As filed with the U.S. Securities and Exchange

Commission on February 13, 2024

Registration No. 333-276631

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

WiSA Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

3674 |

|

30-1135279 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

WiSA Technologies, Inc.

15268 NW Greenbrier Pkwy

Beaverton, OR 97006

(408) 627-4716

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brett Moyer

Chief Executive Officer

WiSA Technologies, Inc.

15268 NW Greenbrier Pkwy

Beaverton, OR 97006

(408) 627-4716

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

David E. Danovitch, Esq.

Aaron M. Schleicher, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

(212) 660-3060 |

Leslie Marlow, Esq.

Patrick J. Egan, Esq.

Hank Gracin, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, New York 10020

(212) 885-5000 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box: x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. x (333-274331)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

Emerging growth company |

¨ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 (this “Post-Effective

Amendment No. 1”) to the Registration Statement on Form S-1 (Registration No. 333-276631) of WiSA Technologies, Inc. (the “Registration

Statement”) is filed pursuant to Section 462(d) of the Securities Act of 1933, as amended, solely to update Exhibit 5.1 that was

previously filed with respect to such Registration Statement in order to reference an increased number of securities. This

Post-Effective Amendment No. 1 does not modify any provision of Part I or Part II of the Registration Statement other than supplementing

Item 16 of Part II as set forth below. The Registration Statement shall become effective upon filing with the U.S. Securities and

Exchange Commission in accordance with Rule 462(d) under the Securities Act of 1933, as amended.

PART II - INFORMATION NOT REQUIRED IN THE

PROSPECTUS

Item 16. Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant

has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Beaverton,

State of Oregon, on February 13, 2024.

| WISA TECHNOLOGIES, INC. |

|

| |

|

| By: |

/s/ Brett Moyer |

|

| |

Name: Brett Moyer |

|

| |

Title: President and Chief Executive Officer |

|

Pursuant to the requirements of the Securities

Act of 1933, the following persons in the capacities and on the dates indicated have signed this registration statement below.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ BRETT MOYER |

|

Chief Executive Officer and Director (principal

executive officer) |

|

February 13, 2024 |

| Brett Moyer |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Chief Accounting Officer (principal financial

officer and principal accounting officer) |

|

February 13, 2024 |

| Gary Williams |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 13, 2024 |

| Lisa Cummins |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 13, 2024 |

| Dr. Jeffrey M. Gilbert |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 13, 2024 |

| David Howitt |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 13, 2024 |

| Helge Kristensen |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 13, 2024 |

| Sriram Peruvemba |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 13, 2024 |

| Robert Tobias |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 13, 2024 |

| Wendy Wilson |

|

|

|

|

| * By: |

/s/ Brett Moyer |

|

| Brett Moyer, as attorney-in-fact |

|

Exhibit 5.1

February 13, 2024

WiSA Technologies, Inc.

15268 NW Greenbrier Pkwy

Beaverton, OR 97006

Ladies and Gentlemen:

We have acted as securities

counsel for WiSA Technologies, Inc., a Delaware corporation (the “Company”), in connection with the preparation of

a Registration Statement on Form S-1 (Registration No. 333-276631) (the “Registration Statement”) originally filed

by the Company with the U.S. Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933,

as amended (the “Securities Act”), on January 19, 2024 and amended on February 5, 2024, February 8, 2024, February

9, 2024 and the date hereof, relating to the proposed public offering of: (A) 23,734,000 units (the “Units”), each

Unit consisting of (i) one share of common stock of the Company, par value $0.0001 per share (the “Shares”) and (ii)

one common stock purchase warrant (the “Warrants”), each such Warrant being exercisable from time to time for one Share

(the “Warrant Shares”); and (B) 130,106,000 pre-funded units (the “Pre-Funded Units”), each Pre-Funded

Unit consisting of (i) one pre-funded warrant (the “Pre-Funded Warrants”), each such Pre-Funded Warrant being exercisable

from time to time for one Share (the “Pre-Funded Warrant Shares”) and (ii) one Warrant. The Units, Shares, Warrants,

Warrant Shares, Pre-Funded Units, Pre-Funded Warrants and Pre-Funded Warrant Shares are collectively referred to herein as the “Securities”.

