) | | | (3,564,483) | |

| Total equity attributable to common stockholders | | 502,078 | | | 340,777 | |

| Noncontrolling interest | | 18,592 | | | 38,039 | |

| Total stockholders’ equity | | $ | 520,670 | | | $ | 378,816 | |

| Total liabilities and stockholders’ equity | | $ | 2,413,677 | | | $ | 1,946,627 | |

1 We have variable interest entities related to the PPA V and a joint venture in the Republic of Korea, which represent a portion of the consolidated balances recorded within these financial statement line items.

In August 2023, we sold the PPA V as a result of the PPA V Repowering of the Energy Servers as such the consolidated balances recorded within these financial statement line items as of December 31, 2023 exclude the PPA V balances.

2 Including amounts from related parties of $262.0 million and $4.3 million as of December 31, 2023 and December 31, 2022, respectively.

3 Including amounts from related parties of $6.9 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

4 Including amounts from related parties of $0.9 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

5 Including amounts from related parties of $2.3 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

6 Including amounts from related parties of $2.0 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

7 Including amounts from related parties of $9.1 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

8 Including amounts from related parties of $0.1 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

9 Including amounts from related parties of $3.4 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

10 Including amounts from related parties of $1.7 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

11 Including amounts from related parties of $0.4 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

12 Including amounts from related parties of $6.7 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

13 Including amounts from related parties of $1.6 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

14 Including amounts from related parties of $4.6 million as of December 31, 2023. There were no respective related party amounts as of December 31, 2022.

Consolidated Statements of Operations

(in thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4'23 | | Q3'23 | | Q4'22 | | FY 23 | | FY 22 |

| | | | | | | | | | |

| Revenue: | | | | | | | | | | |

| Product | | $ | 261,819 | | | $ | 304,976 | | | $ | 360,249 | | | $ | 975,245 | | | $ | 880,664 | |

| Installation | | 26,033 | | | 21,916 | | | 43,156 | | | 92,796 | | | 92,120 | |

| Service | | 52,569 | | | 47,535 | | | 39,942 | | | 183,065 | | | 150,954 | |

| Electricity | | 16,496 | | | 25,841 | | | 19,230 | | | 82,364 | | | 75,387 | |

Total revenue1 | | 356,917 | | | 400,268 | | | 462,577 | | | 1,333,470 | | | 1,199,125 | |

| Cost of revenue: | | | | | | | | | | |

| Product | | 172,514 | | | 182,832 | | | 222,841 | | | 630,105 | | | 616,178 | |

| Installation | | 27,854 | | | 25,902 | | | 46,275 | | | 105,735 | | | 104,111 | |

| Service | | 55,050 | | | 57,370 | | | 43,845 | | | 220,927 | | | 168,491 | |

| Electricity | | 9,108 | | | 139,378 | | | 78,238 | | | 178,909 | | | 162,057 | |

Total cost of revenue2 | | 264,526 | | | 405,482 | | | 391,199 | | | 1,135,676 | | | 1,050,837 | |

| Gross profit (loss) | | 92,391 | | | (5,214) | | | 71,377 | | | 197,794 | | | 148,288 | |

| Operating expenses: | | | | | | | | | | |

| Research and development | | 33,556 | | | 35,126 | | | 38,320 | | | 155,865 | | | 150,606 | |

| Sales and marketing | | 16,026 | | | 20,002 | | | 25,850 | | | 89,961 | | | 90,934 | |

General and administrative3 | | 29,871 | | | 43,366 | | | 47,775 | | | 160,875 | | | 167,740 | |

| Total operating expenses | | 79,452 | | | 98,494 | | | 111,945 | | | 406,701 | | | 409,280 | |

| (Loss) profit from operations | | 12,939 | | | (103,708) | | | (40,568) | | | (208,907) | | | (260,992) | |

| Interest income | | 6,114 | | | 7,419 | | | 2,523 | | | 19,885 | | | 3,887 | |

Interest expense4 | | (14,563) | | | (68,037) | | | (12,493) | | | (108,299) | | | (53,493) | |

| Other (expense) income, net | | 867 | | | (1,577) | | | 4,743 | | | (2,793) | | | 4,998 | |

| Loss on extinguishment of debt | | — | | | (1,415) | | | (4,723) | | | (4,288) | | | (8,955) | |

