false00016750330001675033gecc:FivePointEightSevenFivePercentageNotesDueTwoThousandTwentySixMember2024-02-082024-02-080001675033gecc:EightPointSevenFivePercentageNotesDueTwoThousandTwentyEightMember2024-02-082024-02-0800016750332024-02-082024-02-080001675033us-gaap:CommonStockMember2024-02-082024-02-080001675033gecc:SixPointSevenFivePercentageNotesDueTwoThousandTwentyFiveMember2024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024

Great Elm Capital Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Maryland |

814-01211 |

81-2621577 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

800 South Street, Suite 230, Waltham, MA |

|

02453 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 375-3006

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock, $0.01 par value |

GECC |

Nasdaq Global Market |

6.75% Notes due 2025 |

GECCM |

Nasdaq Global Market |

5.875% Notes due 2026 |

GECCO |

Nasdaq Global Market |

8.75% Notes due 2028 |

GECCZ |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On February 8, 2024, Great Elm Capital Corp. (the “Company”) entered into a Share Purchase Agreement with Great Elm Strategic Partnership I, LLC (the “Purchaser”), pursuant to which the Purchaser purchased, and the Company issued, 1,850,424 shares of the Company’s common stock, par value $0.01 (the “Shares”), at a current net asset value of $12.97 per share or an aggregate purchase price of $24 million.

The Purchaser is a special purpose vehicle which is owned 25% by Great Elm Group, Inc. (“GEG”). Great Elm Capital Management, Inc. (“GECM”), the investment manager of the Company, is a wholly-owned subsidiary of GEG.

The Common Stock was issued in a private placement exempt from registration under Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”).

Item 2.02 Results of Operations and Financial Condition.

On February 8, 2024, the Company issued a press release that included information indicating:

•Net asset value (“NAV”) of the Company of $98.7 million, or $12.99 per share of the Company’s common stock, for the three months ended December 31, 2023;

•Net investment income of the Company of $0.43 per share of the Company’s common stock for the three months ended December 31, 2023; and

•A distribution set by the Company’s board of directors for the three months ending March 31, 2024 at a rate of $0.35 per share.

The foregoing information is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02.

Item 7.01 Regulation FD Disclosure.

The information set forth in Item 2.02 above is incorporated by reference into this Item 7.01.

Item 8.01 Other Events.

On February 8, 2024, the Company issued a press release in connection with the issuance of the Shares. A copy of the press release is filed as Exhibit 99.1 to this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished with this report but shall not be deemed filed:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

GREAT ELM CAPITAL CORP. |

|

|

|

Date: February 8, 2024 |

|

/s/ Keri A. Davis |

|

|

By: |

|

Keri A. Davis |

|

|

Title: |

|

Chief Financial Officer |

Exhibit 10.1

Share PURCHASE AGREEMENT

SHARE PURCHASE AGREEMENT (this “Agreement”), dated as of February 8, 2024, by and between Great Elm Capital Corp., a Maryland corporation (the “Company”), and Great Elm Strategic Partnership I, LLC, a Delaware limited liability company (the “Purchaser”).

WHEREAS:

A.The Company and the Purchaser are executing and delivering this Agreement in reliance upon the exemption from securities registration afforded by Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) of Regulation D (“Regulation D”) as promulgated by the United States Securities and Exchange Commission (the “SEC”) under the Securities Act; and

B.The Purchaser wishes to purchase from the Company, and the Company wishes to sell to the Purchaser, upon the terms and conditions stated in this Agreement, 1,850,424 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”).

NOW THEREFORE, the Company and the Purchaser hereby agree as follows:

2.PURCHASE AND SALE OF THE SHARES.

a.Purchase of the Shares. Subject to the terms and conditions of this Agreement, and in reliance on the representations, warranties and covenants contained herein, the Company will issue and sell to the Purchaser, and the Purchaser agrees to purchase from the Company, 1,850,424 Shares at an aggregate purchase price (the “Purchase Price”) equal to $23,999,999.28, or $12.97 per Share.

b.Form of Payment. Simultaneously with the parties’ execution of this Agreement, (i) the Purchaser shall pay the Purchase Price to the Company for the Shares to be issued and sold to the Purchaser, by wire transfer of immediately available funds in accordance with the Company’s written wire instructions provided to the Purchaser prior to Closing, and (ii) the Company will (x) instruct Equiniti Trust Company, LLC (the “Transfer Agent”) to issue to the Purchaser or its designee, the Shares registered in the name of the Purchaser, in book entry form, free and clear of all restrictions (other than those arising under state or federal securities laws) and (y) provide evidence of such issuance from the Transfer Agent, which evidence may be in the form of an email confirmation from the Transfer Agent.

c.Closing. The closing of the purchase and sale of the Shares shall take place simultaneously with the execution of this Agreement (the “Closing”) at the offices of Jones Day, 250 Vesey Street, New York, NY 10281 or at such other place as the Company and the Purchaser may mutually agree.

3.PURCHASER’S REPRESENTATIONS AND WARRANTIES.

