SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 6)*

Under the Securities Exchange Act of 1934

Tripadvisor, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

896945201

(CUSIP Number)

Renee L. Wilm, Esq.

Chief Legal Officer / Chief Administrative Officer

Liberty TripAdvisor Holdings, Inc.

12300 Liberty Boulevard

Englewood, CO 80112

(720) 875-5200

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

February 9, 2024

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

CUSIP No:

Common

Stock: 896945201

| 1. | Names of Reporting Persons |

| | Liberty TripAdvisor Holdings, Inc. |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

| |

(a) |

¨ |

| |

(b) |

¨ |

| 4. | Source of Funds (See Instructions)

OO |

| 5. | Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. | Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each Reporting

Person With:

|

7. |

Sole Voting Power

29,245,893 shares (1) (2) |

| 8. |

Shared Voting Power

None |

| 9. |

Sole Dispositive Power

29,245,893 shares (1) (2) |

| 10. |

Shared Dispositive Power

None |

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person

29,245,893 shares (1) (2) |

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) x |

| | Excludes shares beneficially owned by the executive officers

and directors of the Reporting Person |

| 13. | Percent of Class Represented by Amount in Row (11)

21.1% (2) (3) |

| 14. | Type of Reporting Person (See Instructions)

CO |

| (1) | Consists of 16,445,894 shares of Common Stock, par value $0.001 per share (“Common Stock”),

of Tripadvisor, Inc., a Delaware corporation (the “Issuer”), and 12,799,999 shares of the Issuer’s Class B

Common Stock, par value $0.001 per share (“Class B Common Stock”), beneficially owned by Liberty TripAdvisor Holdings, Inc.,

a Delaware corporation (the “Reporting Person”). See Item 6 of the Schedule 13D for a description of certain agreements

containing certain restrictions on the Common Stock and Class B Common Stock beneficially owned by the Reporting Person. |

| (2) | Each share of Class B Common Stock is convertible at the option of the holder into one share of Common

Stock. Assumes the conversion of all shares of Class B Common Stock beneficially owned by the Reporting Person into shares of Common

Stock. |

| (3) | Because each share of Class B Common Stock generally is entitled to ten votes per share and each

share of Common Stock is entitled to one vote per share, the Reporting Person may be deemed to beneficially own equity securities of the

Issuer representing approximately 56.9% of the voting power

of the Issuer. See Item 5 of the Schedule 13D. Such percentages are calculated based on the 125,714,553 shares of Common Stock and 12,799,999

shares of Class B Common Stock outstanding as of November 1, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q

for the quarter ended September 30, 2023, filed with the Securities and Exchange Commission on November 6, 2023. |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 6)

Statement of

LIBERTY TRIPADVISOR HOLDINGS, INC.

Pursuant to Section 13(d) of the Securities

Exchange Act of 1934

in respect of

TRIPADVISOR, INC.

This amended statement on

Schedule 13D/A (this “Amendment”) constitutes Amendment No. 6 to the Schedule 13D originally filed with the Securities

and Exchange Commission (the “SEC”) by Liberty TripAdvisor Holdings, Inc., a Delaware corporation (the “Reporting

Person”), with respect to Tripadvisor, Inc., a Delaware corporation (the “Issuer”), on August 29,

2014, as amended by Amendment No. 1 to the Statement on Schedule 13D filed with the SEC by the Reporting Person on June 30,

2016, Amendment No. 2 to the Statement on Schedule 13D filed with the SEC by the Reporting Person on November 20, 2019, Amendment

No. 3 to the Statement on Schedule 13D filed with the SEC by the Reporting Person on March 16, 2020, Amendment No. 4 to

the Statement on Schedule 13D filed with the SEC by the Reporting Person on March 24, 2021 and Amendment No. 5 to the Statement

on Schedule 13D filed with the SEC by the Reporting Person on August 12, 2022 (collectively, the “Schedule 13D”

and together with this Amendment, the “Statement”). The Schedule 13D is hereby amended and supplemented to include

the information set forth herein. Capitalized terms not defined herein have the meanings given to such terms in the Schedule 13D. Except

as set forth herein, the Schedule 13D is unmodified.