| (Loss) gain on revaluation of embedded derivatives | | (428) | | | (114) | | | (56) | | | (1,641) | | | 566 | |

| (Loss) profit before income taxes | | 4,930 | | | (167,432) | | | (50,574) | | | (306,043) | | | (313,989) | |

| Income tax provision | | 811 | | | 646 | | | 209 | | | 1,894 | | | 1,097 | |

| Net (loss) profit | | 4,117 | | | (168,078) | | | (50,783) | | | (307,937) | | | (315,086) | |

| Less: Net (loss) gain attributable to noncontrolling interest | | (394) | | | 921 | | | (3,611) | | | (5,821) | | | (13,378) | |

| Net (loss) gain attributable to common stockholders | | 4,511 | | | (168,999) | | | (47,172) | | | (302,116) | | | (301,708) | |

| Less: Net loss attributable to redeemable noncontrolling interest | | — | | | — | | | — | | | — | | | (300) | |

| Net (loss) gain before portion attributable to redeemable noncontrolling interest and noncontrolling interest | | $ | 4,511 | | | $ | (168,999) | | | $ | (47,172) | | | $ | (302,116) | | | $ | (301,408) | |

| Net (loss) gain per share available to common stockholders, basic | | $ | 0.02 | | | $ | (0.80) | | | $ | (0.23) | | | $ | (1.42) | | | $ | (1.62) | |

| Net (loss) gain per share available to common stockholders, diluted | | $ | 0.02 | | | $ | (0.80) | | | $ | (0.23) | | | $ | (1.42) | | | $ | (1.62) | |

| Weighted average shares used to compute net loss per share available to common stockholders, basic | | 224,204 | | | 210,930 | | | 201,173 | | | 212,681 | | | 185,907 | |

| Weighted average shares used to compute net loss per share available to common stockholders, diluted | | 274,366 | | | 210,930 | | | 201,173 | | | 212,681 | | | 185,907 | |

| | | | | | | | | | |

1 Including related party revenue of $126.2 million, $125.7 million and $6.1 million for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively, and $487.2 million and $36.3 million for the years ended December 31, 2023 and 2022, respectively.

2 Including related party cost of revenue of $0.1 million for the year ended December 31, 2023. There was no related party cost of revenue for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, and for the year ended December 31, 2022.

3 Including related party general and administrative expenses of $0.2 million and $0.2 million for the three months ended December 31, 2023, and September 30, 2023, respectively, and $0.8 million for the year ended December 31, 2023. There were no related party general and administrative expenses for the three months ended December 31, 2022, and for the year ended December 31, 2022.

4 Including related party interest expense of $0.1 million for the year ended December 31, 2023. There was no related party interest expense for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, and for the year ended December 31, 2022.

Consolidated Statement of Cash Flows

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4'23 | | Q3'23 | | Q4'22 | | FY 23 | | FY 22 |

| Cash flows from operating activities: | | | | | | | | | | |

| Net (loss) gain | | $ | 4,117 | | | $ | (168,078) | | | $ | (50,783) | | | $ | (307,937) | | | $ | (315,086) | |

| Adjustments to reconcile net (loss) gain to net cash used in operating activities: | | | | | | | | | | |

| Depreciation and amortization | | 12,349 | | | 14,615 | | | 15,426 | | | 62,609 | | | 61,608 | |

| Non-cash lease expense | | 9,079 | | | 8,356 | | | 2,002 | | | 33,619 | | | 20,155 | |

| Loss (gain) on disposal of property, plant and equipment | | 234 | | | (19) | | | 523 | | | 411 | | | — | |

| Revaluation of derivative contracts | | 428 | | | 114 | | | 56 | | | 1,641 | | | (9,583) | |

| Impairment of assets related to PPAs | | — | | | 130,088 | | | 68,714 | | | 130,088 | | | 113,514 | |

| Derecognition of loan commitment asset related to SK ecoplant Second Tranche Closing | | — | | | 52,792 | | | — | | | 52,792 | | | — | |

| Stock-based compensation expense | | 7,320 | | | 21,315 | | | 30,799 | | | 84,480 | | | 112,259 | |

| Amortization of warrants and debt issuance costs | | 1,472 | | | 1,514 | | | 677 | | | 4,772 | | | 3,032 | |

| Loss on extinguishment of debt | | — | | | 1,415 | | | 4,723 | | | 4,288 | | | 8,955 | |

| Unrealized foreign currency exchange loss (gain) | | (2,411) | | | 1,517 | | | (6,353) | | | 618 | | | (3,267) | |

| Other | | 404 | | | 23 | | | 45 | | | 450 | | | 3,532 | |

| Changes in operating assets and liabilities: | | | | | | | | | | |

Accounts receivable1 | | (6,037) | | | 16,100 | | | (178,622) | | | (89,888) | | | (162,864) | |

