00016187560001618755false00016187562024-02-132024-02-130001618756qsr:RestaurantBrandsInternationalLimitedPartnershipMember2024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2024

RESTAURANT BRANDS INTERNATIONAL INC.

RESTAURANT BRANDS INTERNATIONAL LIMITED PARTNERSHIP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Canada | | 001-36786 | | 98-1202754 |

| Ontario | | 001-36787 | | 98-1206431 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

| incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| 130 King Street West, Suite 300 | | M5X 1E1 |

| Toronto, | Ontario | | |

| (Address of Principal Executive Offices) | | (Zip Code) |

(905) 339-6011

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

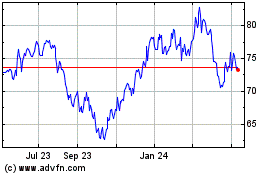

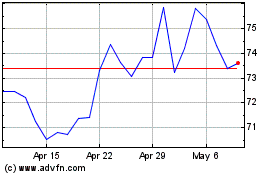

| Common Shares, without par value | | QSR | | New York Stock Exchange |

| | | | Toronto Stock Exchange |

| Securities registered pursuant to Section 12(g) of the Act: |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Class B exchangeable limited partnership units | | QSP | | Toronto Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 13, 2024, Restaurant Brands International Inc. (the “Company”) issued a press release and supplemental financial and operational information regarding results for the three and twelve months ended December 31, 2023. The press release and supplemental financial and operational information are furnished as Exhibit 99 hereto.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | RESTAURANT BRANDS INTERNATIONAL INC.

RESTAURANT BRANDS INTERNATIONAL LIMITED PARTNERSHIP, by its general partner RESTAURANT BRANDS INTERNATIONAL INC. |

| | |

| Date: February 13, 2024 | | /s/ Matthew Dunnigan |

| | Name: | Matthew Dunnigan |

| | Title: | Chief Financial Officer |

EXHIBIT 99

Restaurant Brands International Inc. Reports Full Year and Fourth Quarter 2023 Results

Home market franchisee profitability increases 30% year-over-year, on average

Global system-wide sales grow nearly 10% for the fourth quarter and over 12% for 2023

Comparable sales up nearly 6% in Q4, led by over 8% growth at Tim Hortons Canada and over 6% at Burger King US

Digital sales grow over 20% year-over-year to $14 billion in 2023, representing over a third of system-wide sales

Nearly $1.5 billion of capital returned to shareholders in 2023 while investing for growth and reducing net leverage

Toronto, Ontario – February 13, 2024 – Restaurant Brands International Inc. (“RBI”) (TSX/NYSE: QSR, TSX: QSP) today reported financial results for the full year and fourth quarter ended December 31, 2023. Josh Kobza, Chief Executive Officer of RBI commented, "We are delivering better experiences for our guests, better profitability for our franchisees and are making the right long-term investments behind the growth of our brands. We have started 2024 with a foundation of strong operational performance and I'm thankful to all our teams, franchisees and their team members who work so hard to make us successful."

2023 Highlights:

•System-wide Sales Growth of 12.2%

•Net Restaurant Growth of 3.9%

•Income from Operations of $2,051 million versus $1,898 million in the prior year

•Net Income of $1,718 million versus $1,482 million in the prior year

•Diluted EPS of $3.76 versus $3.25 in the prior year

•Adjusted Operating Income of $2,200 million increased 7.5% organically versus the prior year

•Adjusted Diluted EPS of $3.24 versus $3.14 in prior year

•Net Cash Provided by Operating Activities of $1,323 million and Free Cash Flow of $1,203 million

Changes to operating and reportable segments and changes to measure of segment income

Beginning with the fourth quarter of 2023, we are reporting results under five operating and reportable segments. This shift in reportable segments reflects how our leadership oversees and manages the business. As a result of this change, our five operating and reportable segments consist of the following:

1.Tim Hortons brand in Canada and the U.S. (“TH”);

2.Burger King brand in the U.S. and Canada (“BK”);

3.Popeyes Louisiana Kitchen brand in the U.S. and Canada (“PLK”);

4.Firehouse Subs brand in the U.S. and Canada (“FHS”); and

5.International – which includes all operations of each of our brands outside the U.S. and Canada (“INTL”).

We also transitioned our definition of segment income from Adjusted EBITDA to Adjusted Operating Income (“AOI”). TH AOI, BK AOI, PLK AOI, FHS AOI and INTL AOI are our measures of segment profitability. Unlike Adjusted EBITDA, AOI includes depreciation and amortization (excluding franchise agreement amortization) as well as share-based compensation and non-cash incentive compensation expense.

In order to assist investors, we have provided certain unaudited historical financial and operational data that is on a basis consistent with our revised segment structure and segment income definition. This data can be found on the company's investor relations webpage under "Financial Information." These changes only affect segment allocation of results and do not revise or restate our previously reported consolidated financial statements.

Consolidated Operational Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| System-wide Sales Growth | | | | | | | | | | | |

| TH | | 9.0 | % | | | 10.5 | % | | | 11.0 | % | | | 11.7 | % |

| BK | | 4.9 | % | | | 5.5 | % | | | 6.9 | % | | | 2.8 | % |

| PLK | | 11.2 | % | | | 6.5 | % | | | 10.5 | % | | | 5.6 | % |

| FHS (a) | | 7.8 | % | | | N/A | | | 7.1 | % | | | N/A |

| INTL (b) | | 12.8 | % | | | 18.5 | % | | | 17.6 | % | | | 25.6 | % |

| Consolidated (c) | | 9.6 | % | | | 11.4 | % | | | 12.2 | % | | | 12.9 | % |

| FHS (a) | | N/A | | | 3.9 | % | | | N/A | | | 4.2 | % |

| | | | | | | | | | | |

| System-wide Sales (in US$ millions) | | | | | | | | | | | |

| TH | $ | 1,849 | | $ | 1,701 | | $ | 7,245 | | $ | 6,732 |

| BK | $ | 2,903 | | $ | 2,768 | | $ | 11,474 | | $ | 10,747 |

| PLK | $ | 1,503 | | $ | 1,351 | | $ | 5,886 | | $ | 5,338 |

| FHS (a) | $ | 298 | | $ | 301 | | $ | 1,194 | | $ | 1,154 |

| INTL (b) | $ | 4,332 | | $ | 3,813 | | $ | 17,087 | | $ | 14,700 |

| Consolidated (c) | $ | 10,885 | | $ | 9,934 | | $ | 42,886 | | $ | 38,671 |

| | | | | | | | | | | |

| Comparable Sales | | | | | | | | | | | |

| TH | | 8.4 | % | | | 10.1 | % | | | 10.4 | % | | | 10.4 | % |

| BK | | 6.3 | % | | | 5.0 | % | | | 7.4 | % | | | 2.3 | % |

| PLK | | 5.5 | % | | | 1.7 | % | | | 4.8 | % | | | (0.6) | % |

| FHS (a) | | 3.5 | % | | | N/A | | | 3.8 | % | | | N/A |

| INTL (b) | | 4.6 | % | | | 10.5 | % | | | 9.0 | % | | | 15.4 | % |

| Consolidated (c) | | 5.8 | % | | | 7.5 | % | | | 8.1 | % | | | 7.9 | % |

| FHS (a) | | N/A | | | 0.4 | % | | | N/A | | | 0.6 | % |

| | | | | | | | | | | |

| Net Restaurant Growth | | | | | | | | | | | |

| TH | | 0.1 | % | | | (1.1) | % | | | 0.1 | % | | | (1.1) | % |

| BK | | (3.3) | % | | | (0.6) | % | | | (3.3) | % | | | (0.6) | % |

| PLK | | 4.9 | % | | | 6.7 | % | | | 4.9 | % | | | 6.7 | % |

| FHS (a) | | 3.0 | % | | | 2.4 | % | | | 3.0 | % | | | 2.4 | % |

| INTL (b) | | 8.9 | % | | | 9.1 | % | | | 8.9 | % | | | 9.1 | % |

| Consolidated (c) | | 3.9 | % | | | 4.4 | % | | | 3.9 | % | | | 4.4 | % |

| | | | | | | | | | | |

| System Restaurant Count at Period End | | | | | | | | | | | |

| TH | | 4,525 | | | 4,519 | | | 4,525 | | | 4,519 |

| BK | | 7,144 | | | 7,389 | | | 7,144 | | | 7,389 |

| PLK | | 3,394 | | | 3,235 | | | 3,394 | | | 3,235 |

| FHS (a) | | 1,265 | | | 1,242 | | | 1,265 | | | 1,242 |

| INTL (b) | | 14,742 | | | 13,517 | | | 14,742 | | | 13,517 |

| Consolidated (c) | | 31,070 | | | 29,902 | | | 31,070 | | | 29,902 |

See "Key Operating Metrics" for definitions.

(a) See FHS Segment Results footnote "a."

(b) See INTL Segment Results footnote "a."

(c) Consolidated system-wide sales growth and comparable sales do not include the results of Firehouse Subs for 2022.