Item 2. Identity and Background

The information contained in Item 2(d)-(f) of the Schedule

13D is hereby replaced with the following information:

(d) - (f)

Schedule 1, attached to this

Statement and incorporated herein by reference, provides the requested information with respect to each executive officer and director,

as applicable, of the Reporting Person (the “Schedule 1 Persons”). Each of such executive officers and directors is

a citizen of the United States.

During the last five years,

neither the Reporting Person nor, to the best of the knowledge of the Reporting Person, any of the Schedule 1 Persons has been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors) or has been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction resulting in a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 4. Purpose of Transaction

The information contained

in Item 4 of the Schedule 13D is hereby amended and supplemented by adding the following information:

On February 9, 2024,

the Reporting Person’s board of directors authorized the Reporting Person to engage in discussions with respect to a potential transaction

(“Potential Transaction”), pursuant to which all of the outstanding stock of the Reporting Person and all of the Issuer’s

outstanding Common Stock and Class B Common Stock would be acquired concurrently for cash. In any such Potential Transaction, it

is anticipated that (i) all outstanding shares of Common Stock and Class B Common Stock of the Issuer would receive the same

per share cash consideration, and (ii) all outstanding shares of common stock of the Reporting Person would receive the same per

share cash consideration (with the amount thereof to be determined based on the per share consideration that would be payable for the

underlying shares of the Issuer owned by the Reporting Person following satisfaction of outstanding liabilities, including consideration

due to holders of the Reporting Person’s preferred stock). The board of directors of the Issuer has formed a special committee comprised

of independent and disinterested directors of the board of directors of the Issuer (“Special Committee”). The Special

Committee has authorized the Issuer to, among other things, engage in discussions with respect to a Potential Transaction, subject to

certain guidelines. If any such Potential Transaction is consummated, each of the Reporting Person and the Issuer would cease to be publicly

traded companies.

Any Potential Transaction

would be subject to, among other things, the negotiation and execution of mutually acceptable definitive transaction documents and applicable

board approvals of each of the Reporting Person and the Issuer, including the approval of the Special Committee. No further updates on

any Potential Transaction will be provided unless and until definitive documents are executed or discussions among the various parties

terminate, or unless otherwise required by applicable law.

Other than as described herein,

the Reporting Person does not have any present plans or proposals which relate to or would result in: (i) any acquisition by any

person of additional securities of the Issuer, or any disposition of securities of the Issuer; (ii) any extraordinary corporate transaction,

such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (iii) any sale or transfer of a

material amount of assets of the Issuer or any of its subsidiaries; (iv) any change in the Board or management of the Issuer, including

any plans or proposals to change the number or term of directors or to fill any vacancies on the Board; (v) any material change in

the present capitalization or dividend policy of the Issuer; (vi) any other material change in the Issuer’s business or corporate

structure; (vii) any change in the Issuer’s charter or bylaws or other actions which may impede the acquisition of control

of the Issuer by any person; (viii) any delisting from a national securities exchange or any loss of authorization for quotation

in an inter-dealer quotation system of a registered national securities association of a class of securities of the Issuer; (ix) any

termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended, of a class of equity

securities of the Issuer; or (x) any action similar to any of those enumerated above.

Notwithstanding the foregoing,

the Reporting Person may determine to change its intentions with respect to the Issuer at any time in the future, including with respect

to a Potential Transaction, and may, for example, elect (i) to acquire additional shares of Common Stock or (ii) to dispose

of all or a portion of its holdings of shares of Common Stock, as the case may be. In reaching any determination as to its future course

of action, the Reporting Person will take into consideration various factors, such as the Issuer’s business and prospects, other

developments concerning the Issuer, other business opportunities available to the Reporting Person, liquidity needs and general economic

and stock market conditions, including, but not limited to, the market price of the Common Stock.

Item 5. Interest in Securities of the Issuer

The information contained in Item 5 of the Schedule 13D is

hereby amended and restated as follows:

(a) The

Reporting Person beneficially owns 16,445,894 shares of Common Stock, par value $0.001 per share, of the Issuer (“Common Stock”)

and 12,799,999 shares of Class B Common Stock, par value $0.001 per share, of the Issuer (“Class B Common Stock”),

which shares constitute 13.1% of the outstanding shares of Common Stock and 100% of the outstanding shares of Class B Common Stock.