The Purchaser represents and warrants, as of the date of this Agreement, to the Company that:

a.Investment Purpose. The Purchaser understands that the Shares are “restricted securities” and have not been registered under the Securities Act or any applicable state securities law and the Purchaser is acquiring the Shares hereunder for its own account and not with a view towards, or for resale in connection with, the public sale or distribution thereof, except pursuant to sales registered under, or exempted from, the registration requirements of the Securities Act. The Purchaser is acquiring the Shares hereunder in the ordinary course of its business.

b.Accredited Investor Status. The Purchaser is an “accredited investor” as that term is defined in Rule 501(a) of Regulation D.

c.Reliance on Exemptions. The Purchaser understands that the Shares are being offered and sold to it in reliance on specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying in part upon the truth and accuracy of, and the Purchaser’s

compliance with, the representations, warranties, agreements, acknowledgments and understandings of the Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of the Purchaser to acquire the Shares.

d.Information. The Purchaser acknowledges that it has had the opportunity to review the SEC Documents (as defined below) and the Purchaser and its advisors, if any, have been furnished with all materials relating to the business, finances and operations of the Company and materials relating to the offer and sale of the Shares sufficient in its view to enable it to evaluate its investment. The Purchaser and its advisors, if any, have been afforded the opportunity to ask questions as it has deemed necessary of, and to receive answers from, the Company or its representatives concerning the terms and conditions of the offering of the Shares and the merits and risks of investing in the Shares. The Purchaser has not relied on any representations or warranties from the Company, its employees, agents, or attorneys in making this investment decision other than as set forth in Section 3 below.

e.General Solicitation. The Purchaser is not purchasing the Shares as a result of any advertisement, article, notice or other communication regarding the Shares published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or any other general advertisement.

f.Experience of the Purchaser. The Purchaser, either alone or together with its representatives, has such knowledge, sophistication and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Shares, and has so evaluated the merits and risks of such investment. The Purchaser is able to bear the economic risks of an investment in the Shares and, at the present time, is able to afford a complete loss of such investment.

g.Independent Investment Decision. The Purchaser, together with any of its advisors, has independently evaluated the merits of its decision to purchase the Shares pursuant to this Agreement. The Purchaser understands that nothing in this Agreement or any other materials presented by or on behalf of the Company to the Purchaser in connection with the purchase of the Shares constitutes legal, tax or investment advice. The Purchaser has consulted such legal, tax and investment advisors as it, in its sole discretion, has deemed necessary or appropriate in connection with its purchase of the Shares.

h.Acknowledgment of Risks. The Purchaser acknowledges and understands that its investment in the Shares involves a significant degree of risk, including, without limitation: (i) an investment in the Company is speculative, and the Purchaser should only consider investing in the Company and the Shares if it can afford the loss of its entire investment; (ii) the Purchaser may not be able to liquidate its investment; (iii) transferability of the Shares is extremely limited; (iv) in the event of a disposition of the Shares, the Purchaser could sustain the loss of its entire investment; and (vi) that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the Shares or the fairness or suitability of the investment in the Shares nor have such authorities passed upon or endorsed the merits of the offering of the Shares.

i.Transfer or Resale. The Purchaser understands that, except as provided in Section 4(g) hereof, (i) the Shares have not been and are not being registered under the Securities Act or any state securities laws, and may not be offered for sale, sold, assigned or transferred unless (A) subsequently registered thereunder, (B) the Purchaser shall have delivered to the Company an opinion of counsel, in form and substance reasonably acceptable to the Company, to the effect that such Shares to be sold, assigned or transferred may be sold, assigned or transferred pursuant to an exemption from such registration, or (C) the Purchaser provides the Company with reasonable assurance that such Shares have been or can be sold, assigned or transferred pursuant to Rule 144 promulgated under the Securities Act (or a successor rule thereto) (“Rule 144”); and (ii) neither the Company nor any other Person is under any obligation to register the Shares under the Securities Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder. For purposes of this Agreement, “Person” means an individual, a limited liability company, a partnership, a joint venture, a corporation, a trust, an unincorporated organization or a government or any department or agency thereof or any other legal entity.

j.Brokers and Finders. No Person will have, as a result of the transactions contemplated by this Agreement, any valid right, interest or claim against or upon the Company or the Purchaser for any commission,

2

fee or other compensation pursuant to any agreement, arrangement or understanding entered into by or on behalf of the Purchaser.

k.Authorization; Enforcement; Validity. The Purchaser is a validly existing limited liability company and has the requisite limited liability power and authority to enter into the transactions contemplated by this Agreement. This Agreement has been duly and validly authorized (as applicable), executed and delivered on behalf of the Purchaser and is the legal, valid and binding agreement of the Purchaser, enforceable against the Purchaser in accordance with its terms, except as may be limited by bankruptcy, insolvency, fraudulent conveyance or similar laws affecting creditors’ rights generally or by general principles of equity (the “Enforceability Exceptions”).

l.No Conflicts. The execution, delivery and performance by the Purchaser of this Agreement and the consummation by the Purchaser of the transactions contemplated hereby will not (i) result in a violation of the organizational documents of the Purchaser, (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Purchaser is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws) applicable to the Purchaser, except in the case of clauses (ii) and (iii) above, for such conflicts, defaults, rights or violations which would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the ability of the Purchaser to perform its obligations hereunder.

4.REPRESENTATIONS AND WARRANTIES OF THE COMPANY.

