false

0001066923

0001066923

2024-02-11

2024-02-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 11, 2024

Future FinTech Group Inc.

(Exact name of registrant as specified in its

charter)

| Florida |

|

001-34502 |

|

98-0222013 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Americas Tower, 1177 Avenue of The Americas,

Suite 5100, New York, NY 10036

(Address of principal executive offices, including

zip code)

888-622-1218

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.001 per share |

|

FTFT |

|

Nasdaq Stock Market |

Item 1.01 Entry into a Material Definitive

Agreement

On February 11, 2024, Future

FinTech Group, Inc., a Florida corporation (the “Company”) and Streeterville Capital, LLC, a Utah limited liability company

(the “Lender”) entered into an Amendment (the “Amendment”) to Convertible Promissory Note (the “Note”)

which was originally issued by the Company to the Lender on December 27, 2023, as disclosed in the Form 8-K of the Company filed on December

29, 2023.

Pursuant to the Amendment, the parties agree to

amend the Note as follows: (i) to add a floor price of $0.2272 per share for the redemption conversion (the “Floor Price”);

(ii) in the event the redemption conversion price with respect to any given redemption is below the Floor Price, then Company must pay

the applicable redemption amount requested by the Lender in cash on or before the third trading day immediately following the applicable

redemption date; (iii) delete the Lender’s rights to increase, decrease or waive the Maximum Percentage (defined below) in

connection with Lender’s ownership limitation pursuant to which the Company will not effect any conversion of the Note to the extent

that after giving effect to such conversion would cause the Lender to beneficially own a number of shares exceeding 9.99% of the number

of shares of Common Stock of the Company outstanding on such date (including for such purpose the Common Stock issuable upon such issuance)

(the “Maximum Percentage”).

The description contained herein of the terms

of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment, a copy of which is attached

hereto as Exhibit 10.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Future FinTech Group Inc. |

| |

|

| Date: February 14, 2024 |

By: |

/s/ Shanchun Huang |

| |

Name: |

Shanchun Huang |

| |

Title: |

Chief Executive Officer and President |

2

Exhibit 10.1

AMENDMENT TO CONVERTIBLE PROMISSORY NOTE

This Amendment to Convertible

Promissory Note (this “Amendment”) is entered into as of February 11, 2024, by and between Streeterville

Capital, LLC, a Utah limited liability company (“Lender”), and Future

FinTech Group Inc., a Florida corporation (“Borrower”). Capitalized terms used in this Amendment without definition

shall have the meanings given to them in the Note (as defined below).

A. Borrower

previously issued to Lender that certain Convertible Promissory Note dated December 27, 2023 in the principal amount of $1,100,000.00

(the “Note”).

B. Lender

and Borrower have agreed, subject to the terms, amendments, conditions and understandings expressed in this Amendment, to amend the Note.

NOW, THEREFORE, for good and

valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1. Recitals.

Each of the parties hereto acknowledges and agrees that the recitals set forth above in this Amendment are true and accurate and are hereby

incorporated into and made a part of this Amendment.

2. Redemption

Conversion. The following sentence is hereby added to the end of Section 8.2 of the Note.

“In the event the

Redemption Conversion Price with respect to any given redemption is below the Floor Price, then Borrower must pay the applicable Redemption

Amount in cash on or before the third Trading Day immediately following the applicable Redemption Date.”

3. Addition

of Definition of Floor Price. The following definition of the term “Floor Price” is hereby added to the Note as A25 of

Attachment 1:

“Floor Price”

means $0.2272 per share of Common Stock.

4. Ownership

Limitation. The last two sentences of Section 13 of the Note are deleted in their entirety and replaced with the following:

“The Maximum

Percentage is enforceable, unconditional and non-waivable and shall apply to all affiliates and assigns of Lender.”

5. Representations

and Warranties. In order to induce the other Party to enter into this Amendment, each Party, for itself, and for its affiliates, successors

and assigns, hereby acknowledges, represents, warrants and agrees as follows:

(a) Each Party has

full power and authority to enter into this Amendment and to incur and perform all obligations and covenants contained herein, all of

which have been duly authorized by all proper and necessary action. No consent, approval, filing or registration with or notice to any

governmental authority is required as a condition to the validity of this Amendment or the performance of any of the obligations of such

party hereunder.