Each share of Class B Common Stock is convertible at the option of the holder into one share of Common Stock. Assuming the conversion

of all of the Reporting Person's shares of Class B Common Stock into shares of Common Stock, the Reporting Person beneficially owns

21.1% of the outstanding shares of Common Stock (calculated in accordance with Rule 13d-3 under the Securities Exchange Act of 1934,

as amended). Because each share of Class B Common Stock generally is entitled to ten votes per share and each share of Common Stock

is entitled to one vote per share, the Reporting Person may be deemed to beneficially own equity securities of the Issuer representing

approximately 56.9% of the voting power of the Issuer. The foregoing beneficial ownership amounts exclude shares of Common Stock beneficially

owned by the executive officers and directors of the Reporting Person. Such percentages are calculated based on the 125,714,553 shares

of Common Stock and 12,799,999 shares of Class B Common Stock outstanding as of November 1, 2023, as reported in the Issuer’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on November 6, 2023. Mr. Gregory

B. Maffei beneficially owns 105,248 shares of Common Stock. The Maffei Foundation beneficially owns 1,938 shares of Common Stock, as to

which shares Mr. Maffei has disclaimed beneficial ownership. Mr. Albert E. Rosenthaler beneficially owns 50,340 shares of Common

Stock.

(b) The

Reporting Person has the sole power to vote or to direct the voting of shares of Common Stock beneficially owned by it and has the sole

power to dispose or direct the disposition of such shares, subject to the pledges and restrictions described in Item 6 of the Statement.

To the knowledge of the Reporting

Person, each of Mr. Maffei and Mr. Rosenthaler have sole voting and dispositive power of the Common Stock beneficially owned

by them. Mr. Maffei and his wife, as the two directors of the Maffei Foundation, have shared voting and dispositive power with respect

to any shares held by the Maffei Foundation.

(c) No transactions were effected by the Reporting Person, or, to the knowledge of the Reporting

Person, any Schedule 1 Person, with respect to the Common Stock during the 60 days preceding the date hereof.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: February 12, 2024 |

|

| |

|

| |

LIBERTY TRIPADVISOR HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Brittany A. Uthoff |

| |

Name: |

Brittany A. Uthoff |

| |

Title: |

Vice President |

[Signature Page to Liberty TripAdvisor Holdings, Inc. Amendment

No. 6 to Schedule 13D]

SCHEDULE 1

DIRECTORS AND EXECUTIVE OFFICERS OF LIBERTY

TRIPADVISOR HOLDINGS, INC.

The name and present principal occupation of each

director and executive officer of Liberty TripAdvisor Holdings, Inc. (“LTAH”) are set forth below. Unless otherwise

noted, the business address for each person listed below is c/o Liberty TripAdvisor Holdings, Inc., 12300 Liberty Boulevard, Englewood,

Colorado 80112. All executive officers and directors listed are United States citizens.

|

Name and Business Address

(If Applicable) |

Principal Occupation

and Principal Business

(If Applicable) |

| |

|

| Gregory B. Maffei |

Chairman of the Board, President and Chief Executive Officer of LTAH |

| Christy Haubegger |

Director of LTAH |

| Michael J. Malone |

Director of LTAH |

| Chris Mueller |

Director of LTAH |

| Larry E. Romrell |

Director of LTAH |

| Albert E. Rosenthaler |

Director of LTAH |

| J. David Wargo |

Director of LTAH |

| Brian J. Wendling |

Chief Financial Officer and Senior Vice President of LTAH |

| Renee L. Wilm |

Chief Legal Officer and Chief Administrative Officer of LTAH |

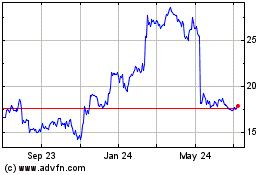

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

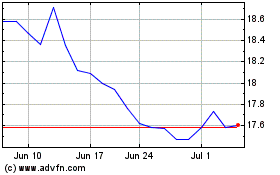

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Apr 2023 to Apr 2024