The Company represents and warrants, as of the date of this Agreement, to the Purchaser that:

a.No Registration. Subject to compliance by the Purchaser with the representations and warranties set forth in Section 2 hereof, it is not necessary in connection with the offer, sale and delivery of the Shares to the Purchaser in the manner contemplated by this Agreement to register the Shares under the Securities Act.

b.Incorporation and Good Standing of the Company. The Company is a Maryland corporation duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization and has all requisite power and authority to own its property and conduct its business as presently conducted in the manner described in the SEC Documents. The Company is duly qualified to do business and is in good standing in each jurisdiction in which the conduct of its business or the ownership or leasing of property requires such qualification, except to the extent that the failure to be so qualified or to be in good standing, individually or in the aggregate, would not have, or reasonably be expected to have, a material adverse effect on (i) the business, assets, properties, financial condition or results of operations of the Company and its affiliates, taken as a whole, or (ii) the power or ability of the Company to perform its obligations under this Agreement (the occurrence of any such event described in the foregoing clauses (i) and (ii) being referred to as a “Material Adverse Effect”)).

c.Authorization. This Agreement has been duly authorized, executed and delivered by the Company.

d.Capitalization. Immediately before giving effect the transactions contemplated by this Agreement, the authorized capital stock of the Company consists of 100,000,000 shares of Common Stock, of which, as of the date hereof, 7,601,958 shares were outstanding. All outstanding capital stock of the Company has been duly authorized and validly issued, is fully paid and nonassessable and was not issued in violation of any preemptive or similar rights.

e.Issuance of Shares. The Shares have been duly and validly authorized and reserved for issuance and, when issued and paid for pursuant to this Agreement, will be validly issued, fully paid and non-assessable and free from all taxes, liens, claims and encumbrances with respect to the issue thereof; and the issuance of the Shares will not be subject to any preemptive or similar rights.

3

f.No Conflicts. The execution, delivery and performance by the Company of this Agreement and the consummation by the Company of the transactions contemplated hereby will not (i) result in a violation of the organizational documents of the Company, (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Company is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws) applicable to the Company, except in the case of clauses (ii) and (iii) above, for such conflicts, defaults, rights or violations which would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

g.SEC Documents; Financial Statements; Sarbanes-Oxley.

(i)Since January 1, 2023, the Company has filed in a timely manner all reports, schedules, forms, statements and other documents required to be filed by it with the SEC pursuant to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (all of the foregoing filed prior to the date this representation is made (including all exhibits included therein and financial statements and schedules thereto and documents incorporated by reference therein), collectively being hereinafter referred to as the “SEC Documents”). The Company has made the SEC Documents available to the Purchaser or its respective representatives, or filed and made the SEC Documents publicly available on the SEC’s Electronic Data Gathering, Analysis, and Retrieval system (or successor thereto). The financial statements (including the related notes) of the Company included in the SEC Documents (the “Financial Statements”) comply as to form in all material respects with the applicable requirements under the Securities Act and the Exchange Act; the Financial Statements have been prepared in accordance with generally accepted accounting principles (“GAAP”) consistently applied throughout the periods covered thereby and fairly present in all material respects the financial position of the entities purported to be covered thereby at the respective dates indicated and the results of their operations and their cash flows for the respective periods indicated. Except as set forth in the Financial Statements filed prior to the date hereof, the Company has not incurred any liabilities, contingent or otherwise, except (i) those incurred in the ordinary course of business, consistent with past practices since the date of such financial statements or (ii) liabilities not required under GAAP to be reflected in the Financial Statements, in either case, none of which, individually or in the aggregate, have had or would reasonably be expected to have a Material Adverse Effect.

(ii)There is and has been no failure on the part of the Company or any of the Company’s directors or officers, in their capacities as such, to comply in all material respects with any provision of the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated in connection therewith, including Section 402 related to loans and Sections 302 and 906 related to certifications.

h.Internal Accounting Controls; Disclosure Controls and Procedures. The Company maintains systems of “internal control over financial reporting” (as defined in Rule 13a-15(f) of the Exchange Act) that comply with the requirements of the Exchange Act and have been designed by, or under the supervision of, their respective principal executive and principal financial officers, or persons performing similar functions, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP, including, but not limited to internal accounting controls sufficient to provide reasonable assurance that (i) transactions are executed in accordance with management’s general or specific authorizations; (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset accountability; (iii) access to assets is permitted only in accordance with management’s general or specific authorization; and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences.

The Company maintains an effective system of “disclosure controls and procedures” (as defined in Rule 13a-15(e) of the Exchange Act) that is designed to ensure that material information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Exchange Act and that such information is communicated to the Company’s management as appropriate to allow timely decisions regarding required disclosure.

4

i.Absence of Certain Changes. Since January 1, 2023, there have been no events, occurrences or developments that have or would reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect. The Company has not taken any steps to seek protection pursuant to any bankruptcy law nor, to the Company’s knowledge, do any creditors of the Company intend to initiate involuntary bankruptcy proceedings nor, to the Company’s knowledge, is there any fact that would reasonably lead a creditor to do so. The Company has not, since the date of the latest financial statements included within its SEC Documents, materially altered its method of accounting or the manner in which it keeps its books and records.

j.No Material Actions or Proceedings. There is no action, suit, proceeding, inquiry or investigation pending or, to the knowledge of the Company, threatened in writing against the Company before or brought by any court or other governmental authority or arbitration board or tribunal, which is required to be disclosed in the SEC Documents (other than as disclosed therein), or which might, individually, or in the aggregate, reasonably be expected to have a Material Adverse Effect.

k.General Solicitation. Neither the Company, nor any of its affiliates, nor any Person acting on its or their behalf, has engaged or will engage in any form of general solicitation or general advertising (within the meaning of Regulation D under the Securities Act) in connection with the offer or sale of the Shares.