Contract assets2 | | 102,509 | | | (108,692) | | | (20,958) | | | 5,361 | | | (21,525) | |

| Inventories | | (25,374) | | | (8,969) | | | (14,081) | | | (231,689) | | | (124,878) | |

Deferred cost of revenue3 | | 17,569 | | | (8,370) | | | (15,426) | | | 1,655 | | | (24,282) | |

| Customer financing receivable | | — | | | — | | | — | | | — | | | 2,510 | |

Prepaid expenses and other assets4 | | 15,095 | | | (22,807) | | | (1,824) | | | (5,754) | | | (17,590) | |

Other long-term assets5 | | (17,000) | | | 10,219 | | | (1,887) | | | (3,366) | | | (2,617) | |

Operating lease right-of-use assets and operating lease liabilities | | (8,922) | | | (8,432) | | | 854 | | | (32,801) | | | 3,016 | |

| Financing lease liabilities | | 104 | | | 171 | | | 397 | | | 1,011 | | | 896 | |

Accounts payable6 | | (23,385) | | | (41,589) | | | 47,856 | | | (29,080) | | | 86,498 | |

| Accrued warranty | | 2,789 | | | 1,631 | | | 3,989 | | | 1,994 | | | 5,586 | |

Accrued expenses and other liabilities7 | | 17,152 | | | 4,782 | | | 42,741 | | | (13,785) | | | 43,243 | |

Deferred revenue and customer deposits8 | | 14,406 | | | (30,275) | | | 47,872 | | | (42,635) | | | 35,156 | |

| Other long-term liabilities | | (65) | | | (590) | | | (11) | | | (1,385) | | | (9,991) | |

| Net cash (used in) provided by operating activities | | 121,833 | | | (133,169) | | | (23,271) | | | (372,531) | | | (191,723) | |

| Cash flows from investing activities: | | | | | | | | | | |

| Purchase of property, plant and equipment | | (16,254) | | | (21,335) | | | (35,916) | | | (83,739) | | | (116,823) | |

| Proceeds from sale of property, plant and equipment | | 11 | | | (22) | | | — | | | 14 | | | — | |

| Net cash used in investing activities | | (16,243) | | | (21,357) | | | (35,916) | | | (83,725) | | | (116,823) | |

| Cash flows from financing activities: | | | | | | | | | | |

Proceeds from issuance of debt9 | | 3,144 | | | — | | | — | | | 637,127 | | | — | |

Payment of debt issuance costs | | (197) | | | (3,711) | | | — | | | (19,736) | | | — | |

Repayment of debt | | — | | | (118,538) | | | (73,112) | | | (191,390) | | | (120,586) | |

| Make-whole payment related to PPA IIIa and PPA IV debt | | — | | | — | | | (4,140) | | | — | | | (6,553) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4'23 | | Q3'23 | | Q4'22 | | FY 23 | | FY 22 |

| Cash flows from operating activities: | | | | | | | | | | |

| Purchase of capped call options related to convertible notes | | — | | | — | | | — | | | (54,522) | | | — | |

| Proceeds from financing obligations | | 2,291 | | | — | | | 3,261 | | | 4,993 | | | 3,261 | |

| Repayment of financing obligations | | (4,970) | | | (4,747) | | | (6,722) | | | (18,445) | | | (35,543) | |

| Distributions and payments to noncontrolling interest | | — | | | (2,265) | | | (882) | | | (2,265) | | | (6,854) | |

| Proceeds from issuance of common stock | | 942 | | | 6,745 | | | 129 | | | 16,945 | | | 15,279 | |

| Proceeds from public share offering | | — | | | — | | | — | | | — | | | 385,396 | |