Consolidated Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions, except per share data, unaudited) | 2023 | | 2022 | | 2023 | | 2022 |

| | | |

| Total Revenues | $ | 1,820 | | | $ | 1,689 | | | $ | 7,022 | | | $ | 6,505 | |

| Income from Operations | $ | 468 | | | $ | 346 | | | $ | 2,051 | | | $ | 1,898 | |

| Net Income | $ | 726 | | | $ | 336 | | | $ | 1,718 | | | $ | 1,482 | |

| Diluted Earnings per Share | $ | 1.60 | | | $ | 0.74 | | | $ | 3.76 | | | $ | 3.25 | |

| | | | | | | |

| | | | | | | |

| TH | $ | 231 | | | $ | 226 | | | $ | 958 | | | $ | 925 | |

| BK | $ | 69 | | | $ | 87 | | | $ | 386 | | | $ | 396 | |

| PLK | $ | 56 | | | $ | 52 | | | $ | 221 | | | $ | 205 | |

| FHS | $ | 8 | | | $ | 8 | | | $ | 38 | | | $ | 33 | |

| INTL | $ | 145 | | | $ | 133 | | | $ | 597 | | | $ | 525 | |

| Adjusted Operating Income (a) | $ | 509 | | | $ | 506 | | | $ | 2,200 | | | $ | 2,084 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted EBITDA (a) | $ | 603 | | | $ | 588 | | | $ | 2,554 | | | $ | 2,378 | |

| | | | | | | |

| Adjusted Net Income (a) | $ | 340 | | | $ | 326 | | | $ | 1,480 | | | $ | 1,430 | |

| Adjusted Diluted Earnings per Share (a) | $ | 0.75 | | | $ | 0.72 | | | $ | 3.24 | | | $ | 3.14 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Twelve Months Ended December 31, |

| (in US$ millions, unaudited) | | | | | 2023 | | 2022 |

| | | | | |

| Net cash provided by operating activities | | | | | $ | 1,323 | | | $ | 1,490 | |

| Net cash provided by (used for) investing activities | | | | | $ | 11 | | | $ | (64) | |

| Net cash used for financing activities | | | | | $ | (1,374) | | | $ | (1,307) | |

| Free Cash Flow (a) | | | | | $ | 1,203 | | | $ | 1,390 | |

| | | | | | | |

| | | | | As of December 31, |

| (in US$ millions, unaudited) | | | | | 2023 | | 2022 |

| Net Debt (a) | | | | | $ | 12,250 | | | $ | 12,210 | |

| Net Income Net Leverage (c) | | | | | 7.1x | | 8.2x |

| Adjusted EBITDA Net Leverage (a) | | | | | 4.8x | | 5.1x |

| | | | | | | |

| | | | | | | |

| | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

SUPPLEMENTAL ANNUAL DISCLOSURE (unaudited) | | | | | Year Ended December 31, |

Home Market Franchisee Profitability (b) (in 000s) | | | | | 2023 | | 2022 |

| TH — Canada | | | | | C$ | 280 | | | C$ | 220 | |

| BK — US | | | | | $ | 205 | | | $ | 140 | |

| PLK — US | | | | | $ | 245 | | | $ | 210 | |

| FHS — US | | | | | $ | 110 | | | $ | 80 | |

| | | | | | | |

Global Digital Sales (d) (in US$ billions) | | | | | $ | 14.0 | | | $ | 11.6 | |

| | | | | | | |

(a) Adjusted Operating Income, Adjusted EBITDA, Adjusted Net Income, Adjusted Diluted Earnings per Share, Free Cash Flow, Net Debt, and Adjusted EBITDA Net Leverage are non-GAAP financial measures. Please refer to "Non-GAAP Financial Measures" for further detail.

(b) 2023 estimates are preliminary and rounded down to the nearest $5,000. Estimates based on unaudited, self-reported franchisee results.

(c) Net Income Net Leverage is defined as net debt (total debt less cash and cash equivalents) divided by Net Income.

(d) In 2023, RBI changed its definition of Digital Sales to exclude duplicative sales from digital coupons. Digital Sales include sales from mobile order and pay ("MO&P"), digital offers excluding MO&P, first and third party delivery, loyalty sales, kiosks and digital catering. Digital Sales for 2022 have been revised to exclude sales from Russia and to conform to RBI's updated definition of Digital Sales.

The year-over-year increases in Total Revenues on an as reported and on an organic basis for the full year and fourth quarter were primarily driven by an increase in system-wide sales in all our segments. On an as reported basis the increase was partially offset by unfavorable FX movements which primarily impacted TH.

The year-over-year increase in Income from Operations for the full year was primarily driven by increases in segment income of INTL, TH, PLK and FHS and a favorable change from the impact of equity method investments, partially offset by an unfavorable change from other operating expenses (income), net, a decrease in BK segment income and unfavorable FX movements. The year-over-year increase in Income from Operations for the fourth quarter was primarily driven by a favorable change from other operating expenses (income), net, a favorable change from the impact of equity method investments, the non-recurrence of FHS Transaction costs and increases in segment income of INTL, TH and PLK, partially offset by a decrease in BK segment income.

The increase in Net Income for the full year was primarily driven by the year-over-year increase in Income from Operations and a greater income tax benefit in the current year than the prior year, partially offset by an increase in interest expense, net, and loss on early extinguishment of debt in the current year. The increase in Net Income for the fourth quarter was primarily driven by a greater income tax benefit in the current year than the prior year and the year-over-year increase in Income from Operations, partially offset by an increase in interest expense.

The year-over-year change in Adjusted Operating Income on an as reported and organic basis for the full year was primarily driven by increases in segment income of INTL, TH, PLK and FHS, partially offset by a decrease in BK segment income. On an as reported basis, the change was impacted by unfavorable FX movements. The year-over-year change in Adjusted Operating Income on an as reported and organic basis for the fourth quarter was primarily driven by increases in segment income of INTL, TH and PLK, partially offset by a decrease in BK segment income.

The year-over-year increase in Adjusted Net Income for the full year was primarily driven by increases in segment income of INTL, TH, PLK and FHS, partially offset by an increase in adjusted interest expense, a decrease in BK segment income and unfavorable FX movements. The year-over-year increase in Adjusted Net Income for the fourth quarter was primarily driven by a decrease in adjusted tax expense and increases in segment income of INTL, TH and PLK, partially offset by a decrease in BK segment income and an increase in adjusted interest expense.

Burger King US Reclaim the Flame

In September 2022, Burger King shared the details of its "Reclaim the Flame" plan to accelerate sales growth and drive franchisee profitability. We will be investing $400 million over the life of the plan, comprised of $150 million in advertising and digital investments ("Fuel the Flame") and $250 million in high-quality remodels and relocations, restaurant technology, kitchen equipment, and building enhancements ("Royal Reset").

During the quarter ended December 31, 2023, we funded approximately $40 million toward the Fuel the Flame investments, including $37 million towards our support behind the Burger King US advertising fund, and $16 million toward our Royal Reset investments, including $8 million towards remodels. As of 2023, we have funded a total of $73 million toward the Fuel the Flame investments and $61 million toward our Royal Reset investments.

Macro Economic Environment

During 2022 and 2023, there were increases in commodity, labor, and energy costs which have resulted in inflation, foreign exchange volatility, rising interest rates and general softening in the consumer environment which have been exacerbated by conflicts in the Middle East.

TH Segment Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| System-wide Sales Growth | | 9.0 | % | | | 10.5 | % | | | 11.0 | % | | | 11.7 | % |

| System-wide Sales | $ | 1,849 | | | $ | 1,701 | | | $ | 7,245 | | | $ | 6,732 | |

| Comparable Sales | | 8.4 | % | | | 10.1 | % | | | 10.4 | % | | | 10.4 | % |

| | | | | | | | | | | |

| Net Restaurant Growth | | 0.1 | % | | | (1.1) | % | | | 0.1 | % | | | (1.1) | % |

| System Restaurant Count at Period End | | 4,525 | | | | 4,519 | | | | 4,525 | | | | 4,519 | |

| | | | | | | | | | | |

| Sales | $ | 701 | | | $ | 694 | | | $ | 2,725 | | | $ | 2,631 | |

| Franchise and Property Revenues | $ | 241 | | | $ | 225 | | | $ | 955 | | | $ | 905 | |

| Advertising Revenues and Other Services | $ | 76 | | | $ | 68 | | | $ | 292 | | | $ | 266 | |

| Total Revenues | $ | 1,018 | | | $ | 987 | | | $ | 3,972 | | | $ | 3,801 | |

| | | | | | | | | | | |

| Cost of Sales | $ | 583 | | | $ | 573 | | | $ | 2,231 | | | $ | 2,131 | |

| Franchise and Property Expenses | $ | 81 | | | $ | 80 | | | $ | 325 | | | $ | 332 | |

| Advertising Expenses and Other Services | $ | 81 | | | $ | 69 | | | $ | 309 | | | $ | 282 | |

| Segment G&A | $ | 47 | | | $ | 42 | | | $ | 168 | | | $ | 151 | |

| Adjustments: | | | | | | | | | | | |

| Franchise Agreement Amortization | $ | 2 | | | $ | 2 | | | $ | 6 | | | $ | 7 | |

| Cash Distributions Received from Equity Method Investments | $ | 4 | | | $ | 2 | | | $ | 14 | | | $ | 13 | |

| Adjusted Operating Income | $ | 231 | | | $ | 226 | | | $ | 958 | | | $ | 925 | |

| | | | | | | | | | | |

| Share-Based Compensation and Non-Cash Incentive Compensation Expense | $ | 14 | | | $ | 11 | | | $ | 51 | | | $ | 37 | |

| Depreciation and Amortization, excluding Franchise Agreement Amortization | $ | 25 | | | $ | 26 | | | $ | 101 | | | $ | 108 | |

| Adjusted EBITDA (a) | $ | 271 | | | $ | 263 | | | $ | 1,111 | | | $ | 1,070 | |

| | | | | | | | | | | |

(a) Adjusted EBITDA for TH is a non-GAAP financial measure. Please refer to "Non-GAAP Financial Measures" for further detail.