l.No Integrated Offering. Neither the Company, nor any of its affiliates, nor any Person acting on its or their behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would require registration of any of the Shares under the Securities Act or cause this offering of the Shares to be integrated with prior offerings by the Company for purposes of the Securities Act or any applicable stockholder approval provisions of any authority.

m.Regulatory Permits and Other Regulatory Matters. The Company possess such valid and current licenses, certificates, authorizations, consents, approvals or permits issued by the appropriate state, federal or foreign regulatory agencies or bodies necessary to conduct its businesses, except where the failure so to possess would not, singly or in the aggregate, result in a Material Adverse Effect, and the Company is not in violation of, in default under, or has not received, or has any reason to believe that it will receive, any notice of proceedings relating to the revocation or modification of, or non-compliance with, any such licenses, certificates, authorizations, consents, approvals or permits which, if the subject of an unfavorable decision, ruling or finding, singly or in the aggregate, would reasonably be expected to result in a Material Adverse Effect.

n.Listing. The Common Stock is registered pursuant to Section 12(b) of the Exchange Act, and the Company has taken no action designed to, or which to its knowledge is likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act nor has the Company received any notification that the SEC is contemplating terminating such registration. The Company has not, in the 12 months preceding the date hereof, received notice from the Nasdaq Global Select Market (the “Principal Market”) that the Company is not in compliance with the listing or maintenance requirements of such Principal Market. The Company is as of the date hereof and will as of the date of the issuance of the Shares pursuant to this Agreement, continue to be in compliance with all such listing and maintenance requirements. The Common Stock is eligible for clearing through DTC, through its Deposit/Withdrawal At Custodian (DWAC) system, and the Company is eligible and participating in the Direct Registration System (DRS) of DTC with respect to the Common Stock.

o.Tax Law Compliance. The Company has filed all necessary federal, state and foreign income and franchise tax returns or have properly requested extensions thereof and has paid all taxes required to be paid by the Company and, if due and payable, any related or similar assessment, fine or penalty levied against the Company except as may be being contested in good faith and by appropriate proceedings. The Company has made adequate charges, accruals and reserves in its financial statements in respect of all federal, state and foreign income and franchise taxes for all periods as to which the tax liability of the Company has not been finally determined.

p.Related Party Transactions. Except for the transactions contemplated by this Agreement, there are no relationships or related-party transactions involving the Company or any other person required to be described in the SEC Documents which have not been described as required.

5

q.Foreign Corrupt Practices and Certain Other Federal Regulations.

(i)Neither the Company nor, to the knowledge of the Company, any director, officer, agent, employee, affiliate or other person acting on behalf of the Company or any of its subsidiaries is aware of or has taken any action, directly or indirectly, that has resulted or would result in a violation of the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder (the “FCPA”), including, without limitation, making use of the mails or any means or instrumentality of interstate commerce corruptly in furtherance of an offer, payment, promise to pay or authorization of the payment of any money, or other property, gift, promise to give, or authorization of the giving of anything of value to any “foreign official” (as such term is defined in the FCPA) or any foreign political party or official thereof or any candidate for foreign political office, in contravention of the FCPA; and the Company and, to the knowledge of the Company, the Company’s affiliates have conducted their respective businesses in compliance with the FCPA and have instituted and maintain policies and procedures designed to ensure, and which are reasonably expected to continue to ensure, continued compliance therewith.

(ii)The operations of the Company are, and have been conducted at all times, in compliance with applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the anti-money laundering statutes of all applicable jurisdictions, the rules and regulations thereunder and any related or similar applicable rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively, the “Anti-Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company with respect to the Anti-Money Laundering Laws is pending.

(iii)Neither the Company nor, to the knowledge of the Company, any of its directors, officers, agents, employees or affiliates is currently the subject or the target of any sanctions administered or enforced by the U.S. government (including the Office of Foreign Assets Control of the U.S. Department of the Treasury or the U.S. Department of State and including the designation as a “specially designated national” or “blocked person”), the United Nations Security Council, the European Union, His Majesty’s Treasury, or other relevant sanctions authority (collectively, “Sanctions,” and each such subject or target, a “Sanctioned Person”), nor is the Company or any of its subsidiaries located, organized, or resident in a country or territory that is the subject or the target of Sanctions, including Russia, the so-called Donetsk People’s Republic, the so-called Luhansk People’s Republic, the non-government controlled areas of the Zaporizhzhia and Kherson Regions of Ukraine, any other Covered Region of Ukraine identified pursuant to Executive Order 14065, Crimea, Cuba, Iran, North Korea and Syria, that broadly prohibit dealings with that country or territory (each, a “Sanctioned Territory”); and the Company will not directly or indirectly use the proceeds of the offering of the Shares hereunder, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other person or entity to fund or facilitate any activities of or business with any person, or in any country or territory, that, at the time of such funding or facilitation, is a Sanctioned Person or Sanctioned Territory in each case, in any manner that will result in a violation by any person (including any person participating in the transaction, whether as initial purchaser, advisor, investor, or otherwise) of Sanctions.

r.RIC Status. The Company is currently organized and operates in compliance in all material respects with the requirements to be taxed as, and has duly elected to be taxed as (which election has not been revoked), a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, including the regulations and published interpretations thereunder (the “Code”). The Company intends to direct the investment of the net proceeds received by it from the sale of the Shares in such a manner as to continue to comply with the requirements of Subchapter M of the Code.