The Securities will be sold pursuant to the Registration Statement and one or more securities purchase agreements (the “Agreements”)

by and among the Company and certain accredited investors or qualified institutional buyers identified on the signature pages thereto

(collectively, the “Investors”). This opinion letter is furnished to you at your request to enable you to fulfill the

requirements of Item 601(b)(5) of Regulation S-K, 17 C.F.R. § 229.601(b)(5), in connection with the Registration Statement.

As counsel to the Company

in connection with the proposed potential issuance and sale of the Securities, we have examined: (i) the Company’s certificate of

incorporation and bylaws, both as currently in effect; (ii) certain resolutions of the board of directors of the Company relating to the

sale of the Securities (the “Resolutions”); (iii) the form of Agreement; (iv) the Registration Statement; and (v) such

other proceedings, documents, and records as we have deemed necessary to enable us to render this opinion. In all such examinations, we

have assumed the genuineness of all signatures, the authenticity of all documents, certificates, and instruments submitted to us as originals,

and the conformity with the originals of all documents, certificates, and instruments submitted to us as copies. We have also assumed

the due execution and delivery of all documents where due execution and delivery are prerequisite to the effectiveness thereof.

Our opinions expressed herein

are subject to the following qualifications and exceptions: (i) the effect of bankruptcy, insolvency, reorganization, arrangement, moratorium,

or other similar laws relating to or affecting the rights of creditors generally, including, without limitation, laws relating to fraudulent

transfers or conveyances, preferences, and equitable subordination; (ii) the effect of general principles of equity, including, without

limitation, concepts of materiality, reasonableness, good faith and fair dealing (regardless of whether considered in a proceeding in

equity or at law); and (iii) we render no opinion as to the effect of the laws of any state or jurisdiction other than the General Corporation

Law of the State of Delaware.

Based upon, subject to and

limited by the foregoing, we are of the opinion that following (i) execution and delivery by the Company and each of the Investors of

the Agreements, (ii) effectiveness of the Registration Statement, (iii) issuance of the Securities pursuant to the terms of the Agreements,

and (iv) receipt by the Company of the consideration for the Securities specified in the Resolutions:

(a) The Units and Pre-Funded

Units will be duly authorized for issuance and, when issued, delivered and paid for in accordance with the terms of the Agreements and

in accordance with and in the manner described in the Registration Statement, the Units and Pre-Funded Units will be validly issued, fully

paid and non-assessable;

(b) The Shares will be duly

authorized for issuance and, when issued, delivered and paid for in accordance with the terms of the Agreements and in accordance with

and in the manner described in the Registration Statement, will be validly issued, fully paid and nonassessable;

(c) The Warrants and Pre-Funded

Warrants will be duly authorized for issuance and, when issued and sold in accordance with the Agreements, the Warrants and the Warrant

Agency Agreement and in accordance with and in the manner described in the Registration Statement, and duly executed and delivered by

the Company to the Investors against payment therefor, will constitute valid and legally binding obligations of the Company enforceable

against the Company in accordance with their respective terms; and

(d) The Warrant Shares and

Pre-Funded Warrant Shares will be duly authorized for issuance and, when issued and paid for and delivered by the Company and upon valid

exercise of the Warrants or Pre-Funded Warrants, as applicable, and against receipt of the exercise price therefor, in accordance with

the provisions of the Agreements, Warrants or Pre-Funded Warrants, as applicable, and the Warrant Agency Agreement, and in accordance

with and in the manner described in the Registration Statement, will be validly issued, fully paid and nonassessable.

It is understood that this

opinion is to be used only in connection with the offer, sale, and issuance of the Securities while the Registration Statement is in effect.

We hereby consent to the filing

of this opinion as an exhibit to the Registration Statement and to the use of our name under the caption “Legal Matters” in

the Registration Statement. In giving this consent, we do not admit that we are “experts” within the meaning of Section 11

of the Securities Act or within the category of persons whose consent is required by Section 7 of the Securities Act.

| |

Very truly yours, |

| |

|

| |

/s/ Sullivan & Worcester LLP |

| |

Sullivan & Worcester LLP |

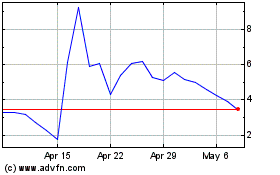

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Mar 2024 to Apr 2024

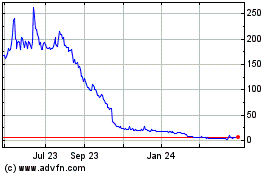

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Apr 2023 to Apr 2024