For the full year and fourth quarter, the increase in system-wide sales was primarily driven by comparable sales of 10.4% and 8.4%, respectively, including Canada comparable sales of 10.9% and 8.7%, respectively.

The year-over-year increase in Total Revenues for the full year and fourth quarter on an as reported and on an organic basis was primarily driven by the increase in system-wide sales as well as increases in commodity prices passed on to franchisees. The increase in Total Revenues on an as reported basis was partially offset by unfavorable FX movements.

The year-over-year increase in Adjusted Operating Income for the full year and fourth quarter on an as reported and on an organic basis was primarily driven by the increase in system-wide sales, partially offset by an increase in Segment G&A, and advertising expenses and other services exceeding advertising revenues and other services in the current year periods to a greater extent than in the prior year periods. Revenues and Adjusted Operating Income for 2023 were impacted by increased promotional activity and trade investments in our TH consumer-packaged goods business, which largely impacted the fourth quarter. The increase in Adjusted Operating Income on an as reported basis was partially offset by unfavorable FX movements.

BK Segment Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| System-wide Sales Growth | | 4.9 | % | | | 5.5 | % | | | 6.9 | % | | | 2.8 | % |

| System-wide Sales | $ | 2,903 | | | $ | 2,768 | | | $ | 11,474 | | | $ | 10,747 | |

| Comparable Sales | | 6.3 | % | | | 5.0 | % | | | 7.4 | % | | | 2.3 | % |

| | | | | | | | | | | |

| Net Restaurant Growth | | (3.3) | % | | | (0.6) | % | | | (3.3) | % | | | (0.6) | % |

| System Restaurant Count at Period End | | 7,144 | | | | 7,389 | | | | 7,144 | | | | 7,389 | |

| | | | | | | | | | | |

| Sales | $ | 33 | | | $ | 18 | | | $ | 97 | | | $ | 70 | |

| Franchise and Property Revenues | $ | 189 | | | $ | 174 | | | $ | 731 | | | $ | 688 | |

| Advertising Revenues and Other Services | $ | 123 | | | $ | 117 | | | $ | 470 | | | $ | 438 | |

| Total Revenues | $ | 345 | | | $ | 310 | | | $ | 1,297 | | | $ | 1,196 | |

| | | | | | | | | | | |

| Cost of Sales | $ | 31 | | | $ | 19 | | | $ | 90 | | | $ | 74 | |

| Franchise and Property Expenses | $ | 44 | | | $ | 37 | | | $ | 144 | | | $ | 144 | |

| Advertising Expenses and Other Services | $ | 165 | | | $ | 134 | | | $ | 543 | | | $ | 467 | |

| Segment G&A | $ | 39 | | | $ | 37 | | | $ | 145 | | | $ | 126 | |

| Adjustments: | | | | | | | | | | | |

| Franchise Agreement Amortization | $ | 3 | | | $ | 3 | | | $ | 11 | | | $ | 11 | |

| | | | | | | | | | | |

| Adjusted Operating Income | $ | 69 | | | $ | 87 | | | $ | 386 | | | $ | 396 | |

| | | | | | | | | | | |

| Share-Based Compensation and Non-Cash Incentive Compensation Expense | $ | 9 | | | $ | 10 | | | $ | 41 | | | $ | 30 | |

| Depreciation and Amortization, excluding Franchise Agreement Amortization | $ | 9 | | | $ | 9 | | | $ | 35 | | | $ | 34 | |

| Adjusted EBITDA (a) | $ | 87 | | | $ | 105 | | | $ | 462 | | | $ | 459 | |

| | | | | | | | | | | |

(a) Adjusted EBITDA for BK is a non-GAAP financial measure. Please refer to "Non-GAAP Financial Measures" for further detail.

For the full year and fourth quarter, the increase in system-wide sales was driven by comparable sales of 7.4% and 6.3%, respectively, including US comparable sales of 7.5% and 6.4%, respectively, partially offset by net restaurant growth of (3.3)%.

The year-over-year increase in Total Revenues for the full year and fourth quarter on an as reported and on an organic basis was primarily driven by the increase in system-wide sales. Sales and Cost of Sales for the full year were also impacted by the temporary acquisition of 17 Company restaurants during the second quarter (of which we only continue to operate one restaurant) and the acquisition of 89 Company restaurants during the fourth quarter.

The year-over-year decrease in Adjusted Operating Income for the full year and fourth quarter was primarily driven by advertising expenses and other services exceeding advertising revenues and other services in the current year periods to a greater extent than in the prior year periods, partially offset by the increase in system-wide sales and improved profitability at Company restaurants resulting in income in the current year periods as compared to net losses in the prior year periods. In addition, Adjusted Operating Income for the full year was impacted by an increase in Segment G&A due to higher compensation-related expenses and Adjusted Operating Income for the fourth quarter was impacted by an increase in bad debt expenses.

PLK Segment Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| System-wide Sales Growth | | 11.2 | % | | | 6.5 | % | | | 10.5 | % | | | 5.6 | % |

| System-wide Sales | $ | 1,503 | | | $ | 1,351 | | | $ | 5,886 | | | $ | 5,338 | |

| Comparable Sales | | 5.5 | % | | | 1.7 | % | | | 4.8 | % | | | (0.6) | % |

| | | | | | | | | | | |

| Net Restaurant Growth | | 4.9 | % | | | 6.7 | % | | | 4.9 | % | | | 6.7 | % |

| System Restaurant Count at Period End | | 3,394 | | | | 3,235 | | | | 3,394 | | | | 3,235 | |

| | | | | | | | | | | |

| Sales | $ | 24 | | | $ | 20 | | | $ | 89 | | | $ | 78 | |

| Franchise and Property Revenues | $ | 79 | | | $ | 72 | | | $ | 314 | | | $ | 284 | |

| Advertising Revenues and Other Services | $ | 79 | | | $ | 70 | | | $ | 289 | | | $ | 256 | |

| Total Revenues | $ | 182 | | | $ | 162 | | | $ | 692 | | | $ | 619 | |

| | | | | | | | | | | |

| Cost of Sales | $ | 22 | | | $ | 18 | | | $ | 80 | | | $ | 72 | |

| Franchise and Property Expenses | $ | 2 | | | $ | 2 | | | $ | 12 | | | $ | 11 | |

| Advertising Expenses and Other Services | $ | 81 | | | $ | 71 | | | $ | 295 | | | $ | 261 | |

| Segment G&A | $ | 22 | | | $ | 20 | | | $ | 86 | | | $ | 72 | |

| Adjustments: | | | | | | | | | | | |

| Franchise Agreement Amortization | $ | 1 | | | $ | 1 | | | $ | 2 | | | $ | 2 | |

| | | | | | | | | | | |

| Adjusted Operating Income | $ | 56 | | | $ | 52 | | | $ | 221 | | | $ | 205 | |

| | | | | | | | | | | |

| Share-Based Compensation and Non-Cash Incentive Compensation Expense | $ | 7 | | | $ | 6 | | | $ | 26 | | | $ | 20 | |

| Depreciation and Amortization, excluding Franchise Agreement Amortization | $ | 2 | | | $ | 2 | | | $ | 9 | | | $ | 8 | |

| Adjusted EBITDA (a) | $ | 66 | | | $ | 60 | | | $ | 257 | | | $ | 232 | |

| | | | | | | | | | | |

(a) Adjusted EBITDA for PLK is a non-GAAP financial measure. Please refer to "Non-GAAP Financial Measures" for further detail.

For the full year and fourth quarter, the increase in system-wide sales was driven by net restaurant growth of 4.9% as well as comparable sales of 4.8% and 5.5%, respectively, including US comparable sales of 4.8% and 5.8%, respectively.

The year-over-year increase in Total Revenues for the full year and fourth quarter was primarily driven by the increase in system-wide sales.

The year-over-year increase in Adjusted Operating Income for the full year and fourth quarter was primarily driven by the increases in system-wide sales, partially offset by higher Segment G&A due to higher compensation-related expenses.