| Payment of public share offering costs | | — | | | — | | | (368) | | | (35) | | | (13,775) | |

| Buyout of noncontrolling interest | | — | | | (6,864) | | | (12,000) | | | (6,864) | | | (12,000) | |

| Proceeds from issuance of redeemable convertible preferred stock | | — | | | — | | | — | | | 310,957 | | | — | |

| Payment of issuance costs related to redeemable convertible preferred stock | | (22) | | | — | | | — | | | (395) | | | — | |

| Contributions from noncontrolling interest | | — | | | — | | | — | | | 6,979 | | | 2,815 | |

| Other | | — | | | (285) | | | (13) | | | — | | | (76) | |

| Net cash provided by (used in) financing activities | | 1,188 | | | (129,665) | | | (93,847) | | | 683,349 | | | 211,364 | |

| Effect of exchange rate changes on cash, cash equivalent and restricted cash | | 704 | | | (657) | | | 2,078 | | | (281) | | | 434 | |

| Net increase (decrease) increase in cash, cash equivalents and restricted cash | | 107,482 | | | (284,848) | | | (150,956) | | | 226,812 | | | (96,748) | |

| Cash, cash equivalents and restricted cash: | | | | | | | | | | |

| Beginning of period | | 637,696 | | | 922,544 | | | 669,322 | | | 518,366 | | | 615,114 | |

| End of period | | $ | 745,178 | | | $ | 637,696 | | | $ | 518,366 | | | $ | 745,178 | | | $ | 518,366 | |

| | | | | | | | | | |

1 Including changes in related party balances of $14.2 million, $241.9 million and $8.1 million for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively, and related party balances of $257.8 million and $0.1 million for the years ended December 31, 2023 and 2022, respectively.

2 Including changes in related party balances of $3.5 million and $3.4 million for the three months ended December 31, 2023, and September 30, 2023, respectively, and related party balance of $6.9 million for the year ended December 31, 2023. There were no associated related party balances as of June 30, 2022, September 30, 2022 and December 31, 2022.

3 Including changes in related party balances of $22.5 million and $23.4 million for the three months ended December 31, 2023, and September 30, 2023, respectively, and related party balance of $0.9 million for the year ended December 31, 2023. There were no associated related party balances as of June 30, 2022, September 30, 2022 and December 31, 2022.

4 Including changes in related party balances of $7.6 million and $9.9 million for the three months ended December 31, 2023, and September 30, 2023, respectively, and related party balance of $2.3 million for the year ended December 31, 2023. There were no associated related party balances as of June 30, 2022, September 30, 2022 and December 31, 2022.

5 Including changes in related party balances of $7.1 million and $2.0 million for the three months ended December 31, 2023, and September 30, 2023, respectively, and related party balance of $9.1 million for the year ended December 31, 2023. There were no associated related party balances as of June 30, 2022, September 30, 2022 and December 31, 2022.

6 Including changes in related party balance of $0.1 million for the three months ended December 31, 2023 and the year ended December 31, 2023. There were no related party balances as of September 30, 2023, June 30, 2022, September 30, 2022 and December 31, 2022.

7 Including changes in related party balances of $2.3 million and $5.7 million for the three months ended December 31, 2023, and September 30, 2023, respectively, and related party balance of $3.4 million for the year ended December 31, 2023. There were no associated related party balances as of June 30, 2022, September 30, 2022 and December 31, 2022.

8 Including changes in related party balances of $2.7 million and $11.1 million for the three months ended December 31, 2023 and September 30, 2023, respectively, and related party balance of $8.4 million for the year ended December 31, 2023. There were no associated related party balances as of June 30, 2022, September 30, 2022 and December 31, 2022.

9 Including changes in related party balance of $4.6 million for the three months ended December 31, 2023 and the year ended December 31, 2023. There were no related party balances as of September 30, 2023, June 30, 2022, September 30, 2022 and December 31, 2022.