s.BDC Election. The Company has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended (the “1940 Act”), and has filed with the SEC, pursuant to Section 54(a) of the 1940 Act, a duly completed and executed Form N-54A (the “Company BDC Election”); the Company has not filed with the SEC any notice of withdrawal of the Company BDC Election pursuant to Section 54(c) of the 1940 Act; the Company BDC Election remains in full force and effect and, to the Company’s knowledge, no order of suspension or revocation of such election under the 1940 Act has been issued or proceedings therefor initiated or threatened by the SEC. The operations of the Company are in compliance with the

6

provisions of the 1940 Act applicable to business development companies, except where such non-compliance would not reasonably be expected to result in a Material Adverse Effect.

t.No Disqualification Events. None of the Company, any director, officer, any beneficial owner of 20% or more of the Company’s outstanding voting equity securities, calculated on the basis of voting power, or any “promoter” (as that term is defined in Rule 405 under the Securities Act) connected with the Company in any capacity at the time of the Closing (each, a “Covered Person” and, together, “Covered Persons”) is subject to any of the “Bad Actor” disqualifications described in Rule 506(d)(1)(i) to (viii) under the Securities Act (a “Disqualification Event”). The Company has exercised reasonable care to determine whether any Covered Person is subject to a Disqualification Event. The Company has complied, to the extent applicable, with its disclosure obligations under Rule 506(e).

u.No Stabilization. Neither the Company, nor to the Company’s knowledge, any of its affiliates, has taken or will take, directly or indirectly, any action designed to cause or result in, or which has constituted or which might reasonably be expected to constitute, the stabilization or manipulation of the price of any security of the Company to facilitate the sale or resale of the Shares in violation of any law, statute, regulation or rule applicable to the Company or its affiliates.

v.Disclosure. The Company understands and confirms that each of the Purchaser will rely on the foregoing representations in effecting transactions in Shares of the Company. Taken as a whole, all disclosure provided to the Purchaser regarding the Company, its business and the transactions contemplated hereby, furnished by or on behalf of the Company, including any information contained in any SEC Documents, is true and correct and does not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in the light of the circumstances under which they were made, not misleading.

a.Form D and Blue Sky. The Company agrees to timely file a Form D with respect to the Shares as required under Regulation D. The Company shall, on or before date hereof, take such action as the Company shall reasonably determine is necessary in order to obtain an exemption for, or to qualify the Shares for, sale to the Purchaser at the Closing pursuant to this Agreement under applicable securities or “Blue Sky” laws of the states of the United States, and shall provide promptly evidence of any such action so taken. The Company shall make all filings and reports relating to the offer and sale of the Shares required under applicable securities or “Blue Sky” laws of the states of the United States following the Closing.

b.Reporting Status. The Company shall timely (including by giving effect to any extensions pursuant to Rule 12b-25 of the Exchange Act) file all reports required to be filed with the SEC pursuant to the Exchange Act from the date of this Agreement until the first date on which any of the following events occur: (i) a Registration Statement (as defined below) with respect to the sale of the Shares has become effective under the Securities Act and all of the Shares are disposed of in accordance with such Registration Statement; (ii) all of the Shares are sold in accordance with Rule 144 or an applicable exemption from registration under the Securities Act; (iii) all of the Shares are eligible to be sold by the holder thereof pursuant to Rule 144 without limitation, restriction or condition (including any current public information requirement) thereunder; or (iv) all of the Shares are sold to the Company.

c.Expenses. At the Closing, the Company and the Purchaser shall each pay all of their own legal, due diligence and other expenses, including fees and expenses of attorney and other consultants costs and all other expenses relating to negotiating and preparing this Agreement.

d.Disclosure of Transactions and Other Material Information. The Company shall (i) issue a press release disclosing all the material terms of the transactions contemplated by this Agreement and (ii) file, within the timeframe required under applicable SEC rules, a Current Report on Form 8-K with the SEC describing the terms of the transactions contemplated by this Agreement and including as exhibits to such Form 8‑K this

7

Agreement. Unless required by applicable law or a rule of the Principal Market, the Company shall not make any public announcement regarding the transactions contemplated hereby prior to the date hereof.

e.Regulation M. Neither the Company, nor any affiliates of the Company, has taken or shall take any action prohibited by Regulation M under the Exchange Act, in connection with the offer, sale and delivery of the Shares contemplated hereby.

f.No Integrated Offering. Neither the Company, nor any affiliates of the Company or any Person acting on the behalf of any of the foregoing, shall, directly or indirectly, make any offers or sales of any security or solicit any offers to purchase any security, under any circumstances that would require registration of any of the Shares under the Exchange Act or require stockholder approval of the issuance of any of the Shares.