FHS Segment Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| System-wide Sales Growth (a) | | 7.8 | % | | | 3.9 | % | | | 7.1 | % | | | 4.2 | % |

| System-wide Sales (a) | $ | 298 | | | $ | 301 | | | $ | 1,194 | | | $ | 1,154 | |

| Comparable Sales (a) | | 3.5 | % | | | 0.4 | % | | | 3.8 | % | | | 0.6 | % |

| | | | | | | | | | | |

| Net Restaurant Growth (a) | | 3.0 | % | | | 2.4 | % | | | 3.0 | % | | | 2.4 | % |

| System Restaurant Count at Period End (a) | | 1,265 | | | | 1,242 | | | | 1,265 | | | | 1,242 | |

| | | | | | | | | | | |

| Sales | $ | 10 | | | $ | 11 | | | $ | 39 | | | $ | 40 | |

| Franchise and Property Revenues | $ | 26 | | | $ | 22 | | | $ | 99 | | | $ | 85 | |

| Advertising Revenues and Other Services | $ | 15 | | | $ | 3 | | | $ | 48 | | | $ | 13 | |

| Total Revenues | $ | 51 | | | $ | 36 | | | $ | 187 | | | $ | 138 | |

| | | | | | | | | | | |

| Cost of Sales | $ | 8 | | | $ | 9 | | | $ | 34 | | | $ | 35 | |

| Franchise and Property Expenses | $ | 1 | | | $ | 1 | | | $ | 9 | | | $ | 7 | |

| Advertising Expenses and Other Services | $ | 15 | | | $ | 4 | | | $ | 49 | | | $ | 12 | |

| Segment G&A | $ | 18 | | | $ | 13 | | | $ | 58 | | | $ | 52 | |

| Adjustments: | | | | | | | | | | | |

| Franchise Agreement Amortization | $ | — | | | $ | — | | | $ | 1 | | | $ | 1 | |

| | | | | | | | | | | |

| Adjusted Operating Income | $ | 8 | | | $ | 8 | | | $ | 38 | | | $ | 33 | |

| | | | | | | | | | | |

| Share-Based Compensation and Non-Cash Incentive Compensation Expense | $ | 6 | | | $ | 3 | | | $ | 17 | | | $ | 8 | |

| Depreciation and Amortization, excluding Franchise Agreement Amortization | $ | 1 | | | $ | 1 | | | $ | 3 | | | $ | 3 | |

| Adjusted EBITDA (b) | $ | 15 | | | $ | 12 | | | $ | 58 | | | $ | 44 | |

| | | | | | | | | | | |

(a) For 2022, FHS system-wide sales growth, system-wide sales, comparable sales and net restaurant growth are for the period from December 27, 2021 through December 31, 2022. FHS 2022 system-wide sales growth and comparable sales figures are shown for informational purposes only. FHS system-wide sales and restaurant count include 14 FHS restaurants in Puerto Rico ("FHS PR") in 2022 but not in 2023. For the purpose of calculating FHS system-wide sales growth, net restaurant growth and comparable sales, we exclude FHS PR in both the current and prior year periods.

(b) Adjusted EBITDA for FHS is a non-GAAP financial measure. Please refer to "Non-GAAP Financial Measures" for further detail.

For the full year and fourth quarter, the increase in system-wide sales was driven by net restaurant growth of 3.0%, and comparable sales of 3.8% and 3.5%, respectively, including US comparable sales of 4.2% and 3.8%, respectively.

The year-over-year increase in Total Revenues for the full year was primarily driven by the increase in system-wide sales. In addition, increases in Advertising Revenues and Other Services and Advertising Expenses and Other Services reflect our modification of the Advertising fund arrangements to be more consistent with those of our other brands.

The year-over-year increase in Adjusted Operating Income for the full year was primarily driven by the increases in system-wide sales, partially offset by an increase in Segment G&A. Adjusted Operating Income for the fourth quarter was relatively flat driven by an increase in Segment G&A, partially offset by the increase in system-wide sales. The increase in Segment G&A was primarily driven by higher compensation-related expenses.

INTL Segment Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| System-wide Sales Growth (a) | | 12.8 | % | | | 18.5 | % | | | 17.6 | % | | | 25.6 | % |

| System-wide Sales (a) | $ | 4,332 | | | $ | 3,813 | | | $ | 17,087 | | | $ | 14,700 | |

| Comparable Sales (a) | | 4.6 | % | | | 10.5 | % | | | 9.0 | % | | | 15.4 | % |

| | | | | | | | | | | |

| Net Restaurant Growth (a) | | 8.9 | % | | | 9.1 | % | | | 8.9 | % | | | 9.1 | % |

| System Restaurant Count at Period End (a) | | 14,742 | | | | 13,517 | | | | 14,742 | | | | 13,517 | |

| | | | | | | | | | | |

| Sales | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Franchise and Property Revenues | $ | 204 | | | $ | 178 | | | $ | 804 | | | $ | 699 | |

| Advertising Revenues and Other Services | $ | 21 | | | $ | 16 | | | $ | 70 | | | $ | 51 | |

| Total Revenues | $ | 224 | | | $ | 194 | | | $ | 874 | | | $ | 750 | |

| | | | | | | | | | | |

| Cost of Sales | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Franchise and Property Expenses | $ | 12 | | | $ | 6 | | | $ | 22 | | | $ | 24 | |

| Advertising Expenses and Other Services | $ | 21 | | | $ | 16 | | | $ | 77 | | | $ | 54 | |

| Segment G&A | $ | 50 | | | $ | 43 | | | $ | 190 | | | $ | 160 | |

| Adjustments: | | | | | | | | | | | |

| Franchise Agreement Amortization | $ | 3 | | | $ | 3 | | | $ | 11 | | | $ | 10 | |

| Cash Distributions Received from Equity Method Investments | $ | — | | | $ | 1 | | | $ | — | | | $ | 1 | |

| Adjusted Operating Income | $ | 145 | | | $ | 133 | | | $ | 597 | | | $ | 525 | |

| | | | | | | | | | | |

| Share-Based Compensation and Non-Cash Incentive Compensation Expense | $ | 17 | | | $ | 13 | | | $ | 58 | | | $ | 41 | |

| Depreciation and Amortization, excluding Franchise Agreement Amortization | $ | 3 | | | $ | 2 | | | $ | 11 | | | $ | 7 | |

| Adjusted EBITDA (b) | $ | 164 | | | $ | 148 | | | $ | 666 | | | $ | 573 | |

| | | | | | | | | | | |

(a) Includes FHS PR beginning January 1, 2023. For the purpose of calculating INTL system-wide sales growth, net restaurant growth and comparable sales, we include FHS PR in both the current and prior year periods.

(b) Adjusted EBITDA for INTL is a non-GAAP financial measure. Please refer to "Non-GAAP Financial Measures" for further detail.

For the full year and fourth quarter, the increase in system-wide sales was driven by net restaurant growth of 8.9%, and comparable sales of 9.0% and 4.6%, respectively.

The year-over-year increase in Total Revenues for the full year and fourth quarter on an as reported and on an organic basis was primarily driven by the increase in system-wide sales. The year-over-year increase in Total Revenues for the fourth quarter on an as reported basis modestly benefited from favorable FX movements.

The year-over-year increase in Adjusted Operating Income for the full year and fourth quarter on an as reported and on an organic basis was primarily driven by the increases in system-wide sales, partially offset by higher Segment G&A primarily due to higher compensation-related expenses. Adjusted Operating Income for the fourth quarter was also impacted by higher Franchise and Property Expenses associated with bad debt expense.

Cash and Liquidity

As of December 31, 2023, total debt was $13.4 billion, and net debt (total debt less cash and cash equivalents of $1.1 billion) was $12.3 billion, net income net leverage was 7.1x and adjusted EBITDA net leverage was 4.8x.

The RBI board of directors has declared a dividend of $0.58 per common share and partnership exchangeable unit of RBI LP for the first quarter of 2024. The dividend will be payable on April 4, 2024 to shareholders and unitholders of record at the close of business on March 21, 2024. In connection with the declared dividend, RBI also announced that it is targeting a total of $2.32 in dividends per common share and partnership exchangeable unit of RBI LP for 2024.

Subsequent Events

On January 16, 2024, RBI and Carrols Restaurant Group, Inc. (“Carrols”) announced that they have reached an agreement for RBI to acquire all of Carrols issued and outstanding shares that are not already held by RBI or its affiliates for $9.55 per share in an all cash transaction, or an aggregate total enterprise value (EV) of approximately $1.0 billion.

The transaction is expected to close in the second quarter of 2024 subject to customary closing conditions, including receipt of certain regulatory approvals and approval of the majority of Carrols common stock, excluding shares held by RBI and its affiliates and officers of Carrols.

As of February 13, 2024, BK had a total company restaurant portfolio of 176 following the acquisition of 38 company restaurants on January 17, 2024.

Investor Conference Call

We will host an investor conference call and webcast at 8:30 a.m. Eastern Time on Tuesday, February 13, 2024, to review financial results for the full year and fourth quarter ended December 31, 2023. The earnings call will be broadcast live via our investor relations website at http://rbi.com/investors and a replay will be available for 30 days following the release. The dial-in number is (833) 470-1428 for U.S. callers, (833) 950-0062 for Canadian callers, and (929) 526-1599 for callers from other countries. For all dial-in numbers please use the following access code: 189424.

Contacts

Investors: investor@rbi.com

Media: media@rbi.com

About Restaurant Brands International Inc.

Restaurant Brands International Inc. (“RBI”) is one of the world’s largest quick service restaurant companies with over $40 billion in annual system-wide sales and over 30,000 restaurants in more than 100 countries. RBI owns four of the world’s most prominent and iconic quick service restaurant brands – TIM HORTONS®, BURGER KING®, POPEYES®, and FIREHOUSE SUBS®. These independently operated brands have been serving their respective guests, franchisees and communities for decades. Through its Restaurant Brands for Good framework, RBI is improving sustainable outcomes related to its food, the planet, and people and communities. To learn more about RBI, please visit the company’s website at www.rbi.com.

