false

0001739940

0001739940

2024-02-15

2024-02-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 14, 2024

The Cigna Group

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation) |

001-38769

(Commission File Number) |

82-4991898

(IRS Employer

Identification No.) |

900 Cottage Grove Road

Bloomfield, Connecticut 06002

(Address of principal executive offices) (Zip

Code)

Registrant’s telephone number, including area

code:

(860) 226-6000

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par Value $0.01 |

CI |

New York Stock Exchange, Inc. |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

On February 14, 2024, The Cigna

Group (“Cigna” or the “Company”) entered into accelerated share repurchase agreements (collectively, the “ASR

Agreements”) with Deutsche Bank AG and Bank of America, N.A. (collectively, the “Dealers”). Under the ASR Agreements,

the Company will purchase an aggregate of $3.2 billion of the Company’s common stock as part of its existing share repurchase program.

Under the terms of the ASR Agreements,

on February 15, 2024, Cigna will receive an aggregate initial delivery of approximately 7.6 million shares in exchange for a prepayment

of $3.2 billion. The specific number of shares that the Company will ultimately repurchase under the ASR Agreements will be determined

based on the volume-weighted average price of Cigna’s common stock during the terms of the transactions, less a discount and subject

to adjustments pursuant to the terms and conditions of the ASR Agreements.

At final settlement, under certain

circumstances the Dealers may be required to deliver additional shares of Cigna common stock to the Company, or in other circumstances,

Cigna may be required to deliver, at its discretion, either shares of its common stock or cash to the Dealers. Final settlement of the

ASR Agreements is expected to occur during the second quarter of 2024.

The ASR Agreements contain customary

terms for these types of transactions, including, but not limited to, the mechanisms to determine the number of shares or the amount of

cash that will be delivered at final settlement, the required timing of delivery of the shares, the specific circumstances under which

final settlement of the transactions may be accelerated or extended or the ASR Agreements may be terminated early by Cigna or the Dealers,

and various acknowledgments, representations and warranties made by the Company and the Dealers to one another. The terms of the ASR Agreements

are subject to adjustment under certain circumstances.

Each of the Dealers perform normal

banking, investment banking and/or advisory services for Cigna from time to time for which they receive customary fees and expenses.

On February 15, 2024, the Company

issued a press release announcing its entry into the ASR Agreements with the Dealers. A copy of the press release is filed as Exhibit

99.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

the Cigna group

|

| Date: February 15, 2024 |

By: |

/s/ Brian C. Evanko |

| |

|

Brian C. Evanko |

| |

|

Executive Vice President and Chief Financial Officer and President and Chief Executive Officer, Cigna Healthcare |

| |

|

|

| |

|

|

Exhibit 99.1

Press Release

The Cigna Group Announces $3.2 Billion Accelerated

Stock Repurchase

Bloomfield, Conn. February 15, 2024 – Global health

company The Cigna Group (NYSE: CI) will repurchase $3.2 billion of common stock through accelerated stock repurchase agreements (the “ASR

Agreements”) with Deutsche Bank AG and Bank of America, N.A. (the “Counterparties”). The ASR Agreements are

part of The Cigna Group’s (the “Company”) existing share repurchase program, which had remaining authority

of $10.6 billion as of February 13, 2024.

“This accelerated share repurchase represents a value-enhancing

deployment of capital,” said David M. Cordani, Chairman and Chief Executive Officer, The Cigna Group. “This is a testament

to the ongoing growth and strength of our businesses, and we remain committed to returning significant value to our shareholders and investing

in our future. We are on track to repurchase $5 billion of common stock over the first half of 2024, inclusive of this accelerated share

repurchase, and continue to expect the majority of discretionary cash flow to be used for share repurchase this year.”

Under the terms of the ASR Agreements, on February 15, 2024, the Company

will receive an aggregate initial delivery of approximately 7.6 million shares in exchange for a prepayment of $3.2 billion. The specific

number of shares that the Company ultimately will repurchase pursuant to the ASR Agreements will be based generally on the daily volume-weighted

average share price of The Cigna Group common stock over the term of the ASR Agreements, less a discount and subject to adjustments pursuant

to the terms and conditions of the ASR Agreements. Final settlement under the ASR Agreements is expected to occur in the second quarter

of 2024. The ASR Agreements contain provisions customary for agreements of this type, including provisions for adjustments to the transaction

terms upon certain specified events, the circumstances generally under which final settlement of the ASR Agreements may be accelerated

or extended or the ASR Agreements may be terminated early by the Company or the Counterparties, and various acknowledgements and

representations made by the parties to each other. At final settlement, under certain circumstances, the Company may be entitled to receive

additional shares of The Cigna Group common stock from the Counterparties or the Company may be required to make a cash payment or,

if the Company elects, deliver shares of The Cigna Group common stock to the Counterparties. All of the shares of The Cigna Group

common stock delivered to the Company under the ASR Agreements will be held in treasury or retired.

About The Cigna Group

The Cigna Group (NYSE: CI) is a global health company committed to creating a better future built on the vitality of every individual

and every community. We relentlessly challenge ourselves to partner and innovate solutions for better health. The Cigna Group includes

products and services marketed under Evernorth Health Services, Cigna Healthcare, or its subsidiaries. The Cigna Group maintains sales

capabilities in more than 30 countries and jurisdictions, and has approximately 165 million customer relationships around the world. Learn

more at www.thecignagroup.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This press release, and oral statements made in connection with this release,

may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

are based on The Cigna Group's current expectations and projections about future trends, events and uncertainties. These statements are

not historical facts. Forward-looking statements may include, among

others, statements concerning the number of shares that ultimately will

be repurchased under the ASR Agreements and other statements regarding our future beliefs, expectations, plans, intentions, liquidity,

cash flows, financial condition or performance. You may identify forward-looking statements by the use of words such as "believe,"

"expect," "project," "plan," "intend," "anticipate," "estimate," "predict,"

"potential," "may," "should," "will" or other words or expressions of similar meaning, although

not all forward-looking statements contain such terms.

Forward-looking statements are subject to risks and uncertainties,

both known and unknown, that could cause actual results to differ materially from those expressed or implied in forward-looking statements.

The discussions in our Annual Report on Form 10-K for the year ended December 31, 2022, including the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” sections therein, as such discussions may be updated from

time to time in our periodic filings with the Securities and Exchange Commission, include both expanded discussion of these factors and

additional risk factors and uncertainties that could affect the matters discussed in the forward-looking statements. You should not place

undue reliance on forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance

or results, and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. The Cigna Group undertakes

no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except

as may be required by law.

INVESTOR RELATIONS CONTACT:

Ralph Giacobbe

(860) 787-7968

ralph.giacobbe@TheCignaGroup.com

MEDIA

CONTACT:

Justine Sessions

(860) 810-6523

justine.sessions@evernorth.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

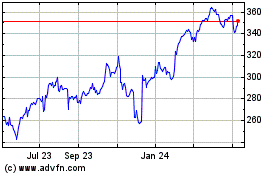

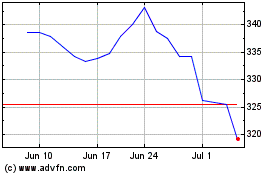

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024