g.Registration Statement. As soon as reasonably possible after the date the Company files its quarterly report on Form 10-Q for the period ended March 31, 2024 with the SEC, the Company will file with the SEC a registration statement on Form N-2 (or any successor form, the “Registration Statement”) covering the resale of the Shares being issued pursuant to the terms of this Agreement. The Company shall use its commercially reasonable efforts to have the Registration Statement declared effective by the SEC as soon as practicable after the filing thereof. The Company’s obligations to include the Shares in the Registration Statement are contingent upon the Purchaser furnishing in writing to Company such information as shall be reasonably requested by the Company to effect such registration, and the Company and the Purchaser shall execute such documents, covenants, including customary indemnification covenants, and agreements in connection with such registration as either party may reasonably request that are customary of a registrant and a selling stockholder in similar situations. The Company shall keep the Registration Statement effective pursuant to Rule 415 under the Securities Act, or any successor rule providing for offering securities on a continuous or delayed basis, at all times until the earlier of (i) the date as of which the Investor may sell all of the Shares covered by the Registration Statement pursuant to Rule 144 without limitation, restriction or condition (including any current public information requirement) thereunder, (ii) the date on which the Investor has sold all of the Shares covered by such Registration Statement in accordance with such Registration Statement or pursuant to Rule 144 or (iii) the date on which all of the Shares have been sold to the Company. On not more than three occasions and for not more than 75 consecutive days in any 12 month period, the Company may delay the filing of the Registration Statement or suspend the use thereof if it reasonably determines that in order for the Registration Statement to not contain a material misstatement or omission, an update thereto would be needed to include information that would at that time not otherwise be required in a current, quarterly, or annual report under the Exchange Act, provided, the Company certifies to promptly complete such update and, provided, further, such delay would not materially interfere with a bono fide material financing, acquisition, disposition or other similar transaction involving the Company or any of its subsidiaries then under consideration.

h.Legends. The Purchaser agrees that the book-entry designation or other instruments representing the Shares, except as set forth below, shall bear a restrictive legend in substantially the following form (the “Securities Act Legend”):

THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE LAWS, AND MAY NOT BE OFFERED, SOLD, ASSIGNED, PLEDGED, TRANSFERRED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT AND, IF REQUESTED BY THE COMPANY, UPON DELIVERY OF AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT THE PROPOSED TRANSFER IS EXEMPT FROM THE SECURITIES ACT.

The Company shall issue, pursuant to instructions provided by the Company to the Transfer Agent, a certificate or book-entry statement without such legend to the holder of the applicable Shares upon which it is stamped or issue to such holder by electronic delivery at the applicable balance account at the Depository Trust Company (“DTC”), only if (i) such Shares are registered for resale under the Securities Act (provided that, if the Purchaser is selling pursuant to the registration statement, the Purchaser agrees to only sell such Shares during such time that the

8

registration statement is effective and not withdrawn or suspended, and only as permitted by the registration statement), (ii) such Shares are sold or transferred pursuant to Rule 144 (if the transferor is not an Affiliate of the Company), or (iii) such Shares are eligible for sale under Rule 144, without the requirement for the Company to be in compliance with the current public information required under Rule 144 as to such securities and without volume or manner-of-sale restrictions.

i.Listing. From and after the Closing, the Company shall use commercially reasonable efforts to maintain the listing and trading of its Common Stock on the Principal Market and, in accordance therewith, will use reasonable best efforts to comply in all material respects with the Company’s reporting, filing and other obligations under the rules and regulations of the Principal Market.

j.Voting. For so long as the Purchaser owns more than 3% of the Common Stock of the Company, Purchaser agrees to vote the Shares held by it in the same proportion as the vote of all other holders of Common Stock to the extent required by the 1940 Act.

k.Holdings. For so long as the Purchaser owns more than 3% of the Common Stock of the Company, such shares are the only investment security (as such term is defined in the 1940 Act) held by the Purchaser.

6.CONDITIONS TO THE COMPANY’S OBLIGATION TO SELL. The obligation of the Company to issue and sell the Shares to the Purchaser at the Closing is subject to the satisfaction, at or before the date hereof, of each of the following conditions:

a.The Purchaser shall have executed this Agreement and delivered the same to the Company.

b.The Purchaser shall have delivered to the Company the Purchase Price for the Shares being purchased by the Purchaser at the Closing by wire transfer of immediately available funds pursuant to the wire instructions provided by the Company.

c.No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction that prohibits the consummation of any of the transactions contemplated by this Agreement.

7.CONDITIONS TO THE PURCHASER’S OBLIGATION TO PURCHASE. The obligation of the Purchaser hereunder to purchase the Shares from the Company at the Closing is subject to the satisfaction, at or before the date hereof, of each of the following conditions:

a.The Company shall have executed this Agreement and delivered the same to the Purchaser.

b.The Company shall have delivered to the Purchaser a certificate evidencing the incorporation and good standing of the Company in its state of incorporation, as well as a certificate evidencing the Company’s qualification as a foreign corporation and good standing in the state of its principal place of business, in each case issued by the Secretary of State (or other applicable authority) of such state.

c.The Company shall have delivered to the Purchaser a certificate, executed by the Secretary of the Company and dated as of the date hereof, as to (i) the resolutions of the board of directors of the Company relating to the execution, delivery and performance by the Company of this Agreement and the transactions contemplated hereunder; (ii) the Articles of Amendment and Restatement of the Company; and (iii) the Bylaws of the Company.

d.No statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction that prohibits the consummation of any of the transactions contemplated by this Agreement.