Forward-Looking Statements

This press release and our investor conference call contain certain forward-looking statements and information, which reflect management's current beliefs and expectations regarding future events and operating performance and speak only as of the date hereof. These forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties. These forward-looking statements include statements about (i) our expectations regarding the effects and continued impact of the macro-economic pressures, such as inflation, rising interest rates and currency fluctuations, on our results of operations, business, liquidity, prospects and restaurant operations and those of our franchisees, (ii) our digital, marketing, remodel and technology enhancement initiatives and expectations regarding further expenditures relating to these initiatives, including our “Reclaim the Flame” plan to accelerate sales growth and drive franchisee profitability at Burger King; (iii) our expectation that franchisee contributions to the ad fund will increase in 2025; (iv) our expectations around our Royal Refresh investments and our remodel program; (v) our confidence of reaching our target net leverage; (vi) our expectations regarding G&A (including stock based compensation), capital expenditures, tenant inducements, remodel investments and net interest expense in 2024; (vii) our commitment to growth opportunities, plans and strategies for each of our brands and ability to enhance operations and drive long-term, sustainable growth; (viii) our expectations regarding restaurant closures; and (ix) our 2024 dividend targets. The factors that could cause actual results to differ materially from RBI’s expectations are detailed in filings of RBI with the Securities and Exchange Commission and applicable Canadian securities regulatory authorities, such as its annual and quarterly reports and current reports on Form 8-K, and include the following: risks related to our franchisees financial stability and their ability to access and maintain the liquidity necessary to operate their business; risks arising from macroeconomic conditions, including inflation and raising interest rates and its impact on discretionary spending; risks related to unforeseen events such as pandemics; risks related to supply chain; risks related to ownership and leasing of properties; risks related to our nearly fully franchised business model, including as a result of current and future legislation, regulations and interpretations relating to joint employer status and other labor matters; risks related to RBI’s ability to successfully implement its domestic and international growth strategy and risks related to its international operations; risks related to RBI’s ability to compete domestically and internationally in an intensely competitive industry; risks related to technology; risks related to the conflict between Russia and Ukraine and the conflict in the Middle East; our ability to address environmental and social sustainability issues and changes in applicable tax and other laws and regulations or interpretations thereof; and regulatory approvals of the acquisition of Carrols. Other than as required under U.S. federal securities laws or Canadian securities laws, we do not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, change in expectations or otherwise.

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In millions of U.S. dollars, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Sales | $ | 767 | | | $ | 743 | | | $ | 2,950 | | | $ | 2,819 | |

| Franchise and property revenues | 740 | | | 672 | | | 2,903 | | | 2,661 | |

| Advertising revenues and other services | 313 | | | 274 | | | 1,169 | | | 1,025 | |

| Total revenues | 1,820 | | | 1,689 | | | 7,022 | | | 6,505 | |

| Operating costs and expenses: | | | | | | | |

| Cost of sales | 643 | | | 619 | | | 2,435 | | | 2,312 | |

| Franchise and property expenses | 140 | | | 126 | | | 512 | | | 518 | |

| Advertising expenses and other services | 364 | | | 295 | | | 1,273 | | | 1,077 | |

| General and administrative expenses | 197 | | | 196 | | | 704 | | | 631 | |

| (Income) loss from equity method investments | (27) | | | 14 | | | (8) | | | 44 | |

| Other operating expenses (income), net | 35 | | | 93 | | | 55 | | | 25 | |

| Total operating costs and expenses | 1,352 | | | 1,343 | | | 4,971 | | | 4,607 | |

| Income from operations | 468 | | | 346 | | | 2,051 | | | 1,898 | |

| Interest expense, net | 152 | | | 144 | | | 582 | | | 533 | |

| Loss on early extinguishment of debt | — | | | — | | | 16 | | | — | |

| Income before income taxes | 316 | | | 202 | | | 1,453 | | | 1,365 | |

| Income tax (benefit) expense | (410) | | | (134) | | | (265) | | | (117) | |

| Net income | 726 | | | 336 | | | 1,718 | | | 1,482 | |

| Net income attributable to noncontrolling interests | 218 | | | 107 | | | 528 | | | 474 | |

| Net income attributable to common shareholders | $ | 508 | | | $ | 229 | | | $ | 1,190 | | | $ | 1,008 | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 1.63 | | | $ | 0.75 | | | $ | 3.82 | | | $ | 3.28 | |

| Diluted | $ | 1.60 | | | $ | 0.74 | | | $ | 3.76 | | | $ | 3.25 | |

| Weighted average shares outstanding (in millions): | | | | | | | |

| Basic | 313 | | | 306 | | | 312 | | | 307 | |

| Diluted | 453 | | | 455 | | | 456 | | | 455 | |

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In millions of U.S. dollars, except share data)

(Unaudited)

| | | | | | | | | | | |

| As of |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,139 | | | $ | 1,178 | |

| Accounts and notes receivable, net of allowance of $37 and $36, respectively | 749 | | | 614 | |

| Inventories, net | 166 | | | 133 | |

| Prepaids and other current assets | 119 | | | 123 | |

| Total current assets | 2,173 | | | 2,048 | |

| Property and equipment, net of accumulated depreciation and amortization of $1,187 and $1,061, respectively | 1,952 | | | 1,950 | |

| Operating lease assets, net | 1,122 | | | 1,082 | |

| Intangible assets, net | 11,107 | | | 10,991 | |

| Goodwill | 5,775 | | | 5,688 | |

| Other assets, net | 1,262 | | | 987 | |

| Total assets | $ | 23,391 | | | $ | 22,746 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts and drafts payable | $ | 790 | | | $ | 758 | |

| Other accrued liabilities | 1,005 | | | 1,001 | |

| Gift card liability | 248 | | | 230 | |

| Current portion of long-term debt and finance leases | 101 | | | 127 | |

| Total current liabilities | 2,144 | | | 2,116 | |

| Long-term debt, net of current portion | 12,854 | | | 12,839 | |

| Finance leases, net of current portion | 312 | | | 311 | |

| Operating lease liabilities, net of current portion | 1,059 | | | 1,027 | |

| Other liabilities, net | 996 | | | 872 | |

| Deferred income taxes, net | 1,296 | | | 1,313 | |

| Total liabilities | 18,661 | | | 18,478 | |

| Commitments and contingencies | | | |

| Shareholders’ equity: | | | |

| Common shares, no par value; unlimited shares authorized at December 31, 2023 and December 31, 2022; 312,454,851 shares issued and outstanding at December 31, 2023; 307,142,436 shares issued and outstanding at December 31, 2022 | 1,973 | | | 2,057 | |

| Retained earnings | 1,599 | | | 1,121 | |

| Accumulated other comprehensive income (loss) | (706) | | | (679) | |

| Total Restaurant Brands International Inc. shareholders’ equity | 2,866 | | | 2,499 | |

| Noncontrolling interests | 1,864 | | | 1,769 | |

| Total shareholders’ equity | 4,730 | | | 4,268 | |

| Total liabilities and shareholders’ equity | $ | 23,391 | | | $ | 22,746 | |

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(In millions of U.S. dollars)

(Unaudited)

| | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 1,718 | | | $ | 1,482 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 191 | | | 190 | |

| Premiums paid and non-cash loss on early extinguishment of debt | 5 | | | — | |

| Amortization of deferred financing costs and debt issuance discount | 27 | | | 28 | |

| (Income) loss from equity method investments | (8) | | | 44 | |

| Loss (gain) on remeasurement of foreign denominated transactions | 20 | | | (4) | |

| Net (gains) losses on derivatives | (151) | | | (9) | |

| Share-based compensation and non-cash incentive compensation expense | 194 | | | 136 | |

| Deferred income taxes | (430) | | | (60) | |

| Other | 26 | | | 19 | |

| Changes in current assets and liabilities, excluding acquisitions and dispositions: | | | |

| Accounts and notes receivable | (147) | | | (110) | |

| Inventories and prepaids and other current assets | (43) | | | (61) | |

| Accounts and drafts payable | 22 | | | 169 | |

| Other accrued liabilities and gift card liability | 9 | | | 37 | |

| Tenant inducements paid to franchisees | (32) | | | (26) | |

| Other long-term assets and liabilities | (78) | | | (345) | |

| Net cash provided by operating activities | 1,323 | | | 1,490 | |

| Cash flows from investing activities: | | | |

| Payments for property and equipment | (120) | | | (100) | |

| Net proceeds from disposal of assets, restaurant closures and refranchisings | 37 | | | 12 | |

| Net payment for purchase of Firehouse Subs, net of cash acquired | — | | | (12) | |

| Settlement/sale of derivatives, net | 112 | | | 71 | |

| Other investing activities, net | (18) | | | (35) | |

| Net cash provided by (used for) investing activities | 11 | | | (64) | |

| Cash flows from financing activities: | | | |

| Proceeds from long-term debt | 55 | | | 2 | |

| Repayments of long-term debt and finance leases | (92) | | | (94) | |

| Payment of financing costs | (44) | | | — | |

| Payment of dividends on common shares and distributions on Partnership exchangeable units | (990) | | | (971) | |

| | | |

| Repurchase of common shares | (500) | | | (326) | |

| Proceeds from stock option exercises | 60 | | | 21 | |

| Proceeds from issuance of common shares | — | | | 30 | |

| Proceeds (payments) from derivatives | 141 | | | 34 | |

| Other financing activities, net | (4) | | | (3) | |

| Net cash used for financing activities | (1,374) | | | (1,307) | |

| Effect of exchange rates on cash and cash equivalents | 1 | | | (28) | |

| (Decrease) increase in cash and cash equivalents | (39) | | | 91 | |

| Cash and cash equivalents at beginning of period | 1,178 | | | 1,087 | |

| Cash and cash equivalents at end of period | $ | 1,139 | | | $ | 1,178 | |

| Supplemental cash flow disclosures: | | | |

| Interest paid | $ | 761 | | | $ | 487 | |

| Net interest paid (a) | $ | 474 | | | $ | 383 | |

| Income taxes paid, net | $ | 290 | | | $ | 275 | |

(a) Refer to reconciliation in Non-GAAP Financial Measures.