Reconciliation of GAAP to Non-GAAP Financial Measures

(unaudited)

(in thousands, except percentages)

| | | | | | | | | | | | | | | | | |

| Q4'23 | Q3'23 | Q4'22 | FY 23 | FY 22 |

| GAAP revenue | 356,917 | | 400,268 | | 462,577 | | 1,333,470 | | 1,199,125 | |

| GAAP cost of sales | 264,526 | | 405,482 | | 391,199 | | 1,135,676 | | 1,050,837 | |

| GAAP gross profit (loss) | 92,391 | | (5,214) | | 71,377 | | 197,794 | | 148,288 | |

| Non-GAAP adjustments: | | | | | |

| Stock-based compensation expense | 2,693 | | 5,581 | | 5,346 | | 17,504 | | 18,955 | |

| Impairment charge (PPA V, PPA IV, PPA IIIa) | — | | 123,700 | | 64,030 | | 123,700 | | 108,830 | |

| Restructuring charges | 2,695 | | 725 | | — | | 3,420 | | — | |

| PPA V Sales property tax | — | | 1,588 | | — | | 1,588 | | — | |

| Non-GAAP gross profit | 97,779 | | 126,380 | | 140,754 | | 344,006 | | 276,073 | |

| | | | | |

| GAAP gross margin % | 25.9 | % | (1.3) | % | 15.4 | % | 14.8 | % | 12.4 | % |

| Non-GAAP adjustments | 1.5 | % | 32.9 | % | 15.0 | % | 11.0 | % | 10.7 | % |

| Non-GAAP gross margin % | 27.4 | % | 31.6 | % | 30.4 | % | 25.8 | % | 23.0 | % |

| | | | | | | | | | | | | | | | | |

| Q4'23 | Q3'23 | Q4'22 | FY 23 | FY 22 |

GAAP (loss) profit from operations | 12,939 | | (103,708) | | (40,568) | | (208,907) | | (260,992) | |

| Non-GAAP adjustments: | | | | | |

| Stock-based compensation expense | 7,500 | | 21,564 | | 31,027 | | 87,095 | | 113,965 | |

| Impairment charge (PPA V, PPA IV, PPA IIIa) | — | | 130,088 | | 68,535 | | 130,088 | | 113,335 | |

| PPA V Sales property tax | — | | 1,588 | | — | | 1,588 | | — | |

| Restructuring charges | 6,940 | | 2,226 | | — | | 9,166 | | — | |

| Amortization of acquired intangible assets | 34 | | 42 | | 37 | | 151 | | 223 | |

| Non-GAAP profit (loss) from operations | 27,411 | | 51,800 | | 59,032 | | 19,181 | | (33,469) | |

| | | | | |

| GAAP operating margin % | 3.6 | % | (25.9) | % | (8.8) | % | (15.7) | % | (21.8) | % |

| Non-GAAP adjustments | 4.1 | % | 38.9 | % | 21.5 | % | 17.1 | % | 19.0 | % |

| Non-GAAP operating margin % | 7.7 | % | 12.9 | % | 12.8 | % | 1.4 | % | (2.8) | % |

Reconciliation of GAAP Net Profit (loss) to non-GAAP Net Profit (Loss) and Computation of non-GAAP Net Profit (Loss) per Share (EPS)

(unaudited)

(in thousands, except share data)

| | | | | | | | | | | | | | | | | |

| Q4'23 | Q3'23 | Q4'22 | FY 23 | FY 22 |

| Net (loss) profit to Common Stockholders | 4,511 | | (168,999) | | (47,172) | | (302,116) | | (301,408) | |

| Non-GAAP adjustments: | | | | | |

| | | | | |

| Add back: (Loss) gain for non-controlling interests | (394) | | 921 | | (3,611) | | (5,821) | | (13,678) | |

| Loss (gain) on derivative liabilities | 428 | | 114 | | 56 | | 1,641 | | (566) | |

| Impairment charge (PPA V, PPA IV, PPA IIIa) | — | | 130,088 | | 68,535 | | 130,088 | | 113,335 | |

| Loss on China JV investment | — | | — | | — | | — | | 1,446 | |

| Loss on extinguishment of debt | — | | 1,415 | | 4,723 | | 4,288 | | 8,955 | |

| Amortization of acquired intangible assets | 34 | | 42 | | 37 | | 151 | | 223 | |

| Restructuring charges | 6,940 | | 2,226 | | — | | 9,166 | | — | |

| PPA V Sales property tax | — | | 1,588 | | — | | 1,588 | | — | |

| Goodwill impairment | — | | — | | — | | — | | 2,000 | |

| Interest expense on SK loan commitment | — | | 52,792 | | — | | 52,792 | | — | |

| Stock-based compensation expense | 7,500 | | 21,564 | | 31,027 | | 87,095 | | 113,965 | |