9

a.Company Indemnification Obligation. In consideration of the Purchaser’s execution and delivery of this Agreement and acquiring the Shares hereunder and in addition to all of the Company’s other obligations under this Agreement, the Company shall defend, protect, indemnify and hold harmless the Purchaser and its affiliates, officers, directors, members, managers and employees, as applicable (collectively, the “Indemnitees”), from and against any and all actions, causes of action, suits, claims, losses, costs, penalties, fees, liabilities and damages, and expenses in connection therewith, and including reasonable and documented attorneys’ fees and disbursements (the “Indemnified Liabilities”), incurred by any Indemnitees as a result of, or arising out of, or relating to any cause of action, suit or claim brought or made against such Indemnitee and arising out of or resulting from the execution, delivery, performance or enforcement of this Agreement in accordance with the terms hereof or any other certificate, instrument or document contemplated hereby or thereby in accordance with the terms thereof (other than a cause of action, suit or claim brought or made against an Indemnitee by such Indemnitee’s owners, investors or affiliates), except, in each case, to the extent any Indemnified Liabilities resulted from such Indemnitee’s gross negligence, willful misconduct or fraud or to the extent that a loss, claim, damage or liability is attributable to the Purchaser’s breach of any of the representations, warranties, covenants or agreements made by the Purchaser in this Agreement. To the extent that the foregoing undertaking by the Company may be unenforceable for any reason, the Company shall make the maximum contribution to the payment and satisfaction of each of the Indemnified Liabilities that is permissible under applicable law.

b.Indemnification Procedures. Each Indemnitee shall (i) give prompt written notice to the Company of any claim with respect to which it seeks indemnification or contribution pursuant to this Agreement (provided, however, that the failure of the Indemnitee to promptly deliver such notice shall not relieve the Company of any liability, except to the extent that the Company is prejudiced in its ability to defend such claim) and (ii) permit the Company to assume the defense of such claim with counsel selected by the Company and reasonably satisfactory to the Indemnitee; provided, however, that any Indemnitee entitled to indemnification hereunder shall have the right to employ separate counsel and to participate in the defense of such claim, but the fees and expenses of such counsel shall be at the expense of the Indemnitee unless (A) the Company has agreed in writing to pay such fees and expenses, or (B) in the reasonable judgment of the Indemnitee, based upon advice of its counsel, a conflict of interest may exist between the Indemnitee and the Company with respect to such claims (in which case, if the Indemnitee notifies the Company in writing that it elects to employ separate counsel at the expense of the Company, the Company shall not have the right to assume the defense of such claim on behalf of the Indemnitee). If the Company assumes the defense of the claim, it shall not be subject to any liability for any settlement or compromise made by the Indemnitee without its consent (but such consent shall not be unreasonably withheld, conditioned or delayed). In connection with any settlement negotiated by the Company, the Company shall not, and no Indemnitee shall be required by the Company to, (I) enter into any settlement which does not include as an unconditional term thereof the giving by the claimant or plaintiff to the Indemnitee of a release from all liability in respect to such claim or litigation, (II) enter into any settlement that attributes by its terms any liability, culpability or fault to the Indemnitee, or (III) consent to the entry of any judgment that does not include as a term thereof a full dismissal of the litigation or proceeding with prejudice. In addition, without the consent of the Indemnitee, the Company shall not consent to entry of any judgment or enter into any settlement which provides for any obligation or restriction on the part of the Indemnitee other than the payment of money damages which are to be paid in full by the Company. If requested by the Company, the Indemnitee agrees (at no expense to the Indemnitee) to reasonably cooperate with the Company and its counsel in contesting any claim that the Company elects to contest.

9.GOVERNING LAW; MISCELLANEOUS.

a.Governing Law; Jurisdiction; Jury Trial. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by, and construed in accordance with, the laws of the State of New York. Each of the parties hereto hereby irrevocably and unconditionally submits, for itself and its property, to the exclusive jurisdiction of any New York State court or federal court of the United States of America sitting in New York County, and of the United States District Court of the Southern District of New York, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Agreement, or for recognition or enforcement of any judgment, and each of the parties hereto irrevocably and unconditionally submits to the jurisdiction of such courts and agrees that all claims in respect of any such action,

10

litigation or proceeding may be heard and determined in such New York State court or, to the fullest extent permitted by applicable law, in such federal court. Each of the parties hereto agrees that a final judgment in any such action, litigation or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law.

Each of the parties hereto hereby irrevocably and unconditionally waives, to the fullest extent it may legally and effectively do so, any objection which it may now or hereafter have to the laying of venue of any suit, action or proceeding arising out of or relating to this Agreement in any New York State or federal court of the United States of America sitting in New York County. Each of the parties hereto hereby irrevocably waives, to the fullest extent permitted by law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court.

EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION HEREWITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY.

b.Counterparts; Execution. This Agreement may be signed in two or more counterparts, each of which shall constitute an original and all of which together shall constitute one and the same agreement. Counterparts may be delivered via facsimile, electronic mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

c.Headings. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement.

d.Severability. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Agreement in that jurisdiction or the validity or enforceability of any provision of this Agreement in any other jurisdiction.

e.Entire Agreement; Amendments; Waivers. This Agreement supersedes all other prior oral or written agreements among the Purchaser, the Company, their affiliates and Persons acting on their behalf with respect to the matters discussed herein, and this Agreement and the instruments referenced herein contain the entire understanding of the parties hereto with respect to the matters covered herein and therein. No provision of this Agreement may be waived, modified, supplemented or amended other than by an instrument in writing signed by the Company and by the Purchaser.

f.Notices. Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Agreement must be in writing and will be deemed to have been delivered upon receipt, when delivered via email, personally or by a nationally recognized overnight delivery service, in each case properly addressed to the party to receive the same. Further, any such notices, consents, waivers or other communications to the Purchaser must include notice via electronic mail. The addresses for such communications shall be:

If to the Company:

Great Elm Capital Corp.