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Key Operating Metrics

We evaluate our restaurants and assess our business based on the following operating metrics.

System-wide sales growth refers to the percentage change in sales at all franchise restaurants and Company restaurants (referred to as system-wide sales) in one period from the same period in the prior year. Comparable sales refers to the percentage change in restaurant sales in one period from the same prior year period for restaurants that have been open for 13 months or longer for TH, BK and FHS and 17 months or longer for PLK. Additionally, if a restaurant is closed for a significant portion of a month, the restaurant is excluded from the monthly comparable sales calculation. System-wide sales growth and comparable sales are measured on a constant currency basis, which means that results exclude the effect of foreign currency translation ("FX Impact") and are calculated by translating prior year results at current year monthly average exchange rates. We analyze key operating metrics on a constant currency basis as this helps identify underlying business trends, without distortion from the effects of currency movements.

System-wide sales represent sales at all franchise restaurants and company-owned restaurants. We do not record franchise sales as revenues; however, our royalty revenues and advertising fund contributions are calculated based on a percentage of franchise sales.

Net restaurant growth refers to the net change in restaurant count (openings, net of permanent closures) over a trailing twelve month period, divided by the restaurant count at the beginning of the trailing twelve month period. In determining whether a restaurant meets our definition of a restaurant and will be included in our NRG, we consider factors such as scope of operations, format and image, separate franchise agreement, and minimum sales thresholds. We refer to restaurants that do not meet our definition as “alternative formats.”

These metrics are important indicators of the overall direction of our business, including trends in sales and the effectiveness of each brand’s marketing, operations and growth initiatives.

2022 consolidated results exclude BK Russia, apart from two months of royalties in the first quarter of 2022.

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Supplemental Disclosure - Home Market and International KPIs by Brand

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | | Twelve Months Ended December 31, |

| KPIs by Market | | 2023 | | | 2022 | | | 2023 | | | 2022 |

| (unaudited) | | (unaudited) |

| System-wide Sales Growth | | | | | | | | | | | |

| TH - Canada | | 9.3 | % | | | 11.2 | % | | | 11.5 | % | | | 12.9 | % |

| BK - US | | 4.6 | % | | | 5.3 | % | | | 6.6 | % | | | 2.4 | % |

| PLK - US | | 11.2 | % | | | 6.1 | % | | | 10.2 | % | | | 5.1 | % |

| FHS - US (a) | | 7.4 | % | | | 4.0 | % | | | 6.9 | % | | | 3.9 | % |

| | | | | | | | | | | |

| International | | | | | | | | | | | |

| TH | | 21.4 | % | | | 44.6 | % | | | 39.7 | % | | | 60.2 | % |

| BK | | 10.4 | % | | | 16.0 | % | | | 15.1 | % | | | 23.6 | % |

| PLK | | 55.0 | % | | | 66.3 | % | | | 61.4 | % | | | 60.8 | % |

| FHS (a) | | 51.2 | % | | | N/A | | | 18.3 | % | | | N/A |

| | | | | | | | | | | |

| System-wide Sales (in US$ millions) | | | | | | | | | | | |

| TH - Canada | $ | 1,654 | | $ | 1,518 | | $ | 6,494 | | $ | 6,032 |

| BK - US | $ | 2,773 | | $ | 2,651 | | $ | 10,957 | | $ | 10,278 |

| PLK - US | $ | 1,404 | | $ | 1,262 | | $ | 5,511 | | $ | 5,001 |

| FHS - US (a) | $ | 283 | | $ | 288 | | $ | 1,138 | | $ | 1,102 |

| | | | | | | | | | | |

| International | | | | | | | | | | | |

| TH | $ | 153 | | $ | 124 | | $ | 600 | | $ | 431 |

| BK | $ | 3,911 | | $ | 3,507 | | $ | 15,545 | | $ | 13,656 |

| PLK | $ | 264 | | $ | 182 | | $ | 927 | | $ | 613 |

| FHS (a) | $ | 4 | | | N/A | | $ | 15 | | | N/A |

| | | | | | | | | | | |

| Comparable Sales | | | | | | | | | | | |

| TH - Canada | | 8.7 | % | | | 11.0 | % | | | 10.9 | % | | | 11.6 | % |

| BK - US | | 6.4 | % | | | 5.0 | % | | | 7.5 | % | | | 2.2 | % |

| PLK - US | | 5.8 | % | | | 1.5 | % | | | 4.8 | % | | | (0.5) | % |

| FHS - US (a) | | 3.8 | % | | | 1.0 | % | | | 4.2 | % | | | 1.1 | % |

| | | | | | | | | | | |

| International | | | | | | | | | | | |

| TH | | (6.3) | % | | | (4.3) | % | | | (3.1) | % | | | 0.9 | % |

| BK | | 4.6 | % | | | 10.2 | % | | | 8.9 | % | | | 15.3 | % |

| PLK | | 14.9 | % | | | 29.2 | % | | | 22.5 | % | | | 28.4 | % |

| FHS (a) | | (7.6) | % | | | N/A | | | (2.9) | % | | | N/A |

(a) See FHS Segment results footnote "a."

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Supplemental Disclosure - Home Market and International KPIs by Brand

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | As of December 31, |

| KPIs by Market | | | | | 2023 | | 2022 |

| | | | | (unaudited) |

| Net Restaurant Growth | | | | | | | |

| TH - Canada | | | | | (0.1) | % | | (1.3) | % |

| BK - US | | | | | (3.7) | % | | (0.9) | % |

| PLK - US | | | | | 4.5 | % | | 6.1 | % |

| FHS - US (a) | | | | | 0.7 | % | | 2.0 | % |

| | | | | | | |

| International | | | | | | | |

| TH | | | | | 21.0 | % | | 50.1 | % |

| BK | | | | | 5.7 | % | | 5.3 | % |

| PLK | | | | | 37.5 | % | | 27.0 | % |

| FHS (a) | | | | | 21.4 | % | | N/A |

| | | | | | | |

| Restaurant Count | | | | | | | |

| TH - Canada | | | | | 3,894 | | | 3,896 | |

| BK - US | | | | | 6,778 | | | 7,042 | |

| PLK - US | | | | | 3,051 | | | 2,921 | |

| FHS - US (a) | | | | | 1,195 | | | 1,187 | |

| | | | | | | |

| International | | | | | | | |

| TH | | | | | 1,308 | | | 1,081 | |

| BK | | | | | 12,240 | | | 11,580 | |

| PLK | | | | | 1,177 | | | 856 | |

| FHS (a) | | | | | 17 | | | N/A |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(a) See FHS Segment results footnote "a."

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Supplemental Disclosure

(Unaudited)

General and Administrative Expenses

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Segment G&A TH (a) | $ | 47 | | | $ | 42 | | | $ | 168 | | | $ | 151 | |

Segment G&A BK (a) | 39 | | | 37 | | | 145 | | | 126 | |

| Segment G&A PLK (a) | 22 | | | 20 | | | 86 | | | 72 | |

Segment G&A FHS (a) | 18 | | | 13 | | | 58 | | | 52 | |

Segment G&A INTL (a) | 50 | | | 43 | | | 190 | | | 160 | |

| FHS Transaction costs | — | | | 16 | | | 19 | | | 24 | |

| Corporate restructuring and advisory fees | 21 | | | 25 | | | 38 | | | 46 | |

| General and administrative expenses | $ | 197 | | | $ | 196 | | | $ | 704 | | | $ | 631 | |

(a) Segment G&A includes segment general and administrative expenses and excludes FHS Transaction costs and corporate restructuring and advisory fees.

Other Operating Expenses (Income), net

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| (in US$ millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Net losses (gains) on disposal of assets, restaurant closures, and refranchisings (a) | $ | (3) | | | $ | 2 | | | $ | 16 | | | $ | 4 | |

| Litigation settlements and reserves, net | 2 | | | 8 | | | 1 | | | 11 | |

| Net losses (gains) on foreign exchange (b) | 31 | | | 78 | | | 20 | | | (4) | |

| Other, net | 5 | | | 5 | | | 18 | | | 14 | |

| Other operating expenses (income), net | $ | 35 | | | $ | 93 | | | $ | 55 | | | $ | 25 | |

(a) Net losses (gains) on disposal of assets, restaurant closures, and refranchisings represent sales of properties and other costs related to restaurant closures and refranchisings. Gains and losses recognized in the current period may reflect certain costs related to closures and refranchisings that occurred in previous periods.

(b) Net losses (gains) on foreign exchange are primarily related to revaluation of foreign denominated assets and liabilities.

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Non-GAAP Financial Measures

(Unaudited)

Below, we define the non-GAAP financial measures, provide a reconciliation of each non-GAAP financial measure to the most directly comparable financial measure calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), and discuss the reasons why we believe this information is useful to management and may be useful to investors. These measures do not have standardized meanings under GAAP and may differ from similarly captioned measures of other companies in our industry.