Other loss | 403 | | — | | — | | 403 | | — | |

| Adjusted Net (Loss) Profit | 19,421 | | 41,751 | | 53,596 | | (20,724) | | (75,728) | |

| | | | | |

| Adjusted net (loss) profit per share (EPS), Basic | $ | 0.09 | | $ | 0.20 | | $ | 0.27 | | $ | (0.10) | | $ | (0.41) | |

| Adjusted net (loss) profit per share (EPS), Diluted | $ | 0.07 | | $ | 0.15 | | $ | 0.22 | | $ | (0.10) | | $ | (0.41) | |

| Weighted average shares outstanding attributable to common, Basic | 224,204 | | 210,930 | | 201,173 | | 212,681 | | 185,907 | |

| Weighted-average shares outstanding attributable to common, Diluted | 274,366 | | 274,337 | | 238,775 | | 212,681 | | 185,907 | |

Reconciliation of GAAP Net Profit (loss) to Adjusted EBITDA

(unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | |

| Q4'23 | Q3'23 | Q4'22 | FY 23 | FY 22 |

| Net (loss) profit to Common Stockholders | 4,511 | | (168,999) | | (47,172) | | (302,116) | | (301,408) | |

| Add back: (Loss) gain for non-controlling interests | (394) | | 921 | | (3,611) | | (5,821) | | (13,678) | |

| Loss (gain) on derivative liabilities | 428 | | 114 | | 56 | | 1,641 | | (566) | |

| Impairment charge (PPA V, PPA IV, PPA IIIa) | — | | 130,088 | | 68,535 | | 130,088 | | 113,335 | |

| Loss on China JV investment | — | | — | | — | | — | | 1,446 | |

| Loss on extinguishment of debt | — | | 1,415 | | 4,723 | | 4,288 | | 8,955 | |

| Amortization of acquired intangible assets | 34 | | 42 | | 37 | | 151 | | 223 | |

| Restructuring charges | 6,940 | | 2,226 | | — | | 9,166 | | — | |

| PPA V Sales property tax | — | | 1,588 | | — | | 1,588 | | — | |

| Goodwill impairment | — | | — | | — | | — | | 2,000 | |

| Interest expense on SK loan commitment | — | | 52,792 | | — | | 52,792 | | — | |

| Stock-based compensation expense | 7,500 | | 21,564 | | 31,027 | | 87,095 | | 113,965 | |

| Other loss | 403 | | — | | — | | 403 | | — | |

| Adjusted Net (Loss) Profit | 19,421 | | 41,751 | | 53,596 | | (20,724) | | (75,728) | |

| | | | | |

| Depreciation & amortization | 12,349 | | 14,615 | | 15,426 | | 62,609 | | 61,608 | |

| Income tax provision | 811 | | 646 | | 209 | | 1,894 | | 1,097 | |

| Interest expense, Other expense, net | 7,179 | | 9,403 | | 5,227 | | 38,012 | | 43,162 | |

| Adjusted EBITDA | 39,760 | | 66,415 | | 74,458 | | 81,791 | | 30,139 | |

Use of non-GAAP financial measures

To supplement Bloom Energy consolidated financial statement information presented on a GAAP basis, Bloom Energy provides financial measures including non-GAAP gross profit (loss), non-GAAP gross margin, non-GAAP operating profit (loss) (non-GAAP earnings from operations), non-GAAP operating profit (loss) margin, non-GAAP net earnings, non-GAAP basic and diluted earnings per share and Adjusted EBITDA. Bloom Energy also provides forecasts of non-GAAP gross margin and non-GAAP operating margin.

These non-GAAP financial measures are not computed in accordance with, or as an alternative to, GAAP in the United States.

•The GAAP measure most directly comparable to non-GAAP gross profit (loss) is gross profit (loss).

•The GAAP measure most directly comparable to non-GAAP gross margin is gross margin.

•The GAAP measure most directly comparable to non-GAAP operating profit (loss) (non-GAAP earnings from operations) is operating profit (loss) (earnings from operations).

•The GAAP measure most directly comparable to non-GAAP operating margin is operating margin.