800 South Street, Suite 230

Waltham, MA 02453

Attention: Adam M. Kleinman

Email: akleinman@greatelmcap.com

With an additional copy to:

11

Jones Day

250 Vesey Street

New York, NY 10281

Attention: Rory T. Hood

Email: rhood@jonesday.com

If to the Purchaser:

Great Elm Strategic Partnership I, LLC

c/o Great Elm Capital Management, Inc.

800 South Street, Suite 230

Waltham, MA 02453

Attention: Adam M. Kleinman

g.Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns, including any purchasers of the Shares. Neither party hereto shall assign this Agreement or any rights or obligations hereunder without the prior written consent of the other party, which consent shall not be unreasonably withheld.

h.No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted successors and assigns and, to the extent provided in Section 7 hereof, each Indemnitee, and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

i.Survival. The representations and warranties of the Company and the Purchaser contained in Sections 2 and 3 hereof, the agreements and covenants set forth in Section 4 hereof and this Section 8, and the indemnification provisions set forth in Section 7 hereof, shall survive the Closing.

j.Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

k.Remedies. The parties hereto agree that (i) irreparable harm would occur in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached, and (ii) money damages or other legal remedies would not be an adequate remedy for any such harm. Any Person having any rights under any provision of this Agreement shall be entitled to enforce such rights specifically (without posting a bond or other security or proving actual damages), to recover damages by reason of any breach of any provision of this Agreement and to exercise all other rights granted by law.

* * * * * *

12

IN WITNESS WHEREOF, the Purchaser and the Company have caused this Share Purchase Agreement to be duly executed as of the date first written above.

COMPANY:

GREAT ELM CAPITAL CORP.

By: /s/ Matt Kaplan

Name: Matt Kaplan

Title: President and Chief Executive Officer

[Signature Page to Share Purchase Agreement]

PURCHASER:

Great Elm Strategic Partnership I, LLC

By: /s/ Adam M. Kleinman

Name: Adam M. Kleinman

Title: Authorized Signatory

[Signature Page to Share Purchase Agreement]

Exhibit 99.1

Great Elm Capital Corp. (“GECC”) Raises $24 Million of Equity at Net Asset Value

Provides Preliminary Fourth Quarter 2023 Financial Results; Declares First Quarter 2024 Distribution of $0.35 per Share

PALM BEACH GARDENS, Florida., February 8, 2024 – Great Elm Capital Corp. (the “Company” or “GECC”), (NASDAQ: GECC), a business development company, today announced it issued approximately 1.85 million shares of the Company’s common stock at a current net asset value of $12.97 per share to a special purpose vehicle for an aggregate gross purchase price of $24 million (the “Transaction”).

The Transaction is supported by a $6 million investment from Great Elm Group, Inc. (“GEG”) in the special purpose vehicle, further aligning the Company’s investment manager with shareholders.

“Our ability to raise capital at net asset value is a testament to the repositioning plan we implemented over the past two years,” said Matt Kaplan, GECC’s Chief Executive Officer. “New non-dilutive equity allows us to grow our asset base to further execute on our growth strategy and pursue our robust pipeline of investments. Increased scale will benefit our shareholders as we leverage our infrastructure and further diversify our portfolio.”

Jason Reese, GEG’s Chief Executive Officer, said, “GEG is committed to scaling GECC. This transaction is beneficial for all parties and supports GECC’s growth strategy. In addition, the investment structure embedded in this transaction provides a potential template for future capital raising and investment opportunities.”

Preliminary Fourth Quarter 2023 Financial Results; Declares First Quarter 2024 Distribution

The Company generated net investment income for the quarter ended December 31, 2023 of $0.43 per share and ended the year with net assets of $98.7 million, or $12.99 per share.

The Company’s Board of Directors has approved a quarterly cash distribution of $0.35 per share for the quarter ending March 31, 2024. This distribution, together with the prior three quarters of distributions and the special distribution declared in December 2023, equates to a 14.6% dividend yield on the Company’s closing market price on February 8, 2024 of $10.26 and a 11.5% dividend yield on the Company’s December 31, 2023 NAV of $12.99 per share.

About Great Elm Capital Corp.

GECC is an externally managed business development company that seeks to generate current income and capital appreciation by investing in debt and income generating equity securities, including investments in specialty finance businesses.

Cautionary Statement Regarding Forward-Looking Statements

Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “expect,” “anticipate,” “should,” “will,” “estimate,” “designed,” “seek,” “continue,” “upside,” “potential” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ

materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit markets, rising interest rates, inflationary pressure, the price of GECC common stock and the performance of GECC’s portfolio and investment manager. Information concerning these and other factors can be found in GECC’s Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

This press release does not constitute an offer of any securities for sale.

Media & Investor Contact:

Investor Relations

investorrelations@greatelmcap.com

Source: Great Elm Capital Corp.

-2-

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gecc_SixPointSevenFivePercentageNotesDueTwoThousandTwentyFiveMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gecc_FivePointEightSevenFivePercentageNotesDueTwoThousandTwentySixMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gecc_EightPointSevenFivePercentageNotesDueTwoThousandTwentyEightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

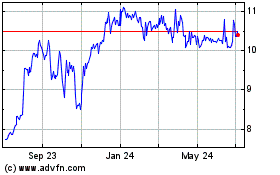

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

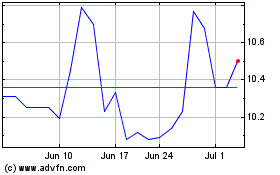

From Mar 2024 to Apr 2024

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Apr 2023 to Apr 2024