Non-GAAP Measures

To supplement our condensed consolidated financial statements presented on a GAAP basis, RBI reports the following non-GAAP financial measures: Adjusted Operating Income (“AOI”), EBITDA, Adjusted EBITDA (on a consolidated and a segment basis), Adjusted Net Income, Adjusted Interest Expense, Adjusted Diluted Earnings per Share (“Adjusted Diluted EPS”), Organic revenue growth, Organic Adjusted Operating Income growth, Organic Adjusted EBITDA growth, Organic Net Income growth, Organic Adjusted Net Income Growth, Organic Adjusted Diluted EPS growth, Free Cash Flow, Net Debt, and Adjusted EBITDA Net Leverage. We believe that these non-GAAP measures are useful to investors in assessing our operating performance or liquidity, as they provide them with the same tools that management uses to evaluate our performance or liquidity and are responsive to questions we receive from both investors and analysts. By disclosing these non-GAAP measures, we intend to provide investors with a consistent comparison of our operating results and trends for the periods presented.

Adjusted Operating Income ("AOI") represents income from operations adjusted to exclude (i) franchise agreement amortization as a result of acquisition accounting, (ii) (income) loss from equity method investments, net of cash distributions received from equity method investments, (iii) other operating expenses (income), net and, (iv) income/expenses from non-recurring projects and non-operating activities. For the periods referenced in the following financial results, income/expenses from non-recurring projects and non-operating activities included (i) non-recurring fees and expense incurred in connection with the Firehouse Acquisition consisting of professional fees, compensation-related expenses and integration costs ("FHS Transaction costs"); and (ii) non-operating costs from professional advisory and consulting services associated with certain transformational corporate restructuring initiatives that rationalize our structure and optimize cash movements as well as services related to significant tax reform legislation and regulations ("Corporate restructuring and advisory fees"). Management believes that these types of expenses are either not related to our underlying profitability drivers or not likely to re-occur in the foreseeable future and the varied timing, size and nature of these projects may cause volatility in our results unrelated to the performance of our core business that does not reflect trends of our core operations. AOI is used by management to measure operating performance of the business, excluding these other specifically identified items that management believes are not relevant to management's assessment of our operating performance. AOI, as defined above, also represents our measure of segment income for each of our five operating segments.

EBITDA is defined as earnings (net income or loss) before interest expense, net, (gain) loss on early extinguishment of debt, income tax (benefit) expense, and depreciation and amortization and is used by management to measure operating performance of the business. Adjusted EBITDA is defined as EBITDA excluding (i) the non-cash impact of share-based compensation and non-cash incentive compensation expense, (ii) (income) loss from equity method investments, net of cash distributions received from equity method investments, (iii) other operating expenses (income), net, and (iv) income or expense from non-recurring projects and non-operating activities (as described above). Adjusted EBITDA for each of the five reporting segments is defined as Adjusted Operating Income for the respective segment operations adjusted to exclude (i) the non-cash impact of share-based compensation and non-cash incentive compensation expense associated with the segment and (ii) depreciation and amortization (excluding franchise agreement amortization as a result of acquisition accounting) associated with the segment.

Adjusted Net Income is defined as net income excluding (i) franchise agreement amortization as a result of acquisition accounting, (ii) amortization of deferred financing costs and debt issuance discount, (iii) loss on early extinguishment of debt and interest expense, which represents non-cash interest expense related to losses reclassified from accumulated comprehensive income (loss) into interest expense in connection with interest rate swaps de-designated in May 2015, November 2019 and September 2021, (iv) (income) loss from equity method investments, net of cash distributions received from equity method investments, (v) other operating expenses (income), net, and (vi) income or expense from non-recurring projects and non-operating activities (as described above).

Adjusted Interest Expense is defined as interest expense, net less (i) amortization of deferred financing costs and debt issuance discount and (ii) non-cash interest expense related to losses reclassified from accumulated comprehensive income (loss) into interest expense in connection with interest rate swaps de-designated in May 2015, November 2019 and September 2021.

Adjusted Diluted EPS is calculated by dividing Adjusted Net Income by the weighted average diluted shares outstanding of RBI during the reporting period. Adjusted Net Income and Adjusted Diluted EPS are used by management to evaluate the operating performance of the business, excluding certain non-cash and other specifically identified items that management believes are not relevant to management’s assessment of operating performance.

Net Debt is defined as Total Debt less cash and cash equivalents. Total Debt is defined as long-term debt, net of current portion plus (i) Finance leases, net of current portion, (ii) Current portion of long-term debt and finance leases and (iii) Unamortized deferred financing

costs and deferred issue discount. Net Debt is used by management to evaluate the Company's liquidity. We believe this measure is an important indicator of the Company's ability to service its debt obligations.

Adjusted EBITDA Net Leverage is defined as net debt (total debt less cash and cash equivalents) divided by Adjusted EBITDA. Net Income Net Leverage is defined as Net Debt divided by Net Income. Both of these metrics are operating performance measures that we believe provides investors a more complete understanding of our leverage position and borrowing capacity after factoring in cash and cash equivalents that eventually could be used to repay outstanding debt.

Revenue growth, Adjusted Operating Income growth and Adjusted EBITDA growth, Adjusted Net Income growth and Adjusted Diluted EPS growth on an organic basis, are non-GAAP measures that exclude the impact of FX movements. Management believes that organic growth is an important metric for measuring the operating performance of our business as it helps identify underlying business trends, without distortion from the effects of FX movements. We calculate the impact of FX movements by translating prior year results at current year monthly average exchange rates.

Free Cash Flow is the total of Net cash provided by operating activities minus Payments for property and equipment. Free Cash Flow is a liquidity measure used by management as one factor in determining the amount of cash that is available for working capital needs or other uses of cash, however, it does not represent residual cash flows available for discretionary expenditures.

Net Interest Paid is the total of cash interest paid in the period, cash proceeds (payments) related to derivatives, net from both investing activities and financing activities and cash interest income received. This liquidity measure is used by management to understand the net effect of interest paid, received and related hedging payments and receipts.

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Non-GAAP Financial Measures | Organic Growth

Three Months Ended December 31, 2023

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Impact of FX | | | | |

| | Actual | | Q4 '23 vs. Q4 '22 | | Movements | | Organic Growth |

| (in US$ millions, except per share data) | | Q4 '23 | | Q4 '22 | | $ | | % | | $ | | $ | | % |

| Revenue | | | | | | | | | | | | | | |

| TH | | $ | 1,018 | | | $ | 987 | | | $ | 31 | | | 3.2 | % | | $ | (2) | | | $ | 33 | | | 3.4 | % |

| BK | | $ | 345 | | | $ | 310 | | | $ | 35 | | | 11.0 | % | | $ | — | | | $ | 35 | | | 11.0 | % |

| PLK | | $ | 182 | | | $ | 162 | | | $ | 20 | | | 12.4 | % | | $ | — | | | $ | 20 | | | 12.4 | % |

| FHS | | $ | 51 | | | $ | 36 | | | $ | 15 | | | 41.9 | % | | $ | — | | | $ | 15 | | | 41.9 | % |

| INTL | | $ | 224 | | | $ | 194 | | | $ | 30 | | | 15.8 | % | | $ | 3 | | | $ | 27 | | | 13.8 | % |

| Total Revenues | | $ | 1,820 | | | $ | 1,689 | | | $ | 131 | | | 7.8 | % | | $ | 1 | | | $ | 130 | | | 7.7 | % |

| | | | | | | | | | | | | | |

| Income from Operations | | $ | 468 | | | $ | 346 | | | $ | 122 | | | 35.8 | % | | $ | (4) | | | $ | 126 | | | 37.5 | % |

| Net Income | | $ | 726 | | | $ | 336 | | | $ | 390 | | | 116.1 | % | | $ | (1) | | | $ | 391 | | | 116.8 | % |

| | | | | | | | | | | | | | |

| Adjusted Operating Income | | | | | | | | | | | | | | |

| TH | | $ | 231 | | | $ | 226 | | | $ | 5 | | | 2.4 | % | | $ | (1) | | | $ | 6 | | | 2.7 | % |

| BK | | $ | 69 | | | $ | 87 | | | $ | (18) | | | (21.4) | % | | $ | — | | | $ | (18) | | | (21.4) | % |

| PLK | | $ | 56 | | | $ | 52 | | | $ | 4 | | | 8.8 | % | | $ | — | | | $ | 4 | | | 8.9 | % |

| FHS | | $ | 8 | | | $ | 8 | | | $ | — | | | (4.5) | % | | $ | — | | | $ | — | | | (4.5) | % |

| INTL | | $ | 145 | | | $ | 133 | | | $ | 12 | | | 8.7 | % | | $ | 1 | | | $ | 11 | | | 8.0 | % |

| Adjusted Operating Income | | $ | 509 | | | $ | 506 | | | $ | 3 | | | 0.5 | % | | $ | — | | | $ | 3 | | | 0.5 | % |

| Adjusted EBITDA | | | | | | | | | | | | | | |

| TH | | $ | 271 | | | $ | 263 | | | $ | 8 | | | 3.2 | % | | $ | (1) | | | $ | 9 | | | 3.4 | % |

| BK | | $ | 87 | | | $ | 105 | | | $ | (18) | | | (17.8) | % | | $ | — | | | $ | (18) | | | (17.8) | % |

| PLK | | $ | 66 | | | $ | 60 | | | $ | 6 | | | 10.2 | % | | $ | — | | | $ | 6 | | | 10.2 | % |

| FHS | | $ | 15 | | | $ | 12 | | | $ | 3 | | | 23.2 | % | | $ | — | | | $ | 3 | | | 23.2 | % |

| INTL | | $ | 164 | | | $ | 148 | | | $ | 16 | | | 11.5 | % | | $ | 1 | | | $ | 15 | | | 10.7 | % |

| Adjusted EBITDA | | $ | 603 | | | $ | 588 | | | $ | 15 | | | 2.6 | % | | $ | — | | | $ | 15 | | | 2.6 | % |

| | | | | | | | | | | | | | |

| Adjusted Net Income | | $ | 340 | | | $ | 326 | | | $ | 14 | | | 3.9 | % | | $ | — | | | $ | 14 | | | 3.8 | % |

| Adjusted Diluted Earnings per Share | | $ | 0.75 | | | $ | 0.72 | | | $ | 0.03 | | | 4.5 | % | | $ | — | | | $ | 0.03 | | | 4.4 | % |

Note: Percentage changes may not recalculate due to rounding.