•The GAAP measure most directly comparable to non-GAAP net earnings is net earnings.

•The GAAP measure most directly comparable to non-GAAP diluted earnings per share is diluted earnings per share.

•The GAAP measure most directly comparable to Adjusted EBITDA is net earnings.

Reconciliations of each of these non-GAAP financial measures to GAAP information are included in the tables above or elsewhere in the materials accompanying this news release.

Use and economic substance of non-GAAP financial measures used by Bloom Energy

Non-GAAP gross profit (loss) and non-GAAP gross margin are defined to exclude charges relating to stock-based compensation expense, PPA V, PPA IV and PPA IIIa repowering related impairment charges, restructuring charges, and PPA V Sales property tax. Non-GAAP net earnings and non-GAAP diluted earnings per share consist of net earnings or diluted net earnings per share excluding charges relating to stock-based compensation expense, (loss) gain for non-controlling interest, loss (gain) on derivatives liabilities, PPA V, PPA IV and PPA IIIa repowering related impairment charges, goodwill impairment, interest expense on SK loan commitment, restructuring charges, PPA V Sales property tax, managed services impairment loss, loss on debt extinguishment, loss on China JV investment and the amortization of acquired intangible assets. Adjusted EBITDA is defined as net profit (loss) before interest expense, provision for income tax, depreciation and amortization expense, charges relating to stock-based compensation expense, (loss) gain for non-controlling interest, loss (gain) on derivatives liabilities, PPA V. PPA IV and PPA IIIa repowering related impairment charges, goodwill impairment, interest expense on SK loan commitment, restructuring charges, PPA V Sales property tax, managed services impairment loss, loss on debt extinguishment, loss on China JV investment and the amortization of acquired intangible assets. Bloom Energy management uses these non-GAAP financial measures for purposes of evaluating Bloom Energy’s historical and prospective financial performance, as well as Bloom Energy’s performance relative to its competitors. Bloom Energy believes that excluding the items mentioned above from these non-GAAP financial measures allows Bloom Energy management to better understand Bloom Energy’s consolidated financial performance as management does not believe that the excluded items are reflective of ongoing operating results. More specifically, Bloom Energy management excludes each of those items mentioned above for the following reasons:

•Stock-based compensation expense consists of equity awards granted based on the estimated fair value of those awards at grant date. Although stock-based compensation is a key incentive offered to our employees, Bloom Energy excludes these charges for the purpose of calculating these non-GAAP measures, primarily because they are non-cash expenses and such an exclusion facilitates a more meaningful evaluation of Bloom Energy current operating performance and comparisons to Bloom Energy operating performance in other periods.

•(Loss) gain for non-controlling interest represents allocation to the non-controlling interests under the hypothetical liquidation at book value (HLBV) method and are associated with our Bloom Energy legacy PPA entities and the joint venture in the Republic of Korea.

•Loss (gain) on derivatives liabilities represents non-cash adjustments to the fair value of the embedded derivatives.

•PPA V repowering related impairment charge represents non-cash impairment charge on old server units decommissioned upon repowering of $123.7 million and non-cash impairment charge on non-recoverable production insurance of $6.4 million.

•PPA IV repowering related impairment charge represents non-cash impairment charges on old server units decommissioned upon repowering of $64.0 million and non-cash impairment charge on non-recoverable production insurance of $4.5 million.

•PPA IIIa repowering related impairment charge represents non-cash impairment charges on old server units decommissioned upon repowering of $44.8 million.

•Goodwill impairment related to the acquisition of BE Japan in Q2 2021.

•Interest expense on SK loan commitment recognized as a result of automatic conversion of 13.5 million shares of our Series B redeemable convertible preferred stock to shares of our Class A common stock.

•Restructuring charges represented by severance expense of $5.3 million, facility closure costs of $2.6 million, and other restructuring expenses of $1.3 million recorded in fiscal 2023.

•PPA V Sales property tax related to PPA V repowering of old server units.

•Other loss incurred upon closure of one of our managed services deals in the fourth quarter of fiscal 2023.

•Loss on debt extinguishment related to PPA V, PPA IV and PPA IIIa repowering.

•Loss on China JV investment upon sale of our equity interest.

•Amortization of acquired intangible assets.