(b) There is no fact

known to Borrower or which should be known to Borrower which Borrower has not disclosed to Lender on or prior to the date of this Amendment

which would or could materially and adversely affect the understanding of Lender expressed in this Amendment or any representation, warranty,

or recital contained in this Amendment.

(c) Except as expressly

set forth in this Amendment, Borrower acknowledges and agrees that neither the execution and delivery of this Amendment nor any of the

terms, provisions, covenants, or agreements contained in this Amendment shall in any manner release, impair, lessen, modify, waive, or

otherwise affect the liability and obligations of Borrower under the Note or any other transaction documents entered into in connection

with the Note (the “Transaction Documents”).

(d) Borrower hereby

acknowledges and agrees that the execution of this Amendment by Lender shall not constitute an acknowledgment of or admission by Lender

of the existence of any claims or of liability for any matter or precedent upon which any claim or liability may be asserted.

(e) Borrower represents

and warrants that as of the date hereof no Events of Default or other material breaches exist under the Transaction Documents or have

occurred prior to the date hereof.

6. Certain

Acknowledgments. Each of the parties acknowledges and agrees that no property or cash consideration of any kind whatsoever has been

or shall be given by either party to the other party in connection with this Amendment.

7. Other

Terms Unchanged. The Note, as amended by this Amendment, remains and continues in full force and effect, constitutes legal, valid,

and binding obligations of each of the parties, and is in all respects agreed to, ratified, and confirmed. Any reference to the Note after

the date of this Amendment is deemed to be a reference to the Note as amended by this Amendment. If there is a conflict between the terms

of this Amendment and the Note, the terms of this Amendment shall control. No forbearance or waiver may be implied by this Amendment.

Except as expressly set forth herein, the execution, delivery, and performance of this Amendment shall not operate as a waiver of, any

right, power, or remedy of Lender under the Note, as in effect prior to the date hereof. For the avoidance of doubt, this Amendment shall

be subject to the governing law, venue, and Arbitration Provisions, as set forth in the Note.

8. No

Reliance. Borrower acknowledges and agrees that neither Lender nor any of its officers, directors, members, managers, equity holders,

representatives or agents has made any representations or warranties to Borrower or any of its agents, representatives, officers, directors,

or employees except as expressly set forth in this Amendment and the Transaction Documents and, in making its decision to enter into the

transactions contemplated by this Amendment, Borrower is not relying on any representation, warranty, covenant or promise of Lender or

its officers, directors, members, managers, equity holders, agents or representatives other than as set forth in this Amendment.

9. Counterparts.

This Amendment may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall

constitute one instrument. The parties hereto confirm that any electronic copy of another party’s executed counterpart of this Amendment

(or such party’s signature page thereof) will be deemed to be an executed original thereof.

10. Further

Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall execute

and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to

carry out the intent and accomplish the purposes of this Amendment and the consummation of the transactions contemplated hereby.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned have executed

this Amendment as of the date set forth above.

| |

LENDER: |

| |

|

|

| |

Streeterville Capital, LLC |

| |

|

|

| |

By: |

/s/ John M. Fife |

| |

|

John M. Fife, President |

| |

|

|

| |

BORROWER: |

| |

|

|

| |

Future FinTech Group Inc. |

| |

|

|

| |

By: |

/s/ Shanchun

Huang |

| |

|

Shanchun Huang CEO |

| |

|

|

[Signature Page to Amendment to Convertible

Promissory Note]

4

v3.24.0.1

Cover

|

Feb. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 11, 2024

|

| Entity File Number |

001-34502

|

| Entity Registrant Name |

Future FinTech Group Inc.

|

| Entity Central Index Key |

0001066923

|

| Entity Tax Identification Number |

98-0222013

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

Americas Tower

|

| Entity Address, Address Line Two |

1177 Avenue of The Americas

|

| Entity Address, Address Line Three |

Suite 5100

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

888

|

| Local Phone Number |

622-1218

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

FTFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

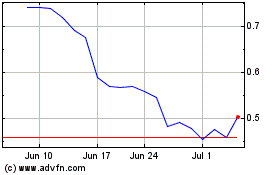

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Future FinTech (NASDAQ:FTFT)

Historical Stock Chart

From Apr 2023 to Apr 2024