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Non-GAAP Financial Measures | Organic Growth

Twelve Months Ended December 31, 2023

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Impact of FX | | | | |

| | Actual | | 2023 vs. 2022 | | Movements | | Organic Growth |

| (in US$ millions, except per share data) | | 2023 | | 2022 | | $ | | % | | $ | | $ | | % |

| Revenue | | | | | | | | | | | | | | |

| TH | | $ | 3,972 | | | $ | 3,801 | | | $ | 171 | | | 4.5 | % | | $ | (115) | | | $ | 286 | | | 7.7 | % |

| BK | | $ | 1,297 | | | $ | 1,196 | | | $ | 101 | | | 8.4 | % | | $ | (2) | | | $ | 103 | | | 8.6 | % |

| PLK | | $ | 692 | | | $ | 619 | | | $ | 73 | | | 11.9 | % | | $ | (1) | | | $ | 74 | | | 12.0 | % |

| FHS | | $ | 187 | | | $ | 138 | | | $ | 49 | | | 34.9 | % | | $ | — | | | $ | 49 | | | 34.9 | % |

| INTL | | $ | 874 | | | $ | 751 | | | $ | 123 | | | 16.5 | % | | $ | — | | | $ | 123 | | | 16.6 | % |

| Total Revenues | | $ | 7,022 | | | $ | 6,505 | | | $ | 517 | | | 7.9 | % | | $ | (118) | | | $ | 635 | | | 9.9 | % |

| | | | | | | | | | | | | | |

| Income from Operations | | $ | 2,051 | | | $ | 1,898 | | | $ | 153 | | | 8.1 | % | | $ | (37) | | | $ | 190 | | | 10.3 | % |

| Net Income | | $ | 1,718 | | | $ | 1,482 | | | $ | 236 | | | 16.0 | % | | $ | (34) | | | $ | 270 | | | 18.7 | % |

| | | | | | | | | | | | | | |

| Adjusted Operating Income | | | | | | | | | | | | | | |

| TH | | $ | 958 | | | $ | 925 | | | $ | 33 | | | 3.6 | % | | $ | (28) | | | $ | 61 | | | 6.9 | % |

| BK | | $ | 386 | | | $ | 396 | | | $ | (10) | | | (2.6) | % | | $ | (1) | | | $ | (9) | | | (2.4) | % |

| PLK | | $ | 221 | | | $ | 205 | | | $ | 16 | | | 8.0 | % | | $ | — | | | $ | 16 | | | 8.3 | % |

| FHS | | $ | 38 | | | $ | 33 | | | $ | 5 | | | 14.4 | % | | $ | — | | | $ | 5 | | | 14.4 | % |

| INTL | | $ | 597 | | | $ | 525 | | | $ | 72 | | | 13.8 | % | | $ | (8) | | | $ | 80 | | | 15.5 | % |

| Adjusted Operating Income | | $ | 2,200 | | | $ | 2,084 | | | $ | 116 | | | 5.6 | % | | $ | (37) | | | $ | 153 | | | 7.5 | % |

| Adjusted EBITDA | | | | | | | | | | | | | | |

| TH | | $ | 1,111 | | | $ | 1,070 | | | $ | 41 | | | 3.8 | % | | $ | (33) | | | $ | 74 | | | 7.1 | % |

| BK | | $ | 462 | | | $ | 459 | | | $ | 3 | | | 0.5 | % | | $ | (1) | | | $ | 4 | | | 0.6 | % |

| PLK | | $ | 257 | | | $ | 232 | | | $ | 25 | | | 10.5 | % | | $ | — | | | $ | 25 | | | 10.8 | % |

| FHS | | $ | 58 | | | $ | 44 | | | $ | 14 | | | 33.1 | % | | $ | — | | | $ | 14 | | | 33.1 | % |

| INTL | | $ | 666 | | | $ | 573 | | | $ | 93 | | | 16.4 | % | | $ | (7) | | | $ | 100 | | | 17.9 | % |

| Adjusted EBITDA | | $ | 2,554 | | | $ | 2,378 | | | $ | 176 | | | 7.4 | % | | $ | (41) | | | $ | 217 | | | 9.3 | % |

| | | | | | | | | | | | | | |

| Adjusted Net Income | | $ | 1,480 | | | $ | 1,430 | | | $ | 50 | | | 3.5 | % | | $ | (32) | | | $ | 82 | | | 5.9 | % |

| Adjusted Diluted Earnings per Share | | $ | 3.24 | | | $ | 3.14 | | | $ | 0.10 | | | 3.3 | % | | $ | (0.07) | | | $ | 0.17 | | | 5.6 | % |

Note: Percentage changes may not recalculate due to rounding.

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Non-GAAP Financial Measures

Reconciliation of Income from Operations to Adjusted Operating Income and Net Income to Adjusted EBITDA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| (in US$ millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Income from operations | | $ | 468 | | | $ | 346 | | | $ | 2,051 | | | $ | 1,898 | |

| Franchise agreement amortization | | 8 | | | 8 | | | 31 | | | 32 | |

FHS Transaction costs(2) | | — | | | 16 | | | 19 | | | 24 | |

Corporate restructuring and advisory fees(3) | | 21 | | | 25 | | | 38 | | | 46 | |

Impact of equity method investments(4) | | (23) | | | 18 | | | 6 | | | 59 | |

| Other operating expenses (income), net | | 35 | | | 93 | | | 55 | | | 25 | |

| Adjusted Operating Income | | $ | 509 | | | $ | 506 | | | $ | 2,200 | | | $ | 2,084 | |

| | | | | | | | |

| Segment income: | | | | | | | | |

| TH | | $ | 231 | | | $ | 226 | | | $ | 958 | | | $ | 925 | |

| BK | | 69 | | | 87 | | | 386 | | | 396 | |

| PLK | | 56 | | | 52 | | | 221 | | | 205 | |

| FHS | | 8 | | | 8 | | | 38 | | | 33 | |

| INTL | | 145 | | | 133 | | | 597 | | | 525 | |

| Adjusted Operating Income | | $ | 509 | | | $ | 506 | | | $ | 2,200 | | | $ | 2,084 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| (in US$ millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Net income | | $ | 726 | | | $ | 336 | | | $ | 1,718 | | | $ | 1,482 | |

Income tax (benefit) expense(5) | | (410) | | | (134) | | | (265) | | | (117) | |

| Loss on early extinguishment of debt | | — | | | — | | | 16 | | | — | |

| Interest expense, net | | 152 | | | 144 | | | 582 | | | 533 | |

| Income from operations | | 468 | | | 346 | | | 2,051 | | | 1,898 | |

| Depreciation and amortization | | 49 | | | 47 | | | 191 | | | 190 | |

| EBITDA | | 517 | | | 393 | | | 2,242 | | | 2,088 | |

Share-based compensation and non-cash incentive compensation expense(1) | | 53 | | | 43 | | | 194 | | | 136 | |

FHS Transaction costs(2) | | — | | | 16 | | | 19 | | | 24 | |

Corporate restructuring and advisory fees(3) | | 21 | | | 25 | | | 38 | | | 46 | |

Impact of equity method investments(4) | | (23) | | | 18 | | | 6 | | | 59 | |

| Other operating expenses (income), net | | 35 | | | 93 | | | 55 | | | 25 | |

| Adjusted EBITDA | | $ | 603 | | | $ | 588 | | | $ | 2,554 | | | $ | 2,378 | |

| | | | | | | | |

| Adjusted EBITDA by segment: | | | | | | | | |

| TH | | $ | 271 | | | $ | 263 | | | $ | 1,111 | | | $ | 1,070 | |

| BK | | 87 | | | 105 | | | 462 | | | 459 | |

| PLK | | 66 | | | 60 | | | 257 | | | 232 | |

| FHS | | 15 | | | 12 | | | 58 | | | 44 | |

| INTL | | 164 | | | 148 | | | 666 | | | 573 | |

| Adjusted EBITDA | | $ | 603 | | | $ | 588 | | | $ | 2,554 | | | $ | 2,378 | |

RESTAURANT BRANDS INTERNATIONAL INC. AND SUBSIDIARIES

Non-GAAP Financial Measures

Reconciliation of Net Income to Adjusted Net Income and Adjusted Diluted Earnings per Share

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| (in US$ millions, except per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 726 | | | $ | 336 | | | $ | 1,718 | | | $ | 1,482 | |

Income tax (benefit) expense(5) | | (410) | | | (134) | | | (265) | | | (117) | |

| Income before income taxes | | 316 | | | 202 | | | 1,453 | | | 1,365 | |