•Adjusted EBITDA is defined as Adjusted Net Income (Loss) before depreciation and amortization expense, provision for income tax, interest expense (income), other expense (income), net. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations.

For more information about these non-GAAP financial measures, please see the tables captioned “Reconciliation of GAAP to Non-GAAP Financial Measures,” “Reconciliation of GAAP Net Loss to non-GAAP Net Profit (Loss) and Computation of non-GAAP Net Profit (Loss) per Share (EPS),” and “Reconciliation of GAAP Net Loss to Adjusted EBITDA” set forth in this release, which should be read together with the preceding financial statements prepared in accordance with GAAP.

Material limitations associated with use of non-GAAP financial measures

These non-GAAP financial measures have limitations as analytical tools, and these measures should not be considered in isolation or as a substitute for analysis of Bloom Energy results as reported under GAAP. Some of the limitations in relying on these non-GAAP financial measures are:

•Items such as stock-based compensation expense that is excluded from non-GAAP gross profit (loss), non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating profit (loss) (non-GAAP earnings from operations), non-GAAP operating margin, non-GAAP net earnings, and non-GAAP diluted earnings per share can have a material impact on the equivalent GAAP earnings measure.

•Gain (loss) for non-controlling interest and loss (gain) on derivatives liabilities, though not directly affecting Bloom Energy’s cash position, represent the loss (gain) in value of certain assets and liabilities. The expense associated with this loss (gain) in value is excluded from non-GAAP net earnings, and non-GAAP diluted earnings per share and can have a material impact on the equivalent GAAP earnings measure.

•Other companies may calculate non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP operating profit (non-GAAP earnings from operations), non-GAAP operating profit margin, non-GAAP net earnings, non-GAAP diluted earnings per share and Adjusted EBITDA differently than Bloom Energy does, limiting the usefulness of those measures for comparative purposes.

Compensation for limitations associated with use of non-GAAP financial measures

Bloom Energy compensates for the limitations on its use of non-GAAP financial measures by relying primarily on its GAAP results and using non-GAAP financial measures only as a supplement. Bloom Energy also provides a reconciliation of each non-GAAP financial measure to its most directly comparable GAAP measure within this news release and in other written materials that include these non-GAAP financial measures, and Bloom Energy encourages investors to review those reconciliations carefully.

Usefulness of non-GAAP financial measures to investors

Bloom Energy believes that providing financial measures including non-GAAP gross profit (loss), non-GAAP gross margin, non-GAAP operating profit (loss) (non-GAAP earnings from operations), non-GAAP operating profit (loss) margin, non-GAAP net earnings, non-GAAP diluted earnings per share in addition to the related GAAP measures provides investors with greater transparency to the information used by Bloom Energy management in its financial and operational decision making and allows investors to see Bloom Energy’s results “through the eyes” of management. Bloom Energy further believes that providing this information better enables Bloom Energy investors to understand Bloom Energy’s operating performance and to evaluate the efficacy of the methodology and information used by Bloom Energy management to evaluate and measure such performance. Disclosure of these non-GAAP financial measures also facilitates comparisons of Bloom Energy’s operating performance with the performance of other companies in Bloom Energy’s industry that supplement their GAAP results with non-GAAP financial measures that may be calculated in a similar manner.

v3.24.0.1

Cover

|

Feb. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 15, 2024

|

| Entity Registrant Name |

BLOOM ENERGY CORPORATION

|

| Entity File Number |

001-38598

|

| Entity Tax Identification Number |

77-0565408

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Postal Zip Code |

95134

|

| Entity Address, State or Province |

CA

|

| Entity Address, City or Town |

San Jose,

|

| Entity Address, Address Line One |

4353 North First Street,

|

| Local Phone Number |

543-1500

|

| City Area Code |

408

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value

|

| Trading Symbol |

BE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001664703

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

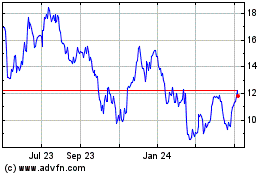

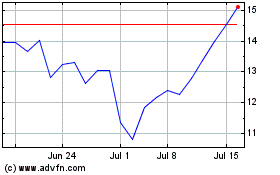

Bloom Energy (NYSE:BE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bloom Energy (NYSE:BE)

Historical Stock Chart

From Apr 2023 to Apr 2024